Professional Documents

Culture Documents

26 U.S.C. 501 (C) 26 U.S.C. 501 (A)

Uploaded by

Jhoana Mutiangpili0 ratings0% found this document useful (0 votes)

28 views2 pagesprovisions

Original Title

Definitions RDI

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentprovisions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views2 pages26 U.S.C. 501 (C) 26 U.S.C. 501 (A)

Uploaded by

Jhoana Mutiangpiliprovisions

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

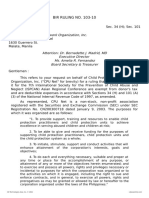

RA 10055: An Act Providing the Framework and Support System for the

Ownership, Management, Use, and Commercialization Of Intellectual

Property Generated from Research and Development Funded by

Government and for Other Purposes

Sec. 4. Definition of Terms. For purposes of this Act:

xxx

(i)

Research and Development Institute or Institution (RDI) refers to a

public or private organization, association, partnership, joint venture,

higher education institution or corporation that performs R&D activities

and is duly registered and/or licensed to do business in the Philippines, or

otherwise with legal personality in the Philippines. In the case of private

RDIs, they shall be owned solely by the citizens of the Philippines or

corporations or associations at least 60% of the capital of which is owned

by such citizens. This does not include RDIs covered by international

bilateral or multilateral agreements.

xxx

Same definition used in:

Joint DOST-IPO Administrative Order No. 02-2010: The Implementing Rules

And Regulations Of Republic Act No. 10055

Rule 3 (s)

Joint DOST-DTI-IPOPHL Administrative Order No. 001: Guidelines on

Intellectual Property Valuation, Commercialization, and Information

Sharing of Republic Act 10050

Sec. 4 (0)

37 CFR Part 401 - RIGHTS TO INVENTIONS MADE BY NONPROFIT

ORGANIZATIONS AND SMALL BUSINESS FIRMS UNDER GOVERNMENT

GRANTS, CONTRACTS, AND COOPERATIVE AGREEMENTS

(h) The term nonprofit organization means universities and other institutions of

higher education or an organization of the type described in section 501(c)(3) of the

Internal Revenue Code of 1954 (26 U.S.C. 501(c) and exempt from taxation under

section 501(a) of the Internal Revenue Code (26 U.S.C. 501(a)) or any nonprofit

scientific or educational organization qualified under a state nonprofit organization

statute.

In relation to:

INTERNAL REVENUE CODE

26 USC Part VI - ITEMIZED DEDUCTIONS FOR INDIVIDUALS AND CORPORATIONS

26 USC 170 - Charitable, etc., contributions and gifts

b) Percentage limitations

(1) Individuals

In the case of an individual, the deduction provided in subsection (a) shall be limited

as provided in the succeeding subparagraphs.

(A) General rule

Any charitable contribution to

xxx

(iii) an organization the principal purpose or functions of which are the providing of

medical or hospital care or medical education or medical research, if the

organization is a hospital, or if the organization is a medical research organization

directly engaged in the continuous active conduct of medical research in

conjunction with a hospital, and during the calendar year in which the contribution

is made such organization is committed to spend such contributions for such

research before January 1 of the fifth calendar year which begins after the date such

contribution is made,

xxx

You might also like

- Lobbying Regulations On Nonprofit OrganizationsDocument16 pagesLobbying Regulations On Nonprofit OrganizationsValerie F. Leonard100% (1)

- Revenue Regulations No. 13-98Document5 pagesRevenue Regulations No. 13-98saintkarriNo ratings yet

- SECTION. 1. Definition of TermsDocument14 pagesSECTION. 1. Definition of TermsJonathan Ocampo BajetaNo ratings yet

- 8088 2010 BIR - Ruling - No. - 103 1020210505 12 Mijt7dDocument4 pages8088 2010 BIR - Ruling - No. - 103 1020210505 12 Mijt7dcatherine joy sangilNo ratings yet

- Lecture-Npos in The PhilippinesDocument14 pagesLecture-Npos in The PhilippinesAngela PaduaNo ratings yet

- Deciding On The Donee: Step3Document4 pagesDeciding On The Donee: Step3FedsNo ratings yet

- Checklist For CSO Laws: 1. Protecting Fundamental FreedomsDocument8 pagesChecklist For CSO Laws: 1. Protecting Fundamental FreedomsEena ClaveroNo ratings yet

- RR 13-98Document13 pagesRR 13-98matinikkiNo ratings yet

- Articles of IncorporationDocument3 pagesArticles of IncorporationPeter BunderNo ratings yet

- Various CabinetDocument4 pagesVarious CabinetCatanauan SK FederationNo ratings yet

