Professional Documents

Culture Documents

People's Leasing and Finance PLC - (PLC) - Q2 FY 16 - BUY

Uploaded by

Sudheera IndrajithCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

People's Leasing and Finance PLC - (PLC) - Q2 FY 16 - BUY

Uploaded by

Sudheera IndrajithCopyright:

Available Formats

Earnings Review Q2 FY 16

65, Braybrooke Place, Colombo 2, Sri Lanka

research@bartleetreligare.com, +94 11 5220200

21 December 2015

BRS Research

Peoples Leasing and Finance PLC (PLC : LKR 22.80)

Too much negativity priced in : BUY

Head of Research - Nikita Tissera

Asst Manager - Vajirapanie Bandaranayake

PLC reported a higher than expected EPS of LKR 0.78 (BRS estimate : LKR 0.58) for the quarter on

lower impairment. PLC disbursed ~6bn per month during the quarter and we expect the growth to

slow down in our forecast period. We have cut gross loan disbursements to LKR 5bn from the current LKR 6bn (-17%) for FY 2017E and 2018E on the back of (1) rising rate scenario and (2) expected

slow down in macro economy. We do not expect a significant wave of incremental leasing business

from the LCBs, triggered by the budget directive for LCBs to stop leasing. We also don't expect the

direction to reduce the Loan to Value (LTV) ratio to 70% to have a material impact on PLC, as the

company has been historically lending within similar risk parameters. PLC MPS has fallen 10% since

our last review and we upgrade the stock to BUY on the back of price weakness and fall in risk free

rates since our last update.

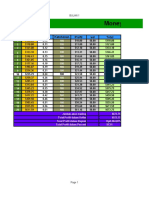

Year Ending 31 March

Net interest income (LKR mn)

Net interest margin %

2013

2014

2015

2016E

2017E

2018E

7,177

8,657

10,244

10,529

11,429

12,456

7.8%

8.4%

9.2%

9.2%

9.0%

8.9%

3,110

3,464

4,101

4,679

5,096

5,655

EPS (LKR)

1.98

2.19

2.60

2.96

3.23

3.58

ROA %

3.2%

3.2%

3.5%

3.8%

3.8%

3.8%

ROE %

17.6%

18.3%

19.6%

20.0%

19.3%

19.0%

Net asset value per share (LKR)

Recurring net profit (LKR mn)

Trading Snapshot

Market cap (LKR mn)

36,021

Market cap (USD mn)

247

Outstanding shares (mn)

1,580

Free float (%)

18.4%

52-week High/Low (LKR)

28.00/20.40

YTD ASPI return (%)

-5.7%

YTD Stock return (%)

-6.9%

Beta

1.0

Valuation Summary

CMP (LKR)

22.80

Intrinsic value (LKR)

25.16

DPS (LKR)

1.25

11.60

12.67

14.14

15.93

17.92

20.28

DPS (LKR)

1.25

1.25

1.25

1.25

1.25

1.25

Dividend yield (%)

9.5%

8.7%

5.7%

5.5%

5.5%

5.5%

Cost to income ratio %

47.4%

49.4%

44.3%

46.6%

46.0%

46.8%

Valuation method

P/E (x)

6.6 x

6.5 x

8.5 x

7.7 x

7.1 x

6.4 x

Total return %

P/BV (x)

1.1 x

1.1 x

1.6 x

1.4 x

1.3 x

1.1 x

TP based on total return (LKR)

26.41

Residual Income

15.8%

Rating

Buy

Source: Company data and BRS Equity Research

Pressure on NIMs to continue

PLC reported a bottom line of LKR 1.2bn (+13.7% YoY) for the quarter, aided 350bps YoY drop in

average interest on IBL (interest bearing liabilities) and fall in impairment costs. We expect NIMs to

come under pressure in our forecast period, as post war loans granted at high rates are now nearing

maturity. We expect PLC to post a PAT of LKR 4.7bn (+14.1% YoY) for FY 2016E. BRS ROE projection

for FY 2016E is 20% and 19.3% and 19% for FY 2017E and 2018E respectively. We estimate the incremental tax expense from the budget proposals (increase in VAT, NBT and corporate tax) to be close

to LKR 450mn (LKR 0.28 per share) for FY 2017E.

