Professional Documents

Culture Documents

Term Report On Healthcare Industry

Uploaded by

Sabeen Jeffy ThomasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Term Report On Healthcare Industry

Uploaded by

Sabeen Jeffy ThomasCopyright:

Available Formats

TERM REPORT ON

Healthcare Industry

Submitted by Alowe

As a course assignment under Human Resource

Term Paper on Healthcare Industry

HEALTHCARE INDUSTRY BY DEFINITION

Comprises of providers of diagnostic, preventive, remedial, and therapeutic services such as doctors,

nurses, hospitals and other private, public, and voluntary organizations. It also includes

medical equipment and pharmaceutical manufacturers and health insurance firms. (Definition/ Health

care industry , 2016)

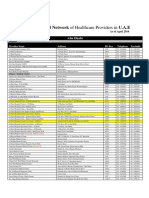

THE U.A.E. HEALTHCARE INDUSTRY

The United Arab Emirates (U.A.E.) growing healthcare sector is actively expanding its national

healthcare system to meet the growing needs of its people and support economic expansion. The

U.A.E. has created an infrastructure of healthcare services recognized as on par with international

standards and the health issues that affect Emiratis today. The healthcare sector is among the 14 major

areas attracting large forms of investment in U.A.E. investment map.

The key drivers of this regions healthcare is due to the quick increase in the population and income of

UAE as well as movement towards a sedentary lifestyle. This inactive lifestyle coupled with fast food

has led to conditions such as obesity and diabetes and aging Emiratis are facing heart diseases and

cancer.

The healthcare market in the UAE is expected to grow by seven per cent during the period between

2015 and 2020, according to UAE Healthcare Sector Outlook 2020, issued by RNCOS. The UAE

remains one of the top countries in health spending per capita in the region. Owing to the growing

need for health services there is also a proportional increased demand for specialized medical

Term Paper on Healthcare Industry

professionals. A growing demand for infertility treatment and cosmetic surgeries which are the main

attractions for medical tourists.

All seven emirates provide healthcare services to their citizens and are rapidly building their

healthcare infrastructure inclusive of hospitals and clinics, while simultaneously developing their

local workforce. In the U.A.E., there are five government healthcare regulators: the Ministry of

Health (MOH), Ministry of Finance (MOF), Federal Health Insurance Authority, Dubai Health

Authority, and the Health Authority Abu Dhabi (HAAD). These entities regulate healthcare service

providers on the ground such as the Abu Dhabi Health Services Company (SEHA). These entities

often partner with foreign healthcare organizations to run the daily operations of hospitals and clinics

throughout the U.A.E. Private healthcare service providers such as the New Medical Centre are nongovernment run hospitals and clinics that provide specialty and full-spectrum care for the U.A.E.

population. Needless to say, these Emirati private sector initiatives, like New Medical Centre and Al

Noor Hospital, are very important to the U.A.E.s overall and long-term healthcare development.

U.A.E. Healthcare Entities Roles and Responsibilities

The Ministry of Health (MoH) is the federal authority responsible for unifying the U.A.E.s health

policies, developing a comprehensive, nationwide health service, and ensuring that healthcare

remains accessible across the country. The MoH is also the primary healthcare regulator in the

Northern Emirates. Whereas Emirate-run healthcare entities in Abu Dhabi and Dubai directly manage

their own emirates healthcare needs, the Northern Emirates do not have the necessary healthcare

infrastructure and rely heavily upon the MoH for administration and regulation. The Minister of

Health is H.E. Abdul Rahman Mohammed Al Owais and the Undersecretary is Dr. Mohamed Salim

Al Olama.

Term Paper on Healthcare Industry

The Federal Health Authority (FHA) handles the executive responsibilities for the MoH, with a

focus on increasing the efficiency and competitiveness of the U.A.E. health system. The Minister of

Health is H.E. Abdul Rahman Mohammed Al Owais and the Undersecretary is Dr. Mohamed Salim

Al Olama.

