Professional Documents

Culture Documents

CMA2 P1 A Budgeting Alpha Tech P3694Q3

Uploaded by

Omnia HassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CMA2 P1 A Budgeting Alpha Tech P3694Q3

Uploaded by

Omnia HassanCopyright:

Available Formats

2010 CMA Part 1

Section A Budgeting

Alpha-Tech

Estimated time 30 minutes

Alpha-Tech, a rapidly growing distributor of electronic components, is formulating its plans for 2012.

Carol Jones, the firm's marketing director, has completed the sales forecast presented below.

Alpha-Tech

2012 Forecasted Sales

(in thousands)

Month

Sales

January

$9,000

July

February

10,000

August

15,000

September

16,000

March

9,000

Month

Sales

$15,000

April

11,500

October

16,000

May

12,500

November

15,000

June

14,000

December

17,000

Phillip Smith, an accountant in the Planning and Budgeting Department, is responsible for preparing

the cash flow projection. The following information will be used in preparing the cash flow projection.

Alpha-Tech's excellent record in accounts receivable collection is expected to continue. Sixty

percent of billings are collected the month after the sale and the remaining 40 percent two

months after.

The purchase of electronic components is Alpha-Tech's largest expenditure and is estimated to be

40 percent of sales. Seventy percent of the parts are received by Alpha-Tech one month prior to

sale and 30 percent are received during the month of sale.

Historically, 75 percent of accounts payable have been paid one month after receipt of the

purchased components, and the remaining 25 percent is paid two months after receipt.

Hourly wages and fringe benefits, estimated to be 30 percent of the current month's sales, are

paid in the month incurred.

General and administrative expenses are projected to be $15,620,000 for the year. The

breakdown of these expenses is presented below. All expenditures are paid uniformly throughout

the year, except the property taxes which are paid at the end of each quarter in four equal

installments.

2012 Forecasted General and Administrative Costs

(in thousands)

Salaries and fringe benefits

$ 3,200

Promotion

3,800

Property taxes

1,360

Insurance

2,000

Utilities

1,800

Depreciation

3,460

Total

$15,620

Income tax payments are made at the beginning of each calendar quarter based on the income of

the prior quarter. Alpha-Tech is subject to an effective income tax rate of 40 percent. AlphaTech's operating income for the first quarter of 2012 is projected to be $3,200,000. The company

pays 100 percent of the estimated tax payment.

2010 CMA Part 1

Section A Budgeting

Alpha-Tech

Alpha-Tech maintains a minimum cash balance of $500,000. If the cash balance is less than

$500,000 at the end of each month, the company borrows amounts necessary to maintain this

balance. All amounts borrowed are repaid out of subsequent positive cash flow. The projected

April 1, 2012 opening balance is $500,000.

Alpha-Tech has no short-term debt as of April 1, 2012.

Alpha-Tech uses a calendar year for both financial reporting and tax purposes.

REQUIRED:

A.

Prepare a cash budget for Alpha-Tech by month for the second quarter of 2012. Ignore any

interest expense associated with borrowing.

B.

Discuss why cash budgeting is important for Alpha-Tech.

2010 CMA Part 1

Section A Budgeting

Alpha-Tech

Solution

A. The pro forma cash budget for Alpha-Tech for the second quarter of 1995 is presented below.

Supporting calculations are presented on the next page.

Alpha-Tech

Cash Budget

For the Second Quarter 2012

Beginning balance

Collections (1)

February sales

March sales

April sales

May sales

April

500,000

4,000,000

5,400,000

May

500,000

3,600,000

6,900,000

June

$ 1,230,000

4,600,000

7,500,000

Total receipts

9,400,000

10,500,000

12,100,000

Total cash available

9,900,000

11,000,000

13,330,000

4,155,000

3,450,000

900,000

4,735,000

3,750,000

900,000

5,285,000

4,200,000

900,000

340,000

9,785,000

9,385,000

10,725,000

Cash balance

115,000

1,615,000

2,605,000

Cash borrowed

385,000

Disbursements

Accounts payable

Wages (2)

General & Admin (3)

Property taxes

Income taxes (4)

Total disbursements

1,280,000

Cash repaid

Ending balance

(1)

(2)

(3)

(4)

(385,000)

$500,000

$1,230,000

$2,605,000

60% of sales in first month; 40% of sales in second month.

