Professional Documents

Culture Documents

Cases - LPG Digest

Uploaded by

Mecs NidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cases - LPG Digest

Uploaded by

Mecs NidCopyright:

Available Formats

Greater Balanga Development Corporation v.

Municipality

of Balanga, Bataan (1998)

Facts:

The case involves a parcel of land, Lot 261-B-6-A-3

located behind the public market in the Municipality of

Balanga, Province of Bataan. It is registered in the name

of Greater Balanga Development, Corp., owned and

controlled by the Camacho family. The lot was part of Lot

261-B, formerly registered in the name of Aurora Banzon

Camacho, which was later subdivided into certain lots,

some of which were sold, others donated. Five buyers of

the lot filed a civil case against Camacho for partition and

delivery of titles.

Petitioner applied for and was granted a business

permit by the Office of the Mayor of Balanga but failed to

mention the existence of the civil case for partition and

delivery of titles. The permit was granted the privilege of

a real estate dealer/privately-owned market operator.

However, the Sangguniang Bayan (SB) passed Resolution

No. 12 s-88, annulling the Mayor's permit issued to

Petitioner, on the ground that the issue as to the

ownership of the lot caused anxiety, uncertainty and

restiveness among the stallholders and traders in the lot,

and advising the Mayor to revoke the permit to operate a

public market. The Mayor then revoked the permit

through EO No. 1 s-88.

Petitioner filed this petition with prayer for

preliminary prohibitory and mandatory injunction or

restraining order and to reinstate the Mayor's permit and

to curtail the municipality's collection of market and

entrance fees from the lot occupants. He alleges that: 1)

it didn't violate any law, thus, there's no reason for

revocation of the permit; 2) Respondents failed to observe

due process in the revocation; 3) the collection of market

fees is illegal.

On the other hand, Respondents assert that the Mayor

as the local chief executive has the power to issue, deny

or revoke permits. They claim that the revocation was due

to the violation by Petitioner of Section 3A-06(b) of the

Balanga Revenue Code when it: 1) made false statement in

the application form, failing to disclose that the lot was

subject to adverse claims for which a civil case was filed;

2) failed to apply for 2 separate permits for the 2 lines of

business (real estate and public market).

Issue: W/N the revocation of the Mayor's permit was valid.

Held: NO.

The powers of municipal corporations are to be

construed in strictissimi juris and any doubt or ambiguity

must be construed against the municipality. The authority

of the Mayor to revoke permits is premised on a violation

by the grantee of any of its conditions for its grant. For

revocation to be justified under the Balanga Revenue

Code, there must be: 1) proof of willful

misrepresentation, and 2) deliberate intent to make a

false statement. Good faith is always presumed.

In this case, the application for Mayor's permit

requries the applicant to state the type of business,

profession, occupation, privileges applied for.

Petitioner left this entry bank in its application

form. It is only in the Mayor's permit itself that

petitioner's lines of business appear. Revocation is

not justified because Petitioner did not make any

false statement therein.

Neither was petitioner's applying for two

businesses in one permit a ground for revocation.

The second paragraph of Section 3A-06(b) does not

expressly require two permits for their conduct of

two or more businesses in one place, but only that

separate fees be paid for each business. Granting,

however, that separate permits are actually

required, the application form does not contain any

entry as regards the number of businesses the

applicant wishes to engage in.

The SB's Resolution merely mentioned the plan to

acquire the Lot for expansion of the Balanga Public

Market adjacent thereto. The SB doesn't actually

maintain a public market on the area. Until

expropriation proceedings are instituted in court, the

landowner cannot be deprived of its right over the land.

Of course, the SB has the duty in the exercise of its

police powers to regulate any business subject to

municipal license fees and prescribe the conditions

under which a municipal license already issued may be

revoked (B.P. Blg. 337, Sec. 149 [1] [r]), but the "anxiety,

uncertainty, restiveness" among the stallholders and

traders doing business on a property not owned by the

Municipality cannot be a valid ground for revoking the

permit of Petitioner.

Also, the manner by which the Mayor revoked the

permit transgressed petitioner's right to due process.

The alleged violation of Section 3A-06(b) of the Balanga

Revenue Code was not stated in the order of revocation,

and neither was petitioner informed of this specific

violation. Moreover, Respondent Municipality isn't the

owner of Lot 261 B-6-A-3, and thus cannot collect

market fees, which only an owner can do.

Lidasan v. Comelec

Digest

Lidasan v Comelec

G.R. No. L-28089 October 25, 1967

Sanchez, J.:

Facts:

1. Lidasan, a resident and taxpayer of the

detached portion of Parang, Cotabato, and a

qualified voter for the 1967 elections assails

the constitutionality of RA 4790 and

petitioned that Comelec's resolutions

implementing the same for electoral

purposes be nullified. Under RA 4790, 12

barrios in two municipalities in the province

of Cotabato are transferred to the province

of Lanao del Sur. This brought about a

change in the boundaries of the two

provinces.

