Professional Documents

Culture Documents

FIN 321 CH 11 Quiz

Uploaded by

spikeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 321 CH 11 Quiz

Uploaded by

spikeCopyright:

Available Formats

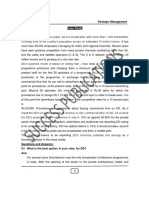

If returns of S&P 500 stocks are normally distributed, what range of returns would

you expect to see 95% of the time. Base your answer on the information below.

Average

Return

Standard

Deviation of

returns

Small Stocks

S&P 500

11.19%

Corporate

Bonds

6.66%

21.66%

42.65%

T-Bills

4.74%

20.73%

7.29%

3.46%

To find the 95% confidence interval, use the following formulas

Average + (2 x standard deviation)

And

Average (2 x standard deviation)

11.19%+(2 x 20.73%) and 11.19-(2 x 20.73%)

= - 30.27% and 52.65%

Use the data for Starbucks (SBUX) and Google (GOOG) to answer the following

questions:

a. What is the return for SBUX over the period without including its dividends?

With the dividends?

b. What is the return for GOOG over the period?

c. If you have 31% of your portfolio in SBUX and 69% in GOOG, what was the

return on your portfolio excluding dividends?

Date

2011-11-14

2012-02-06

2012-05-07

2012-08-06

2012-12-13

SBUX

$43.64

$48.29

$55.48

$43.48

$53.18

Dividend

0.00

0.17

0.17

0.17

0.21

GOOG

$613.00

$609.09

$607.55

$642.82

$659.05

Dividend

0.00

0.00

0.00

0.00

0.00

A. The return for SBUX over the period without including its dividend is:

R = P2/P1 x P3/P2 x P4/P3 x P5/P4 1

48.29/43.64 x 55.48/48.29 x 43.48/55.48 x 53.18/43.48 1 = 21.86%

The return with the dividends is:

R = P2 + Div2 / P1 1

48.29+0.17 / 43.64 x 55.48+0.17 / 48.29 x 43.48+0.17 / 55.48 x 53.18 +

0.21 / 43.48 1 = 23.63%

B. The return for GOOG is:

R = 609.09 / 613.00 x 607.55 / 609.09 x 642.82 / 607.55 x 659.05 / 642.82

1 = 7.51%

C. The return on your portfolio excluding dividends is:

R = w1 x R1 + w2 x R2

0.31 x 21.86% + .069 x 7.51% = 11.96%

Explain the difference between an arithmetic average return and a geometric

average return. Are both useful? If so, explain why?

A: Both numbers are useful. The geometric average return tells you what you would

actually make if you held the stock over this period. You can use the arithmetic

average return over the period as an estimate of the expected return. If you use this

estimate, it is what you would expect to make in the next period.

You bought a stock one year ago for $49.24 per share and sold it today for $55.13

per share. It paid a $1.01 per share dividend today. What was your realized return?

A: Rt + 1 = Div t + 1 + (Pt+1 Pt) / Pt

$1.01 + (55.13-49.24) / 49.24 = $14.0%

Consider two local banks. Bank A has 90 loans outstanding, each for $1.0 million,

that it expected will be repaid today. Each loan has a 5% probability of default, in

which case the bank is not repaid anything. The chance of default is independent

across all the loans. Bank B has only one loan of $90 million outstanding, which it

also expects will be repaid today. It also has a 5% probability of not being repaid.

Calculate the following:

a. The expected overall payoff of each bank.

b. The standard deviation of the overall payoff of each bank.

A:

a.

E[R]Sigma pR x R

Bank A = E[R] = 1 million x 0.95 x 90 = $86 million.

Bank B = E[R] = 90 million x 0.95 = $86 million.

b.

Variance of each loan for Bank A = ((1-.95)^2 x 0.95) + (0-0.95)^2 x 0.05 = 0.0475

Sqrt 0.0475 = 0.217945 = 21.7945%

Standard Deviation of the average loan = 0.217945 / Sqrt 90 = 0.022973

Standard Deviation of portfolio = 90 loans x 0.022973 = 2.0676

Standard deviation of the overall payoff of Bank B is:

Variance of the loan for Bank B = ((90-86)^2 x 0.95) + (0-86)^2 x 0.05 = 385

Standard deviation of the loan = Sqrt 385 = 19.62

You bought a stock one year ago for $51.06 per share and sold it today for $58.69

per share. It paid a $1.63 per share dividend today. If you assume that the stock fell

$6.72 to $44.34 instead:

a. Is your capital gain different? Why or why not?

b. Is your dividend yield different? Why or why not?

