Professional Documents

Culture Documents

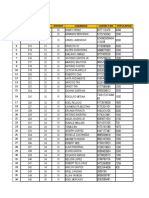

The Standard - Business Daily Stocks Review (May 6, 2015)

Uploaded by

Manila Standard TodayCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

The Standard - Business Daily Stocks Review (May 6, 2015)

Uploaded by

Manila Standard TodayCopyright:

MST Business Daily Stocks Review

Wednesday, May 6, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

7.88

75.3

124.4

104

63

4.2

18.48

31.6

9.5

890

1.01

99.4

1.46

30.5

75

94.95

137

361.2

59

174.8

1700

127.9

2.5

66

84.6

84.5

45.8

2.03

12.02

23.55

6.3

625

0.225

78

0.9

18.02

58

76.5

95

276

45

107.6

1200

66

AG Finance

8

Asia United Bank

70.9

Banco de Oro Unibank Inc. 112.50

Bank of PI

102.90

China Bank

46

Bright Kindle Resources 2.04

COL Financial

15.38

Eastwest Bank

22.15

Filipino Fund Inc.

7.40

Manulife Fin. Corp.

792.00

MEDCO Holdings

0.490

Metrobank

93.65

Natl. Reinsurance Corp. 0.98

PB Bank

18.20

Phil Bank of Comm

31.50

Phil. National Bank

76.90

Phil. Savings Bank

94

PSE Inc.