2. Barrios Togaig and Madalum are within the

municipality of Buldon in the Province of

Cotabato, and that Bayanga, Langkong,

Sarakan, Kat-bo, Digakapan, Magabo,

Tabangao,

Tiongko,

Colodan

and

Kabamakawan are parts and parcel of

another municipality, the municipality

of Parang,

also

in

the Province

of

Cotabato and not of Lanao del Sur.

3. Apprised of this development, the Office of

the President, recommended to Comelec

that the operation of the statute be

suspended until "clarified by correcting

legislation."

4. Comelec, by resolution declared that the

statute should be implemented unless

declared unconstitutional by the Supreme

Court.

ISSUE: Whether or not RA 4790, which is

entitled "An Act Creating the Municipality

of Dianaton in the Province of Lanao del

Sur", but which includes barrios located in

another

province

Cotabato is

unconstitutional for embracing more than

one subject in the title

YES. RA 4790 is null and void

1. The constitutional provision contains dual

limitations upon legislative power. First.

Congress is to refrain from conglomeration,

under one statute, of heterogeneous

subjects. Second. The title of the bill is to

be couched in a language sufficient to notify

the legislators and the public and those

concerned of the import of the single

subject thereof. Of relevance here is the

second directive. The subject of the statute

must be "expressed in the title" of the bill.

This constitutional requirement "breathes

the spirit of command." Compliance is

imperative, given the fact that the

Constitution does not exact of Congress the

obligation to read during its deliberations

the entire text of the bill. In fact, in the

case of House Bill 1247, which became RA

4790, only its title was read from its

introduction to its final approval in the

House where the bill, being of local

application, originated.

2. The Constitution does not require Congress

to employ in the title of an enactment,

language of such precision as to mirror, fully

index or catalogue all the contents and the

minute details therein. It suffices if the title

should serve the purpose of the

constitutional demand that it inform the

legislators, the persons interested in the

subject of the bill, and the public, of the

nature, scope and consequences of the

proposed law and its operation. And this, to

lead them to inquire into the body of the

bill, study and discuss the same, take

appropriate action thereon, and, thus,

prevent surprise or fraud upon the

legislators.

3. The test of the sufficiency of a title is

whether or not it is misleading; and, which

technical accuracy is not essential, and the

subject need not be stated in express terms

where it is clearly inferable from the details

set forth, a title which is so uncertain that

the average person reading it would not be

informed of the purpose of the enactment

or put on inquiry as to its contents, or which

is misleading, either in referring to or

indicating one subject where another or

different one is really embraced in the act,

or in omitting any expression or indication

of the real subject or scope of the act, is

bad.

4. The title "An Act Creating the Municipality

of Dianaton, in the Province of Lanao del

Sur" projects the impression that only the

province of Lanao del Sur is affected by the

creation of Dianaton. Not the slightest

intimation is there that communities in the

adjacent province of Cotabato are

incorporated in this new Lanao del Sur

town. The phrase "in the Province of Lanao

del Sur," read without subtlety or

contortion, makes the title misleading,

deceptive. For, the known fact is that the

legislation has a two-pronged purpose

combined in one statute: (1) it creates the

municipality of Dianaton purportedly from

twenty-one barrios in the towns of Butig and

Balabagan, both in the province of Lanao

del Sur; and (2) it also dismembers two

municipalities in Cotabato, a province

different from Lanao del Sur.

5.

Finally, the title did not inform the

members of Congress the full impact of the

law. One, it did not apprise the people in

the towns of Buldon and Parang in Cotabato

and in the province of Cotabato itself that

part of their territory is being taken away

from their towns and province and added to

the adjacent Province of Lanao del Sur. Two,

it kept the public in the dark as to what

towns and provinces were actually affected

by the bill.

MMDA v Bel-Air

Village

Association, Inc.

Posted on November 18, 2012

GR 135962

March 27, 2000

FACTS:

On December 30, 1995, respondent received

from petitioner a notice requesting the former

to open its private road, Neptune Street, to

public vehicular traffic starting January 2, 1996.

On the same day, respondent was apprised that

the perimeter separating the subdivision from

Kalayaan Avenue would be demolished.

legislative councils, that possess legislative

Respondent instituted a petition for injunction

power and police power.

against petitioner, praying for the issuance of a

The Sangguniang Panlungsod of Makati City did

TRO and preliminary injunction enjoining the

not pass any ordinance or resolution ordering

opening of Neptune Street and prohibiting the

the opening of Neptune Street, hence, its

demolition of the perimeter wall.

proposed opening by the MMDA is illegal.

ISSUE:

WON MMDA has the authority to open Neptune

Street to public traffic as an agent of the state

endowed with police power.

HELD:

A local government is a political subdivision

of a nation or state which is constituted by law

and has substantial control of local affairs. It is

a body politic and corporate one endowed

with powers as a political subdivision of the

National Government and as a corporate entity

representing the inhabitants of its territory

(LGC of 1991).

Our Congress delegated police power to the

LGUs in Sec.16 of the LGC of 1991. It

empowers the sangguniang panlalawigan,

panlungsod and bayan to enact ordinances,

approve resolutions and appropriate funds for

the general welfare of the [province, city or

municipality] and its inhabitants pursuant

to Sec.16 of the Code and in the proper exercise

of the [LGUs corporate powers] provided under

the Code.

