Professional Documents

Culture Documents

Chap11 Translation Pbms

Uploaded by

kkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap11 Translation Pbms

Uploaded by

kkCopyright:

Available Formats

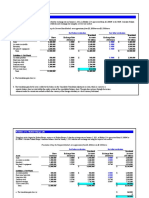

Problem 11.

1 Ganado Europe (A)

Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2006, in Exhibit 11.4 dropped in value from $1.2000/ to $0.9000/

rather than to $1.0000/. Recalculate Ganado Europes translated balance sheet for January 2, 2006 with the new exchange rate using the current rate method.

a. What is the amount of translation gain or loss?

b. Where should it appear in the financial statements?

Translation Using the Current Rate Method: euro depreciates from $1.2000/euro to $0.9000/euro.

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Euros

Statement

1,600,000

3,200,000

2,400,000

4,800,000

12,000,000

Liabilities & Net Worth

Accounts payable

Short-term bank debt

Long-term debt

Common stock

Retained earnings

CTA account (loss)

Total

800,000

1,600,000

1,600,000

1,800,000

6,200,000

12,000,000

Just before devaluation

Translated

Exchange Rate

Accounts

(US$/euro)

US dollars

1.2000

$

1,920,000

1.2000

3,840,000

1.2000

2,880,000

1.2000

5,760,000

$

14,400,000

1.2000

1.2000

1.2000

1.2760

1.2000

$

$

960,000

1,920,000

1,920,000

2,296,800

7,440,000

(136,800)

14,400,000

Just after devaluation

Exchange Rate

(US$/euro)

0.9000

0.9000

0.9000

0.9000

0.9000

0.9000

0.9000

1.2760

1.2000

$

$

$

a. The translation gain (loss) is ---------------------------------------------------------------------------------------------------------------->

Translated

Accounts

US dollars

1,440,000

2,880,000

2,160,000

4,320,000

10,800,000

720,000

1,440,000

1,440,000

2,296,800

7,440,000

(2,536,800)

10,800,000

(2,536,800)

136,800

(2,400,000)

b. The translation gain (loss) for the year is added to the balance in the Cumulative Translation adjustment account, which is carried as a separate balance

sheet account within the equity section of the consolidated balance sheet. The loss does not pass through the income statement under the Current Rate

Method, in which the currency of the foreign subsidiary is local currency functional.

Problem 11.2 Ganado Europe (B)

Using facts in the chapter for Ganado Europe, assume as in question Ganado Europe (A) that the exchange rate on January 2, 2006, in Exhibit 11.4 dropped in

value from $1.2000/ to $0.9000/ rather than to $1.0000/. Recalculate Ganado Europes translated balance sheet for January 2, 2006 with the new

exchange rate using the temporal rate method.

Translation Using the Temporal Method: euro depreciates from $1.2000/euro to $0.9000/euro.

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Euros

Statement

1,600,000

3,200,000

2,400,000

4,800,000

12,000,000

Liabilities & Net Worth

Accounts payable

Short-term bank debt

Long-term debt

Common stock

Retained earnings

CTA account (loss)

Total

800,000

1,600,000

1,600,000

1,800,000

6,200,000

12,000,000

Just before devaluation

Translated

Exchange Rate

Accounts

(US$/euro)

(US dollars)

1.2000

$

1,920,000

1.2000

3,840,000

1.2180

2,923,200

1.2760

6,124,800

$

14,808,000

1.2000

1.2000

1.2000

1.2760

1.2437

$

$

960,000

1,920,000

1,920,000

2,296,800

7,711,200

(0)

14,808,000

Just after devaluation

Exchange Rate

(US$/euro)

0.9000

0.9000

1.2180

1.2760

0.9000

0.9000

0.9000

1.2760

1.2437

$

$

$

a. The translation gain (loss) is: --------------------------------------------------------------------------------------------------------------->

b. Under the Temporal Method, the translation loss of $240,000 would be closed into retained earnings through the income statement,

rather than as a separate line item. It is shown as a separate line item above for pedagogical purposes only. Actual year-end retained

earnings would be $7,711,200 - $240,000 = $7,471,200.

c. The translation gain (loss) differs from the Current Rate Method because "exposed assets" under the Current Rate Method are larger than

under the temporal method by the amount of inventory and net plant & equipment.

