Professional Documents

Culture Documents

1 PDF

Uploaded by

MarkLouiseSumugatOlandresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 PDF

Uploaded by

MarkLouiseSumugatOlandresCopyright:

Available Formats

8 2i.

2O6

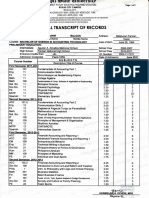

BIR Form 2550M II

:i rjc

i

Guidelines and Instructions I Help

Reference No:091 600014379848

Date FiledFebruary 202016 04:46 PM

Batch Number:1 607440974

PSOC:

PSIC:

B:r Form No.

Monthly Value-Added Tax

Declaration

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Intemas

c

l;Llilr)

For the Month of

(MM/YYYY)

01

2 Amended Return

January

No

No. of

sheets attached

Background Information

PART I

I TIN

Yes

2550-M

February 2007 ENCS)

h83

j433

J770

RDO

code

000

Line of

6 Business

'l4

IOTHER BUILDING COMPLETION ACTIVITIES

I Taxpayefs Name (Last Name, First Name, Middle Name for Individuals) / (Registered Name for Non-Individual)

IFALSIS, CELIA TABACON

Telephone Number

14412068

10

9 Registered Address (Please indicate complete address)

Zip code

j5001

BRGY. PAGSANGA-AN ILOILO

Are you availing of tax relief under Special Law

or International Tax Treaty?

Yes

'

it yes, please specify

No

Computation of Tax

PART II

Sales/Receipts forthe Month

(Exclusive of VAT)

12 Vatabte Sales/Receipt

- Private (Sch 1)

13 Sales to Government

384,817.31

1 2B

1 3A

0.00

1 3B

0.00

1 6B

46,178.08

i 7A

0.00

1 7B

0.00

['

14

14 Zero Rated Sales/Receipts

15 Exempt Sales/Receipts

1 6A

46,178.08

0.00

15

16 Total Sales/Receipts and Output Tax Due

Output Tax Due for the Month

1 2A

0.00

384,817.31

17 Less: Allowable Input Tax

i 7A

1 7B

Input Tax Carried Over from Previous Period / Excess over 70% of Output VAT to Input Tax Carried Over from

Previous Period

Input Tax Deferred on Capital Goods Exceeding PI Million from Previous Period

17C Transitional Input Tax

17C

0.00

17D

Presumptive Input Tax

17D

17E

Others

17E

0.00

17F

Total (Sum of Item hA, 17B, 17C, 17D & 17E)

17F

0.00

0.00

0.00

Purchases

18Current Transactions

I 8NB Purchase of Capital Goods not exceeding P1 Million (See Sch 21

1 BA

0.00

18 B

18C/D

Purchase of Capital Goods exceeding PiMition (See Sch 3)

1 BC

0.00

1 SD

0.00

18E/F

Domestic Purchases of Goods Other than Capital Goods

1 8E

366,733.11

18F

44,007.97

18G/H

Importation of Goods Other than Capital Goods

1 8G

0.00

1 8H

0.00

181/J

Domestic Purchase otServices

181

0.00

181

0.00

18K/L

Services rendered by Non-residents

18K

0.00

18L

0.00

18M

Purchases Not Qualified for Input Tax

IBM

0.00

18N10

Others

18N

0.00

180

0.00

18P

Total Current Purchases (Sum of Item 18A, 18C, 18E, 180.181,

18K, 18M & 18N)

18P

366,733.11

19TotaI Available Input Tax (Sum of Item 17F, 188,180. 18F. 18H. 18J, 18L

& 180)

19

44,007.97

20 Less: Deductions from Input Tax

the succeeding period (See

20A

Input Tax on Purchases of Capital Goods exceeding P1 Million deferred for

Sch 3)

20B

Input Tax on Sale to Govt. closed to expense (Sch 4)

20B

20C

Input Tax allocable to Exempt Sales (Sch 5)