There is no syllable in RA 7924 that grants the

MMDA police power, let alone legislative power.

Unlike the legislative bodies of the LGUs, there

is no grant of authority in RA 7924 that allows

the MMDA to enact ordinances and regulations

for the general welfare of the inhabitants of

Metro Manila. The MMDA is merely a

development authority and not a political

unit of government since it is neither an LGU or

a public corporation endowed with legislative

power. The MMDA Chairman is not an elective

official, but is merely appointed by the

President with the rank and privileges of a

cabinet member.

In sum, the MMDA has no power to enact

ordinances for the welfare of the community. It

is the LGUs, acting through their respective

15 SCRA 569 Political Law Sufficient

Standard Test and Completeness Test

In 1964, President Ferdinand Marcos issued

executive orders creating 33 municipalities

this was purportedly pursuant to Section 68 of

the Revised Administrative Code which provides

in part:

The President may by executive order define

the boundary of any municipality and may

change the seat of government within any

subdivision to such place therein as the public

welfare may require

The then Vice President, Emmanuel Pelaez,

as a taxpayer, filed a special civil action to

prohibit the auditor general from disbursing

funds to be appropriated for the said

municipalities. Pelaez claims that the EOs were

unconstitutional. He said that Section 68 of the

RAC had been impliedly repealed by Section 3 of

RA 2370 which provides that barrios may not

be created or their boundaries altered nor their

names changed except by Act of Congress.

Pelaez argues: If the President, under this new

law, cannot even create a barrio, how can he

create a municipality which is composed of

several barrios, since barrios are units of

municipalities?

The Auditor General countered that there was

no repeal and that only barrios were barred

from being created by the President.

Municipalities are exempt from the bar and that

a municipality can be created without creating

barrios. He further maintains that through Sec.

68 of the RAC, Congress has delegated such

power to create municipalities to the President.

ISSUE: Whether or not Congress has delegated

the power to create barrios to the President by

virtue of Sec. 68 of the RAC.

HELD: No.

There

was

no

delegation

here. Although Congress may delegate to

another branch of the government the power to

fill in the details in the execution, enforcement

or administration of a law, it is essential, to

forestall a violation of the principle of

separation of powers, that said law: (a) be

complete in itself it must set forth therein

the policy to be executed, carried out or

implemented by the delegate and (b) fix a

standard the limits of which are sufficiently

determinate or determinable to which the

delegate must conform in the performance of

his functions. In this case, Sec. 68 lacked any

such standard. Indeed, without a statutory

declaration of policy, the delegate would, in

effect, make or formulate such policy, which is

the essence of every law; and, without the

aforementioned standard, there would be no

means to determine, with reasonable certainty,

whether the delegate has acted within or

beyond the scope of his authority.

Further, although Sec. 68 provides the qualifying

clause as the public welfare may require

which would mean that the President may

exercise such power as the public welfare may

require is present, still, such will not replace

the standard needed for a proper delegation of

power. In the first place, what the phrase as

the public welfare may require qualifies is the

text which immediately precedes hence, the

proper interpretation is the President may

change the seat of government within any

subdivision to such place therein as the public

welfare may require. Only the seat of

government may be changed by the President

when public welfare so requires and NOT the

creation of municipality.

establishing the Program for Devolution

Adjustment and Equalization to enhance the

capabilities of LGUs in the discharge of the

functions and services devolved to them through

the LGC.

The Oversight Committee under Executive

Secretary Ronaldo Zamora passed Resolutions

No. OCD-99-005, OCD-99-006 and OCD-99-003

which were approved by Pres. Estrada on

October 6, 1999. The guidelines formulated by

the Oversight Committee required the LGUs to

identify the projects eligible for funding under

the portion of LGSEF and submit the project

proposals and other requirements to the DILG

for appraisal before the Committee serves

notice to the DBM for the subsequent release of

the corresponding funds.

Hon. Herminaldo Mandanas, Governor of

Batangas, petitioned to declare unconstitutional

and void certain provisos contained in the

General Appropriations Acts (GAAs) of 1999,

2000, and 2001, insofar as they uniformly

earmarked for each corresponding year the

amount of P5billion for the Internal Revenue

Allotment (IRA) for the Local Government

Service Equalization Fund (LGSEF) & imposed

conditions for the release thereof.

ISSUE:

Whether the assailed provisos in the GAAs of

The Supreme Court declared that the power to

create municipalities is essentially and

eminently

legislative

in

character

not

administrative (not executive).

1999, 2000, and 2001, and the OCD resolutions

Province of

Batangas

vs. Romulo

The assailed provisos in the GAAs of 1999, 2000,

Posted on November 20, 2012

GR 152774

May 27, 2004

FACTS:

In 1998, then President Estrada issued EO No. 48

infringe the Constitution and the LGC of 1991.

HELD:

Yes.

and 2001, and the OCD resolutions constitute a

withholding of a portion of the IRA they

effectively encroach on the fiscal autonomy

enjoyed by LGUs and must be struck down.

