Professional Documents

Culture Documents

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

--- Jagronpal

Finance (?1LeMing Limited

0-45, Ground Floor, Pamposh Enclave, Greater Kailash-I, New Oelhi-11 0048 CIN No. L659290L 1991 PLC043182

Tel' 011-26238849 Fax 011-41633812 Web: www.jagsonpal co In, Email jagsonpalfinance@gmailcom

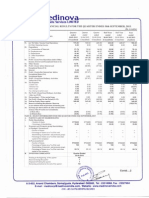

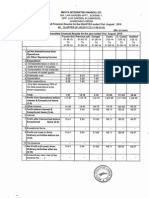

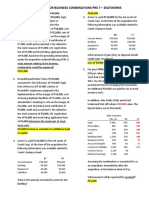

U AUDITED RESULTS FOR THE QUARTER AND HALF YEAR ENDED SEPTEMBER 30, 2015

Part - I

PARTICULARS

I Income from Operations

2 Expenditure

Employee Cost

Other expenditure

Depreciation

total

3 Profit/tl.oss) from operation (1-2)

before Interest & Exceptional items

4 Other Income

5 Profit'(l.oss) from operation (3+4)

before Interest & Exceptional items

6 Finance Cost

7 Profit/Il.oss) after interest (5-6)

before Exceptional items

8 Exceptional items

9 Profit/Il.oss) before tax (7-8)

10 Tax Expenses

II Net Profit/tl.oss) after tax (9-10)

12 Extra ordinary Income

13 Net Profit/tl.oss) for there period

(11-12)

14 Paid up Equity Share Capital

(Face value of the per shares Rs.IO/-)

15 Reserves

16 Earning Per Shares (Rs.)

a) Basic and Diluted before Extra-ordinary items

(Rs. in Lacs

Unaudited Unaudited Unaudited Unaudited Unaudited Audited

half year

the year

three montr three rnontl three rnontr half year

ended

ended

ended

ended

ended

ended

30.09.201530.06.201530.09.20143009.2015

30.09.2014 31.03.2015

0.59

(6.42)

(52.41 ) (1554)

(67.95)

(27.27)

b) Basic and Diluted after Extra-ordinay items

1.74

1.67

2.89

000

4.63

(5704)

3.16

000

4.83

(2037)

040

(56.64)

1.61

1.83

3.41

7.45

(986)

4.72

0.00

8.13

(76.08)

3.39

4.35

0.00

7.74

(35.01 )

(12.74)

(2009)

0.38

(948)

0.68

(7540)

0.54

(3447)

1.55

(11.19)

0.00

(56.64)

0.00

(2009)

0.00

(948)

0.00

(7540)

0.00

(3447)

0.00

(11.19)

0.00

(5664)

0.00

(56.64)

0.00

0.00

(2009)

0.00

(2009)

0.00

0.00

(948)

0.00

(9.48)

0.00

(7540)

0.00

(75.40)

0.00

(3447)

0,00

(34.47)

0.00

(11.19)

0.00

0.00

0.00

(56.64)

550.04

(2009)

550.04

(75.40)

(34.47)

550.04

550.04

550.04

(1119)

550.04

(1.03)

(036)

(017)

(137)

(063)

(020)

(1.03)

(036)

(017)

(137)

(063)

(020)

0.28

000

3.44

(9.48)

5.88

0.00

13.33

0.00

(11.19)

0.00

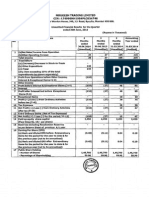

INFORMATION FOR THE QUARTER AND HALF YEAR ENDED SEPTEMBER 30, 2015

Part - II

Unaudited Unaudited Unaudited Unaudited Unaudited Audited

PARTICULARS

three rnontr three montr three montr half year

half year

the year

ended

ended

ended

ended

ended

ended

3009.2015300620153009.2014300920153009201431.03.2015

A

PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

2423390

2423390

2423390

2423390

2423390 2423390

- Percentage of Shareholding

44.06

44.06

4406

4406

44.06

4406

2 Promoters & Promoters Group Shareholding

a)Pledge/Encumbered

umber of Shares

- Percentage of Shares

(as a% of the total shareholding of promoter and

promoter group)

Percentage of Shares

(as a% of the total Share Capital of the company)

b) on-encumbered

- Number of Shares

3077010

3077010

3077010

3077010

30770 I 0 30770 10

- Percentage of Shares

100.00

100.00

100.00

100.00

100.00

100.00

(as a% of the total shareholding of promoter and

promoter group)

- Percentage of Shares

55.94

55.94

55.94

55.94

55.94

55.94

(as a% of the total Share Capital of the company)

13

PARTICULARS

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Quarter ended September 30, 2015

Nil

For Jagsonpal Finance & Leasing Ltd.