20C

20D VAT Refund/TCC claimed

20E

Others

20F

Total (Sum of Item 20A, 208, 20C. 200

&

21 Total Allowable Input Tax (Item 19 less Item 20F)

20E)

20A

'

0.00

0.00

20D

0.00

20E

0.00

20 F

21

0.00

44,007.97

23A

Creditable Value-Added Tax Withheld (Sch 6)

23B

23C

Advance Payment ( Sch 7)

23D

23A

0.00

23B

0.00

23C

0.00

VAT paid in return previously filed, if this is an amended return

23D

0.00

23E

Others

23E

23F

Total Tax Cred it s/Payment (Sum of Item 23A. 23B, 23C, 230 & 236)

23F

VAT withheld on Sales to Government ( Sch 8)

24Tax Still Payable/(Overpayment) (Item 22 less Item 23F)

25Add: Penalties

25A

Surcharge

24

Interest

25B

0.00

0.00

2,170.11

0.00

Compromise

25Cr -

0.00

0.00 25D

26

26 Total Amount Payable/ (Overpayment) (Sum of Items 24 8 25D)

0.00

2,170.11

Attachments

Add Attachments

Remove Attachments)

SIR Main

Payment Details

Tax Return Inquiry I User Menu

Proceed to Payment

Guidelines and Instructions I Help

e2016

Payment Detail Inquiry

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

eFPS Payment Details

TIN

:183-770-433-000

Name

FALSIS CELIA TABACON

Tax Period

:01/31/2016

Reference Number :091600014379848

Tax Type

VT Monthly Value-Added Tax Declaration

:

Payment Transaction Number

:162195372

Date

02/20/2016

Cash Amount Paid

2,1 70.11

Bank

086000

Origin

Bank

Code

Amount

Online Confirmation

Batch Confirmation

Batch AcIoowledgment

086000

086000

086000

2.170,11

2,170.11

2,170.11

LBP

Number

Date

00022020161649172780 02120/2016

CNO22020161649172780 02/20/2016

ANO22020161649172780 02/20/2016

Total Payments (Successful/Unsuccessful): 2,170.11

Total Payments (Successful): 2,170.11

Close

Status

Message

CBR BCS No.

Authorized

Authorized

Authorized

0- Successful

0 - Successful

0-Successful

55571

55571

55571

You might also like

- Monthly Value-Added Tax DeclarationDocument3 pagesMonthly Value-Added Tax DeclarationMarkLouiseSumugatOlandresNo ratings yet

- For BIR Annual Income Tax Return Form 1702-MXDocument9 pagesFor BIR Annual Income Tax Return Form 1702-MXJp AlvarezNo ratings yet

- Monthly Value-Added Tax Declaration: 105 Specialty Store First Premium Global Dealer Co. LTDDocument3 pagesMonthly Value-Added Tax Declaration: 105 Specialty Store First Premium Global Dealer Co. LTDAbs PangaderNo ratings yet

- New Form 2550 M - Monthly VAT Return P 1-2Document3 pagesNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Monthly Value-Added Tax DeclarationDocument17 pagesMonthly Value-Added Tax DeclarationMIRAHNELNo ratings yet

- 2550m FormDocument1 page2550m FormAileen Jarabe80% (5)

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument4 pagesMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesNo ratings yet

- BIR Form 1702 Annual Income Tax Return GuideDocument6 pagesBIR Form 1702 Annual Income Tax Return GuideMary Monique Llacuna Lagan100% (1)

- 2550MDocument9 pages2550MAngel AlfaroNo ratings yet

- 2016 Itr4 PR3Document165 pages2016 Itr4 PR3TejasNo ratings yet

- VAT Return Form DetailsDocument9 pagesVAT Return Form DetailsAdriel Torreda NaturalNo ratings yet

- 2550Mv 2Document7 pages2550Mv 2nelsonNo ratings yet

- Quarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoDocument1 pageQuarterly Income Tax Return: (YYYY) 1st 2nd 3rd Yes NoAlexis TrinidadNo ratings yet