According to Art. II, Sec.25 of the

Constitution, the State shall ensure the local

autonomy of local governments. Consistent

with the principle of local autonomy,

theConstitution confines the Presidents power

over the LGUs to one of general supervision,

which has been interpreted to exclude

the power of control. Drilon v.

purpose or a separate fiscal unit any

Limdistinguishes supervision from

provision therein which is intended to amend

control: control lays down the rules in the

another law is considered an inappropriate

doing of an act the officer has the discretion

provision. Increasing/decreasing the IRA of

to order his subordinate to do or redo the act,

LGUs fixed in the LGC of 1991 are matters of

or decide to do it

general & substantive law. To permit the

himself; supervision merely sees to it that the

Congress to undertake these amendments

rules are followed but has no authority to set

through the GAAs would unduly infringe the

down the rules or the discretion to

fiscal autonomy of the LGUs.

modify/replace them.

The value of LGUs as institutions of

The entire process involving the distribution &

democracy is measured by the degree of

release of the LGSEF is constitutionally

autonomy they enjoy. Our national officials

impermissible. The LGSEF is part of the IRA or

should not only comply with the constitutional

just share of the LGUs in the national

provisions in local autonomy but should also

taxes. Sec.6, Art.X of the

appreciate the spirit and liberty upon which

Constitution mandates that the just

these provisions are based.

share shall beautomatically released to the

LGUs. Since the release is automatic, the LGUs

arent required to perform any act to receive

the just share it shall be released to them

without need of further action. To subject its

distribution & release to the vagaries of the

implementing rules & regulations as sanctioned

by the assailed provisos in the GAAs of 19992001 and the OCD Resolutions would violate this

constitutional mandate.

The only possible exception to the mandatory

automatic release of the LGUs IRA is if the

national internal revenue collections for the

current fiscal year is less than 40% of the

collections of the 3rd preceding fiscal year. The

exception does not apply in this case.

The Oversight Committees authority is limited

to the implementation of the LGC of 1991

not to supplant or subvert the same, and

neither can it exercise control over the IRA of

the LGUs.

Congress may amend any of the provisions of

the LGC but only through a separate lawand not

through appropriations laws or GAAs. Congress

cannot include in a general appropriations bill

matters that should be more properly enacted

in a separate legislation.

A general appropriations bill is a special type of

legislation, whose content is limited to

specified sums of money dedicated to a specific

SAN JUAN VS SCS, DBM & ALMAJOSE

Posted by kaye lee on 6:50 PM

Reynaldo R. San Juan vs CSC, DBM, Cecilia Almajose

GR No. 92299, April 19, 1991

FACTS:

The position of Provincial Budget Officer for the Province of

Rizal was left vacant on March 22, 1988.

Provincial Governor, petitioner informed the Director of DBM

that Ms. Dalisay Santos, then Municipal Budget Officer of

Taytay, Rizal, assumed offices as Acting PBO since March 22,

1988 and requested the Director of DBM to endorse the

appointment of Ms. Santos to the position of PBO. DBM

Regional Director found Cecilia Almajose, among the

nominees of the petitioner to be the most qualified and

recommended to the DBM Secretary the appointment of

Almajose as PBO of Rizal, which the DBM USec signed the

appointment papers of Almajose as PBO.

Upon learning of Almajoses appointment, petitioner wrote

DBM Sec protesting against the said appointment on the

grounds that the DBM Usec is not legally authorized to

appoint the PBO, that Almajose lacks the required 3 yrs works

experience as provided in Local Budget Circular No. 31, and

that under EO No. 112, it is the Provincial Governor, not the

Regional Director or a Congressman, who has the power to

recommend nominees for the position of PBO.

ISSUE:

Whether or not the DBM has the power to appoint the PBO

without violating the principle of Local Autonomy.

RULING:

We have to obey the clear mandate on local autonomy. Where

a law is capable of two interpretations, one in favor of

centralized power in Malacaang and the other beneficial to

local autonomy, the scales must be weighed in favor of

autonomy.

The 1935 Constitution had no specific article on local

autonomy but distinguished presidential control to

supervision:

"The President shall have control of all the executive

departments, bureaus, or offices, exercise general

supervision over all local governments as may be provided by

law, and take care that the laws be faithfully executed. (Sec.

11, Article VII, 1935 Constitution)"

The President controls the executive departments. He has no

such power over local governments. He has only supervision

and that supervision is both general and circumscribed by

statute.

Article II, S. 25, 1987 Constitution states:

"Sec. 25. The State shall ensure the autonomy of local

governments."

The 14 sections in Article X, on Local Government not only

reiterate earlier doctrines but give in greater detail the

provisions making local autonomy more meaningful.

"Sec. 2. The territorial and political subdivisions shall enjoy

local autonomy.

"Sec. 3. The Congress shall enact a local government code

which shall provide for a more responsive and accountable

local government structure instituted through a system of

decentralization with effective mechanisms of recall,

initiative, and referendum, allocate among the different local

government units their powers, responsibilities, and

resources, and provide for the qualifications, election,

appointment and removal, term, salaries, powers and

functions and duties of local officials, and all other matters

relating to the organization and operation of the local units."