The Ministry of Finance (MoF) is the federal authority involved in the insurance aspects of the

U.A.E. healthcare sector. For instance, the MoF has drafted a law that would mandate federal

compulsory health insurance in all seven emirates and appears to be underwriting the rollout of the

new health insurance program. The Minister of Finance is H.E. Obaid Humaid Al Tayer.

The Federal Health Insurance Authority (FHIA) will eventually be a stand-alone organization,

though it is still in its developmental stages as overseen by the MoH, MoF, and emirate-level health

authorities, to manage all aspects of health insurance in the U.A.E. as well as licensing, registration,

and codes of conduct for healthcare service providers.

The Dubai Health Authority (DHA), the regulator and operator of the Emirate of Dubais healthcare

sector, oversees and sets healthcare policy and strategy, develops medical education and research, and

regulates and licenses all healthcare facilities and services in Dubai and its free trade zones. Universal

healthcare, expected to be fully implemented in Dubai by 2016, is a key priority. Diabetes treatment

and care is another area of focus for the DHA. The President of the Dubai Health Authority is H.H.

Sheikh Hamdan Bin Rashid Al Maktoum, Deputy Ruler of Dubai, Minister of Finance and Industry.

The Director General is H.E. Engineer Essa Al Maidoor.

The Health Authority of Abu Dhabi (HAAD) is the Emirate of Abu Dhabis financially and

administratively independent public health authority that creates all requirements for healthcare

facilities, health insurance, clinicians, and health services while overseeing the management of health

Term Paper on Healthcare Industry

services at the policy level. The Chairman of HAAD is H.E. Mohammed Sultan Al Hameli and the

Director General is H.E. Dr. Maha Taysir Barakat.

The Dubai Health Authority (DHA) serves a dual role as regulator, as mentioned previously, and

operator of the Emirate of Dubais healthcare sector inclusive of all public healthcare facilities,

hospitals, clinics, and services in Dubai and its free trade zones. The President of the Dubai Health

Authority is H.H. Sheikh Hamdan Bin Rashid Al Maktoum, Deputy Ruler of Dubai, Minister of

Finance and Industry. The Director General is H.E. Engineer Essa Al Maidoor.

Term Paper on Healthcare Industry

THE HEALTH AUTHORITY OF ABU DHABI (HAAD)

In this report the functions and structure of the HAAD has been explored in detail so as to study the

Healthcare Industry in the U.A.E. The vision of HAAD can be represented through the following

diagram:

1.Populati

on

Episodes

Financin

2.Provider

s

3Payers

Claim

s

The main vision of HAAD is to provide quality healthcare services with the help of key Performance

Indicators set by the regulatory authority of the Emirate. In the above diagram, the population

signifies the right of everyone in the emirate access to healthcare. A system encompassing the full

spectrum of health - protecting, promoting, sustaining and restoring services across the territory of the

Emirate. An Episode is an inpatient Encounter or a set of outpatient Encounters linked to the same

clinical case based on the patient (identified by insurance member ID), and principal diagnosis.

Provider is an open system for all certified providers of health services who delivers world-class

quality care and outcomes in compliance with the highest international standards. Payers are the

mandatory health insurance for all Abu Dhabi residents. The financing system is flexible to manage

for change over time and the degree of subsidy is managed as efficiently as possible.

Term Paper on Healthcare Industry

POPULATION & VITALSTATISTICS:

According to HAAD the total population including Abu Dhabi, Eastern and Western Region in 2013

is 2,732,557 residents and according to DHA Dubai Emirate had a total of 2,158,740 residents in

2013

Birth

The UAEs Total Fertility Rate has declined from 4.4 to 1.7 per woman between 1990 and 2011

(World Health Statistics 2013 (WHO)). Declining birth rates are attributed to urbanization, delayed

marriage, changing attitudes about family size, and increased education and work opportunities for

women.