Translated

Accounts

(US dollars)

1,440,000

2,880,000

2,923,200

6,124,800

13,368,000

720,000

1,440,000

1,440,000

2,296,800

7,711,200

(240,000)

13,368,000

(240,000)

0

(240,000)

Problem 11.3 Ganado Europe ( C )

Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2006, in Exhibit 11.4 appreciated from $1.2000/ to $1.500/.

Calculate Ganado Europe's translated balance sheet for January 2, 2006 with the new exchange rate using the current rate method.

Translation Using the Current Rate Method: euro appreciates from $1.2000/euro to $1.5000/euro.

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Euros

Statement

1,600,000

3,200,000

2,400,000

4,800,000

12,000,000

Liabilities & Net Worth

Accounts payable

Short-term bank debt

Long-term debt

Common stock

Retained earnings

CTA account (loss)

Total

800,000

1,600,000

1,600,000

1,800,000

6,200,000

12,000,000

Just before revaluation

Translated

Exchange Rate

Accounts

(US$/euro)

US dollars

1.2000

$

1,920,000

1.2000

3,840,000

1.2000

2,880,000

1.2000

5,760,000

$

14,400,000

1.2000

1.2000

1.2000

1.2760

1.2000

$

$

960,000

1,920,000

1,920,000

2,296,800

7,440,000

(136,800)

14,400,000

Just after revaluation

Exchange Rate

(US$/euro)

1.5000

1.5000

1.5000

1.5000

1.5000

1.5000

1.5000

1.2760

1.2000

$

$

$

a. The translation gain (loss) is: --------------------------------------------------------------------------------------------------------------->

Translated

Accounts

US dollars

2,400,000

4,800,000

3,600,000

7,200,000

18,000,000

1,200,000

2,400,000

2,400,000

2,296,800

7,440,000

2,263,200

18,000,000

2,263,200

136,800

2,400,000

b. The translation gain for the year is added to the balance in the Cumulative Translation adjustment account, which is carried as a separate balance sheet

account within the equity section of the consolidated balance sheet. The gain does not pass through the income statement under the current rate method in

which the currency of the foreign subsidiary is a local currency functional.

Problem 11.4 Ganado Europe (D)

Using facts in the chapter for Ganado Europe, assume as in Ganado Europe (C) that the exchange rate on January 2, 2006, in Exhibit 11.4 appreciated from

$1.2000/ to $1.5000/. Calculate Ganado Europes translated balance sheet for January 2, 2006 with the new exchange rate using the temporal method.

Translation Using the Temporal Method: euro appreciates from $1.2000/euro to $1.5000/euro.

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Euros

Statement

1,600,000

3,200,000

2,400,000

4,800,000

12,000,000

Liabilities & Net Worth

Accounts payable

Short-term bank debt

Long-term debt

Common stock

Retained earnings

CTA account (loss)

Total

800,000

1,600,000

1,600,000

1,800,000

6,200,000

12,000,000

Just before revaluation

Translated

Exchange Rate

Accounts

(US$/euro)

(US dollars)

1.2000

$

1,920,000

1.2000

3,840,000

1.2180

2,923,200

1.2760

6,124,800

$

14,808,000

1.2000

1.2000

1.2000

1.2760

1.2437

$

$

960,000

1,920,000

1,920,000

2,296,800

7,711,200

(0)

14,808,000

Just after revaluation

Exchange Rate

(US$/euro)

1.5000

1.5000

1.2180

1.2760

1.5000

1.5000

1.5000

1.2760

1.2437

a. The translation gain (loss) is:

$

$

$

$

b. Under the Temporal Method, the translation gain of $240,000 would be closed into retained earnings through the income statement,

rather than as a separate line item. It is shown as a separate line item above for pedagogical purposes only. Actual year-end retained

earnings would be $7,711,200 + $240,000 = $7,951,200.

c. The translation gain (loss) differs from the Current Rate Method because "exposed assets" under the Current Rate Method are larger than

under the temporal method by the amount of inventory and net plant & equipment.

