Professional Documents

Culture Documents

Paradoxes and Dilemmas For Stakeholder Responsive Firms in The Extractive Sector Lessons From The Case of Shell and The Ogoni AAA

Uploaded by

elbokharOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paradoxes and Dilemmas For Stakeholder Responsive Firms in The Extractive Sector Lessons From The Case of Shell and The Ogoni AAA

Uploaded by

elbokharCopyright:

Available Formats

Paradoxes and Dilemmas for

Stakeholder Responsive Firms

in the Extractive Sector:

Lessons from the Case of

Shell and the Ogoni

ABSTRACT. This paper examines some of the

paradoxes and dilemmas facing firms in the extractive sector when they attempt to take on a more

stakeholder-responsive orientation towards issues of

environmental and social responsibility. We describe

the case of SheU and the Ogoni and attempt to draw

out some of the lessons of that case for more sustainable operations in the developing world. We argue

that firms such as SheU, Rio Tinto and others may

well exhibit increasingly stakeholder-responsive

behaviours at the corporate, strategic level. However

for reasons of strategy, lack of competency or institutional wiU this increasing level of corporate responsiveness may not be mirrored effectively in dealings

between subsidiary business units and their most

important direct stakeholders: for example local communities and in the developing world. We contrast

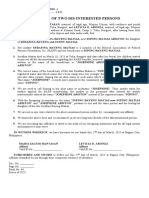

David Wheeler is Director and Erivan K Haub Chair of

Business and SustainabiUty at the Schulich School of

Business, York University, Toronto. He is also Visiting

Professor in Sustainable Enterprise at Kingston

University Business School (U.K.). Previously, he was

Executive Director of Environmental & Social Policy at

The Body Shop International. He has been a frequent

consultant to the World Health Organisation and various

development agencies working in water and sanitation

programmes in less developed countries. He is co-author

of The Stakeholder Corporation the first business

text to be endorsed by Prime Minister, Tony Blair. He

was an advisor to the U.K. Government on governance

aspects of the Company Law Review and is currently a

member of the Government Advisory Group on

Consumer Products and the Environment. He was cofounder of the U.K. business-led Committee of Inquiry

A New Vision for Business.

David Wheeler

Heike Fabig

Richard Boele

the struggles of Shell to replicate its corporate stakeholder-responsiveness at the local level in Nigeria

with the experiences of other firms that seem to have

developed managerial capabilities at a somewhat

deeper level throughout the firm with consequent

benefits both for stakeholders and the business.

KEY WORDS: corporate social responsibility. Shell,

stakeholder theory, sustainability

Heike Fabig is a Ph.D. student in corporate responsibility

at the Graduate Research Centre for the Comparative

Study of Culture, Development and Environment at the

University of Sussex. Her research examines the engagement of The Body Shop with the campaign for social

and environmental justice of the Ogoni people in

Nigeria. She worked previously as a human rights campaigner for a Flemish non-governmental organisation

focusing on the collective human rights of indigenous

peoples, as a researcher and consultant for The Body

Shop International and a tutor at the University of

Sussex School of African and Asian Studies.

Richard Boele is a founding director of the Australian

Institute of Corporate Citizenship (AICC). He works

as a corporate social responsibility consultant and social

auditor and has a range of clients including BP, the Novo

Group, BHP Billiton, the British government and

Amnesty International. He has previously held key positions at The Body Shop International (U.K.) and

human rights organisations, both in Australia and

Europe. His civil society experience ranges from work

with local communities around the world to international

organisations such as the United Nations. He also holds

an Industrial Fellowship with the Centre for

Stakeholding and Sustainable Enterprise at the Kingston

University Business School in London, U.K.

fournal of Business Ethics 39: 2 9 7 - 3 1 8 , 2002.

2002 Kluwer Academic Publishers. Printed in the Netherlands.

298

David Wheeler et al.

1. Introduction

One of the most helpful conceptual frameworks

for exploring the corporate attitude of Shell and

other firms in the extractive sector towards stakeholders is that of Corporate Social Responsibility

(CSR). Along with references to stakeholders,

sustainability and "triple bottom line" thinking,

CSR terminology is employed widely by Shell

and other actors in the extractive industries who

are members of the World Business Council on

Sustainable Development (WBCSD). Consistent

with current definitions of sustainable development, WBCSD recognises "corporate responsibility" in the three domains of financial,

environmental and social responsibihty (WBCSD,

2001). The WBCSD also offers a number of

candidate definitions for CSR which it may be

assumed refiect the views of Shell and other

influential members of the organisation. One

definition is that CSR requires "the continuing

commitrhent by business to behaving ethically

and contributing to economic development

while iniproving the quality of life of the workforce and their families as well as of the community and society at large" (Watts and Holme,

1999).

The CSR literature also bridges well to practical applications of allied concepts such as stakeholder- Responsiveness on which this paper will

focus. In this paper we will not assume that "corporate responsibility" and "sustainability" are

more or less interchangeable terms for the overarching notion that business must be economically, environmentally and socially viable in the

long term. We will, however, assume that as a

subsidiary construct "corporate social responsibility" encompasses many of those ethical questions which reside in the relationship between a

firm and its stakeholders. We also recognise that

there are those who would describe CSR or

"corporate citizenship" as an overarching notion,

so we will be careful to include all of these terms

in the appropriate way in our commentary and

discussion.

The literature on corporate social responsibility has been reviewed at length by Carroll

(1999). Describing the phenomenon as centuries

old but the literature as mostly associated with

the second half of the 20th century, Carroll cites

landmark definitions of social responsibility in

business, some of which have deep salience for

companies such as Shell. For example, Keith

Davis in 1960: "some socially responsible business

decisions can be justified by a long, complicated

process of reasoning as having a good chance of

bringing long-run economic gain to the firm".

And Peter Drucker (1982): " . . . the proper

'social responsibility' of business is to tame the

dragon, that is to turn a social problem into

economic opportunity and economic benefit,

into productive capacity, into human competence, into well paid jobs, and into wealth". We

know that the rational-instrumentalist approach

to CSR is one that resonates well with firms in

the WBCSD which asserts: "a coherent CSR

strategy based on sound ethics and core values

offers clear business benefits" (Watts and Holme,

1999).

Carroll also summarised some of the more

important attempts to categorise firms'

approaches to CSR - for example Harold

Johnson's "four perspectives", one of which

explicitly presaged the rise of stakeholder theory:

"a socially responsible firm is one whose managerial staff balance a multiplicity of interests"

(Johnson, 1971). Two key texts developed three

tier models of CSR (Committee for Economic

Development, 1971; Sethi, 1975). In the first,

socially responsible activity was categorised as

(i) related to products, jobs and economic

growth; (ii) related to societal expectations; and

(iii) related to activities aimed at improving the

social environment of the firm (Committee for

Economic Development, 1971). In the second

(Sethi, 1975), the three tiers were (i) social

obligation (a response to legal and market constraints); (ii) social responsibility (congruent with

societal norms); and (iii) social responsiveness

(adaptive, anticipatory and preventive). In both

cases the second tier required an ability to recognise and internalise societal expectations and the

third tier required the competence to engage

with external stakeholders on issues and

concerns.

Later Carroll developed his own four part

definition and three dimensional model of CSR

predicated on an underlying assumption that the

Paradoxes and Dilemmas for Stakeholder Responsive Firms

first obligation of a firm is to provide the goods

and services that society wants whilst making a

profit (Carroll, 1979). Carroll's classification of

the CSR obligations of the firm may be summarised thus: economic, legal, ethical and philanthropic/discretionary. Though Carroll was

keen to point out that no sequential hierarchy is

implied, there is no doubting the pragmatic

importance of the economic base to the pyramid.