~~-

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

I

I

il

I) The above unaudited results were reviewed by Audit Committee and taken on record by the Board

or DIrectors in their meeting held on 13th November,20 15.

2) The Statutory Auditor of the company have carried out the Limited Review for the quarter ended

30th September 2015.

3) Statement of Assets and Liabilities as at 30th September, 2015.

Rs. In lacs

PARTICULARS

A

Unaudited

30.9.2015

Audited

3JJ.2015

EQUITY AND LIABILITIES

Shareholders' fund

(a) Share Capital

(b) Reserves and Surplus

Sub Total- Shareholders' fund

2 Current Liabilities

(a) Trade payables

(b) Other current Liabiluies

(c) Short-term provisions

Sub Total -Current liabilities

TOTAL - EQUITY AND LIABILITIES

BASSETS

Non-current Assets

(a) Fixed assets

(b) Long-term loans and advances

Sub-total- Non-current assets

2 Current Assets

(a) Inventories

(b) Cash and Cash equivalents

(c) Trade receivable

(d) Short-term loans and advances

Sub-total- Current Assets

TOTAL- ASSETS

~) The figures has been regrouped/re-arranged

ew Delhi, 13th November, 2015

55004

-441.39

108.65

550.04

-365.99

184.05

0.41

2.38

136.10

0.10

3.13

24.66

27.89

211.94

0.00

13.25

13.25

0.00

13.25

13.25

71.01

73.55

26.75

5.63

92.76

198.69

211.94

24.66

27.45

5.58

5.63

34.63

122.85

136.10

wherever necessary.

For and on Behalf of the Board of Directors

(KPS KOCHHAR) Managing Director

DIN 00529230

P.P. THUKRAL & CO.

54, LGF, WORLD TRADE CENTRE,

BABAR ROAD, NEW DELHI- 110 001

CHARTERED

PH.: 23709115,23413486

ACCOUNTANTS

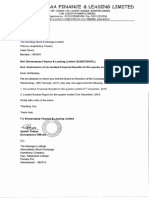

Review Report

To the Board of Directors of Jagsonpal Finance & Leasing Ltd.

1.

We have reviewed

the accompanying

Leasing Ltd ("the Company")

the Company

disclosures

pursuant

regarding

Committee

for the quarter

of un-audited

ended J.30,

financial

'Public

Shareholding'

and 'Promoter

made by the management

of the Company's

of Board of Directors.

management

Our responsibility

results of Jagsonpal

2015 ("the Statement"),

to Clause 41 of the Listing Agreement

been traced from disclosures

the responsibility

statement

being submitted

with the Stock Exchanges.

and Promoter

Finance &

by

except for the

Group Shareholding'

which have

and have not been audited by us. This statement

and has been approved

by the Board

is

of Directors!

is to issue a report on these financial statements

based

on our review.

2.

We conducted

our review in accordance

Interim Financial

of Chartered

moderate

information

Accountants

assurance

obtain moderate

with the Standard on Review Engagement

Performed

of India.

by the Independent

review is limited primarily

data and thus provides

as to whether

statement

the financial

requires that we plan and perform the review to

statement

to inquiries of company personnel

less assurance

issued by the Institute

This standard required that we plan and perform the review to obtain

as to whether the financial

assurance

Auditor of the Entity'

(SRE) 2410, 'Review of

than an audit.

are free of material

and analytical

procedures

We have not performed

misstatement.

applied to financial

an audit and accordingly,

we

do not express an audit opinion.

3.