Translated

Accounts

(US dollars)

2,400,000

4,800,000

2,923,200

6,124,800

16,248,000

1,200,000

2,400,000

2,400,000

2,296,800

7,711,200

240,000

16,248,000

240,000

0

240,000

Problem 11.5 Italiana S.A. (A)

Italiana S.A. is the Italian subsidiary of a British automobile spare parts company. The following is its

balance sheet as at December 31, when the exchange rate between the euro and the British pound was

1.3749/GBP.

Using the current rate method, calculate the contribution of the Italian subsidiary to the translation

exposure of its parent on December 31. Assume that there was no change in Italianicas accounts since the

beginning of the year.

Balance Sheet (thousands of euros)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Liabilities & Net Worth

Current liabilities

Long-term debt

Capital stock

Retained earnings

Calculation of Accounting Exposures:

Exposed assets (all assets)

Less exposed liabilities (curr liabs + lt debt)

a) Net exposure

December 31st

95,000

180,000

125,000

250,000

650,000

60,000

110,000

350,000

130,000

650,000

(000s)

650,000

(170,000)

480,000

Exchange Rate

/

1.3749

1.37

1.37

1.37

1.37

1.37

1.37

1.37

b) Translation

Dec-31

/

1.37

472,762

(123,645)

349,116

Problem 11.6 Italiana S.A. (B)

Please refer to the same balance sheet as in Problem 5. Calculate Italianicas contribution to its British

parents translation loss if the exchange rate on December 31 is 1.4/. Assume that there are no changes

in the accounts of the subsidiary in euros during the last six months.

Balance Sheet (thousands of euros)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Liabilities & Net Worth

Current liabilities

Long-term debt

Capital stock

Retained earnings

Calculation of Accounting Exposures:

Exposed assets (all assets)

Less exposed liabilities (curr liabs + lt debt)

Net exposure

Exchange Rate

(/)

1.40

1.40

1.40

1.40

June 30th

95,000

180,000

125,000

250,000

650,000

60,000

110,000

350,000

130,000

650,000

(000s)

650,000

(170,000)

480,000

1.40

1.40

1.40

1.40

$

$

June 30th

/

1.40

464,286

(121,429)

342,857

Problem 11.7 Italiana S.A. (C)

Calculate Italianas contribution to its parents translation gain/loss using the current rate method if the

exchange rate on September 30 is 1.2/. Assume that there are no changes in the accounts of the

subsidiary in euros during the last nine months.

Balance Sheet (thousands of euros)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Liabilities & Net Worth

Current liabilities

Long-term debt

Capital stock

Retained earnings

Calculation of Accounting Exposures:

Exposed assets (all assets)

Less exposed liabilities (curr liabs + lt debt)

Net exposure

December 30th

95,000

180,000

125,000

250,000

650,000

60,000

110,000

350,000

130,000

650,000

(000s)

650,000

(170,000)

480,000

Exchange Rate

(/)

1.20

1.20

1.20

1.20

1.20

1.20

1.20

1.20

December 30th

(/)

1.20

$

541,667

(141,667)

$

400,000

Problem 11.8 Bangkok Instruments, Ltd (A)

Bangkok Instruments, Ltd., is the Thai affiliate of a U.S. seismic instrument manufacturer. Bangkok Instruments manufactures the instruments primarily for the oil

and gas industry globally, though with recent commodity price increases of all kinds -- including copper -- its business has begun to grow rapidly. Sales are

primarily to multinational companies based in the United States and Europe. bankok Instruments' balance sheet in thousands of Thai bahts (B) as of March 31st is

as follows.