Death

Mortality rates have also declined steadily over the past years. Infant mortality is from 22 to 7 per

1000 live births between 1990 and 2011 across the UAE. In 2013, the diseases of circulatory system

Term Paper on Healthcare Industry

caused the highest number of deaths, accounting for 36.7% of all death cases registered in the Abu

Dhabi Emirate.

1) Injuries -Injuries are the second leading cause of death (19.6%) among this 62% are road

traffic injuries are the main cause.

2) Non-communicable diseases -The Emirate has high rates of chronic diseases related to

lifestyle, such as obesity, diabetes, and cardiovascular diseases. Cardiovascular diseases

accounted for 36.7% of all death cases in 2013.

3) Cancer-Cancer caused 12.9% of all deaths in the Emirate in 2013. Lymphoid, Hematopoietic

and related tissue cancers are the dominant cancers in Abu Dhabi. Late detection of breast

cancer leads to significant increases in mortality.

4) Communicable diseases -Rates of childhood communicable diseases are very low, due to

immunization programs targeting children aged

PROVIDERS

SEHA is the major provider of health care services with the following hospitals:ABU DHABI ISLAND

Sheikh Khalifa Medical City staff numbers more than 4,183. It has total capacity of roughly

764 beds.

Corniche Hospital is the UAEs leading referral hospital for obstetric and neo-natal care. It has

a professional staff of about 1,200.

Ambulatory Healthcare Services (AHS) operates 62 ambulatory and primary healthcare

clinics. The four AHS subsidiaries are Ambulatory Care Centers (ACCs), Disease Prevention

& Screening Centers (DPSCs), School Health Services (SHS), and Mobile Clinic Solutions

(MCS)

MIDDLE REGION

Mafraq Hospital has a bed capacity for roughly 451 beds and a professional staff of almost

2,000

Mafraq Dialysis Center is a state-of-the-art dialysis clinic.

Al Rahba Hospital is a 114-bed hospital with a professional staff of about 845.

EASTERN REGION

Term Paper on Healthcare Industry

Al Ain hospital is a 412-bed hospital. It has a professional staff of 2,000

Tawam Hospital has 461 beds and a professional staff that numbers over 3,400.

Al Wagan Hospital is a primary care and critical access hospital with two wards, ambulatory

treatment clinics, general dentistry facilities, and a critical access emergency department.

AL GHARBIA REGION

Al Sila Hospital is a 36-bed facility with a total staff of 16 doctors, 40 nurses, 17 allied health,

and 15 administrative personnel.

Dalma Hospital provides emergency services as well as specialized medical care in the fields

of Internal Medicine, Pediatrics, Obstetrics and Gynecology, General Surgery, and Dialysis.

Ghiathy Hospital is a 30-bed facility with a team of 22 doctors, two surgeons, 48 nurses, and

20 technicians and paramedics.

Marfa Hospital is a 28-bed rural community secondary hospital with a professional staff of 20

physicians and surgeons, 49 nurses, and 26 technicians and paramedics.

Madinat Zayed is a 155-bed secondary hospital. It is well-equipped and provides all basic and

specialized medical services.

Liwa Hospital provides emergency services as well as outpatient services in the fields of

General Medicine, Pediatrics, and Mother and Child Health.

Other Hospitals in the region include N M C Specialty, Al Noor, Burjeel Hospital, Life Line

Hospital, Al Rewaise, Dar Al Shifaa, Emirates International, Gulf Diagnostic Centre, Specialized

Medical Care Al Ain, Cromwell Women & Childrens Hospital, Provita International Medical

Centre, Al Salama, Al Ahalia, Oasis Emirates, French, Al Raha, Disabled Custodial Care Centre,

Provita International Medical Centre - Al Ain, Long Term Medical And Rehabilitation, National

Lifecare Al Khaleej, Hospital Universal, Health Point

PAYERS

Insurance: Regulations, Reimbursement, and Competitiveness

Term Paper on Healthcare Industry

10

The U.A.E. ranks among top 20 countries in the world for healthcare spending per capita. A universal

healthcare system is being devised in order to sustain all of its healthcare costs. A law passed in 2005

required all expatriates and their families living in Abu Dhabi to have private medical coverage, and a

law passed in 2007 gave HAAD the mandate to develop insurance policy and provide health

insurance regulation services.

