Professional Documents

Culture Documents

Apeejay Tea LTD.: Balance Sheet: (Rs. in Crore)

Uploaded by

tatai_85Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apeejay Tea LTD.: Balance Sheet: (Rs. in Crore)

Uploaded by

tatai_85Copyright:

Available Formats

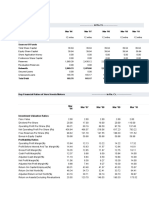

Apeejay Tea Ltd.

: Balance Sheet

(Rs. in Crore)

March ' 07 March ' 06 March ' 05 March ' 04 March ' 03

12 Months 12 Months 12 Months 12 Months 12 Months

SOURCES OF FUNDS

Owner's Fund

Equity Share Capital 6.00 6.00 6.00 6.00 6.00

Share Application Money 0.00 0.00 0.00 0.00 0.00

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves & Surplus 58.31 57.63 64.54 67.15 77.89

Loan Funds

Secured Loans 43.22 31.96 12.19 11.78 18.80

Unsecured Loans 20.00 42.16 22.97 22.57 36.52

Total 127.53 137.75 105.70 107.50 139.21

USES OF FUNDS

Fixed Assets

Gross Block 237.11 262.50 256.32 253.54 252.22

Less : Revaluation Reserve 99.42 113.02 118.23 127.27 133.25

Less : Accumulated Depreciation 103.16 113.49 105.22 93.53 84.25

Net Block 34.54 35.99 32.87 32.74 34.71

Capital Work-in-progress 1.52 0.31 1.00 0.60 0.38

Investments 6.58 3.27 2.58 3.20 4.37

Net Current Assets

Current Assets, Loans & Advances 105.70 119.92 91.91 95.52 127.22

Less : Current Liabilities & Provisions 20.81 21.75 22.66 24.57 27.47

Total Net Current Assets 84.89 98.17 69.25 70.95 99.75

Miscellaneous expenses not written 0.00 0.00 0.00 0.00 0.00

Total 127.53 137.74 105.70 107.49 139.21

Note :