- IRS InfoDocument2 pagesIRS Infokatenunley100% (1)

- RR No 13-98 DonationsDocument16 pagesRR No 13-98 DonationsGil PinoNo ratings yet

- White Paper: China's Foreign NGO Activities Management LawDocument5 pagesWhite Paper: China's Foreign NGO Activities Management LawUSChinaStrongNo ratings yet

- Irs Petition July 27 2011Document20 pagesIrs Petition July 27 2011Doug AlexanderNo ratings yet

- Bir Ruling 103-10 - Cod and NodDocument5 pagesBir Ruling 103-10 - Cod and NodJerwin DaveNo ratings yet

- IRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusDocument16 pagesIRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusgeneisaacNo ratings yet

- A Layman’s Guide to The Right to Information Act, 2005From EverandA Layman’s Guide to The Right to Information Act, 2005Rating: 4 out of 5 stars4/5 (1)

- General Provisions (5 ILCS 140/) Freedom of Information ActDocument21 pagesGeneral Provisions (5 ILCS 140/) Freedom of Information ActletscurecancerNo ratings yet

- RR 13-98Document18 pagesRR 13-98fatmaaleahNo ratings yet

- Lobbying Compliance, Registration and FilingDocument10 pagesLobbying Compliance, Registration and FilingMichele Di FrancoNo ratings yet

- Nonprofit Law in The Philippines Council On FoundationsDocument1 pageNonprofit Law in The Philippines Council On Foundationsemployee assistanceNo ratings yet

- Republic Act No. 11954Document16 pagesRepublic Act No. 11954najaisisusuNo ratings yet

- Law Non ProfitDocument10 pagesLaw Non ProfitDena ValdezNo ratings yet

- Bir RR 13-98 PDFDocument13 pagesBir RR 13-98 PDFsimgcoNo ratings yet

- 2nd AssignmentDocument8 pages2nd AssignmentMonisahNo ratings yet

- RR 13-98 PDFDocument16 pagesRR 13-98 PDFAris Basco DuroyNo ratings yet

- Syllabus Corpo/SRC/FIADocument91 pagesSyllabus Corpo/SRC/FIAmkabNo ratings yet

- Accounting for Non-Profits (NPOsDocument15 pagesAccounting for Non-Profits (NPOsDieter DyNo ratings yet

- RR No. 13-98Document16 pagesRR No. 13-98Ana DocallosNo ratings yet

- COA Lacks Jurisdiction to Audit Philippine Red CrossDocument3 pagesCOA Lacks Jurisdiction to Audit Philippine Red Crosslovelycruz yanoNo ratings yet

- Investment Management Study of NGO Prachodana HassanDocument83 pagesInvestment Management Study of NGO Prachodana HassanrnaganirmitaNo ratings yet

- Assignment - 401Document6 pagesAssignment - 401achal.yadav125No ratings yet

- FcraDocument41 pagesFcraPrem TiwariNo ratings yet

- The Non-Governmental Organisations ActDocument14 pagesThe Non-Governmental Organisations ActvaxNo ratings yet

- Nonprofit Law in The Philippines: International Center For Not-for-Profit Law Lily LiuDocument15 pagesNonprofit Law in The Philippines: International Center For Not-for-Profit Law Lily LiuAlexaNo ratings yet

- Articles of IncorporationDocument3 pagesArticles of IncorporationNini Lucero100% (1)

- Philippine Supreme Court rules on foreign ownership of public utility sharesDocument2 pagesPhilippine Supreme Court rules on foreign ownership of public utility sharesMarioneMaeThiam100% (1)

- Republic Act No. 7042Document55 pagesRepublic Act No. 7042Prasef Karl Andres Cortes IIINo ratings yet

- Foreign Investments Act of 1991Document10 pagesForeign Investments Act of 1991Catherine DavidNo ratings yet

- ATARC AIDA Guidebook - FINAL 96Document7 pagesATARC AIDA Guidebook - FINAL 96dfgluntNo ratings yet

- Articles of IncorporationDocument4 pagesArticles of IncorporationElaisa Nina Marie TrinidadNo ratings yet

- TRH - Articles of IncorporationDocument3 pagesTRH - Articles of IncorporationDaniel WatsonNo ratings yet

- Deductibility of Donations to Accredited InstitutionsDocument162 pagesDeductibility of Donations to Accredited InstitutionsMaisie Rose VilladolidNo ratings yet

- Oplan AlalayDocument4 pagesOplan AlalayJohana MiraflorNo ratings yet

- White Paper, Excluded Party Screening For Medical Research and Healthcare OrganizationsDocument9 pagesWhite Paper, Excluded Party Screening For Medical Research and Healthcare Organizationssattam23No ratings yet

