Professional Documents

Culture Documents

The Standard - Business Daily Stocks Review (May 11, 2015)

Uploaded by

Manila Standard TodayCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

The Standard - Business Daily Stocks Review (May 11, 2015)

Uploaded by

Manila Standard TodayCopyright:

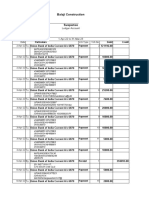

MST Business Daily Stocks Review

Monday, May 11, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

7.88

75.3

124.4

104

63

2.49

4.2

18.48

31.6

9.5

2.95

890

1.01

99.4

1.46

30.5

94.95

137

361.2

59

174.8

1700

127.9

2.5

66

84.6

84.5

45.8

1.97

2.03

12.02

23.55

6.3

1.75

625

0.225

78

0.9

18.02

76.5

95

276

45

107.6

1200

66

AG Finance

7.5

Asia United Bank

70.5

Banco de Oro Unibank Inc. 111.20

Bank of PI

101.00

China Bank

47.25

BDO Leasing & Fin. INc. 2.51

Bright Kindle Resources 2.05

COL Financial

15.34

Eastwest Bank

22.8

Filipino Fund Inc.

7.40

I-Remit Inc.

1.78

Manulife Fin. Corp.

820.00

MEDCO Holdings

0.440

Metrobank

93

Natl. Reinsurance Corp. 0.98

PB Bank

18.30

Phil. National Bank

76.00

Phil. Savings Bank

94

PSE Inc.

