Professional Documents

Culture Documents

Content Detail QQQ

Uploaded by

zmcoupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Content Detail QQQ

Uploaded by

zmcoupCopyright:

Available Formats

P-QQQ-PC-1_FactSheet 7/14/2015 4:13 PM Page 1

QQQ

PowerShares QQQ

As of June 30, 2015

Fund Description

PowerShares QQQ, formerly known as "QQQ"

or the "Nasdaq-100 Index Tracking Stock," is an

exchange-traded fund based on the Nasdaq-100

Index. The Fund will, under most circumstances,

consist of all the stocks in the Index. The Index

includes 100 of the largest domestic and

international nonfinancial companies listed on the

Nasdaq Stock Market based on market

capitalization. The Fund and the Index are

rebalanced quarterly and reconstituted annually.

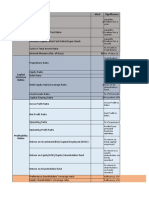

Fund Data

QQQ

Intraday NAV (IIV)

CUSIP

Listing Exchange

Options

Number of Securities

30-Day SEC Yield

30-Day SEC Unsubsidized Yield

Total Expense Ratio

n NASDAQ-100 Index

$32,094

Growth of $10,000

$40k

n PowerShares QQQ

$31,449

$30k

n NASDAQ Composite Index

$24,244

$20k

n Russell 3000 Index

$21,894

$10k

$0

QQQ

QXV

73935A104

NASDAQ

Yes

107

1.02%

N/A

0.20%

Gross expenses of the Trust for the prior year were also

0.20% of the net asset value of the Trust and,

accordingly, no expenses of the Trust were assumed by

the Sponsor. The Sponsor has undertaken that the

ordinary operating expenses of the Trust will not be

permitted to exceed 0.20% per annum of the daily net

assets of the Trust.

N/A indicates that during the 30-day period shown,

Fund costs did not exceed the expense cap as outlined

in the prospectus and the Adviser did not waive any

fees in accordance with the Fee Waiver and Expense

Assumption Agreement. Please see current prospectus

for more information.

Underlying Index Data

NASDAQ-100

XNDX

The NASDAQ OMX Group, Inc.

Index Provider

'06 '07 '08 '09 '10 '11 '12 '13 '14 '15

Data beginning 10 years prior to the ending date of June 30, 2015. Fund performance shown at NAV.

Fund Performance & Index History (%)

YTD

1 year

3 year

5 year

10 year

Fund

Inception

Underlying Index

NASDAQ-100 Index

4.42

15.58

20.51

21.81

12.37

5.44

Benchmark Indexes

NASDAQ Composite Index

Russell 3000 Index

5.30

1.94

13.13

7.29

19.33

17.73

18.78

17.54

9.26

8.15

4.57

5.55

Fund

NAV

After Tax Held

After Tax Sold

Market Price

4.30

4.11

2.45

4.34

15.33

14.93

8.80

15.45

20.24

19.85

15.96

20.34

21.53

21.24

17.64

21.57

12.14

11.97

10.14

12.16

5.23

5.12

4.28

5.23

Returns less than one year are cumulative. Performance data quoted represents past performance. Past

performance is not a guarantee of future results; current performance may be higher or lower than performance

quoted. Investment returns and principal value will fluctuate and Shares, when redeemed, may be worth more or

less than their original cost. See invescopowershares.com to find the most recent month-end performance numbers.

After Tax Held represents total return after taxes on distributions and assumes Shares have not been sold. After Tax

Sold represents total return after taxes on distributions and the sale of Fund Shares. After-tax returns reflect the

highest federal income tax rate but exclude state and local taxes. Market returns are based on the midpoint of the

bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at

other times. Fund performance reflects fee waivers, absent which, performance data quoted would have been lower.

10-Year Index Statistics

NASDAQ-100 Index

NASDAQ Composite Index

Russell 3000 Index

Alpha

Beta

Correlation

Sharpe Ratio

Volatility (%)

2.87

3.83

1.01

1.06

0.98

0.91

0.63

0.46

0.45

17.76

17.32

15.28

Alpha, beta and correlation are that of the underlying index.

Fund Inception: March 10, 1999

Index returns do not represent Fund returns. An

investor cannot invest directly in an index.

