Professional Documents

Culture Documents

Taxcaptightens0715 PDF

Uploaded by

jspectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxcaptightens0715 PDF

Uploaded by

jspectorCopyright:

Available Formats

Local Government Snapshot

N E W YO R K S TAT E O F F I C E O F T H E S TAT E CO M P T R O L L E R

Thomas P. DiNapoli State Comptroller

July 2015

Tax Cap Tightens As Inflation Drops: Local Governments

Will Need to Prepare for Little or No Levy Growth

Generally, the States property tax cap

law limits local government and school

district levy growth to the lesser of 2

percent or the rate of inflation.1 Since

2014, these entities have been dealing

with the stark reality of a less than

2 percent scenario. Now, they face

a significantly less than 2 percent

scenario.

Based on the newly released

Consumer Price Index (CPI) data, the

downward trend in inflation means

that local governments operating on a

December 31 fiscal year end will see

the inflation factor decrease to 0.73

percent, thereby causing a significant

reduction over prior years in an

important component of their tax cap

calculation (the allowable levy growth

factor).

Although the allowable levy growth

factor represents only one component

of the complex, multi-step calculation

of the tax cap, its an important one.

In fact, OSC estimates that these

calendar year local governments will

have roughly $88.3 million less in

available tax levy growth compared to

what they had in 2015 when the factor

was 1.56 percent, and $135.1 million

less than they would have had when

the factor was at 2 percent as it was in

2012 and 2013.

Allowable Levy Growth for Local Governments

with Fiscal Years Ending 12/31

2.00%

2.00%

2.00%

1.66%

1.60%

1.56%

1.20%

0.80%

0.73%

0.40%

0.00%

2012

2013

2014

2015

2016

Estimated Reduction in Allowable Levy Limit

($ Millions)

Local Governments with 12/31 Fiscal Year End

Cities (44 of 61)

Counties

Fire Districts

Towns

$5.9

$44.9

$6.0

$31.1

Villages (10 of 552)

$0.3

Total (12/31 FYE)

$88.3

Note: The estimate was generated by applying the 2016 inflation factor of 0.73% to the

2015 data filed by local governments that operate on a calendar year fiscal year. We

re-calculated the tax levy limit using the lower 2016 allowable levy growth factor and

subtracted this amount from the 2015 tax levy limit (which was based on a 1.56% growth

factor). The difference represents the levy impact of the lower allowable levy growth factor.

Division of Local Government and School Accountability

Local Government Snapshot

If these trends continue, it is possible that some local governments with fiscal years beginning

later in 2016 could even be faced with zero allowable levy growth.

For example, in school districts (which have fiscal years beginning July 1), the impact of a more

restrictive allowable levy growth factor on the tax levy could range from a loss of $182.7 million,

assuming an inflation factor of 0.73 percent similar to calendar year local governments, to a loss

of $332.6 million, assuming an inflation factor of zero. These potential losses reflect comparisons

to 2015-16, when the factor was at 1.62 percent.2

The Big Four Cities of Buffalo, Rochester, Syracuse and Yonkers (all having fiscal years

beginning July 1) face the possibility of losing from $7.2 million to $13.1 million as a result of the

potential lower cap in 2016, while villages (most of which have fiscal years beginning June 1)

could lose from $12.6 to $22.3 million.

New policy developments at the State level, such as the Tax Freeze and the newly enacted Circuit

Breaker program, mean that both local governments and school districts face added pressure to

stay under the cap, since overriding the cap would render their taxpayers ineligible for these credits.3

General Municipal Law Section 3-c, Education Law Section 2023-a.

The allowable levy growth factor (ALGF) for school districts (and other localities with a June 30 fiscal year end) will be available in January 2016.

Local governments can legally exceed the tax levy limit by passing a local law (counties, cities, towns and villages) or a resolution (fire districts and

others) to override the cap. An override requires at least a 60 percent supermajority vote of the governing board in order to pass. School districts

may seek an override of the tax levy limit as well, but this override requires approval from at least 60 percent of the voters.

New York State Office of the State Comptroller

Division of Local Government and School Accountability

110 State Street, 12th Floor Albany, New York 12236

Like us on Facebook at facebook.com/nyscomptroller

Follow us on Twitter @nyscomptroller

w w w. o s c . s t a t e . n y. u s

July 2015

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Reading Comprehension Animals Copyright English Created Resources PDFDocument10 pagesReading Comprehension Animals Copyright English Created Resources PDFCasillas ElNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ThiruppavaiDocument157 pagesThiruppavaiajiva_rts100% (49)

- Understanding Death Through the Life SpanDocument52 pagesUnderstanding Death Through the Life SpanKaren HernandezNo ratings yet

- 2023 Civil LawDocument7 pages2023 Civil LawJude OnrubiaNo ratings yet

- Exam 2 Study GuideDocument11 pagesExam 2 Study GuideAnonymous ewJy7jyvNNo ratings yet

- CES Wrong Answer SummaryDocument4 pagesCES Wrong Answer SummaryZorg UANo ratings yet