317

RCBC `A

45

Security Bank

169.4

Sun Life Financial

1440.00

Union Bank

66.20

FINANCIAL

7.51

7.5

70.85

70.5

111.90 111.00

102.00 101.20

48.45

47.3

2.54

2.33

2.05

2.03

15.36

15.34

23.15

22.45

7.40

7.40

1.78

1.77

833.00 805.00

0.400

0.445

94.6

93

0.99

0.98

18.24

18.24

76.00

75.25

94

94

319

316

45.75

44.75

171

169.4

1470.00 1450.00

66.85

65.00

INDUSTRIAL

42.5

42.05

1.08

1.07

2.08

2.04

11.56

11.3

90.00

90.00

19.6

19.52

125

125

28

27.5

60.95

58

2.53

2.41

1.77

1.73

13.16

12.8

20.950 20.6

11.48

11.36

8.10

7.96

10.40

10.30

1.88

1.75

15.1

14.5

28

26.9

94

91.8

14.38

14.10

0.4150 0.4100

14.20

14.20

6.2

6

0.590

0.590

211.80 210.00

10.36

10.16

32.25

32.00

2.62

2.5

24.95

24.5

28.65

27.55

7.75

7.4

266.60 262.80

4.29

4.09

4.2

4.15

9.95

9.70

4.4

4.4

11.80

11.60

4.04

3.95

2.30

2.26

2.4

2.31

5.06

5.00

1.93

1.9

6.21

6.18

193.1

190

4.45

4.44

1.66

1.61

0.167

0.161

1.37

1.37

2.36

2.19

203

199.6

4.5

4.47

0.69

0.67

1.33

1.31

HOLDING FIRMS

0.465

0.465

57.90

57.55

25.00

24.55

7.04

7.00

0.315

0.290

0.31

0.29

810

799.5

8.25

8.19

14.94

14.40

3.6

3.6

4.37

4.32

0.280

0.270

1306

1293

6.40

6.40

71.50

70.80

5.07

5.07

8.75

8.1

0.74

0.72

15.46

15

0.67

0.67

4.65

4.54

1.400

1.400

1.210

1.150

68.10

66.75

905.00 894.50

1.42

1.28

98.45

95.00

0.3750 0.3650

0.2330 0.2330

PROPERTY

8.880

8.770

10.30

9.38

0.73

0.70

40.40

39.65

4.12

4.08

5.2

5.18

0.89

0.87

Net Foreign

Change Volume

Trade/Buying

7.5

70.85

111.70

101.50

47.8

2.54

2.04

15.34

23

7.40

1.78

815.00

0.445

94.5

0.98

18.24

76.00

94

318.8

45

171

1450.00

65.00

0.00

0.50

0.45

0.50

1.16

1.20

-0.49

0.00

0.88

0.00

0.00

-0.61

1.14

1.61

0.00

-0.33

0.00

0.00

0.57

0.00

0.94

0.69

-1.81

50,100

9,810

2,002,540

631,330

115,500

11,000

8,000

4,700

2,984,800

10,000

28,000

960

280,000

2,067,110

27,000

1,100

2,070

30

38,840

92,100

23,240

220

16,510

42.3

1.08

2.04

11.3

90.00

19.52

125

28

58.15

2.41

1.76

12.8

20.650

11.40

8.00

10.36

1.75

14.5

27.1

92

14.10

0.4150

14.20

6

0.590

211.60

10.22

32.25

2.62

24.6

27.55

7.4

263.80

4.29

4.16

9.73

4.4

11.80

3.95

2.29

2.31

5.01

1.93

6.21

193

4.44

1.66

0.162

1.37

2.36

200

4.5

0.68

1.31

0.71

0.00

-1.45

-0.18

0.00

-0.20

-7.41

2.19

-6.21

0.00

-0.56

-1.08

-0.72

-0.18

-0.62

0.78

-6.91

-3.33

-1.63

-2.02

0.00

-3.49

0.00

-1.64

0.00

0.76

0.39

-11.52

2.75

-1.01

-3.84

-2.63

-0.45

5.15

0.24

0.21

0.00

1.72

-1.25

-0.43

-1.70

-0.99

3.76

0.16

3.21

6.73

3.11

-2.99

-0.72

7.76

-0.99

0.67

-1.45

-2.96

2,266,100

53,000

1,455,000

7,900

10

102,300

30

98,100

155,210

6,569,000

1,246,000

61,800

2,438,200

725,600

15,040,300

65,300

54,000

79,900

4,387,500

183,120

11,600

320,000

900

746,900

200,000

419,790

2,386,200

200

103,000

3,061,200

263,500

516,300

142,360

186,000

604,000

445,000

10,000

100,300

884,000

561,000

351,000

303,700

9,000

70,500

8,670

4,000

59,000

520,000

1,000

14,956,000

7,858,330

86,000

399,000

366,000

0.465

57.90

24.80

7.00

0.300

0.3

804.5

8.21

14.46

3.6

4.35

0.270

1300

6.40

70.95

5.07

8.1

0.72

15.04

0.67

4.62

1.400

1.180

67.95

898.00

1.30

98.45

0.3650

0.2330

1.09

0.43

1.22

-0.57

-3.23

-4.84

-0.06

0.00

-0.96

2.86

0.69

-5.26

0.54

0.00

0.28

-20.66

-7.11

0.00

-2.97

0.00

0.22

0.00

0.00

1.65

-0.88

5.69

1.49

-1.35

-0.85

20,000

658,060

8,177,300

11,500

14,640,000

1,760,000

77,970

1,029,200

2,899,300

5,000

62,000

250,000

100,470

51,300

1,418,100

1,000

12,686,400

569,000

7,509,700

1

13,524,000

1

1,329,000

225,910

169,070

3,723,000

37,670

2,070,000

60,000

8.800

10.30

0.70

40.35

4.09

5.2

0.88

-0.45

8.88

-1.41

1.38

-0.73

1.36

-1.12

253,600

3,800

2,805,000

2,933,900

807,000

26,000

2,615,000

531,054.00

-11,463,705.00

-15,540,497.00

33,705.00

5,741,315.00

367,095.00

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

1.48

0.201

0.98

2.25

1.87

1.8

6.34

4.88

0.180

0.470

27

8.54

31.8

2.29

20.6

1.02

7.56

1.96

8.59

0.97

0.083

0.445

1.4

1.42

1.19

2.8

2.75

0.090

0.325

23

2.57

21.35

1.64

15.08

0.69

3.38

1

5.69

Net Foreign

Change Volume

Trade/Buying

Cityland Dev. `A

1.10

Crown Equities Inc.

0.156

Cyber Bay Corp.

0.450

Global-Estate

1.36

Filinvest Land,Inc.

1.87

Interport `A

1.43

Keppel Properties

5.48

Megaworld Corp.