- Euv 1ST 2011 1701QDocument6 pagesEuv 1ST 2011 1701QAdrian Raymnd EspirituNo ratings yet

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDocument5 pagesQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloNo ratings yet

- 1702q PDFDocument2 pages1702q PDFfloriza binadayNo ratings yet

- Sichsi Vat-March 2010Document7 pagesSichsi Vat-March 2010egettobol10No ratings yet

- 1702 QDocument2 pages1702 Qitik_usteNo ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- Bir-2550q 2007Document1 pageBir-2550q 2007Atashii Xenxi60% (5)

- BIR Form 1702 Filing GuideDocument18 pagesBIR Form 1702 Filing GuideBeatriceChuNo ratings yet

- NNNDocument4 pagesNNNJemely BagangNo ratings yet

- Information Return/Annual Income Tax Return: Republika NG Pilipinas Kagawaran NG PananalapiDocument12 pagesInformation Return/Annual Income Tax Return: Republika NG Pilipinas Kagawaran NG PananalapifatmaaleahNo ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument12 pagesFor BIR Use Only Annual Income Tax Returnmiles1280No ratings yet

- 2550 Bir FormDocument48 pages2550 Bir FormKisu ShuteNo ratings yet

- New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)Document4 pagesNew Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)Michelle G. Minor0% (1)

- BIR Form 1702-ExDocument7 pagesBIR Form 1702-ExShiela PilarNo ratings yet

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDocument6 pagesImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahNo ratings yet

- Monthly Remittance ReturnDocument1 pageMonthly Remittance ReturnValerieAnnVilleroAlvarezValienteNo ratings yet

- Select Applicable Sheets Below by Choosing Y/N and Click On ApplyDocument69 pagesSelect Applicable Sheets Below by Choosing Y/N and Click On ApplysreetomapaulNo ratings yet

- 1702-EX June 2013 Pages 1 To 2 PDFDocument2 pages1702-EX June 2013 Pages 1 To 2 PDFJulio Gabriel AseronNo ratings yet

- Quarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaDocument5 pagesQuarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaJacinto TanNo ratings yet

- 1702 June 2011Document18 pages1702 June 2011fatmaaleahNo ratings yet

- Form 16 TDS certificateDocument2 pagesForm 16 TDS certificateSuchitra BakulyNo ratings yet

- Chatto PT 3Document2 pagesChatto PT 3LabLab Chatto0% (1)

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- Annual Income Tax Return FilingDocument8 pagesAnnual Income Tax Return FilingShiela PilarNo ratings yet

- Annual Income Tax Return for CorporationDocument9 pagesAnnual Income Tax Return for CorporationMarvin CeledioNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryFrom EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryFrom EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Application Program CPDD 02 Rev 03 CPD ProgramDocument2 pagesApplication Program CPDD 02 Rev 03 CPD ProgramMarkLouiseSumugatOlandresNo ratings yet

- 1st ANNOUNCEMENT AND CALL FOR PAPERSDocument1 page1st ANNOUNCEMENT AND CALL FOR PAPERSMarkLouiseSumugatOlandresNo ratings yet

- 6 - NBC Form No - B-10 - Civil Works (Application For Occupancy Permit Form) PDFDocument1 page6 - NBC Form No - B-10 - Civil Works (Application For Occupancy Permit Form) PDFMarkLouiseSumugatOlandres100% (2)

- Handling and Care of Pipes and ConnectionsDocument3 pagesHandling and Care of Pipes and ConnectionsMichael VelascoNo ratings yet

- ABC DO - 197 - s2016Document5 pagesABC DO - 197 - s2016Carol Santos63% (8)

- Lesson 4Document3 pagesLesson 4MarkLouiseSumugatOlandresNo ratings yet

- Lesson 4Document3 pagesLesson 4MarkLouiseSumugatOlandresNo ratings yet

- DPWH Standard Specification for WaterproofingDocument7 pagesDPWH Standard Specification for Waterproofingalterego1225No ratings yet

