Professional Documents

Culture Documents

Congressional Letter To Colleges Regarding Their Endowment

Uploaded by

PennLive0 ratings0% found this document useful (0 votes)

3K views4 pagesThis is a letter that was sent to 56 private colleges and universities across the country with large endowments as part of a comprehensive tax reform discussion.

Original Title

Congressional letter to colleges regarding their endowment

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is a letter that was sent to 56 private colleges and universities across the country with large endowments as part of a comprehensive tax reform discussion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3K views4 pagesCongressional Letter To Colleges Regarding Their Endowment

Uploaded by

PennLiveThis is a letter that was sent to 56 private colleges and universities across the country with large endowments as part of a comprehensive tax reform discussion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

Congress of the United States

Washington, BC 20515

February 8, 2016

Dr. Amy Gutmann

President

University of Pennsylvania

Philadelphia, PA 19104

Dear President Gutmann,

In the United States Congress, the Senate Committee on Finance and House Committee

‘on Ways and Means have exclusive jurisdiction over federal revenue measures. Under

Senate and House rules, the commitiees have corresponding authority to conduct

‘oversight of activities within their jurisdiction. As chairmen of these committees and the

Ways and Means Oversight Subcommittee, we are conducting an inquiry into the

activities of colleges and universities related to the numerous tax preferences they enjoy

under the Internal Revenue Code. We write to request information regarding the

operations of University of Pennsylvania and status of the university’s endowment.

The National Association of College and University Business Officers reports that 56

private universities and colleges have endowments of more than $1 billion.’ This study

showed endowments had an average return on investment of 15.5 percent and an average

payout rate of 4.4 percent during the 2014 fiscal year. Despite these large and growing

endowments, many colleges and universities have raised tuition far in excess of

inflation.

In recent years, a greater amount of information has been made publicly available about

endowments. The Internal Revenue Service revised the Form 990, which tax-exempt

private colleges and universities are required to file, to include certain high-level

information about endowments. The Committees are conducting additional oversight of

how colleges and universities are using endowment assets to fulfill their charitable and

educational purposes. To help the Committees understand this issue, please answer each

question below for the past three tax years, and, to the extent possible, for the

current tax year, unless otherwise specified.

1 Building on 11.7% gain in FY2013, educational endowments" investment returns averaged 15.5% in

FY2014, NACUBO (Jan. 29, 2015), available at

htp:/iww.nacubo.org/About_NACUBO/Press_ Room/2014_NACUBO-

Commonfund_Study_of Endowments 9628Final_Data%29.html.

"ohn W. Schoen, Why does a college degree cost 0 much?, CNBC, lune 16,2015, available at

het /ivorw.enbo.com/201 5/06) 6lwhy-college-costs-are-so-high-and-rising.himl (breaking down the

tuition costs of public and private two and four year colleges and universities from 1994 to 2015 compared

to inflation).

Endowment Management

1, What categories of assets are included in your college or university’s endowment?

For each category, please indicate the amount of funds that are:

unrestricted;

permanently restricted by donors;

temporarily restricted by donors;

permanently restricted by your college or university (quasi-endowments);

and

temporarily restricted by your college or university.

For each restricted asset, please describe the uses for which the funds are

restricted and the amount of the fair market value of the endowment

apportioned to each use. How and why were the restrictions put into

place?

aese

me

2. Does your college or university hold any investments that are not included in the

endowment? If so, what are they, and what are their fair market values and basis?

How are they used to further the educational purpose of the college or university?

3. What is your endowment size, as measured by total fair market value of its assets?

‘What has been the net growth and net investment return on your endowment each

year?

4, How much has your college or university spent each year to manage the

endowment, and how many staff and contractors are employed to manage the

endowment? For any fees paid to nonemployees for investment advice, asset

‘management, or otherwise, please provide detail on the amounts paid, to whom,

and the fee arrangement.

5. If your endowment is required to file a Form 990 separately from your college or

university's Form 990, please provide the endowment entity name(s) and

Employment Identification Number.

Endowment Spending and Use

6. How does your college or university determine what percentage of the

endowment will be paid out each year? If any, what has been the target

endowment payout as a percentage of the endowment’s beginning balance each

year? If that answer differs from the percentage paid out, please explain why.

Please attach any payout policies or guidance.

7. Does your college or university have policies regarding spending the endowment

principal? Has your college or university ever spent endowment principal? If'so,

under what circumstances?

8. How much and what percentage of the endowment’s beginning balance has your

college or university spent each year? How much and what percentage of the

endowments return on investment has your college or university spent each year?

9. What percentage of your endowment does your college or university devote to

financial aid for student tuition? How much for other forms of student financial

aid? Please specify the types of non-tuition financial aid provided.

10. Does your college or university have policies regarding whether itis allowed to

accept funds restricted to a specific purpose? Has your college ot university ever

declined a donation because it was restricted to a certain purpose? If so, please

describe those specific scenarios in which your school rejected a donation.