5.3

MRC Allied Ind.

0.127

Phil. Estates Corp.

0.3400

Phil. Tob. Flue Cur & Redry 24.05

Primex Corp.

7.3

Robinsons Land `B

29.10

Rockwell

1.76

SM Prime Holdings

19.64

Sta. Lucia Land Inc.

0.76

Starmalls

6.56

Suntrust Home Dev. Inc. 0.990

Vista Land & Lifescapes 7.410

1.04

1.04

1.04

0.160

0.156

0.159

0.450

0.450

0.450

1.40

1.36

1.37

1.92

1.88

1.90

1.41

1.40

1.40

3.68

3.33

3.68

5.42

5.31

5.37

0.125

0.121

0.125

0.3350 0.3250

0.3350

24.00

21.05

21.90

7.37

7.29

7.35

29.10

28.80

28.95

1.74

1.71

1.72

19.78

19.56

19.64

0.77

0.76

0.76

6.9

6.85

6.9

1.000

0.970

0.970

7.480

7.400

7.400

SERVICES

1.97 2GO Group

6.5

6.5

6.37

6.5

32.5 ABS-CBN

62.1

62.5

61.5

61.5

1

Acesite Hotel

1.04

1.09

1.04

1.04

0.6

APC Group, Inc.

0.660

0.690

0.670

0.670

10

Asian Terminals Inc.

13.7

13.96

13.54

13.96

9.61 Bloomberry

11.50

11.84

11.58

11.70

0.0770 Boulevard Holdings

0.1010

0.1010 0.1000

0.1000

2.95 Calata Corp.

4.23

4.17

3.98

4.05

46.55 Cebu Air Inc. (5J)

84.3

86

84.5

85.7

10.14 Centro Esc. Univ.

10

10

10

10

5.88 DFNN Inc.

7.00

7.14

7.00

7.00

2.58 Easy Call Common

2.98

2.87

2.87

2.87

830 FEUI

946

961

961

961

1600 Globe Telecom

2184

2238

2186

2238

5.95 GMA Network Inc.

6.21

6.25

6.20

6.20

30

Grand Plaza Hotel

30.40

30.40

22.00

22.00

1.36 Harbor Star

1.45

1.44

1.41

1.44

105 I.C.T.S.I.

109

110.2

108.5

109.9

8.72 IPeople Inc. `A

12.4

12.4

11.66

12.38

0.012 IP E-Game Ventures Inc. 0.013

0.013

0.013

0.013

0.036 Island Info

0.226

0.227

0.223

0.225

1.200 ISM Communications

1.2500

1.2600 1.2500

1.2600

2.34 Jackstones

2.43

2.45

2.38

2.4

6.5

Leisure & Resorts

9.42

10.00

9.45

10.00

1.1

Lorenzo Shipping

1.29

1.28

1.25

1.28

2

Macroasia Corp.

2.13

2.14

2.14

2.14

1.05 Manila Broadcasting

46.85

46.80

25.00

25.00

0.490 Manila Bulletin

0.670

0.680

0.680

0.680

1.8

Manila Jockey

2

2

2

2

8.7

Melco Crown

9.14

9.9

8.98

9.9

0.34 MG Holdings

0.360

0.360

0.355

0.355

0.37 NOW Corp.

0.430

0.440

0.435

0.440

14.54 Pacific Online Sys. Corp. 18.5

18.42

18.42

18.42

3

PAL Holdings Inc.

4.85

4.85

4.50

4.50

2.28 Paxys Inc.

3.05

3.25

3.05

3.25

79

Phil. Seven Corp.