319

RCBC `A

45

Security Bank

167.1

Sun Life Financial

1420.00

Union Bank

66.50

FINANCIAL

7.99

7.85

70.85

69.5

112.50 110.10

102.80 100.50

46

45.55

2.10

2.03

15.38

14.9

22.2

22.05

7.40

7.40

785.00 781.00

0.455

0.455

94.4

93.3

1.09

0.97

18.24

18.24

30.65

30.60

76.60

76.30

93.5

93.5

319

315

45.45

45

167.1

166.1

1420.00 1410.00

66.90

66.80

INDUSTRIAL

43.6

43.3

1.09

1.06

2.1

2.08

11.32

11.3

66

54.4

19.7

19.42

67.5

55

27.85

25

63.2

62

2.48

2.32

1.86

1.77

13.2

12.9

20.850 20.3

11.50

11.38

8.34

8.01

10.50

10.20

1.85

1.81

15.22

14

28.75

28.25

94.6

93.4

14.30

14.30

0.4200 0.4200

14.20

14.20

6.2

6.02

211.00 207.00

10.26

10.12

36.65

34.00

2.79

2.52

52.10

51.95

24.7

24.45

28

27.2

7.780

7.670

264.00 262.00

4.28

4.26

9.98

9.80

4.71

4.1

11.60

11.58

4.00

3.96

2.34

2.22

2.38

2.26

5.11

5.10

1.95

1.91

6.39

6.39

195.9

193

4.2

4.2

1.7

1.62

0.165

0.162

1.37

1.37

2.30

2.22

221.6

213.6

0.72

0.7

20.80

20.50

1.40

1.35

HOLDING FIRMS

0.470

0.465

57.50

57.00

25.65

24.90

1.30

1.30

7.10

6.99

0.325

0.295

0.32

0.3

813

790

8.26

8.19

15.06

14.86

3.5

3.5

3.79

3.5

0.285

0.275

1330

1305

6.41

6.39

74.00

72.85

5.25

4.7

6.5

5.5

7.2

5.99

8.94

8.8

0.74

0.72

15.7

15

0.67

0.65

4.59

4.53

5.05

5

0.0390 0.0380

1.440

1.440

1.170

1.120

2.42

2.42

68.00

67.15

926.00 905.00

1.21

1.21

263.20 252.40

98.00

98.00

0.3800 0.3750

0.2450 0.2400

PROPERTY

8.880

8.710

0.77

0.72

40.30

39.80

4.18

4.13

5.2

5.1

6.45

5.75

Net Foreign

Change Volume

Trade/Buying

7.93

70.5

111.00

102.00

46

2.10

15.3

22.05

7.40

785.00

0.455

94.4

1.07

18.24

30.60

76.40

93.5

318

45.05

167

1410.00

66.90

-0.88

-0.56

-1.33

-0.87

0.00

2.94

-0.52

-0.45

0.00

-0.88

-7.14

0.80

9.18

0.22

-2.86

-0.65

-0.53

-0.31

0.11

-0.06

-0.70

0.60

22,600

64,240

3,645,310

3,944,610

34,300

395,000

32,700

72,500

16,300

640

100,000

4,935,680

4,090,000

3,000

1,800

41,120

1,000

43,900

267,000

282,970

240

2,020

43.6

1.08

2.09

11.3

63.5

19.62

67.5

26.95

63

2.38

1.77

12.9

20.700

11.48

8.16

10.50

1.85

15.14

28.55

94

14.30

0.4200

14.20

6.19

209.00

10.2

34.00

2.78

52.10

24.65

28

7.700

263.00

4.27

9.90

4.71

11.60

4.00

2.24

2.34

5.10

1.91

6.39

194.9

4.2

1.66

0.162

1.37

2.22

218

0.7

20.50

1.36

-0.11

0.00

0.00

-0.70

31.20

0.93

50.00

-3.23

0.00

-2.06

-4.84

-1.98

0.49

0.00

-2.51

2.94

2.78

-0.26

-0.70

-0.63

0.00

-1.18

1.43

0.32

-0.95

0.00

-2.86

2.96

0.19

0.00

1.63

-0.90

-0.23

0.00

1.02

4.67

0.00

0.00

-3.86

-2.50

0.00

-0.52

6.50

-0.56

1.20

-3.49

-2.41

0.00

-0.89

-1.27

-2.78

-2.84

0.74

2,433,800

1,374,000

577,000

2,500

3,100

91,700

1,100

174,200

135,620

9,442,000

317,000

162,500

3,434,200

394,500

25,464,100

3,232,700

20,000

134,000

2,719,700

440,810

10,300

150,000

1,800

177,600

477,890

438,000

1,100

19,000

5,580

3,256,000

169,200

108,400

295,730

13,890,000

1,992,500

3,000

7,200

135,000

3,086,000

535,000

313,900

87,000

1,500

124,920

2,000

999,000

2,310,000

17,000

4,446,000

1,763,490

3,427,000

5,400

85,000

0.470

57.50

25.10

1.30

7.10

0.310

0.31

812

8.24

14.98

3.5

3.79

0.285

1320

6.40

73.55

4.8

6.5

7.2

8.89

0.73

15.54

0.67

4.56

5.05

0.0380

1.440

1.160

2.42

67.25

910.50

1.21

252.40

98.00

0.3800

0.2440

0.00

0.35

-2.14

1.56

1.43

1.64

1.64

1.37

0.49

-0.66

11.11

0.00

1.79

0.38

0.16

-0.61

-4.00

25.97

50.00

-0.11

2.82

3.60

1.52

0.44

-0.98

-2.56

0.70

2.65

0.00

-0.22

-1.57

-2.42

-4.18

-0.51

1.33

1.67

10,000

778,200

9,920,800

10,000

30,400

93,630,000

6,970,000

559,430

1,045,200

7,015,200

2,000

24,000

690,000

213,090

375,800

1,302,640

17,200

26,100

9,000

1,239,400

66,000

9,529,400

86,000

32,333,000

100,000

2,600,000

12,000

5,194,000

3,000

139,070

809,820

1,000

130

4,630

2,020,000

480,000

8.880

0.72

40.00

4.14

5.2

6.45

0.34

-4.00

-1.11

-0.72

-0.57

-0.77

236,500

1,559,023.00

2,112,000

4,883,800 -67,332,190.00

5,605,000 19,547,330.00

43,900

100,200

1,705,550.00

-132,745,395.00

-97,586,575.00

-228,950.00

137,550.00

-187,875.00

486,695.00

-1,921,507.00

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

7.1

1.54

1.97

0.201

0.98

1.09

0.305

2.25

1.87

1.8

5.73

0.180

0.470

0.72

27

8.54

31.8

2.29

3.6

20.6

1.02

1.96

8.59

4.6

0.89

1.1

0.083

0.445

0.85

0.188

1.4

1.42

1.19

4.13

0.090

0.325

0.39

23

2.57

21.35

1.64

3.08

15.08

0.69

1

5.69

Cebu Prop. `B

6.49

Century Property

0.9

City & Land Dev.

