Professional Documents

Culture Documents

Taxation Trends in The European Union - 2012 71

Uploaded by

d05registerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Trends in The European Union - 2012 71

Uploaded by

d05registerCopyright:

Available Formats

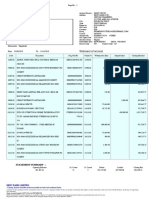

Part II

Developments in the Member States

The share of taxes on capital in GDP (9.5 %) is - despite a considerable drop in 2009 - still over 40 % above the

EU-27 average. This is due to the capital income taxation of corporations, which includes the Defence

Contributions, and amounts to more than twice the EU-27 average. While these taxes continued to fall in 2010

other taxes on capital such as the capital income of households and taxes on the stocks of capital/wealth picked up

slightly.

C

y

p

r

u

s

Albeit on a decreasing path, the share of environmental taxes in GDP in Cyprus (2.9 %) is still above EU-27

average. This is mainly due to the large share of transport taxes (1.1 % of GDP), which has been trending

downwards since 2007, but is still twice the EU-27 average. Revenue from energy taxes has almost tripled since

2000 as a proportion of GDP; the 2010 hike of 0.3 percentages points was bringing it in line with EU-27 average

(1.9 % of GDP). This development is also reflected in the ITR on energy.

Current topics and prospects; policy orientation

Given that despite tax increasing measures taken at the beginning of 2011 the budget deficit was expected to

increase further to around 6 %, three additional austerity packages were passed in 2011.

With the package of 26.8.2011 an additional tax bracket with a top rate of 35 % for personal income over 60 000

was introduced. Registered companies have to pay an annual levy of 350. The defence contribution on interest

payments on deposits of local banks was increase from 10 % to 15 % and the tax rate on dividends was increased

from 15 % to 17 %. Tax rates of the real estate tax were increased now ranging from 0 % to 0.8 %, depending on

the property value (previously 0 % - 0.4 %). The construction/purchase of first residences is now only subject to a

5 % VAT rate, while at the same time the existing funding scheme was abolished. Moreover, a permanent

contribution of 3 % on gross earnings of current government employees towards the government pension schemes

was introduced and the contribution to the widows and orphans fund was increased by 1.25 pp to 2 % of gross

earnings. A temporary special contribution to strengthen public finances was introduced. It is levied on gross

wages at progressive rates for 24 months, starting on 01.09.2011 for public sector employees. This special

contribution was extended to private sector employees and pensioners in the package of the 14.12.2011 coming

into effect on 01.12.2012. The rates for public and private sector employees were set at 2.5 % for income between

2 501 - 3 500, 3 % in the tax bracket 3 501 to 4 500 and 3.5 % above. The defence contribution for

dividends was raised to 20 % for two years as of 01.01.2012. Finally, with the last austerity package that

completed the legal process on 16.12.2011 an increase of the VAT from 15 % to 17 % as from 01.03.2012 was

passed.

Main features of the tax system

Personal income tax

Cyprus applies a personal income tax with a progressive rate structure. After 1991, three brackets were used, with

rates set at 20 %, 30 % and 40 %. The rates were reduced, however, in 2003 to 20 %, 25 % and 30 %. In 2011 an

additional tax bracket with a top rate of 35% for income over 60 000 was introduced. There is a standard relief

(basic allowance) which was progressively raised from 8 500 in 1995 up to 19 500 since 2008, as a result of

which the number of people subject to personal income tax has decreased substantially. Special provisions apply to

high earning individuals not having been resident of Cyprus before taking up the employment for the first 5 years.

A special contribution to strengthen public finances is levied on gross wages at progressive rates for 24 months, at

rates of 2.5% for income between 2.501 - 3.500, 3% in the tax bracket 3501 to 4500 and 3.5% above. The

special contribution is shared equally between the employer and the employee and deductible from taxable income.

Capital gains, in particular dividends, interest income and income from the sale of securities are exempt from

income taxation. They are taxed under the Defence Contribution and a capital gains tax on the disposal of

immovable property.

