Professional Documents

Culture Documents

Marketing Management Project

Uploaded by

vipinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing Management Project

Uploaded by

vipinCopyright:

Available Formats

Marketing Management Project

Project Title: Creation of the Premium Bus Segment in India by Volvo

Product:-Volvo 9400

Contents

Acknowledgement................................................................................................................... 3

Executive Summary........................................................................................................... 3

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Problem Statement............................................................................................................ 4

Situation Analysis............................................................................................................... 5

Volvo Marketing Plan for 9400 XL....................................................................................... 6

Brand performance and Position in the market:.................................................................7

Key opportunities and challenges for the brand.................................................................7

Business Strategy and Marketing Objectives- 2014-15......................................................8

Volvo Financial data........................................................................................................... 8

Volvo 9400 XL competition................................................................................................. 9

Volvo vs Tata Divo............................................................................................................ 12

Volvo vs Scania Metrolink................................................................................................. 12

SWOT Analysis................................................................................................................. 15

Market demand analysis and Forecast for FY 2015-16.....................................................16

Acknowledgement

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

The study of this report is intended to understand the current marketing plan for

Volvo buses in luxury segment in India and forecast the plan for next financial year as

part of the course requirement for the Marketing Management in the 1st quarter of

the Executive Post Graduate Program (EPGP-07) from IIMK under the guidance of Prof.

Joffi Thomas.

Executive Summary

In the year 2001, Volvo Buses entered Indian market.

First time Indian passengers witnessed a world class air conditioned intercity

coaches as public transport.

The Volvo 9400 is an intercity coach designed in Europe and built in India at Volvo

Buses facility at Hosakote, Bangalore.

These Buses perfectly suited for long distance intercity operations, ideal for

excursions as well as short trips for city tourism.

The Volvo 9400 also features Volvo disc brakes with EBS (Electronic Brake System)

which offers excellent braking performance and rapid, gentle and controlled

braking.

The current Volvo model 9400 6x2 multi-axle takes the intercity coaches

performance to the next level.

Volvo 9400 XL is an advanced transport solution for operators and passengers.

Current situation many international players are eyeing to capture the market

share in India with ultra-luxury intercity transport solutions.

Problem Statement

Volvo Buses see a dip in market demand for their luxury buses in recent years, deliveries

during 2012-2013 were only 237 buses from R&D center located in Bangalore R&D

center 28% lower than the previous year. Order intake for the next 2014 Q1 also has

witnessed a declined trend for intercity buses by 16%.

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

The recently launched Volvo 9400XL buses with D9B 340 257 kW (340 hp) @ 1900 rpm

output offers greater performance and occupancy level. This segment of intercity

transport is launched in 8.5 M INR which 25% higher than closest competitor TATA Divo

(price 6.6 M INR). Ashok Leyland iT09 also competes Volvo 9400 XL on Indian roads but

in lesser price point at 2.2 M INR. Scania Metrolink and Mercedes-Benz 3 axial luxury

coaches also join the public transport intercity market segments, creating challenge for

Volvo to retain market capture.

Cheaper price of flights and multiple ticket quotas declared by Indian railways also

making impact on intercity travel by roads.

Volvo Global Group declares 9% decline in sales to SEK 272.6 billion (299.8) against

last year which reduces the investment opportunity in emerging markets and leads to

the cost cutting and product reformation. Volvo India observed restructure in operating

margin which reduces the operating cost in the center. Volvo Group is looking for

extensive product renewal in current year and moving away from large segment buses to

medium segment buses.

Volvo buses early entry to Indian market helps to capture major market share of 74%

which has been reduced by 2% from the previous year.

Safety Concerns: Recent Accidents

Volvo, manufacturers of thousands of buses running on Indian roads, said the blaze that

charred to death 45 passengers on the Bangalore-Hyderabad bus, might have been

caused by a fuel tank explosion.

45 killed as speeding bus headed to Hyderabad catches fire

Two Gruesome Bus Accidents In India Put Spotlight On Bus Maker Volvo

Situation Analysis

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Volvo Marketing Plan for 9400 XL

Brand History

Volvo is one of the world's largest manufacturers of buses and bus chassis. Volvo Buses'

product programme comprises city buses, intercity buses and tourist coaches, and

services in the areas of financing, servicing, vehicle diagnostics and traffic information

systems.