Neither the underlying Index nor the benchmark

indexes charge management fees or brokerage

expenses, and no such fees or expenses were

deducted from the performance shown; nor do any of

the indexes lend securities, and no revenues from

securities lending were added to the performance

shown. In addition, the results actual investors might

have achieved would have differed from those shown

because of differences in the timing, amounts of their

investments, and fees and expenses associated with an

investment in the Fund.

The NASDAQ Composite Index measures all NASDAQ

domestic and international-based common stocks listed

on The Nasdaq Stock Market.

The Russell 3000 Index is an unmanaged index

considered representative of the US stock market. The

Russell 3000 Index is a trademark/service mark of the

Frank Russell Co. Russell is a trademark of the Frank

Russell Co.

Shares are not FDIC insured, may lose value and

have no bank guarantee.

Shares are not individually redeemable and owners of

the Shares may acquire those Shares from the Fund

and tender those Shares for redemption to the Fund

in Creation Unit aggregations only, typically

consisting of 50,000 Shares.

P-QQQ-PC-1_FactSheet 7/14/2015 4:13 PM Page 2

QQQ

PowerShares QQQ

As of June 30, 2015

Annual Index Performance (%)

Top Fund Holdings (%)

Name

Weight

Apple

Microsoft

Amazon.com

Facebook 'A'

Google 'C'

Gilead Sciences

Google 'A'

Intel

Cisco Systems

Comcast 'A'

Amgen

Qualcomm

Biogen Idec

Walgreens Boots Alliance

Celgene

Starbucks

eBay

Mondelez International

Express Scripts

Priceline.com

Costco Wholesale

Baidu ADR

Texas Instruments

Regeneron Pharmaceuticals

Kraft Foods Group

DIRECTV

Twenty-First Century Fox

Adobe Systems

Netflix

ADP

14.31

7.07

4.00

3.82

3.53

3.41

3.08

2.86

2.76

2.54

2.31

2.02

1.88

1.82

1.82

1.59

1.45

1.33

1.28

1.18

1.18

1.09

1.06

1.02

1.00

0.93

0.81

0.80

0.79

0.75

Please see the website for complete holdings

information. Holdings are subject to change.

Leading the Intelligent ETF Revolution

About risk

There are risks involved with investing in ETFs,

including possible loss of money. Shares are not

actively managed and are subject to risks similar to

those of stocks, including those regarding short selling

and margin maintenance requirements. Ordinary

brokerage commissions apply. The Funds return may

not match the return of the Underlying Index. The

fund is subject to certain other risks. Please see the

current prospectus for more information regarding the

risk associated with an investment in the fund.

The Intraday NAV is a symbol representing

estimated fair value based on the most recent

intraday price of underlying assets.Volatility is the

annualized standard deviation of index returns. Beta

is a measure of relative risk and the slope of

regression. Sharpe Ratio is a risk-adjusted measure

calculated using standard deviation and excess

return to determine reward per unit of risk. A higher

Sharpe Ratio indicates better risk-adjusted

performance. Correlation indicates the degree to

which two investments have historically moved in

the same direction and magnitude. Alpha is a

measure of performance on a risk-adjusted basis.

Weighted Harmonic Average Stock Price-to-Earnings

Ratio (P/E Ratio) is the share price divided by

earnings per share. It is measured on a 12-month

2015 Invesco PowerShares Capital Management LLC

NASDAQ-100

NASDAQ Composite Index

Russell 3000 Index

1.89

7.28

19.24

-41.57

54.61

20.14

3.65

18.35

36.92

19.40

4.42

1.37

9.52

9.81

-40.54

43.89

16.91

-1.79

15.91

38.32

13.40

5.30

6.12

15.72

5.14

-37.31

28.34

16.93

1.02

16.42

33.55

12.56

1.94

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015 YTD

Fund Details

P/B Ratio

P/E Ratio

Return on Equity

Weighted Market Cap ($MM)

4.74

20.30

24.37%

214,132

Fund Industry Allocations (%)

