Professional Documents

Culture Documents

TSG Report - Merchant Cash Overview - PREVIEW

Uploaded by

hkljhjhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TSG Report - Merchant Cash Overview - PREVIEW

Uploaded by

hkljhjhCopyright:

Available Formats

PREVIEW

Merchant Cash

Advance Overview

A detailed analysis of the U.S. MCA market,

the opportunities within, and current player offerings

STRICTLY CONFIDENTIAL.

For discussion purposes only.

This Report, and all information, analysis and

conclusions hereunder, is in all respects

subject to and governed by the terms and

provisions of the Engagement Agreement

between The Strawhecker Group and the

Client.

Copyright 2014. The Strawhecker Group.

All Rights Reserved.

About the Report

WHAT IS THIS REPORT?

This 21 page report provides an overview of the value-adding service known as merchant cash advance and includes

an explanation of the service, the benefits it provides to both merchants and funders, and a look at leading funding

providers and the landscape they are a part of. The report also gives insights into eight acquirers/ISOs that have

deployed a successful MCA program and the reasons behind their success

WHY IS THIS USEFUL?

Acquirers/ISOs looking to improve their performance can consider offering a merchant cash advance program as it

can lead to additional revenue opportunities and stickier merchants

HOW CAN IT BE PURCHASED?

To order online with a credit card, please click here. The report is $2,250.

Topics Covered

Merchant Cash Advance (MCA) defined

Benefits of MCA

U.S. Competitive Landscape: leading MCA funders

U.S. Competitive Landscape: TSG estimate of U.S. Daily Remittance Funding market size

MCA Funders Primary Distribution Partners

MCA Partners Among the Top 50 U.S. Merchant Acquirers

Key Industry Trends Over the Last Five Years

Successful ISOs and Acquirers

Lessons Learned from Successful ISOs, Acquirers, and MCA Funders

Where TSG Can Assist

Confidential. For discussion purposes only.

Copyright 2014. The Strawhecker Group. All Rights Reserved.

About the Author

Barry Davis, Senior Management Consultant / 410-793-5590 / BDavis@TheStrawGroup.com

Barry Davis has 15 year's experience in the Electronic Payments and Financial Services industries. With a deep

background in consulting, he has worked on a variety of engagements at TSG including business planning,

M&A due diligence, portfolio sale advisory, processing and BIN bank RFP assistance, market research, and

consultative sales. Barrys clients have included merchant acquirers, ISOs, processors, card networks, POS

vendors, and other product, technology, and marketing firms that serve the merchant acquiring industry.

Davis is also ETA CPP certified.

Prior to joining TSG, Davis headed up business development at RapidAdvance for over three years and helped

the merchant cash advance provider place over $300 million in funding to over 15,000 small businesses in the

U.S. and Canada. During this time, he initiated partnerships with over 1,000 ISOs and bankcard acquirers

which helped the company become the industrys second largest player. Previous to RapidAdvance, Barry was

a principal at First Annapolis Consulting where he focused on the Merchant Acquiring and Transaction Processing industries for nine

years. He supported his U.S. and Canadian clients in the areas of strategic & tactical planning, financial management and analysis, M&A

advisory, portfolio valuations, portfolio performance analysis, vendor/processor selection, merchant retention, risk management, and

market intelligence.

During Davis consulting career, he personally managed over 125 project teams including 14 M&A related projects involving portfolio

sales, over 20 risk and operational management reviews of bank acquirers and ISOs, and over 40 merchant acquiring valuations. Prior to

First Annapolis, Davis worked at Accenture Consulting in its Change Management practice.

Davis began his career in the U.S. Navy, serving ten years as an F-14 jet aviator and instructor at the U.S. Naval Academy. During his

distinguished service, he achieved the rank of Lieutenant Commander and was awarded the Navys Air Medal for serving as a jet mission

commander during Desert Storm. He recently retired from the Navy Reserves after 20 years of service.

Davis received his Masters of Business Administration from the Kellogg School of Management at Northwestern University, a M.S. in

International Management from the University of Maryland, and a B.S. in Computer Science from the U.S. Naval Academy.

Confidential. For discussion purposes only.

Copyright 2014. The Strawhecker Group. All Rights Reserved.

MCA Overview Example Slide

Merchant Cash Advance (MCA) defined:

MCA is a small business financing product that involves the sale of a business future credit card

receivables at a discounted purchase price

The MCA is typically structured as a lump sum payment to a business in exchange for an agreed upon

percentage of future credit and debit card sales

Example: Merchant is provided a lump-sum of $20,000 (purchase price) in exchange for rights to

$27,000 worth of card receivables. The MCA company withholds/debits a percentage (typically 5%

to 50%) of the merchants daily credit/debit card batches until repaid in full.