Volvo Buses has approximately 7900 employees worldwide, with production activities in

Europe, North and South America, Asia and Africa.The head office is in Sweden,

Gothenburg, where product planning and product development are primarily

concentrated.

Volvo Buses also has a wide-ranging distributor network for aftermarket services with

servicing and spare parts distribution at 1 200 workshops located in over 80 countries.

Volvo launched its new range of buses comprising the city buses and coaches, aimed at

interstate routes and cities. They expanded range of Volvo buses in India including its

premium feature enriched segment 9400 XL which is expected to address Volvos recent

fear over losing market share to its competitors. The Volvo 9400 XL is campaigned as

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

the drive quality of life with its enhanced safety features and performance. Volvo

expects more than 50% sales coming from Asian market in future years and hence it is

primarily targeting Indian public transport market. Volvo 9400 XL is going to be show

cased in Delhi Auto Expo while launching the buses later in time. Volvo is marketing its

new product as the instrument to cater to the local needs of emerging market. Unlike its

predecessors this segment is going to be the value segment with 20% cheaper than

previous segment so intercity buses.

Passenger comfort and driving safety being the key agenda of the product development,

this bus is developed with multiple unique features. Electronically controlled brake

system (EBS) which further amplifies the safety for 9400 6X2. Volvo 9400 XL offers low

noise and vibration-free interiors with ergonomic seats and a perfect climate controlled

environment. Roof mounted air conditioning system and heat insulated window take the

passenger comfort to next level.

This ultra-luxury bus is going to be launched in 13 cities in India including 4 metros and

other tire I, tire II cities to increase awareness of the company and products.

Brand performance and Position in the market:

Volvo 9400XL is the first multi-axle in India and has raised the industry Standards again.

Within a year since its introduction, it has become the bestselling coach in the country,

leading across all elements - comfort & safety for passengers and offering the best in

transport economy for the fleet operators. With advanced features like electronic

suspension, electronic brakes, the latest

Generation engine management system among other industry-leading features, the

Volvo 9400XL has set the standards once more. India is progressing and Volvo Buses will

continue to ensure that the future is safer and friendlier for all - drivers, passengers,

customers and everyone associated.

Key opportunities and challenges for the brand

Redefined efficient bus travel with high vehicle uptime, ride comfort, transport

economy, a flexible and versatile design that offers reliable, safe and profitable

transport solutions.

It translates into increased revenues and improved transport economy and for

the passengers it means an even more comfortable ride on long distance

travel.

Market share of 82 per cent in premium coaches.

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Expensive compared to the competitors.

Localization of parts only till 35-40%.

Low penetration in Indian cities.

Few skilled drivers.

Business Strategy and Marketing Objectives- 2014-15

Increase

Increase

Increase

Increase

localization to reduce cost, source engines from its Pithampur plant .

the city operations to 15.

the number of trained drivers to 25000.

the presence of buses to 5000+

Volvo Financial data

Operating Income and Operating margin

Volvo Group's operating income amounted to SEK 7,138 M (18,069).Operating income for the

Industrial Operations decreased to SEK 5,616 M compared with SEK 16,573 M in the

preceding year. The Customer Finance operations' operating income rose to SEK 1,522 M

(1,496).

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Net Sales

Net sales for the Volvo Group decreased by 9% to SEK 272,622 M in 2013, compared

with SEK 299,814 M in the preceding year.

Volvo 9400 XL competition

Table II: Comparing marketing plan of the selected brand with close

competition

Elements of

Marketing Plan

Brand performance

and Position in the

market

(Compare Sales,

market share

(category

/segment), growth

over years),

profitability)

Volvo 9400 XL

76% Market

share

Monopoly in

Inter-City

Market

segment

20 coaches

from 2001 to

5000 in Dec-11

Tata Divo

Launched in

Dec 2011.

150-200

units

annually.

Scania

MetroLink

Scania is

also a

Swedish

manufactur

er and is a

tough

competitor

for Volvo in

European

market.

