Professional Documents

Culture Documents

Horizontal and Vertical Analysis of Profit

Uploaded by

Ifzal Ahmad0 ratings0% found this document useful (0 votes)

1K views3 pagesHorizontal and Vertical Analysis of Profit and Loss Statement Horizontal Analysis 2009 2008 Net sales Cost of sales Gross profit Other operating Income Other operating expenses profit before Interest & taxation Finance costs profit before taxation Taxation Profit after taxation Vertical Analysis 2009 Horizontal Analysis 2008 2007 Vertical Analysis 2009 2008 ASSETS Non-current assets Fixed assets Long-term loans Long-term deposits long term investment long term receivables Deferred Tax Asset Current assets Trade debts loans and advances Short-term prepayments Accrued financial income

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHorizontal and Vertical Analysis of Profit and Loss Statement Horizontal Analysis 2009 2008 Net sales Cost of sales Gross profit Other operating Income Other operating expenses profit before Interest & taxation Finance costs profit before taxation Taxation Profit after taxation Vertical Analysis 2009 Horizontal Analysis 2008 2007 Vertical Analysis 2009 2008 ASSETS Non-current assets Fixed assets Long-term loans Long-term deposits long term investment long term receivables Deferred Tax Asset Current assets Trade debts loans and advances Short-term prepayments Accrued financial income

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views3 pagesHorizontal and Vertical Analysis of Profit

Uploaded by

Ifzal AhmadHorizontal and Vertical Analysis of Profit and Loss Statement Horizontal Analysis 2009 2008 Net sales Cost of sales Gross profit Other operating Income Other operating expenses profit before Interest & taxation Finance costs profit before taxation Taxation Profit after taxation Vertical Analysis 2009 Horizontal Analysis 2008 2007 Vertical Analysis 2009 2008 ASSETS Non-current assets Fixed assets Long-term loans Long-term deposits long term investment long term receivables Deferred Tax Asset Current assets Trade debts loans and advances Short-term prepayments Accrued financial income

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC or read online from Scribd

You are on page 1of 3

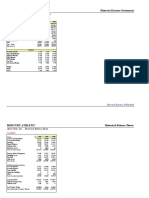

Horizontal and Vertical Analysis of Profit & Loss Statement

Horizontal analysis Vertical analysis

2009 2008 2007 2009 2008 2007 2009 2008

Rs0 Rs0 Rs0

et sales 61,580,072 45,716,789 38,382,645 134.70 119.11 100.00 100% 100%

ost of sales 20,624,486 16,210,385 13,841,367 127.23 117.12 100.00 33.5% 35.5%

ross profit 40,955,586 29,506,404 24,541,278 138.80 120.23 100.00

her operating Income 4,149,732 3,092,142 2,465,022 134.20 125.44 100.00 6.7% 6.8%

her operating expenses 3,103,270 2,085,367 2,600,106 148.81 80.20 100.00 5.0% 4.6%

ofit before Interest &

xation 41,908,420 30,513,179 24,406,194 137.35 125.02 100.00

nance costs 93,628 66,624 49,424 140.53 134.80 100.00 0.2% 0.1%

ofit before taxation 41,908,420 30,446,555 24,356,770 137.65 125.00 100.00

axation 14,205,629 10,739,157 7,588,996 132.28 141.51 100.00 23.1% 23.5%

ofit after taxation 27,702,791 19,707,398 16,767,774 140.57 117.53 100.00 45.0% 43.1%