Book Value of Unquoted Investments 7.44 3.23 3.21 3.21 4.10

Market Value of Quoted Investments 0.56 1.68 0.68 0.56 1.51

Contingent liabilities 7.23 8.51 4.45 4.15 5.52

Number of Equity shares outstanding (in Lacs) 60.00 60.00 60.00 60.00 60.00

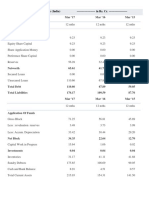

Apeejay Tea Ltd. : Ratio Analysis

March ' 07 March ' 06 March ' 05 March ' 04 March ' 03

12 Months 12 Months 12 Months 12 Months 12 Months

PER SHARE RATIOS

Adjusted E P S (Rs.) -4.49 -11.69 -2.89 -19.61 5.02

Adjusted Cash EPS (Rs.) 1.41 -6.06 2.58 -13.96 10.96

Reported EPS (Rs.) 1.14 -11.52 -4.31 -17.90 4.68

Reported Cash EPS (Rs.) 7.04 -5.90 1.16 -12.25 10.61

Dividend Per Share 0.00 0.00 0.00 0.00 2.00

Operating Profit Per Share (Rs.) -0.79 -10.46 -5.56 -22.03 8.45

Book Value (Excl Rev Res) Per Share (Rs.) 107.18 106.04 117.56 121.91 139.81

Book Value (Incl Rev Res) Per Share (Rs.) 272.88 294.41 314.61 334.02 361.90

Net Operating Income Per Share (Rs.) 154.27 156.15 145.49 143.50 154.99

Free Reserves Per Share (Rs.) 94.64 93.50 105.02 109.37 127.27

PROFITABILITY RATIOS

Operating Margin (%) -0.51 -6.69 -3.81 -15.34 5.44

Gross Profit Margin (%) -4.33 -10.29 -7.57 -19.28 1.61

Net Profit Margin (%) 0.69 -6.86 -2.73 -11.41 2.83

Adjusted Cash Margin (%) 0.85 -3.61 1.63 -8.89 6.64

Adjusted Return On Net Worth (%) -4.18 -11.02 -2.46 -16.08 3.59

Reported Return On Net Worth (%) 1.06 -10.86 -3.66 -14.67 3.34

Return On long Term Funds (%) 2.31 -2.30 0.82 -8.17 6.20

LEVERAGE RATIOS

Long Term Debt / Equity 0.46 0.81 0.31 0.43 0.43

Total Debt/Equity 0.98 1.16 0.49 0.46 0.65

Owners fund as % of total Source 50.42 46.19 66.73 68.04 60.25

Fixed Assets Turnover Ratio 0.39 0.35 0.34 0.33 0.36

LIQUIDITY RATIOS

Current Ratio 5.08 5.51 4.06 3.89 4.63

Current Ratio (Inc. ST Loans) 1.57 2.63 1.92 3.33 1.95

Quick Ratio 4.26 4.93 3.62 3.63 4.31

Inventory Turnover Ratio 7.06 10.78 15.59 29.24 15.59

PAYOUT RATIOS

Dividend payout Ratio (Net Profit) 0.00 0.00 0.00 0.00 48.24

Dividend payout Ratio (Cash Profit) 0.00 0.00 0.00 0.00 21.26

Earning Retention Ratio 100.00 0.00 0.00 0.00 55.09

Cash Earnings Retention Ratio 100.00 0.00 100.00 0.00 79.41

COVERAGE RATIOS

Adjusted Cash Flow Time Total Debt 74.82 0.00 22.74 0.00 8.41

Financial Charges Coverage Ratio 1.18 0.16 1.48 -1.55 3.41

Fin. Charges Cov.Ratio (Post Tax) 1.87 0.16 1.25 -1.18 2.97

COMPONENT RATIOS

Material Cost Component(% earnings) 16.06 15.55 17.69 18.45 11.76

Selling Cost Component 6.91 5.61 4.89 5.76 6.32

Exports as percent of Total Sales 11.38 3.12 12.69 17.51 15.72

Import Comp. in Raw Mat. Consumed 0.00 0.00 0.00 0.00 0.00

Long term assets / Total Assets 0.28 0.24 0.28 0.27 0.23

Bonus Component In Equity Capital (%) 50.00 50.00 50.00 50.00 50.00

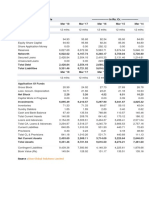

Apeejay Tea Ltd. : Income Statement

(Rs. in Crore)

March ' 07 March ' 06 March ' 05 March ' 04 March ' 03

12 Months 12 Months 12 Months 12 Months 12 Months

Income :

Operating Income 92.56 93.69 87.30 86.10 92.99

Expenses

Material Consumed 9.43 11.54 12.72 18.89 10.16

Manufacturing Expenses 16.22 17.56 15.25 14.95 12.22

Personnel Expenses 51.00 55.76 50.75 52.44 51.98

Selling Expenses 6.40 5.26 4.27 4.96 5.88

Adminstrative Expenses 9.99 9.85 7.64 8.07 7.69

Expenses Capitalised 0.00 0.00 0.00 0.00 0.00

Cost Of Sales 93.04 99.97 90.63 99.31 87.93

Operating Profit -0.48 -6.27 -3.33 -13.22 5.07

Other Recurring Income 6.20 6.98 7.38 8.00 5.96

Adjusted PBDIT 5.72 0.70 4.04 -5.21 11.02

Financial Expenses 4.83 4.25 2.73 3.36 3.23

Depreciation 3.54 3.38 3.28 3.39 3.56

Other Write offs 0.00 0.00 0.00 0.00 0.00

Adjusted PBT -2.65 -6.93 -1.96 -11.96 4.23

Tax Charges 0.04 0.09 -0.23 -0.20 1.22

Adjusted PAT -2.69 -7.01 -1.74 -11.76 3.01

Non Recurring Items 3.06 -0.09 -0.85 1.01 -0.21

Other Non Cash adjustments 0.31 0.19 0.00 0.02 0.00

Reported Net Profit 0.69 -6.91 -2.59 -10.74 2.81

Earnigs Before Appropriation 0.69 -6.91 -2.59 -6.13 6.24

Equity Dividend 0.00 0.00 0.00 0.00 1.20

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Dividend Tax 0.00 0.00 0.00 0.00 0.15