We shall explore later in the paper how these

categorisations may be applied to the experience

of Shell and other firms with respect to their

stakeholder-responsiveness.

It is well recognised that as with most of the

business ethics literature, the CSR literature is

divided between authors who assert the possibility of creating economic and social value in

well managed companies, and those who take a

more philosophically critical approach to the

juxtaposition of economics and ethics. Authors

in the latter category frequently start with a

search for a normative explanation or theory of

the firm and end with an examination of the

rights and responsibilities of business and the

various actors involved (or vice versa). This debate

is often framed in the context of stakeholder

theory and the moral obligations which a firm

owes to its various consituents (Donaldson and

Preston, 1995).

For example, Wesley Cragg has argued that

"the business case for stakeholder theory is fatally

fiawed" (Cragg, forthcoming). In essence, Cragg

believes that whilst pragmatic stakeholder

theories may attempt to effect moral neutrality

(Goodpaster, 1998), in reality they are held

captive by the dominant business model. While

accepting the increasing empirical evidence for

win-win outcomes between investors and other

stakeholders in well managed firms, Cragg

expresses caution in what this might mean in

terms of how we might ensure that the ethical

obligations of the firm and its agents are satisfactorily discharged. Cragg also searches in vain

for a coherent normative grounding for stakeholder theory. Other ethicists who acknowledge

the possibility of a positive correlation between

ethical behaviour by firms towards their stakeholders and commercial success have expressed

discomfort about the discourse this involves:

299

"The intellectual currents propelling the "ethics

pays" argument conceal a dangerous undertow

. . . Rather than being a domain of rationality

capable of challenging economics, ethics is conceived only as a tool of economics" (Paine,

2000).

However, as Edward Freeman has argued,

commentators using stakeholder theory in the

context of business critique may be overlooking

the basic premise of capitalism that the project

is essentially about trade and the creation of value

(Freeman, 2000). Refreshingly, Freeman does not

exempt himself from this criticism.

In a typically robust re-defence of a pragmatic,

approach to stakeholder theory. Freeman (2000)

offers a vision of capitalism ("stakeholder capitalism") which would be recognisable in a

number of business cultures world wide

(Charkham, 1995). According to Freeman, stakeholder capitalism is predicated on the notion of

win-win outcomes for different actors whilst

recognising the importance of understanding

complexity, the value creation process and

competition all of which create choice for

individual stakeholders. Freeman (2000) asserts

that stakeholder capitalism "sets a high standard,

recognizes the common-sense practical world of

global business today, and asks managers to get

on with the task of creating value for all stakeholders".

In advancing this vision. Freeman is providing

a partial answer to critiques of the potentially

negative effects of globalisation and the "new

economy" on wider society from infiuential

social commentators such as Robert Putnam and

Robert Reich (Putnam, 2000; Reich, 2001).

Freeman's stakeholder-inclusive model for

business has found a strong echo in contemporary European thought on the future for capitalism. The U.K. discourse on stakeholder

capitalism emerged in the mid-1990s more or less

simultaneously from economic, political and

business fields (Kay, 1995; Hutton, 1996; Plender,

1997; Wheeler and Sillanpaa, 1997, 1998). The

discourse is alive and well too in North America

(Svendsen, 1998; Cohen and Prusak, 2000).

Freeman is also in tune with the nascent

business hterature on sustainability and the "triple

bottom line". Texts in this field generally allude

300

David Wheeler et al.

to the necessity of a Schumpeterian re-invention

of business and industry whilst maintaining a

balance between economic development, social

justice and environmental protection both in

the developed and the developing world

(Schmidheiny, 1992; Hawken, 1993; Hart, 1997;

Elkington, 1998; Hawken et al., 1999; Hart and

Milstein, 1999).

The fact is that the empirical evidence for a

positive correlation between stakeholder inclusive, socially responsible business practice and

business performance - as defined by growth in

sales or stock price - is now quite compelling

(Kotter and Heskett, 1992; Collins and Porras,

1995; Waddock and Graves, 1997; Roman et al.,

1999). Similar evidence is emerging with respect

to companies and their "sustainability" i.e.

combined social, environmental and financial

performance (cf. the Dow Jones Sustainability

Index and Innovest's Eco-Value Rating system,

both of which demonstrate reasonably consistent

stock price premia for firms with superior environmental and social performance).

Thus we can see how corporations and their

leaderships have developed a growing level of

confidence in concepts such as corporate sustainability, corporate social responsibility and

stakeholder-responsiveness. Increasingly, they are

argued from a pragmatic perspective, they are

grounded in business language, and - perhaps

most importantly - they are re-inforcing of the

importance of and potential for enhanced financial performance. Peter Drucker's robust vision

of CSR as a leverage opportunity for economic

advantage and societal benefit has come of age.

Meanwhile,

Freeman's

business-friendly

description of stakeholder capitalism, together

v^^ith Hawken and co-workers' and Elkington's

win-win prescriptions for environmentally sustainable enterprise provide clear direction for

turning vision into strategic intent. This explains

the increasing assertiveness of business leader

rhetoric on issues as diverse as global climate

change, social inclusion and human rights

(Wheeler et al., 2000). Here we may acknowledge the various public declarations of such luminaries as William Clay Ford (Ford Motor

Company), Carly Fiorina (Hewlett-Packard), Sir

John Browne (BP) and of course Sir Mark

Moody-Stewart (Shell). It also explains the

growing success of business membership organisations such as Business for Social Responsibility

(U.S.), Business in the Community (U.K.), CSREurope (Europe), the Prince of Wales' Business

Leader's Forum (international) and the World

Business Council for Sustainable Development

(international).

The fundamental question remains, however,

whether strategic CSR intent - if it exists - is

readily transferable to operational reality within

acceptable time scales or whether there remain

barriers: eg lack of capability or lack institutional

will which will negate this transfer in some circumstances. It is this question which lies at the

heart of the case of Shell and the Ogoni, which

we shall now examine.

2. Shell's Damascene Conversion on the

road to corporate social responsibility

Shell's approach to dealing with stakeholder

concerns came under significant pressure in 1995.

First there was the Brent Spar controversy and

then there was the hanging by the Nigerian

military regime of Ogoni writer and environmental and human rights activist Ken Saro-Wiwa

and eight of his colleagues on November 10,

1995 (Lawrence, 1999a, b; Boele et al., 2000a).

In this paper we will consider only the implications of the Ogoni case, although it is clear that

the double impact of these two incidents induced

a vaccine-like response from the firm's reputational immune system.

The Ogoni struggle is an archetypal "David

and Goliath" story with a seemingly powerless

minority ethnic group taking on one of the

world's largest and most powerful transnational

companies (Boele, 1995; Human Rights Watch,

1995; Cayford, 1996; Robinson, 1996; Boele,

2000; Boele et al., 2000a). Many environmental

and human rights groups accused Shell and its

Nigerian subsidiary, the Shell Petroleum

Development Company (SPDC) of having

degraded the Ogoni environment for 40 years

with little or no economic or social benefits

accruing to the community. Worse still, some of

those groups which had supported the Ogoni

Paradoxes and Dilemmas for Stakeholder Responsive Firms

cause since the early 1990s also accused Shell of

a vicarious role in the executions.