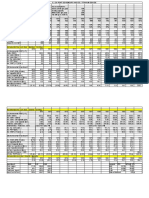

Horizontal and Vertical Analysis of Balance Sheet

Horizontal Analysis Vertical Analysis

2009 2008 2007 2009 2008 2007 2009 2008

Rs0 Rs0 Rs0

ASSETS

Non-current assets

Fixed assets 34,970,717 21,368,020 15,377,148 163.7 139.0 100.0 42.18% 35.02%

Long-term loans 9,897 11,752 10,853 84.2 108.3 100.0 0.01% 0.02%

Long-term deposits 615,000 0.74% 0.00%

Long term investment 1,854,333 1,781,469 677,384 104.1 263.0 100.0 2.24% 2.92%

Long-term receivables 27,531 - 0.03% 0.00%

Deferred Tax Asset - - 711,337 100.0

37,477,478 23,161,241 16,776,722 161.8 138.1 100.0 45.20% 37.95%

Current assets -

Stores and spares 1,871,644 1,604,385 1,474,655 116.7 108.8 100.0 2.26% 2.63%

Trade debts 27,779,864 13,228,456 9,002,094 210.0 146.9 100.0 33.50% 21.68%

Loans and advances 414,760 46,506 34,001 891.8 136.8 100.0 0.50% 0.08%

Short-term prepayments 319,967 698,029 408,658 45.8 170.8 100.0 0.39% 1.14%

Accrued financial income 308,003 212,877 116,755 144.7 182.3 100.0 0.37% 0.35%

current maturity of long-term investments 24,980

current maturity of long-term receivables 19,029 231,289 100.0

Other Receivables 99,347 8,858 21,669 1121.6 40.9 100.0 0.12% 0.01%

Short Term Investments 13,216,706 20,968,017 21,515,496 63.0 97.5 100.0 15.94% 34.36%

Cash and Bank Balances 1,384,353 1,094,892 787,786 126.4 139.0 100.0 1.67% 1.79%

Total current Assets 45,438,653 37,862,020 33,592,403 120.0 112.7 100.0 54.80% 62.05%

TOTAL ASSETS 82,916,131 61,023,261 50,369,125 135.9 121.2 100.0 100% 100%

SHARE CAPITAL AND RESERVES

Share capital 8,298,606 7,544,200 6,858,376 110.0 110.0 100.0 10.01% 12.36%

54,759,95 36,110,07 33,239,67

Reserves 1 1 5 151.6 108.6 100.0 66.04% 59.17%

63,058,55 43,654,27 40,098,05

7 1 1 144.4 108.9 100.0 76.05% 71.54%

NON CURRENT LIABILITIES

Provision for decommissioning obligation 3,974,307 2,813,374 1,744,823 141.3 161.2 100.0 4.79% 4.61%

Liabilities against assets subject to finance lease 100,105 77,564 69,152 129.1 112.2 100.0 0.12% 0.13%

Deferred Liabilities 990,685 859,779 742,059 115.2 115.9 100.0 1.19% 1.41%

Deferred Income 5,830 0.01% 0.00%

Deferred taxation 138,563 39,157 353.9 0.17% 0.06%

5,209,490 3,789,874 2,556,034 137.5 148.3 100.0 6.28% 6.21%

CURRENT LIABILITIES

13,474,43 12,241,94

Trade and other payables 4 3 7,220,468 110.1 169.5 100.0 16.25% 20.06%

current maturity of long term liability for gas

development surcharge - 231,289 100.0

Current maturity of liabilities against assets subject

to finance lease 45,946 44,795 50,696 102.6 88.4 100.0 0.06% 0.07%

Current maturity of deferred income 971 0.00% 0.00%

Taxation 1,126,773 1,292,378 212,587 87.2 607.9 100.0 1.36% 2.12%

14,648,084 13,579,116 7,715,040 107.9 176.0 100.0 17.67% 22.25%

CONTINGENCIES AND COMMITMENTS

TOTAL EQUITY AND LIABILITIES 82,916,131 61,023,261 50,369,125 135.9 121.2 100.0 100% 100%

You might also like

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Financial Analysis: Horizontal Analysis: (As Per Excel)Document7 pagesFinancial Analysis: Horizontal Analysis: (As Per Excel)mehar noorNo ratings yet

- Home Depot and Lowes Balance Sheets Vertical AnalysisDocument7 pagesHome Depot and Lowes Balance Sheets Vertical AnalysisKenny O'BrienNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisLiza KhanNo ratings yet

- Petron Corporation Vertical Analysis of Balance Sheet RatiosDocument2 pagesPetron Corporation Vertical Analysis of Balance Sheet RatiosMeyNo ratings yet