Asset quality to improve despite slow loan growth

We expect PLCs loan growth to slow down during the forecast period due to (1) rising rate scenario

and (2) expected macro economy slow down. On a conservative note, we have trimmed PLC monthly

disbursements to LKR 5bn (from LKR 6bn) for FY 2017E and FY 2018E. Directive on cessation of bank

leasing credit might not have a material impact to PLC in our view, as banks cater to credit worthy

retail customers, a client base that is different to PLCs sub prime customer base. Further, in our view

there is a high possibility of this directive being revised in banks favour. Reduction of LTV ratio to

70% too would not have a significant volume impact, as PLC has been historically lending within

similar risk parameters. We expect asset quality to improve and future impairment levels to decline

due to increased credit discipline and reduction in repossession losses with the recent hike in vehicle

prices.

PLC Price Vs ASPI Movement

ASPI

PLC

PLC

ASPI

8,000

30.00

7,500

25.00

7,000

20.00

6,500

15.00

6,000

10.00

Dec-14

Mar-15

Jun-15

Sep-15

Dec-15

EPS

LKR

4.00

3.50

3.00

2.50

2.00

1.50

1.00

Valuation: TP LKR 26.40 on total return: BUY

The Residual Income based target price is LKR 25.16, with a total return of LKR 26.40 (including cash

DPS of LRK 1.25). PLC is currently trading at 1.4x PBV and 7.7x PER based on FY 2016E forecasts. With

the price drop of 10% to LKR 22.80, we upgrade our recommendation to BUY.

For analyst certification and other important disclosures, please refer to the Disclosure and

Disclaimer section at the end of this report.

0.50

2013

2014

2015

2016E

Page 1

2017E

2018E

Company Information Note

65, Braybrooke Place, Colombo 2, Sri Lanka

research@bartleetreligare.com, +94 11 5220200

21 December 2015

Peoples Leasing and Finance PLC

Year Ending 31 March

2013

2014

2015

2016E

2017E

2018E

Summary Information

Company profile

BRS EPS (LKR)

1.98

2.19

2.60

2.96

3.23

3.58

BRS EPS growth (%)

-9.9%

11.0%

18.4%

14.1%

8.9%

11.0%

PLC is the largest registered finance company in the

country with an asset base of LKR 102bn. PLC accounts

for an island-wide distribution network with 92 fully

fledged branches and 102 window offices.

P/E (x) based on BRS EPS

6.4 x

NIM and Cost to Income ratios

Cost to

income %

NIM %

55.0%

10.0%

6.6 x

6.5 x

8.5 x

7.7 x

7.1 x

10.2 x

9.0 x

12.6 x

na

na

1.80

2.19

2.60

NAV per share (LKR)

11.60

12.67

14.14

15.93

17.92

20.28

Tangible NAV per share LKR

11.37

12.29

13.74

15.51

17.48

19.80

P/BV (x)

1.1 x

1.1 x

1.6 x

1.4 x

1.3 x

1.1 x

P/TBV (x)

1.2 x

1.2 x

1.6 x

1.5 x

1.3 x

1.2 x

Sector P/BV (x)

1.8 x

1.4 x

1.6 x

na

na

na

DPS LKR

1.25

1.25

1.25

1.25

1.25

1.25

Sector P/E (x)

Reported EPS LKR as per annual report

Dividend yield (%)

50.0%

7.0%

45.0%

4.0%

Mkt price

Weighted average shares (mn)

Average mkt cap (LKR'mn)

na

9.5%

8.7%

5.7%

5.5%

5.5%

5.5%

13.10

14.30

22.10

22.80

22.80

22.80

1,560

1,580

1,580

1,580

1,580

1,580

20,436

22,592

34,915

36,021

36,021

36,021

Income Statement (LKR'mn)