30% of current month sales.

(Total less property taxes and depreciation) / 12.

40% x $3,200,000 million.

B. Cash budgeting is important for Alpha-Tech because as sales grow so will expenditures for input

factors. Since these expenditures generally precede cash receipts, the company must plan for possible

financing to cover the gap between payments and receipts. The cash budget shows the probable cash

position at certain points in time, allowing the company to plan for borrowing, as Alpha-Tech must do

in April.

Cash budgeting also facilitates the control of excess cash. The company may be losing investment

opportunities, if excess cash is left idle in a checking account. The cash budget alerts management to

periods when there will be excess cash available for investment, thus facilitating financial planning

and cash control.

2010 CMA Part 1

Section A Budgeting

Alpha-Tech

Supporting Calculations

Accounts payable - parts received:

Cost of goods sold

Month

40% of sales

February

March

March

April

April

May

May

June

Timing

$4,000,000

3,600,000

3,600,000

4,600,000

4,600,000

5,000,000

5,000,000

5,600,000

.30

.70

.30

.70

.30

.70

.30

.70

$3,720,000

4,300,000

4,300,000

4,880,000

4,880,000

5,420,000

.25

.75

.25

.75

.25

.75

February

$ 1,200,000

2,520,000

$ 3,720,000

March

$1,080,000

3,220,000

$4,300,000

April

$1,380,000

3,500,000

$4,880,000

May

June

$1,500,000

3,920,000

$5,420,000

(5)

Payments

February

March

March

April

April

May

(5)

$0

$0

930,000

3,225,000

$4,155,000

$1,075,000

3,660,000

$4,735,000

$1,220,000

4,065,000

$5,285,000

No calculation of COGS is needed for June because the payments will be made in July and

August, which is outside the second quarter. (This note added by HOCK.)

You might also like

- Cost and Management Accounting Sample TestDocument22 pagesCost and Management Accounting Sample TestSudip Issac Sam67% (3)

- Level 1 - Financial StatementDocument11 pagesLevel 1 - Financial StatementVimmi BanuNo ratings yet

- CMAPart2 PDFDocument53 pagesCMAPart2 PDFarslaan89No ratings yet

- Cma Part 1 Mock Test 3Document37 pagesCma Part 1 Mock Test 3soner onurNo ratings yet

- CMA Sample Questions and Answers 2020Document25 pagesCMA Sample Questions and Answers 2020LhenNo ratings yet

- CMA Part I PDFDocument173 pagesCMA Part I PDFNicolai AquinoNo ratings yet

- SEC D – RISK MANAGEMENT techniquesDocument3 pagesSEC D – RISK MANAGEMENT techniquesshreemant muni0% (1)

- Cma Part One SummaryDocument2 pagesCma Part One SummarypowellarryNo ratings yet

- Comprehensive ExamDocument37 pagesComprehensive ExamAngeline DionicioNo ratings yet

- CMA Part 2 Study Plan Using HOCK MaterialsDocument26 pagesCMA Part 2 Study Plan Using HOCK MaterialsSanthosh K KomurojuNo ratings yet

- CMA Part 1 Virtual Classroom No. 1Document28 pagesCMA Part 1 Virtual Classroom No. 1Amr TarekNo ratings yet

- Miles CMA SJCCDocument21 pagesMiles CMA SJCCShravan Subramanian BNo ratings yet

- CMA (USA) - Recorded Lectures Details V2Document15 pagesCMA (USA) - Recorded Lectures Details V2frostyfusioncreameryNo ratings yet

- CMA-MCQ 100.pdf: DownloadDocument1 pageCMA-MCQ 100.pdf: Downloadjuly jeesNo ratings yet

- Practice Exam 1 - With SolutionsDocument36 pagesPractice Exam 1 - With SolutionsMd Shamsul Arif KhanNo ratings yet

- US CMA - Part 1 TerminologyDocument127 pagesUS CMA - Part 1 TerminologyamitsinghslideshareNo ratings yet

- CMA FAR ExamDocument30 pagesCMA FAR ExamAbd-Ullah AtefNo ratings yet

- Cma UsaDocument2 pagesCma UsaADWAID RAJAN0% (1)

- Wiley Cmaexcel Learning System Exam Review 2020: Complete Set (2-Year Access)Document2 pagesWiley Cmaexcel Learning System Exam Review 2020: Complete Set (2-Year Access)Maruf Hasan NirzhorNo ratings yet