- Financial Forecasting: Pro Forma Statements Using Percent-of-SalesDocument3 pagesFinancial Forecasting: Pro Forma Statements Using Percent-of-SalesMikie AbrigoNo ratings yet

- HomeDepotvs LowesReportDocument20 pagesHomeDepotvs LowesReportLuke Rafla-yuanNo ratings yet

- Practice of Ratio Analysis Development of Financial StatementsDocument8 pagesPractice of Ratio Analysis Development of Financial StatementsZarish AzharNo ratings yet

- Clarkson Lumber - Cash FlowDocument1 pageClarkson Lumber - Cash FlowSJNo ratings yet

- Share & Business Valuation Case Study Question and SolutionDocument6 pagesShare & Business Valuation Case Study Question and SolutionSarannyaRajendraNo ratings yet

- (GR1) TCDN - Case 4Document19 pages(GR1) TCDN - Case 4Thắng Vũ Nguyễn Đức100% (1)

- Financial Analysis of PEPSICODocument8 pagesFinancial Analysis of PEPSICOUsmanNo ratings yet

- Tire City-Spread SheetDocument6 pagesTire City-Spread SheetVibhusha SinghNo ratings yet

- Real Options and Capital Budgeting (I Wish I Had A Crystal Ball)Document4 pagesReal Options and Capital Budgeting (I Wish I Had A Crystal Ball)Ian S. DaosNo ratings yet

- Monthly Info 2023.08Document10 pagesMonthly Info 2023.08onlychess96No ratings yet

- Innocents Abroad - Currencies and International Stock ReturnsDocument112 pagesInnocents Abroad - Currencies and International Stock ReturnsGragnor PrideNo ratings yet

- Mergers & Acquisitions ValuationDocument5 pagesMergers & Acquisitions ValuationAparna KalaskarNo ratings yet

- SDPK Financial Position Project FinalDocument33 pagesSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- Total 621 1749 2544 3300Document6 pagesTotal 621 1749 2544 3300Anupam ChaplotNo ratings yet

- ACCO 420 Midterm Fall 2017Document6 pagesACCO 420 Midterm Fall 2017conu studentNo ratings yet

- Tire City 1997 Pro FormaDocument6 pagesTire City 1997 Pro FormaXRiloXNo ratings yet

- Chapter 5 - Group DisposalsDocument4 pagesChapter 5 - Group DisposalsSheikh Mass JahNo ratings yet

- Ducati Case ExhibitsDocument10 pagesDucati Case Exhibitslucien_lu0% (1)

- Case 3 - Starbucks - Assignment QuestionsDocument3 pagesCase 3 - Starbucks - Assignment QuestionsShaarang BeganiNo ratings yet

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- Petron Corp Financial AnalysisDocument2 pagesPetron Corp Financial AnalysisNeil NaduaNo ratings yet

- Eyedropper Clinic: Accounting Equation: Current Assets Non Current AssetsDocument5 pagesEyedropper Clinic: Accounting Equation: Current Assets Non Current AssetsSofía MargaritaNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Session 33-34 Meralco Student Spreadsheet - 1556507703Document31 pagesSession 33-34 Meralco Student Spreadsheet - 1556507703Alexander Jason LumantaoNo ratings yet

- Master Budget and ForecastDocument10 pagesMaster Budget and ForecastNour SawaftaNo ratings yet

- Case Analysis. There's More To Us Than Meets The EyeDocument5 pagesCase Analysis. There's More To Us Than Meets The EyeCorporate Accountant Marayo BankNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- MGAC2 ForecastingDocument22 pagesMGAC2 ForecastingJoana TrinidadNo ratings yet

- Probability of End-Year Portfolio ValueDocument130 pagesProbability of End-Year Portfolio ValueSyed Ameer Ali ShahNo ratings yet

- Titanium Dioxide ExhibitsDocument7 pagesTitanium Dioxide Exhibitssanjayhk7No ratings yet

- Absor Pvt. LTDDocument4 pagesAbsor Pvt. LTDsam50% (2)

- House of Quality: Google Glass: Name Humayun Khan Registration No 160161Document3 pagesHouse of Quality: Google Glass: Name Humayun Khan Registration No 160161Muhammad Humayun KhanNo ratings yet