1.22

Crown Equities Inc.

0.156

Cyber Bay Corp.

0.465

Empire East Land

0.860

Ever Gotesco

0.183

Global-Estate

1.38

Filinvest Land,Inc.

1.94

Interport `A

1.40

Megaworld

5.42

MRC Allied Ind.

0.122

Phil. Estates Corp.

0.3400

Phil. Realty `A

0.5000

Phil. Tob. Flue Cur & Redry 25.00

Primex Corp.

7.01

Robinsons Land `B

29.35

Rockwell

1.76

Shang Properties Inc.

3.30

SM Prime Holdings

19.90

Sta. Lucia Land Inc.

0.76

Suntrust Home Dev. Inc. 1.000

Vista Land & Lifescapes 7.520

Net Foreign

Change Volume

Trade/Buying

6

6

6

0.91

0.89

0.9

1.24

1.24

1.24

0.162

0.155

0.158

0.470

0.460

0.470

0.860

0.860

0.860

0.185

0.182

0.182

1.40

1.39

1.40

1.93

1.90

1.91

1.44

1.40

1.40

5.45

5.33

5.45

0.127

0.121

0.125

0.3400 0.3300

0.3300

0.5000 0.5000

0.5000

37.50

32.80

37.50

7.24

7.08

7.2

29.50

29.35

29.40

1.76

1.75

1.76

3.30

3.30

3.30

19.86

19.54

19.60

0.77

0.75

0.77

1.000

1.000

1.000

7.630

7.520

7.540

SERVICES

1.97 2GO Group

6.5

6.5

6.35

6.5

32.5 ABS-CBN

62.2

62.35

62

62

0.6

APC Group, Inc.

0.680

0.690

0.670

0.680

10

Asian Terminals Inc.

13.54

13.98

13.52

13.98

9.61 Bloomberry

11.70

11.80

11.54

11.68

0.0770 Boulevard Holdings

0.1020

0.1020 0.1010

0.1010

2.95 Calata Corp.

4.9

4.95

4.64

4.77

46.55 Cebu Air Inc. (5J)

87

87.5

86.1

86.25

10.14 Centro Esc. Univ.

10

10

10

10

1.6

Discovery World

1.7

1.7

1.7

1.7

5.88 DFNN Inc.

7.18

7.18

7.09

7.10

2.58 Easy Call Common

3.30

2.98

2.98

2.98

1600 Globe Telecom

2212

2230

2180

2230

5.95 GMA Network Inc.

6.27

6.27

6.20

6.24

30

Grand Plaza Hotel

45.90

46.90

32.00

39.00

1.36 Harbor Star

1.43

1.43

1.40

1.42

105 I.C.T.S.I.

111

111.3

110

111

3.01 Imperial Res. `A

6.55

7.58

7.00

7.00

8.72 IPeople Inc. `A

12.4

12.42

12.4

12.4

0.012 IP E-Game Ventures Inc. 0.014

0.014

0.013

0.014

0.036 Island Info

0.232

0.234

0.228

0.229

1.200 ISM Communications

1.2500

1.2800 1.2600

1.2800

2.34 Jackstones

2.6

2.5

2.43

2.43

6.5

Leisure & Resorts

9.55

9.60

9.45

9.47

1.69 Liberty Telecom

2.04

2.09

2.04

2.09

1.1

Lorenzo Shipping

1.26

1.29

1.27

1.27

2

Macroasia Corp.

2.19

2.18

2.18

2.18

1.05 Manila Broadcasting

30.35

45.50

45.50

45.50

8.7

Melco Crown

9.05

9.1

8.95

8.95

0.34 MG Holdings

0.370

0.365

0.355

0.355

14.54 Pacific Online Sys. Corp. 18.44

18.42

18.42

18.42

3

PAL Holdings Inc.

5.10

5.10

4.70

4.94

2.28 Paxys Inc.

2.99

3

3

3

79

Phil. Seven Corp.