- Fernández Kelly - Death in Mexican Folk CultureDocument21 pagesFernández Kelly - Death in Mexican Folk CultureantoniadelateNo ratings yet

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsNo ratings yet

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorNo ratings yet

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorNo ratings yet

- State Health CoverageDocument26 pagesState Health CoveragejspectorNo ratings yet

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorNo ratings yet

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorNo ratings yet

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorNo ratings yet

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinNo ratings yet

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorNo ratings yet

- Class of 2022Document1 pageClass of 2022jspectorNo ratings yet

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanNo ratings yet

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorNo ratings yet

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorNo ratings yet

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyNo ratings yet

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinNo ratings yet

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorNo ratings yet

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorNo ratings yet

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorNo ratings yet

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorNo ratings yet

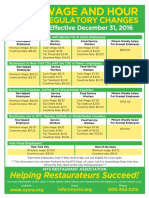

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorNo ratings yet

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorNo ratings yet

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonNo ratings yet

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorNo ratings yet

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorNo ratings yet

- Voting Report CardDocument1 pageVoting Report CardjspectorNo ratings yet

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanNo ratings yet

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorNo ratings yet

- Myanmar Thilawa SEZ ProspectusDocument92 pagesMyanmar Thilawa SEZ ProspectusfrancistsyNo ratings yet

- ĐỀ MINH HỌA 15-19Document25 pagesĐỀ MINH HỌA 15-19Trung Vũ ThànhNo ratings yet

- Focus2 2E Review Test 4 Units1 8 Vocabulary Grammar UoE Reading GroupBDocument4 pagesFocus2 2E Review Test 4 Units1 8 Vocabulary Grammar UoE Reading GroupBaides1sonNo ratings yet

- Specification For Corrugated Bitumen Roofing Sheets: Indian StandardDocument10 pagesSpecification For Corrugated Bitumen Roofing Sheets: Indian StandardAmanulla KhanNo ratings yet

- Doubles and Doppelgangers: Religious Meaning For The Young and OldDocument12 pagesDoubles and Doppelgangers: Religious Meaning For The Young and Old0 1No ratings yet

- MA KP3-V2H-2 enDocument155 pagesMA KP3-V2H-2 enJavier MiramontesNo ratings yet

- Product Data: Real-Time Frequency Analyzer - Type 2143 Dual Channel Real-Time Frequency Analyzers - Types 2144, 2148/7667Document12 pagesProduct Data: Real-Time Frequency Analyzer - Type 2143 Dual Channel Real-Time Frequency Analyzers - Types 2144, 2148/7667jhon vargasNo ratings yet

- FINAL Conflicts 2019 Official Guidelines PDFDocument48 pagesFINAL Conflicts 2019 Official Guidelines PDFxsar_xNo ratings yet

- Talha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFDocument4 pagesTalha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFMohammad TalhaNo ratings yet

- Tarea 1Document36 pagesTarea 1LUIS RVNo ratings yet

- Ganuelas v. CawedDocument4 pagesGanuelas v. CawedHanna AlfantaNo ratings yet

- The Cult of Demeter On Andros and The HDocument14 pagesThe Cult of Demeter On Andros and The HSanNo ratings yet

- Introduction To Intelligent BuildingsDocument3 pagesIntroduction To Intelligent Buildingsmamta jainNo ratings yet

- The Son of Man Rides The Clouds Pt. 2b - Answering Islam BlogDocument5 pagesThe Son of Man Rides The Clouds Pt. 2b - Answering Islam BlogbenciusilviuNo ratings yet

- Innovations in Teaching-Learning ProcessDocument21 pagesInnovations in Teaching-Learning ProcessNova Rhea GarciaNo ratings yet

- Chemistry The Molecular Science 5th Edition Moore Solutions Manual 1Document36 pagesChemistry The Molecular Science 5th Edition Moore Solutions Manual 1josephandersonxqwbynfjzk100% (27)

- Yoga For The Primary Prevention of Cardiovascular Disease (Hartley 2014)Document52 pagesYoga For The Primary Prevention of Cardiovascular Disease (Hartley 2014)Marcelo NorisNo ratings yet

- Plants Promoting Happiness: The Effect of Indoor Plants on MoodDocument11 pagesPlants Promoting Happiness: The Effect of Indoor Plants on MoodWil UfanaNo ratings yet

- Miles and Snow's Organizational StrategiesDocument15 pagesMiles and Snow's Organizational StrategiesVirat SahNo ratings yet

- PERTANYAAN INTERVIEW WinaDocument2 pagesPERTANYAAN INTERVIEW WinaDidi SetiadiNo ratings yet

- SMS Romantis Bhs Inggris Buat Pacar TercintaDocument5 pagesSMS Romantis Bhs Inggris Buat Pacar TercintaAdnan MaruliNo ratings yet

- Java Thread Priority in MultithreadingDocument3 pagesJava Thread Priority in MultithreadingMITALI SHARMANo ratings yet

- The Names & Atributes of Allah - Abdulillah LahmamiDocument65 pagesThe Names & Atributes of Allah - Abdulillah LahmamiPanthera_No ratings yet