Professional Documents

Culture Documents

Property Tax Bill

Uploaded by

Anonymous GF8PPILW5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Tax Bill

Uploaded by

Anonymous GF8PPILW5Copyright:

Available Formats

2

0

1

5

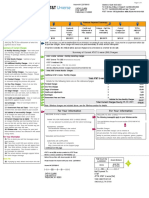

Charlie Cardwell, Metropolitan Trustee

Printed Date: 05/10/2016

ACCOUNT # 05800020800

BILL # 2015-56617

700 Second Avenue South, Suite 220

P.O. Box 196358

Nashville, TN 37219-6358

2015 REAL PROPERTY TAX STATEMENT

SEE ENCLOSED BROCHURE FOR IMPORTANT TAX INFORMATION.

Owner Address

MASON, WILLIAM D. ET UX

4421 CLARKSVILLE PK

NASHVILLE, TN 37218

Property Address

4425 CLARKSVILLE PIKE

Classification

Residential

Lot

Acres

1.00

Land Value

Improvement Value

Personal Property

Total Value

Exemption

Equal Factor

Assessed %

Assessed Value

Tax Rate

Base Tax

Rollback Tax

P & I Due

Prior Payments

Balance Due

$

$

$

$

$

$

$

$

$

$

RETAIN THIS PORTION FOR YOUR TAX RECORDS.

Additional Property Description

Block

GSD

Your taxes are distributed as follows:

Fund Description

GSD GENERAL FUND

GSD DEBT SERVICES

GSD SCHOOL DEBT SERVICE

GSD SCHOOL GENERAL PURPOSE

GSD FIRE PROTECTION

Total Base Tax

21,000.00

91,500.00

0.00

112,500.00

No

0.0000

25

28,125.00

3.9240

1,103.63

0.00

0.00

1,103.63

0.00

Rate

GSD Tax

USD Tax

Amount

1.82500

0.42300

0.18000

1.41600

0.08000

513.28

118.97

50.63

398.25

22.50

0.00

0.00

0.00

0.00

0.00

513.28

118.97

50.63

398.25

22.50

3.9240

$ 1,103.63

$ 1,103.63

Payment History

Original Tax Due

Adjustments

Penalty and Interest Accrued

Previous Base Tax Payments

Previous Penalty and Interest Payments

1,103.63

0.00

0.00

1,103.63

0.00

Current Base Tax Due

Current Penalty and Interest Due

Total Current Amount Due

0.00

0.00

0.00

ADA (615) 862-6330

Charlie Cardwell, Metropolitan Trustee

0

1

5

700 Second Avenue South, Suite 220

P.O. Box 196358

Nashville, TN 37219-6358

ACCOUNT

05800020800

BILL #

2015-56617

PROPERTY ADDRESS

4425 CLARKSVILLE PIKE

AMOUNT REMITTED:

Current Amount Due :

$ 0.00

To avoid penalty and interest, total tax must be paid in full

before : March 1st, 2016

MASON, WILLIAM D. ET UX

4421 CLARKSVILLE PK

NASHVILLE, TN 37218

Important: Return this portion with

your payment. Use the address

below for current payment only.

Make check payable to:

Address Change

Credit Card Payment

Metropolitan Trustee

Real Property Tax Dept.

PO BOX 305012

Nashville, TN 37230-5012

120150005661700000000000000000000008

Your payment options are:

By mail: PO BOX 305012, NASHVILLE, TN 37210

At our office: 700 Second Avenue South, Suite 220, Nashville, TN 37210

Any First Tennessee Bank branch location in Davidson County

(Full payment only)*

Pay online by visiting our website at www.nashville.gov/trustee

Making payment at First Tennessee (Davidson County Only):

* You must present the payment stub from your property tax notice

* You must make payment in full. First Tennessee branches will not

accept partial payments

* Only current year property tax payments will be accepted. After

the last day of February, payment must be made by mail, or

in person at the Trustee's office, or via the internet.

* Bank personnel cannot answer tax-related questions. Please contact

the Trustee's Office at (615) 862-6330 if you have any questions.