- Essay Part 1Document56 pagesEssay Part 1Sachin KumarNo ratings yet

- Section A: External Financial Reporting DecisionsDocument1 pageSection A: External Financial Reporting DecisionsLhenNo ratings yet

- CMA P1 Plan A4 PDFDocument39 pagesCMA P1 Plan A4 PDFsuresh nvNo ratings yet

- CMA MCQs BankDocument85 pagesCMA MCQs BankmonsterNo ratings yet

- Cima E1Document5 pagesCima E1Enoch Abassey0% (1)

- Hock Section B QuestionsDocument137 pagesHock Section B QuestionsMustafa AroNo ratings yet

- CMA Part 2 Ethics Essay - PointsDocument11 pagesCMA Part 2 Ethics Essay - PointsNipun BajajNo ratings yet

- CMA Exam Part 2: Overview, Syllabus and Pass RateDocument21 pagesCMA Exam Part 2: Overview, Syllabus and Pass RateJaved Khan50% (2)

- CMA Exam Questions by Surgent CMA and I Pass The CMA ExamDocument13 pagesCMA Exam Questions by Surgent CMA and I Pass The CMA ExamMai JaberNo ratings yet

- of US Cma Part 1Document75 pagesof US Cma Part 1mohammed100% (1)

- New CMA Part 1 Section DDocument112 pagesNew CMA Part 1 Section DHaythem AliNo ratings yet

- CMA Part 2 - Section E - BondsDocument4 pagesCMA Part 2 - Section E - Bondsasafoabe4065No ratings yet

- CMA Part 1 Sample Questions From ChinaIMADocument49 pagesCMA Part 1 Sample Questions From ChinaIMAnanchen1No ratings yet

- CMA Part 2 Financial Decision Making Cram SessionDocument190 pagesCMA Part 2 Financial Decision Making Cram SessionElenaIvanovaNo ratings yet

- CMA Part 2 Financial Decision Making Cram SessionDocument190 pagesCMA Part 2 Financial Decision Making Cram SessionOZLEMNo ratings yet

- Hock CMA P1 2019 (Sections D & E)Document270 pagesHock CMA P1 2019 (Sections D & E)Nathan DrakeNo ratings yet

- Cma V1Document13 pagesCma V1Ahmed FawzyNo ratings yet

- Answers To QuestionsDocument8 pagesAnswers To QuestionsElie YabroudiNo ratings yet

- F5 FinalDocument18 pagesF5 FinalPrashant PandeyNo ratings yet

- Cma Usa 56QDocument58 pagesCma Usa 56QSB100% (1)

- Acf8 (RN) Mar19 LR PDFDocument84 pagesAcf8 (RN) Mar19 LR PDFDiana IlievaNo ratings yet

- ICMA Questions Dec 2012Document55 pagesICMA Questions Dec 2012Asadul HoqueNo ratings yet

- CMA PART 2 FormulasDocument36 pagesCMA PART 2 Formulasashokpandey8650% (4)

- CMA Exam Secrets Cheat SheetDocument5 pagesCMA Exam Secrets Cheat Sheetswanbez100% (1)

- CMA Part 1 - Section CDocument82 pagesCMA Part 1 - Section CAqeel HanjraNo ratings yet

- Miles CMA Roadmap - 2018 - 11 PDFDocument22 pagesMiles CMA Roadmap - 2018 - 11 PDFRahib JaskaniNo ratings yet

- CMA Exam Study Plan Breakdown by SectionDocument13 pagesCMA Exam Study Plan Breakdown by SectionKevin100% (1)

- Cost and Management Accounting FundamentalsDocument202 pagesCost and Management Accounting FundamentalsAvinash Kumar100% (1)

- CMA Part 1 Sec CDocument131 pagesCMA Part 1 Sec CMusthaqMohammedMadathilNo ratings yet

- IMA 24549 CMA Exam Questions Low Res PDFDocument20 pagesIMA 24549 CMA Exam Questions Low Res PDFIjup CupidaNo ratings yet

- CMA Part 1Document11 pagesCMA Part 1Aaron Abano100% (1)

