Professional Documents

Culture Documents

Actuaries Coursesasadjhajhdghgasjhdjhgasjhfdhgfgahgsfdgashdgafsdadasda

Uploaded by

Saiteja Gundapu0 ratings0% found this document useful (0 votes)

12 views2 pagessaghagdjhfadshgaytsgdhgagsdjhjhsahdajhsdmhjahkdhgjhsahjdjhsajdhjahdghasjhdhgagjdghasjhdjaghdgjasdhggajvhgdayhsdjahgdgjhadghhsadbhagsjhdhagjhdnaghdgnagjdghasd

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsaghagdjhfadshgaytsgdhgagsdjhjhsahdajhsdmhjahkdhgjhsahjdjhsajdhjahdghasjhdhgagjdghasjhdjaghdgjasdhggajvhgdayhsdjahgdgjhadghhsadbhagsjhdhagjhdnaghdgnagjdghasd

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesActuaries Coursesasadjhajhdghgasjhdjhgasjhfdhgfgahgsfdgashdgafsdadasda

Uploaded by

Saiteja Gundapusaghagdjhfadshgaytsgdhgagsdjhjhsahdajhsdmhjahkdhgjhsahjdjhsajdhjahdghasjhdhgagjdghasjhdjaghdgjasdhggajvhgdayhsdjahgdgjhadghhsadbhagsjhdhagjhdnaghdgnagjdghasd

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

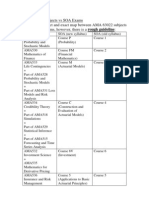

Actuaries Courses

Introduction:

Actuarial science or Insurance is a subject that applies mathematical principles to assess

risks of insurance and premium. Actuaries are organizations that provide services in

sectors like finance and investment, insurance (health, life, general) and several benefit

plans regarding employee retirement. There are quite a number of students who are now

opting for Actuaries courses. Courses in Actuarial Science have opened up lucrative

career opportunities for many.

Qualifications: Actuarial Science is taught in India as a three year degree course; though

several short term courses are also offered by many Institutions. The courses on Actuarial

Science and their details are

B.A (Insurance), B.A (pass) with insurance as a subject, Duration: 3 years.

Eligibility: Class XII.

PG Diploma in Certified Risk and Insurance management, Duration: 3 years

(regular), 2 years (accelerated)

Eligibility: Graduation (for regular), Post Graduation (for accelerated)

Certificate course in intermediaries in Specific insurance subjects, Duration: 3

months, Eligibility: Graduation

Course for insurance agents, duration: 100-150 hours

Eligibility: Class XII

Courses for Insurance managers, Duration: 1 year

Eligibility: Graduation

PG Diploma in Insurance and Risk Management, Duration: 1 Year (regular), 18

months (part time)

Eligibility: Graduation/CA

B.S.C (with Actuarial science as a subject as an approved combination), Duration:

3 years

Eligibility: Class XII

PG Diploma in Insurance Science, Duration: 1 year

Eligibility: Graduation

PG Diploma in management of Insurance and financial services, Duration: 15

months, Eligibility: Graduation

Master's program in Insurance Business, Duration: 2 years

Eligibility: Graduation.

Foundation in Financial Planning

Eligibility: Graduation.

M.S.C in Actuarial Science, Duration: 2 years

Eligibility: B.S.C

Institutes offering Actuarial Courses

Major institutes offering courses on actuarial science are Actuarial Institute of India, Mumbai

Institute of Certified Risk and Insurance Managers, Hyderabad

University of Delhi, Delhi

The College of Vocational Studies (University of Delhi),

Academy of Insurance Management, Asia Pacific Institute of Management, New

Delhi

Birla Institute of Management Technology, New Delhi

Goa University, Goa

Kurukshetra University, Kurukshetra

Department of Humanities and Social Sciences, Indian Institute of Technology

(IIT), Mumbai

University of Bombay, Mumbai,

University of Pune

University of Chennai

Aligarh Muslim University, Aligarh

University of Kalyani

For becoming an actuary, it is necessary for an individual to pass an entrance test

conducted by the Actuarial Soiety of India (ASI).

Benefits: The courses on actuarial science and insurance provide an individual with the

skills required to find a job in this field. A person can choose the course according to his

academic background.