Technology Hardware, Storage & Peripherals 15.40

Internet Software & Services

13.95

Biotechnology

11.75

Software

10.49

Semiconductors & Semiconductor

8.31

Equipment

Media

8.16

Internet & Catalog Retail

6.55

Communications Equipment

4.79

Food & Staples Retailing

3.28

Food Products

2.56

trailing basis. Weighted Harmonic Average Stock

Price-to-Book-Value Ratio (P/B Ratio) is the ratio of

a stocks market price to a companys net asset

value. Weighted Harmonic Average is a method of

calculating an average value that lessens the impact

of large outliers and increases the impact of small

ones. Weighted Average Return on Equity is net

income divided by net worth. Weighted Market

Capitalization is the sum of each underlying

securities market value.The 30-Day SEC Yield is

based on a 30-day period and is computed by

dividing the net investment income per share earned

during the period by the maximum offering price per

share on the last day of the period. The 30-Day SEC

Unsubsidized Yield reflects the 30-day yield if the

investment adviser were not waiving all or part of its

fee or reimbursing the fund for part of its expenses.

Total return would have also been lower in the

absence of these temporary reimbursements or

waivers.

Typically, security classifications used in calculating

allocation tables are as of the last trading day of the

previous month.

The Global Industry Classification Standard was

developed by and is the exclusive property and a

service mark of MSCI, Inc. and Standard & Poors.

The sponsor of the Nasdaq-100 TrustSM, a unit

investment trust, is Invesco PowerShares Capital

Management LLC ("Invesco PowerShares"). NASDAQ,

Nasdaq-100 Index, Nasdaq-100 Index Tracking Stock

P-QQQ-PC-1 07/15 QQQ001690

10/31/15

Fund Market-Cap Allocations (%)

Large-Cap Blend

Large-Cap Growth

Large-Cap Value

Mid-Cap Blend

Mid-Cap Growth

Mid-Cap Value

Small-Cap Blend

Small-Cap Growth

Small-Cap Value

28.37

61.75

1.72

2.25

4.14

1.78

Fund Sector Allocations (%)

Consumer Discretionary

Consumer Staples

Energy

Financials

Health Care

Industrials

Information Technology

Materials

Telecommunication Services

Utilities

19.76

6.29

15.63

2.07

55.14

0.33

0.78

and QQQ are trade/service marks of The Nasdaq Stock

Market, Inc. and have been licensed for use by Invesco

PowerShares Capital Management LLC, QQQ's

sponsor. NASDAQ makes no representation regarding

the advisability of investing in QQQ and makes no

warranty and bears no liability with respect to QQQ,

the Nasdaq-100 Index, its use or any data included

therein.

ALPS Distributors, Inc. is the distributor for the

QQQ.

Invesco PowerShares Capital Management LLC is

not affiliated with ALPS Distributors, Inc.

PowerShares is a registered trademark of Invesco

PowerShares Capital Management LLC, investment

adviser. Invesco PowerShares Capital Management

LLC (Invesco PowerShares) and Invesco

Distributors, Inc., ETF distributor, are indirect,

wholly owned subsidiaries of Invesco Ltd.

An investor should consider investment

objectives, risks, charges and expenses

carefully before investing. To obtain a

prospectus, which contains this and other

information about the QQQ, a unit investment

trust, please contact your broker, call 800 983

0903 or visit invescopowershares.com. Please

read the prospectus carefully before investing.

Note: Not all products available through all firms or in

all jurisdictions.

800 983 0903

invescopowershares.com

twitter: @PowerShares

You might also like

- Powershares Buyback Achievers Portfolio: As of Dec. 31, 2013Document2 pagesPowershares Buyback Achievers Portfolio: As of Dec. 31, 2013hkm_gmat4849No ratings yet

- First Trust Value Line® 100 Exchange-Traded Fund: Fund Objective Index DescriptionDocument2 pagesFirst Trust Value Line® 100 Exchange-Traded Fund: Fund Objective Index Descriptionwesleybean9381No ratings yet

- LVOLDocument2 pagesLVOLSteven VandewieleNo ratings yet

- SCIF Factsheet 0315Document2 pagesSCIF Factsheet 0315MLastTryNo ratings yet

- DSPBRUSFlexibleEquity 2014jan02Document4 pagesDSPBRUSFlexibleEquity 2014jan02Yogi173No ratings yet