Entered

Indian

market in

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

2013

Key opportunities

and challenges for

the brand

(outcome of

situation analysis)

Tap Tier II and

tier III markets

where still the

market is ruled

by Non-Luxury

segment.

Maintain the

monopoly in

Luxury Bus

segment which

they got as

party of first

mover

advantage.

Increase

the

production

and

promotion.

Provide

better

services

and comfort

Fight for the

remaining

competition

and

gradually

compete

with Volvo.

Business Strategy

and Marketing

Objectives- 201415

Increase

localization to

reduce cost,

source engines

from its

Pithampur

plant

Increase the

city operations

to 15.

Increase the

number of

trained drivers

to 25000.

Increase the

presence of

buses to

5000+

Increase

their

production

and meet

the target

of selling

150-200

buses

annually.

Tata Motors

will also

launch

multi-axle

Divo in

fiscal 2014.

Promotion

and fight

for market

place.

Increase

their

production.

Can use

the

advantage

to compete

with Volvo

being a

successful

competitor

to it in

European

market.

Target of

1,000

selling

buses per

year in the

Indian

market

within the

next five

years and

employee

about 800

people at

this facility.

Current

Marketing

Strategy

Target Segment(s)

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

( share of brand in

different targeted

consumer

segments)

Positioning

Statement

Marketing

Program

Product & brand

Management

(analyse product

mix; product/brand

extension

decisions in the

past)

Luxury Segment

Luxury Segment

Luxury Segment

Volvo 9400 XL

Volvo 9400

Volvo 8400 (Low

Floor)

Volvo introduced

9400XL as a brand

extension strategy

Introducing a 14 Ft

bus in India.

Tata Divo

Tata Starbus Ultra

Tata Introduced

DIVO as a product

line extension

strategy

Scania Metrolink

Scania Citywide

Promotions:

promotion mix,

spends (analyse

successful /not so

successful

campaigns for

insights)

It ran commercials in

film theatres.

Scania entered

into India market

with a JV with L&T

for Trucks. And

further extended

their product line

to enter the bus

segment in 2013.

Privided 2 buses

to KSRTC for a

trial run

Before launching the

B7R in 2001, it

sought driver and

passenger feedback.

Volvo imported two

Volvo B7R inter-city

buses from Hong

Kong and Singapore,

and sent them out on

a six-month

demonstration drive

West and South India

PAN India

South India

Pricing Strategy

(brand extension,

variants and

pricing)

78 Lakhs

66 Lakhs

85 Lakhs

(approx.)

Future prospects of

High Growth Potential

High Growth

High Growth

Place: Channel

share

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

the brand

(Growth potentialHigh, Medium,

Low- Why?)

&efforts required in

attaining business

objectives

To expand its

presence in the

country, the

company has also

launched Volvo

9100 coach for

routes that cater

specially to tier-II

and -III cities.

Localization to

reduce the

manufacturing

cost

Pay per use

model/ leasing of

Buses

Plant capacity is

5000 units/year

as against the

current production

of 600 units/years

15% of the

aftermarket cost

goes as good will

and can be

optimized by

educating

customers

Potential

Potential

Increase

product

awareness by

Promotions

through

advertisements

Product

differentiatorlow cost as

their USP

Leveraging

long term

TRUST factor in

Indian market

for future

growth

Increase

product

awareness by

Promotions

through

advertisement

s

Product

differentiatorQuality

product, Brand

value

Free demo

buses to

increase brand

awareness

Volvo vs Tata Divo

The second-largest bus manufacturer in the world after Daimler Benz is aiming for a 50%

market share by 2015 in the super luxury bus segment, where Volvo rules with a 60-70%

market share.These buses cost between Rs60 lakh and Rs90 lakh.Tata Motors launched

Divo, priced at Rs66 lakh (ex-showroom Thane) for the western region.

We are looking at a scooping up half of this market in three years, said Ashish Tondon,

head - marketing - buses for Tata Motors.

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Growth in the bus segment is seen flat this fiscal due to slower orders from state

transport undertakings under the Jawaharlal Nehru National Urban Renewal Mission.

According to Society of Indian Automobile Manufacturers Association, the industry sold

43,000 buses this year.

