Professional Documents

Culture Documents

Global Hedge Fund Secondary Market Index

Uploaded by

ZerohedgeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Hedge Fund Secondary Market Index

Uploaded by

ZerohedgeCopyright:

Available Formats

Hedgebay

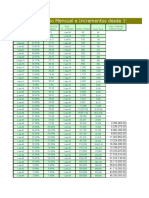

GLOBAL HEDGE FUND SECONDARY MARKET INDEX

Edition 05 January 2010

!" Index rebounds in solid trade volume

J anuary’s index value increased by almost 8 points thanks in large part to some heavy trading in “more liquid” issues - funds that

were not gated or impaired, but which investors found themselves still within the lock-up period. Dispersion widened again to

more than 64 points with meaningful volume transacting towards the lower end of the range.

For the second month in a row activity in private equity related issues was substantial. As the quarter progresses and year end

statements are delivered to investors there should be an even greater focus on this asset class. Credit is still and should continue to

be heavily traded this year. While some stability has returned to these markets, most believe the underlying fundamentals have not

changed all that much and that the “concept” of credit is still quite fragile. As a result, prices have been muted in what is expected to

be a longer work-out time frame.

ALL FIGURES BELOW ARE RELATIVE TO A TRADE AT NAV EQUALLING 100%

!" Average discount or premium (to NAV) since 1999 !" Average price of trades

Date Average % Monthly %

108.00 of NAV change

106.00

104.00 Hedgebay SMI (ex-distressed) 31-Jan-10 87.93% 9.27%

102.00

100.00 31-Dec-09 79.78% -7.34%

(at NAV)

98.00 30-Nov-09 86.10% -0.72%

96.00

30-Oct-09 86.73% 4.41%

94.00

92.00 30-Sep-09 82.90% -6.22%

90.00

31-Aug-09 88.40% -0.33%

88.00

86.00 31-Jul-09 88.69% -1.84%

84.00 30-Jun-09 90.35% -2.07%

82.00

80.00 31-May-09 92.26% 3.28%

78.00 30-Apr-09 89.33% 11.23%

01-Aug-99

01-Nov-99

01-Feb-00

01-May-00

01-Aug-00

01-Nov-00

01-Feb-01

01-May-01

01-Aug-01

01-Nov-01

01-Feb-02

01-May-02

01-Aug-02

01-Nov-02

01-Feb-03

01-May-03

01-Aug-03

01-Nov-03

01-Feb-04

01-May-04

01-Aug-04

01-Nov-04

01-Feb-05

01-May-05

01-Aug-05

01-Nov-05

01-Feb-06

01-May-06

01-Aug-06

01-Nov-06

01-Feb-07

01-May-07

01-Aug-07

01-Nov-07

01-Feb-08

01-May-08

01-Aug-08

01-Nov-08

01-Feb-09

01-May-09

01-Aug-09

01-Nov-09

31-Mar-09 80.31% -4.80%

28-Feb-09 84.36% 1.28%

!" Top traded strategy !" Highest & lowest trades (relative to NAV)

Date 1st 2nd Date Highest trade Lowest trade

Jan-10 Relative Value Credit Jan-10 93.50% 29.00%

The Hedgebay Global Secondary Market Index (GSMI) is a proprietary, asset-weighted index that describes the average premium or discount paid for hedge funds that trade in the secondary market in any given month. An

investor may wish to use the index as a sentiment indicator to describe hedge fund investors’ future expectations for performance, a benchmarking tool for hedge fund investors to assess latent value in their portfolios or

as indicators of the cost of liquidity.

GSMI information is obtained through the Hedgebay website and its associated marketing licensees. There are limitations in using indices for comparison purposes because such indices may have different inclusion criteria

and other material characteristics. No representation is made about the value of GSMI as a predictive or other indicator or benchmarking tool or that any investor will achieve any results shown. This information is not

intended to be, nor should it be construed or used as, a recommendation, or investment or other advice, or an offer, or the solicitation of an offer, to buy or sell any security, including an interest in any hedge fund, which

may only be made through delivery of a fund’s confidential offering documents, which must be read carefully. There are substantial risks in investing in hedge funds. Certain information has been obtained from third party

sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Past performance is not indicative of future results. The GSMI may not be

distributed without our consent.