If you assume that the stock feel $6.72 to $44.34 instead, the capital gain is

different because the difference between the current price and the purchase price is

difference than in the first case. The dividend yield will not be different because the

change in selling price does not effect the dividend yield. The dividend yield is equal

to the dividend, which did not change, divided by the price paid per share, which is

not effected by the change in selling price.

A:

a. The capital gain will be different because the selling price has changed.

b. The dividend yield will not be different because the dividend is the same and

the change in selling price does not effect the dividend yield.

Ten annual returns are listed in the following table:

-19.4 16.6 18.4 -49.3 43.4 1.5 -16.9 45.7 44.5 -3.5.

a. What is the arithmetic average return over the 10-year period?

b. What is the geometric average return over the 10-year period?

c. If you invested $100 at the beginning how much would you have at the end?

You might also like

- Sage Green Minimalist Business Proposal PresentationDocument35 pagesSage Green Minimalist Business Proposal PresentationMjane JamitoNo ratings yet

- The Private Insurance Industry: Financial Operations of InsurersDocument11 pagesThe Private Insurance Industry: Financial Operations of InsurersSunny SunnyNo ratings yet

- Critical Reasoning: Read The Following Statements and Answer Questions 02 and 03Document6 pagesCritical Reasoning: Read The Following Statements and Answer Questions 02 and 03Raiad rafiNo ratings yet

- Insurance Basics: Insurers Assume and Manage Risk in Return For A PremiumDocument6 pagesInsurance Basics: Insurers Assume and Manage Risk in Return For A Premiumgaggu747No ratings yet

- IFRS 4 Basis For ConclusionsDocument87 pagesIFRS 4 Basis For ConclusionsMariana Mirela0% (1)

- GMAT CR Flaw Special Set 1 QuestionsDocument4 pagesGMAT CR Flaw Special Set 1 QuestionsKay Q100% (1)

- GMAT 逻辑笔记区Document80 pagesGMAT 逻辑笔记区AdityaNo ratings yet

- CR QuestionsDocument87 pagesCR QuestionsSushobhan SanyalNo ratings yet

- St. Mary's Business Management ChapterDocument340 pagesSt. Mary's Business Management Chapterhelen gugsaNo ratings yet

- Foundations of PlanningDocument31 pagesFoundations of PlanningUYEN Pham Thuy PhuongNo ratings yet

- Lecture 1Document44 pagesLecture 1Inzamam Ul HaqNo ratings yet

- Controlling With ExamplesDocument39 pagesControlling With ExamplesteuuuuNo ratings yet

- Companies in CrisisDocument16 pagesCompanies in Crisismilla_nezlinaNo ratings yet

- Ch13 - Change StrategyDocument6 pagesCh13 - Change StrategyAntara AwasthiNo ratings yet

- Principles of Corporate FinanceDocument36 pagesPrinciples of Corporate FinanceOumayma KharbouchNo ratings yet

- CH 06Document18 pagesCH 06harisadhaNo ratings yet

- Control AccountDocument6 pagesControl AccountPranitha RaviNo ratings yet

- FINANCE FOR MANAGER TERM PAPERxxxDocument12 pagesFINANCE FOR MANAGER TERM PAPERxxxFrank100% (1)

- Ch08, Operations Strategy, Slack & LouisDocument27 pagesCh08, Operations Strategy, Slack & LouisAbe SailorNo ratings yet

- MM PropositionDocument61 pagesMM PropositionVikku AgarwalNo ratings yet

- Seminar in Public Management CHAPTER 3Document28 pagesSeminar in Public Management CHAPTER 3ibudanish79No ratings yet

- Financial Statements of Insurance Companies (PDFDrive)Document106 pagesFinancial Statements of Insurance Companies (PDFDrive)Putin PhyNo ratings yet

- Financial StatementsDocument35 pagesFinancial StatementsTapish GroverNo ratings yet

- Educational Leadership and Management CourseDocument231 pagesEducational Leadership and Management CourseAbdul QadeemNo ratings yet

- Insurance AccountingDocument16 pagesInsurance Accountingssp2000No ratings yet

- Unit 1: School Culture, Leadership and ManagementDocument126 pagesUnit 1: School Culture, Leadership and ManagementGim CheniNo ratings yet