Mailing Address Changes:

Contact the Davidson County Assessor's Office

at (615) 862-6080 with any changes in address

and/or any Assessment related questions.

*** By State Law (67-5-210) Failure to pay the

entire amount of the taxes prior to the delinquency

date subjects any unpaid balance to 1 1/2% per month

penalties and interest. To avoid Penalty and

Interest, total taxes must be paid by February 29, 2016

*IMPORTANT LEGAL NOTICE: All Bankruptcy

Notices and other Legal Notices must be sent to:

Metropolitan Department of Law

PO Box 196300

Nashville, TN 37219

State Tax Relief Program

Tax Deferral Program

If you are 65 or older, or if you are totally and permanently disabled and live on the

property, and the 2014 annual income of all owners (all sources) was $28,690 or

less, you may qualify for the State of Tennessee/Metro Tax Relief program. If you

feel that you or someone you know qualifies, please contact our office You have

until April 5, 2016 to apply. Taxes must be paid in full by February 29, 2016.

To qualify for tax deferral you must be a single person 65 or

older, a married couple of which both are 65 or older, or

any totally and permanently disabled person or a family group

which has more than one person residing permanently in the

residence and are 65 or older or totally and permanently

disabled, whose combined gross income is less than $25,000

a year. If you qualify, the current taxes on your residence

may be deferred until the death of the deferral recipient or

until the residence is sold, and shall be subject to 6%

simple interest a year. There is a $6.00 application fee and

the deadline to apply is December 31, 2015.

All participants must reapply each year.

Tax Freeze Program

The tax freeze program was approved by Tennessee voters in a November

2006 contitutional amendment referendum. The Tax Freeze Act of 2007

permits local governments to implement the program, and Metropolitan

Nashville-Davidson County became the first jurisdiction in the state

to establish a tax freeze program. Under the program qualifying

homeowners age 65 or older making less than $40,960 can "freeze" the

taxes due on their property at the amount for the year they qualify,

even if tax rates increase. You have until April 5, 2016 to apply.

Taxes must be paid in full by February 29, 2016.

Paperless Billing: You may now sign up for our new e-billing

service. To opt-out of paper statements and begin receiving

your bill via electronic mail, please add your email address

and check the opt out box below. Information provided to our

office becomes public record.

If you feel you may qualify for one or more of the above programs, please contact our office at (615) 862-6330 and my staff will

answer any questions you may have.

Sincerely,

***IMPORTANT*** A convenience fee of 2.30% will be added to all credit and debit cards processed by the Metropolitan Trustee's

Office. This fee is charged by the electronic processing company and no part of the fee goes to Metro. Pay online by visiting

our Website at www.Nashville.gov/trustee

Map/Parcel Account Number:

05800020800

Any change of address shown on the front

should be noted here

American Express

Discover

Master Card

Visa

Credit Card Number:

Exp. Date:

Amount:

Signature *REQUIRED*

Print Name Here *REQUIRED*

Mailing Address Change Here:

Signature required to change mailing address

Date:

*IMPORTANT LEGAL NOTICE: All Bankruptcy

Notices and other Legal Notices must be sent

to: Metropolitan Department of Law

PO Box 196300

Nashville, TN 37219

***Email Address***

Daytime Phone Number *REQUIRED*

Yes, I would like to opt-out of paper

billing and begin receiving my tax

statement via electronic mail

You might also like

- Nationstar 122016Document6 pagesNationstar 122016kathy bechtleNo ratings yet

- Carsons Deed Tax BillDocument14 pagesCarsons Deed Tax BillBurton PhillipsNo ratings yet

- 11-2-15 BillDocument2 pages11-2-15 Billapi-224572596100% (1)

- Monthly Statement 8 PDFDocument2 pagesMonthly Statement 8 PDFKit KatNo ratings yet

- Energy Statement Energy Statement Energy StatementDocument3 pagesEnergy Statement Energy Statement Energy StatementFelipe Acosta50% (2)