© 2004-2010 Hedgebay Trading Corporation. All rights reserved.

You might also like

- Hedgebay Index - July 2010Document2 pagesHedgebay Index - July 2010economicburnNo ratings yet

- Savings Rates HistoricalDocument2 pagesSavings Rates HistoricalKhizar Muhammad KhanNo ratings yet

- Ric Profit Rates 17-06-2021Document4 pagesRic Profit Rates 17-06-2021Mobashir Mehmood KhanNo ratings yet

- Australia's key economic indicators from 2005 to 2010Document1 pageAustralia's key economic indicators from 2005 to 2010coolies123No ratings yet

- Customer retention and S&M metricsDocument48 pagesCustomer retention and S&M metricsdouglas silvaNo ratings yet

- Panel OrnamentDocument2 pagesPanel OrnamentMarketing TanajawaNo ratings yet

- LMP-Lampiran - KPI USE April 2019 PT PERTAMINA F1.0-28-05-2019 - 170832943Document8 pagesLMP-Lampiran - KPI USE April 2019 PT PERTAMINA F1.0-28-05-2019 - 170832943Agung Ananta PutraNo ratings yet

- Analisa Kesesuaian Data Exp Date Gudang FarmasiDocument5 pagesAnalisa Kesesuaian Data Exp Date Gudang FarmasiHafiz SurahmanNo ratings yet

- ROFIT RATES - SAVINGS ACCOUNT Historical Rates Remained Applicable On Savings Account From1st January, 2000 To OnwardsDocument3 pagesROFIT RATES - SAVINGS ACCOUNT Historical Rates Remained Applicable On Savings Account From1st January, 2000 To OnwardsShahid Majeed ChaudhryNo ratings yet

- Liquidación de CréditoDocument5 pagesLiquidación de Créditocamila cuadrosNo ratings yet

- 1 Liq. Pesos 305Document4 pages1 Liq. Pesos 305Danilo Acosta PerezNo ratings yet

- Oklahoma Budget Overview: Trends and Outlook, August 2010Document45 pagesOklahoma Budget Overview: Trends and Outlook, August 2010dblattokNo ratings yet

- Growth of $1.00: Using Randomized Returns: Dates DjiDocument16 pagesGrowth of $1.00: Using Randomized Returns: Dates DjiPoorni ShivaramNo ratings yet

- Bahbood Savings Certificates Profit RatesDocument2 pagesBahbood Savings Certificates Profit Ratesadnan haiderNo ratings yet

- ACE Nifty Futures Trading System - Performance Report (01.04.2007 To 31.03.2013)Document3 pagesACE Nifty Futures Trading System - Performance Report (01.04.2007 To 31.03.2013)Prasad SwaminathanNo ratings yet

- CASH FLOW - Financial With %Document1 pageCASH FLOW - Financial With %Chamux skalNo ratings yet

- Catch Up Schedule 2Document1 pageCatch Up Schedule 2JOHN CARLO AZORESNo ratings yet

- Growth Porto Share PINADocument8 pagesGrowth Porto Share PINApinaNo ratings yet

- Analyze customer retention, lifetime value & revenue using cohort tablesDocument8 pagesAnalyze customer retention, lifetime value & revenue using cohort tablesMANAV SAHUNo ratings yet

- GRAFIK GIZI WordDocument5 pagesGRAFIK GIZI WordMoch Shoffyan LubieesNo ratings yet

- Achievements in May for K/S, D/S, N/D and Nutrition IndicatorsDocument5 pagesAchievements in May for K/S, D/S, N/D and Nutrition IndicatorsMoch Shoffyan LubieesNo ratings yet

- ACT HISTÓRICO SMM y CuantíasDocument9 pagesACT HISTÓRICO SMM y CuantíasJose BustamanteNo ratings yet

- IC Executive Dashboard 8673Document5 pagesIC Executive Dashboard 8673mogfa.zNo ratings yet

- Tier IndexDocument1 pageTier Indexkettle1No ratings yet

- MULA$$24Document6 pagesMULA$$24ThompsonNo ratings yet

- Mid Term Assignment Pop - 301 BDocument14 pagesMid Term Assignment Pop - 301 BMahmudul HasanNo ratings yet