- Accounting For Insurance LiabilitiesDocument18 pagesAccounting For Insurance LiabilitiesDudenNo ratings yet

- Critical reasoningDocument10 pagesCritical reasoningShine Sam ShineNo ratings yet

- Buad 804 Sourced MCQ LQADocument21 pagesBuad 804 Sourced MCQ LQAAbdulrahman Adamu AhmedNo ratings yet

- Accounting Assignment (Question Number 1)Document4 pagesAccounting Assignment (Question Number 1)wasifNo ratings yet

- Corporate Finance QBDocument27 pagesCorporate Finance QBVelu SamyNo ratings yet

- Educational Leadership and ManagementDocument19 pagesEducational Leadership and ManagementAyesha KhalidNo ratings yet

- Managing Infrastructure Projects in Developing CountriesDocument41 pagesManaging Infrastructure Projects in Developing CountriesAlice S LunguNo ratings yet

- CONTROLLING2Document30 pagesCONTROLLING2Shantanu MohantyNo ratings yet

- Investement Analysis and Portfolio Management Chapter 6Document12 pagesInvestement Analysis and Portfolio Management Chapter 6Oumer ShaffiNo ratings yet

- Chapter 8 Project ManagementDocument65 pagesChapter 8 Project ManagementLove StrikeNo ratings yet

- Critical Reasoning For Clat 2020 ClatimpstuffDocument23 pagesCritical Reasoning For Clat 2020 ClatimpstuffDonnagerNo ratings yet

- CAF2-Intorduction To Economics and Finance - StudytextDocument332 pagesCAF2-Intorduction To Economics and Finance - StudytextAli Zafar100% (2)

- ManageDocument89 pagesManagebhuvaneshwari100% (1)

- CASE 01 - Walker Wire Products Co.Document2 pagesCASE 01 - Walker Wire Products Co.Kenneth CalzoNo ratings yet

- Public Sector AccountingDocument5 pagesPublic Sector AccountingKhushboo JainNo ratings yet

- Donner Case Study - MBA 621 PDFDocument35 pagesDonner Case Study - MBA 621 PDFViswateja KrottapalliNo ratings yet

- Cost of Capital and Capital Structure DecisionsDocument21 pagesCost of Capital and Capital Structure DecisionsGregory MakaliNo ratings yet

- DBFOT - Term SheetDocument26 pagesDBFOT - Term SheetIES-GATEWizNo ratings yet

- An Assessment On The Practice and Challenges of Project Monitoring and EvaluationDocument72 pagesAn Assessment On The Practice and Challenges of Project Monitoring and EvaluationbenNo ratings yet

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- Educational Management and Educational AdministrationDocument15 pagesEducational Management and Educational AdministrationAbacini J BNo ratings yet

- Case StudyDocument16 pagesCase StudyAmruta MohiteNo ratings yet

- BF R. Kit As at 25 April 2006Document255 pagesBF R. Kit As at 25 April 2006Winny Shiru Machira100% (2)

- Unit Five: Controlling and Decision MakingDocument50 pagesUnit Five: Controlling and Decision MakingFami MohammedNo ratings yet

- Capital Market, Consumption and Investment RelationshipsDocument22 pagesCapital Market, Consumption and Investment RelationshipsKamran Kamran100% (1)

- Modigliani Miller TheoremDocument4 pagesModigliani Miller TheoremmeetwithsanjayNo ratings yet

- Chapter 12 Test BankDocument49 pagesChapter 12 Test BankMariA YAGHINo ratings yet

- Chapter 01Document40 pagesChapter 01Ankita ShringareNo ratings yet

- MA 204 Monitoring and Evaluation PlanDocument16 pagesMA 204 Monitoring and Evaluation PlanCyndzJoe D AnocheNo ratings yet

- Book For Practice V2.01 Reasoning & DIDocument141 pagesBook For Practice V2.01 Reasoning & DIRutuja JadhavNo ratings yet

- Final Exam Review QuestionsDocument18 pagesFinal Exam Review QuestionsArchiePatelNo ratings yet

- CH 4 Classpack With SolutionsDocument24 pagesCH 4 Classpack With SolutionsjimenaNo ratings yet