Cost to income

NIM

40.0%

1.0%

2013

2014

2015

2016E

2017E

2018E

ROE and ROA %

ROE %

ROA %

25.0%

ROE

ROA

20.0%

Interest income

17,485

20,053

19,594

18,397

20,989

23,284

Interest expenses

(10,308)

(11,396)

(9,350)

(7,868)

(9,560)

(10,828)

Net interest income

7,177

8,657

10,244

10,529

11,429

12,456

Other operating income

3,329

4,123

3,984

4,346

5,204

6,016

10,506

12,780

14,228

14,894

16,633

18,472

Total income

Personnel cost

(1,123)

(1,522)

(1,802)

(2,093)

(2,385)

(2,759)

6.0%

Other cost

(3,857)

(4,795)

(4,495)

(4,851)

(5,259)

(5,884)

5.0%

Loan loss provisions

(699)

(1,229)

(1,671)

(669)

(733)

(677)

Value added tax on financial services

(288)

(302)

(372)

(526)

(655)

(716)

4,540

4,932

5,888

6,754

7,602

8,436

4.0%

3.0%

Profit from operations

Share of associates /(loss)

Exceptionals/non-recurrings

15.0%

2.0%

1.0%

10.0%

0.0%

2013

2014

2015

2016E

2017E

2018E

Recurring PAT LKR 'mn (2013-18E)

5,655

(1,429)

(1,468)

(1,787)

(2,075)

(2,505)

(2,781)

Net income (with non recurring)

3,110

3,464

4,101

4,679

5,096

5,655

Recurring net income

3,110

3,464

4,101

4,679

5,096

5,655

3,082

3,464

4,101

4,679

5,096

5,655

Minorities

Profit attributable to equity holders

Liquid assets

2,454

11,696

3,414

2,751

4,877

6,654

90,480

98,184

110,952

119,860

128,832

2,641

3,052

3,808

3,987

4,077

4,203

358

357

342

345

345

345

Other assets

7,233

12,833

11,413

8,927

12,814

13,397

Total Assets

153,431

Property plant & equipment

Intangible assets

11%

101,144

118,417

117,161

126,961

141,973

Total deposits

18,710

40,839

33,930

35,980

40,780

45,580

Borrowings

56,821

49,629

50,977

55,709

60,259

61,048

7,362

8,182

10,201

9,539

12,079

13,983

18,094

19,767

22,053

24,848

27,960

31,630

Other liabilities

Shareholders funds

Minorities

2013

2014

2015

2016E

2017E

28

88,458

Loans and advances

9%

18%

3,110

Tax expense

Balance sheet (LKR'mn)

11%

14%

2018E

2018E

PLC - Loan Portfolio (FY 2015)

2%

885

894

1,190

101,144

118,417

117,161

126,961

141,973

153,431

Interest earning assets

95,928

111,262

110,749

119,324

134,004

144,557

Interest bearing liabilities

75,531

90,468

84,907

91,689

101,039

106,628

Total liabilities and equity

158

Growth rates and margins

20%

Growth in interest income %

26.0%

14.7%

-2.3%

-6.1%

14.1%

10.9%

Finance lease

Growth in interest expense %

39.1%

10.6%

-18.0%

-15.8%

21.5%

13.3%

Hire purchase

Growth in net interest income %

10.9%

20.6%

18.3%

2.8%

8.6%

9.0%

Growth in personnel cost %

22.4%

35.6%

18.4%

16.2%

14.0%

15.7%

Term loans

Net interest margin %

7.8%

8.4%

9.2%

9.2%

9.0%

8.9%

Other loans

Cost to income ratio %

47.4%

49.4%

44.3%

46.6%

46.0%

46.8%

55%

23%

Source: PLC Annual Reports and BRS Equity Research

Return on assets

3.2%

3.2%

3.5%

3.8%

3.8%

3.8%

Return on equity

17.6%

18.3%

19.6%

20.0%

19.3%

19.0%

Interest income to interest bearing assets

18.9%

19.4%

17.7%

16.0%

16.6%

16.7%

Interest expenses to interest bearing liabilities

14.0%

13.7%

10.7%

8.9%

9.9%

10.4%

Growth in interest earning assets %

7.8%

16.0%

-0.5%

7.7%

12.3%

7.9%

Growth in interest bearing liabilities %

5.5%

19.8%

-6.1%

8.0%

10.2%

5.5%

Page 2

BRS Equity Research

Financial Analysis

Income Statement - People's Leasing and Finance PLC

Year ending 31 March

2013

2014

2015

2016E

2017E

2018E

17,485

20,053

19,594

18,397

20,989

23,284

26.0%

14.7%

-2.3%

-6.1%

14.1%

10.9%

(10,308)