More radical activists argued that there was

direct complicity and as a consequence there

were direct attacks on Shell gas stations in

Europe. But the majority of commentators saw

the events of November 1995 simply as the

inevitable, tragic outcome of the company's

clumsy approach to dealing with the Ogoni community over the previous four decades. Whatever

the evidence and the merits of the accusations,

the company's reputation was severely tarnished.

World wide campaigns of disinvestment and

general vilification were launched against Shell

by actors as diverse as church groups, Greenpeace, Amnesty International and The Body

Shop International. The media were happy to

report on the anger of the communities and the

acute discomfort of Shell (Brooks, 1994;

Wheeler, 1995; Human Rights Watch, 1995;

O'Sullivan, 1995; Duodu, 1996; Lewis, 1996).

Perhaps directly as a result of its tragic

outcome, the Ogoni struggle against Shell is

arguably the quintessential case that put the

interconnectedness of business, the natural environment and human rights on the corporate

agenda. Elsewhere we have argued that the case

is also one of the most poignant examples of

"unsustainable development" involving a major

corporation (Boele et al., 2001a, b; Wheeler et

al., 2001), although we would accept that the

Bhopal incident must rank alongside in terms of

its impact on corporate thinking with respect to

the management of risks and liabilities

(Shrivastava, 1995). But what makes the Ogoni

affair almost unique is that it helped precipitate

a fundamental change in corporate strategy and

orientation towards stakeholders in one of the

world's largest companies.

As a result of the Ogoni experience. Shell

International revisited and updated its Statement

of General Business Principles, first crafted in

1976 (Shell International, 1997). The company

re-invented its corporate strategy in line with

principles of sustainable development. This latter

process involved the development of a Sustainable

Development (SD) Road Map and SD

Management Framework - both of which made

explicit reference to stakeholder interests and

301

"triple bottom hne" concepts (May et al., 1999;

Boele et al., 2001a, b; Wheeler et al., 2001).

Shell also committed itself to a level of stakeholder engagement on its environmental and

social performance that would have been

unthinkable in the early 1990s, commencing in

1998 with the first of a series of annual statements of corporate social, economic and environmental performance. The first report was

entitled Profits and Principles: Does there have to be

a choice? (Shell International, 1998).

As a result of all this corporate activity, catalysed by the vision of Chairman of the

Committee of Managing Directors Mark

Moody-Stewart and guided by a plethora of high

calibre consultants and advisors such as

SustainAbility and Arthur D. Little, Shell's corporate reputation among opinion formers started

to recover (Vidal, 1999a). By the end of the

decade environmentalists and human rights

activists who would not have dreamed of sharing

a public platform with a Shell spokesperson in

late 1995 had accepted that in London and the

Hague, at least. Shell was a different company

from that which had resisted all entreaties for

early and effective intervention in the military

trial and execution of Ken Saro-Wiwa and the

Ogoni eight.

The way in which these strategic changes

played through to operational activities in countries as diverse as Canada, the U.K. and Peru have

been described (May et al., 1999). The company

is especially proud of the processes of stakeholder

consultation and decision-making in the Camisea

Gas Project in the Peruvian Amazonas a project

which eventually did not proceed for business

reasons.

Despite all of this progress at the corporate

level and in some important countries since

1995, there remained troubling questions over

Shell's behaviours in Nigeria and specifically in

relation to the Ogoni even as late as January

2001. During the Oputa Panel hearings on

Human Rights Violations held Port Harcourt in

early 2001, local activists felt Shell's position

emerged as unrepentent and defensive (authors'

experience). SPDC's evidence to those hearings

was certainly not conciliatory (Imomah, 2001).

For their part the Ogoni questioned Shell's new

302

David Wheeler et al.

im^age as the socially and environmentally responsible company portrayed in magazine advertisements and promotional videos around the world.

They pointed to what they saw as a continuing

difference between what Shell International

espoused and how Shell in Nigeria behaved. And

they reflected on their ongoing experience of

Shell in Nigeria as clumsy and unresponsive to

their needs (authors' experience).

3. The paradox of global intent versus

local reality

We will leave aside the long history of the clash

between Shell and the Ogoni which we have

documented elsewhere (Boele et al., 2001a).

Instead, we will examine the key ethical

dilemmas that the Ogoni posed to Shell during

the 1990s and we will explore the implications

of these dilemmas for Shell and others in the

extractive industry who operate in the developing world.

The fundamental question we posed earlier in

this article is whether strategic corporate social

responsibility intent is transferable to operational

reality within acceptable time scales or whether

there remain barriers (for example lack of appropriate strategy, management capability or institutional will) which will prevent this transfer in

certain operating conditions. We might also

frame this question as an inquiry, more specifically and positively from an Ogoni perspective:

what would it mean for a company like Shell to

become a stakeholder-responsive corporation in

Nigeria - for example with respect to minority

ethnic groups such as the Ogoni?

Before returning to the question of strategic

intent and potential barriers to implementation,

we will take the positively formulated question

and focus on two discrete but inter-related questions. The questions arise directly from the

stakeholder management literature that invariably

advocates or describes processes of stakeholder

mapping and inclusion in dialogue (if not always

inclusion in governance processes and decisionmaking) .

First, we will look at who defines and who

qualifies as a stakeholder; who decides which

stakeholders are legitimised and brought into

processes of dialogue?

Second, we will examine how weighting is

accorded to different stakeholders: are all stakeholders' views and perspectives assigned appropriate value and what are the implications for

stakeholder-responsiveness of the weighting of

views and perspectives?

We will address these two questions initially

with respect to specific aspects of the case of

Shell and the Ogoni and afterwards with respect

to more generic models of stakeholder-responsiveness, with particular reference to natural

resources and extractive industries.

4. Who defines and who qualifies as a

stakeholder?

A tenet of stakeholder-responsive practice and

thus corporate social responsibility requires that

companies define who they believe their stakeholders to be. Ideally this should be a flexible and

iterative process (Wheeler and Sillanpaa, 1997,

1998; Svendsen, 1998). It is not recommended;

but nonethleless typical for practitioners to take

a company-centric approach that assumes the

firm takes the initiative. However, as many companies have discovered, this approach comes with

risks. Where a social movement challenges a corporation, the members of that movement can

"self-declare" as stakeholders. Social movements

do so by launching campaigns, taking direct

action and making demands that directly impact

on the corporation. Companies may respond by

recognising they have a problem but may not

formally accept previously unrecognised stakeholders until other actors have legitimised them

and afforded them stakeholder status.

MOSOP would argue this was the case in

their clash with Shell. Initially, the company

failed to publicly acknowledge MOSOP as a

stakeholder. Instead Shell referred generally to

"the Ogoni community" in its corporate literature on the issue without articulating who they

considered their specific Ogoni stakeholders to

be. Throughout the early 1990s, as Ken SaroWiwa's charismatic leadership began to make an

impact on opinion formers around the world.

Paradoxes and Dilemmas for Stakeholder Responsive Firms

Shell questioned MOSOP's claims and went to

considerable lengths to point out that MOSOP

was not a legitimate stakeholder and that its

ability to represent the Ogoni was questionable.

This experience provides a powerful illustration

of the potentially fiawed nature of companycentric processes used to define stakeholder

groups. Sometimes inconvenient stakeholders

may be ignored in the hope they will eventually

lose their influence. The Shell experience in

Nigeria also demonstrates how a company can

undermine a group's claim to be a stakeholder.