- SPDR Barclays Capital Intermediate Term Treasury ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Treasury ETF 1-10YRoberto PerezNo ratings yet

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezNo ratings yet

- Ishares Barclays 10-20 Year Treasury Bond FundDocument0 pagesIshares Barclays 10-20 Year Treasury Bond FundRoberto PerezNo ratings yet

- AMANX FactSheetDocument2 pagesAMANX FactSheetamnoman17No ratings yet

- VQT Overview - Hedged ETFDocument19 pagesVQT Overview - Hedged ETFPhil MironenkoNo ratings yet

- SPDR Barclays Capital Long Term Corporate Bond ETF 10+YDocument2 pagesSPDR Barclays Capital Long Term Corporate Bond ETF 10+YRoberto PerezNo ratings yet

- Invesco QQQ Trust: Growth of $10,000Document2 pagesInvesco QQQ Trust: Growth of $10,000TotoNo ratings yet

- Ishares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummaryDocument3 pagesIshares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummarywanwizNo ratings yet

- Ishares Barclays 1-3 Year Treasury Bond FundDocument0 pagesIshares Barclays 1-3 Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 20+ Year Treasury Bond FundDocument0 pagesIshares Barclays 20+ Year Treasury Bond FundRoberto PerezNo ratings yet

- ValueResearchFundcard DSPBRTop100EquityReg 2011jun22Document6 pagesValueResearchFundcard DSPBRTop100EquityReg 2011jun22Aditya TipleNo ratings yet

- Ishares Barclays 7-10 Year Treasury Bond FundDocument0 pagesIshares Barclays 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- ValueResearchFundcard EdelweissELSS 2013may28Document6 pagesValueResearchFundcard EdelweissELSS 2013may28hemant1108aranghNo ratings yet

- ValueResearchFundcard RelianceEquityOpportunitiesFund 2015nov01Document4 pagesValueResearchFundcard RelianceEquityOpportunitiesFund 2015nov01spvengiNo ratings yet

- Ishares Barclays 3-7 Year Treasury Bond FundDocument0 pagesIshares Barclays 3-7 Year Treasury Bond FundRoberto PerezNo ratings yet

- Uupt Powershares DB 3X Long Us Dollar Index Futures Exchange Traded NotesDocument3 pagesUupt Powershares DB 3X Long Us Dollar Index Futures Exchange Traded NotessailfurtherNo ratings yet

- Fs SP 400Document6 pagesFs SP 400hkm_gmat4849No ratings yet

- Weekly Market Recap-Week of May 6th-MSFDocument2 pagesWeekly Market Recap-Week of May 6th-MSFasmith2499No ratings yet

- Weekly Market Recap, May 13-Main Street FinancialDocument2 pagesWeekly Market Recap, May 13-Main Street Financialasmith2499No ratings yet

- SPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YRoberto PerezNo ratings yet

- Practice Essentials Birds Eye View Income InvestingDocument11 pagesPractice Essentials Birds Eye View Income InvestingzencrackerNo ratings yet

- Birla Sun Life Cash ManagerDocument6 pagesBirla Sun Life Cash ManagerrajloniNo ratings yet

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173No ratings yet

- MOSt Shares M50 ETF RatingDocument4 pagesMOSt Shares M50 ETF RatingYogi173No ratings yet

- Ishares FM100 FactsheetDocument2 pagesIshares FM100 FactsheetSorin Ioan PirăuNo ratings yet

- Fundcard FranklinAsianEquityDocument4 pagesFundcard FranklinAsianEquityYogi173No ratings yet

- Dow Jones Corporate Bond Index Fact SheetDocument3 pagesDow Jones Corporate Bond Index Fact SheetjiamintayNo ratings yet

- Ishares Core S&P 500 Etf: Historical Price Performance Quote SummaryDocument3 pagesIshares Core S&P 500 Etf: Historical Price Performance Quote SummarywanwizNo ratings yet

- QQQ 2Document2 pagesQQQ 2Dominic angelNo ratings yet

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Document4 pagesFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173No ratings yet

- DBC Fact SheetDocument2 pagesDBC Fact SheetLincoln WebberNo ratings yet

- 02 - Ishares Barclays Credit Bond FundDocument0 pages02 - Ishares Barclays Credit Bond FundRoberto PerezNo ratings yet

