Professional Documents

Culture Documents

Lcdglobalsnapshot: LCD Snapshot

Uploaded by

api-26423003Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lcdglobalsnapshot: LCD Snapshot

Uploaded by

api-26423003Copyright:

Available Formats

April, 2010

LCDGlobalSnapshot €800B

Published by Standard & Poor’s

US

Leveraged Commentary

Total Volume & Data

Europe

Institutional www.lcdcomps.com

€600B

US Europe

€800B

€400B Total Volume Institutional

US Europe

Europe/U.S. Universe - S&P European Leveraged Leveraged

€800B Loan Volume

€600B Total Volume Institutional

Loan Index & S&P/LSTA Loan Index €200B

US Europe

€600B

€800B

€400B

€0B Total Volume Institutional

10 Largest Issuers Based Upon Current Par 2005 2006 2007 2008 2009 1Q10 2005 2006 2007 2008 2009 1Q10

€600B

€400B

Outstanding (€ & $) €200B

First Data Corp €200B

€400B

€0B

Ford Motor Company

2005 2006 2007 2008 2009 1Q10 2005 2006 2007 2008 2009 1Q10

Harrah’s Entertainment Inc €0B

€200B

HCA - The Healthcare Company 2005 2006 2007 2008 2009 1Q10 2005 2006 2007 2008 2009 1Q10

LyondellBasell Industries

NTL Inc €0B

US Europe

Tribune Company 100% 2005 2006 2007 2008 2009 1Q10 2005 2006 2007 2008 2009 1Q10

TXU Corp Source: Standard & Poor’s LCD

Univision Communications Inc 75%

Wind Telecommunicazioni Institutional Investors’

US Share of the Primary Market

Europe

100%

50%

10 Largest Industries Based Upon Current Par US Europe

100%

Outstanding (€ & $) 75%

25%

US Europe

Health care . . . . . . . . . . . . . . . . . . 9.8% 100%

75% NA*

Publishing . . . . . . . . . . . . . . . . . . . 7.0% 50%

0%

Business equipment and services . . 6.7% 2005 2006 2007 2008 2009 LTM 31/03/10

50%

75%

Chemical/Plastics . . . . . . . . . . . . . 6.4% 25%

Cable television . . . . . . . . . . . . . . . 6.2% NA*

Utilities . . . . . . . . . . . . . . . . . . . . . 5.2% 50%

25%

0%

Telcommunications . . . . . . . . . . . . 5.1% 2005 2006 2007 2008 2009

NA* LTM 31/03/10

Automotive . . . . . . . . . . . . . . . . . . 4.2% 0%

25%

2005 2006 2007 2008 2009 LTM 31/03/10

Broadcast radio and television . . . . 3.9% NA*

Retailers (other than food/drug) . . . 3.8% 0%did not track enough European observations to form a meaningful sample for 2009.

* LCD Source: Standard & Poor’s LCD

2005

US Europe

2006 2007 2008 2009 LTM 31/03/10

€600B

Rating Diversification (€ & $) Year-End Institutional Par Amount Outstanding

BBB- . . . . . . . . . . . . . . . . . . . . . . . 2.1%

BB+ . . . . . . . . . . . . . . . . . . . . . . . 5.6% €400B

US Europe

BB . . . . . . . . . . . . . . . . . . . . . . . 10.9% €600B

BB- . . . . . . . . . . . . . . . . . . . . . . . 12.1% US Europe

B+ . . . . . . . . . . . . . . . . . . . . . . . 19.3% €600B

€200B

B . . . . . . . . . . . . . . . . . . . . . . . . 16.1% €400B

US Europe

B- . . . . . . . . . . . . . . . . . . . . . . . . 11.0% €600B

Other . . . . . . . . . . . . . . . . . . . . . . 12.8% €400B

€0B

NR . . . . . . . . . . . . . . . . . . . . . . . 10.0% €200B 2005 2006 2007 2008 2009 31/03/10

€400B

€200B

€0B

For more information about LCD products, €200B 2005 2006 2007 2008 2009 31/03/10

contact Anna Cini at +44 20 7176 3997 or by €0B

Source: S&P European Leveraged Loan Index & S&P/LSTA Loan Index

2005 2006 2007 2008 2009 31/03/10

email at anna_cini@standardandpoors.com

or Sucheet Gupte at +44 20 7176 7235 or by €0B

email at sucheet_gupte@standardandpoors.com Total Return 2005 2006 2007 2008 2009 31/03/10

US Europe (Multi-Currency) Europe (EUR Denominated)

60%

40%

20% US Europe (Multi-Currency) Europe (EUR Denominated)

60%

0% US Europe (Multi-Currency) Europe (EUR Denominated)

40%

60%

-20%

20%

40% US Europe (Multi-Currency) Europe (EUR Denominated)