(11,396)

(9,350)

(7,868)

(9,560)

(10,828)

39.1%

10.6%

-18.0%

-15.8%

21.5%

13.3%

All numbers in LKR' mn

Interest Income

YoY Growth %

Interest Expense

YoY Growth %

Net Interest Income

7,177

8,657

10,244

10,529

11,429

12,456

YoY growth %

10.9%

20.6%

18.3%

2.8%

8.6%

9.0%

Other income

3,329

4,123

3,984

4,346

5,204

6,016

YoY growth %

54.1%

28.7%

-8.6%

12.3%

24.3%

16.5%

Total Income

10,506

12,780

14,228

14,894

16,633

18,472

YoY growth %

20.4%

21.6%

11.3%

4.7%

11.7%

11.1%

Operating expenses

(4,980)

(6,317)

(6,297)

(6,944)

(7,644)

(8,643)

YoY growth %

34.9%

26.8%

-0.3%

10.3%

10.1%

13.1%

Cost to income ratio

47.4%

49.4%

44.3%

46.6%

46.0%

46.8%

Pre provision profits

5,526

6,463

7,931

7,949

8,989

9,828

YoY Growth %

9.8%

17.0%

22.7%

0.2%

13.1%

9.3%

Loan loss provisions

(699)

(1,229)

(1,671)

(669)

(733)

(677)

VAT on financial services

Profit before tax

(288)

(302)

(372)

(526)

(655)

(716)

4,540

4,932

5,888

6,754

7,602

8,436

6.1%

8.6%

19.4%

14.7%

12.5%

11.0%

Income tax expense

(1,429)

(1,468)

(1,787)

(2,075)

(2,505)

(2,781)

Profit after tax

3,110

3,464

4,101

4,679

5,096

5,655

YoY Growth %

YoY change %

7.8%

11.4%

18.4%

14.1%

8.9%

11.0%

Profit to equity holders

3,077

3,464

4,101

4,670

5,086

5,645

Reported EPS (Note 1)

1.80

2.19

2.60

BRS EPS (Note 2)