139.00

185.00 128.00

140.00

4.39 Philweb.Com Inc.

14.74

14.74

14.60

14.74

2726 PLDT Common

2884.00

2886.00 2848.00

2868.00

0.380 PremiereHorizon

0.610

0.640

0.620

0.630

0.32 Premium Leisure

1.660

1.680

1.600

1.610

31.45 Puregold

40.30

41.10

39.85

40.90

60.55 Robinsons RTL

85.90

86.95

85.90

85.90

7.59 SSI Group

10.72

10.72

10.42

10.72

0.63 STI Holdings

0.66

0.68

0.66

0.67

6.45 Travellers

6.8

6.79

6.71

6.79

0.305 Waterfront Phils.

0.340

0.345

0.340

0.345

1.04 Yehey

1.300

1.290

1.290

1.290

MINING & OIL

0.0043 Abra Mining

0.0053

0.0053 0.0052

0.0053

1.72 Apex `A

2.60

3.12

2.72

3.10

8.65 Atlas Cons. `A

8.00

8.12

8.01

8.05

9.43 Atok-Big Wedge `A

15.00

15.00

15.00

15.00

0.236 Basic Energy Corp.

0.265

0.260

0.255

0.260

6.5

Benguet Corp `A

6.7000

6.7000 6.7000

6.7000

6.98 Benguet Corp `B

6.8000

6.8000 6.8000

6.8000

0.61 Century Peak Metals Hldgs 1.04

1.05

1.03

1.03

0.78 Coal Asia

0.9

0.9

0.87

0.9

5.99 Dizon

7.68

7.90

7.68

7.70

1.08 Ferronickel

1.87

1.94

1.88

1.93

0.330 Geograce Res. Phil. Inc. 0.350

0.370

0.350

0.350

0.2130 Lepanto `A

0.233

0.234

0.232

0.232

0.2160 Lepanto `B

0.235

0.238

0.235

0.238

0.014 Manila Mining `A

0.0140

0.0140 0.0140

0.0140

0.014 Manila Mining `B

0.0150

0.0140 0.0140

0.0140

3.660 Marcventures Hldgs., Inc. 4.2

4.56

4.25

4.54

20.2 Nickelasia

24.2

26.9

24.7

26.6

2.11 Nihao Mineral Resources 3.83

3.98

3.86

3.97

0.365 Omico

0.7100

0.7200 0.7100

0.7200

1.54 Oriental Peninsula Res. 2.200

2.260

2.150

2.180

0.012 Oriental Pet. `A

0.0130

0.0130 0.0120

0.0130

0.013 Oriental Pet. `B

0.0140

0.0130 0.0130

0.0130

5.4

Petroenergy Res. Corp. 4.50

4.50

4.45

4.48

7.26 Philex `A

7.15

7.2

7.06

7.08

2.27 PhilexPetroleum

1.67

1.73

1.59

1.6

0.015 Philodrill Corp. `A

0.016

0.016

0.015

0.016

115.9 Semirara Corp.

164.50

165.50 16.50

163.50

3.67 TA Petroleum

5.7

6.31

5.7

5.8

0.0100 United Paragon

0.0100

0.0110 0.0100

0.0100

PREFERRED

33

ABS-CBN Holdings Corp. 65

65

62.7

65

500 Ayala Corp. Pref B2

525

525

525

525

480 GLOBE PREF P

511

511

511

511

5.88 GMA Holdings Inc.

6.2

6

5.98

5.98

6.5

Leisure and Resort

1.09

1.09

1.09

1.09

997 PCOR-Preferred A

1066

1067

1060

1060

1011 PF Pref 2

1045

1045

1043

1045

74.2 SMC Preferred A

76.1

76.2

75.95

76.2

74.5 SMC Preferred B

83.95

84

83.95

84

75

SMC Preferred C

85

85.9

85.2

85.9

WARRANTS & BONDS

0.8900 LR Warrant

4.300

4.300

4.190

4.200

SME

2.4

Double Dragon

9.2

9.59

9.1

9.5

3.5

Makati Fin. Corp.