However, luxury coach segment has been growing in double digits with orders coming

from private fleet operators. The overall super luxury segment remains a niche market

as of now with 40-50 buses sold in a month or 600 buses a year.

Tata Motors is planning to sell around 150 in the first year and 500 down the road.

Though we are little late to enter this segment, we are hopeful that a Tata brand will

work in our favour, said Ravi Pisharody, president - commercial vehicles business unit

for Tata Motors.

According to the company, Divo is priced at least 10% cheaper than existing products in

the market. To further expand the super luxury bus range, Tata Motors is also planning to

launch a multiaxle super luxury coach by fiscal 2014. The company showcased the

product during the Auto Expo in Delhi in January this year.

Tata Motors offers value for money on their luxury buses. It can surely be a tough

competitor in this segment, said an analyst from PINC Research. Along with Divo, Tata

Motors also launched Starbus Ultra for the intra-city requirements. The company

launched Divo in December last year for the Northern region.

Volvo vs Scania Metrolink

Scania Metrolink is a premium multi-purpose coach from the Swedish manufacturer for

medium and long-distance travel, specially designed to meet the needs of both the

driver and the passengers.

The Inter-city luxury bus segment in India is long-dominated and completely

monopolised by Volvo for more than a decade. Volvo entered the market in 2001 to mark

the beginning of a new era -with true bus chassis concept, low floor city buses, multiaxle coaches, and host of comfort and safety. There was hardly a direct substitute for its

likeness, but Indian buses with the expertise of local bus body builders have flared so

well that costly Volvo could hardly penetrate beyond the periphery of the market.

Mercedes Benz does offer series of luxury intercity buses in the single rear axle (4x2)

configuration, as does Isuzu Motors, but both are comparatively new to the market and

are gradually gaining momentum. At least in the past few years, escalating market

standards and consumer requirements have resulted in more takers for Volvo buses. Now

Scania is here to test the sector. The Volvo 9400 finally gets a strong rival. In fact,

Metrolink is the only rival to the 9400 in the 14-metre, multi-axle (6x2) segment in India.

The coaches are assembled from CKD units with localisation of 30% initially. Let us

explore both of them in detail.

Engine and Output

The Metrolink coaches are powered by Scania's 13-litre 6-cylinders turbo-charged DC 13

diesel engine, producing a max power of 410 bhp @ 1900 rpm and max torque of 2000

Nm @ 1000-1350 rpm. The engine is coupled with an 8-speed fully automatic Opticruise

gearbox, a build-in retarder and an inter-cooler. It is Euro-III compliant and is capable of

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

running in Ethanol ED95 fuel configuration i.e a fuel mixure of 95% ethanol and 5%

ignition improver (often used in modified diesel engines). In fact, the company claims

that its entire engine lineup is compatible with ethanol and bio-diesel. Scania has also

started trial runs of Ethanol powered city buses at the city of Nagpur.

Scania's Driver Seat

While Volvo 9400 has in its rear a comparably smaller 9-litre 6-cylinders D9B diesel

motor that is Turbo-charged and Intercooled, with a build in retarder. The max output

values are 340 bhp of power and 1600 Nm of torque. It comes with a 6-speed mannual,

fully synchronised gearbox. The motor is Euro-III compliant as well. It is to be noted that

Volvo has not updated its engine offering for a fairly long time owing to its monopoly and

high sales. I don't think it can be that lethargic anymore!

Dynamics

The hydraulic power assisted steering system with a circulating ball-and-nut type

steering gear enables small turning circle (considering its length) for both the buses. The

9400 has a turning radius of 10.5 metres while the Metrolink has a little larger radius at

12.5 metres. Ground Clearance for both the coaches is 270 mm. Pneumatic (Compressed

Air) suspension is a standard features in all wheels with almost same configuration in

both 9400 and Metrolink.

The Metrolink has a speed limiter at 90 kmph, while the Volvo can touch a top speed of

100 kmph. Sophisticated suspension system with multi-axle configuration lends a

balanced center-of-gravity and superior high speed stability for the buses.