Retained Earnings 0.69 -6.91 -2.59 -6.13 4.88

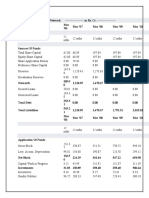

Apeejay Tea Ltd. : Annual Results

(Rs. in Crore)

March ' 07 March ' 06 March ' 05 March ' 04 March ' 03

12 Months 12 Months 12 Months 12 Months 12 Months

Sales 92.56 94.18 88.87 86.95 93.16

Other Income 9.37 7.29 7.54 10.04 6.25

Stock Adjustment -5.43 -3.04 -2.72 3.00 -0.78

Raw Material 2.29 2.17 3.98 3.88 0.17

Power And Fuel 14.58 15.48 13.70 13.11 10.77

Employee Expenses 51.00 55.76 50.75 52.44 51.98

Excise 0.00 0.45 1.55 0.92 0.16

Admin And Selling Expenses 0.00 0.00 0.00 0.00 0.00

Research And Devlopment Expenses 0.00 0.00 0.00 0.00 0.00

Expenses Capitalised 0.00 0.00 0.00 0.00 0.00

Other Expeses 30.60 29.92 25.96 27.83 26.29

Provisions Made 0.00 0.00 0.00 0.00 0.00

Operating Profit -0.48 -6.56 -4.35 -14.23 4.57

Interest 4.83 4.25 2.73 3.36 3.23

Gross Profit 4.06 -3.52 0.46 -7.55 7.59

Depreciation 3.54 3.38 3.28 3.39 3.56

Taxation -0.17 0.01 -0.23 -0.20 1.22

Net Profit / Loss 0.69 -6.91 -2.59 -10.74 2.81

Extra Ordinary Item 0.00 0.00 0.00 0.00 0.00

Prior Year Adjustments 0.00 0.00 0.00 0.00 0.00

Equity Capital 6.00 6.00 6.00 6.00 6.00

Equity Dividend Rate 0.00 0.00 0.00 0.00 20.00

Agg.Of Non-Prom. Shares (in Lacs) 15.44 15.44 15.44 15.44 15.44

Agg.Of Non PromotoHolding(%) 25.73 25.73 25.73 25.73 25.73

OPM(%) -0.51 -6.96 -4.89 -16.36 4.90

GPM(%) 3.98 -3.46 0.47 -7.78 7.63

NPM(%) 0.67 -6.80 -2.68 -11.07 2.82

EPS (in Rs.) 1.15 -11.52 -4.32 -17.90 4.68

You might also like

- Hold On To HopeDocument2 pagesHold On To HopeGregory J PagliniNo ratings yet

- ISO 50001 Audit Planning MatrixDocument4 pagesISO 50001 Audit Planning MatrixHerik RenaldoNo ratings yet

- Aikido NJKS PDFDocument105 pagesAikido NJKS PDFdimitaring100% (5)

- How K P Pinpoint Events Prasna PDFDocument129 pagesHow K P Pinpoint Events Prasna PDFRavindra ChandelNo ratings yet

- Pascal, Francine - SVH M 12 The Patmans of Sweet ValleyDocument140 pagesPascal, Francine - SVH M 12 The Patmans of Sweet ValleyClair100% (2)

- Disaster Drilling Land RigsDocument21 pagesDisaster Drilling Land Rigsmohanned salahNo ratings yet

- ChildBook Mother Is Gold Father Is Glass Gender An - Lorelle D Semley PDFDocument257 pagesChildBook Mother Is Gold Father Is Glass Gender An - Lorelle D Semley PDFTristan Pan100% (1)

- Quicho - Civil Procedure DoctrinesDocument73 pagesQuicho - Civil Procedure DoctrinesDeanne ViNo ratings yet

- Pilot Exam FormDocument2 pagesPilot Exam Formtiger402092900% (1)

- The Witch of Kings CrossDocument11 pagesThe Witch of Kings CrossMarguerite and Leni Johnson100% (1)

- Gati Limited Distribution Supply Chain Solutions Provider Asia Pacific SAARCDocument6 pagesGati Limited Distribution Supply Chain Solutions Provider Asia Pacific SAARCAman UpadhyayNo ratings yet

