Professional Documents

Culture Documents

Unaudited Financial Results For The Quarter Ended December 31, 2010

Uploaded by

Arun KCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unaudited Financial Results For The Quarter Ended December 31, 2010

Uploaded by

Arun KCCopyright:

Available Formats

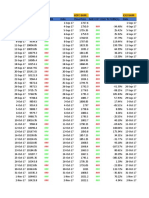

Amara Raja Batteries Limited

Regd. Office: Renigunta-Cuddapah Road, Karakambadi,Tirupati - 517520, Andhra Pradesh

Unaudited financial results for the quarter and nine months ended December 31, 2010

Rs. in Lakhs

Audited

Year ended

Unaudited

S.No

Particulars

1(a) Net Sales/Income from Operations

(b) Other Operating Income

Total - 1

2 Expenditure

a. (Increase)/decrease in stock in trade and work in progress

b. Consumption of raw materials

c. Purchase of traded goods

d. Employees cost

e. Depreciation

f. Other expenditure

Total - 2

3Profit from Operations before Other Income, Interest & Exceptional

Items (1-2)

4Other Income

5Profit before Interest and Exceptional Items (3+4)

6Interest

7Profit after Interest but before Exceptional Items (5-6)

8Exceptional Items

9Profit (+)/ Loss (-) from Ordinary Activities before tax (7+8)

10Tax expense

11Net Profit (+)/Loss(-) from Ordinary Activities after tax (9-10)

12Extraordinary Item

13Net Profit (+)/Loss(-) for the period (11-12)

14Paid-up equity share capital (Face Value Rs. 2)

15Reserve excluding Revaluation Reserves as per balance sheet of

previous accounting year

16Earnings Per Share (EPS)

a) Basic and diluted EPS before Extraordinary items for the period, for

the year to date and for the previous year

b) Basic and diluted EPS after Extraordinary items for the period, for

the year to date and for the previous year

17Public shareholding

- Number of shares

- Percentage of shareholding

18Promoters and Promoter Group Shareholding

a) Pledged / Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

- Percentage of shares (as a % of the total share capital of the

company)

b) Non - encumbered

- Number of shares

Quarter ended

Nine months ended

December

December

December

December

March 31,2010

31,2010

42,492.57

58.74

42,551.31

31,2009

36,684.55

63.73

36,748.28

31,2010

126,026.89

219.30

126,246.19

31,2009

103,273.72

133.00

103,406.72

146,449.15

215.04

146,664.19

(2,509.50)

29,879.96

89.25

1,953.75

1,047.46

6,490.86

36,951.78

(4,501.72)

26,499.37

82.17

1,610.42

1,165.56

6,134.65

30,990.45

(720.99)

82,675.25

333.63

5,945.28

3,124.65

19,478.52

110,836.34

(4,786.01)

63,924.43

216.52

4,630.66

3,251.37

16,812.47

84,049.44

(3,568.77)

91,179.75

353.28

6,237.04

4,294.51

23,514.45

122,010.26

5,599.53

162.21

5,761.74

27.41

5,734.33

(160.05)

5,894.38

5,757.83

62.86

5,820.69

63.38

5,757.31

(384.00)

6,141.31

15,409.85

408.94

15,818.79

113.85

15,704.94

(244.85)

15,949.79

19,357.28

219.94

19,577.22

619.07

18,958.15

(902.77)

19,860.92

24,653.93

280.36

24,934.29

677.16

24,257.13

(1,206.35)

25,463.48

1,929.06

3,965.32

3,965.32

1,708.12

2,154.94

3,986.37

3,986.37

1,708.12

5,251.57

10,698.22

10,698.22

1,708.12

6,827.45

13,033.47

13,033.47

1,708.12

8,760.15

16,703.33

16,703.33

1,708.12

52,656.15

4.64

4.67

12.53

15.26

19.56

4.64

4.67

12.53

15.26

19.56

40,942,524

47.94

40,942,524

47.94

40,942,524

47.94

40,942,524

47.94

40,942,524

47.94

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

44,463,726

44,463,726

44,463,726

44,463,726

44,463,726

- Percentage of shares (as a % of the total shareholding of the

Promoter and Promoter group)

100

100

100

100

100

- Percentage of shares (as a % of the total share capital of the

company)

52.06

52.06

52.06

52.06

52.06

Notes:

1

As the Company's business activity falls within a single primary business segment, viz., Lead Acid Storage Batteries", the disclosure requirement of AS-17 "Segment

Reporting", notified by the Companies (Accounting Standards) Rules, 2006 are not applicable.