1.98

2.19

2.60

2.96

3.23

3.58

Source: Company Financial Reports and BRS Equity Research

Note 1 : Based on reported earnings

Note 2 : Based on recurring earnings

www.bartleetreligare.com

Page 3

BRS Equity Research

Financial Analysis

Statement of Financial Position - People's Leasing and Finance PLC

As at 31 March

2013

2014

Cash and cash equivalents

2,454

11,696

Deposits with banks and financial institutions

3,744

4,726

Derivative financial instruments

Financial investments - Held for trading

238

2015

2016E

2017E

2018E

3,414

2,751

4,877

6,654

1,831

1,980

1,750

1,750

378

503

589

589

589

88,298

90,342

97,997

110,714

119,581

128,505

159

138

187

238

279

327

Financial investments - Available for sale

1,174

1,317

2,043

2,519

2,855

3,191

Financial investments - Held to maturity

540

4,747

5,266

1,980

5,469

5,469

Investments in associates

Intangible assets

358

357

342

345

345

345

All numbers in LKR' mn

Assets

Loans and advances

Reinsurance and insurance receivable

Investment Property

Property plant and equipment

Other assets

Total Assets

2,641

3,052

3,808

3,987

4,077

4,203

1,539

101,144

1,665

118,417

1,770

117,161

1,859

126,961

2,151

141,973

2,399

153,431

Liabilites

Deposits

18,710

40,839

33,930

35,980

40,780

45,580

Borrowings

56,821

49,629

50,977

55,709

60,259

61,048

Redeemable preference shares

725

518

342

285

238

Derivative financial instruments

3,043

2,759

3,166

2,980

3,831

4,178

79,298

93,745

88,165

95,011

105,156

111,044

2,217

2,571

2,894

3,791

4,723

5,816

86

541

618

1,174

1,976

2,482

1,213

Creditors

Total financial liabilities

Insurance liabilities and reinsurance payable

Tax payable

Deferred tax payable

92

1,210

1,599

1,976

1,213

1,213

Other liabilities

82

194

1,455

40

51

56

Other liabilities

3,594

4,905

6,943

6,217

7,963

9,567

Stated capital

12,258

12,736

12,936

13,036

13,036

13,036

Reserve fund

860

1,016

1,204

1,433

1,687

1,970

4,976

6,015

7,913

10,379

13,236

16,625

18,094

19,767

22,053

24,848

27,960

31,630

885

894

1,190

126,961

141,973

153,431

Equity

Other reserves

Shareholders' Funds

Minority interest

Total Liabilities & Equity

158

101,144

118,417

117,161

Source: Company Financial Reports, Prospectus and BRS Equity Research

www.bartleetreligare.com

Page 4

BRS Equity Research

Top 20 Shareholders as of 30.06.2015

Name of the Shareholder

No. of Shares

Peoples Bank

1,184,896,862

75.00

BNYM SA/NV-Neon Liberty Lorikeet Master Fund LP

63,069,853

3.99

National Savings Bank

44,990,757

3.03

Employees Provident Fund

43,643,831

2.76

Wasatch Frontier Emerging Small Countries Fund

24,753,100

1.57

Bank of Ceylon No. 1 Account

11,453,600

0.72

Frontier Market Opportunities Master FD,L.P.

10,150,000

0.68

CF Ruffer Investment Funds: CF Ruffer Pacific Fund

10,000,000

0.65

Acadian Frontier Markets Equity Fund

8,329,273

0.64

Northern Trust Company S/A Ashmore Emerging Markets Frontier Equity Fund

8,183,492

0.63

Mr. Y.S.H.I. Silva

7,445,555

0.39

BNYM SA/NV-Frontier Market Select Fund II L.P.

7,370,008

0.35

AIA Insurance Lanka PLC A/C No. 07

5,376,721

0.31

Ceylon Investment PLC A/C # 01

4,954,891

0.31

BNYM SA/NV-NLCF Fund LP

4,916,003

0.29

Sri Lanka Insurance Corporation Ltd - General Fund

4,033,000

0.29

Union Assurance PLC/No - 01A/C

3,821,672

0.24

CB NY S/A Wasatch Frontier Emerging Small Countries CIT Fund

3,732,745

0.24

Northern Trust Global Services Ashmore Sicav Emerging Markets Frontier Equity Fund

2,383,305

0.15

Candor Growth Fund

2,358,804

0.13

Source: PLC Q2 FY 16 interim financial statement

www.bartleetreligare.com

Page 5

BRS Equity Research

DISCLAIMER

Important Disclosures

This report was prepared by Strategic Research Limited for clients of Bartleet Religare Securities.

Special Disclosures

Special Disclosures for certain additional disclosure statements (if applicable).

Intended Recipients

This report is intended only for the use of the individual or entity named above and may contain information that is confidential and privileged. It is intended only for

the perusal of the individual or entity to whom it is addressed and others who are authorized to receive it. If you are not the intended recipient of this report, you are

hereby on notice that any disclosure, dissemination, distribution, copying or taking action relying on the contents of this information is strictly prohibited and illegal.

BRS, is not liable for the accurate and complete transmission of the information contained herein nor any delay in its receipt. If you have received this email in error,

please notify us immediately by return email and please destroy the original message

This report is not intended for citizens (individual or corporate) based in the United States of America.

Analyst Certification

Each of the analysts identified in this report certifies, with respect to the companies or securities that the individual analyses, that the views expressed in this report

reflect his or her personal views about all of the subject companies and all of the securities and No part of his or her compensation was, is or will be directly or indirectly dependent on the specific recommendations or views expressed in this report. If the lead analyst holds shares of the coverage; that will be listed here.