139.90

140.60 138.00

140.60

4.39 Philweb.Com Inc.

14.74

14.74

14.70

14.72

2726 PLDT Common

2836.00

2850.00 2820.00

2832.00

0.380 PremiereHorizon

0.660

0.700

0.640

0.680

0.32 Premium Leisure

1.610

1.670

1.600

1.650

31.45 Puregold

39.55

39.60

38.90

38.95

60.55 Robinsons RTL

85.50

86.00

85.50

86.00

7.59 SSI Group

10.30

10.56

10.24

10.32

0.63 STI Holdings

0.67

0.68

0.66

0.68

6.45 Travellers

6.65

6.68

6.6

6.6

0.305 Waterfront Phils.

0.325

0.330

0.330

0.330

MINING & OIL

0.0043 Abra Mining

0.0054

0.0055 0.0053

0.0054

1.72 Apex `A

3.04

2.90

2.80

2.89

8.65 Atlas Cons. `A

8.20

8.21

8.14

8.15

9.43 Atok-Big Wedge `A

15.00

14.50

14.50

14.50

0.236 Basic Energy Corp.

0.255

0.255

0.255

0.255

6.98 Benguet Corp `B

8.0000

7.4000 7.4000

7.4000

0.61 Century Peak Metals Hldgs 1.03

1.05

1.01

1.05

0.78 Coal Asia

0.89

0.89

0.87

0.89

5.99 Dizon

7.73

8.24

7.88

8.02

1.08 Ferronickel

1.85

1.88

1.75

1.79

0.330 Geograce Res. Phil. Inc. 0.365

0.370

0.340

0.350

0.2130 Lepanto `A

0.232

0.233

0.230

0.231

0.2160 Lepanto `B

0.241

0.241

0.235

0.241

0.014 Manila Mining `A

0.0140

0.0150 0.0140

0.0140

0.014 Manila Mining `B

0.0150

0.0160 0.0150

0.0150

3.660 Marcventures Hldgs., Inc. 4.34

4.4

4.25

4.29

20.2 Nickelasia

26.7

27

26

26.5

2.11 Nihao Mineral Resources 3.92

4

3.93

3.95

0.365 Omico

0.7100

0.7100 0.7100

0.7100

1.54 Oriental Peninsula Res. 2.150

2.120

2.090

2.100

0.012 Oriental Pet. `A

0.0130

0.0130 0.0120

0.0130

0.013 Oriental Pet. `B

0.0130

0.0130 0.0130

0.0130

5.4

Petroenergy Res. Corp. 4.49

4.59

4.45

4.45

7.26 Philex `A

7.09

7.15

7.01

7.02

2.27 PhilexPetroleum

1.5

2.25

1.5

2.11

0.015 Philodrill Corp. `A

0.016

0.016

0.016

0.016

115.9 Semirara Corp.

162.80

162.80 161.50

162.00

3.67 TA Petroleum

5.73

8.38

5.78

7.8

0.0100 United Paragon

0.0100

0.0110 0.0100

0.0100

PREFERRED

33

ABS-CBN Holdings Corp. 62.75

62.8

62.15

62.7

490 Ayala Corp. Pref `B1

515

520

518

520

500 Ayala Corp. Pref B2

525

525

524.5

525

101.5 First Gen G

119

119.1

119.1

119.1

480 GLOBE PREF P

513

520

515

520

5.88 GMA Holdings Inc.

5.95

6

5.95

6

6.5

Leisure and Resort

1.09

1.09

1.09

1.09

101 MWIDE PREF

108.1

115.5

109

115

1011 PF Pref 2

1045

1048

1044

1048

74.2 SMC Preferred A

76.1

76.1

76

76

74.5 SMC Preferred B

84

83.5

83.5

83.5

75

SMC Preferred C

87

87

86.5

86.95

WARRANTS & BONDS

0.8900 LR Warrant

4.160

4.700

4.180

4.650

SME

2.4

Double Dragon

9.89

9.92

9.6

9.61

3.5

Makati Fin. Corp.