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Safety

This class of luxury coaches are loaded with safety features, which are desperately

absent in every others buses on our roads. Of course you pay too much for these luxury

liners, but considering the instances of highway accidents by intercity buses and their

massive death tolls, we have to understand its importance. Because every buses carry

almost same amount of passengers, and even our modern low-cost Tata and AL buses

are capable of reaching a max speed of 100 kmph on open highways. So vulnerability is

indeed the same for every intercity buses.

Both the Metrolink and the Volvo 9400 enjoy disc brakes in all wheels, ABS and Electronic

Braking System, Electronic Stability Programme, Electronic stability programme, Hill

Hold, and seat belts. In addition, the Metrolink gets Traction Control and reversing

camera. Since both the coaches are built on a strong frame upon ladder-frame chassis,

roll-over protection is much better than a typical custom-built coaches. Radial tube-less

tyres in both the coaches ensure better road grip and stability.

Comfort

Unlike cars, these coaches comes with variety of optional packages. Buyers can choose

among accessories like curtains on windows, reading lights, gangway lights, LED

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Screens, DVD player, Radio/USB, Speakers with sub-woofers, Refrigerator, Lavatory in

both the models. Air conditioning is standard. Scania comes with Radio, 2 LCD screen in

front and middle as standard.

Neutral

Ok, I lied. It isn't a 'Swedish Clash' in true sense. In fact there is nothing like Swedish or

German or American! Every automobile of our times are "Global" is strict sense. Volvo is

now owned by Geely (a Chinese firm) and earlier by Ford. Scania now belongs to VW

group. But it's little exotic to use such phrases of nationalities and to exploit stereotypes

associated to them, and so media loves to do so. I'm too!

Don't ask me Scania or Volvo. It isn't that

simple to answer. Truly, I haven't even taken a ride in the new Metrolink. Even more, I

don't even have a proper driving license for CVs to sit behind their wheels to say which

drives better! And even if I get one soon, damn it - they cost almost 100 lakhs, who's

gonna give a free drive so easily? But the whole point is that we have got a new liner in

the segment, the only rival to the Volvo 9400. That's lot!

And to the question of which looks better, that I was deliberately trying to avoid, again, it

is not like cars to comment. Buses are boxy and tall, there is no big deal here! But I like

the use of black tone in the face and the panels of the Metrolink. The rear design is also

little different. I'm bored of Volvo's looks, so why not consider newbie??

SWOT Analysis

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Market demand analysis and Forecast for FY 2015-16

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

From the above exhibit it is clear that the demand for luxury buses in India will

be 7479 units in 2015 -16. As Volvo is the market leader we could estimate

companys sales target to be 65% of the market demand. Hence the projected

volume should be 4681 Units.

EPGP07 - Indian Institute of Management - Kozhikode

Marketing Management Project

Reference:http://wagenclub.blogspot.in/2014/09/scania-metrolink-vs-volvo-9400swedish.html#sthash.FzhJUF6g.dpuf

http://bangalore.citizenmatters.in/articles/4710-in-bangalore

http://planningcommission.nic.in/aboutus/committee/wrkgrp11/wg11_roadtpt.pdf

www.volvobuses.com/SiteCollectionDocuments/VBC/india/BUS%20STOP%20NEWS

%20ISSUE_01-2011.pdf

http://www.motorindiaonline.in/buses/volvo-buses-remains-unchallenged/

http://www.dnaindia.com/money/report-with-cheaper-divo-tamo-aims-at-volvo-1662514

EPGP07 - Indian Institute of Management - Kozhikode

You might also like

- Volvo Buses PressRelease New Coach Range ALLDocument14 pagesVolvo Buses PressRelease New Coach Range ALLRaj ThakurNo ratings yet

- 2020 July 26 Mazimba Theresa 16102273 BF 450 Assignment 8.. 6Document8 pages2020 July 26 Mazimba Theresa 16102273 BF 450 Assignment 8.. 6Daniel DakaNo ratings yet

- Automobile Industry FInalDocument10 pagesAutomobile Industry FInalSarita ManjunathNo ratings yet

- Volvo PPT 1Document20 pagesVolvo PPT 1Rupsikha Borah100% (1)

- VOLVODocument6 pagesVOLVOLester100% (1)