In 2010, a requirement in Abu Dhabi was enacted for all hospitals and insurers to bill on a diagnosis

rate group (DRG) system. This requirement, plus other measures such as standardized contracts, is

expected to slow the rising cost of medical services. Today, universal healthcare insurance is in place

in Abu Dhabi and Dubai but only actively enforced in Abu Dhabi. Dubai is in the process of rolling

out its universal healthcare insurance system and recently mandated that the population of the entire

emirate must be covered by 2016. Sharjah is expected to implement a health authority and policies

similar to HAAD and DHA in the near future.

Disease and Healthcare Management Programs in the U.A.E. Healthcare Industry

Weqaya: HAAD has implemented a population screening and intervention program for Emiratis that

currently focuses on diabetes and cardiovascular disease.

Wareed: This is a MoH initiative to integrate electronic medical records in all 14 public hospitals and

68 affiliated clinics across Dubai and the Northern Emirates as well as automate all healthcare

processes across departments, such as radiology, pathology, pharmacy, surgery, accident/emergency,

and registration.

Tammini Program: This is another MoH initiative which provides information to the public for

medical products registered and marketed in the U.A.E. The program also provides warnings and

medication safety alerts for existing medical products in the country.

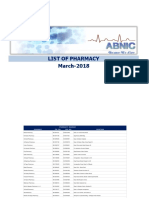

Pharmaceuticals and Medical Devices

Term Paper on Healthcare Industry

11

The pharmaceutical industry is expected to grow at a Compound Annual Growth Rate (CAGR) of

around 14.5 percent, reaching $3.58 billion by 2019, as patents expire on numerous drugs and the

U.A.E. government promotes the use of generic and over-the-counter drugs. Many of the worlds

largest pharmaceutical companies currently have a presence in the U.A.E., including Johnson &

Johnson, Sanofi-Aventis, MSD, Bayer, Merck Serano, Eli Lilly and AstraZeneca. There are also a

number of private Emirati pharmaceutical distributing and manufacturing companies that are driving

innovation in this sector. This list includes Pharmatrade, Neopharma and many others. In the medical

device market, U.S. imports account for more than a quarter (28.5%) of the $361 million annual

market, reflecting a CAGR of more than 11 percent from 2009- 2012. The quest to position the

U.A.E. as a global healthcare leader has driven demand for higher-end technology products, and

companies such as GE Healthcare already have a robust presence in the U.A.E.

Challenges and Areas of Improvement

To develop a world class healthcare sector there are number of challenges which the U.A.E.

government faces and hence is working with international partners is important to overcoming some

of these obstacles. The U.A.E. has developed international partners to support in the development of

specialty care practices in the fields of womens care, oncology, pediatrics, and diabetes.

Pharmaceuticals and their subsequent pricing in the region stands out as a key area of focus.

The Abu Dhabi 2030 plan specifically states that the Emirate has still to develop capabilities in key

areas; specifically by enhancing intellectual property rights, revising international trade agreements,

establishing a reliable drug testing and approval system, developing investment attraction

mechanisms and marketing and distribution capabilities the growth of a dynamic pharmaceuticals

segment will go hand-in-hand with the development of a world-class healthcare system, with the

development of each sector reinforcing the other. Dubai and the Northern Emirates are similarly

focused on developing a healthy pharmaceuticals industry in the U.A.E.

Over the next decade the main area of development is the growth and retaining of the healthcare

workforce. A gap has been identified in healthcare education and training among the nationals thus

liming the number of qualified physicians, nurses and technicians. This gap is being filled with hiring

Term Paper on Healthcare Industry

12

a lot of experts in the field from other countries, however retaining these experts can sometimes pose

a challenge.