- Pressure Test Certificate PDFDocument1 pagePressure Test Certificate PDFMarkLouiseSumugatOlandresNo ratings yet

- POCB-F-SVD-004 Biodata of Key Personnel - FDocument1 pagePOCB-F-SVD-004 Biodata of Key Personnel - FHilda BetidosNo ratings yet

- View SoaDocument6 pagesView SoaMarkLouiseSumugatOlandresNo ratings yet

- DPWH Standard Specification for WaterproofingDocument7 pagesDPWH Standard Specification for Waterproofingalterego1225No ratings yet

- Application For Building Permit FormDocument2 pagesApplication For Building Permit FormMarkLouiseSumugatOlandresNo ratings yet

- Mojon Extension RevisedDocument18 pagesMojon Extension RevisedMarkLouiseSumugatOlandresNo ratings yet

- Banga Nang PinoyDocument86 pagesBanga Nang PinoyMarkLouiseSumugatOlandresNo ratings yet

- Sahara Clear Masonry Sealer 2-2 DescriptionDocument3 pagesSahara Clear Masonry Sealer 2-2 DescriptionNathaniel Gutierez MangubatNo ratings yet

- See Attached Docs PDFDocument2 pagesSee Attached Docs PDFMarkLouiseSumugatOlandresNo ratings yet

- See Attached DocsDocument2 pagesSee Attached DocsMarkLouiseSumugatOlandresNo ratings yet

- Floor Plan Ceiling Plan: C J Denosta ConstructionDocument1 pageFloor Plan Ceiling Plan: C J Denosta ConstructionMarkLouiseSumugatOlandresNo ratings yet

- Gateway 21-25 Construction Corp. Fenete Street, District Iii, Sibalom, Antique Name of Procuring Entity: Brgy. Capagao, Panitan, CapizDocument2 pagesGateway 21-25 Construction Corp. Fenete Street, District Iii, Sibalom, Antique Name of Procuring Entity: Brgy. Capagao, Panitan, CapizMarkLouiseSumugatOlandresNo ratings yet

- 6Document5 pages6MarkLouiseSumugatOlandresNo ratings yet

- See Attached DocsDocument2 pagesSee Attached DocsMarkLouiseSumugatOlandresNo ratings yet

- See Attached DocsDocument1 pageSee Attached DocsMarkLouiseSumugatOlandresNo ratings yet

- See Attached DocsDocument2 pagesSee Attached DocsMarkLouiseSumugatOlandresNo ratings yet

- See Attached DocsDocument2 pagesSee Attached DocsMarkLouiseSumugatOlandresNo ratings yet

- Pen9.Sta Fiimaeie Balgos L-Astname Firstname Ffi F Bachelo@Unttngtechnology Dateofbirth@Document1 pagePen9.Sta Fiimaeie Balgos L-Astname Firstname Ffi F Bachelo@Unttngtechnology Dateofbirth@MarkLouiseSumugatOlandresNo ratings yet

- Tation To Bid Rtisement No.: Item Qty. Unit S/services Description Brand Offered NoDocument2 pagesTation To Bid Rtisement No.: Item Qty. Unit S/services Description Brand Offered NoMarkLouiseSumugatOlandresNo ratings yet

- See Attached DocsDocument2 pagesSee Attached DocsMarkLouiseSumugatOlandresNo ratings yet

- AbsDocument2 pagesAbsAnonymous oYT7mQt3No ratings yet

- Ridgid Tools - Catalog - Cosmo Petra - Safe Lifting Solutions - WWW - Cpworks-EgDocument182 pagesRidgid Tools - Catalog - Cosmo Petra - Safe Lifting Solutions - WWW - Cpworks-EgSafe Lifting Solutions100% (1)

- Parking Lot ContractDocument11 pagesParking Lot ContractThe Valley IndyNo ratings yet