The exceptional items as mentioned in item no. 8 represent translation loss/(gain), due to rupee depreciation/ appreciation, against foreign currency assets/liabilities accounted

as per AS - 11 "The effect of changes in Foreign Exchange Rates", notified by the Companies (Accounting Standards) Rules, 2006.

The Board of Directors have declared a One-Time Special Dividend of Rs. 2/- per equity share of Rs. 2 each to commemorate the Silver Jubilee year of the Company.

Net Sales are net of trade discounts / trade incentives.

Remuneration (commission) of Rs.520.16 lakhs payable to Non-Executive Chairman for the period ended December 31, 2010 is subject to approval from Central

Government under Section 309 of the Companies Act, 1956.

The details of the number of investor complaints for the quarter ended December 31, 2010: beginning: nil; received 15; resolved: 14 and pending: 1.

Previous year figures have been re-grouped / re-classified wherever necessary to conform to current year figures.

The aforementioned results together with the draft limited review report thereon provided by the auditors of the Company were reviewed by the Audit Committee and approved

by the Board of Directors at their meeting held on January 24, 2011.

By Order of the BoardHyderabadDr. Ramachandra N GallaJayadev GallaJanuary 24, 2011ChairmanManaging Directo

You might also like

- Employee Retention StrategiesDocument46 pagesEmployee Retention StrategiesArun KCNo ratings yet

- Sureti Insurance Marketing PVT LTDDocument1 pageSureti Insurance Marketing PVT LTDArun KCNo ratings yet

- Carcinoma of Upper Gastrointestinal SystemDocument65 pagesCarcinoma of Upper Gastrointestinal SystemArun KCNo ratings yet

- Employee Retention StrategiesDocument46 pagesEmployee Retention StrategiesArun KCNo ratings yet

- Pricing Strategy of LenovoDocument5 pagesPricing Strategy of LenovoShriya Dhar50% (2)

- RBIDocument28 pagesRBIGauravSinhaNo ratings yet

- In Retrospect: Revenue 2008-09 13,132 2009-10 16,645 2010-11 17,611Document6 pagesIn Retrospect: Revenue 2008-09 13,132 2009-10 16,645 2010-11 17,611Arun KCNo ratings yet

- Marketing Project FinalDocument19 pagesMarketing Project FinalArun KCNo ratings yet

- A Report ON: Understanding Customers Needs and PreferencesDocument36 pagesA Report ON: Understanding Customers Needs and PreferencesArun KCNo ratings yet

- Technical AnalysisDocument61 pagesTechnical AnalysisArun KCNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderArun KCNo ratings yet

- New Doc 2019-11-04 22.20.01Document4 pagesNew Doc 2019-11-04 22.20.01Arun KCNo ratings yet

- Consumer Behavior Mini ProjectDocument80 pagesConsumer Behavior Mini ProjectArun KCNo ratings yet

- Self Study FormDocument1 pageSelf Study FormArun KCNo ratings yet

- Financial Planning Goal Worksheet v1Document8 pagesFinancial Planning Goal Worksheet v1Arun KCNo ratings yet

- Financial Goals Worksheet BreakdownDocument6 pagesFinancial Goals Worksheet BreakdownArun KCNo ratings yet

- Company Profile & Internship DetailsDocument2 pagesCompany Profile & Internship DetailsArun KCNo ratings yet

- Mini Project On Nse Nifty (Bank)Document74 pagesMini Project On Nse Nifty (Bank)Arun KCNo ratings yet

- Multiple CamScanner Scans in One DocumentDocument16 pagesMultiple CamScanner Scans in One DocumentArun KCNo ratings yet

- II MBA SpecialisationDocument120 pagesII MBA SpecialisationArun KCNo ratings yet

- How To Play SudokuDocument34 pagesHow To Play SudokujitnikhilNo ratings yet

- JD - SSB-Analyst-1Document1 pageJD - SSB-Analyst-1Arun KCNo ratings yet

- Week 2 - E Text - Part 1 - Residential Status and Tax IncidenceDocument13 pagesWeek 2 - E Text - Part 1 - Residential Status and Tax IncidenceArun KCNo ratings yet

- SSRN Id2621942Document15 pagesSSRN Id2621942Arun KCNo ratings yet

- GST E Book PDFDocument63 pagesGST E Book PDFnaveen chaudharyNo ratings yet

- Transfer PricingDocument10 pagesTransfer PricingArun KCNo ratings yet

- GST and It's Implementation: T. Syamala Devi, A.NagamaniDocument6 pagesGST and It's Implementation: T. Syamala Devi, A.NagamaniArun KCNo ratings yet