Stock Ratings

Recommendation

Expected absolute returns (%) over 12 months

Buy

More than 10%

Hold

Between 10% and 0%

Sell

Less than 0%

Expected absolute returns are based on the share price at market close unless otherwise stated. Stock recommendations are based on absolute upside (downside)

and have a 12-month horizon. Our target price represents the fair value of the stock based upon the analysts discretion. We note that future price fluctuations could

lead to a temporary mismatch between upside/downside for a stock and our recommendation.

General Disclaimers

This report is strictly confidential and is being furnished to you solely for your information purposes.

The information, tools and material presented in this report are not to be used or considered as an offer or solicitation of an offer to sell or to purchase

or subscribe for securities.

SRL has not taken any measures to guarantee in any way that the securities referred to herein are suitable investments for any particular investor. SRL

will not under any circumstance, consider recipients as its customers by virtue of them receiving the report. The investments or services contained or

referred to in this report may not be suitable for you and it is highly recommended that you consult an independent investment advisor if you are in any

doubt about such investments or related services.

Further, nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or

appropriate to your individual circumstances, investment needs or otherwise construes a personal recommendation to you.

Information and opinions presented herein were obtained or derived from sources that SRL believes to be relied upon, but SRL makes no representations or warranty, express or implied, as to their accuracy or completeness or correctness.

SRL accepts no liability whatsoever for any loss arising from the use of the material presented in this report.

This report is not to be relied upon as a substitute for the exercise of independent judgment. SRL may have issued, and may in the future issue, a trading

call regarding this security. Trading calls are short term trading opportunities based on market events and catalysts, while stock ratings reflect investment recommendations based on expected absolute return over a 12-month period as defined in the disclosure section. Because trading calls and stock

ratings reflect different assumptions and analytical methods, trading calls may differ directionally from the stock rating.

Past performance should not be taken as any indication or guarantee of future performance, and no representation or warranty, express or implied, is

made regarding future performance.

Information, opinions and estimates contained in this report reflect a judgment of its original date of publication by SRL and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value

of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such

securities.

SRL may or may not seek to do business with companies covered in our research report. As a result, investors should be aware that the firm may have a

conflict of interest that could affect the objectivity of research produced by SRL. Investors should consider our research as only a single factor in making

their investment decision.

Any reference to a third party research material or any other report contained in this report represents the respective research organization's estimates and views

and does not represent the views and opinions of SRL. SRL, its officers and employees do not accept any liability or responsibility whatsoever with respect to the

accuracy or correctness of such information. Further, SRL has included such reports or made reference to such reports in good faith (bona fide).

www.bartleetreligare.com

Page 6

Bartleet Religare Securities (Pvt) Ltd

www.bartleetreligare.com

BRS Equity Research - research@bartleetreligare.com

Page 7

You might also like

- BRS End of The Week Results Snapshot - 21.10.2022Document9 pagesBRS End of The Week Results Snapshot - 21.10.2022Sudheera IndrajithNo ratings yet

- GSM BSS Network KPI (SDCCH Call Drop Rate) Optimization ManualDocument26 pagesGSM BSS Network KPI (SDCCH Call Drop Rate) Optimization ManualJohn PinedaNo ratings yet

- Trader's Daily Digest 15.11.2022Document8 pagesTrader's Daily Digest 15.11.2022Sudheera IndrajithNo ratings yet

- BRS Market Report: Week IVDocument7 pagesBRS Market Report: Week IVSudheera IndrajithNo ratings yet

- Sunday Aruna 14-112021Document47 pagesSunday Aruna 14-112021Sudheera IndrajithNo ratings yet

- BRS Morning Shout - 15.02.2022Document2 pagesBRS Morning Shout - 15.02.2022Sudheera IndrajithNo ratings yet

- BRS Weekly Report 14.10.2022Document13 pagesBRS Weekly Report 14.10.2022Sudheera IndrajithNo ratings yet

- Trader's Daily Digest 14.09.2021Document8 pagesTrader's Daily Digest 14.09.2021Sudheera IndrajithNo ratings yet