- Case 68 Sweet DreamsDocument12 pagesCase 68 Sweet Dreams3happy3No ratings yet

- Annual Report ProjectDocument56 pagesAnnual Report ProjectJoan Frazzetto100% (2)

- Management Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099Document15 pagesManagement Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099prithvi17No ratings yet

- FinShiksha Maruti Suzuki UnsolvedDocument12 pagesFinShiksha Maruti Suzuki UnsolvedGANESH JAINNo ratings yet

- Annual Report Project (ARP)Document17 pagesAnnual Report Project (ARP)Abhishek SuranaNo ratings yet

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- Zip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)Document12 pagesZip Co Ltd. - Acquisition of QuadPay and Capital Raise (Z1P-AU)JacksonNo ratings yet

- Godrej AgrovetDocument37 pagesGodrej AgrovetBandaru NarendrababuNo ratings yet

- Apollo TyresDocument37 pagesApollo TyresBandaru NarendrababuNo ratings yet

- N Ot Co Py: ICMR Case CollectionDocument22 pagesN Ot Co Py: ICMR Case CollectionAnuroop BethuNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Group BDocument10 pagesGroup BHitin KumarNo ratings yet

- Problems 1-30: Input Boxes in TanDocument37 pagesProblems 1-30: Input Boxes in TanAshekin Mahadi100% (1)

- Assignment 9Document17 pagesAssignment 9Beenish JafriNo ratings yet

- Group valuation modelDocument3 pagesGroup valuation modelSoufiane EddianiNo ratings yet

- CH 25 Mini CaseDocument4 pagesCH 25 Mini CaseAravindanelangovanNo ratings yet

- Tire RatiosDocument7 pagesTire Ratiospp pp100% (1)

- Titanium Dioxide and Super Project Prof. Joshy JacobDocument3 pagesTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHNo ratings yet

- PepsiCo financial analysis reveals decreasing profitability 2006-2008Document5 pagesPepsiCo financial analysis reveals decreasing profitability 2006-2008Zaina Alkendi100% (1)

- HW8 AnswersDocument6 pagesHW8 AnswersPushkar Singh100% (1)

- Dell Annual ReportDocument55 pagesDell Annual ReportOmotoso EstherNo ratings yet

- Lettuce ProductionDocument14 pagesLettuce ProductionJay ArNo ratings yet

- Comaprative Financial Statment Analysis of HBL & MCBDocument28 pagesComaprative Financial Statment Analysis of HBL & MCBIfzal Ahmad86% (7)

- Hand Outs of Ten Values To Creat Shareholder Value MaximizationDocument5 pagesHand Outs of Ten Values To Creat Shareholder Value MaximizationIfzal AhmadNo ratings yet

- Financial Statments Analysis of PPLDocument25 pagesFinancial Statments Analysis of PPLIfzal Ahmad100% (2)

- Pack Sugarcane Juice - 2nd DraftDocument13 pagesPack Sugarcane Juice - 2nd DraftIfzal Ahmad100% (3)

- Final Research DesignDocument9 pagesFinal Research DesignIfzal AhmadNo ratings yet

- Lucky Cement Comparative Financial Statments AnalysisDocument63 pagesLucky Cement Comparative Financial Statments AnalysisIfzal Ahmad67% (6)

- 1-Introduction: History of NestleDocument24 pages1-Introduction: History of NestleIfzal AhmadNo ratings yet

- Final Report Allied BankDocument70 pagesFinal Report Allied BankIfzal Ahmad100% (6)

- Pakistan Tobacco Company Internship Report Finance DepartmentDocument115 pagesPakistan Tobacco Company Internship Report Finance DepartmentIfzal Ahmad88% (16)

- International Capital Budgeting: Dr. Ch. Venkata Krishna Reddy Associate ProfessorDocument39 pagesInternational Capital Budgeting: Dr. Ch. Venkata Krishna Reddy Associate Professorkrishna reddyNo ratings yet

- ACC 111 Chapter 2 Lecture NotesDocument5 pagesACC 111 Chapter 2 Lecture NotesLoriNo ratings yet