Scope in India: A person trained in actuarial sciences can join the government as well as

the private sectors. He can find a job as an agent or a licensed insurance surveyor. The

salary in case of Government jobs ranges between Rs.3, 000-Rs.8, 000 for development

officer and Rs.14, 000-Rs.16, 000 for Zonal managers. In Private sectors the salary starts

from Rs.6, 000-Rs.9, 000 and management graduates can join for Rs.15, 000-Rs.25, 000.

Scope abroad: Multinational insurance companies are hiring trained Indian personnel for

comparatively higher salary jobs in countries like U.K

You might also like

- Life Is ShortDocument1 pageLife Is ShortSaiteja GundapuNo ratings yet

- Python SyllabusDocument4 pagesPython SyllabusSaiteja GundapuNo ratings yet

- Nano Technology CoursesDocument2 pagesNano Technology CoursesSaiteja GundapuNo ratings yet

- Aeronautical Engineering Courses in AssamDocument1 pageAeronautical Engineering Courses in AssamSaiteja GundapuNo ratings yet

- Java Complete TopicsDocument12 pagesJava Complete TopicsSaiteja GundapuNo ratings yet

- Sensorless Tracking System For The Solar Panel by Timed MovementDocument2 pagesSensorless Tracking System For The Solar Panel by Timed MovementSaiteja GundapuNo ratings yet

- Medical Entrance Exams in DelhiDocument2 pagesMedical Entrance Exams in DelhiSaiteja GundapuNo ratings yet

- Java TopicsDocument6 pagesJava TopicsSaiteja GundapuNo ratings yet

- Anamalai University Medical Entrance Exam, Tamil NaduDocument2 pagesAnamalai University Medical Entrance Exam, Tamil NaduSaiteja GundapuNo ratings yet

- Aeronautical Engineering Institutes in Uttar PradeshDocument2 pagesAeronautical Engineering Institutes in Uttar PradeshSaiteja GundapuNo ratings yet

- Infy Selects - A.P Region (Events Held at Kakinada, Tirupati, Guntur and Vizag For 2015 Passouts)Document10 pagesInfy Selects - A.P Region (Events Held at Kakinada, Tirupati, Guntur and Vizag For 2015 Passouts)Saiteja GundapuNo ratings yet

- Architecture Courses India GuideDocument1 pageArchitecture Courses India GuideSaiteja GundapuNo ratings yet

- VDFVDFVDFVDFVDFVFDVDFVDFVDFVDFVDFVDFVDocument15 pagesVDFVDFVDFVDFVDFVFDVDFVDFVDFVDFVDFVDFVSaiteja GundapuNo ratings yet

- CDocument146 pagesCPradeep NaikNo ratings yet

- Basic FPGA Architectures: Altera XilinxDocument8 pagesBasic FPGA Architectures: Altera XilinxkvinothscetNo ratings yet

- Testing Digital Systems I: Boolean Testing Using Fault Models (D-Algorithm, PODEM)Document28 pagesTesting Digital Systems I: Boolean Testing Using Fault Models (D-Algorithm, PODEM)Garima BhatiaNo ratings yet

- CMOS-VLSI-Mtech - Anil Nand+punith Gowda MBDocument19 pagesCMOS-VLSI-Mtech - Anil Nand+punith Gowda MBPunith Gowda M BNo ratings yet

- OOPS 2marksDocument19 pagesOOPS 2marksGeethaa MohanNo ratings yet

- DC aDCghskjskksks FjsDocument4 pagesDC aDCghskjskksks FjsSaiteja GundapuNo ratings yet

- Computer Organization JWFILESDocument23 pagesComputer Organization JWFILESNetaji GandiNo ratings yet

- Code of Sun Trecking Soalr PanrlkDocument1 pageCode of Sun Trecking Soalr PanrlkSaiteja GundapuNo ratings yet

- License. Conditioned Upon Compliance With The Terms and Conditions of This Agreement, CiscoDocument8 pagesLicense. Conditioned Upon Compliance With The Terms and Conditions of This Agreement, CiscoJuan Luis Borrego MorenoNo ratings yet

- SSC Related SyllabusDocument1 pageSSC Related SyllabusSaiteja GundapuNo ratings yet

- Capgemini Aaaaaaaaaaaaaaaaalist of CandidatesDocument8 pagesCapgemini Aaaaaaaaaaaaaaaaalist of CandidatesSaiteja GundapuNo ratings yet

- DSP Part B 05 LinearConvolutionInCDocument3 pagesDSP Part B 05 LinearConvolutionInCSaiteja GundapuNo ratings yet