- GERAN ZGB-03-05-001 Coding Scheme CS1 CS4 Feature GuideDocument17 pagesGERAN ZGB-03-05-001 Coding Scheme CS1 CS4 Feature GuideSudheera IndrajithNo ratings yet

- 02 WO - NP2002 - E01 - 0 UMTS Coverage Estimation P29Document29 pages02 WO - NP2002 - E01 - 0 UMTS Coverage Estimation P29fatehmeNo ratings yet

- Trader's Daily Digest 30.08.21Document7 pagesTrader's Daily Digest 30.08.21Sudheera IndrajithNo ratings yet

- Wo - Nast3013 - E01 - 0 Umts Radio Network Kpi p38Document37 pagesWo - Nast3013 - E01 - 0 Umts Radio Network Kpi p38Sudheera IndrajithNo ratings yet

- WO - NP2003 - E01 - 0 UMTS Capacity Estimation P37Document33 pagesWO - NP2003 - E01 - 0 UMTS Capacity Estimation P37Sudheera IndrajithNo ratings yet

- BRS Morning Shout 03.09.2021Document2 pagesBRS Morning Shout 03.09.2021Sudheera IndrajithNo ratings yet

- GO - BT1004 - E01 - 0 GPRS and EDGE Introduction-41Document38 pagesGO - BT1004 - E01 - 0 GPRS and EDGE Introduction-41Sudheera IndrajithNo ratings yet

- Trader's Daily Digest - 12.03.2020Document8 pagesTrader's Daily Digest - 12.03.2020Sudheera IndrajithNo ratings yet

- Tems Cel File FormatDocument2 pagesTems Cel File FormatSudheera IndrajithNo ratings yet

- Cell Performance Analysis ReportDocument3 pagesCell Performance Analysis ReportSudheera IndrajithNo ratings yet

- Project PlannerDocument19 pagesProject Plannerraahul_nNo ratings yet

- Trader's Daily Digest - 15.05.2019Document7 pagesTrader's Daily Digest - 15.05.2019Sudheera IndrajithNo ratings yet

- Chess Results ListDocument8 pagesChess Results ListSudheera IndrajithNo ratings yet

- GERAN ZGB-02!01!001 Paging Feature GuideDocument17 pagesGERAN ZGB-02!01!001 Paging Feature GuideSudheera IndrajithNo ratings yet

- BRS Quarterly Results Snapshot - 1Q FY 19Document4 pagesBRS Quarterly Results Snapshot - 1Q FY 19Sudheera IndrajithNo ratings yet

- Bartleet Religare Securities Earnings Preview - Colombo Dockyard 4Q FY19 Sell RatingDocument9 pagesBartleet Religare Securities Earnings Preview - Colombo Dockyard 4Q FY19 Sell RatingSudheera IndrajithNo ratings yet

- Trader's Daily Digest - 15.05.2019Document7 pagesTrader's Daily Digest - 15.05.2019Sudheera IndrajithNo ratings yet

- 2058-34 15.02.2018 Public Officer PermitDocument2 pages2058-34 15.02.2018 Public Officer PermitSudheera IndrajithNo ratings yet

- Comment:-: Page 1 of 1Document1 pageComment:-: Page 1 of 1Sudheera IndrajithNo ratings yet

- Cell Selection and ReselectionDocument16 pagesCell Selection and ReselectionjangkrikbossNo ratings yet

- TRC Application for Cellular Frequency License RenewalDocument3 pagesTRC Application for Cellular Frequency License RenewalSudheera IndrajithNo ratings yet

- 1-WO - NP2001 - E01 - 1 UMTS Radio Network Planning Process-++-P65Document65 pages1-WO - NP2001 - E01 - 1 UMTS Radio Network Planning Process-++-P65Sudheera IndrajithNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DM21A24 - Hitakshi ThakkarDocument8 pagesDM21A24 - Hitakshi ThakkarRAHUL DUTTANo ratings yet