11, How much and what percentage of your college or university's endowment is,

invested in real property (not including REITs or other publicly-traded

securities)? Please list and describe your college or university’s real estate

holdings, including real estate held by the college or university, the endowment,

and all related entities. Ifthe college or university has made any Payments in

Lieu of Taxes, please provide the date and amount of the payment.

Donations

12, Does your college or university grant naming rights to donors based on certain

donation levels? If so, please describe the naming rights program, including how

‘much and what percentage of any naming rights donations your college or

university has used for tuition assistance.

Conflicts of Interest

13. What conflict of interest policies does your college or university have in place to

address financial interest in endowment investments (including potential conflicts

of interest among and between governing boards, trustees, executives, internal

employees tasked with overseeing the endowment, and extemal asset managers of

endowment assets)? How do you vet board members” potential conflicts of

interest? What are your policies if a conflict arises with a member of the board of

trustees?

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Quinn's Resignation LetterDocument2 pagesQuinn's Resignation LetterPennLiveNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Regan Response To Cumberland County GOP ChairmanDocument1 pageRegan Response To Cumberland County GOP ChairmanPennLiveNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Correspondence From Conference To Institution Dated Nov 10 2023Document13 pagesCorrespondence From Conference To Institution Dated Nov 10 2023Ken Haddad100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Letter Regarding PASS ProgramDocument3 pagesLetter Regarding PASS ProgramPennLive100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Letter To Senator ReganDocument2 pagesLetter To Senator ReganPennLiveNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Letter To FettermanDocument1 pageLetter To FettermanPennLiveNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Do Democrats Hold The Majority in The Pa. House of Representatives?Document12 pagesDo Democrats Hold The Majority in The Pa. House of Representatives?PennLiveNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Calling For Rep. Zabel To ResignDocument2 pagesCalling For Rep. Zabel To ResignPennLiveNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Senate Subpoena To Norfolk Southern CEODocument1 pageSenate Subpoena To Norfolk Southern CEOPennLiveNo ratings yet

- Atlantic Seaboard Wine Association 2022 WinnersDocument11 pagesAtlantic Seaboard Wine Association 2022 WinnersPennLiveNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Letter To Chapman Regarding The ElectionDocument2 pagesLetter To Chapman Regarding The ElectionPennLiveNo ratings yet

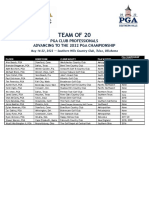

- 2022 Team of 20 GridDocument1 page2022 Team of 20 GridPennLiveNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Wheeler's Letter To LeadersDocument2 pagesWheeler's Letter To LeadersPennLiveNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 23 PA Semifinalists-NatlMeritProgramDocument5 pages23 PA Semifinalists-NatlMeritProgramPennLiveNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Description of Extraordinary OccurrenceDocument1 pageDescription of Extraordinary OccurrencePennLiveNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ishmail Thompson Death FindingsDocument1 pageIshmail Thompson Death FindingsPennLiveNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Corman Letter Response, 2.25.22Document3 pagesCorman Letter Response, 2.25.22George StockburgerNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Project Milton in Hershey, 2022Document2 pagesProject Milton in Hershey, 2022PennLiveNo ratings yet

- Jake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoDocument5 pagesJake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoPennLiveNo ratings yet

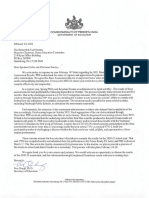

- Letter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyDocument1 pageLetter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyPennLiveNo ratings yet

- Letter Regarding PPE and UkraineDocument2 pagesLetter Regarding PPE and UkrainePennLiveNo ratings yet

- Letter To Auditor General Timothy DeFoorDocument2 pagesLetter To Auditor General Timothy DeFoorPennLiveNo ratings yet

- TWW PLCB LetterDocument1 pageTWW PLCB LetterPennLiveNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pa. House Leaders' Letter Requesting Release of PSSA ResultsDocument3 pagesPa. House Leaders' Letter Requesting Release of PSSA ResultsPennLiveNo ratings yet

- Cumberland County Resolution Opposing I-83/South Bridge TollingDocument2 pagesCumberland County Resolution Opposing I-83/South Bridge TollingPennLiveNo ratings yet

- Greene-Criminal Complaint and AffidavitDocument6 pagesGreene-Criminal Complaint and AffidavitPennLiveNo ratings yet

- Redistricting ResolutionsDocument4 pagesRedistricting ResolutionsPennLiveNo ratings yet

- Envoy Sage ContractDocument36 pagesEnvoy Sage ContractPennLiveNo ratings yet

- Gov. Tom Wolf's LetterDocument1 pageGov. Tom Wolf's LetterPennLiveNo ratings yet

- James Franklin Penn State Contract 2021Document3 pagesJames Franklin Penn State Contract 2021PennLiveNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)