- STPDocument3 pagesSTPVishal SrivastavaNo ratings yet

- Volvo India Pvt. LTD.: Navigating Through The Roads Ahead: Sapna Rakesh Kiran S NairDocument6 pagesVolvo India Pvt. LTD.: Navigating Through The Roads Ahead: Sapna Rakesh Kiran S NairVaibhav RajoreNo ratings yet

- Assignment On: Supply Chain Management System of Runner Automobiles LTDDocument8 pagesAssignment On: Supply Chain Management System of Runner Automobiles LTDIfaz Mohammed Islam 1921237030No ratings yet

- VOLVO Buses IndiaDocument47 pagesVOLVO Buses IndiaNeeraj Naman50% (6)

- SCM FinalDocument27 pagesSCM FinalSHIVANSHU PANDEYNo ratings yet

- Internatio NAL Marketing Assignmen T 1.3: SCOPE: Reasons For Success of Global Brands in IndiaDocument10 pagesInternatio NAL Marketing Assignmen T 1.3: SCOPE: Reasons For Success of Global Brands in IndiaPrasadSuryawanshiNo ratings yet

- Volvo India 2010Document2 pagesVolvo India 2010Vishal JojowarNo ratings yet

- Volvo Group Report - Ba2465bDocument21 pagesVolvo Group Report - Ba2465bNIK DIANA FAQIERA NIK JAMILINo ratings yet

- Volvo Cars Global Supply ChainDocument33 pagesVolvo Cars Global Supply ChainBảo ChâuuNo ratings yet

- Company OverviewDocument2 pagesCompany OverviewDeepikaNo ratings yet

- HR Planning Aftab Automobile LimitedDocument11 pagesHR Planning Aftab Automobile LimitedMd. Shahnewaz KhanNo ratings yet

- Bombardier Transportation CountryBrochure India en 201407Document16 pagesBombardier Transportation CountryBrochure India en 201407rinkleNo ratings yet

- TVS Motor Company Background and OverviewDocument12 pagesTVS Motor Company Background and Overviewachint9100% (1)

- Volkswagon Polo Launch in India: Company ProfileDocument4 pagesVolkswagon Polo Launch in India: Company ProfileShilpa ChadarNo ratings yet

- Project On Bharat Benz: Submitted To Prof. Jo Jo JoyDocument24 pagesProject On Bharat Benz: Submitted To Prof. Jo Jo JoyShradha NambiarNo ratings yet

- Downloads AnalystPresentation Investors Presentation Q2 2012Document35 pagesDownloads AnalystPresentation Investors Presentation Q2 2012Somnath MannaNo ratings yet

- An Overview On BharatbenzDocument5 pagesAn Overview On BharatbenzArun Karthik VNo ratings yet

- Tvs Motors ProjectDocument79 pagesTvs Motors ProjectSatwic Mittal0% (1)

- Volvo Trucks FH, FM and FMX India Press ReleaseDocument3 pagesVolvo Trucks FH, FM and FMX India Press ReleaseRushLaneNo ratings yet

- Ashok Leyland: Company ProfileDocument3 pagesAshok Leyland: Company ProfileShraddha Acharya100% (1)

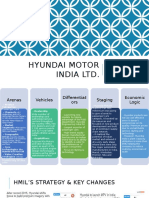

- HMIL's Strategy & Key ChangesDocument31 pagesHMIL's Strategy & Key Changesshiva198920060% (1)

- Volvo 8400 City Bus Brochure For Sales KitDocument8 pagesVolvo 8400 City Bus Brochure For Sales KitER Balram YadavNo ratings yet

- Vaishnavi TVS-1Document85 pagesVaishnavi TVS-1ravi singhNo ratings yet

- Marketing Project Bharat BenzDocument24 pagesMarketing Project Bharat BenzSoumya Siddharth Rout64% (11)

- AL Company Profile & ProductsDocument40 pagesAL Company Profile & ProductsGaurav ChaudharyNo ratings yet

- Tata MotorsDocument81 pagesTata MotorsvinayaroraknpNo ratings yet

- Ashok Leyland FinalDocument45 pagesAshok Leyland FinalsmitaNo ratings yet

- Chapter 1Document12 pagesChapter 1Zaint0p GamingNo ratings yet

- Bajaj Auto manufacturing facilities and product portfolioDocument7 pagesBajaj Auto manufacturing facilities and product portfolioMohit NarayanNo ratings yet