- Overall Performance of the Attica Hotel Industry - Μάρτιος 2019 Έναντι Μαρτίου 2018Document1 pageOverall Performance of the Attica Hotel Industry - Μάρτιος 2019 Έναντι Μαρτίου 2018TatianaNo ratings yet

- ELSS Tax Planning Wealth CreationDocument1 pageELSS Tax Planning Wealth CreationmukeshNo ratings yet

- Martabe gold mine detox tank s-curve refurbishmentDocument1 pageMartabe gold mine detox tank s-curve refurbishmentYorgieNo ratings yet

- UnitPrice EdibleOils MostUsed BiodieselProdDocument7 pagesUnitPrice EdibleOils MostUsed BiodieselProdomarNo ratings yet

- Petroleum Historical DataDocument4 pagesPetroleum Historical Datamwirishscot2100% (2)

- South Suburban - EastDocument1 pageSouth Suburban - EastpsobaniaNo ratings yet

- SRP2 Cistern Tank Project ScheduleDocument1 pageSRP2 Cistern Tank Project ScheduleRichard DamiagoNo ratings yet

- KMMDocument6 pagesKMMGerardo Mauricio Rodríguez FloresNo ratings yet

- Investing Like Warren Buffett: Nicola BorriDocument36 pagesInvesting Like Warren Buffett: Nicola BorriZoe RossiNo ratings yet

- PBA W.E.F 12 04 23Document2 pagesPBA W.E.F 12 04 23Rashid AhmadaniNo ratings yet

- Plymouth Michigan Real Estate Stats - January 2011Document4 pagesPlymouth Michigan Real Estate Stats - January 2011Todd Waller Real EstateNo ratings yet

- Ampliacion de concentradora Toquepala a 60,000 TMPD resumen por faseDocument15 pagesAmpliacion de concentradora Toquepala a 60,000 TMPD resumen por faseArturo Saenz ArteagaNo ratings yet

- May - 2023Document177 pagesMay - 2023Alinutz BusinessNo ratings yet

- Hedgefund Fee StructureDocument5 pagesHedgefund Fee Structureaslam810No ratings yet

- 30 stocks correlation tableDocument53 pages30 stocks correlation tablePoorni ShivaramNo ratings yet

- Grafik Gizi Posy 2016Document12 pagesGrafik Gizi Posy 2016Siti RisniaNo ratings yet

- IC Executive Dashboard1Document8 pagesIC Executive Dashboard1waqas malikNo ratings yet

- AskingvssoldDocument2 pagesAskingvssoldmrathbunNo ratings yet

- Overall performance of the Attica Hotel Industry- Ιούνιος 2019, έναντι Ιουνίου 2018Document1 pageOverall performance of the Attica Hotel Industry- Ιούνιος 2019, έναντι Ιουνίου 2018Tatiana RokouNo ratings yet

- RIC Rates W.E.F 12 01 23Document2 pagesRIC Rates W.E.F 12 01 23Federal Land CommissionNo ratings yet

- Ali CorpDocument12 pagesAli CorpMerlysita GVNo ratings yet

- Dramatic Credit Card System Reform: What Happened?: Joshua Gans Melbourne Business School (March 2006)Document12 pagesDramatic Credit Card System Reform: What Happened?: Joshua Gans Melbourne Business School (March 2006)Core ResearchNo ratings yet

- 1q10hpi StsDocument3 pages1q10hpi Stskettle1No ratings yet

- All ChartDocument100 pagesAll ChartThanh NguyenNo ratings yet

- April 2010 Plymouth MI Housing Stats - Professional One Real EstateDocument4 pagesApril 2010 Plymouth MI Housing Stats - Professional One Real EstateTodd Waller Real EstateNo ratings yet

- Lynx Fund Performance SummaryDocument2 pagesLynx Fund Performance Summarymrobertson3890No ratings yet

- Tahun 2017Document15 pagesTahun 2017EVI STEVENSONNo ratings yet

- Tabla para Liquidar Créditos en CivilDocument10 pagesTabla para Liquidar Créditos en CivilJuan David Gomez CardonaNo ratings yet

- Entregas en Tiempo Pasva 2020Document1 pageEntregas en Tiempo Pasva 2020AlbertNo ratings yet