- Wiley - Wiley CMAexcel Learning System Exam Review 2020 - Complete Set (2-Year Access) - 978-1-119-59646-2 PDFDocument2 pagesWiley - Wiley CMAexcel Learning System Exam Review 2020 - Complete Set (2-Year Access) - 978-1-119-59646-2 PDFMohamed ShaheenNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Cost And Management Accounting A Complete Guide - 2021 EditionFrom EverandCost And Management Accounting A Complete Guide - 2021 EditionRating: 3 out of 5 stars3/5 (1)

- Capital budgeting A Clear and Concise ReferenceFrom EverandCapital budgeting A Clear and Concise ReferenceRating: 2.5 out of 5 stars2.5/5 (2)

- Computer Auditing Prepared by Omnia HassanDocument7 pagesComputer Auditing Prepared by Omnia HassanOmnia HassanNo ratings yet

- Audit Sampling TechniquesDocument5 pagesAudit Sampling TechniquesOmnia HassanNo ratings yet

- Audit Evidence Prepared by Omnia HassanDocument22 pagesAudit Evidence Prepared by Omnia HassanOmnia HassanNo ratings yet

- Nazlawi Business College: Project Cost ManagementDocument72 pagesNazlawi Business College: Project Cost ManagementOmnia HassanNo ratings yet

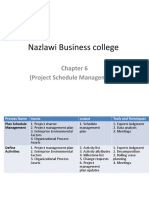

- Project Schedule Management PlanDocument55 pagesProject Schedule Management PlanOmnia HassanNo ratings yet

- Nazlawi Business College: PMP Chapter OneDocument30 pagesNazlawi Business College: PMP Chapter OneOmnia HassanNo ratings yet

- Nazlawi Business College: Pmbok Role of Project ManagerDocument15 pagesNazlawi Business College: Pmbok Role of Project ManagerOmnia HassanNo ratings yet

- Systems Assessment Prepared by Omnia HassanDocument25 pagesSystems Assessment Prepared by Omnia HassanOmnia HassanNo ratings yet

- Audit Ethics and Regulations Prepared by Omnia HassanDocument22 pagesAudit Ethics and Regulations Prepared by Omnia HassanOmnia HassanNo ratings yet

- Economics Chapter 1Document20 pagesEconomics Chapter 1Omnia HassanNo ratings yet

- Nazlawi Business School: (Project Communication Management)Document24 pagesNazlawi Business School: (Project Communication Management)Omnia HassanNo ratings yet

- Nazlawi Business College: Chapter Seven Project Cost ManagementDocument30 pagesNazlawi Business College: Chapter Seven Project Cost ManagementOmnia HassanNo ratings yet

- Economics Chapter 1Document20 pagesEconomics Chapter 1Omnia HassanNo ratings yet

- Project Stakeholder Management Tools and TechniquesDocument25 pagesProject Stakeholder Management Tools and TechniquesOmnia HassanNo ratings yet

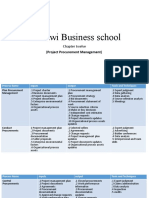

- Nazlawi Business School: (Project Procurement Management)Document32 pagesNazlawi Business School: (Project Procurement Management)Omnia HassanNo ratings yet

- Nazlawi Business College: Pmbok 13, Knowledge Areas Project Integration ManagementDocument52 pagesNazlawi Business College: Pmbok 13, Knowledge Areas Project Integration ManagementOmnia HassanNo ratings yet

- Nazlawi Business School: (Project Risk Management)Document50 pagesNazlawi Business School: (Project Risk Management)Omnia HassanNo ratings yet

- Nazlawi Business College: PMP Chapter OneDocument30 pagesNazlawi Business College: PMP Chapter OneOmnia HassanNo ratings yet

- Nazlawi Business College: Project Scope ManagementDocument43 pagesNazlawi Business College: Project Scope ManagementOmnia HassanNo ratings yet

- Class Notes 6-8Document11 pagesClass Notes 6-8Omnia HassanNo ratings yet

- Class NotesDocument16 pagesClass NotesOmnia HassanNo ratings yet

- Nazlawi Business School: Chapter Eight Project Quality ManagementDocument32 pagesNazlawi Business School: Chapter Eight Project Quality ManagementOmnia HassanNo ratings yet

- Class NotesDocument16 pagesClass NotesOmnia HassanNo ratings yet

- Class Notes 6-8Document11 pagesClass Notes 6-8Omnia HassanNo ratings yet

- Cid TG Fin Risk MGMT May08 PDFDocument16 pagesCid TG Fin Risk MGMT May08 PDFSheelaMaeMedinaNo ratings yet