- SAVW Factsheet en April 2020Document4 pagesSAVW Factsheet en April 2020Saswat MohantyNo ratings yet

- Volvo Bus CorporationDocument20 pagesVolvo Bus CorporationMax William DCostaNo ratings yet

- VW India IMC Case Study on Successful Market EntryDocument24 pagesVW India IMC Case Study on Successful Market Entrysaikatpaul22No ratings yet

- Stufdy of Perception in Scooter in Rural Marketing Perception of Tvs Scooter in Rural MarketingDocument53 pagesStufdy of Perception in Scooter in Rural Marketing Perception of Tvs Scooter in Rural MarketingAritra Ravenor JanaNo ratings yet

- Project Report AkkiDocument33 pagesProject Report AkkiaakashNo ratings yet

- Working Capital Management of Tata MotorsDocument24 pagesWorking Capital Management of Tata MotorsThë FähãdNo ratings yet

- Perodua Company Overview and LeadershipDocument11 pagesPerodua Company Overview and LeadershipNur Amni Shafika0% (1)

- SM Module 5Document15 pagesSM Module 5JD ChauhanNo ratings yet

- Motor Industry by The Year 2020Document10 pagesMotor Industry by The Year 2020anon_13341922No ratings yet

- Ashok Leyland LtdDocument1 pageAshok Leyland Ltdaaryamannarang199No ratings yet

- Investments in Smart Transportation - Global & Local Trends. - Shirley ShefferDocument24 pagesInvestments in Smart Transportation - Global & Local Trends. - Shirley ShefferLogtelNo ratings yet

- Shubham Deshmukh FSCLDocument21 pagesShubham Deshmukh FSCLShubham DeshmukhNo ratings yet

- Working Capital Management - Project - Tata MotorsDocument26 pagesWorking Capital Management - Project - Tata MotorsSusmita Biswas67% (9)

- Bajaj Auto LTD Supply ChainDocument24 pagesBajaj Auto LTD Supply ChainVikash Kumar100% (2)

- Production Process of Ashok LeylandDocument14 pagesProduction Process of Ashok LeylandMohan Rajamani50% (10)

- Volvo CompanyDocument6 pagesVolvo CompanyAnonymous s2BjhnNo ratings yet

- Global Manufacturing of VolkswagenDocument3 pagesGlobal Manufacturing of Volkswagennarmin mammadli0% (1)

- Tata Motors Strategic AnalysisDocument19 pagesTata Motors Strategic AnalysisMainali GautamNo ratings yet

- Failure analysis of hanger bracket bolt and lower beam bolt looseningDocument32 pagesFailure analysis of hanger bracket bolt and lower beam bolt looseningLoneNo ratings yet

- ON Ola Cab Services: BY P MARIAN (097) DIVYANSHUDocument6 pagesON Ola Cab Services: BY P MARIAN (097) DIVYANSHUMarian Anthony RajuNo ratings yet

- About Caparo Maruti:-: Business TypeDocument5 pagesAbout Caparo Maruti:-: Business TypeKomal NagpalNo ratings yet

- Tata Motors Group Company ProfileDocument9 pagesTata Motors Group Company ProfileAtharva SheteNo ratings yet

- Ashok Leyland CaseDocument21 pagesAshok Leyland CaseAshish VermaNo ratings yet

- Running Board ReportDocument48 pagesRunning Board ReportAlmubeenNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Malaysia Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Malaysia Country ReportNo ratings yet

- Teletalk An AnalysisDocument14 pagesTeletalk An AnalysisMd. Mustafizur Rahman AzadNo ratings yet

- FS2011 Event ProgrammeDocument84 pagesFS2011 Event ProgrammeesukemNo ratings yet

- Oscar MyerDocument8 pagesOscar MyerMustafa RokeryaNo ratings yet

- NotesDocument43 pagesNotesVaishnavi BabuNo ratings yet

- Teva Pharmaceuticals LTD (1)Document60 pagesTeva Pharmaceuticals LTD (1)Prateek Gupta50% (2)

