Professional Documents

Culture Documents

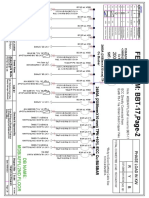

Capex FTTH PDF

Uploaded by

Japari JaporaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capex FTTH PDF

Uploaded by

Japari JaporaCopyright:

Available Formats

Very High Broadband in the Local Loop

May 2007

Very High Broadband FTTx- in the local loop

Moving Europe towards the future?

Abstract

Fiber based broadband access is considered the long-term goal for last mile access

Regulation is taking place in many European countries to enable the development of these

New Generation Networks

VDSL and FTTx disrupt current strategies of alternative operators and highly impact their

broadband positioning.

Network Migration

Competition and the appetite of the consumers

for multimedia offerings entice operators to

deploy the Next Generation of Local Loop

Infrastructure, enabling higher Data Rates up

to the Consumer. Fiber based broadband

access is considered the ultimate and most

future-proof last mile platform since its capacity

for high bandwidth is unmatched by any other

delivery platform. Major European operators

have so far started their first launch of Fiber

based network deployment.

This is a real change as up to recently fiber

deployments

in

Europe

were

mainly

outspringing from public initiatives, be it in

France ( among others: Sipperec, Conseil

Gnral Hauts de Seine.) or in Netherlands (

Amsterdam Rotterdam, Eindhoven.) Sweden

(176 municipal projects with according to B2,

5-7% of all subscribers connected to a neutral

active network), Iceland (Reykjavik).

Despite these new activities outspringing from

private operators, Europe is still expected to

lag behind the growth of FTTH occuring in

North-America or in Asia.

In April 2007 NTT revealed that fibre-optic

networks have overtaken ADSL lines as NTTs

most popular broadband internet access

method. According to the telco, ADSL

subscribers fell for the first time since the

introduction of ADSL in 2000, down 360,000 in

the last year to 5.32 million. Meanwhile, during

the same period 2.66 million fibre-optic users

were added, taking the total to 6.08 million.

The Japanese giant hopes to sign up 30 million

subscribers to its fibre-optic networks by 2010,

with 3.4 million coming in this fiscal year alone.

At the end of 2006 NTT held a 67.5% share of

the countrys fibre-optic market.

One push for FTTH is the will of public

authorities or governments, such as the French

one declaring to have 4 millions FTTH

households

connected

by

2012.

source: FTTH council 2006

1/1

www.bmp-tc.com

Very High Broadband in the Local Loop

May 2007

Threefold barriers: costs, regulation

and services

Announcements from operators have been

multiple wihtin the last months, especially in

markets experiencing high competition. France

seems to be one of the most active in this

regard, where as

France Telecom has claimed to skip the

step of VDSL, deploying (PON) fiber

networks in Paris and by 2009 in 10 major

or medium cities in France. After this

phase a mass market roll out is foreseen .

9cegetel having acquired Erenis and

having started its roll out, intends to invest

300 million euros in FTTx over 2007-09, to

connect 1 million homes with FTTH and

acquire 250,000 customers.

Iliad (Free Telecom) having announced to

deploy in the main cities and having

overtaken Cit Fibre and its FTTB network

in Paris, plans to invest 1 billion by 2012,

covering 4 millions of households by then.

and

the

national

cable

operator

Numericable Noos has decided to cover 5

millions Households by 2010 with FTTB.

Investments are considerable, in total

exceeding several billions of within the

coming 5 years for the French market alone.

Other markets have already experienced

significant private FTTx deployments: just to

name the most significant ones: fastweb

(acquired by Swisscom), B2 (acquired by

Telenor) or electro-com in Russia.

Announcements have also occurred, even if

broadband is still emerging such as in

Slovakia, where Orange intends to invest 32

million in 2007 and to reach 200 000 homes

passed in ten cities at the end of 2007. The

final objective is to cover the entire country

according to Orange. Same plans have been

initiated by various actors in CEE (Vestitel,

Vodatel.).

Costs for connecting the end user with fiber

remain the main barrier, 60% to 80 % of the

investments have to be done for the network

and optical infrastructure (*based on bmp TC

analysis, orange and arcep indications).