Based on our review conducted

the accompanying

statement

as above, nothing has come to our attention

prepared

in accordance

with the Accounting

Companies

Act, 2013, read with Rule 7 of the Companies

accounting

practices

be disclosed

and policies generally

accepted

(Account)

Statdard as per Section 133 of the

Rule, 2014, and other recognized

in India has not disclosed

in terms of Clause 41 of the Listing Agreement

manner in which it is to be disclosed,

that causes us to believe that

the information

with the Stock Exchanges

or that it contains any material misstatement.

For P. P. THUKRAL & CO.

Chartered Accountants

Place : New Delhi

Dated:

13.1 1.2015

#

~

(Partner)

M.No. 089318

F.R.N.000632N

required to

including

the

You might also like

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Updates On Financial Results For Sept 30, 2015 (Result)Document5 pagesUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document4 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Materi Bu AprilDocument29 pagesMateri Bu AprilQorry Aini HaniNo ratings yet

- Investments and International Operations QuizDocument61 pagesInvestments and International Operations Quizlana del reyNo ratings yet

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingNo ratings yet

- Financial Management-Module 2 NewDocument29 pagesFinancial Management-Module 2 New727822TPMB005 ARAVINTHAN.SNo ratings yet

- Financial Accounting Problem Set ReviewDocument60 pagesFinancial Accounting Problem Set ReviewJill SolisNo ratings yet

- Business Combination Q4Document2 pagesBusiness Combination Q4Sweet EmmeNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 7 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- Case StudyDocument7 pagesCase StudyPatricia TabalonNo ratings yet

- Accounting For Business Combinations Pre 7 - SeatworksDocument4 pagesAccounting For Business Combinations Pre 7 - SeatworksJalyn Jalando-on50% (2)

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Mas Board RaisingDocument23 pagesMas Board Raisingneo14No ratings yet

- Cost of Capital2022Document39 pagesCost of Capital2022Yassin IslamNo ratings yet

- Personal Assignment Fraud Audit ReviewDocument8 pagesPersonal Assignment Fraud Audit ReviewNimas KartikaNo ratings yet

- CH 10 Accruals and PrepaymentsDocument8 pagesCH 10 Accruals and PrepaymentsBuntheaNo ratings yet

- Chapter 2 Financial Statements and Accounting Concepts and PrinciplesDocument57 pagesChapter 2 Financial Statements and Accounting Concepts and Principlesbrendon laverNo ratings yet

- Ch09 BudgetingDocument118 pagesCh09 Budgetingemanmaryum7No ratings yet

- 06 Quiz 1Document1 page06 Quiz 1Angelo MorenoNo ratings yet

- Chapter - 2 - Exercise & Problems ANSWERSDocument5 pagesChapter - 2 - Exercise & Problems ANSWERSFahad Mushtaq100% (2)

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- Chapter 5 Advanced AccountingDocument19 pagesChapter 5 Advanced AccountingMarife De Leon VillalonNo ratings yet

- Analyzing Financial Statement of Vinamilk Group 2Document24 pagesAnalyzing Financial Statement of Vinamilk Group 2Phan Thị Hương TrâmNo ratings yet

- Accounting Cost ConceptsDocument57 pagesAccounting Cost ConceptsMelanie GraceNo ratings yet

- Fundamentals of Accountancy and Business Management 2 - Financial Statement AnalysisDocument7 pagesFundamentals of Accountancy and Business Management 2 - Financial Statement AnalysisTwelve Forty-fourNo ratings yet

- Funds and CashDocument65 pagesFunds and Cashramesh vaishnav100% (1)

- MBA Accounting For Managers MBA 201Document4 pagesMBA Accounting For Managers MBA 201AMIT JANGIR50% (2)

- Dilutive Earnings Per ShareDocument3 pagesDilutive Earnings Per ShareMargielyn ErguizaNo ratings yet

- Chapter 09, Modern Advanced Accounting-Review Q & ExrDocument28 pagesChapter 09, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- Financial Accounting Part 3 Quiz 1Document1 pageFinancial Accounting Part 3 Quiz 1Jenica Joyce Bautista100% (1)

- Zgjidhje Ushtrime InvaDocument6 pagesZgjidhje Ushtrime InvainvaNo ratings yet

- Financial Analysis InsDocument56 pagesFinancial Analysis InsAbebe TilahunNo ratings yet