Additionally, the licensing of Board Certified Physicians is not streamlined or

transparent, leading to problems recruiting and retaining primary care physicians in particular, and

leaving hospitals understaffed. Finally, medical malpractice issues, inconsistent licensing procedures

for physicians, antiquated and lengthy procurement regulations, and inability to access medical

information are all points of focus and improvement for the U.A.E.

Term Paper on Healthcare Industry

13

Bibliography

1) AME

Info

Staff.

(2015,

http://ameinfo.com/finance-and

July

13).

Health

care.

Retrieved

from

AME

Info:

economy/economy/healthcare/uae-healthcare-market-expected-

to-grow-7-per-cent/

2) Definition/ Health care industry . (2016, March 7). Retrieved from Business Dictionary:

http://www.businessdictionary.com/definition/health-care-industry.html

3) (2014). Health Statistics. Abu Dhabi: Health Authority Abu Dhabi .

4) SANA Enterprise Solutions. (2013). Healthcare Market : UAE. Dubai: SANA Enterprise

Solutions.

5) (2013). SEHA 2013 ANNUAL REPORT. Abu Dhabi: SEHA.

6) usuaebusiness/resources.

(2013,

http://usuaebusiness.org/resources/

March

01).

Retrieved

from

usuaebusiness:

You might also like

- Health Statistics Abu DhabiDocument107 pagesHealth Statistics Abu DhabiUdit DattaNo ratings yet

- 2021 U.a.E. Healthcare ReportDocument67 pages2021 U.a.E. Healthcare ReportSneha HarishNo ratings yet

- HAADStatisticsEng2013 PDFDocument91 pagesHAADStatisticsEng2013 PDFHitesh MotwaniiNo ratings yet

- NMC Hospital Abu Dhabi - 2011!06!08Document16 pagesNMC Hospital Abu Dhabi - 2011!06!08Manjul TakleNo ratings yet

- UAE Healthcare Overview Q4 2013 Colliers InternationalDocument12 pagesUAE Healthcare Overview Q4 2013 Colliers InternationalWing WongNo ratings yet

- CV Prof Husni TanraDocument1 pageCV Prof Husni TanraZulkarnainBustamamNo ratings yet

- Out Patient Abu Dhabi 2015Document24 pagesOut Patient Abu Dhabi 2015Desai NileshNo ratings yet

- General NetworkDocument36 pagesGeneral NetworkFathelbabNo ratings yet

- Oman Medical DirectoryDocument4 pagesOman Medical DirectoryR RatheeshNo ratings yet

- Uae Diamond Network - Outpatient HS6Document17 pagesUae Diamond Network - Outpatient HS6Savin KpNo ratings yet

- Abu Dhabi Basic PlanDocument3 pagesAbu Dhabi Basic Plannraza2000No ratings yet

- CRYSTAL NETWORK UNITED ARAB EMIRATES Direct Billing Treatment allowed in the below facilitiesDocument27 pagesCRYSTAL NETWORK UNITED ARAB EMIRATES Direct Billing Treatment allowed in the below facilitiesmanit fernandesNo ratings yet

- Researched ListDocument938 pagesResearched ListRikke Legarth0% (1)

- Super Restricted Network of Healthcare Providers in U.A.E: Abu DhabiDocument16 pagesSuper Restricted Network of Healthcare Providers in U.A.E: Abu DhabiAnas EidNo ratings yet

- Comparison of Apple and Samsung LaptopDocument8 pagesComparison of Apple and Samsung LaptopHassan AnwarNo ratings yet

- PCP Network List Oct.02Document96 pagesPCP Network List Oct.02ashrookpNo ratings yet

- GN Plus Provider ListDocument193 pagesGN Plus Provider Listsonia87No ratings yet

- Customer Satisfaction UAE ExchangeDocument108 pagesCustomer Satisfaction UAE ExchangeRenjith Raj100% (8)

- "Managing Your Care Process ": Aafiya - IndividualDocument35 pages"Managing Your Care Process ": Aafiya - Individualk4alpNo ratings yet