Traditionally, the product was structured to be repaid over a six-month timeframe. Increased

competition has led to shorter and longer term payback periods (commonly in the three to 18 month

range now). This has led to a multitude of pricing levels by MCA competitors and is dependent on

the merchants risk and credit profile.

MCA companies now offer loans and ACH financing that is based more on a merchants total sales

volume (not just credit card volume). Instead of a fixed % being debited from each daily card batch,

a fixed dollar amount is debited daily from the merchants card batch or DDA account.

Consequently, the term, Daily Remittance Funding, is becoming more common to collectively

describe the MCA and loan/ACH products offered by funders

Confidential. For discussion purposes only.

Copyright 2014. The Strawhecker Group. All Rights Reserved.

MCA Overview Example Slide

Benefits of the MCA:

For the merchant:

Less paperwork required than a bank commercial loan

Shorter approval and funding timeframe than a bank commercial loan

More likely to be approved than via a bank commercial loan

Collection requires minimal effort from merchant and occurs daily via processor splitfunding, ACH debit, or lockbox

No late fees if business sales slow

No obligation to repay if business failure occurs

For the MCA Funder or ISO:

Attractive returns

High commissions

Unregulated industry

Low barriers to entry

Growing need for capital from small businesses

High loan renewal rate typically 50% to 60% of MCA customers renew multiple times

Confidential. For discussion purposes only.

Copyright 2014. The Strawhecker Group. All Rights Reserved.

MCA Overview Example Slide

U.S. Competitive Landscape: Several small business finance brokers (cash brokers) and ISOs have been the

primary distribution channel for the MCA funders. Some of the leading companies include:

MCA Funders

Primary Distribution

Partners

Cash Brokers

ISOs/Acquirers

Yellowstone Capital

Pearl Capital

iPayment

Pearl Capital

Channel Partners

Priority Payments

Merchant Cash

Group

Bankers Healthcare

Group (BHG)

Vantiv/NPC

Five Point Capital

Merchant Resources

International

Capital Stack

Swift Financial

MCFunding

Rapid Capital

Funding

Merchant One

Solutions

WorldPay

IRN Payment Systems

First American Payment Systems

Benchmark Merchant Solutions

Leaders Merchant Services

Merchants Choice Payment Solutions

First Merchant

Funding

Advanced Merchant Services

Biz2Credit

Citizens Bank

Charter Bank

Confidential. For discussion purposes only.

Copyright 2014. The Strawhecker Group. All Rights Reserved.

About TSG

Comparable Company Analysis

The Strawhecker Group (TSG) is a management consulting company focused on the electronic payments industry.

TSGs Service Groups

Payments Strategy - Payments Strategy encompasses the full spectrum of advisory services within the Payments Industry. The depth of these services is built on

deep industry knowledge - the Partners and Associates of the firm have an average of over 20 years of industry experience. With clients from card issuers to

merchant acquirers, TSG has the experience and expertise to provide real-time strategies.

Transaction Advisory - Whether buying or selling, seeking investment funding, or planning your companys exit strategy, TSGs experience can be critical to

achieving success. TSG has performed more than 100 Payments Company Valuation and/or Business Assessments in the past three years - ranging in value from

$1 million to $1 billion.

TSG Metrics - TSG Metrics, the strategic research and analysis division of TSG, provides the Payments Industry with highly focused research and industry-wide

studies. TSG Metrics takes data, boils it down to information, transforms it to knowledge and presents it to provide wisdom to its client partners.

TSGs Unparalleled Experience

TSG consists of Industry leaders with extensive experience leading teams through explosive growth periods, mergers and acquisitions, and international and

domestic expansion within the Payments Industry. Both Partners and Associates of the firm have held key senior management positions at leading industry

companies including First Data / First Data International, Visa Inc., MasterCard, TSYS, Humboldt Merchant Services, WorldPay, Heartland Payment Systems,

Cardservice International, iPayment, Alliance Data, RapidAdvance, Accenture Consulting, Redwood Merchant Services, Chase Paymentech, as well as other

leading financial institutions and Payments companies.

TSGs Influence Shapes the Payments Industry

Over the last three years, TSG has completed over 400 projects for more than 200 different clients including financial institutions, merchant acquirers, card

issuers, card associations, technology providers, ISOs, processing companies and the investment community. Additionally, the firm and its Associates sit on

several industry committees whose focuses range from emerging product development to governmental regulation advisement.

Other recent TSG reports and analysis include (Click for more information):

The Top 10 Ways

Acquirers Can Block

the Breach

TSG Analysis: Global

Acquisition of PayPros

What Benefits Me By

Paying a Credit Card

Swipe Fee

TSG Mobile Payments

Infographic

ETA/TSG Q3 2014

Economic Indicators

Report

For more information, contact TSG at info@thestrawgroup.com

Subscribe to TSG's NewsFilter * PaymentsPulse.com * Follow TSG on Twitter * Follow TSG on LinkedIn * TheStrawGroup.com

Confidential. For discussion purposes only.