- Asian Paints: BSE: 500820 - NSE: ASIANPAINT - ISIN: INE021A01018 - Paints/VarnishesDocument6 pagesAsian Paints: BSE: 500820 - NSE: ASIANPAINT - ISIN: INE021A01018 - Paints/Varnishesopenid_ovmLEUQfNo ratings yet

- Profit and Loss: Rs. CR IncomeDocument2 pagesProfit and Loss: Rs. CR IncomeRavi KumarNo ratings yet

- Balance Sheet - in Rs. Cr.Document3 pagesBalance Sheet - in Rs. Cr.jelsiya100% (1)

- Previous YearsDocument9 pagesPrevious YearsBhat Ashiq AzizNo ratings yet

- NHPC Financial Ratios AnalysisDocument2 pagesNHPC Financial Ratios Analysissathish kumarNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Document11 pages12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNo ratings yet

- Eveready Industries India Balance Sheet - in Rs. Cr.Document5 pagesEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNo ratings yet

- Balance Sheet of Gitanjali GemsDocument5 pagesBalance Sheet of Gitanjali GemsHarold GeorgeNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Reliance Chemotex Balance SheetDocument2 pagesReliance Chemotex Balance SheetRushil GabaNo ratings yet

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- Balance Sheet of Allahabad BankDocument26 pagesBalance Sheet of Allahabad BankMemoona RizviNo ratings yet

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Balance Sheet of Empee DistilleriesDocument4 pagesBalance Sheet of Empee DistilleriesArun PandiyanNo ratings yet

- Rdy Mad e Pmegp 10 LacsDocument13 pagesRdy Mad e Pmegp 10 LacssyedNo ratings yet

- ABB India Standalone Balance SheetDocument2 pagesABB India Standalone Balance SheetAbhay Kumar SinghNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Jubilant CompleteDocument16 pagesJubilant CompleteShivamKhareNo ratings yet

- Adlabs InfoDocument3 pagesAdlabs InfovineetjogalekarNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Balance Sheet of Blue Dart ExpressDocument6 pagesBalance Sheet of Blue Dart ExpressTakauv-thiyagi ThiyaguNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Key Financial Ratios of UCO Bank - in Rs. Cr.Document19 pagesKey Financial Ratios of UCO Bank - in Rs. Cr.anishbhattacharyyaNo ratings yet

- Book1 Accounting RevieDocument10 pagesBook1 Accounting RevieShivendra Kumar SinghNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Balance Sheet: StandaloneDocument9 pagesBalance Sheet: StandaloneKabita BuragohainNo ratings yet

- Ceat Balance SheetDocument2 pagesCeat Balance Sheetkcr kc100% (2)

- Sagar CementsDocument33 pagesSagar Cementssarbjeetk21No ratings yet

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Document14 pagesBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Arvind - Profit & Loss Account - Textiles - Denim - Profit & Loss Account of Arvind - BSE - 500101, NSE - ARVINDDocument2 pagesArvind - Profit & Loss Account - Textiles - Denim - Profit & Loss Account of Arvind - BSE - 500101, NSE - ARVINDAjay CharlesNo ratings yet

- Balance Sheet of Everest Kanto CylinderDocument2 pagesBalance Sheet of Everest Kanto Cylindersatya936No ratings yet

- FINACIALDocument1 pageFINACIALPrakash GuptaNo ratings yet

- Cma-Data RajeshwarDocument16 pagesCma-Data RajeshwarVIRAT SAXENANo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- Balance Sheet MaricoDocument2 pagesBalance Sheet Maricoajisha10No ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsKavitha prabhakaranNo ratings yet

- Apollo Tyres: PrintDocument2 pagesApollo Tyres: PrintTiaNo ratings yet

- HTTP WWW - MoneycontrolDocument1 pageHTTP WWW - MoneycontrolPavan PoliNo ratings yet

- HDFC Bank LTD.: Profit and Loss A/CDocument4 pagesHDFC Bank LTD.: Profit and Loss A/CsureshkarnaNo ratings yet

- Financial Ratios of Zee Entertainment Over 5 YearsDocument2 pagesFinancial Ratios of Zee Entertainment Over 5 Yearssagar naikNo ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- Asian Paints Money ControlDocument19 pagesAsian Paints Money ControlChiranth BhoopalamNo ratings yet