70

Taxation trends in the European Union

You might also like

- Taxation Trends in The European Union - 2012 225Document1 pageTaxation Trends in The European Union - 2012 225d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 219Document1 pageTaxation Trends in The European Union - 2012 219d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 222Document1 pageTaxation Trends in The European Union - 2012 222d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 214Document1 pageTaxation Trends in The European Union - 2012 214d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 221Document1 pageTaxation Trends in The European Union - 2012 221d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 223 PDFDocument1 pageTaxation Trends in The European Union - 2012 223 PDFd05registerNo ratings yet

- Taxation Trends in The European Union - 2012 223Document1 pageTaxation Trends in The European Union - 2012 223d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 217Document1 pageTaxation Trends in The European Union - 2012 217d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 213Document1 pageTaxation Trends in The European Union - 2012 213d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 215Document1 pageTaxation Trends in The European Union - 2012 215d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 211Document1 pageTaxation Trends in The European Union - 2012 211d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 212Document1 pageTaxation Trends in The European Union - 2012 212d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 198Document1 pageTaxation Trends in The European Union - 2012 198d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tom Lives On An Island and Has 20 Coconut TreesDocument1 pageTom Lives On An Island and Has 20 Coconut Treestrilocksp SinghNo ratings yet

- EFSL Annual Report FY2011-12Document184 pagesEFSL Annual Report FY2011-12ranokshivaNo ratings yet

- Clearing-Settlement and Risk Management of BATS at ISLAMABADDocument4 pagesClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989No ratings yet

- GR12 Business Finance Module 5-6Document10 pagesGR12 Business Finance Module 5-6Jean Diane JoveloNo ratings yet

- Trial Memorandum Plaintiff SAMPLEDocument10 pagesTrial Memorandum Plaintiff SAMPLEHannah Escudero100% (3)

- Financial Management Formulas With Solution VuabidDocument13 pagesFinancial Management Formulas With Solution Vuabidsaeedsjaan100% (3)

- Finman Financial Ratio AnalysisDocument26 pagesFinman Financial Ratio AnalysisJoyce Anne SobremonteNo ratings yet

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDocument10 pagesRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNo ratings yet

- Cpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Document4 pagesCpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Anthoni BacaniNo ratings yet

- BANKDocument25 pagesBANKAnand SharmaNo ratings yet

- Final Intership Report SampleDocument32 pagesFinal Intership Report SampleMaham QureshiNo ratings yet

- QA Cash Flow Statement 25.1.2010 PDFDocument8 pagesQA Cash Flow Statement 25.1.2010 PDFJanine padronesNo ratings yet

- AUDITING PROBLEMS IDocument9 pagesAUDITING PROBLEMS IEdlyn LiwagNo ratings yet

- Fundamental & Technical Analysis On HDFC BankDocument56 pagesFundamental & Technical Analysis On HDFC BankYogendra SanapNo ratings yet

- Nurul HidayanitaDocument11 pagesNurul HidayanitanurulNo ratings yet

- MBA 711 Chapter 06 Leverage and Capital SturctureDocument42 pagesMBA 711 Chapter 06 Leverage and Capital SturctureDesalegn Baramo GENo ratings yet

- Principles of Corporate Finance 12Th Edition Brealey Solutions Manual Full Chapter PDFDocument35 pagesPrinciples of Corporate Finance 12Th Edition Brealey Solutions Manual Full Chapter PDFgephyreashammyql0100% (11)

- Chapter 5: Risk and ReturnDocument31 pagesChapter 5: Risk and ReturnEyobedNo ratings yet

- Bear Stearns - Case Study Project ReportDocument6 pagesBear Stearns - Case Study Project ReportMarketing Expert100% (1)

- DMFI SAVING AND LOAN ANALYSISDocument20 pagesDMFI SAVING AND LOAN ANALYSISMehari TemesgenNo ratings yet

- Canadian Mortgage CalculatorDocument33 pagesCanadian Mortgage Calculatorvijay sainiNo ratings yet

- ACC2200 Milestone 1Document7 pagesACC2200 Milestone 1Kayla IgwuokuNo ratings yet

- Mission and Vision of The BSPDocument3 pagesMission and Vision of The BSPAnonymous loixthr100% (1)

- Assignment 1: Submitted byDocument9 pagesAssignment 1: Submitted byzarin tasnimNo ratings yet

- Bank Statement FinalDocument2 pagesBank Statement FinalShemeem SNo ratings yet

- Omnibus Counter Guarantee Aarti PhosphatesDocument3 pagesOmnibus Counter Guarantee Aarti PhosphatesChetan PatilNo ratings yet

- Chapter 2 - Measuring Income To Assess PerformanceDocument4 pagesChapter 2 - Measuring Income To Assess PerformanceArmanNo ratings yet

- CKSBDocument23 pagesCKSBayushiNo ratings yet

- China S Stock Market VolatilityDocument8 pagesChina S Stock Market Volatilitygabriel chinechenduNo ratings yet

- Chapter 24Document20 pagesChapter 24Daphne PerezNo ratings yet