- Case Analysis Coke DessertDocument8 pagesCase Analysis Coke DessertSumit JhaNo ratings yet

- Unisem 2107Document182 pagesUnisem 2107Ekin IsaNo ratings yet

- Risk Analysis in Port FinanceDocument108 pagesRisk Analysis in Port FinanceSwati Jain100% (2)

- The Effect of Marketing Strategy On Organizational Profitability in The Case of Ontex EthiopiaDocument91 pagesThe Effect of Marketing Strategy On Organizational Profitability in The Case of Ontex EthiopiaYonasBirhanuNo ratings yet

- Marketing Management Summary: Customer-Focused Strategies for GrowthDocument37 pagesMarketing Management Summary: Customer-Focused Strategies for GrowthLatolidNo ratings yet

- SCB Swot AnalysisDocument2 pagesSCB Swot AnalysisHina Bibi0% (2)

- Final Report of EntrepreneurshipDocument17 pagesFinal Report of Entrepreneurshiposama newtonNo ratings yet

- Internal Analysis of GoogleDocument20 pagesInternal Analysis of GoogleAzim Mohammed100% (1)

- 02 VistasDocument56 pages02 VistasfadligmailNo ratings yet

- Strategic Management of Starbucks CompanDocument95 pagesStrategic Management of Starbucks Compan143incomeNo ratings yet

- Black Stallion Brewery: Antonio, Milette Mae Behnke, Patrick Cadenas, Kobie Fontanilla, Harley Louie Guan, June RainierDocument21 pagesBlack Stallion Brewery: Antonio, Milette Mae Behnke, Patrick Cadenas, Kobie Fontanilla, Harley Louie Guan, June RainierMelvin DayaoNo ratings yet

- The Effect of Customer Relationship Management and Its Significant - Relationship by Customers' ReactionsDocument9 pagesThe Effect of Customer Relationship Management and Its Significant - Relationship by Customers' ReactionsCyril AnthonyNo ratings yet

- Book Review Nadya StoynovaDocument9 pagesBook Review Nadya StoynovaDenitsa AnastasovaNo ratings yet

- Sales Promotion/Imc BudgetDocument11 pagesSales Promotion/Imc BudgetAparna Singh100% (1)

- Unit Iv: 111 Foreign Direct InvestmentDocument18 pagesUnit Iv: 111 Foreign Direct InvestmentgprapullakumarNo ratings yet

- Competitive Analysis Porters Five Forces ModelDocument4 pagesCompetitive Analysis Porters Five Forces ModelSajakul SornNo ratings yet

- Honda Vs Harley - The Real Story Behind Honda's Success - CMRDocument26 pagesHonda Vs Harley - The Real Story Behind Honda's Success - CMRLazaros KarapouNo ratings yet

- Account Management Grid - SOPDocument8 pagesAccount Management Grid - SOPMarissa LauNo ratings yet

- Best ValueDocument168 pagesBest ValueZubair AhmadNo ratings yet

- 'Certified Service Advisors': Module 1: Successful in The Role of A Service AdvisorDocument30 pages'Certified Service Advisors': Module 1: Successful in The Role of A Service AdvisorĐông ĐoànNo ratings yet

- STARBUCKS' Line Up Strategy: by Eirini Tougli Penny Vlagos Global Strategies New York CollegeDocument22 pagesSTARBUCKS' Line Up Strategy: by Eirini Tougli Penny Vlagos Global Strategies New York CollegeEirini Tougli75% (4)

- Ec Competition Law and Policy Albertina AlborsDocument191 pagesEc Competition Law and Policy Albertina Alborsruth_o_No ratings yet

- Highlights from "Selling the InvisibleDocument7 pagesHighlights from "Selling the InvisibleAshok Kalra100% (3)

- Southwest Airlines Possible Solution-HBR CaseDocument17 pagesSouthwest Airlines Possible Solution-HBR Casekowshik yakkala100% (19)

- Ritz-Carlton's Consistent Excellence in Luxury HospitalityDocument23 pagesRitz-Carlton's Consistent Excellence in Luxury HospitalityMuneeb Ur-Rehman50% (2)