- Doctors LsitDocument6 pagesDoctors LsitNoushad N HamsaNo ratings yet

- Premium Network List - January 2016Document40 pagesPremium Network List - January 2016Afrath_nNo ratings yet

- Healthcare Provider Network Directory - Kuwait - KFHDocument4 pagesHealthcare Provider Network Directory - Kuwait - KFHarif420_999No ratings yet

- UAE AXA 3 Network - Mar 2020Document19 pagesUAE AXA 3 Network - Mar 2020Kannan SrinivasanNo ratings yet

- List of Current Aeromedical Examiners as of 2010Document26 pagesList of Current Aeromedical Examiners as of 2010naveenbalaNo ratings yet

- Health QatarDocument58 pagesHealth QatarDuilio GuerreroNo ratings yet

- List of Hospitals in DubaiDocument6 pagesList of Hospitals in Dubaiasimedgextech100% (1)

- UAE Health System & Daman Insurance A Thesis Submitted To Sarhad UniversityDocument69 pagesUAE Health System & Daman Insurance A Thesis Submitted To Sarhad UniversityawaisNo ratings yet

- Hospitals - ASCICO InsuranceDocument40 pagesHospitals - ASCICO InsuranceAshiq MaanNo ratings yet

- Arab Orient Green NetworkDocument159 pagesArab Orient Green NetworkMuhammad SiddiuqiNo ratings yet

- KSA Healthcare OpportunitiesDocument6 pagesKSA Healthcare OpportunitiesRaven BlingNo ratings yet

- PRO Over: Duct ViewDocument77 pagesPRO Over: Duct ViewAnonymous W5ffUouwNo ratings yet

- Region Provider Address Contact Covered Gatekeeper RequiredDocument106 pagesRegion Provider Address Contact Covered Gatekeeper RequiredClaudia AsafteiNo ratings yet

- RN Providers ListDocument99 pagesRN Providers ListAnNo ratings yet

- Press CTRL+F AND THAN ENTER YOUR AREA LIKE BUR DUBAI, QUSAIS, DEIRADocument185 pagesPress CTRL+F AND THAN ENTER YOUR AREA LIKE BUR DUBAI, QUSAIS, DEIRARAJ KOTINo ratings yet

- 3 RN3Document138 pages3 RN3Yazan MohmmadNo ratings yet

- CBAHI Accredited Hospitals Full ListDocument1 pageCBAHI Accredited Hospitals Full ListRashed AlibrahemNo ratings yet

- Bundled Episode Payment Contract for Total Joint ReplacementDocument20 pagesBundled Episode Payment Contract for Total Joint ReplacementSonia Saini100% (1)

- Allied Doctor Bahrain DataDocument12 pagesAllied Doctor Bahrain DataShibu KavullathilNo ratings yet

- OP IP Network - IRIS FortuneDocument88 pagesOP IP Network - IRIS FortunehamzadarbarNo ratings yet

- General Network of Healthca Providers in Abu Dhabi and Al Ain as of April 2022Document159 pagesGeneral Network of Healthca Providers in Abu Dhabi and Al Ain as of April 2022PIANGONo ratings yet

- Hospitals' EmailsDocument8 pagesHospitals' EmailsAkil eswarNo ratings yet

- General - Network1 - Al KhaznaDocument22 pagesGeneral - Network1 - Al KhaznasivakallamNo ratings yet

- Find Doctors, Book Appointments with OlaDoc Digital Healthcare PlatformDocument2 pagesFind Doctors, Book Appointments with OlaDoc Digital Healthcare PlatformHassanNiazi100% (1)

- Healthcare Sector ProfileDocument49 pagesHealthcare Sector ProfilepRiNcE DuDhAtRa100% (1)

- Approved Medical Facilities List for Abu DhabiDocument22 pagesApproved Medical Facilities List for Abu DhabiArafath MuhammedNo ratings yet

- Your Network Provider DirectoryDocument47 pagesYour Network Provider DirectoryJalal QuteinehNo ratings yet