8

8.44

8.4

8.42

13.5 IRipple E-Business Intl 75.9

75

73.5

75

5.95 Xurpas

9.3

9.29

9.12

9.23

EXCHANGE TRADED FUNDS

105.6 First Metro ETF

128.9

129.2

127.6

127.9

-7.55

0.00

1.64

1.28

1.08

0.00

-0.55

1.45

-1.55

0.00

0.55

2.46

-2.94

0.00

50.00

2.71

0.17

0.00

0.00

-1.51

1.32

0.00

0.27

451,000

2,828,000

15,000

23,430,000

1,160,000

1,000

460,000

314,000

16,495,000

42,000

11,209,100

3,890,000

1,210,000

1,717,000

47,600

103,200

1,112,200

390,000

54,000

32,406,500

1,203,000

67,000

3,514,600

-306,000.00

-1,888,160.00

0.00

-0.32

0.00

3.25

-0.17

-0.98

-2.65

-0.86

0.00

0.00

-1.11

-9.70

0.81

-0.48

-15.03

-0.70

0.00

6.87

0.00

0.00

-1.29

2.40

-6.54

-0.84

2.45

0.79

-0.46

49.92

-1.10

-4.05

-0.11

-3.14

0.33

0.72

0.00

-0.55

3.28

-3.01

1.49

0.00

0.00

1.52

-0.15

1.47

-0.77

198,900

10,470

138,000

294,100

-581,434.00

17,976,700 -3,859,226.00

15,820,000

694,000

23,650.00

182,510

-783,539.00

7,700

50,000

28,900.00

106,900

1,000

124,570

-89,629,050.00

42,900

19,300

393,000

112,800.00

862,680

4,090,531.00

2,800

3,700

106,900,000 52,000.00

7,180,000

67,000

22,000

1,725,400 14,474,932.00

11,000

20,000

2,000

23,000

3,598,500 -3,144,146.00

300,000

1,000

19,700

20,000

20,320

87,364.00

88,600

270,976.00

104,400

-54,215,940.00

14,125,000 10.00

7,711,000 -168,320.00

4,291,800 -35,393,790.00

309,230

514,806.00

2,734,800 10,498,042.00

1,393,000 -105,840.00

568,600

569,120.00

50,000

11,000

0.00

19.23

0.63

0.00

-1.89

0.00

0.00

-0.96

0.00

0.26

3.21

0.00

-0.43

1.28

0.00

-6.67

8.10

9.92

3.66

1.41

-0.91

0.00

-7.14

-0.44

-0.98

-4.19

0.00

-0.61

1.75

0.00

46,000,000

816,000

592,900

3,100

1,550,000

800

20,000

433,000

494,000

1,400

20,882,000

1,200,000

1,640,000

700,000

200,000

200,000

979,000

14,233,900

8,133,000

473,000

1,210,000

5,100,000

700,000

107,000

135,900

1,862,000

48,500,000

1,081,200

3,004,300

24,100,000

0.00

0.00

0.00

-3.55

0.00

-0.56

0.00

0.13

0.06

1.06

173,360

4,740

500

63,000

100,000

1,400

100

218,190

8,870

24,850

-2.33

333,000

3.26

5.25

-1.19

-0.75

4,339,700

700

400

520,400

-0.78

12,030

-207,860.00

4,700.00

-4,030,200.00

6,664,532.00

MST

47

35.6 Aboitiz Power Corp.

43.65

1.66

1.04 Alliance Tuna Intl Inc.

1.08

2.36

1.41 Alsons Cons.

2.09

15.3

7.92 Asiabest Group

11.38

113

40.3 Bogo Medelin

48.4

20.6

14.6 Century Food

19.44

85

20.2 Conc. Aggr. A

45

32

10.08 Cirtek Holdings (Chips) 27.85

65.8

29.15 Concepcion

63

Crown Asia

2.43

4.57

1.04 Da Vinci Capital