- 7-2-15 BillDocument2 pages7-2-15 Billapi-224572596100% (2)

- Oct Water BillDocument2 pagesOct Water Billapi-224572596100% (1)

- 10-2-15 BillDocument2 pages10-2-15 Billapi-22457259650% (2)

- Bill 06242018Document5 pagesBill 06242018Sukrit Ghorai50% (2)

- BillDocument2 pagesBillBASS Producción Artística IntegralNo ratings yet

- Proof of AddressDocument2 pagesProof of AddressKeith MillerNo ratings yet

- Columbia Gas Sample BillDocument2 pagesColumbia Gas Sample BillYoutube Master75% (4)

- GasDocument2 pagesGasYağmur Ersayın100% (1)

- Bill StatementDocument2 pagesBill StatementWILENEUSNo ratings yet

- Mortgage Statement DummyDocument1 pageMortgage Statement DummyAjha Dortch100% (1)

- Energy statement summaryDocument2 pagesEnergy statement summarySharon Jones100% (1)

- Please Return This Portion When Mailing Your Payment: PO BOX 80062 PRESCOTT AZ 86304-8062Document1 pagePlease Return This Portion When Mailing Your Payment: PO BOX 80062 PRESCOTT AZ 86304-8062Sylvanna CedillosNo ratings yet

- Ebill 12 19 2018Document1 pageEbill 12 19 2018Ace MereriaNo ratings yet

- Past BillsDocument9 pagesPast BillsRahul BhatiaNo ratings yet

- Aug Water BillDocument2 pagesAug Water Billapi-224572596No ratings yet

- Utility BillDocument1 pageUtility Billmahvash otter50% (2)

- Utility News Summary of Service: Account Number: 70799 25364Document4 pagesUtility News Summary of Service: Account Number: 70799 25364Gloria MusicTexasNo ratings yet

- Account Summary and Gas Usage TrendsDocument2 pagesAccount Summary and Gas Usage TrendsGuadalupe FloresNo ratings yet

- Tax RecordDocument1 pageTax RecordmicantbabyNo ratings yet

- New Titusville Utility BillDocument2 pagesNew Titusville Utility BillBrevard Times100% (2)

- EversourceDocument2 pagesEversourceAlicjaVictoriaMucha100% (1)

- Account Summary and Current ChargesDocument1 pageAccount Summary and Current Chargescathy clarkNo ratings yet

- (Type Here) : For More Information About Residential Electric Service, Please VisitDocument4 pages(Type Here) : For More Information About Residential Electric Service, Please Visitమనోహర్ రెడ్డిNo ratings yet

- Mortgage Tax StatementDocument1 pageMortgage Tax StatementAriz10No ratings yet

- Your Electricity Bill Your Account SummaDocument4 pagesYour Electricity Bill Your Account SummaRAMIRESNo ratings yet

- Account Number:: Rate: Date Prepared: RS-Residential ServiceDocument4 pagesAccount Number:: Rate: Date Prepared: RS-Residential ServiceRoopa Roopavathy0% (1)

- Janette Utility BillDocument2 pagesJanette Utility BillSharon JonesNo ratings yet

- Texarkana Water Utilities: Account SummaryDocument2 pagesTexarkana Water Utilities: Account SummaryNicole VargasNo ratings yet

- Paper Bill PDFDocument4 pagesPaper Bill PDFDavid CaplanNo ratings yet

- News From Comcast: Kimberly BraccianteDocument3 pagesNews From Comcast: Kimberly Bracciantejbracciante6540100% (1)

- 2012 03 07 - BillDocument2 pages2012 03 07 - BillBrandi Berryhill KeeseeNo ratings yet

- File your taxes with ease using Form 1098Document2 pagesFile your taxes with ease using Form 1098Jay EvansNo ratings yet

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochNo ratings yet

- October 2010 BillDocument2 pagesOctober 2010 BillJames Lawruk100% (1)

- Electric bill details for Cindy ThaxtonDocument1 pageElectric bill details for Cindy ThaxtonA Random GamerNo ratings yet