A key reason for the late uptake of European

incumbents is the potential threat of having to

unbundle the new investments to challenging

operators. The US regulatory authority FCC

clarified in October 2004 that new fiber network

need not be shared with competitors. Following

this SBC and Verizon have announced large

deployments with SBC's Project Lightspeed

fiber initiative targeted at 18 million households

by the end of 2007, though plans have not

been realised as announced up to now. In a

similar way, the regulatory holiday for

Germanys Deutsche Telekom has impulsed its

investments of 3 billion into VDSL.

Regulatory bodies in all European markets

evaluate these NGN activities and are in the

process of designing regulatory set of

measures (SLU, bitstream offers, ducts/pipes

sharing.). these will have a decisive impact

on the deployment of FTTx infrastructure.

Last issue is the business plan for such

deployment, operators involved into FTTx

deployments require a high penetration

(usually- according to bmp sources, a 16% to

25 % penetration is being forecasted). Main

applications are HDTV, multi-access, multiscreen TV, photos, video, home working,

sharing of contents ARPU must be

definitively higher than current DSL offerings in

order to sustain the specific business case for

FTTx.

source: Arcep 2007.

2/2

www.bmp-tc.com

Very High Broadband in the Local Loop

May 2007

Fttx- a disruptive technology for the

alternative operators

VDSL and FTTH deployments by the

incumbent hold a strong disruptive potential for

alternative operators.

The challenges for altnets are highly

dependent on defined factors such as length of

the subloop, central office dismantling, price

set by the incumbent for the new offers

Alternative operators have so far and for most

invested into LLU and own infrastructure in

order to enhance their competitive broadband

offerings and enable differentiation. Following

the ladder of investment into FTTx endangers

the business model/plan of the alternative

telcos, this being in the first place solely to be

realised in dense urban areas. Indeed

implementing VDSL is cost intensive for the

alternative operators, (according to a recent

study of JPMorgan on some markets with a

varying penetration rate assumption) the

migration to VDSL might represent from 5% to

25% more investments than their current DSL

deployments.

So what is the strategies to be employed by

alternatives? Firstly the regulatory environment

has a strong impact on their prospects for

success. The business case is determined by

local market conditions such as dark fiber

rental costs, the structure of MDUs, and

consumers characteristics and demand on top

of the regulation issues.

Access to ducts and dark fibre infrastructure is

one key for setting up the business case, the

incumbent being mostly in a (more) favourable

position. This topic has to be embraced by

regulatory authorities and is recognised as key,

it is thus in discussions in many markets be it

Sweden, France, Germany, etc

In order to gain (or maintain) full control of their

service offerings and customer relationships,

SLU (Subloop Unbundling) and FTTx seems

for any significant alternative to be a must

however.

These various forms of Very High Broadband

platforms will co-exist, according to the market

specifics. However the alternative operators

will strive for signifcant or total coverage as it is

important to challenge the incumbent. And

scale advantages arise from volume

A strong driver for Fttx deployments beneath

the competitive advantage of being able to

offer bandwith hungry services to a higher

proportion of the population- is the cost

reduction on OPEX (operational expenditures)

Opting for VDSL or FTTH strategy enables the

alternative telco to save the LLU (Line rental,

Co-location.) related costs and to reduce its

manpower expenses. According to analysts

FTTH deployment is about 12 times the costs

for unbundling, but solely 2,5 times the costs

for a VDSL deployment, still implying strong

business case and demand forecast.

Conclusion

While an overall surge in fiber deployments is

expected, many uncertainties remain in order

to secure the development of FTTx strategies

of operators.

Key issue is about sharing the available

infrastructure: national regulators have been

increasingly addressing the mutualisation of

ducts, pipes but also inbuilding ducts. Indeed a

lack of regulation on access to the essential

infrastructure might entail a new monopoly in

markets,

especially

where

competitive

infrastructure such as cable networks is

missing. It appears however that aside from

very high population density areas, fiber will be

delayed or at least remain one of several

platforms in the operators technology portfolio.