1.86

23.35

10.72 Del Monte

13.16

21.6

8.44 DNL Industries Inc.

20.600

12.98

9.79 Emperador

11.48

9.13

5.43 Energy Devt. Corp. (EDC) 8.37

12.34

9.54 EEI

10.20

2.89

1.06 Euro-Med Lab

1.8

17

8.61 Federal Res. Inv. Group 15.18

31.8

18.06 First Gen Corp.

28.75

109

67.9 First Holdings A

94.6

20.75

14

Ginebra San Miguel Inc. 14.30

0.820

0.0076 Greenergy

0.4250

15.3

13.24 Holcim Philippines Inc. 14.00

9.4

3.12 Integ. Micro-Electronics 6.17

241

168 Jollibee Foods Corp.

211.00

12.5

8.65 Lafarge Rep

10.2

79

34.1 Liberty Flour

35.00

3.95

2.3

LMG Chemicals

2.7

45.45

16

Macay Holdings

52.00

33.9

24.4 Manila Water Co. Inc.

24.65

90

16.2 Maxs Group

27.55

13.98

7.62 Megawide

7.770

292.4

250.2 Mla. Elect. Co `A

263.60

5.25

3.87 Pepsi-Cola Products Phil. 4.27

13.04

9

Petron Corporation

9.80

6.8

3.7

Phil H2O

4.5

14.5

9.94 Phinma Corporation

11.60

7.03

3.03 Phoenix Petroleum Phils. 4.00

3.4

2.22 Phoenix Semiconductor 2.33

4.5

1

Pryce Corp. `A

2.4

6.68

4.72 RFM Corporation

5.10

7.86

1.65 Roxas and Co.

1.92

8.1

6

Roxas Holdings

6

253

201.6 San MiguelPure Foods `B 196

5.5

4.1

SPC Power Corp.

4.15

3.28

1.67 Splash Corporation

1.72

0.315

0.122 Swift Foods, Inc.

0.166

2.5

1.02 TKC Steel Corp.

1.37

2.68

2.01 Trans-Asia Oil

2.24

226.6

143.4 Universal Robina

220.8

1.3

0.670 Vitarich Corp.

0.72

26

9.01 Vivant Corp.

21.10

2.17

1.39 Vulcan Indl.

1.35

0.7

59.2

31.85

2.16

7.39

3.4

3.35

800

11.06

84

3.35

3.68

0.66

1380

6.68

72.6

8.9

5.29

6.66

9.25

0.9

18.9

0.73

5.53

6.55

0.0670

2.31

0.84

2.99

87

934

2.2

390

156

0.710

0.435

0.45

48.1

20.85

1.6

6.62

1.4

1.6

600

7.390

14.18

2.6

1.15

0.144

818

5.3

46.6

4.96

3

3.52

4.43

0.59

12

0.580

4.22

4.5

0.036

1.23

0.450

2.26

66.7

709.5

1.13

170

85.2

0.200

0.173

Abacus Cons. `A

0.470

Aboitiz Equity

57.30

Alliance Global Inc.

25.65

Anglo Holdings A

1.28

Anscor `A

7.00

ATN Holdings A

0.305

ATN Holdings B

0.31

Ayala Corp `A

801

Cosco Capital

8.2

DMCI Holdings

15.08

F&J Prince A

3.15

F&J Prince B

3.79

Forum Pacific

0.280

GT Capital

1315

House of Inv.

6.39

JG Summit Holdings

74.00

Jolliville Holdings

5

Keppel Holdings `A

5.16

Keppel Holdings `B

4.8

Lopez Holdings Corp.

8.9

Lodestar Invt. Holdg.Corp. 0.71

LT Group

15

Mabuhay Holdings `A

0.66

Metro Pacific Inv. Corp. 4.54

Minerales Industrias Corp. 5.1

Pacifica `A

0.0390

Prime Media Hldg

1.430

Prime Orion

1.130

Republic Glass A

2.42

San Miguel Corp `A

67.40

SM Investments Inc.

925.00

Solid Group Inc.