8.24

8.4

6.5

8.4

5.95 Xurpas

9.13

9.39

9.13

9.35

EXCHANGE TRADED FUNDS

105.6 First Metro ETF

126.2

126.9

126.3

126.7

-5.45

1.92

0.00

0.74

1.60

-2.10

-32.85

1.32

-1.57

-1.47

-8.94

0.68

-0.52

-2.27

0.00

0.00

5.18

-2.02

-0.13

13,000

14,120,000

290,000

2,714,000

10,449,000

251,000

1,100

7,268,800

720,000

630,000

19,400

39,400

994,800

339,000

7,752,900

105,000

109,400

460,000

1,685,200

0.00

-0.97

0.00

1.52

1.90

1.74

-0.99

-4.26

1.66

0.00

0.00

-3.69

1.59

2.47

-0.16

-27.63

-0.69

0.83

-0.16

0.00

-0.44

0.80

-1.23

6.16

-0.78

0.47

-46.64

1.49

0.00

8.32

-1.39

2.33

-0.43

-7.22

6.56

0.50

-0.14

-0.14

3.03

2.48

-1.52

0.58

0.19

1.49

-0.75

1.54

111,900

26,810

17,000

369,000

3,600

13,716,200

26,880,000

815,000

157,140

7,000

25,100

15,000

1,300

24,875

39,600

1,500

145,000

679,810

10,400

10,500,000

7,130,000

129,000

211,000

3,674,800

17,000

1,000

29,500

7,000

40,000

9,578,900

310,000

90,000

11,200

43,000

2,000

930

89,800

62,795

28,107,000

27,404,000

4,071,000

30,150

1,920,500

377,000

1,622,300

10,000

0.00

-4.93

-0.61

-3.33

0.00

-7.50

1.94

0.00

3.75

-3.24

-4.11

-0.43

0.00

0.00

0.00

-1.15

-0.75

0.77

0.00

-2.33

0.00

0.00

-0.89

-0.99

40.67

0.00

-0.49

36.13

0.00

423,000,000

583,000

195,000.00

85,000

1,700

50,000

1,600

267,000

336,000

43,500.00

18,800

-824.00

24,571,000 3,506,570.00

5,190,000

2,690,000

900,000

800,000

30,900,000 -30,200.00

304,000

-226,580.00

4,118,500 -52,879,400.00

762,000

3,940.00

83,000

331,000

-414,010.00

6,200,000

900,000

465,000

211,000

22,713,000 -522,330.00

304,100,000 -3,409,600.00

161,730

-11,383,121.00

10,354,900 455,948.00

19,800,000

-0.08

0.97

0.00

0.08

1.36

0.84

0.00

6.38

0.29

-0.13

-0.60

-0.06

192,600

9,110

9,400

500

2,140

3,000

207,000

43,500

7,820

63,570

6,000

20,540

11.78

3,941,000 -45,100.00

-2.83

1.94

2.41

1,387,700

600

749,100

779,988.00

0.40

15,100

64,617.00

-1,684,390.00

5,475,050.00

-29,647,090.00

5,961,955.00

-444,750.00

-3,851,200.00

MST

47

35.6 Aboitiz Power Corp.

42

1.66

1.04 Alliance Tuna Intl Inc.

1.08

2.36

1.41 Alsons Cons.

2.07

15.3

7.92 Asiabest Group

11.32

148

32

C. Azuc De Tarlac

90.00

20.6

14.6 Century Food

19.56

125

62.5 Chemphil

135

32

10.08 Cirtek Holdings (Chips) 27.4

65.8

29.15 Concepcion

62

Crown Asia

2.41

4.57