The right given by Local Budget Circular No. 31 which states:

Sec. 6.0 The DBM reserves the right to fill up any existing

vacancy where none of the nominees of the local chief

executive meet the prescribed requirements.

is ultra vires and is, accordingly, set aside. The DBM may

appoint only from the list of qualified recommendees

nominated by the Governor. If none is qualified, he must

return the list of nominees to the Governor explaining why no

one meets the legal requirements and ask for new

recommendees who have the necessary eligibilities and

qualifications.

Tano vs Socrates

Natural and Environmental Laws; Constitutional

Law; Regalian Doctrine

GR No. 110249; August 21, 1997

FACTS:

On Dec 15, 1992, the Sangguniang Panglungsod

ng Puerto Princesa enacted an ordinance

banning the shipment of all live fish and lobster

outside Puerto Princesa City from January 1,

1993 to January 1, 1998. Subsequently the

Sangguniang Panlalawigan, Provincial

Government of Palawan enacted a resolution

prohibiting the catching , gathering, possessing,

buying, selling, and shipment of a several

species of live marine coral dwelling aquatic

organisms for 5 years, in and coming from

Palawan waters.

Petitioners filed a special civil action for

certiorari and prohibition, praying that the

court declare the said ordinances and

resolutions as unconstitutional on the ground

that the said ordinances deprived them of the

due process of law, their livelihood, and unduly

restricted them from the practice of their

trade, in violation of Section 2, Article XII and

Sections 2 and 7 of Article XIII of the 1987

Constitution.

ISSUE:

Are the challenged ordinances unconstitutional?

HELD:

No. The Supreme Court found the petitioners

contentions baseless and held that the

challenged ordinances did not suffer from any

infirmity, both under the Constitution and

applicable laws. There is absolutely no showing

that any of the petitioners qualifies as a

subsistence or marginal fisherman. Besides,

Section 2 of Article XII aims primarily not to

bestow any right to subsistence fishermen, but

to lay stress on the duty of the State to protect

the nations marine wealth. The so-called

preferential right of subsistence or marginal

fishermen to the use of marine resources is not

at all absolute.

In accordance with the Regalian Doctrine,

marine resources belong to the state and

pursuant to the first paragraph of Section 2,

Article XII of the Constitution, their

exploration, development and

utilization...shall be under the full control and

supervision of the State.

In addition, one of the devolved powers of the

LCG on devolution is the enforcement of fishery

laws in municipal waters including the

conservation of mangroves. This necessarily

includes the enactment of ordinances to

effectively carry out such fishery laws within

the municipal waters. In light of the principles

of decentralization and devolution enshrined in

the LGC and the powers granted therein to LGUs

which unquestionably involve the exercise of

police power, the validity of the questioned

ordinances cannot be doubted.

G.R. No. 91649 May 14, 1991Basco vs. PAGCOR

H.B. Basco & Associates for petitioners Valmonte

Law Offices collaborating counsel for

petitionersAguirre, Laborte and Capule for

respondent PAGCOR

Facts:

The Philippine Amusements and Gaming

Corporation (PAGCOR) was created by virtue of

P.D. 1067-A dated January 1, 1977 and was

granted a franchise under P.D. 1067-B also dated

January 1, 1977"to establish, operate and

maintain gambling casinos on land or water within

the territorial jurisdictionof the Philippines."

Petitioners filed an instant petition seeking to

annul the Philippine Amusement and

GamingCorporation (PAGCOR) Charter PD 1869,

because it is allegedly contrary to morals, public

policy and order

Petitioners claim that P.D. 1869 constitutes a

waiver of the right of the City of Manila to impose

taxesand legal fees; that the exemption clause in

P.D. 1869 is in violation of the principle of

localautonomy.

oSection 13 par. (2) of P.D. 1869 exempts PAGCOR,

as the franchise holder from paying any"tax of any

kind or form, income or otherwise, as well as

fees, charges or levies of whatever nature,

whether National or Local."Issue:

Does the local Government of Manila have the

power to impose taxes on PAGCOR?Held

No, the court rules that The City government of

Manila has no power to impose taxes on

PAGCOR.Reason:

The principle of Local autonomy does not make

local governments sovereign within the state; the

principle of local autonomy within the constitution

simply means decentralization. It cannot be

anImperium in imperio it can only act intra

sovereign, or as an arm of the National

Government.

PAGCOR has a dual role, to operate and to

regulate gambling casinos. The latter role is

governmental,which places it in the category of

an agency or instrumentality of the Government.

Being aninstrumentality of the Government,

PAGCOR should be and actually is exempt from

local taxes.

The power of local government to "impose taxes

and fees" is always subject to "limitations" which

Congress may provide by law. Since PD 1869

remains an "operative" law until "amended,

repealed or revoked" (Sec. 3, Art. XVIII, 1987

Constitution), its "exemption clause" remains as an

exception tothe exercise of the power of local

governments to impose taxes and fees. It cannot

therefore beviolative but rather is consistent with

the principle of local autonomy.