1.24

Transgrid

263.40

Top Frontier

98.50

Unioil Res. & Hldgs

0.3750

Wellex Industries

0.2400

10.5

1.99

40

6.15

5.4

5.6

6.01

0.91

29.1

4.1

4.96

2.8

8990 HLDG

A. Brown Co., Inc.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Cebu Prop. `A

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

19,468,136

88,902,645

177,605,072

135,320,337

188,930,336

187,595,340

802,695,169

8.850

0.75

40.45

4.17

5.23

6.5

-1,810,849.00

4,622,360.00

-1,175,030.00

12,226,083.00

29,240,105.00

-53,500.00

-198,550.00

542,888.00

405,290.00

-14,092,360.00

-2,970,750.00

-71,394,113.00

1,441,838.00

-994,200.00

-8,204,935.50

16,800.00

12,200.00

-17,971,402.00

-1,805,696.00

-9,428,210.00

-680,075.00

-544,369.00

-28,656,908.00

-700,260.00

19,970.00

-4,595,350.00

1,068,163.00

-23,756,278.00

-111,920.00

11,100.00

-25,164,692.00

1,248,000.00

-1,830,079.50

3,314,995.00

-170,800.00

899,900.00

199,614,990.00

-382,363.00

-35,217,352.00

40,647,865.00

620,410.00

15,464,549.50

2,172,780.00

3,948,886.00

-50,485,330.00

20,600.00

-1,583,095.00

-380,091,535.00

10.5

66

1.09

12.46

15.82

0.1460

4.61

99.1

12.3

2.6

9

4

2090

8.41

33

1.97

119.5

7

12.5

0.017

0.8200

2.2800

5.93

12.28

2.85

2.2

3.2

5.9

15.2

0.62

22.8

6.41

4

110.2

14

3486

0.710

2.28

48.5

90.1

11.6

0.87

10.2

0.490

1.6

0.0098

5.45

17.24

25

0.330

12.7

12.8

1.2

1.73

10.98

4.2

0.48

0.455

0.475

0.023

0.026

8.2

49.2

4.27

1.030

3.06

0.020

0.021

7.67

12.88

10.42

0.040

420

9

0.016

70

525

515

8.21

12.28

1060

1047

76.9

78.95

84.8

6.98

10.96

15

88

12.88

130.7

T op G ainers

VALUE

1,513,495,628.22

1,368,297,182.454

2,354,472,372.60

1,136,356,659.48

1,234,902,483.60

753,898,341.031

8,408,614,402.983

STOCKS

FINANCIAL

1,796.50 (DOWN) 7.71

INDUSTRIAL

12,428.12 (DOWN) 95.89

HOLDING FIRMS

7,038.45 (DOWN) 24.17

PROPERTY

3,202.20 (DOWN) 27.90

SERVICES

2,152.39 (DOWN) 4.50

MINING & OIL

15,483.16 (UP) 284.54

PSEI

7,873.64 (DOWN) 45.57

All Shares Index

4,541.98 (DOWN) 10.25

Gainers: 82; Losers: 99; Unchanged: 50; Total: 131

9,137,135.00

379,750.00

4,304,184.00

-3,635,498.00

-541,400.00

-164,790.00

900.00

-8,510.00

14,305,570.00

-2,350.00

26,284,030.00

-2,472,100.00

-154,730.00

242,860.00

67,600.00

-554,227.00

11,920.00

468,979.00

-185,112.00

-52,160.00

33,528.00

13,767.00

1,812,641.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

Keppel Holdings `B'

7.2

50.00

Grand Plaza Hotel

39.00

-15.03

Phil. Tob. Flue Cur & Redry

37.50

50.00

Easy Call "Common"

2.98

-9.70

Conc. Aggr. 'A'

67.5

50.00

Cebu Prop. `B'

-7.55

Manila Broadcasting

45.50

49.92

Oriental Pet. `B'

0.0130

-7.14

Bogo Medelin

63.5

31.20

MEDCO Holdings

0.455

-7.14

Keppel Holdings `A'

6.5

25.97

Manila Mining `B'

0.0140

-6.67

Apex `A'

3.10

19.23

Jackstones

2.43

-6.54

F&J Prince 'A'

3.5

11.11

Da Vinci Capital

1.77

-4.84

Nickelasia

26.6

9.92

PhilexPetroleum

1.6

-4.19

Natl. Reinsurance Corp.