- IDT Energy IDT Energy: Current Gas Bill Information Current Gas Bill InformationDocument2 pagesIDT Energy IDT Energy: Current Gas Bill Information Current Gas Bill InformationYoutube MasterNo ratings yet

- Estimated Water BillDocument1 pageEstimated Water BillAnonymous Pb39klJNo ratings yet

- CurrentBillDownload 1 PDFDocument4 pagesCurrentBillDownload 1 PDFElena Moronta100% (1)

- Earnings Statement: SSN: XXX-XX-2691Document1 pageEarnings Statement: SSN: XXX-XX-2691emily ambrosino0% (2)

- Debit Account Transactions Date Description Type Amount Available Norman Carl Richard JRDocument3 pagesDebit Account Transactions Date Description Type Amount Available Norman Carl Richard JRfreeman p. donNo ratings yet

- Amount Paid: Payment Charged On:: Back To Summary Download PDF PrintDocument2 pagesAmount Paid: Payment Charged On:: Back To Summary Download PDF PrintQw QweNo ratings yet

- GA Infinite Energy Bill PDFDocument2 pagesGA Infinite Energy Bill PDFSohail Zaidi67% (3)

- Please Pay by Total Due: Contact UsDocument5 pagesPlease Pay by Total Due: Contact Usnguyen tung100% (1)

- Santa Rosa Water BillDocument2 pagesSanta Rosa Water BillAce MereriaNo ratings yet

- Verizon Bill 03 16 2019Document1 pageVerizon Bill 03 16 2019duttasurajit50% (2)

- Rent Ledger 2021Document1 pageRent Ledger 2021LazaroSantiagoNo ratings yet

- Eversource-Bill1 1Document2 pagesEversource-Bill1 1Александр Тимофеев100% (1)

- 2011 04 08 - BillDocument10 pages2011 04 08 - Billneshama_tlcNo ratings yet

- Disconnect Notice: Total Past Due $364.55Document4 pagesDisconnect Notice: Total Past Due $364.55Aut BeatNo ratings yet

- Display ViewDocument6 pagesDisplay ViewSindy Delgado0% (3)

- Monthly Invoice: How We Calculated Your BillDocument4 pagesMonthly Invoice: How We Calculated Your Billca812000100% (1)

- Billing Summary and Usage History for Solar Energy CustomerDocument3 pagesBilling Summary and Usage History for Solar Energy CustomerAngeli mariel novaNo ratings yet

- New Tax Information For New HomeownersDocument1 pageNew Tax Information For New HomeownersO'Connor AssociateNo ratings yet

- 2015 Battle Creek Individual Income Tax Forms and InstructionsDocument24 pages2015 Battle Creek Individual Income Tax Forms and InstructionsHelpin HandNo ratings yet

- Verizon Bill 01 18 2020Document28 pagesVerizon Bill 01 18 2020jason56% (9)

- Mississippi AG Opposes Reproductive Care Privacy RuleDocument17 pagesMississippi AG Opposes Reproductive Care Privacy RuleJonathan AllenNo ratings yet

- Response To Metro Notice of FilingDocument18 pagesResponse To Metro Notice of FilingAnonymous GF8PPILW5No ratings yet

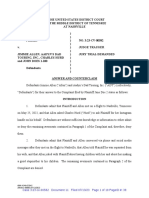

- Jimmie Allen Counterclaim Jane Doe 2Document19 pagesJimmie Allen Counterclaim Jane Doe 2Anonymous GF8PPILW5No ratings yet

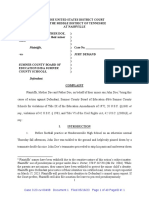

- Lawsuit Vs Jimmie Allen & OthersDocument20 pagesLawsuit Vs Jimmie Allen & OthersAnonymous GF8PPILW5100% (1)

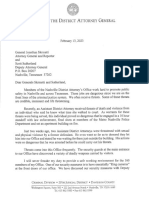

- Ma23 27 LetterDocument19 pagesMa23 27 LetterAnonymous GF8PPILW5No ratings yet

- Jimmie Allen CounterclaimDocument24 pagesJimmie Allen CounterclaimAnonymous GF8PPILW5No ratings yet