60%

-40%

20%

0%

40% 2005 2006 2007 2008 2009 1Q10

-20%

0% Source: S&P European Leveraged Loan Index & S&P/LSTA Loan Index

20%

-20%

-40%

0% 2005 2006 2007 2008 2009 1Q10

-40%

-20%

2005 2006 2007 2008 2009 1Q10

You might also like

- Interim Rules of Procedure Governing Intra-Corporate ControversiesDocument28 pagesInterim Rules of Procedure Governing Intra-Corporate ControversiesRoxanne C.No ratings yet

- The Classical PeriodDocument49 pagesThe Classical PeriodNallini NarayananNo ratings yet

- Macchi Stretch and Shrink FilmsDocument41 pagesMacchi Stretch and Shrink Filmsmiguel romanoNo ratings yet

- EMS Term 2 Controlled Test 1Document15 pagesEMS Term 2 Controlled Test 1emmanuelmutemba919No ratings yet

- Mycobacterium TuberculosisDocument54 pagesMycobacterium TuberculosisDaniel WaweruNo ratings yet

- Worldwide Paper Company: Case Solution Company BackgroundDocument4 pagesWorldwide Paper Company: Case Solution Company BackgroundJauhari WicaksonoNo ratings yet

- Introduction - Sanskrit Varnamala: - ह्रस्व (short vowels) - अ इ उ ऋ लृ and दीर्ण (long vowels) - आ ई ऊ ॠ ए ऐ ओ औDocument3 pagesIntroduction - Sanskrit Varnamala: - ह्रस्व (short vowels) - अ इ उ ऋ लृ and दीर्ण (long vowels) - आ ई ऊ ॠ ए ऐ ओ औVijaykumar KunnathNo ratings yet

- Keller SME 12e PPT CH01Document19 pagesKeller SME 12e PPT CH01NAM SƠN VÕ TRẦN100% (1)

- Sample Question Paper PMADocument5 pagesSample Question Paper PMAjasminetsoNo ratings yet

- Facepot AmigurumiDocument10 pagesFacepot AmigurumiAna Laura Marçal Monsores100% (2)

- IAB Online Advertising Expenditure Report: Quarter Ended December 2009Document42 pagesIAB Online Advertising Expenditure Report: Quarter Ended December 2009jitinsharmanewNo ratings yet

- Outotec Q1-Q3 2011 Roadshow Presentation 22112011Document69 pagesOutotec Q1-Q3 2011 Roadshow Presentation 22112011Ivanoff Vladimir Rojas TelloNo ratings yet

- Odoo Survivalguide Recruitment 31aug20Document36 pagesOdoo Survivalguide Recruitment 31aug20Stu FeesNo ratings yet

- SP2025 enDocument64 pagesSP2025 enJoseph AgulloNo ratings yet

- LCD European Quarterly 1Q16Document11 pagesLCD European Quarterly 1Q16Shawn PantophletNo ratings yet

- Ideocon: Experience Change - The Indian Multinational WayDocument131 pagesIdeocon: Experience Change - The Indian Multinational WayAmitvikram ToraskarNo ratings yet

- London Stock Exchange Etfs - Highlights of Ten Years of TradingDocument5 pagesLondon Stock Exchange Etfs - Highlights of Ten Years of Tradingjini02No ratings yet

- A Sectoral Perspective On Recent Trends in Mergers and AcquisitionsDocument32 pagesA Sectoral Perspective On Recent Trends in Mergers and AcquisitionslixueyuanNo ratings yet

- Bouteiller 1Document27 pagesBouteiller 1Yaseen AlAjmi CompanyNo ratings yet

- Research and Innovation: ICT Projects in Horizon 2020Document9 pagesResearch and Innovation: ICT Projects in Horizon 2020Dan DannyNo ratings yet

- Statoil Annual Report 2004 PDFDocument150 pagesStatoil Annual Report 2004 PDFRocky VNo ratings yet

- Impact Globalization Growth CSO-IrelandDocument32 pagesImpact Globalization Growth CSO-IrelandAditiNo ratings yet

- The Global Champion in SteelDocument15 pagesThe Global Champion in SteelsirdrinkalotNo ratings yet

- Eskom Baseline Vs Actuals 2006 To 2022 Grootvlei Medupi Kusile IngulaDocument14 pagesEskom Baseline Vs Actuals 2006 To 2022 Grootvlei Medupi Kusile IngulaDavid LipschitzNo ratings yet

- AseanDocument1 pageAseanAnyarocNo ratings yet

- Roskill PreseentationDocument21 pagesRoskill Preseentationjiawen dingNo ratings yet

- F E H I 2010: Ormula Lectric and Ybrid TalyDocument39 pagesF E H I 2010: Ormula Lectric and Ybrid TalyAlfredo MarinucciNo ratings yet