- Pharmacy List March 2018Document47 pagesPharmacy List March 2018shajahanputhusseriNo ratings yet

- How Can I Apply For Family Visa in Dubai?Document5 pagesHow Can I Apply For Family Visa in Dubai?ReyNo ratings yet

- Saudi Family NetworkDocument232 pagesSaudi Family NetworkIbrahim Ansari 2218073No ratings yet

- 36 NetworkListDocument21 pages36 NetworkListHussain IftikharNo ratings yet

- 2-PCP Network List - MayDocument84 pages2-PCP Network List - MaycmthebossNo ratings yet

- Presentation Saudi-ArabiaDocument91 pagesPresentation Saudi-ArabiaStanGeorgianNo ratings yet

- Organogram (Group Level)Document21 pagesOrganogram (Group Level)zeeshanshani1118No ratings yet

- Nextcare - Network List-February-2023Document562 pagesNextcare - Network List-February-2023Balaji Guru100% (1)

- Clinic Provider Listing in DubaiDocument18 pagesClinic Provider Listing in DubaiyasirNo ratings yet

- Mobile App Survey ReportDocument18 pagesMobile App Survey ReportvictrrocksNo ratings yet

- Dubai&SwizDocument28 pagesDubai&SwizLinzKie NorBacNo ratings yet

- Health EconomicsDocument23 pagesHealth EconomicsmanjisthaNo ratings yet

- An Overview of Health Care System in United Arab EmiratesDocument3 pagesAn Overview of Health Care System in United Arab Emiratessuhail Ahamed0% (1)

- GCC Healthcare Market Rapid GrowthDocument4 pagesGCC Healthcare Market Rapid GrowthNamrataShahaniNo ratings yet

- M-Service On Transportation System in GASCODocument12 pagesM-Service On Transportation System in GASCOSabeen Jeffy ThomasNo ratings yet

- Dhiru Bhai AmbaniDocument12 pagesDhiru Bhai AmbaniAnkita MehtaNo ratings yet

- Properties IndubaiDocument1 pageProperties IndubaiSabeen Jeffy ThomasNo ratings yet

- Malayalam Calender 2011Document12 pagesMalayalam Calender 2011veejai_kumarNo ratings yet

- Emirates German Club PDFDocument56 pagesEmirates German Club PDFSurya Sundar100% (1)

- Smoking and Its RisksDocument9 pagesSmoking and Its Risksalien ribNo ratings yet

- Psychological Incapacity - Persons NotesDocument9 pagesPsychological Incapacity - Persons NotesBeatriz VillafuerteNo ratings yet

- P4-S1-Surveilan Epid-Manajemen Sistem Surveilan Dan Kendali Mutu Data Surveilan (Autosaved)Document26 pagesP4-S1-Surveilan Epid-Manajemen Sistem Surveilan Dan Kendali Mutu Data Surveilan (Autosaved)ambar fahanikaNo ratings yet

- Somatization and Psychosomatic SymptomsDocument320 pagesSomatization and Psychosomatic Symptomsalex_crina100% (7)

- Application of HBMDocument12 pagesApplication of HBMKeneniNo ratings yet

- Org ChartDocument1 pageOrg ChartLia HanafieNo ratings yet

- Teaching Complementary Colors and Harmony in PaintingDocument17 pagesTeaching Complementary Colors and Harmony in PaintingMary Jean EmpengNo ratings yet

- Essentials of Human Diseases and Conditions 6th Edition Frazier Test Bank Full Chapter PDFDocument32 pagesEssentials of Human Diseases and Conditions 6th Edition Frazier Test Bank Full Chapter PDFEugeneMurraykspo100% (10)

- Efficacy of Retrowalking in Patients With Chronic Knee Osteoarthritis: A Single Group Experimental Pilot StudyDocument9 pagesEfficacy of Retrowalking in Patients With Chronic Knee Osteoarthritis: A Single Group Experimental Pilot StudyDr. Krishna N. SharmaNo ratings yet