- Raymond Presentation FinalDocument23 pagesRaymond Presentation FinalStanley FernandesNo ratings yet

- Correct Answers Are Shown in - Attempted Answers, If Wrong, Are inDocument5 pagesCorrect Answers Are Shown in - Attempted Answers, If Wrong, Are insindhu123100% (1)

- Full download book Options Futures And Other Derivatives Eleventh Edition Global Pdf pdfDocument41 pagesFull download book Options Futures And Other Derivatives Eleventh Edition Global Pdf pdfhenry.darley707100% (7)

- Rajaneesh Company - Cash FlowsDocument3 pagesRajaneesh Company - Cash FlowsAyushi Aggarwal0% (2)

- Chapter 4 - Exchange Rate DeterminationDocument9 pagesChapter 4 - Exchange Rate Determinationhy_saingheng_760260980% (10)

- Individual Customer Information FormDocument8 pagesIndividual Customer Information Formodan81No ratings yet

- VI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFDocument10 pagesVI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFSakshi MehraNo ratings yet

- Canada NewsletterDocument6 pagesCanada Newslettercjrumbines100% (1)

- Multiple Choice Questions 1 The Definition of Gross Income in The PDFDocument1 pageMultiple Choice Questions 1 The Definition of Gross Income in The PDFTaimour HassanNo ratings yet

- Tabla HistretSPDocument43 pagesTabla HistretSPKevin Santiago Jimenez PinzonNo ratings yet

- Real Estate Market Outlook - Belgrade 2011Document25 pagesReal Estate Market Outlook - Belgrade 2011Zana SipovacNo ratings yet

- Sun Tzu Strategic - Human.resource - ManagementDocument76 pagesSun Tzu Strategic - Human.resource - Managementyongbm313100% (1)

- QA-05 Ratio-2 - QDocument31 pagesQA-05 Ratio-2 - Qlalit kumawatNo ratings yet

- Rate of Return 14.33%Document3 pagesRate of Return 14.33%Smriti MehtaNo ratings yet

- Kuruwita Textile Mills PLC: Annual Report 09/10Document42 pagesKuruwita Textile Mills PLC: Annual Report 09/10mimriyathNo ratings yet

- Recall Notice Shiddhivinayak AutolineDocument2 pagesRecall Notice Shiddhivinayak AutolineRaj Royal0% (1)

- Formulation of Project ReportDocument4 pagesFormulation of Project Reportarmailgm100% (1)

- Revised Loyalty Card Application Form (HQP-PFF-108)Document2 pagesRevised Loyalty Card Application Form (HQP-PFF-108)louiegi001No ratings yet

- Lean Fundly - Pitch Deck 02-11-13 V 0.3Document18 pagesLean Fundly - Pitch Deck 02-11-13 V 0.3analyticsvr100% (1)

- Vertical Integration 1Document9 pagesVertical Integration 1shagun86100% (1)

- Deposit Collection at BOKDocument34 pagesDeposit Collection at BOKKrishna Bahadur ThapaNo ratings yet

- How To Assess Nonprofit Financial PeformanceDocument84 pagesHow To Assess Nonprofit Financial PeformanceRay Brooks100% (1)

- How To Become A Great Boss Jeffrey J. FoxDocument19 pagesHow To Become A Great Boss Jeffrey J. FoxFrancisco MoralesNo ratings yet

- CONTROLLING. Your TRADES, MONEY& EMOTIONS. by Chris VermeulenDocument11 pagesCONTROLLING. Your TRADES, MONEY& EMOTIONS. by Chris VermeulenfrankkinunghiNo ratings yet

- Crypto TradingDocument22 pagesCrypto TradingSOZEK Loyozu70% (10)

- David Aaker Be PDFDocument8 pagesDavid Aaker Be PDFPreeti BajajNo ratings yet

- Research Paper Corporate FinanceDocument7 pagesResearch Paper Corporate Financeaflbrpwan100% (1)

- Preliminary Topic Five - Financial MarketsDocument12 pagesPreliminary Topic Five - Financial MarketsBaro LeeNo ratings yet