- Balance Sheet of Sun TV NetworkDocument2 pagesBalance Sheet of Sun TV NetworkMehadi NawazNo ratings yet

- 2 - Aditya - Balaji TelefilmsDocument12 pages2 - Aditya - Balaji Telefilmsrajat_singlaNo ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- Total Liabilities 1431.29 1316.59 1224.31 1070.79 703.54Document71 pagesTotal Liabilities 1431.29 1316.59 1224.31 1070.79 703.54Payal SinghNo ratings yet

- Adani Green Balance SheetDocument2 pagesAdani Green Balance SheetTaksh DhamiNo ratings yet

- Balancesheet - Pfizer LTDDocument1 pageBalancesheet - Pfizer LTDGhanshyam MeenaNo ratings yet

- Balance Sheet of Balrampur Chini MillsDocument1 pageBalance Sheet of Balrampur Chini MillsAsrar Ahmed HamidaniNo ratings yet

- Matrukrupa Travells: Bunglow No 4, Janta Society, Jamnagar - 361006Document1 pageMatrukrupa Travells: Bunglow No 4, Janta Society, Jamnagar - 361006JIGNA NAKARNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- Marico BSDocument2 pagesMarico BSAbhay Kumar SinghNo ratings yet

- Balance Sheet of Essar Oil: - in Rs. Cr.Document7 pagesBalance Sheet of Essar Oil: - in Rs. Cr.sonalmahidaNo ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Titan Balance-SheetDocument2 pagesTitan Balance-SheetDt.vijaya ShethNo ratings yet

- Mediocrity-The Unwated SinDocument3 pagesMediocrity-The Unwated SinJay PatelNo ratings yet

- Addressing Menstrual Health and Gender EquityDocument52 pagesAddressing Menstrual Health and Gender EquityShelly BhattacharyaNo ratings yet

- San Beda UniversityDocument16 pagesSan Beda UniversityrocerbitoNo ratings yet

- Family Law Final Exam ReviewDocument2 pagesFamily Law Final Exam ReviewArielleNo ratings yet

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Document2 pagesForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalNo ratings yet

- Pride & Prejudice film sceneDocument72 pagesPride & Prejudice film sceneha eunNo ratings yet

- ERP in Apparel IndustryDocument17 pagesERP in Apparel IndustrySuman KumarNo ratings yet

- HB Nutrition FinalDocument14 pagesHB Nutrition FinalJaoNo ratings yet

- Annamalai University: B.A. SociologyDocument84 pagesAnnamalai University: B.A. SociologyJoseph John100% (1)

- APWU Contract Effective DatesDocument5 pagesAPWU Contract Effective DatesPostalReporter.comNo ratings yet

- Addis Ababa University-1Document18 pagesAddis Ababa University-1ASMINO MULUGETA100% (1)

- Battle of Qadisiyyah: Muslims defeat Sassanid PersiansDocument22 pagesBattle of Qadisiyyah: Muslims defeat Sassanid PersiansMustafeez TaranNo ratings yet

- Application No. 2140 6100 0550: OJEE FORM F - Application Form For B.Tech (SPECIAL) 2021Document1 pageApplication No. 2140 6100 0550: OJEE FORM F - Application Form For B.Tech (SPECIAL) 2021Siba BaiNo ratings yet

- Marine Insurance Final ITL & PSMDocument31 pagesMarine Insurance Final ITL & PSMaeeeNo ratings yet

- PÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Document33 pagesPÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Mario Davi BarbosaNo ratings yet

- Unit Test: VocabularyDocument2 pagesUnit Test: VocabularyTrang PhạmNo ratings yet

- Filipino Values and Patriotism StrategiesDocument3 pagesFilipino Values and Patriotism StrategiesMa.Rodelyn OcampoNo ratings yet

- MGT420Document3 pagesMGT420Ummu Sarafilza ZamriNo ratings yet

- Global BF Scorecard 2017Document7 pagesGlobal BF Scorecard 2017sofiabloemNo ratings yet

- Mobile Pixels v. Schedule A - Complaint (D. Mass.)Document156 pagesMobile Pixels v. Schedule A - Complaint (D. Mass.)Sarah BursteinNo ratings yet