MOSOP recognised this and drew attention to

Shell's preference for dealing with more malleable

groups, for example so-called "Shell Chiefs"

conservative Ogoni chiefs and contractors who

did not represent the majority of ordinary Ogoni

people (Boele, 2000).

MOSOP only gained recognised stakeholder

status from Shell when the organisation succeeded in attracting third party legitimation

through the internationalisation of the Ogoni

issue. When international NGOs such as

Amnesty International and Greenpeace and the

international media afforded a platform for Ken

Saro-Wiwa as the recognised MOSOP and Ogoni

spokesperson. Shell was forced to respond to

Saro-Wiwa and MOSOP as stakeholders. Shell's

failure to truly engage with MOSOP as a key

stakeholder in the early 1990s undoubtedly contributed to the later difficulties of the company

in achieving reconciliation with the Ogoni

nation in general and MOSOP in particular - a

problem that persisted throughout the 1990s.

Nevertheless, a cursory exploration of the Shell

Nigeria web site demonstrates just how much of

a presence Ken Saro-Wiwa and MOSOP have

in the consciousness of that part of Royal

Dutch/Shell today (SPDC, 2001).

We would not suggest that defining MOSOP

as a stakeholder was all Shell needed to do to

prevent their conflict with the Ogoni. MOSOP

was not and is not a single organisation but an

umbrella for grassroots Ogoni organisations

representing various parts of the community. The

grass roots groups included the National Youth

Council of Ogoni People (NYCOP), the

Federation of Ogoni Women's Associations

(FOWA), the Conference of Ogoni Traditional

303

Rulers (COTRA), the National Union of Ogoni

Students (NUOS) and the Council of Ogoni

Churches (COC). Even though these organisations could agree on many goals for the

movement, and shared a remarkably consistent

ability to articulate the grievances and aspirations

of the Ogoni struggle, there were significant

differences of views and approaches. MOSOP was

not a single stakeholder - instead it represented

a diverse set of interests which usually (but not

always) overlapped and that presented Shell with

a significant challenge in managing complexity.

MOSOP's first major split came in 1994 when

a number of the organisations' founders felt Ken

Saro-Wiwa had taken the movement in the

wrong direction by focusing on the mobilisation

of all the Ogoni people and keeping the organisation outside the mainstream political process

by calhng for electoral boycotts. Since the

execution of Ken Saro-Wiwa and his colleagues,

other divisions within MOSOP have arisen.

Unfortunately Shell has been unable to refrain

from commentary on these splits. In 2000, Shell

argued publicly that the presence of "two

factions" (sic) in MOSOP made resolving the

Ogoni question difficult for them (Achebe,

2000). As late as 2001 SPDC continued to play

on MOSOP splits in its corporate communications: "Divisions have appeared in the Ogoni

ranks with moderate factions speaking out against

the strategy of MOSOP" (SPDC, 2001).

Apparently, by the time Shell finally accepted

MOSOP as a stakeholder, it wanted MOSOP to

speak as one for the entire Ogoni people. But

even then. Shell appeared to be employing

divisive rhetoric, attempting to define the

stakeholders, and thereby potentially denying

legitimacy to Ogoni groups that could claim

status as separate stakeholders. To compound the

problem, since the removal of the military

government in Nigeria yet more stakeholders are

claiming Shell's recognition in Ogoni - the local

Ogoni government chairs, elected local government officials, and the Ogoni Development

Committee, created by MOSOP to deal with the

development of Ogoni.

This experience presents a powerful paradox

for advocates of a "managerialist" approach to

stakeholders:

304

David Wheeler et al.

Paradox i(a): How can a powerful corporation

avoid legitimation or de-legitimation of

stakeholders simply through who it chooses

to conduct dialogue with? Failure to

identify stakeholders certainly precludes

dialogue; but the very act of identifying

certain stakeholders for the purposes of

initiating dialogue may prevent from occurring those dialogues which are most necessary.

Some might argue that this sort of dilemma is

a convenient excuse for inaction since it effectively absolves the company of responsibility for

progress; how can Shell be expected to come to

an agreement with the Ogoni people when they

cannot agree amongst themselves? On the other

hand it may be argued that all nations of peoples

are diverse. A truly stakeholder-responsive

approach demands the acceptance of multiple

stakeholders and requires the company to develop

a tolerance for ambiguity together with the sensitivities and capabilities needed to inspire trust

with diverse and sometimes competing interests.

Clearly there are parts of Royal Dutch/Shell

which understand this and indeed practice it, for

example in the Camisea example (May et al.,

1999).

Of course the same paradox also plays out

from the perspective of the stakeholder when it

emerges that the company too is not a homogeneous entity. Shell International, based in

London and the Hague, is very different from

Shell in Nigeria. Within these two "Shellactors", there are individual managers and directors, and different departments, who do not

necessarily share the same understanding of the

Ogoni situation and how to resolve it. While it

seemed that, as a whole. Shell did not define

MOSOP as a stakeholder for most of the 1990s,

there were individuals within Shell who met with

Ken Saro-Wiwa and his international supporters

at different points in the story. The mixed

messages emanating from different (and sometimes the same) actors within Shell both with

respect to the Brent Spar and Ogoni cases have

been described in some detail (Livesey, 2001).

This leads us to the second paradox:

Paradox l(b): How can a stakeholder group

relate effectively to a complex multinational

corporation which exhibits contradictions

and inconsistencies in its rhetoric and

behaviours between and within the corporation and its business units? How can a

stakeholder group be simultaneously in

opposition to one part of a corporation and

in constructive dialogue with another whilst

maintaining its own integrity and internal

cohesion?

5. The weighting game: Valuing the

vieAvs and perspectives of stakeholders

and establishing effective engagement

Once stakeholders have been defined by the

company or they have self-declared and been

legitimised by other actors, companies need to

develop processes and systems for allocating

priority to different stakeholder views and perspectives and consequently to establishing the

appropriate level of engagement with stakeholders expressing those views. This is a difficult process loaded with potential for

misunderstanding because it is necessarily based

on judgements which risk favouring one group

over another. It is also about managing expectations; "responsiveness" may include a wide range

of attitudes from choosing almost to ignore a

stakeholder group altogether - MOSOP's experience in the early 1990s to allowing them

power within a company's governance structure.

In the Shell-Ogoni case questions concerning

the value assigned to the Ogoni perspective were

significantly compounded by the problem of

strongly divergent beliefs held by the main protagonists. In 2001, Shell Nigeria stiU made clear

its perspective on the nature of the MOSOP

organisation: "Mosop (sic) espouses a peaceful

approach but violence has been a feature of the

campaign" (SPDC, 2001). And for their part

MOSOP continued to question the true intentions of Shell. MOSOP Acting President Ledum

Mitee said in 1998:

Shell the company that this year promised to

balance principles with profit has not made a

Paradoxes and Dilemmas for Stakeholder Responsive Firms

single concession to help bring about the peace and

reconciliation it says it wants to see. I have a simple

question for the Directors of SheU: when will you

balance principles with practice in Ogoni

(MOSOP International Secretariat, 1998).

Thus Shell and the Ogoni ended up developing and articulating "competing truths" with

undiminished vehemence.

For proponents of stakeholder theory, this case

is especially interesting for it reveals that disagreements over rationally presented "scientific

truths" are not necessarily the cause of conflict

nor a means of resolving conflict. Husted (2000)

has argued that there are three types of social

issue: 1) disagreements between the firm and its

stakeholders over "what is"; 2) disagreement over

"what is" and "what ought to be"; and 3) disagreement over "what ought to be". The Ogoni

case adds a powerful embellishment to this

typology as it demonstrates that "type 1" issues

may play out almost entirely around beliefs and

perceptions rather than facts. Indeed facts may

be superfiuous to the discourse. This entirely

removes the potential for addressing and correcting errors of fact as a route to reconciliation.