Using the data presented, assume that the Thai baht dropped in value from B30/$ to B40/$ between March 31st and April 1st. Assuming no change in balance

sheet accounts between these two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation

gain or loss in terms of changes in the value of exposed accounts.

TRANSLATION BY THE CURRENT RATE METHOD

Balance Sheet (thousands)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Liabilities & Net Worth

Accounts payable

Bank loans

Common stock

Retained earnings

CTA account (loss)

Total

Before Devaluation

Thai baht

Statement

24,000

36,000

48,000

60,000

168,000

Exchange Rate

(Baht/US$)

30

30

30

30

18,000

60,000

18,000

72,000

0

168,000

30

30

20

34

After Devaluation

Translated

Accounts

US dollars

800

1,200

1,600

2,000

5,600

Exchange Rate

(Baht/US$)

40

40

40

40

600

2,000

900

2,100

5,600

40

40

20

34

$

$

Translated

Accounts

US dollars

600

900

1,200

1,500

4,200

450

1,500

900

2,100

(750)

4,200

Note: Dollar retained earnings before devaluation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange

rates in effect in each of those years.

This cumulative translation account (CTA) loss of $750,000 would be entered into the company's consolidated balance sheet under equity.

TRANSLATION BY THE TEMPORAL METHOD

Balance Sheet (thousands)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Liabilities & Net Worth

Accounts payable

Bank loans

Common stock

Retained earnings

CTA account (loss)

Total

Before Devaluation

Thai baht

Statement

24,000

36,000

48,000

60,000

168,000

Exchange Rate

(Baht/US$)

30

30

30

20

18,000

60,000

18,000

72,000

0

168,000

30

30

20

23

After Devaluation

Translated

Accounts

US dollars

800

1,200

1,600

3,000

6,600

Exchange Rate

(Baht/US$)

40

40

30

20

600

2,000

900

3,100

6,600

40

40

20

23

$

$

Note a: Dollar retained earnings before devaluation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange

rates in effect in each of those years.

Note b: Retained earnings after devaluation are translated at the same effective rate (see Note a) as before devaluation.

The translation gain of $150,000 would be passed-through to the consolidated income statement.

EXPLANATION OF DIFFERENT OUTCOME BY TRANSLATION METHODOLOGY

The Temporal Method results in a translation gain, as opposed to the CTA loss found under the Current Rate Method, because of the different

exchange rates used against Net plant & equipment and the inventory line items. This gain would be impossible under the Current Rate

Method because ALL assets are exposed under that method, whereas the Temporal Method carries Net plant & equipment and inventory

at relevant historical exchange rates.

Translated

Accounts

US dollars

600

900

1,600

3,000

6,100

450

1,500

900

3,100

150

6,100

Problem 11.9 Bangkok Instruments, Ltd (B)

Using the original data provided for Bangkok Instruments, assume that the Thai baht appreciated in value from B30/$ to B25/$ between March 31 and April 1.

Assuming no change in balance sheet accounts between those two days, calculate the gain or loss from translation by both the current rate method and the

temporal method. Explain the translation gain or loss in terms of changes in the value of exposed accounts.

TRANSLATION BY THE CURRENT RATE METHOD

Balance Sheet (thousands)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Liabilities & Net Worth

Accounts payable

Bank loans

Common stock

Retained earnings

CTA account (loss)

Total

Before Devaluation

Thai baht

Statement

24,000

36,000

48,000

60,000

168,000

Exchange Rate

(Baht/US$)

30

30

30

30

18,000

60,000

18,000

72,000

0

168,000

30

30

20

34

After Devaluation

Translated

Accounts

US dollars

800

1,200

1,600

2,000

5,600

Exchange Rate

(Baht/US$)

25

25

25

25

600

2,000

900

2,100

5,600

25

25

20

34

$

$

Translated

Accounts

US dollars

960

1,440

1,920

2,400

6,720

720

2,400

900

2,100

600

6,720

Note: Dollar retained earnings before devaluation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange

rates in effect in each of those years.