- Turno DIA Turno Noche: Consumo de ReactivosDocument8 pagesTurno DIA Turno Noche: Consumo de ReactivosCHARLES DANIEL JACAY LINONo ratings yet

- Planilla para LiquidacionDocument31 pagesPlanilla para LiquidacionValentina SierraNo ratings yet

- Tipo Cambio RealDocument5 pagesTipo Cambio RealCamilo Andres Bernal PuentesNo ratings yet

- Hors Garantie Hardware Softwares CA NB Acte CA NB Acte: Année 2021 Mois 7 Date 7/12/2021 POSDocument6 pagesHors Garantie Hardware Softwares CA NB Acte CA NB Acte: Année 2021 Mois 7 Date 7/12/2021 POSCOSMO PUBGMNo ratings yet

- Fomc Minutes 20240320Document11 pagesFomc Minutes 20240320ZerohedgeNo ratings yet

- Rising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumDocument51 pagesRising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumZerohedge100% (1)

- JPM Q1 2024 PresentationDocument14 pagesJPM Q1 2024 PresentationZerohedgeNo ratings yet

- NSF Staff ReportDocument79 pagesNSF Staff ReportZerohedge Janitor100% (1)

- Fomc Minutes 20240131Document11 pagesFomc Minutes 20240131ZerohedgeNo ratings yet

- Fomc Minutes 20231213Document10 pagesFomc Minutes 20231213ZerohedgeNo ratings yet

- TBAC Basis Trade PresentationDocument34 pagesTBAC Basis Trade PresentationZerohedgeNo ratings yet

- TSLA Q4 2023 UpdateDocument32 pagesTSLA Q4 2023 UpdateSimon AlvarezNo ratings yet

- BOJ Monetary Policy Statemetn - March 2024 Rate HikeDocument5 pagesBOJ Monetary Policy Statemetn - March 2024 Rate HikeZerohedge0% (1)

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- Warren Buffett's Annual Letter To ShareholdersDocument16 pagesWarren Buffett's Annual Letter To ShareholdersFOX Business100% (2)

- BTCETFDocument22 pagesBTCETFZerohedge JanitorNo ratings yet

- SCA Transit FeesDocument2 pagesSCA Transit FeesZerohedgeNo ratings yet

- X V Media Matters ComplaintDocument15 pagesX V Media Matters ComplaintZerohedge Janitor100% (1)

- AMD Q3'23 Earnings SlidesDocument33 pagesAMD Q3'23 Earnings SlidesZerohedgeNo ratings yet

- Tesla Inc Earnings CallDocument20 pagesTesla Inc Earnings CallZerohedge100% (1)

- Hunter Biden Indictment 120723Document56 pagesHunter Biden Indictment 120723New York PostNo ratings yet

- Jerome Powell SpeechDocument6 pagesJerome Powell SpeechTim MooreNo ratings yet

- Earnings Presentation Q3 2023Document21 pagesEarnings Presentation Q3 2023ZerohedgeNo ratings yet

- 3Q23 PresentationDocument12 pages3Q23 PresentationZerohedgeNo ratings yet

- BofA The Presentation Materials - 3Q23Document43 pagesBofA The Presentation Materials - 3Q23Zerohedge100% (1)

- 2023-09-14 OpinionDocument42 pages2023-09-14 OpinionZerohedgeNo ratings yet

- Hunter Biden ReportDocument64 pagesHunter Biden ReportZerohedge50% (2)

- Fomc Minutes 20230726Document10 pagesFomc Minutes 20230726ZerohedgeNo ratings yet

- Powell 20230825 ADocument16 pagesPowell 20230825 AJuliana AméricoNo ratings yet

- November 2021 Secretary Schedule RedactedDocument62 pagesNovember 2021 Secretary Schedule RedactedNew York PostNo ratings yet

- TBAC Presentation Aug 2Document44 pagesTBAC Presentation Aug 2ZerohedgeNo ratings yet

- Yellow Corporation Files Voluntary Chapter 11 PetitionsDocument2 pagesYellow Corporation Files Voluntary Chapter 11 PetitionsZerohedgeNo ratings yet

- Earnings Presentation Q4 2022Document21 pagesEarnings Presentation Q4 2022ZerohedgeNo ratings yet