In the Ogoni case it is different stakeholders'

305

social impacts of oil development in Ogoni since

the 1950s.

Competing truths on environmental impacts in

Ogoni

For the Ogoni the conflict with Shell was about

"environmental devastation" and the hopelessly

inadequate sharing of the benefits of the extraction of oil resources. In essence, the Ogoni took

issue with the type of development forced upon

them and the distribution of costs and benefits

of this development. The Ogoni accused Shell of

"devastating" their environment from the start of

Shell's operations in 1958. Throughout the

conflict Shell responded that the Ogoni claims of

environmental devastation were "exaggerated".

In the mid-1990s the company's response to the

environmental accusations of the Ogoni was

clear:

The company recognises there are environmental

problems associated with its operations and it is

committed to dealing with them, but these

problems do not add up to anything like devastation (Shell International, 1995b).

perceptions and beliefs or "perceptual truths"

that offer the key to understanding the causes

of confiict and therefore, the possible solutions.

This phenomenon is likely to be especially

relevant in cases where radically different world

views, such as often prevail when transnational

companies and their scientific "development"

rationale alight in relatively politically and economically isolated communities in developing

countries. Recognising this phenomenon may be

a first and vital step towards reconciling the

prevailing corporate mentality with a more ecological rationale. This may in turn free the corporation to take full advantage of the feedback

loops (positive and negative) that stakeholders

provide and perhaps to value more ambiguous

and emotionally-based "perceptual truths" as

highly as rational, scientific truths.

By way of illustration we will describe the different beliefs and perceptions between the Ogoni

and Shell with respect to the environmental and

As noted above, the gainsaying of the MOSOP

charges continued until as late as January 2001

(SPDC, 2001) despite the fact that like MOSOP,

Shell also identified the underlying issues as those

of under-development and the failure to return

adequate benefits from the oil revenues for the

oil-bearing communities. Indeed, to give tbem

full credit. Shell always positioned itself as being

sympathetic to the communities on this issue.

However, following Friedmanite notions of "the

business of business" Shell sought to defer issues

such as development, resource sharing and

politics to the Nigerian state.

In addition to the general accusation of

"devastating" the Ogoni environment. Shell

stood accused of specific instances of environmental irresponsibility. These included operational

oil spills, gas fiaring, acid rain, inappropriate land

use and poor waste management practices.

Specifically, the Ogoni pointed to out-dated

equipment most of the Ogoni oil infrastruc-

306

David Wheeler et al.

ture was built in the 1960s and 1970s - which

was poorly maintained over the years and which

led to numerous spills. The company acknowledged there were environmental impacts but put

these into a wider context of development in the

Delta including a rapidly-expanding population,

over-farming, deforestation and industry (Shell

International, 1995b). Referring to the equipment problems Shell agreed that "they were

acceptable then and in line with standards of

technology then prevalent, but we would not

build them that way now" (Shell International,

1995a).

In an effort to address some of the debate

around "devastation" Shell announced its support

for the Niger Delta Environmental Survey

(NDES) process in 1995 which the company

hoped would catalogue the physical and biological diversity and natural resources of the 70 000

square kilometre delta (Shell International,

1995b). Shell's developing understanding of the

need for a more responsive approach to Nigerian

stakeholders manifested itself in this process. Shell

determined that there should be community

representation on the Survey as represented by

respected Nigerian academic Professor Claude

Ake (now deceased). Unfortunately for Shell they

decided to persist with the project for some time

even after Professor Ake resigned and the process

had lost the confidence of the communities.

Eventually Shell did withdraw from direct

involvement with the NDES - presumably

because it was failing to achieve the desired level

of stakeholder legitimacy.

Notwithstanding their good intentions it is

questionable how far scientific studies such as the

NDES are helpful in resolving such divergent

world views and clashing perceptions of the

truth. Conventional environmental impact assessments are undeniably part of a Western, rational

approach to the environment. They deliver

quantitative, scientific assessments of damage to

the environment - a conceptual approach at odds

with the communities' more emotional and

spiritual relationship with their homeland.

For the Ogoni their environment holds a

cultural and spiritual value that can only be

appreciated and felt - not measured in figures or

summarised in tables and graphs. In that respect,

conventional environmental impact assessments

may be unhelpful or distracting as they completely side-step the issue of perception and focus

on a constructed "reality". The Ogoni lived with

what they believed were dramatic changes in

their environment; first the clearing of land for

seismic testing, then the construction of well

sites, then operational pollution from gas fiares,

production waste and oil spills. These impacts

were compounded by the failure of oil exploitation to deliver real benefits to the majority of the

people. The fact that the development did benefit

an eUte within the Ogoni people was only the

cause of even greater resentment against the oil

companies and the government.

Shell's response to Ogoni perceptions said

much about their weighting of the MOSOP

view. As noted above, the company responded by

saying that the Ogoni claims were "exaggerated"

and juxtaposed this (to their mind) irrational and

emotional view with the use of rational, "scientific" evidence to refute Ogoni accusations of

environmental devastation and developmental

neglect. Naturally, these responses did nothing to

prevent their escalating international confiict

witb the Ogoni. Indeed in retrospect it probably

exacerbated the situation. The Ogoni and their

supporters became even more highly motivated

to claim, witness and prove examples of environmental damage in Ogoni - eventually through

the broadcast of television documentaries witb

titles such as " The Drilling Fields" commissioned by British television Channel 4 and by

the placing of full page advertisements in the

quality press.

How can such radically different truths be

embraced in a managerial approach to stakeholder issues, as described, for example by

Freeman (1984, 2000)? How can stakeholderresponsive practices resolve radically opposing

beliefs and perceptions that may require emotional, spiritual and other intangible (and nonmeasurable) factors being taken into account?

This leads us to our next paradox.

Paradox 2(a): Stakeholder dialogue requires

shared language and meaning. But shared

language and meaning may not be possible

when two "truths" and two world views are

Paradoxes and Dilemmas for Stakeholder Responsive Firms

opposed. Can a company give up its

"rational truths" when even the embracing

of stakeholder-responsive practices is based

on rational analysis?

Implications for engagement

Shell's first Profit and Principles report (Shell

International, 1998) publicly committed the

company to taking a more sensitive approach to

their relations with communities. Prior to that,

and indeed for several years. Shell's attempts at

re-engagement with the Ogoni did not prove

especially successful.

In a unilateral attempt to create a climate of

reconciliation, in May 1996 Shell proposed a Plan

for Action in Ogoniland. Tbe plan outlined a

number of steps towards improving the situation

in Ogoni. These included "cleaning up all oil

spills - whether or not due to sabotage - that

have happened since the company withdrew staff

in 1993, and make safe all facilities (. . .) rehabilitate its past community projects where necessary and take over their maintenance (. . .)

[and] investigate further development projects in

the area" (Shell International, 1996a).

The then Managing Director of the Shell

Petroleum Development Corporation in Nigeria

(SPDC) said "[t]hese proposals are offered in the

spirit of reconciliation. All we need to start the

process is the assurance of aU Ogoni communities that our staff can work safely in Ogoniland"

(Shell International, 1996a). Unfortunately, the

company failed to inform MOSOP of this plan

before releasing it to the press. For MOSOP

actions like these reinforced their perception of

a dismissive attitude on the part of Shell in

Nigeria towards the Ogoni. Shell countered that

it had no intention of recommencing development without the consent of the Ogoni people.