1.07

9.18

Transgrid

252.40

-4.18

You might also like

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 13, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 2, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 24, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 11, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (January 11, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 27, 2012)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - August 24, 2012 IssueDocument1 pageManila Standard Today - August 24, 2012 IssueManila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stocks Review (May 28, 2012)Document1 pageManila Standard Today - Business Weekly Stocks Review (May 28, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 15, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 15, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 19, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 19, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 30, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 30, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Document1 pageManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- Historical Development of The Banking System in The PhilippinesDocument1 pageHistorical Development of The Banking System in The PhilippinesJane SudarioNo ratings yet

- Top 100 Philippine companiesDocument25 pagesTop 100 Philippine companiesCharmaine Yape - ResmaNo ratings yet

- Lists of Authorized Banks in Bir Rdo 60Document1 pageLists of Authorized Banks in Bir Rdo 60Aljohn SebucNo ratings yet

- Group 1 Henry SyDocument11 pagesGroup 1 Henry Syulolmo taekaNo ratings yet

- Consumer Affairs DirectoryDocument45 pagesConsumer Affairs Directorynavin.aherNo ratings yet

- Deck SlabDocument5 pagesDeck SlabJohn Rom CabadonggaNo ratings yet

- List of 262 Philippine IT Parks and CentersDocument12 pagesList of 262 Philippine IT Parks and CentersJoan Plete-KoNo ratings yet

- Prefix - Smart Globe SunDocument1 pagePrefix - Smart Globe SunzhenNo ratings yet

- Barangay ListDocument22 pagesBarangay ListAnonymous FqiIrcf100% (2)

- 009764107P (122021)Document15 pages009764107P (122021)RedJaladNo ratings yet

- Mindanao Geo Reg. FormDocument2 pagesMindanao Geo Reg. FormChristine BernalNo ratings yet

- Eei Corporation: Daily Workload ScheduleDocument1 pageEei Corporation: Daily Workload SchedulemargarettNo ratings yet

- PSE Daily Quotations Report for March 12, 2013Document7 pagesPSE Daily Quotations Report for March 12, 2013srichardequipNo ratings yet

- PPC List (Names)Document8 pagesPPC List (Names)gcardinoza5150No ratings yet

- 2nd Letter For CoveringDocument37 pages2nd Letter For CoveringRhina De AsisNo ratings yet

- CA Case Law Finder (2008-2012)Document29 pagesCA Case Law Finder (2008-2012)nasenagunNo ratings yet

- ECE OJT Company ListDocument3 pagesECE OJT Company ListFranz Henri de Guzman80% (5)

- PESONet ParticipantsDocument2 pagesPESONet ParticipantsHoly Wayne 'Trinity' ChuaNo ratings yet

- San Miguel Corporation: Holy Angel University 1Document11 pagesSan Miguel Corporation: Holy Angel University 1Aira MedinaNo ratings yet

- ClientsDocument2 pagesClientsRicardo Delacruz100% (1)

- 10 famous Filipino entrepreneurs and their inspiring storiesDocument4 pages10 famous Filipino entrepreneurs and their inspiring storiesShaina CastroverdeNo ratings yet

- Sun Account DetailsDocument12 pagesSun Account DetailsJulius AlcantaraNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012srichardequipNo ratings yet

- 2013 BirDocument106 pages2013 BirPaul EspinosaNo ratings yet

- BPI1Document12 pagesBPI1Russell Stanley Que GeronimoNo ratings yet

- Philippine TV & Radio Schedules 2018 EditionDocument3,027 pagesPhilippine TV & Radio Schedules 2018 EditionPcnhs SalNo ratings yet

- Date: 17-Jun-19 Soa No: ZEUS SOA # 0406 Name of Trucker: Rafran TruckingDocument4 pagesDate: 17-Jun-19 Soa No: ZEUS SOA # 0406 Name of Trucker: Rafran Truckingtim josephNo ratings yet

- Comm Oj SitesDocument53 pagesComm Oj Sitesapi-306485332No ratings yet

- New CR 2019.012Document54 pagesNew CR 2019.012Jhaymon MendozaNo ratings yet

- Kim Domingo State of Undress Read - Google SearchDocument4 pagesKim Domingo State of Undress Read - Google Searchdean stoneNo ratings yet