- 2Q23 PresentationDocument12 pages2Q23 PresentationZerohedgeNo ratings yet

- I/zlanila: Section As ofDocument25 pagesI/zlanila: Section As ofGilbert AguillonNo ratings yet

- 2018 CTA LEVEL 1 Manfin Test 3 - SolutionDocument12 pages2018 CTA LEVEL 1 Manfin Test 3 - SolutionJames MutarauswaNo ratings yet

- CFAP Syllabus Advanced Accounting and Financial ReportingDocument16 pagesCFAP Syllabus Advanced Accounting and Financial ReportingTuseef Ahmad QadriNo ratings yet

- Trial Version: Bb318 Bank Treasury ManagementDocument4 pagesTrial Version: Bb318 Bank Treasury ManagementmsanusiNo ratings yet

- Nomura Warns S&P 500 Options Driven Vol Killer Looms Into Year EndDocument8 pagesNomura Warns S&P 500 Options Driven Vol Killer Looms Into Year EndKien NguyenNo ratings yet

- 522 114 Solutions-4Document5 pages522 114 Solutions-4Mruga Pandya100% (3)

- Basic Derivatives - StudentDocument4 pagesBasic Derivatives - StudentdgdeguzmanNo ratings yet

- Shipping EconomistDocument52 pagesShipping EconomistJames RobbinsNo ratings yet

- BBrief Six Degrees of Tiger Management 01 03 12Document11 pagesBBrief Six Degrees of Tiger Management 01 03 12Sarah RamirezNo ratings yet

- Automated ArbitrageDocument47 pagesAutomated ArbitrageranikumarNo ratings yet

- Derivatives Interview QuestionsDocument14 pagesDerivatives Interview Questionsanil100% (3)

- FX Risk Types and Hedging MethodsDocument20 pagesFX Risk Types and Hedging MethodsanushaNo ratings yet

- Effective Financial SystemDocument5 pagesEffective Financial SystemMartin LiuNo ratings yet

- ForecastsDocument30 pagesForecastscdsudduth100% (1)

- Option Special Report PDFDocument22 pagesOption Special Report PDFbastian_wolf100% (1)

- DB Guide To FX IndicesDocument84 pagesDB Guide To FX Indicesmzanella82No ratings yet

- BMA 12e SM CH 26 Final PDFDocument14 pagesBMA 12e SM CH 26 Final PDFNikhil ChadhaNo ratings yet

- Financial Derivatives: Prof. Scott JoslinDocument49 pagesFinancial Derivatives: Prof. Scott Joslinarnav100% (2)

- Investment Pattern in Commodities and Associated RisksDocument92 pagesInvestment Pattern in Commodities and Associated Risksjitendra jaushik100% (3)

- Currency DerivativesDocument17 pagesCurrency DerivativesRimjhimNo ratings yet

- Financial DerivativesDocument309 pagesFinancial DerivativessuryaNo ratings yet

- Cfmip 28092 P 2Document19 pagesCfmip 28092 P 2Amit MakwanaNo ratings yet

- Finnair Financial Report 2010Document104 pagesFinnair Financial Report 2010Shi ZhanNo ratings yet

- HedgingDocument6 pagesHedgingNikita PradhanNo ratings yet

- Bullish Options Strategies for Maximum ReturnsDocument41 pagesBullish Options Strategies for Maximum ReturnsVaidyanathan Ravichandran100% (1)

- IIM Bangalore Foreign Exchange MarketsDocument14 pagesIIM Bangalore Foreign Exchange MarketsGautam PatelNo ratings yet

- SOA 30 Sample Problems On Derivatives MarketsDocument24 pagesSOA 30 Sample Problems On Derivatives MarketsSilvioMassaro100% (1)

- Material 6 Inventories Other Investments.. Lucky Version Part 1Document5 pagesMaterial 6 Inventories Other Investments.. Lucky Version Part 1M.K. TongNo ratings yet

- Alternative Risk TRF e 02Document5 pagesAlternative Risk TRF e 02Vladi B PMNo ratings yet

- ITJEGAN's Option PPT - Mumbai March 23Document63 pagesITJEGAN's Option PPT - Mumbai March 23Pankaj D. Dani82% (38)