- 01 - Ishares 7-10 Year Treasury Bond FundDocument0 pages01 - Ishares 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- HDFC Arbitrage Fund RatingDocument6 pagesHDFC Arbitrage Fund RatingagrawalshashiNo ratings yet

- 01 - Vanguard Total Bond Market FundDocument2 pages01 - Vanguard Total Bond Market FundRoberto PerezNo ratings yet

- Vanguard Funds: Supplement To The ProspectusesDocument45 pagesVanguard Funds: Supplement To The Prospectusesnotmee123No ratings yet

- ValueResearch FundDocument4 pagesValueResearch FundAkhilesh KumarNo ratings yet

- Invesco WilderHill Clean Energy ETF Document SummaryDocument2 pagesInvesco WilderHill Clean Energy ETF Document SummaryRahul SalveNo ratings yet

- Mutual Fund FundcardDocument4 pagesMutual Fund FundcardYogi173No ratings yet

- CSD - Invesco S&P Spin-Off ETF Fact SheetDocument2 pagesCSD - Invesco S&P Spin-Off ETF Fact SheetSack ValperNo ratings yet

- XX - US Corporate VanguardDocument2 pagesXX - US Corporate VanguardRoberto PerezNo ratings yet

- The Vice Fund: Investor Class: Vicex A Share: Vicax C Share: Viccx Portfolio Emphasis: Long-Term Growth of CapitalDocument2 pagesThe Vice Fund: Investor Class: Vicex A Share: Vicax C Share: Viccx Portfolio Emphasis: Long-Term Growth of CapitaladithyaindiaNo ratings yet

- Ishares Barclays 20+ Year Treasury Bond Fund (TLT) FS 13-10-10Document3 pagesIshares Barclays 20+ Year Treasury Bond Fund (TLT) FS 13-10-10João Silva TavaresNo ratings yet

- SBI Contra Fund Performance and AnalysisDocument5 pagesSBI Contra Fund Performance and AnalysissaiyuvatechNo ratings yet

- PLTVF Factsheet October 2015Document4 pagesPLTVF Factsheet October 2015gadiyaranandNo ratings yet

- Vanguard Long-Term Corporate Bond ETF 10+Document2 pagesVanguard Long-Term Corporate Bond ETF 10+Roberto PerezNo ratings yet

- SP 557672Document4 pagesSP 557672gghNo ratings yet

- Pro Shares Fact Sheet KruDocument2 pagesPro Shares Fact Sheet Krumorucha_chicleNo ratings yet

- PineBridge India Liquid Fund - Standard Plan Rating: Low Risk, Below Average ReturnDocument4 pagesPineBridge India Liquid Fund - Standard Plan Rating: Low Risk, Below Average ReturnYogeshpote173No ratings yet

- Callan Periodoc Table of Investment ReturnsDocument2 pagesCallan Periodoc Table of Investment Returnsambasyapare1No ratings yet

- Fundcard L&TCashDocument4 pagesFundcard L&TCashYogi173No ratings yet

- GYLD Fact Sheet (ArrowShares)Document2 pagesGYLD Fact Sheet (ArrowShares)Russell FryNo ratings yet

- ICICIPrudential Capital Protection Oriented Series IIIPlan DRegDocument4 pagesICICIPrudential Capital Protection Oriented Series IIIPlan DRegYogi173No ratings yet

- Equal Weight Indexes MethodologyDocument8 pagesEqual Weight Indexes MethodologythickskinNo ratings yet

- SPX MiniDocument2 pagesSPX Minizmcoup100% (1)

- Bloomberg Terminal Getting Started StudentsDocument38 pagesBloomberg Terminal Getting Started StudentsK Park80% (5)

- SM CFAsolutions Reilly1ceDocument58 pagesSM CFAsolutions Reilly1cesky_6129250% (2)

- WI15 ADMS 4900R Course OutlineDocument7 pagesWI15 ADMS 4900R Course OutlinezmcoupNo ratings yet

- Business Ethics and Corporate Social Responsibility Course OutlineDocument7 pagesBusiness Ethics and Corporate Social Responsibility Course OutlinezmcoupNo ratings yet