- Top 100 Finance and Accounting QuestionsDocument7 pagesTop 100 Finance and Accounting QuestionsArun KC0% (1)

- Accounting Interview QuesDocument8 pagesAccounting Interview QuesArun KCNo ratings yet

- Top 100 Finance and Accounting QuestionsDocument7 pagesTop 100 Finance and Accounting QuestionsArun KCNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2024 Predictions - by Luke Belmar - by Luke Belmar - Dec, 2023 - MediumDocument3 pages2024 Predictions - by Luke Belmar - by Luke Belmar - Dec, 2023 - MediumAshish RaiNo ratings yet

- The Value of Enterprise Risk ManagementDocument22 pagesThe Value of Enterprise Risk ManagementbreezeeeNo ratings yet

- Name Section: Final Examination EntrepreneurshipDocument2 pagesName Section: Final Examination Entrepreneurshipjoshua baguio100% (1)

- MK Share Genius Back TestingDocument4 pagesMK Share Genius Back Testingyash MunotNo ratings yet

- CH 07Document36 pagesCH 07Suresh Devaraji100% (1)

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Oceanis Q3 Market ReportDocument12 pagesOceanis Q3 Market ReportIneffAble MeloDyNo ratings yet

- ICICI Bank ACQUISITION WITH BANK OF RAJASTHANDocument6 pagesICICI Bank ACQUISITION WITH BANK OF RAJASTHANPrayagraj PradhanNo ratings yet

- Draft 2 Financial Literacy Survey Questionnaire NewDocument2 pagesDraft 2 Financial Literacy Survey Questionnaire NewCuestas Jelou100% (17)

- Quizzes - Topic 4 - Attempt ReviewDocument5 pagesQuizzes - Topic 4 - Attempt ReviewNguyễn Hữu ThọNo ratings yet

- The Wise Investor PDFDocument19 pagesThe Wise Investor PDFKatrina0% (1)

- Paper-3g HhummnDocument4 pagesPaper-3g Hhummnshemin hrNo ratings yet

- Basic Derivatives PDFDocument2 pagesBasic Derivatives PDFlcNo ratings yet

- CH 6Document6 pagesCH 6rgkusumbaNo ratings yet

- Technical Analysis Signals for Options TradesDocument15 pagesTechnical Analysis Signals for Options Tradesamin rafeehNo ratings yet

- Exercise 3-3 to 3-10 Net Income CalculationsDocument13 pagesExercise 3-3 to 3-10 Net Income CalculationsAnne GuamosNo ratings yet

- LT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Document2 pagesLT Foods Limited (DAAWAT - NS) - Long: Ritu Singh '22Sampann PatodiNo ratings yet

- DerivativesDocument31 pagesDerivativesChandru Mathapati100% (1)

- Yale Endowment Generates $2.29 Billion Gain in FY2013Document24 pagesYale Endowment Generates $2.29 Billion Gain in FY2013alainvaloisNo ratings yet

- Sarazan Corp Purchased A 1 Million Four Year 7 5 Fixed Rate Interest Only PDFDocument1 pageSarazan Corp Purchased A 1 Million Four Year 7 5 Fixed Rate Interest Only PDFLet's Talk With HassanNo ratings yet

- Application For Ethics ApprovalDocument6 pagesApplication For Ethics ApprovalFawad AhmedNo ratings yet

- Funding Models in IT FinalDocument16 pagesFunding Models in IT FinalHARISH BHARADWAJNo ratings yet

- Seatwork Financial StatementsDocument3 pagesSeatwork Financial StatementsJean Diane JoveloNo ratings yet

- FIN619 FinalDocument95 pagesFIN619 Finalqundeel.com80% (5)

- Best Ultra Short Term Debt Fund: A Performance AnalysisDocument125 pagesBest Ultra Short Term Debt Fund: A Performance Analysisavinash singh50% (2)

- Loan and AdvancesDocument11 pagesLoan and AdvanceswubeNo ratings yet

- Models of Cash ManagementDocument12 pagesModels of Cash ManagementBasantMundhraNo ratings yet

- Philippine Financial System StructureDocument28 pagesPhilippine Financial System StructureJenielyn Delamata83% (6)

- Ebook - Ryan Litchfield - Fun Filled GapsDocument43 pagesEbook - Ryan Litchfield - Fun Filled GapspankajparimalNo ratings yet

- Google 10k 2015Document3 pagesGoogle 10k 2015EliasNo ratings yet