197 SCRA 52 Political Law Constitutional Law

Bill of Rights Equal Protection Clause

Municipal Corporation Local Autonomy

Imperium in Imperio

In 1977, the Philippine Amusements and Gaming

Corporation (PAGCOR) was created by Presidential

Decree 1067-A. PD 1067-B meanwhile granted

PAGCOR the power to establish, operate and

maintain gambling casinos on land or water within

the territorial jurisdiction of the Philippines.

PAGCORs operation was a success hence in 1978,

PD 1399 was passed which expanded PAGCORs

power. In 1983, PAGCORs charter was updated

through PD 1869. PAGCORs charter provides that

PAGCOR shall regulate and centralize all games of

chance authorized by existing franchise or

permitted by law. Section 1 of PD 1869 provides:

Section 1.

Declaration of Policy. It is hereby

declared to be the policy of the State to

centralize and integrate all games of chance not

heretofore authorized by existing franchises or

permitted by law.

Atty. Humberto Basco and several other lawyers

assailed the validity of the law creating PAGCOR.

They claim that PD 1869 is unconstitutional

because a) it violates the equal protection clause

and b) it violates the local autonomy clause of the

constitution.

Basco et al argued that PD 1869 violates the equal

protection clause because it legalizes PAGCORconducted gambling, while most other forms of

gambling are outlawed, together with

prostitution, drug trafficking and other vices.

Anent the issue of local autonomy, Basco et al

contend that P.D. 1869 forced cities like Manila to

waive its right to impose taxes and legal fees as

far as PAGCOR is concerned; that Section 13 par.

(2) of P.D. 1869 which exempts PAGCOR, as the

franchise holder from paying any tax of any kind

or form, income or otherwise, as well as fees,

charges or levies of whatever nature, whether

National or Local is violative of the local

autonomy principle.

ISSUE:

1. Whether or not PD 1869 violates the equal

protection clause.

2. Whether or not PD 1869 violates the local

autonomy clause.

HELD:

1. No. Just how PD 1869 in legalizing gambling

conducted by PAGCOR is violative of the equal

protection is not clearly explained in Bascos

petition. The mere fact that some gambling

activities like cockfighting (PD 449) horse racing

(RA 306 as amended by RA 983), sweepstakes,

lotteries and races (RA 1169 as amended by BP 42)

are legalized under certain conditions, while

others are prohibited, does not render the

applicable laws, PD. 1869 for one,

unconstitutional.

Bascos posture ignores the well-accepted

meaning of the clause equal protection of the

laws. The clause does not preclude classification

of individuals who may be accorded different

treatment under the law as long as the

classification is not unreasonable or arbitrary. A

law does not have to operate in equal force on all

persons or things to be conformable to Article III,

Sec 1 of the Constitution. The equal protection

clause does not prohibit the Legislature from

establishing classes of individuals or objects upon

which different rules shall operate. The

Constitution does not require situations which are

different in fact or opinion to be treated in law as

though they were the same.

2. No. Section 5, Article 10 of the 1987

Constitution provides:

Each local government unit shall have the power

to create its own source of revenue and to levy

taxes, fees, and other charges subject to such

guidelines and limitation as the congress may

provide, consistent with the basic policy on local

autonomy. Such taxes, fees and charges shall

accrue exclusively to the local government.

A close reading of the above provision does not

violate local autonomy (particularly on taxing

powers) as it was clearly stated that the taxing

power of LGUs are subject to such guidelines and

limitation as Congress may provide.

Further, the City of Manila, being a mere

Municipal corporation has no inherent right to

impose taxes. The Charter of the City of Manila is

subject to control by Congress. It should be

stressed that municipal corporations are mere

creatures of Congress which has the power to

create and abolish municipal corporations due

to its general legislative powers. Congress,

therefore, has the power of control over Local

governments. And if Congress can grant the City of

Manila the power to tax certain matters, it can

also provide for exemptions or even take back the

power.

Further still, local governments have no power to

tax instrumentalities of the National Government.

PAGCOR is a government owned or controlled

corporation with an original charter, PD 1869. All

of its shares of stocks are owned by the National

Government. Otherwise, its operation might be

burdened, impeded or subjected to control by a

mere Local government.

This doctrine emanates from the supremacy of

the National Government over local governments.

200 SCRA 271 Political Law Control Power Local

Government

Rodolfo Ganzon was the then mayor of Iloilo City. 10

complaints were filed against him on grounds of

misconduct and misfeasance of office. The Secretary of

Local Government issued several suspension orders against

Ganzon based on the merits of the complaints filed

against him hence Ganzon was facing about 600 days of

suspension. Ganzon appealed the issue to the CA and the

CA affirmed the suspension order by the Secretary. Ganzon

asserted that the 1987 Constitution does not authorize the

President nor any of his alter ego to suspend and remove

local officials; this is because the 1987 Constitution

supports local autonomy and strengthens the same. What

was given by the present Constitution was mere

supervisory power.

ISSUE: Whether or not the Secretary of Local Government,

as the Presidents alter ego, can suspend and or remove

local officials.

HELD: Yes. Ganzon is under the impression that the

Constitution has left the President mere supervisory

powers, which supposedly excludes the power of

investigation, and denied her control, which allegedly

embraces disciplinary authority. It is a mistaken

impression because legally, supervision is not

incompatible with disciplinary authority.