With damage of over $50 million to their

facilities, the chances of restarting significant

production - even were consent to be given were slim in any case.

SPDC claimed its engagement and support for

the communities in the wider Delta "dates back

to the 1950s and has become increasingly focused

on long term goals in partnership with the

307

communities themselves" (SPDC, 1998b). SPDC

claimed it spent more than $20 million each year

on community development in the Niger Delta

as a whole ($52 million in 1999), and formed a

new Community Programme Development Unit

in late 1997 (SPDC, 1998a, 1998b, 2000). Yet

in 1997 and 1998, Shell Nigeria recorded 150

and 325 incidents, - ranging from peaceful

invasion to violence against staff and hostage

taking - threatening the safety of staff working

on Shell field locations (SPDC, 1998c).

In Ogoni, one of the main problems identified by MOSOP was the fact that, in order to

execute planned community development. Shell

reactivated the network of Ogoni Chiefs and

contractors that local people largely saw as Shell

people. From MOSOP's perspective these were

people within the Ogoni community who had

histories of using their relationship with the

company for their own private gain often to

the detriment of the community as a whole.

This was a significant error for a company that

presented itself internationally as a practitioner of

a more sensitive and stakeholder-responsive

approach to sustainable development. The

network of "Shell Chiefs" and contractors may

have served Shell well in pre-MOSOP days when

these people represented Shell's interests within

the communities. But the level of organisation

and education within Ogoni communities by the

late 1990s made the reactivation of the network

very problematic. For many Ogoni it was a

potent symbol of the fact that in Nigeria at least

Shell had not changed.

Even more damaging for Shell than their

apparent reliance and re-mobilisation of old aUies

in the Ogoni community was their continuing,

stumbling record on engagement and community

development. Shell sponsored development

projects were associated with violence and death

as late as 1999. In that year residents in the village

of K-Dere in central Ogoni were shot and killed

and more than 15 houses were burnt down by

the Nigerian Mobile Police. This was the first

manifestation of renewed fatal violence since the

end of military rule. The village was regarded as

a focal point for the MOSOP organisation, and

was the home village of MOSOP Acting

President Ledum Mitee. Tensions increased in the

308

David Wheeler et al.

Dere area due to a pending road project, paid for

by SPDC, which many local people felt had not

faced adequate consultation, a view shared by the

Federal Senator for the area.

To give them credit. Shell in Nigeria has

recognised "the gap between its intentions and

its current performance" (SPDC, 1998c).

MOSOP and its supporters agree with this

appraisal, and point to what they see as good

evidence. For example, in its public statements

SPDC claimed that "[i]n December 1998, the

company was able to restore electricity to the

area" (Shell International, 1999). But a mission

comprising journalists and senior figures from

The Body Shop International in September

1999' found pockets of unreliable electricity

supply in Ogoni, and large areas with no, or

damaged infrastructure (Roddick and Roddick,

1999).

In a 1996 press release. Shell had announced

that "[f]ollowing talks with government health

authorities and Ogoni community leaders, the

Shell Petroleum Development Company of

Nigeria Limited (SPDC) this week takes over

responsibility for the maintenance and supply of

drugs for the Gokana general hospital, Terabor.

It will also supplement staff wages" (Shell

International, 1996b). However, three years later

The Body Shop team found the reality to be

quite different. The conditions in the hospital

were dreary:

Gokana hospital has fewer drugs than most people

in Britain keep in their bathrooms. It has no electricity and no running or hot water. The beds have

no mattresses, there are holes in the roof, the

medical records are kept on the floor (Roddick and

Roddick, 1999).

Shell admitted that "SPDC has not been able

to look after this particular hospital as well as it

would have liked" because "unlike with other

hospitals and health centres Shell supports in the

Niger Delta (. . .) Shell staff are still not welcome

in Ogoniland" (Achebe, 1999).

Furthermore, the way in which development

monies were deployed remained a cause of deep

resentment. In late 1999, villagers had accused

the company of being "parsimonious at best,

incompetent at development work, neglecting

consultation, and paternalistic" (Vidal, 1999b).

The community development projects supported

by Shell were dismissed by Ledum Mitee, Acting

President of MOSOP as "ineffective, unnecessary or just PR for the company (. . .) They

decide what is good for us. They are just wasting

resources. We have yet to see the impact of all

this spending" (Vidal, 1999b). The Ogoni

described the "continuing failure of Shell and

other multinationals to make substantive changes

to their practices in the Niger Delta" as one of

"the current areas of prime political concern for

MOSOP" (MOSOP, 1999).

Thus by early 2001, very little common

ground existed between SheU and MOSOP. Little

or no meaningful dialogue was occurring with

respect to substantive issues and many questions

remained with respect to specific commitments

made by SPDC. With Shell still persona non-grata

in Ogoni, it was entirely unclear how Shell

would keep its promise to bury all fiowlines,

renew production infrastructure, remediate oil

spills, and undertake its program of Environmental Impact Assessments and Environmental

Evaluation Reports (SPDC, 1998a).

Despite all of the corporate policies and commitments, and nearly five years of active stakeholder-responsivenss at the international level.

Shell in Nigeria had still not (by early 2001)

established either a mutual understanding of perspectives and views with the Ogoni or an ability

to engage effectively with the community. In

SPDC's submission to the Human Rights

Violations Investigation Commission or Oputa Panel

(Imomah, 2001), Shell Nigeria listed its contacts

with MOSOP and other Ogoni stakeholders over

a period of years and noted: "It can therefore be

seen, that SPDC has reached out to a broad

spectrum of leaders and organisations for reconciliation. However, these efforts have not yielded

as much result as would be expected, perhaps,

because of the multiplicity of opinion in Ogoni".

The submission concluded: "In every confiict,

no matter how deep, parties have to meet and

have dialogue. SPDC had its hand outstretched

since 1996. Our hand is still outstretched".

And so to our last paradox:

Paradoxes and Dilemmas for Stakeholder Responsive Firms

Paradox 2(b): A company that fails to establish

genuine dialogue with the community

cannot easily facilitate genuine engagement

and development in that community. But a

stakeholder group that perceives a company

to have no legitimacy may not permit

dialogue or engagement, regardless of the

potential benefits which might accrue. Both

parties may have something to gain from

dialogue but neither has the capability or

desire to create the conditions for progress.

6. Addressing the paradoxes - experience

from elsewhere

We have uncovered four paradoxes arising from

the Shell experience in Ogoni. They all relate

to the specific dilemmas of Shell and the Ogoni,

but they may have wider relevance. In summary

they involve four specific challenges: two for the

company and two "mirror challenges" for the

stakeholders:

l(a) The company's challenge in avoiding

legitimation and de-legitimation of fragmented stakeholder groups

l(b) The stakeholders' challenge in dealing

with contradictory views and attitudes

within the company

2 (a) The company's challenge in establishing

credible and inclusive dialogue in the

absence of shared understanding and

perceptions.

2(b) The stakeholders' challenge in agreeing

to dialogue in the absence of trust,

whatever the long term potential benefits

may be to the community.

We are proposing no universal solutions to the

paradoxes. But we will reflect on how these challenges have been addressed by other companies

and their stakeholders in other circumstances.