This cumulative translation account (CTA) gain of $600,000 would be entered into the company's consolidated balance sheet under equity.

TRANSLATION BY THE TEMPORAL METHOD

Balance Sheet (thousands)

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Liabilities & Net Worth

Accounts payable

Bank loans

Common stock

Retained earnings

CTA account (loss)

Total

Before Devaluation

Thai baht

Statement

24,000

36,000

48,000

60,000

168,000

Exchange Rate

(Baht/US$)

30

30

30

20

18,000

60,000

18,000

72,000

0

168,000

30

30

20

23

After Devaluation

Translated

Accounts

US dollars

800

1,200

1,600

3,000

6,600

Exchange Rate

(Baht/US$)

25

25

30

20

600

2,000

900

3,100

6,600

25

25

20

23

$

$

Note a: Dollar retained earnings before devaluation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange

rates in effect in each of those years.

Note b: Retained earnings after devaluation are translated at the same effective rate (see Note a) as before devaluation.

The translation loss of $120,000 would be passed-through to the consolidated income statement.

EXPLANATION OF DIFFERENT OUTCOME BY TRANSLATION METHODOLOGY

The Temporal Method results in a translation gain, as opposed to the CTA loss found under the Current Rate Method, because of the different

exchange rates used against Net plant & equipment and the inventory line items. This gain would be impossible under the Current Rate

Method because ALL assets are exposed under that method, whereas the Temporal Method carries Net plant & equipment and inventory

at relevant historical exchange rates.

Translated

Accounts

US dollars

960

1,440

1,600

3,000

7,000

720

2,400

900

3,100

(120)

7,000

Problem 11.10 Cairo Ingot, Ltd.

Cairo Ingot, Ltd., is the Egyptian subsidiary of TransMediterranean Aluminum, a British multinational that fashions automobile engine blocks from aluminum. TransMediterraneans home reporting currency is the British pound. Cairo Ingots December 31st balance sheet is shown below. At the date of this balance sheet the exchange

rate between Egyptian pounds and British pounds sterling was E5.50/UK.

a. What is Cairo Ingots contribution to the translation exposure of Trans-Mediterranean on December 31st, using the current rate method?

b. Calculate the translation exposure loss to Trans-Mediterranean if the exchange rate at the end of the following quarter is E6.00/. Assume all balance sheet accounts

are the same at the end of the quarter as they were at the beginning.

Balance Sheet of Cairo Ingot, Ltd.

Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Egyptian pounds

Statement

16,500,000

33,000,000

49,500,000

66,000,000

165,000,000

Liabilities & Net Worth

Accounts payable

Long-term debt

Invested capital

CTA account (loss)

Total

a. Calculation of Actg Exposures:

Exposed assets (all assets)

Less exposed liabilities (c.liabs + lt debt)

Net exposure

24,750,000

49,500,000

90,750,000

165,000,000

Egyptian pounds

165,000,000

(74,250,000)

90,750,000

Before Exchange Rate Change

Translated

Exchange Rate

Accounts

British pounds

(Egyptian /UK)

5.50

3,000,000.00

5.50

6,000,000

5.50

9,000,000

5.50

12,000,000

30,000,000.00

5.50

5.50

5.50

4,500,000.00

9,000,000

16,500,000

30,000,000.00

December 31st

5.50

30,000,000.00

(13,500,000)

16,500,000.00

After Exchange Rate Change

Translated

Exchange Rate

Accounts

British pounds

(Egyptian /UK)

6.00

2,750,000.00

6.00

5,500,000

6.00

8,250,000

6.00

11,000,000

27,500,000.00

6.00

6.00

5.50

4,125,000.00

8,250,000

16,500,000

-1,375,000.00

27,500,000.00

End of Quarter

6.00

27,500,000.00

(12,375,000)