- Chartbook of The IGWT20 Gold Conquering New Record HighsDocument68 pagesChartbook of The IGWT20 Gold Conquering New Record HighsTFMetals100% (1)

- RAB McMillan SGT Products and Maintenance PhilosophyDocument23 pagesRAB McMillan SGT Products and Maintenance PhilosophybgraoNo ratings yet

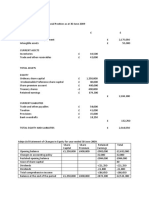

- IOL Chemicals and Pharmaceuticals LimitedDocument70 pagesIOL Chemicals and Pharmaceuticals Limitedpreshu12No ratings yet

- Financial Analysis of ONGC: Key Metrics and Performance Over 5 YearsDocument20 pagesFinancial Analysis of ONGC: Key Metrics and Performance Over 5 YearsJobin Jose KadavilNo ratings yet

- Calgon Carbon CorporationDocument5 pagesCalgon Carbon CorporationAndrew HostetlerNo ratings yet

- Chapter 3.figure 3.2. Business and Public Investment Have Expanded Global Research Capacity Version 1 - Last Updated: 06-Oct-2016Document10 pagesChapter 3.figure 3.2. Business and Public Investment Have Expanded Global Research Capacity Version 1 - Last Updated: 06-Oct-2016ana mariaNo ratings yet

- 2015 CommentaryDocument43 pages2015 Commentaryduong duongNo ratings yet

- 2017 Eu Fishing Fleet Economic Performance Infographic - enDocument1 page2017 Eu Fishing Fleet Economic Performance Infographic - enMarian AntonescuNo ratings yet

- Operating Profit: A. Founded in 1892, Calcutta B. C. Chairman/Head-Nusli Wadia D. Managing Director - Varun BerryDocument5 pagesOperating Profit: A. Founded in 1892, Calcutta B. C. Chairman/Head-Nusli Wadia D. Managing Director - Varun BerryVIDHI AGARAIYANo ratings yet

- Huawei CorporateDocument18 pagesHuawei CorporateMarcelo SilvaNo ratings yet

- 2006 AGM SlidesDocument41 pages2006 AGM Slidesrahul02bNo ratings yet

- Session 4 SPE Training Exceptional Price PerformanceDocument67 pagesSession 4 SPE Training Exceptional Price PerformanceJarodNo ratings yet

- AnalysisDocument5 pagesAnalysisRamasamy JayaramanNo ratings yet

- Business Plan Highlights for Salon Beauty VenusDocument20 pagesBusiness Plan Highlights for Salon Beauty VenusEzike Tobe ChriszNo ratings yet

- Environmental Ipv6 Monitoring Application: Bof-05 Patrick Grossetete Product Management and Customers SolutionsDocument19 pagesEnvironmental Ipv6 Monitoring Application: Bof-05 Patrick Grossetete Product Management and Customers Solutionssabah.falahNo ratings yet

- Income StatementDocument3 pagesIncome StatementKhari haranNo ratings yet

- AR2008Document148 pagesAR2008Dennis AngNo ratings yet

- The State of European Food-Tech 2019Document23 pagesThe State of European Food-Tech 2019selcukNo ratings yet

- Eurekahedge May 2011 Key Trends in Fund of Hedge Funds - AbridgedDocument1 pageEurekahedge May 2011 Key Trends in Fund of Hedge Funds - AbridgedEurekahedgeNo ratings yet

- United KingdomDocument16 pagesUnited KingdomspephdNo ratings yet

- European - United States Defence Expenditure in 2009: Date: 21.12.2010Document16 pagesEuropean - United States Defence Expenditure in 2009: Date: 21.12.2010wavijunkNo ratings yet

- Robotics 1 Lecture 2 Characteristics and Applications: October 2015Document47 pagesRobotics 1 Lecture 2 Characteristics and Applications: October 2015FerrolinoLouieNo ratings yet

- Appendix D - Answers To Self-Test Problems PDFDocument32 pagesAppendix D - Answers To Self-Test Problems PDFgmcrinaNo ratings yet

- Analisis Market 1.0Document7 pagesAnalisis Market 1.0Juwita MeNo ratings yet

- Chapter 8Document14 pagesChapter 8Ma Elhen Jane AutajayNo ratings yet

- HDFCPMS Presentation May2010Document26 pagesHDFCPMS Presentation May2010SimplythrNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- Barrick Annual Report 2021Document215 pagesBarrick Annual Report 2021percy f.fNo ratings yet

- Sales Growth Rate: Richard L. Keyser Chairman and Chief Executive OfficerDocument57 pagesSales Growth Rate: Richard L. Keyser Chairman and Chief Executive OfficerchabucaNo ratings yet