- Scott School Parents Teachers Association RevDocument14 pagesScott School Parents Teachers Association RevJeff BercasioNo ratings yet

- Nifacommunitylandtrustsamplearticles PDFDocument4 pagesNifacommunitylandtrustsamplearticles PDFKath SapitanNo ratings yet

- Nonprofit Law in The Philippines: Types of OrganizationsDocument14 pagesNonprofit Law in The Philippines: Types of OrganizationsAtty. Lyndon CanaNo ratings yet

- Deductibility of Contributions to Accredited Donee InstitutionsDocument11 pagesDeductibility of Contributions to Accredited Donee InstitutionsalexjalecoNo ratings yet

- 62298bos50449 Mod2 cp13Document79 pages62298bos50449 Mod2 cp13monicabhat96No ratings yet

- RA No. 9049 Medal of ValorDocument4 pagesRA No. 9049 Medal of Valorchrissa magatNo ratings yet

- Corporate Nationality Requirements and GuidelinesDocument23 pagesCorporate Nationality Requirements and GuidelinesPaul Ryan VillanuevaNo ratings yet

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation TemplatesonnykobNo ratings yet

- Nonprofit ArticlesDocument11 pagesNonprofit ArticlesJahlaney NewsonNo ratings yet

- Outline in Corporation LDocument91 pagesOutline in Corporation LmkabNo ratings yet

- PHILHEALTHDocument15 pagesPHILHEALTHHanna Pentiño100% (1)

- Issue On Lawless ViolenceDocument10 pagesIssue On Lawless ViolenceAnonymous P5eW9V3ANo ratings yet

- RA 7192 - Women in Development and Nation Building ActDocument9 pagesRA 7192 - Women in Development and Nation Building ActRosa Gamaro100% (2)

- ANALYSIS OF SECTION 115BBC ON TAXATION OF ANONYMOUS DONATIONSDocument12 pagesANALYSIS OF SECTION 115BBC ON TAXATION OF ANONYMOUS DONATIONSAbhimanyuNo ratings yet

- Chapter-Iii: Non-Governmental Organisation Has Been Generally Defined As Voluntary, Autonomous, Non-ProfitDocument32 pagesChapter-Iii: Non-Governmental Organisation Has Been Generally Defined As Voluntary, Autonomous, Non-ProfitPratik ShindeNo ratings yet

- Itinerary For KoreaDocument13 pagesItinerary For KoreaJhoana MutiangpiliNo ratings yet

- Eastern Mediterranean CaseDocument7 pagesEastern Mediterranean CaseJhoana MutiangpiliNo ratings yet

- Bayan vs. ExecSecDocument13 pagesBayan vs. ExecSecJhoana MutiangpiliNo ratings yet

- Pub Off/Election Law CasesDocument12 pagesPub Off/Election Law CasesJhoana MutiangpiliNo ratings yet

- Poli Law Cases 1Document58 pagesPoli Law Cases 1Jhoana MutiangpiliNo ratings yet

- PubOff 6 PDFDocument16 pagesPubOff 6 PDFJhoana MutiangpiliNo ratings yet

- PubOff 12Document41 pagesPubOff 12Jhoana MutiangpiliNo ratings yet

- BrionDocument21 pagesBrionTommyjames ElfiroNo ratings yet

- Specpro Cases 1Document43 pagesSpecpro Cases 1Jhoana MutiangpiliNo ratings yet

- Pub Off/Election Law CasesDocument12 pagesPub Off/Election Law CasesJhoana MutiangpiliNo ratings yet

- Specpro Cases 2Document17 pagesSpecpro Cases 2Jhoana MutiangpiliNo ratings yet

- Specpro Cases 3 PDFDocument30 pagesSpecpro Cases 3 PDFJhoana MutiangpiliNo ratings yet

- Boumedienne V BushDocument25 pagesBoumedienne V BushJhoana MutiangpiliNo ratings yet

- Pub Off/Election Law CasesDocument12 pagesPub Off/Election Law CasesJhoana MutiangpiliNo ratings yet

- Poli Law Cases 1Document58 pagesPoli Law Cases 1Jhoana MutiangpiliNo ratings yet

- PubOff 2Document44 pagesPubOff 2Jhoana MutiangpiliNo ratings yet

- Property Cases 1Document73 pagesProperty Cases 1Jhoana MutiangpiliNo ratings yet

- Specpro Cases 1Document43 pagesSpecpro Cases 1Jhoana MutiangpiliNo ratings yet

- Nego Cases Up To 620Document15 pagesNego Cases Up To 620Jhoana MutiangpiliNo ratings yet