15,125,000.00

b. Change in translation exposure: Gain (Loss)

-1,375,000.00

Alternatively, the translation loss arising from the fall in the value of the Egyptian pound can be found as follows:

Net exposed assets ()

Percentage change in the value of the British pound

Translation gain (loss)

16,500,000.00

-8.3%

-1,375,000.00

You might also like

- Translation Gains and Losses Under Current and Temporal MethodsDocument10 pagesTranslation Gains and Losses Under Current and Temporal MethodsnahorrNo ratings yet

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- MBF13e Chap08 Pbms - FinalDocument25 pagesMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)

- International FinanceDocument10 pagesInternational FinancelabelllavistaaNo ratings yet

- MBF13e Chap06 Pbms - FinalDocument20 pagesMBF13e Chap06 Pbms - Finalaveenobeatnik100% (2)

- Chap12 Pbms MBF12eDocument10 pagesChap12 Pbms MBF12eBeatrice BallabioNo ratings yet

- MBF13e Chap10 Pbms - FinalDocument17 pagesMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- BioTron Medical Foreign Exchange Risk AnalysisDocument19 pagesBioTron Medical Foreign Exchange Risk AnalysisQurratul Asmawi100% (2)

- Week 3 Tutorial ProblemsDocument6 pagesWeek 3 Tutorial ProblemsWOP INVESTNo ratings yet

- MBF13e Chap20 Pbms - FinalDocument11 pagesMBF13e Chap20 Pbms - FinalAnonymous 8ooQmMoNs1100% (3)

- MBF14e Chap06 Parity Condition PbmsDocument23 pagesMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- CH 7Document7 pagesCH 7Asad Ehsan Warraich100% (3)

- 6.18 East Asiatic CompanyDocument2 pages6.18 East Asiatic Companydummy yummyNo ratings yet

- Chap15 Tax PbmsDocument10 pagesChap15 Tax PbmskkNo ratings yet

- BUS322Tutorial9 SolutionDocument15 pagesBUS322Tutorial9 Solutionjacklee1918100% (1)

- Ch07 SSolDocument7 pagesCh07 SSolvenkeeeee100% (1)

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- Problem 11.3Document1 pageProblem 11.3SamerNo ratings yet

- BUS322Tutorial5 SolutionDocument20 pagesBUS322Tutorial5 Solutionjacklee191825% (4)

- MBF14e Chap06 Parity Condition PbmsDocument23 pagesMBF14e Chap06 Parity Condition Pbmsanon_355962815No ratings yet

- Finance - Module 7Document3 pagesFinance - Module 7luckybella100% (1)

- BUS322Tutorial8 SolutionDocument10 pagesBUS322Tutorial8 Solutionjacklee1918100% (1)

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX Marketskk50% (2)

- Chap08 Pbms SolutionsDocument25 pagesChap08 Pbms SolutionsDouglas Estrada100% (1)

- Chap07 Pbms MBF12eDocument22 pagesChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- FX IV PracticeDocument10 pagesFX IV PracticeFinanceman4100% (4)

- FNE306 Assignment 6 AnsDocument9 pagesFNE306 Assignment 6 AnsCharles MK ChanNo ratings yet

- Laura Cervantes currency speculator problemDocument5 pagesLaura Cervantes currency speculator problemWOP INVESTNo ratings yet

- Tristan Narvaja's Contribution to Translation Exposure Using Current Rate Method (ADocument1 pageTristan Narvaja's Contribution to Translation Exposure Using Current Rate Method (ASamerNo ratings yet

- MBF14e Chap02 Monetary System PbmsDocument13 pagesMBF14e Chap02 Monetary System PbmsKarlNo ratings yet

- Week 5 Tutorial ProblemsDocument6 pagesWeek 5 Tutorial ProblemsWOP INVESTNo ratings yet

- Pbm7 2Document1 pagePbm7 2jordi92500No ratings yet

- IFM TB Ch08Document9 pagesIFM TB Ch08isgodNo ratings yet

- Mid-Term I Review QuestionsDocument7 pagesMid-Term I Review Questionsbigbadbear3100% (1)