- LuxmDocument1 pageLuxmPardeep_Dhanda_1755No ratings yet

- Robotics Lecture 2Document47 pagesRobotics Lecture 2rolyronald7No ratings yet

- SK Energy NDR PT 20100407Document62 pagesSK Energy NDR PT 20100407Thierno Samassa LyNo ratings yet

- Indoneisa 2013Document36 pagesIndoneisa 2013Iam IbadNo ratings yet

- Seminar Teknik Untirta 2010Document23 pagesSeminar Teknik Untirta 2010Wawan GunawanNo ratings yet

- BusinessPlan Mooncard 2019 2026 vIGF VadDocument2,151 pagesBusinessPlan Mooncard 2019 2026 vIGF VadHed GnabryNo ratings yet

- Acquisition of Arcelor Steel by Mittal SteelDocument16 pagesAcquisition of Arcelor Steel by Mittal SteelSagar AtulNo ratings yet

- The Economic Foundations of Imperialism: Guglielmo Carchedi and Michael Roberts HM London November 2019Document28 pagesThe Economic Foundations of Imperialism: Guglielmo Carchedi and Michael Roberts HM London November 2019MrWaratahsNo ratings yet

- Q1 2022 European PE BreakdownDocument15 pagesQ1 2022 European PE BreakdownAkbaraly KevinNo ratings yet

- 10 Tut Intro Sustain V02Document117 pages10 Tut Intro Sustain V02Jasleen KaurNo ratings yet

- Glo DGF Ocean Market UpdateDocument23 pagesGlo DGF Ocean Market UpdateKicki AnderssonNo ratings yet

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryFrom EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Been Gone PDFDocument2 pagesBeen Gone PDFmorriganssNo ratings yet

- Company Profile: "Client's Success, Support and Customer Service Excellence Is Philosophy of Our Company"Document4 pagesCompany Profile: "Client's Success, Support and Customer Service Excellence Is Philosophy of Our Company"Sheraz S. AwanNo ratings yet

- Scenario - River Spray Company Was Organized To Gro...Document5 pagesScenario - River Spray Company Was Organized To Gro...Ameer Hamza0% (1)

- JENESYS 2019 Letter of UnderstandingDocument2 pagesJENESYS 2019 Letter of UnderstandingJohn Carlo De GuzmanNo ratings yet

- ArtmuseumstoexploreonlineDocument1 pageArtmuseumstoexploreonlineapi-275753499No ratings yet

- Ten Anglican ChantsDocument10 pagesTen Anglican ChantsAndrew WrangellNo ratings yet

- Impact of Social Media on Grade 12 STEM Students' Academic PerformanceDocument41 pagesImpact of Social Media on Grade 12 STEM Students' Academic PerformanceEllie ValerNo ratings yet

- Drama tiktbt notesDocument3 pagesDrama tiktbt notestedjackson608No ratings yet

- Objectives of Community Based RehabilitationDocument2 pagesObjectives of Community Based Rehabilitationzen_haf23No ratings yet

- NewsRecord15 01 28Document12 pagesNewsRecord15 01 28Kristina HicksNo ratings yet

- Villafuerte v. RobredoDocument3 pagesVillafuerte v. RobredoClarisseNo ratings yet

- 4 Rizal's Childhood & 1st TripDocument46 pages4 Rizal's Childhood & 1st TripRain Storm PolgaderaNo ratings yet

- Sd-Wan Zero-to-Hero: Net Expert SolutionsDocument11 pagesSd-Wan Zero-to-Hero: Net Expert SolutionsFlorick Le MahamatNo ratings yet

- Comparing Freight Rates for Chemical ShipmentsDocument2 pagesComparing Freight Rates for Chemical ShipmentsNothing was0% (1)

- Review - Reformation of The SupperDocument2 pagesReview - Reformation of The SupperSteve Vander WoudeNo ratings yet

- Ekkliton Persons, Basil OsborneDocument5 pagesEkkliton Persons, Basil Osbornegabriel6birsan-1No ratings yet

- Some Common Abbreviations in Newspapers and TestsDocument2 pagesSome Common Abbreviations in Newspapers and TestsIrfan BalochNo ratings yet

- WHO TRS 999 Corrigenda Web PDFDocument292 pagesWHO TRS 999 Corrigenda Web PDFbhuna thammisettyNo ratings yet

- Bailment and PledgeDocument60 pagesBailment and PledgebijuprasadNo ratings yet

- Compare Quickbooks Plans: Buy Now & Save Up To 70%Document1 pageCompare Quickbooks Plans: Buy Now & Save Up To 70%Agustus GuyNo ratings yet

- 40 Rabbana DuasDocument3 pages40 Rabbana DuasSean FreemanNo ratings yet

- Financial Market StructureDocument17 pagesFinancial Market StructureVishnu Pathak100% (1)