- 2 Company Chapter and Marketing Strategy 2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing StrategyDocument16 pages2 Company Chapter and Marketing Strategy 2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategy2 Company Chapter and Marketing Strategyshonu2009No ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- OR Problems (All Topics) Linear Programming FormulationDocument24 pagesOR Problems (All Topics) Linear Programming FormulationHi HuNo ratings yet

- 1 Business Correspondence - For STUDENTSDocument7 pages1 Business Correspondence - For STUDENTSHanna SianturiNo ratings yet

- Copy of Various Types of Tyre SegmentDocument9 pagesCopy of Various Types of Tyre Segmentprasadsawant121No ratings yet

- Bawai's Group of RestaurantDocument14 pagesBawai's Group of RestaurantMarc Jason Cruz Delomen100% (1)

- Business Plan Adventure Tourism Prateek & VaebhavDocument53 pagesBusiness Plan Adventure Tourism Prateek & Vaebhavvaebhav dogra100% (1)

- Buyer's Guide To Controlled Tolerance StampingsDocument12 pagesBuyer's Guide To Controlled Tolerance StampingsmattgrubbsNo ratings yet

- Tax Invoice Inter StateDocument4 pagesTax Invoice Inter Statereavanth rathinasamyNo ratings yet

- Marketing Prospects of Sudha DairyDocument98 pagesMarketing Prospects of Sudha DairyRahul Gujjar100% (3)

- Oracle Order Management Cloud 2018 Implementation Essentials Exam Questions & AnswersDocument38 pagesOracle Order Management Cloud 2018 Implementation Essentials Exam Questions & AnswersNittin BaruNo ratings yet

- Sale DeedDocument3 pagesSale DeedAnonymous v5NLHFwgNNo ratings yet

- IP Sale AgreementDocument7 pagesIP Sale AgreementBolaji OlowofoyekuNo ratings yet

- Classified Advertising: More Classified More Classified F PDocument5 pagesClassified Advertising: More Classified More Classified F PsasikalaNo ratings yet

- Chapter 13 Breakeven AnalysisDocument10 pagesChapter 13 Breakeven Analysisoo2011No ratings yet

- Production and Operations Management - Ece 6bDocument14 pagesProduction and Operations Management - Ece 6bTanu NewarNo ratings yet

- Marketing Plan for Goli Vada Pav in Marine DriveDocument20 pagesMarketing Plan for Goli Vada Pav in Marine DriveVishnu PriyaNo ratings yet

- SALES AND DISTRIBUTION MANAGEMENTDocument118 pagesSALES AND DISTRIBUTION MANAGEMENT9304768839100% (1)

- Question Bank Answer: UNIT 2: Partnership and Sale of Goods ActDocument7 pagesQuestion Bank Answer: UNIT 2: Partnership and Sale of Goods Actameyk89No ratings yet

- Economics Globalisation and The Indian Economy PDFDocument2 pagesEconomics Globalisation and The Indian Economy PDFmajji satishNo ratings yet

- IE 6605 PPC 2 Marks With QBDocument20 pagesIE 6605 PPC 2 Marks With QBasathishmctNo ratings yet

- Variation Proforma Journal EntriesDocument11 pagesVariation Proforma Journal EntriesZaheer Ahmed SwatiNo ratings yet

- Creating A Sales VortexDocument98 pagesCreating A Sales Vortexkaiden5No ratings yet

- Nilesh Deshmukh's SEO-Optimized Resume TitleDocument5 pagesNilesh Deshmukh's SEO-Optimized Resume TitleJustine JoseNo ratings yet

- The Digital FirmDocument4 pagesThe Digital FirmeldociNo ratings yet

- Literature Review and SurveyDocument4 pagesLiterature Review and SurveyBalkrishna KarmaNo ratings yet

- How Mahindra & Mahindra Came To Dominate The Indian Automotive IndustryDocument10 pagesHow Mahindra & Mahindra Came To Dominate The Indian Automotive IndustryKunwar AdityaNo ratings yet