- MBF13e Chap07 Pbms - FinalDocument21 pagesMBF13e Chap07 Pbms - FinalMatthew Stojkov100% (6)

- Tutorial 4 Exercises IFMDocument5 pagesTutorial 4 Exercises IFMNguyễn Gia Phương Anh100% (1)

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Fund 4e Chap07 PbmsDocument14 pagesFund 4e Chap07 PbmsPablo MelchorNo ratings yet

- SS - 08partDocument11 pagesSS - 08partMrudul KotiaNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- Fund 4e Chap07 PbmsDocument14 pagesFund 4e Chap07 Pbmsjordi92500100% (1)

- P&G India hedges Japanese yen payableDocument17 pagesP&G India hedges Japanese yen payableNguyễn Gia Phương Anh100% (1)

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Sallie Schnudel currency option choicesDocument1 pageSallie Schnudel currency option choicesSamer100% (1)

- Ex - TransExposure SOLDocument5 pagesEx - TransExposure SOLAlexisNo ratings yet

- Chapter 6 Excel - CIA1Document10 pagesChapter 6 Excel - CIA1tableroof100% (1)

- Total Inflow Total Outflow Net Inflow or Ouftlow Expected Exchange Rate Net Inflow or Outflow As Measured in US Dollars British PoundsterlingDocument3 pagesTotal Inflow Total Outflow Net Inflow or Ouftlow Expected Exchange Rate Net Inflow or Outflow As Measured in US Dollars British Poundsterlingcatarina alexandriaNo ratings yet

- DerivativeDocument16 pagesDerivativeShiro Deku100% (1)

- Inventory Simulation Game Student HandoutDocument3 pagesInventory Simulation Game Student HandoutRhobeMitchAilarieParelNo ratings yet

- International Corporate Finance March 22, 2011: Managing Operating Exposure Suggested Exercises: 1, 4, 6Document54 pagesInternational Corporate Finance March 22, 2011: Managing Operating Exposure Suggested Exercises: 1, 4, 6faycal626No ratings yet

- Translation Exposure Problems ModuleDocument7 pagesTranslation Exposure Problems ModuleAlissa BarnesNo ratings yet

- Solutions To Multiple Choice Questions, Exercises and ProblemsDocument41 pagesSolutions To Multiple Choice Questions, Exercises and ProblemsJan SpantonNo ratings yet

- Operating ExposureDocument27 pagesOperating Exposureashu khetanNo ratings yet

- Operating Exposure (Or Chapter 9)Document19 pagesOperating Exposure (Or Chapter 9)sindhupallavigundaNo ratings yet

- Block 3 Adjustments To Company AccountsDocument49 pagesBlock 3 Adjustments To Company AccountsNguyễn Hạnh Linh100% (1)

- Week 7 Homework Problems & AnswersDocument4 pagesWeek 7 Homework Problems & Answersleelee0302No ratings yet

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- Trident Europe current rate translation with euro appreciationDocument3 pagesTrident Europe current rate translation with euro appreciationatierazainolNo ratings yet

- baitap-sinhvien-IAS 21Document12 pagesbaitap-sinhvien-IAS 21tonight752No ratings yet

- Solution Manual Self Made BAF 433Document3 pagesSolution Manual Self Made BAF 433kkNo ratings yet

- Chap15 Tax PbmsDocument10 pagesChap15 Tax PbmskkNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX Marketskk50% (2)

- Extrachapter6 ACO311Document16 pagesExtrachapter6 ACO311kkNo ratings yet

- GE Hca15 PPT ch02Document35 pagesGE Hca15 PPT ch02kkNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX Marketskk50% (2)

- Health Promotion Throughout The Life Span 8Th Edition Edelman Test Bank Full Chapter PDFDocument30 pagesHealth Promotion Throughout The Life Span 8Th Edition Edelman Test Bank Full Chapter PDFDeborahAndersonmkpy100% (10)