- Store Employee Safety Handbook: Dear Dollar General EmployeeDocument6 pagesStore Employee Safety Handbook: Dear Dollar General EmployeeLaura HugginsNo ratings yet

- Professional Services vs. AganaDocument3 pagesProfessional Services vs. AganaAnonymous 5MiN6I78I0No ratings yet

- Dancing Plague ScriptDocument3 pagesDancing Plague Scriptapi-589176154No ratings yet

- Impact of Uncontrolled Hba1C On The Outcome of Tuberculosis Treatment in TB Patients With DiabetesDocument11 pagesImpact of Uncontrolled Hba1C On The Outcome of Tuberculosis Treatment in TB Patients With DiabetesAdjie PrakosoNo ratings yet

- Dwnload Full Health Care Economics 7th Edition Feldstein Test Bank PDFDocument20 pagesDwnload Full Health Care Economics 7th Edition Feldstein Test Bank PDFlatifahhanhga7100% (6)

- Banchbo AN INITIATIVE FOR THE WELFARE OF SR. CITIZENSDocument61 pagesBanchbo AN INITIATIVE FOR THE WELFARE OF SR. CITIZENSRana BandyopadhyayNo ratings yet

- Determinan Kepatuhan Suplementasi Zat Besi Pada Remaja Putri Dalam Upaya Intervensi Spesifik Pencegahan Stunting: A Systematic ReviewDocument7 pagesDeterminan Kepatuhan Suplementasi Zat Besi Pada Remaja Putri Dalam Upaya Intervensi Spesifik Pencegahan Stunting: A Systematic ReviewShania BaraqbahNo ratings yet

- Lời giải chi tiết đề thi học kì 1 môn Tiếng Anh lớp 7Document5 pagesLời giải chi tiết đề thi học kì 1 môn Tiếng Anh lớp 7Ngọc KhánhNo ratings yet

- Z Week 8 2 Accumulative SkillDocument5 pagesZ Week 8 2 Accumulative Skillapi-263459333No ratings yet

- America Looks To 2024Document55 pagesAmerica Looks To 2024The AtlanticNo ratings yet

- Roles and Function of A NurseDocument2 pagesRoles and Function of A NurseHengky HanggaraNo ratings yet

- The Impact of COVID-19 On Early Childhood Education and CareDocument505 pagesThe Impact of COVID-19 On Early Childhood Education and CareFrincess Apple Mae ErroNo ratings yet

- Medical Surgical Nursing Test VIIDocument7 pagesMedical Surgical Nursing Test VIIclobregasNo ratings yet

- Fungi Types, Morphology & Structure, Uses and Disadvantages: AscomycotaDocument7 pagesFungi Types, Morphology & Structure, Uses and Disadvantages: Ascomycotacasey lynNo ratings yet

- AIIMS Peds Pulmo Protocols-Version June 2017Document102 pagesAIIMS Peds Pulmo Protocols-Version June 2017Vijay ArumugamNo ratings yet

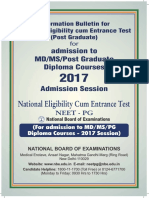

- Neet PG BrochureDocument80 pagesNeet PG BrochureKaish DahiyaNo ratings yet

- Insanity (A) 1Document6 pagesInsanity (A) 1Mradul JainNo ratings yet

- Ebook Canadian Fundamentals of Nursing 6Th Edition Potter Test Bank Full Chapter PDFDocument30 pagesEbook Canadian Fundamentals of Nursing 6Th Edition Potter Test Bank Full Chapter PDFmilcahtrinhkyrzvz100% (8)

- Omaha Chiefs Youth FootballDocument2 pagesOmaha Chiefs Youth FootballTony GramazioNo ratings yet

- Impact of Covid-19 on Ethiopia's Tourism and Hotel IndustryDocument6 pagesImpact of Covid-19 on Ethiopia's Tourism and Hotel IndustryFuadNo ratings yet