- Admin For TuesdayDocument22 pagesAdmin For TuesdayJhoana MutiangpiliNo ratings yet

- UC v. BakkeDocument5 pagesUC v. BakkeJhoana MutiangpiliNo ratings yet

- 22017Document134 pages22017sohamNo ratings yet

- Comparison of Mutual Funds With Other Investment Options FINALSDocument51 pagesComparison of Mutual Funds With Other Investment Options FINALSankitNo ratings yet

- eNPSForm PDFDocument5 pageseNPSForm PDFPradnyaNo ratings yet

- Diversifikasi Korporasi Dan Biaya Modal: Jurnal Siasat Bisnisvol.21 No. 2, 2017,181-198Document18 pagesDiversifikasi Korporasi Dan Biaya Modal: Jurnal Siasat Bisnisvol.21 No. 2, 2017,181-198sriintan09gmail.com intan99No ratings yet

- Prospectus AssignmentDocument3 pagesProspectus AssignmentAmy Doll100% (2)

- Government Accounting and AuditingDocument190 pagesGovernment Accounting and AuditingCharles John Palabrica CubarNo ratings yet

- The Valuation of Ship, Art and Science - Roger BartlettDocument36 pagesThe Valuation of Ship, Art and Science - Roger BartlettWisnu KertaningnagoroNo ratings yet

- Dell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Document71 pagesDell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Henry WijayaNo ratings yet

- Investors' and Exporters' FX Window: Click Here To View CBN Circular)Document2 pagesInvestors' and Exporters' FX Window: Click Here To View CBN Circular)KantNo ratings yet

- SIP ProjectDocument26 pagesSIP ProjectsherryNo ratings yet

- Oil and GasDocument4 pagesOil and GasmanasthaNo ratings yet

- CME Group Daily Bulletin GlossaryDocument2 pagesCME Group Daily Bulletin GlossaryavadcsNo ratings yet

- Balance Sheet of Tata SteelDocument9 pagesBalance Sheet of Tata SteelsahumonikaNo ratings yet

- LanzaTech Investor Presentation - March 2022 - VFDocument60 pagesLanzaTech Investor Presentation - March 2022 - VFhzulqadadarNo ratings yet

- Sesión 1.3. Cyclical Vs Counter-Cyclical StockDocument4 pagesSesión 1.3. Cyclical Vs Counter-Cyclical StockVictorTRNo ratings yet

- Ra 6957Document15 pagesRa 6957Shalena Salazar-SangalangNo ratings yet

- Ch24 ShowDocument46 pagesCh24 ShowMahmoud AbdullahNo ratings yet

- CH 9 Capital Asset Pricing ModelDocument25 pagesCH 9 Capital Asset Pricing ModelShantanu ChoudhuryNo ratings yet

- Registration Prospectus (Clean) (131010)Document355 pagesRegistration Prospectus (Clean) (131010)ckyeakNo ratings yet

- "Generally Accepted Accounting Principles" (GAAP)Document6 pages"Generally Accepted Accounting Principles" (GAAP)lakhan619No ratings yet

- Investment Houses: Boss Chicks JULY 2,6, 2019Document7 pagesInvestment Houses: Boss Chicks JULY 2,6, 2019Elijah PerolNo ratings yet

- Bullish Concealing Baby SwallowDocument3 pagesBullish Concealing Baby SwallowSyam Sundar ReddyNo ratings yet

- AutoPart TrainingDocument59 pagesAutoPart TrainingShankara Narayan Venkatachalam (Shanky)No ratings yet

- China Evergrande Group - IllustrationDocument14 pagesChina Evergrande Group - Illustration常超No ratings yet

- MMFS AGM NoticeDocument249 pagesMMFS AGM Noticejitendra76No ratings yet

- Bay' Al-Dayn: Understanding Debt Sales in Islamic FinanceDocument9 pagesBay' Al-Dayn: Understanding Debt Sales in Islamic FinancemhfxtremeNo ratings yet

- Dawson Stores Inc.Document3 pagesDawson Stores Inc.Juris PasionNo ratings yet

- Bolt Mar 20201588157751190Document83 pagesBolt Mar 20201588157751190Leo ClintonNo ratings yet

- Turnbull S, 1997 Corporate GovDocument27 pagesTurnbull S, 1997 Corporate GovMila Minkhatul Maula MingmilaNo ratings yet

- This Study Resource Was: Accounting For BondsDocument4 pagesThis Study Resource Was: Accounting For BondsSeunghyun ParkNo ratings yet