1.04 Da Vinci Capital

1.77

23.35

10.72 Del Monte

12.94

21.6

8.44 DNL Industries Inc.

20.800

12.98

9.79 Emperador

11.42

9.13

5.43 Energy Devt. Corp. (EDC) 8.05

12.34

9.54 EEI

10.28

2.89

1.06 Euro-Med Lab

1.88

17

8.61 Federal Res. Inv. Group 15

31.8

18.06 First Gen Corp.

27.55

109

67.9 First Holdings A

93.9

20.75

14

Ginebra San Miguel Inc. 14.10

0.820

0.0076 Greenergy

0.4300

15.3

13.24 Holcim Philippines Inc. 14.20

9.4

3.12 Integ. Micro-Electronics 6.1

0.98

0.395 Ionics Inc

0.590

241

168 Jollibee Foods Corp.

210.00

12.5

8.65 Lafarge Rep

10.18

79

34.1 Liberty Flour

36.45

3.95

2.3

LMG Chemicals

2.55

33.9

24.4 Manila Water Co. Inc.

24.85

90

16.2 Maxs Group

28.65

13.98

7.62 Megawide

7.600

292.4

250.2 Mla. Elect. Co `A

265.00

5

3.37 Panasonic Mfg Phil. Corp. 4.08

5.25

3.87 Pepsi-Cola Products Phil. 4.15

13.04

9

Petron Corporation

9.71

6.8

3.7

Phil H2O

4.4

14.5

9.94 Phinma Corporation

11.60

7.03

3.03 Phoenix Petroleum Phils. 4.00

3.4

2.22 Phoenix Semiconductor 2.30

4.5

1

Pryce Corp. `A

2.35

6.68

4.72 RFM Corporation

5.06

7.86

1.65 Roxas and Co.

1.86

8.1

6

Roxas Holdings

6.2

253

201.6 San MiguelPure Foods `B 187

5.5

4.1

SPC Power Corp.

4.16

3.28

1.67 Splash Corporation

1.61

0.315

0.122 Swift Foods, Inc.

0.167

2.5

1.02 TKC Steel Corp.

1.38

2.68

2.01 Trans-Asia Oil

2.19

226.6

143.4 Universal Robina

202

5.5

4.28 Victorias Milling

4.47

1.3

0.670 Vitarich Corp.

0.69

2.17

1.39 Vulcan Indl.

1.35

0.7

59.2

31.85

7.39

3.4

3.35

800

11.06

84

3.35

5.14

0.66

1380

6.68

72.6

5.29

9.25

0.9

18.9

0.73

5.53

2.31

0.84

87

934

2.2

156

0.710

0.435

0.45

48.1

20.85

6.62

1.4

1.6

600

7.390

14.18

2.6

4.25

0.144

818

5.3

46.6

3

4.43

0.59

12

0.580

4.22

1.23

0.450

66.7

709.5

1.13

85.2

0.200

0.173

Abacus Cons. `A

0.460

Aboitiz Equity

57.65

Alliance Global Inc.

24.50

Anscor `A

7.04

ATN Holdings A

0.310

ATN Holdings B

0.31

Ayala Corp `A

805

Cosco Capital

8.21

DMCI Holdings

14.60

F&J Prince A

3.5

Filinvest Dev. Corp.

4.32

Forum Pacific

0.285

GT Capital

1293

House of Inv.

6.40

JG Summit Holdings

70.75

Keppel Holdings `A

6.39

Lopez Holdings Corp.

8.72

Lodestar Invt. Holdg.Corp. 0.72

LT Group

15.5

Mabuhay Holdings `A

0.67

Metro Pacific Inv. Corp. 4.61

Prime Media Hldg

1.400

Prime Orion

1.180

San Miguel Corp `A

66.85

SM Investments Inc.

906.00

Solid Group Inc.