Copyright 2014. The Strawhecker Group. All Rights Reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kishinchand Chellaram College Insurance OverviewDocument41 pagesKishinchand Chellaram College Insurance OverviewNiket Dattani100% (2)

- List of MLPsDocument6 pagesList of MLPscordolisNo ratings yet

- Role of MICRO Finance in Financial InclusionDocument16 pagesRole of MICRO Finance in Financial InclusionBharath Pavanje75% (4)

- Bank Company ActDocument16 pagesBank Company Actmd nazirul islam100% (2)

- Sample Auditors ReportDocument1 pageSample Auditors ReportNayra DizonNo ratings yet

- Presentation On Women Empowerment in Banking SectorDocument18 pagesPresentation On Women Empowerment in Banking SectorAj100% (1)

- Internship Report Al BarakaDocument38 pagesInternship Report Al BarakaIrsa Khan100% (2)

- Metrobank and Trust Company v. Court of Appeals and RBPGDocument2 pagesMetrobank and Trust Company v. Court of Appeals and RBPGRalph HonoricoNo ratings yet

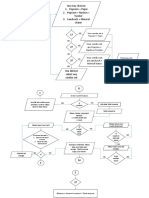

- Process Flow For (1) New Registration and (2) Re-Issue of Login Password (3) NRI CustomersDocument6 pagesProcess Flow For (1) New Registration and (2) Re-Issue of Login Password (3) NRI CustomersSACHIN VASHISTHNo ratings yet

- Banking Laws Reviewer Partyduh NotesDocument55 pagesBanking Laws Reviewer Partyduh NotesClint D. Lumberio100% (1)

- Chanderprabhu Jain College of Higher Studies School of LawDocument68 pagesChanderprabhu Jain College of Higher Studies School of LawRahul YadavNo ratings yet

- Ifm Field ReportDocument25 pagesIfm Field ReportEmmanuel Patrick100% (8)

- Evaluating Consumer Loans - 3rd Unit NotesDocument18 pagesEvaluating Consumer Loans - 3rd Unit NotesDr VIRUPAKSHA GOUD GNo ratings yet

- Jackson V AndersonDocument31 pagesJackson V AndersonTHROnline100% (2)

- TMD Security Deep Insert Skimming and CPP Overview June 2016Document14 pagesTMD Security Deep Insert Skimming and CPP Overview June 2016rdfv rNo ratings yet

- SAP in House Cash With MySAP ERPDocument28 pagesSAP in House Cash With MySAP ERPulanaro100% (1)

- Guide To European CMBSDocument53 pagesGuide To European CMBSUpendra Choudhary100% (1)

- Comparison Between Religare and Other FirmsDocument91 pagesComparison Between Religare and Other FirmsAshish AryaNo ratings yet

- MSU-IIT Cooperative ArticlesDocument5 pagesMSU-IIT Cooperative ArticlesMariver LlorenteNo ratings yet

- FlowchartDocument3 pagesFlowchartSarah SazaliNo ratings yet

- PSO 3100 Clinical Governance Quality in Prison HealthcareDocument11 pagesPSO 3100 Clinical Governance Quality in Prison HealthcareA RizaNo ratings yet

- Can On ContractDocument128 pagesCan On ContractDZSSALESNo ratings yet

- Prelimnary Audit of 2013 PREPA Bond Issue Econd Interim Pre-Audit Report On 2013 PREPA Debt Emission Con Anejos PDFDocument53 pagesPrelimnary Audit of 2013 PREPA Bond Issue Econd Interim Pre-Audit Report On 2013 PREPA Debt Emission Con Anejos PDFDebtwire MunicipalsNo ratings yet

- Wren Kitchens Terms and ConditionsDocument1 pageWren Kitchens Terms and Conditionst-rex200850% (2)

- Online Dish Recharge GuideDocument6 pagesOnline Dish Recharge GuidenoblemanimalaNo ratings yet

- Lloyds Bank - Print Friendly Statement PDFDocument3 pagesLloyds Bank - Print Friendly Statement PDFAnonymous aksuAOiG40% (5)

- 21.) UCPB V Samuel and BelusoDocument2 pages21.) UCPB V Samuel and BelusojoyceNo ratings yet

- Senior Certified Financial Planner in Charlotte NC Resume Russell HeuchertDocument2 pagesSenior Certified Financial Planner in Charlotte NC Resume Russell HeuchertRussellHeuchertNo ratings yet

- SEC 21 Sources of RevenueDocument11 pagesSEC 21 Sources of RevenueJustin LoredoNo ratings yet

- AuditWPsDocument2 pagesAuditWPsJane LubangNo ratings yet