A company which has had almost as much

attention as Shell with respect to its dealing with

indigenous communities and the social and environmental performance of its subsidiary operating

units is Rio Tinto (Mulhgan, 1999). This British

based mining company has an impressive set of

policies under the strapline "global citizen, local

309

partner" which embrace health, safety and the

environment, communities, human rights, transparency, corporate governance and accountability,

business integrity, political involvement and

employment (Rio Tinto, 2001a). The company

also has a Board Committee on social and

environmental accountability comprising only

non-executive directors.

Despite these policies and structures, there are

few mining companies which have commanded

as much antipathy from labour, environmental

and community activists as Rio Tinto and its

subsidiaries (ICEM, 1999; Friends of tbe Earth,

1998; Project Underground, 2000). Controversy

has occurred in places as diverse as Indonesia,

Madagascar, South Africa, Canada and Australia

(Project Underground, 2000).

If we take Rio Tinto's policy and structures

at face value, these would seem to indicate an

attitude to stakeholders and the environment

which covered most of the territory in Carroll's

four part definition of CSR: economic, legal,

ethical and philanthropic/discretionary (Carroll,

1979, 1999). Rio Tinto's policies would also seem

to map well against the Committee for Economic

Development (1971) and Sethi (1975) three tier

models of corporate social responsibility. In this

they would be no different from Shell, whose

own policies, structures and indeed stated strategies embrace sustainable development in an

explicit way.

However, as we have argued elsewhere (Boele

et al., 2000a, b. Wheeler et al., 2000), when it

comes to strategy formulation and implementation - especially at the business unit level - there

is much room for disconnects between CSR

policy and economic and operational reality. It

is interesting to note, for example, that Rio

Tinto's stated business strategy is based entirely

on questions of economic value, competitiveness

and profitable expansion: "minerals and metals

for the world" is the company's strategic strapline

(Rio Tinto, 2001b). Shell fares somewhat better

in this comparison. The strategies of Shell's

business areas have varied in the degree of social

and environmental responsibility which is made

explicit - with upstream business units tending

to be more financially and technically driven and

downstream units being more stakeholder

310

David Wheeler et al.

responsive (Wheeler et al., 2000). Moreover, at

corporate level Shell has demonstrated a relatively

high degree of competence in the third tier of

the CSR models of the Committee for

Economic Development (1971) and Sethi (1975).

Perhaps it is the gap between corporate policy

and competence in particular subsidiary business

units which is most to blame for the troubles Rio

Tinto and Shell have experienced in particular

countries. But formal business strategy and the

hierarchy of economic, social and environmental

values must also be a factor. In this regard we

may define Rio Tinto's approach to CSR as

wholly instrumental to its economic mission and

Shell's approach as at least partially instrumental

- most especially in its upstream business units.

It is interesting to note that the WBCSD's

landmark publication on Corporate Social

Responsibility was published under the joint

names of Phil Watts and Lord Richard Holme,

key players respectively in SheU and Rio Tinto

(Watts and Holme, 1999). The two case studies

quoted earliest in the document were those of

Rio Tinto's wind down of the Kelian mine in

East Kalimantan in Indonesia and Shell's Camisea

case in Peru. The document went on to list many

other positive examples of WBCSD member

involvement in CSR. The report was also honest

enough to list some of the principal barriers to

adoption of CSR by companies. Rather

poignantly the barriers included "lack of local

management understanding of good practice",

"poorly trained managers" and "governmental

action or the demands of military regimes".

In comparison to the difficulties of Shell and

Rio Tinto in establishing universal competencies

for stakeholder- responsiveness at the local level,

some companies seem to have developed a

culture where this is taken for granted. Like Shell

and Rio Tinto, Canadian oil and gas company

Suncor and international oil and gas major BP

have placed sustainability and stakeholder inclusion firmly within their corporate policies and

strategies. But unlike Shell and Rio Tinto's

experience in certain parts of the world, these

companies seem to have been able to generate a

greater level of community confidence where

they operate and seem to benefit from a higher

level of acceptance for their developments.

Suncor's very rapid securing of permission to

develop oil sands exploitation in Alberta

(McKague et al., 2001) and BP's securing of

exploration rights in Alaska with the support of

civic leaders and community groups (BP, 2001),

demonstrate the point. Throughout the 1990s

these companies also enjoyed a much higher level

of respect with the NGO community (Arnold,

2000).

Of course social capital (as defined by

Nahapiet and Ghoshal, 1998), requires maintenance if it is to avoid erosion. For example, BP's

difficulties in Colombia in the late 1990s and its

subsequent investment in PetroChina strained

relations with human rights campaigners - particularly those with a focus on Tibet or Sudan

(Milarepa Fund and Project Underground, 2000).

Alongside Canadian oil company Talisman

(which had already received significant crtiticism

for its activities in Sudan), PetroChina's presence

in Sudan led to urgent calls for withdrawal and

disinvestment by BP in PetroChina in March

2001 (Christian Aid, 2001). One interpretation

of the more recent difficulties of BP might be

that they have become over-confident in their

reliance on a universal licence to operate in difficult parts of the world. Thus BP has stretched

their stakeholder relations to such a degree that

the company has re-introduced risk. Another

interpretation could be a shift in corporate

strategy whereby licence to operate is taken for

granted and less importance is accorded to the

care and maintenance of social capital.

The question we must pose is why Suncor (to

date) and BP (throughout the 1990s) have been

able to generate positive stakeholder relations

relatively easily and why has it appeared to be so

much harder for companies like Shell and Rio

Tinto?

In our view this is likely to be based on a

number of inter-related factors. Three of those

factors seem to be:

(i)

The absence of a strategy or defining crisis

which confirm the corporation as an

entity which asserts or demonstrates the

primacy of conventional economic motivation

and/or

stakeholder-exclusive

behaviours. Despite the controversies

Paradoxes and Dilemmas for Stakeholder Responsive Firms

around BP's activities in Colombia and

their aggressive pursuit of new hydrocarbon reserves in Alaska and elsewhere,

they did not seem to generate anything

like the level of labour, NGO and community antipathy which attached to Shell

and Rio Tinto during the 1990s. In early

2001 it remained to be seen whether BP's

involvement with PetroChina's adventures

in Tibet and Sudan would emerge as a

defining (and damaging) crisis for that

company.

(ii) The ability of the corporation to navigate com-

plexity, to span boundaries within and

between the firm and to deal with the

sorts of paradoxes which we have explored

in this article. Thus even when problems

arose for BP in Colombia and Alaska in

the 1990s, there were attitudes and competencies in place, an assumed level of

respect and humility, a bank of social

capital (ie relational attributes) to draw on,

and space for dialogue based on perceived

potential commonality of interests.

(iii) The ability of leaderships to establish a con-

sistent tone for stakeholder-responsive

dialogue within the organisation, balancing economic and social obligations

effectively at multiple levels. This links

directly to the issue of integrity and consistency in strategy and implementation of

CSR. BP's Sir John Browne and Suncor's

Rick George modelled this behaviour

throughout the 1990s.

These three factors are all highly relevant to

effective development of the second and third

tiers of corporate social responsibility described

by the Committee on Economic Development

(1971) and Sethi (1975). As we noted earlier,

those are the tiers relating to the ability of the

firm to recognise and internalise societal expectations and to engage with external stakeholders

on issues and concerns. They also relate strongly

to Carroll's categories of ethical and philanthropic/discretionary CSR.