The SC had occasion to discuss the scope and extent of

the power of supervision by the President over local

government officials in contrast to the power of control

given to him over executive officials of our government

wherein it was emphasized that the two terms, control

and supervision, are two different things which differ one

from the other in meaning and extent. In administration

law supervision means overseeing or the power or

authority of an officer to see that subordinate officers

perform their duties. If the latter fail or neglect to fulfill

them the former may take such action or step as

prescribed by law to make them perform their duties.

Control, on the other hand, means the power of an officer

to alter or modify or nullify of set aside what a

subordinate officer had done in the performance of his

duties and to substitute the judgment of the former for

that of the latter. But from this pronouncement it cannot

be reasonably inferred that the power of supervision of

the President over local government officials does not

include the power of investigation when in his opinion the

good of the public service so requires.

The Secretary of Local Government, as the alter ego of

the president, in suspending Ganzon is exercising a valid

power. He however overstepped by imposing a 600 day

suspension.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Fraud On The Court - RICO in The Face of Summary JudgmentDocument9 pagesFraud On The Court - RICO in The Face of Summary JudgmentColorblind Justice100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Submit Fire Safety Certificate UndertakingDocument1 pageSubmit Fire Safety Certificate UndertakingMecs NidNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Title 13 Crimes Against HonorDocument12 pagesTitle 13 Crimes Against HonorJomar dela TorreNo ratings yet

- Certificate of AssumptionDocument1 pageCertificate of AssumptionMecs Nid100% (3)

- Wack-Wack Golf and Country Club Vs WonDocument3 pagesWack-Wack Golf and Country Club Vs WonJImlan Sahipa Ismael100% (2)

- Consuegra V GSIS GDocument2 pagesConsuegra V GSIS GWonder WomanNo ratings yet

- Jose - Reply To OppositionDocument4 pagesJose - Reply To OppositionMecs NidNo ratings yet

- Akbayan-Youth v. ComelecDocument2 pagesAkbayan-Youth v. ComelecRaymond Roque100% (1)

- Ceruilia v. Delantar DigestDocument4 pagesCeruilia v. Delantar Digestkathrynmaydeveza100% (1)

- Dr. Aquino v. CalayagDocument3 pagesDr. Aquino v. CalayagGia DimayugaNo ratings yet

- Writing Security ReportsDocument41 pagesWriting Security ReportsSintas Ng SapatosNo ratings yet

- Tourist Arrival Form: Republic of The Philippines Province of AklanDocument2 pagesTourist Arrival Form: Republic of The Philippines Province of AklanMecs NidNo ratings yet

- Weekly Safety Seal Report for Caloocan CityDocument2 pagesWeekly Safety Seal Report for Caloocan CityMecs NidNo ratings yet

- Pilpino Cable Corp - 2021 Permit CTCDocument1 pagePilpino Cable Corp - 2021 Permit CTCMecs NidNo ratings yet

- Report-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Document4 pagesReport-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Mecs NidNo ratings yet

- Report-on-Safety-Seal-Certification-2021 (October 14-20, 2021)Document2 pagesReport-on-Safety-Seal-Certification-2021 (October 14-20, 2021)Mecs NidNo ratings yet

- Report-on-Safety-Seal-Certification-2021 (Sept. 16 To Sept. 22, 2021)Document2 pagesReport-on-Safety-Seal-Certification-2021 (Sept. 16 To Sept. 22, 2021)Mecs NidNo ratings yet

- Report-on-Safety-Seal-Certification-2021 (October 6-13, 2021)Document2 pagesReport-on-Safety-Seal-Certification-2021 (October 6-13, 2021)Mecs NidNo ratings yet

- LFCs - Working PaperDocument15 pagesLFCs - Working PaperMecs NidNo ratings yet

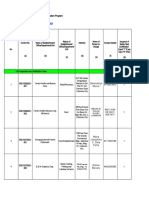

- Document Review For Local Government Unit: Bplo@caloocancity - Gov.phDocument4 pagesDocument Review For Local Government Unit: Bplo@caloocancity - Gov.phMecs NidNo ratings yet

- Mo North OctDocument5 pagesMo North OctMecs NidNo ratings yet

- Personnel Inventory Business Permits and Licensing OfficeDocument1 pagePersonnel Inventory Business Permits and Licensing OfficeMecs NidNo ratings yet

- Team 1 Team 2: Alcaraz Gonzales de Regla Yang EchevarriaDocument1 pageTeam 1 Team 2: Alcaraz Gonzales de Regla Yang EchevarriaMecs NidNo ratings yet

- Online Mcle Day 1Document1 pageOnline Mcle Day 1Mecs NidNo ratings yet

- Encoder: Atty. Emmanuel Emilio P. Vergara Chief, BPLODocument1 pageEncoder: Atty. Emmanuel Emilio P. Vergara Chief, BPLOMecs NidNo ratings yet

- Memorandum: December 2, 2014 TO: Atty. Emmanuel Emilio P. VergaraDocument1 pageMemorandum: December 2, 2014 TO: Atty. Emmanuel Emilio P. VergaraMecs NidNo ratings yet