- Sumner County LawsuitDocument42 pagesSumner County LawsuitAnonymous GF8PPILW5No ratings yet

- TNDP Resolution Re - SextonDocument2 pagesTNDP Resolution Re - SextonAnonymous GF8PPILW5No ratings yet

- 1606 12162 011123Document13 pages1606 12162 011123Anonymous GF8PPILW5No ratings yet

- ComplaintDocument7 pagesComplaintAnonymous GF8PPILW5No ratings yet

- United States District Court Western District of Washington at SeattleDocument23 pagesUnited States District Court Western District of Washington at SeattleAnonymous GF8PPILW5No ratings yet

- Chief Drake LetterDocument2 pagesChief Drake LetterAnonymous GF8PPILW5No ratings yet

- 20230329161826738Document2 pages20230329161826738Anonymous GF8PPILW5No ratings yet

- Recommended Policy Actions To Reduce Gun Violence in TennesseeDocument4 pagesRecommended Policy Actions To Reduce Gun Violence in TennesseeAnonymous GF8PPILW5No ratings yet

- Letter To Skrmetti and SutherlandDocument2 pagesLetter To Skrmetti and SutherlandAnonymous GF8PPILW5No ratings yet

- Booker Beyer Lead Colleagues in Urging CPSC To Address Dangerous Indoor Air Pollutions Emitted by Gas StovesDocument4 pagesBooker Beyer Lead Colleagues in Urging CPSC To Address Dangerous Indoor Air Pollutions Emitted by Gas StovesAnonymous GF8PPILW5No ratings yet

- Wilson Co Law SuitDocument15 pagesWilson Co Law SuitAnonymous GF8PPILW5No ratings yet

- Choice Lanes Website FAQs 06Document2 pagesChoice Lanes Website FAQs 06Anonymous GF8PPILW5No ratings yet

- HB0001Document11 pagesHB0001Anonymous GF8PPILW5No ratings yet

- Ma23 01Document1 pageMa23 01Anonymous GF8PPILW5No ratings yet

- pr23 05 BriefDocument135 pagespr23 05 BriefAnonymous GF8PPILW5No ratings yet

- Parrish Complaint ExhibitsDocument64 pagesParrish Complaint ExhibitsAnonymous GF8PPILW5No ratings yet

- Show MultidocsDocument33 pagesShow MultidocsAnonymous GF8PPILW5No ratings yet

- PR23 03Document1 pagePR23 03Anonymous GF8PPILW5No ratings yet

- Wittman No Budget No Pay Final 118thDocument4 pagesWittman No Budget No Pay Final 118thAnonymous GF8PPILW5No ratings yet

- City of Forest Hills LawsuitDocument8 pagesCity of Forest Hills LawsuitAnita Wadhwani100% (1)

- Cicilline 14th Amd Bill TextDocument28 pagesCicilline 14th Amd Bill TextAnonymous GF8PPILW5No ratings yet

- Federal Funding Fallout: How Tennessee Public Schools Are Spending Billions in Relief FundsDocument17 pagesFederal Funding Fallout: How Tennessee Public Schools Are Spending Billions in Relief FundsAnonymous GF8PPILW5No ratings yet

- 2022.10.17 - Stamped Filed ComplaintDocument8 pages2022.10.17 - Stamped Filed ComplaintAnonymous GF8PPILW5No ratings yet

- Gender Diversity Philosophy at Harpeth HallDocument1 pageGender Diversity Philosophy at Harpeth HallAnonymous GF8PPILW5No ratings yet

- Cordero Vs FS Management - Contract To Sell Not RescisiibleDocument5 pagesCordero Vs FS Management - Contract To Sell Not RescisiibleFacio BoniNo ratings yet

- Chapter 2 - Taxes, Tax Laws, and Tax AdministrationDocument7 pagesChapter 2 - Taxes, Tax Laws, and Tax Administrationreymardico100% (2)