- Finance 340 - Financial Management: Dr. Stanley D. Longhofer TTH 9:30-10:45Document6 pagesFinance 340 - Financial Management: Dr. Stanley D. Longhofer TTH 9:30-10:45Naneun NabilahNo ratings yet

- MBA Competency Exam 3 Spring 2011 PDFDocument7 pagesMBA Competency Exam 3 Spring 2011 PDFSankalan GhoshNo ratings yet

- SpritzerDocument152 pagesSpritzerSYARMILA BINTI HASHIMNo ratings yet

- Assignment#2Document3 pagesAssignment#2Kit KatNo ratings yet

- Cash Flow Statement Format Direct MethodDocument4 pagesCash Flow Statement Format Direct MethodvishalkulthiaNo ratings yet

- AR2010Document62 pagesAR2010Phú ĐàoNo ratings yet

- Torrent Power Limited - Annaul Report 2009-10Document94 pagesTorrent Power Limited - Annaul Report 2009-10rajbank6_sNo ratings yet

- 04TP1 GovernanceDocument4 pages04TP1 GovernanceAilaJeanineNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 3Document40 pagesFINANCE MANAGEMENT FIN420 CHP 3Yanty Ibrahim50% (2)

- Ratio. AnalysisDocument72 pagesRatio. AnalysisRaveendhar.S -MCANo ratings yet

- Cicular Booklet 04 12 13Document45 pagesCicular Booklet 04 12 13Kristi DuranNo ratings yet

- Tax 2Document11 pagesTax 2cutieaikoNo ratings yet

- PWC Worldwide Tax Summaries Corporate Taxes 2017 18 AfricaDocument444 pagesPWC Worldwide Tax Summaries Corporate Taxes 2017 18 AfricaYoxana León LandinNo ratings yet

- Tutorial 12 QuestionsDocument8 pagesTutorial 12 QuestionsDylan Rabin PereiraNo ratings yet

- Strictly Confidential: (For Internal and Restricted Use Only)Document28 pagesStrictly Confidential: (For Internal and Restricted Use Only)Simran KaurNo ratings yet

- ch2 UzdaviniaiDocument3 pagesch2 UzdaviniaiLeonid LeoNo ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Acctg 12 Second SeatworkDocument6 pagesAcctg 12 Second SeatworksarahbeeNo ratings yet

- Examination: Subject CT1 Financial Mathematics Core TechnicalDocument211 pagesExamination: Subject CT1 Financial Mathematics Core TechnicalMfundo MshenguNo ratings yet

- Test Paper-2 Master Question PGBPDocument3 pagesTest Paper-2 Master Question PGBPyeidaindschemeNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Importance of ROIC Part 1: Compounders and Cheap Stocks: Update: For Those Interested, I Wrote ADocument7 pagesImportance of ROIC Part 1: Compounders and Cheap Stocks: Update: For Those Interested, I Wrote AGurjeevNo ratings yet

- Case Study of The Banking Sector in The UK - HSBC & BarclaysDocument50 pagesCase Study of The Banking Sector in The UK - HSBC & BarclaysMuhammad Salman Khan67% (3)

- CH # 4 Financial StatementsDocument4 pagesCH # 4 Financial StatementsAbubakar AliNo ratings yet

- Individual Tax Payer - TeachersDocument8 pagesIndividual Tax Payer - TeachersKhervin EvangelistaNo ratings yet

- Financial Accounting: Balance SheetDocument53 pagesFinancial Accounting: Balance SheetSNo ratings yet

- Apollo Hospital Enterprise Limited: India - Healthcare Initiating CoverageDocument15 pagesApollo Hospital Enterprise Limited: India - Healthcare Initiating CoverageHarsh BhutaNo ratings yet

- Law 227 - 2015 - Tax CodeDocument363 pagesLaw 227 - 2015 - Tax Codecatacata100% (1)

- How To Use the Excel Based Business Financial Planner TemplateDocument28 pagesHow To Use the Excel Based Business Financial Planner TemplatemkmattaNo ratings yet

- Telus Dividend Policy FinalDocument7 pagesTelus Dividend Policy Finalmalaika12No ratings yet

- NFJPIA Mock Board Exam 2014Document12 pagesNFJPIA Mock Board Exam 2014Arwind ReyesNo ratings yet

- Step 1 - Introduzca información sobre su empresaDocument36 pagesStep 1 - Introduzca información sobre su empresaSamuel FLoresNo ratings yet