- Certification - Tax Waiver For Pei - 2015Document1 pageCertification - Tax Waiver For Pei - 2015Mecs NidNo ratings yet

- Student's Copy: Stud. Year SCHOOL YEAR: 2017-2018 Semester Enrl StatusDocument1 pageStudent's Copy: Stud. Year SCHOOL YEAR: 2017-2018 Semester Enrl StatusMecs NidNo ratings yet

- Registration Form 2nd NABPLO ConventionDocument2 pagesRegistration Form 2nd NABPLO ConventionMecs NidNo ratings yet

- NABPLO 2nd National Convention invitationDocument1 pageNABPLO 2nd National Convention invitationMecs NidNo ratings yet

- K A P K A P K A P K A P K A P K A P K A PDocument1 pageK A P K A P K A P K A P K A P K A P K A PMecs NidNo ratings yet

- Constitutional Law Jurisprudence Amendments Due ProcessDocument2 pagesConstitutional Law Jurisprudence Amendments Due ProcessMecs NidNo ratings yet

- Assignment No. 1Document26 pagesAssignment No. 1Mecs NidNo ratings yet

- Case Digest - Credit Transaction2Document1 pageCase Digest - Credit Transaction2Mecs NidNo ratings yet

- Case Digest - Credit Transaction2Document11 pagesCase Digest - Credit Transaction2Mecs NidNo ratings yet

- Unsanitary Facilities, Noise Issues MLQU Student LetterDocument1 pageUnsanitary Facilities, Noise Issues MLQU Student LetterMecs NidNo ratings yet

- English Subjects No. of Units ScheduleDocument1 pageEnglish Subjects No. of Units ScheduleMecs NidNo ratings yet

- Constitutional Law Review 1Document8 pagesConstitutional Law Review 1Mecs NidNo ratings yet

- Buczek 20051226 Hockey Game Liberty Dollars Incident - DetailsDocument42 pagesBuczek 20051226 Hockey Game Liberty Dollars Incident - DetailsBob HurtNo ratings yet

- 15562711-ad97-4f6d-9325-e852a0c8add9Document7 pages15562711-ad97-4f6d-9325-e852a0c8add9Julia FairNo ratings yet

- Extrajudicial foreclosure proceduresDocument2 pagesExtrajudicial foreclosure procedureschill21ggNo ratings yet

- Villavicencio vs Lukban case digest on deportation of womenDocument2 pagesVillavicencio vs Lukban case digest on deportation of womenLawrenz Guevara0% (1)

- Heller PresentationDocument44 pagesHeller PresentationmattgreenNo ratings yet

- Press Release - Prominent Phoenix Criminal Defense Attorney Announces New FirmDocument2 pagesPress Release - Prominent Phoenix Criminal Defense Attorney Announces New FirmSeth WintererNo ratings yet

- Paugh v. City of SeattleDocument2 pagesPaugh v. City of SeattleKevin PekoNo ratings yet

- Knockerball Participant WaiverDocument2 pagesKnockerball Participant WaiverStarr NewmanNo ratings yet

- USA v. Xiaolang ZhangDocument15 pagesUSA v. Xiaolang ZhangMacRumors100% (3)

- Land Titles CasesDocument58 pagesLand Titles CasesMikkaEllaAnclaNo ratings yet

- The rule in Foss v Harbottle and exceptionsDocument3 pagesThe rule in Foss v Harbottle and exceptionsMartha Shingano100% (1)

- Teotico vs. Del Val: in The Matter of The Adoption of Stephanie Nathy Astorga GarciaDocument15 pagesTeotico vs. Del Val: in The Matter of The Adoption of Stephanie Nathy Astorga GarcianathNo ratings yet

- Declaratory ReliefDocument2 pagesDeclaratory ReliefGlenda DuyaoNo ratings yet

- List of Latin Legal Terms: Common LawDocument27 pagesList of Latin Legal Terms: Common LawDr. Joginder SinghNo ratings yet

- Reyes Vs CADocument3 pagesReyes Vs CASamii JoNo ratings yet

- Presumptions To Notarial DocumentsDocument27 pagesPresumptions To Notarial DocumentsKen ArnozaNo ratings yet

- Digest People V Rodrigo CalmaDocument1 pageDigest People V Rodrigo CalmaDhin CaragNo ratings yet

- Parada V Veneracion DigestDocument1 pageParada V Veneracion DigestJay SosaNo ratings yet

- Member and Authorised Person Agreement This Agreement Executed On This The - Day of - at - by and BetweenDocument5 pagesMember and Authorised Person Agreement This Agreement Executed On This The - Day of - at - by and BetweenAshish AgarwalNo ratings yet

- 9193 CMSDocument2 pages9193 CMSRecordTrac - City of OaklandNo ratings yet

- ACCT212 Individual Learning Project QuestionsDocument6 pagesACCT212 Individual Learning Project QuestionsRobert B. JacksonNo ratings yet

- A comparative study of judicial precedents in Philippine hybrid legal systemsDocument25 pagesA comparative study of judicial precedents in Philippine hybrid legal systemsacir_05No ratings yet