- Corporate Finance: Final Exam - Spring 2003Document38 pagesCorporate Finance: Final Exam - Spring 2003Omnia HassanNo ratings yet

- Class NotesDocument16 pagesClass NotesOmnia HassanNo ratings yet

- Class NotesDocument15 pagesClass NotesOmnia HassanNo ratings yet

- 04 Inventory MGT PDFDocument17 pages04 Inventory MGT PDFOmnia HassanNo ratings yet

- Supply Chain Management StrategiesDocument21 pagesSupply Chain Management StrategiesOmnia HassanNo ratings yet

- September 1 - AndrewDocument11 pagesSeptember 1 - AndrewDrewNo ratings yet

- Samsung Cash Flow and Fund Flow2Document14 pagesSamsung Cash Flow and Fund Flow2Suhas ChowdharyNo ratings yet

- CHP 10Document62 pagesCHP 10Frandy KarundengNo ratings yet

- TCS Financial ModelDocument47 pagesTCS Financial ModelPrince PriyadarshiNo ratings yet

- Capital Budgeting Techniques and Project Risk AnalysisDocument3 pagesCapital Budgeting Techniques and Project Risk AnalysisbalachmalikNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document66 pagesKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINo ratings yet

- Chapter 10 PropertyDocument10 pagesChapter 10 Propertymaria isabellaNo ratings yet

- Financial Accounting and Analysis MaterialDocument132 pagesFinancial Accounting and Analysis MaterialkarthikreddyNo ratings yet

- MWG 2020 Financial StatementsDocument143 pagesMWG 2020 Financial StatementsNgọc NguyễnNo ratings yet

- Engineering Economy Module 6Document52 pagesEngineering Economy Module 6Bry An CañaresNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaRaquel Villar DayaoNo ratings yet

- 92 08 DeductionsDocument18 pages92 08 DeductionsNikkoNo ratings yet

- Basic - Model - FSA - 2Document8 pagesBasic - Model - FSA - 2AhisjNo ratings yet

- Chapter 2 Cost Concepts AnalysisDocument8 pagesChapter 2 Cost Concepts AnalysisMaria Elliane Querubin RosalesNo ratings yet

- IMS Proschool CFA EbookDocument356 pagesIMS Proschool CFA EbookAjay Yadav0% (1)

- Generally Accepted Accounting PrinciplesDocument6 pagesGenerally Accepted Accounting PrinciplesMuhammad RizwanNo ratings yet

- Cambridge International Examinations Cambridge International Advanced LevelDocument8 pagesCambridge International Examinations Cambridge International Advanced LevelIlesh DinyaNo ratings yet

- Adv Acc Sol Manual 2008Document190 pagesAdv Acc Sol Manual 2008Khey Soniga RollanNo ratings yet

- FABM AJE and Adjusted Trial Balance Service BusinessDocument18 pagesFABM AJE and Adjusted Trial Balance Service BusinessMarchyrella Uoiea Olin Jovenir50% (4)

- Funds Flow and Cash Flow NotesDocument12 pagesFunds Flow and Cash Flow NotesSoumendra RoyNo ratings yet

- Revenue ProjectionDocument17 pagesRevenue ProjectionKriti AhujaNo ratings yet

- 31211Document10 pages31211Agung Widya GocaNo ratings yet

- Real Estate Investment AnalysisDocument26 pagesReal Estate Investment AnalysisRenold DarmasyahNo ratings yet

- Capital Budgeting ExerciseDocument57 pagesCapital Budgeting Exerciseshani27No ratings yet

- Mas6 7Document46 pagesMas6 7Villena Divina VictoriaNo ratings yet

- FABM1 Q4 Module 6 Preparing of Reversing EntriesDocument14 pagesFABM1 Q4 Module 6 Preparing of Reversing Entriesrio100% (1)

- FT Problem Set 01 DepreciationDocument2 pagesFT Problem Set 01 DepreciationshaneNo ratings yet

- Bank Soal SAP AC010Document16 pagesBank Soal SAP AC010agus tamanNo ratings yet

- Arini Alfahani - Tugas AKM IDocument2 pagesArini Alfahani - Tugas AKM Iarini alfahaniNo ratings yet