- Computer Organization JWFILESDocument23 pagesComputer Organization JWFILESNetaji GandiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Internship Project Ravish KumarDocument42 pagesInternship Project Ravish KumarManish SharmaNo ratings yet

- The SOA QFI Pathway: A Career with ImpactDocument2 pagesThe SOA QFI Pathway: A Career with ImpactKostasSoufrasNo ratings yet

- White Paper of The Swiss Solvency TestDocument43 pagesWhite Paper of The Swiss Solvency TestWubneh AlemuNo ratings yet

- IB Scotia477BR CoverletterDocument3 pagesIB Scotia477BR Coverletterphuongdpl2s4518No ratings yet

- Accounting For Pensions and Post Retirement BenefitsDocument54 pagesAccounting For Pensions and Post Retirement BenefitsAlverdo RicardoNo ratings yet

- B Report On The Conversion Experience Study For The Level Premium Term PlansDocument138 pagesB Report On The Conversion Experience Study For The Level Premium Term PlansMikhail FrancisNo ratings yet

- Pass Mark For CAS Exam 5: Casualty Actuarial SocietyDocument2 pagesPass Mark For CAS Exam 5: Casualty Actuarial Societypianoflute6No ratings yet

- Employee BenefitsDocument82 pagesEmployee BenefitsFilemon KristineNo ratings yet

- How Actuaries Help Plan for an Uncertain FutureDocument12 pagesHow Actuaries Help Plan for an Uncertain FuturePrajakta Kadam67% (3)

- Risk and InsuranceDocument16 pagesRisk and InsurancehafeezhasnainNo ratings yet

- Present: Manager / Apr'17 - May'19 Deputy Manager/ Apr'15 - May'17 Assistant Manager/Apr'12 - Apr'15Document2 pagesPresent: Manager / Apr'17 - May'19 Deputy Manager/ Apr'15 - May'17 Assistant Manager/Apr'12 - Apr'15AtulNo ratings yet

- Pratik Sapkota: Work ExperienceDocument1 pagePratik Sapkota: Work ExperiencePratik SapkotaNo ratings yet

- IAS 19 Employee BenefitsDocument32 pagesIAS 19 Employee BenefitsTamirat Eshetu WoldeNo ratings yet

- (499148095) DR MLC SolutionsDocument29 pages(499148095) DR MLC SolutionskvnnunzNo ratings yet

- Micro Insurance CompilationDocument126 pagesMicro Insurance Compilationapi-3862918100% (1)

- Production Costs CalculationDocument4 pagesProduction Costs CalculationDheeraj Y V S RNo ratings yet

- Job Corps Employment HandbookDocument72 pagesJob Corps Employment HandbookJobCorps LivesNo ratings yet

- ST2 Life Insurance PDFDocument5 pagesST2 Life Insurance PDFVignesh SrinivasanNo ratings yet

- General InsuranceDocument48 pagesGeneral InsurancePreeti PurohitNo ratings yet

- GIC and LICDocument2 pagesGIC and LICNiket SharmaNo ratings yet

- Drake University's Actuarial Science and Risk Management and Insurance ProgramsDocument12 pagesDrake University's Actuarial Science and Risk Management and Insurance ProgramsMahedrz GavaliNo ratings yet

- Insurance Sector Career Guide: Roles, Courses & SkillsDocument44 pagesInsurance Sector Career Guide: Roles, Courses & SkillsMinal Dalvi100% (1)

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaNo ratings yet

- Dict PDFDocument86 pagesDict PDFSanket GahlotNo ratings yet

- Cover Letter Examples For Insurance CompanyDocument8 pagesCover Letter Examples For Insurance Companye77211rw100% (2)

- MMUrepo 6Document27 pagesMMUrepo 6GERALD NOEL CHIKEREMANo ratings yet

- ST2 Pu 13Document44 pagesST2 Pu 13Shabbeer ZafarNo ratings yet

- SOA IssuesDocument2 pagesSOA IssuesDustin GaoNo ratings yet

- Life Insurance Specialist Principles Subject SP2 CMP 2019 - BPP ActEd PDFDocument1,120 pagesLife Insurance Specialist Principles Subject SP2 CMP 2019 - BPP ActEd PDFAakash Sharma0% (1)

- ACTL2111 Course Outline FinalDocument15 pagesACTL2111 Course Outline FinalAnonymous fsKjt1jUnnNo ratings yet