We have explored the first of these factors at

some length in this article in tbe context of

Shell's difficulties in Nigeria. Corporate strategy

311

is determined by the firm but "defining crises"

may be somewhat random and event-dependent

factors yvhich may or may not be wholly within

the capacity of the firm to contain or control.

The second is about developing organisational

competencies (or capabilities) and the third is

about leadership integrity - two factors which

firms certainly can do something about.

Sanjay Sharma (2001) identified a number of

organisational capabilities which he postulated

were required to deliver effective "stakeholder

integration" i.e. "the ability to establish trustbased collaborative relationships -with a wide

variety of stakeholders - especially those with

non-economic goals" (Sharma and Vredenburg,

1998). The principal capabiHties were: boundary

spanning, higher-order learning and a commitment to sustainability. He linked these capabilities to the way in which stakeholders exert

influence eg through collaborative or adversarial

relations and to the way in which corporations

may achieve competitive outcomes such as the

building of social capital (as defined by Nahapiet

and Ghoshal, 1998), "competitive imagination"

(as defined by Hamel and Prahalad, 1991), lower

costs and differentiation.

Of particular interest to this case is the capability for boundary spanning. As we have seen,

the evidence is that at corporate, strategic level

Shell has established growing competence in the

areas of higher order learning and committing

to sustainability. We have insufficient evidence to

comment on whether in Nigeria SPDC has now

made a serious commitment to sustainability or

whether they are now capable of higher order

learning (although judging by the content of

their public declarations, sensitivity and humility

has not been a hallmark). But it is arguable that

whilst Shell International has employed staff

who can span the boundaries of the firm and

establish more trust-based relations with key

stakeholders, SPDC (Shell Nigeria) has either

chosen not to do this or has attempted to do so

and the boundary spanners have failed.

On the third factor (leadership integrity),

Sergio Sciarelli (1999) has proposed a useful

model describing how business leaders may

achieve "prestige" for themselves and their

corporations through effective navigation of

312

David Wheeler et al.

economic and ethical values. SciareUi argues that

business leaders who achieve prestige follow a

path where profit, power and prestige are

achieved sequentially, with economic values

dominating earlier and ethical values later in the

progression. If we apply this model to BP and

Suncor, there is little question that this sequence

was followed effectively by strong CEOs in both

companies throughout the 1990s.

With his landmark Stanford speech on chmate

change and successive speeches on human rights

and the corporate social responsibility of business.

Sir John Browne of BP achieved "first mover"

status and clear differentiation for his leadership

on sustainability and CSR. In our experience,

despite significant concerns over BP's activities in

Colombia and Alaska, NGOs and other opinion

formers continued to be impressed by Browne's

dynamism and the expectations this created in his

company. In many ways, Browne seemed to

allow little room for ambiguity on CSR performance - at least until the PetroChina issue

emerged.

Similarly Rick George, CEO of Suncor in

Canada allows little room for doubt on his

personal commitment to sustainability and CSR

based on the speeches he makes and the expectations he creates for his managers and employees

(McKague et al., 2001).

Other companies in extractive industries have

CEOs with similar vision and stakeholderresponsive commitments. In addressing an

international ethics conference held in Ottawa in

2000, the President and CEO of Placer Dome

Jay Taylor articulated the need for partnership

with NGOs and other civil society groups

bringing competencies into his company that

they did not possess. Taylor elaborated on the

twin philosophical notions of "do no harm" and

"do as much good as possible" and he summarised the "ethical question" for his company

in Canada and elsewhere as "how to balance the

considerable infiuence we can wield in these

countries with a necessary respect for local

culture" (Taylor, 2000).

There is no question, in our view, of the

sincerity of the statements of Mark MoodyStuart (Chairman of Shell's Committee of

Managing Directors until mid-2001) on issues

such as sustainability and stakebolder- responsiveness (Moody-Stuart et al., 1998; MoodyStuart, 1999). As we have noted, at the corporate

level Shell International has well articulated

strategies, systems and processes to describe their

commitment to sustainability and corporate social

responsibihty (Wheeler et al., 2000). But for

some reason Shell has not fared as well in

reputational terms with NGOs and opinionformers as BP (Arnold, 2000) and the issue of

Nigeria remains a seemingly intractable challenge. It seems to us that the lack of consistency

between corporate leadership and strategy (in

London and the Hague) and local leadership and

operational behaviour (in Nigeria) is a major part

of the problem.

Interestingly, there are cases in the natural

resources sector where boundary spanning and

leadership questions have been addressed simultaneously with remarkable results. Boutilier and

Svendsen (forthcoming) have described how after

several years of bitter confiict with non-governmental organisations and first nations groups,

forestry company MacMillan Bloedel (since

bought by Weyerhaeuser) renounced clearcutting

on Vancouver Island and even formed a joint

venture company with its former adversaries in

Clayoquot Sound. The company appointed a

new CEO who immediately announced his

intention for MacMillan Bloedel to eliminate

antagonism with stakeholders and instead become

the safest, most respected, and most profitable

forest company in Canada. These breakthroughs

occurred almost entirely as a result of effective

boundary spanning by individuals representing

the protagonists and the subsequent integrity of

leadership pronouncements and behaviours.

In contrast to the MacMillan Bloedel story, it

is clear that SheU Nigeria has been permitted to

continue using defensive and non-conciliatory

language on its corporate web site. And the

evidence the company gave to the Oputa panel

hearings in Port Harcourt in early 2001 was

abrasive and unhelpful. Thus however many good

things may be happening in London and the

Hague and in other parts of Shell's international

operations, the continued flawed implementation

of Shell's approach to CSR and stakeholderresponsiveness in a Nigerian context continued

Paradoxes and Dilemmas for Stakeholder Responsive Firms

to undermine the company's credibihty and call

into question the integrity of its leadership and

corporate strategy. Most damaging of all for Shell

globally, the continued under-performance of

Shell Nigeria in stakeholder-responsiveness

demonstrated that at least in one part of Shell's

global operations:

(i)

it was permissable to continue to play the

game of legitimation and de-legitimation

of stakeholders (paradox la);

(ii) it was permissable to perpetuate debates

arising from an absence of shared language

and perceptions (paradox 2a);

(iii) the combination of past events (defining

crisis) and evident lack of competencies

on the ground (to navigate complexity

and deal with paradox) was allowed to

foster confiictive rather than conciliatory

relations with stakeholders;

(iv) the integrity and consistency of the corporation's global strategy and performance

on sustainability, CSR and stakeholderresponsiveness was permitted to be put at

risk; and therefore, it may be postulated

that.

Given the size of the investment Shell has made

in its corporate repositioning since 1995, the

tolerance of this risk only be permitted for

reasons of significant institutional blockage

and/or some higher purpose/organisational

imperative.

313

International (1999). In many ways, at the corporate level SheU is now a model company with

respect to the concepts of CSR advocated by

Committee on Economic Development (1971),

Sethi (1975) and Carroll (1979). At the corporate level, and indeed in a number of key business

units (May et al., 1999), SheU has developed and

continues to operate a comprehensive and leading

edge approach to CSR and stakeholder-responsiveness.

But for the Ogoni, the exploitation of oil in

their homeland - and their subsequent introduction into a global economic system has left

them struggling to make sense of SheU's approach

to CSR as it has impacted on them. The Ogoni

feel that oil exploitation without sufficient regard

for the environment and local customs may well

be beneficial for the economic growth of Nigeria

as a whole but it has done little or nothing to

improve the quality of life for the local communities who live above the oil reserves.

Have the Ogoni been unreasonable in tbeir