- MSS Command ReferenceDocument7 pagesMSS Command Referencepaola tixeNo ratings yet

- Activity 1.docx AjDocument2 pagesActivity 1.docx AjMaya BabaoNo ratings yet

- Using Accelerometers in A Data Acquisition SystemDocument10 pagesUsing Accelerometers in A Data Acquisition SystemueidaqNo ratings yet

- Deflected Profile of A BeamDocument2 pagesDeflected Profile of A BeamPasindu MalithNo ratings yet

- Solids, Liquids and Gases in the HomeDocument7 pagesSolids, Liquids and Gases in the HomeJhon Mark Miranda SantosNo ratings yet

- 10 Common Problems in The ClassroomDocument2 pages10 Common Problems in The ClassroomNonnie CamporedondoNo ratings yet

- MNL036Document22 pagesMNL036husni1031No ratings yet

- Hrm-Group 1 - Naturals Ice Cream FinalDocument23 pagesHrm-Group 1 - Naturals Ice Cream FinalHarsh parasher (PGDM 17-19)No ratings yet

- R 449 PDFDocument24 pagesR 449 PDFKhaleel KhanNo ratings yet

- W1 PPT ch01-ESNDocument21 pagesW1 PPT ch01-ESNNadiyah ElmanNo ratings yet

- IIT Ropar Calculus Tutorial Sheet 1Document2 pagesIIT Ropar Calculus Tutorial Sheet 1jagpreetNo ratings yet

- Write EssayDocument141 pagesWrite Essayamsyous100% (1)

- Pavement Design and Maintenance: Asset Management Guidance For Footways and Cycle RoutesDocument60 pagesPavement Design and Maintenance: Asset Management Guidance For Footways and Cycle RoutesGaneshmohiteNo ratings yet

- Validate Analytical MethodsDocument9 pagesValidate Analytical MethodsFernando Silva BetimNo ratings yet

- Frusciante InterviewsDocument21 pagesFrusciante Interviewslukiguitar100% (1)

- CHAPTER 7development StrategiesDocument29 pagesCHAPTER 7development StrategiesOngHongTeckNo ratings yet

- Interventional Radiology & AngiographyDocument45 pagesInterventional Radiology & AngiographyRyBone95No ratings yet

- Arduino Project: Smart Irrigation SystemDocument13 pagesArduino Project: Smart Irrigation SystemAleeza AnjumNo ratings yet

- 27 of The Best Ever Sex Positions To Play DirtyDocument1 page27 of The Best Ever Sex Positions To Play DirtyFrankie CulbertsonNo ratings yet

- Class XII PHY - EDDocument7 pagesClass XII PHY - EDsampoornaswayamNo ratings yet

- Agriculture DisciplineDocument3 pagesAgriculture DisciplineUmair FaheemNo ratings yet

- Malunggay cooking oil substituteDocument5 pagesMalunggay cooking oil substitutebaba112No ratings yet

- Reactive DyeingDocument23 pagesReactive Dyeingshivkalia8757100% (2)

- A Complete Guide To Amazon For VendorsDocument43 pagesA Complete Guide To Amazon For Vendorsnissay99No ratings yet

- 01 035 07 1844Document2 pages01 035 07 1844noptunoNo ratings yet

- Speaking Topics b1Document3 pagesSpeaking Topics b1Do HoaNo ratings yet

- Reading - Zeeshan UsmaniDocument25 pagesReading - Zeeshan UsmaniHanif AbbasNo ratings yet

- BIO125 Syllabus Spring 2020Document3 pagesBIO125 Syllabus Spring 2020Joncarlo EsquivelNo ratings yet

- Measurement Techniques Concerning Droplet Size Distribution of Electrosprayed WaterDocument3 pagesMeasurement Techniques Concerning Droplet Size Distribution of Electrosprayed Waterratninp9368No ratings yet