1.23

Top Frontier

97.00

Unioil Res. & Hldgs

0.3700

Wellex Industries

0.2350

10.5

26.95

1.99

40

6.15

5.4

1.54

6.01

12

0.91

29.1

4.1

4.96

0.89

8990 HLDG

8.840

Anchor Land Holdings Inc. 9.46

A. Brown Co., Inc.

0.71

Ayala Land `B

39.80

Belle Corp. `A

4.12

Cebu Holdings

5.13

Century Property

0.89

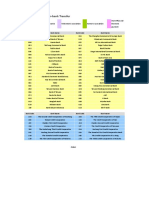

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

8,406,117

83,002,045

78,395,929

57,410,938

142,940,022

860,133,923

1,232,441,474

37,485,177.00

-14,312.50

4,806,160.00

-638,425.00

2,654,539.00

145,000.00

-152,297.00

-10,700.00

120,950.00

-7,403,181.00

-447,630.00

1,136,785.00

-2,894,082.00

13,715,439.00

362,262.00

105,700.00

-77,514,020.00

1,675,696.00

-73,800.00

18,010.00

42,060,032.00

-6,154,464.00

6,829,990.00

-926,205.00

-25.00

20,805,522.00

-42,000.00

448,920.00

-2,013,050.00

34,260.00

614,700.00

398,661.00

30,590.00

-430,450.00

-709,601,050.00

26,820.00

-2,986,474.50

-100,296,945.00

-10,560.00

163,500.00

1,306,933.00

1,306,933.00

-21,202,672.00

130,500.00

24,633,065.00

128,000.00

-1,457,398.50

-42,713,212.00

-31,390.00

-1,150,930.00

239,190.00

10,576,360.00

12,600.00

-316,880.00

-3,043,138.00

-69,457,720.00

13,260.00

-3,565,880.00

200,750.00

10.5

66

1.44

1.09

12.46

15.82

0.1460

4.61

99.1

12.3

9

4

1700

2090

8.41

33

1.97

119.5

12.5

0.017

0.8200

2.2800

5.93

12.28

2.2

3.2

5.9

1.97

2.46

15.2

0.62

1.040

22.8

6.41

4

110.2

14

3486

0.710

2.28

48.5

90.1

11.6

0.87

10.2

0.490

0.0098

5.45

17.24

25

0.330

12.8

1.2

1.73

10.98

4.2

0.48

0.455

0.475

0.023

0.026

8.2

49.2

4.27

1.030

3.06

0.020

0.021

7.67

12.88

10.42

0.040

420

9

0.016

70

553

525

120

515

8.21

12.28

111

1047

76.9

78.95

84.8

1,405,823.00

-2,152.00

77,000.00

4,530,775.00

-280,310.00

10.96

15

12.88

-1,450,290.00

130.7

6.98

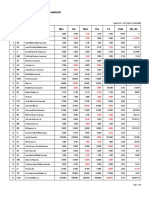

T op G ainers

VALUE

579,449,194.70

2,380,997,580.12

1,124,348,993.20

389,321,120.98

912,882,487.795

323,916,344.718

5,733,354,953.51

STOCKS

FINANCIAL

1,806.08 (up) 13.14

INDUSTRIAL

12,032.28 (down) 52.35

HOLDING FIRMS

6,935.78 (down) 14.71

PROPERTY

3,203.50 (up) 16.97

SERVICES

2,137.67 (up) 13.39

MINING & OIL

15,407.90 (down) 68.32

PSEI

7,777.90 (up) 14.69

All Shares Index

4,487.48 (down) 0.33

Gainers: 85 Losers: 96; Unchanged: 43; Total: 224

-7,247,811.00

-99,960.00

40,118,238.00

100,000.00

-4,430,333.00

16,780,740.00

4,076,184.00

15,576,084.00

60,518,456.00

14,450.00

6,300.00

104,184.00

203,136.00

66,477,360.00

-488,700.00

10,965,980.00

-44,595,260.00

2,150,121.00

1,150,572.00

-3,251,989.00

-152,030.00

116,630.00

-805,000.00

52,200.00

761,000.00

-546,360.00

4,403,375.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

PhilexPetroleum

2.11

40.67

Manila Broadcasting

25.00

-46.64

TA Petroleum

7.8

36.13

Keppel Properties

3.68

-32.85

LR Warrant

4.650

11.78

Grand Plaza Hotel

22.00

-27.63

Anchor Land Holdings Inc.

10.30

8.88

Keppel Holdings `A'

5.07

-20.66

Melco Crown

9.9

8.32

Liberty Flour

32.25

-11.52

Trans-Asia Oil

2.36

7.76

Phil. Tob. Flue Cur & Redry

21.90

-8.94

SPC Power Corp.

4.44

6.73

Benguet Corp `B'

7.4000

-7.50

Paxys Inc.

3.25

6.56

Chemphil

125

-7.41

MWIDE PREF

115

6.38

PAL Holdings Inc.

4.50

-7.22

Leisure & Resorts

10.00

6.16

Lopez Holdings Corp.

8.1

-7.11

You might also like

- BHEL E-Proc - Vendors PDFDocument3 pagesBHEL E-Proc - Vendors PDFmahotkatNo ratings yet

- Ajeet Business Tracker Aug 20221234Document14 pagesAjeet Business Tracker Aug 20221234Gaurav SinghNo ratings yet

- POP SP Details 090323Document7,313 pagesPOP SP Details 090323AvishekNNo ratings yet

- Database For CTDocument201 pagesDatabase For CTChaitali DegavkarNo ratings yet

- Current Account New MewaDocument15 pagesCurrent Account New MewaSonu F1No ratings yet