- Abacus Ticketing System GuideDocument125 pagesAbacus Ticketing System GuideJonathan LiewNo ratings yet

- RCBC v. Hi-Tri Development Corporation, G.R. No. 192413, June 13, 2012Document12 pagesRCBC v. Hi-Tri Development Corporation, G.R. No. 192413, June 13, 2012liz kawiNo ratings yet

- Copy Invoice: Invoice To: Deliver ToDocument1 pageCopy Invoice: Invoice To: Deliver ToGeorge BeattieNo ratings yet

- Cash and Cash Equivalents GuideDocument6 pagesCash and Cash Equivalents Guideanon_752939353100% (1)

- SGD Transfer InstructionsDocument38 pagesSGD Transfer InstructionsSnehal SamantNo ratings yet

- FNF Servicelink Title Closing Agent ContractDocument14 pagesFNF Servicelink Title Closing Agent ContractJennifer BrayNo ratings yet

- Chapter 3 - Problems - Revenue From Contracts With CustomersDocument28 pagesChapter 3 - Problems - Revenue From Contracts With CustomersVictor Tuco100% (1)

- 109 Ocejo Perez & Co. V International BankDocument4 pages109 Ocejo Perez & Co. V International Bankav783100% (1)

- Barangay - Acctg. System - Edited.emrDocument104 pagesBarangay - Acctg. System - Edited.emrAnnamaAnnama100% (2)

- Invoice 54480Document1 pageInvoice 54480combatgoaNo ratings yet

- Union Public Service Commission: 6th July 2022 15th July 2022Document25 pagesUnion Public Service Commission: 6th July 2022 15th July 2022Garima LohiaNo ratings yet

- Sipoc-For Accounts DepartmentDocument3 pagesSipoc-For Accounts DepartmentSanjay .. SanjuNo ratings yet

- Ril PVC Price DT.01.02.2019Document13 pagesRil PVC Price DT.01.02.2019Akshat JainNo ratings yet

- WellsFargoDocument12 pagesWellsFargoqazimoeez191No ratings yet

- Paypal User AgreementDocument34 pagesPaypal User Agreementspark4uNo ratings yet

- 2 NEGO Digest and AnalysisDocument82 pages2 NEGO Digest and AnalysisJustin EnriquezNo ratings yet

- Charges: Applied Satellite Technology Asia Pte LTDDocument2 pagesCharges: Applied Satellite Technology Asia Pte LTDFirman JohariansyahNo ratings yet

- TCodeDocument12 pagesTCodeSudhakar RaiNo ratings yet

- SAP ERP Financials: Value Date Calculation Logic During Automatic Payment Process (APP)Document10 pagesSAP ERP Financials: Value Date Calculation Logic During Automatic Payment Process (APP)Sisir PradhanNo ratings yet

- Payment Procedurte FIDIC 1999Document5 pagesPayment Procedurte FIDIC 1999asi midobarNo ratings yet

- Franchisee Offer LetterDocument3 pagesFranchisee Offer LetterNikhil DeshpandeNo ratings yet

- Bupa Gold Membership GuideDocument14 pagesBupa Gold Membership GuidebupavietnamNo ratings yet

- Accounts PayableDocument11 pagesAccounts PayableKrishnaNo ratings yet

- WB ZP and PS Finance and Accounts Rules 2003 PDFDocument457 pagesWB ZP and PS Finance and Accounts Rules 2003 PDFSouravNo ratings yet

- Payment Guide For ERC Transactions As of March 2023Document7 pagesPayment Guide For ERC Transactions As of March 2023ARTHUR CHRISTION CRUZNo ratings yet

- Project ReportDocument28 pagesProject Reportsilkroute143No ratings yet

- SAP FICO Course Content - Core Global ITDocument12 pagesSAP FICO Course Content - Core Global ITVenkatrao VaraganiNo ratings yet

- Statement 2020 04 10Document6 pagesStatement 2020 04 10BrendaNo ratings yet