- Cu 31924019330905Document888 pagesCu 31924019330905trustkonanNo ratings yet

- Career Profile of Ramachandra RaoDocument4 pagesCareer Profile of Ramachandra RaoRobin SinghNo ratings yet

- 2023 Ijmfa-110014 PPVDocument22 pages2023 Ijmfa-110014 PPVRe DreamNo ratings yet

- Britannia: Business Conduct (COBC) For Its Employees. This Handbook Covers The CodeDocument17 pagesBritannia: Business Conduct (COBC) For Its Employees. This Handbook Covers The CodevkvarshakNo ratings yet

- Strategy Analysis of Year 6Document18 pagesStrategy Analysis of Year 6Anh Thư Nguyễn TrangNo ratings yet

- LSE AC444 Analysis PDFDocument256 pagesLSE AC444 Analysis PDFHu HeNo ratings yet

- Punjab VAT Act SummaryDocument12 pagesPunjab VAT Act SummarySuraj SinghNo ratings yet

- Management of Funds Entire SubjectDocument85 pagesManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- Study Notes On Financial Statement Analysis PDFDocument2 pagesStudy Notes On Financial Statement Analysis PDFKris ANo ratings yet

- Accounting For Investments in Debt Securities and Other Non-Current Financial AssetsDocument57 pagesAccounting For Investments in Debt Securities and Other Non-Current Financial AssetsMarriel Fate CullanoNo ratings yet

- Instructions: Submit Within Due DateDocument4 pagesInstructions: Submit Within Due DateDanish SajjadNo ratings yet

- Stock MarketDocument2 pagesStock MarketDNLNo ratings yet

- Careers in Financial Markets 2014 (Efinancialcareers)Document64 pagesCareers in Financial Markets 2014 (Efinancialcareers)Cups upNo ratings yet

- Financial Risk Management Fs Analysis Students CopyDocument7 pagesFinancial Risk Management Fs Analysis Students Copyshai santiagoNo ratings yet

- Introduction To InvestmentDocument11 pagesIntroduction To InvestmentMaryland Munji67% (3)

- XI Business StudiesDocument89 pagesXI Business Studiessurbhi jindalNo ratings yet

- Aarti Industries - The Scheme of Arrangement - PhillipCapital (India)Document6 pagesAarti Industries - The Scheme of Arrangement - PhillipCapital (India)darshanmaldeNo ratings yet

- Unit 2 The CompanyDocument4 pagesUnit 2 The CompanyMai AnhNo ratings yet

- Managing Small FirmsDocument41 pagesManaging Small FirmsTusher SahaNo ratings yet

- Project Report Sonam GuptaDocument89 pagesProject Report Sonam Guptarafeeq505No ratings yet

- Local Business EnvironmentDocument3 pagesLocal Business EnvironmentJayMoralesNo ratings yet

- Set 5 ENGLISH Questions & Answers 180309: Answer ADocument9 pagesSet 5 ENGLISH Questions & Answers 180309: Answer AAzri LunduNo ratings yet

- Draft SSHA General PDFDocument47 pagesDraft SSHA General PDFumang24No ratings yet

- Katten - ESOP Fact SheetDocument8 pagesKatten - ESOP Fact SheetRichandCo100% (1)

- LIQUIDITY AND SOLVENCY RATIOSDocument26 pagesLIQUIDITY AND SOLVENCY RATIOSDeep KrishnaNo ratings yet

- Investor Protection and Corporate Governance Dissertation For Seminar Paper I 1Document58 pagesInvestor Protection and Corporate Governance Dissertation For Seminar Paper I 1Palash JainNo ratings yet

- Stock Valuation Assignment Lpu Review No AnswerDocument5 pagesStock Valuation Assignment Lpu Review No Answerjackie delos santosNo ratings yet

- Tài liệu không có tiêu đềDocument24 pagesTài liệu không có tiêu đềVũ Minh HoàngNo ratings yet

- Gladiator Indicator: IntroducingDocument5 pagesGladiator Indicator: IntroducingDhiraj RawatNo ratings yet

- ECI - Consumer Resource Guide - CURRENTDocument110 pagesECI - Consumer Resource Guide - CURRENThpNo ratings yet