- SLBC List of Members 1. Banks Operating in Bihar: Details: State Level Bankers Committee, BiharDocument2 pagesSLBC List of Members 1. Banks Operating in Bihar: Details: State Level Bankers Committee, Biharsaurs2No ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 13, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 2, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 24, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 24, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 24, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (April 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 15, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 11, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 11, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 12, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 14, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 14, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (November 28, 2014)Document1 pageManila Standard Today - Business Daily Stock Review (November 28, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- TODAY Tourism & Business Magazine, Volume 22, December, 2015From EverandTODAY Tourism & Business Magazine, Volume 22, December, 2015No ratings yet

- TODAY Tourism & Business Magazine, Volume 22, October , 2015From EverandTODAY Tourism & Business Magazine, Volume 22, October , 2015No ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Document1 pageManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- VeenaDocument4 pagesVeenaJason LewisNo ratings yet

- Head of Family Bank Account DetailsDocument2 pagesHead of Family Bank Account DetailsMd Saharukh AhamedNo ratings yet

- Bank statement transactions summaryDocument4 pagesBank statement transactions summaryMridul ChitranshiNo ratings yet

- CONTACT DETAIL of BCs Cheak Karna H eDocument89 pagesCONTACT DETAIL of BCs Cheak Karna H eHEMANT THAKURNo ratings yet

- Bank Codes For Inter-Bank Transfer: PublicDocument6 pagesBank Codes For Inter-Bank Transfer: PublicGia nnaNo ratings yet

- Perusahaan lq45Document7 pagesPerusahaan lq45Putri ainun jariaNo ratings yet

- 2016 OldDocument44 pages2016 OldPradipta Kumar MohantyNo ratings yet

- KV Duty List AmbernathDocument2 pagesKV Duty List AmbernathRinishaNo ratings yet

- SL.N O. Case No. Applicant Vs Defendant AdvocateDocument5 pagesSL.N O. Case No. Applicant Vs Defendant AdvocateLaxmikant DugeNo ratings yet

- Rural Immersion Program Allowances 2010-2011Document4 pagesRural Immersion Program Allowances 2010-2011rsvpnidhiNo ratings yet

- ConectadosDocument136 pagesConectadosAnonymous 5J2qhNEeNo ratings yet

- Balaji ConstructionDocument102 pagesBalaji ConstructionShrinivas.Yadav Btech2020No ratings yet

- Televisores Con Sintonizador IntegradoDocument8 pagesTelevisores Con Sintonizador IntegradoShualo RqNo ratings yet

- India Strategy 4qfy17 20170410 Mosl RP Pg292Document292 pagesIndia Strategy 4qfy17 20170410 Mosl RP Pg292Saurabh KaushikNo ratings yet

- Nse 20181008Document34 pagesNse 20181008BellwetherSataraNo ratings yet

- WEEKLY REPORT - Price Movement: Sym Name Mon Tue Wed Thu Fri NFB - Nfs Yield NosDocument8 pagesWEEKLY REPORT - Price Movement: Sym Name Mon Tue Wed Thu Fri NFB - Nfs Yield Nosανατολή και πετύχετεNo ratings yet

- SipDocument2 pagesSipNew Age InvestmentsNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument31 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceTyrion LannisterNo ratings yet

- Country-Wise Branches of Indian Banks at Overseas Centres As On September 30, 2013Document6 pagesCountry-Wise Branches of Indian Banks at Overseas Centres As On September 30, 2013KamalNo ratings yet

- Nationalised Banks: S.No Name of The Bank Controlling Authority Name & Address Phone NosDocument4 pagesNationalised Banks: S.No Name of The Bank Controlling Authority Name & Address Phone NosratishbalachandranNo ratings yet

- Major Pipelines in IndiaDocument2 pagesMajor Pipelines in IndiaAnil Kumar SinghNo ratings yet

- Sbi BranchesDocument14 pagesSbi BranchesvinaisharmaNo ratings yet

- Rab 2020 Kembang AyunDocument79 pagesRab 2020 Kembang AyunArie Ikhwan SaputraNo ratings yet

- State Bank of India customer loan detailsDocument6 pagesState Bank of India customer loan detailsYashwanth yashuNo ratings yet