- Chapter 8 Corporate Social Responsibility and Corruption in A Global ContextDocument12 pagesChapter 8 Corporate Social Responsibility and Corruption in A Global ContextKaye Joy TendenciaNo ratings yet

- Uts Manajemen KeuanganDocument8 pagesUts Manajemen KeuangantntAgstNo ratings yet

- Day 4 - CompleteDocument42 pagesDay 4 - CompleteRehan HabibNo ratings yet

- Handout 3 Audit IntegDocument8 pagesHandout 3 Audit IntegCeage SJNo ratings yet

- Valuation Workbook QuestionsDocument200 pagesValuation Workbook Questionsprafulvg100% (1)

- Sample Ques MidsDocument8 pagesSample Ques MidsWaasfaNo ratings yet

- SaranshYadav Project Report GoldDocument25 pagesSaranshYadav Project Report Goldanon_179532672No ratings yet

- Project ReportDocument92 pagesProject ReportAnXit Pathak100% (1)

- 8503Document8 pages8503sajid bhatti100% (1)

- Chocopizza! Business Plan & New InnovationDocument51 pagesChocopizza! Business Plan & New InnovationHuba ZehraNo ratings yet

- Arbitrage Pricing TheoryDocument6 pagesArbitrage Pricing TheoryKate AlvarezNo ratings yet

- Fundamentals of Investing 13th Edition Smart Test BankDocument37 pagesFundamentals of Investing 13th Edition Smart Test Bankreputedrapergjyn100% (27)

- Activity 1 Finman 1Document6 pagesActivity 1 Finman 1lykaNo ratings yet

- Nigerian Stock Recommendation For August 7th 2023Document4 pagesNigerian Stock Recommendation For August 7th 2023DMAN1982No ratings yet

- Xii Ni Ui4 QBDocument35 pagesXii Ni Ui4 QBMishti GhoshNo ratings yet

- 3-Strategies Spreads Guy BowerDocument15 pages3-Strategies Spreads Guy BowerNicoLazaNo ratings yet

- Historical Data Analysis: (DIGI: Appendix 6.0-8.0)Document9 pagesHistorical Data Analysis: (DIGI: Appendix 6.0-8.0)Ayame DelanoNo ratings yet

- International Finance - MBA 926Document10 pagesInternational Finance - MBA 926Tinatini BakashviliNo ratings yet

- Petition For Judicial ReviewDocument10 pagesPetition For Judicial ReviewBINGE TV EXCLUSIVENo ratings yet

- Timing The Mexican 1994-95 Financial Crisis Using A Markov Switching ApproachDocument21 pagesTiming The Mexican 1994-95 Financial Crisis Using A Markov Switching ApproachViverNo ratings yet

- Fly Ash Brick Production PlanDocument25 pagesFly Ash Brick Production PlanHiren PatelNo ratings yet

- Money Management Trading Forex: Hari Modal Lot Ketahanan Profit WD TotalDocument26 pagesMoney Management Trading Forex: Hari Modal Lot Ketahanan Profit WD TotallezanofanNo ratings yet

- 911 BIZ201 Assessment 3 Student WorkbookDocument7 pages911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaNo ratings yet

- Finance ManagementDocument2 pagesFinance ManagementSakib ShaikhNo ratings yet

- Anuario 2010 - Techint ContruccionesDocument128 pagesAnuario 2010 - Techint Contruccionesculiadin22No ratings yet

- IBPS PO Mains – Set 1 Reasoning QuestionsDocument93 pagesIBPS PO Mains – Set 1 Reasoning QuestionsRoopaNo ratings yet

- Financial Markets and Instiutions Wcmw4e8ThMDocument3 pagesFinancial Markets and Instiutions Wcmw4e8ThMKhushi SangoiNo ratings yet

- Analyst Report on Cupid LtdDocument8 pagesAnalyst Report on Cupid LtdNeetu LatwalNo ratings yet

- Earnings Quality Score 90: Nike Inc - Balance Sheet 25-Mar-2022 19:25Document12 pagesEarnings Quality Score 90: Nike Inc - Balance Sheet 25-Mar-2022 19:25Yamilet Maria InquillaNo ratings yet