A key role for the FTTx market remain the

public authorities which might develope

policies to establish and operate neutral fiber

networks or at least facilitate them as well as

the utilities which have the opportunities to

play a key role in this respect. (see our related

market review scheduled later this year onto

the subject ). Clearly a panoply of different

actors are diving into FTTx deployments,

In view of current developments, one might

think on the overall that this decade will see

the beginning of the end of the copper era for

broadband.

3/3

www.bmp-tc.com

Very High Broadband in the Local Loop

May 2007

Previous Market Reviews are available on the website below.

bmp TELECOMMUNICATIONS CONSULTANTS GmbH

Achillesstrasse 17, D 40545 Duesseldorf

GERMANY

Tel.: +49 211-577973-0

Fax.: +49 211-577973-11

www.bmp-tc.com

For further information please contact:

Mrs. Nadine Berezak-Lazarus- CEO

Tel.: +49 211-577973-0

Email: info@bmp-tc.com

We work with your visions !

About bmp Telecommunications Consultants:

bmp TC is a strategic consultancy in the field of telecommunications with a focus on central

issues related to business models based on broadband platforms such as DSL, Wireless, Fiber or

Powerline Communications. The longstanding experience & a wide-ranging industry view enables

to create and launch new services for the market and support the implementation and introduction

of unique and sound business models.

Selected recent references (complete references upon request)

Operators/ISPs

Utilities

British Telecom

Copel Brasil

Cegetel

Compagnie Ivoirienne

Electro-com,

Russia

France Telecom

GTS Central

Europe

Smart Telecom

Investors

Integrators,

venues

Cegelec

Energie

Electricity Authority of

EDEV-CPL

Cyprus

Electricit de France

ESB Ireland

RWE

Sogetrel

Public authorities

Cmgi

Tank & Rast

Suppliers

Baring Vostok

African Telecom. Union

Hewlett Packard

Capital

Partners

Bearing Point

Durlacher

Morgan

Stanley

Dpartement Meurthe&

Itochu

Moselle

DCMNR-Irish Government

Luxembourg City

Rgion Alsace/Alsace

Connexia

Legrand

TELECOMMUNICATIONS

CONSULTANTS

4/4

www.bmp-tc.com

Mitsubishi

Schneider

Electric

Siemens

You might also like

- Improving The FTTH Business Case-A Joint Telco-Utility Network Rollout ModelDocument12 pagesImproving The FTTH Business Case-A Joint Telco-Utility Network Rollout ModelDamaris Wesly LubisNo ratings yet

- Fiber Broadband Your Community: What Can Do ForDocument32 pagesFiber Broadband Your Community: What Can Do ForMichael TateNo ratings yet

- FTTH Business GuideDocument78 pagesFTTH Business Guidesatyvan2003No ratings yet

- FiberOne Home Plan SheetDocument2 pagesFiberOne Home Plan SheetShriyansh SrivastavaNo ratings yet

- FTTH Business Guide V5Document97 pagesFTTH Business Guide V5CapLinux100% (1)

- FTTH Smart Guide 2015 V3.0Document486 pagesFTTH Smart Guide 2015 V3.0KumarRajaMNo ratings yet

- 2016 RFP For FTTH Network Design and EngineeringDocument13 pages2016 RFP For FTTH Network Design and EngineeringTaha AlhatmiNo ratings yet

- The Complete Guide To Fiber To The Premises Deployment: Options For The Network OperatorDocument17 pagesThe Complete Guide To Fiber To The Premises Deployment: Options For The Network OperatorAhsept HGNo ratings yet

- Exploring The Costs and Benefits of Fibre To The Home (FTTH) in The UKDocument27 pagesExploring The Costs and Benefits of Fibre To The Home (FTTH) in The UKNestaNo ratings yet

- McKinsey Telecoms. RECALL No. 12, 2010 - The Fiber FutureDocument63 pagesMcKinsey Telecoms. RECALL No. 12, 2010 - The Fiber FuturekentselveNo ratings yet

- A World of FiberDocument13 pagesA World of FiberHande Büşra KeleşNo ratings yet

- UMTS Forum Activity Report 2010-2011Document38 pagesUMTS Forum Activity Report 2010-2011mhmd_4uNo ratings yet

- APC ISSUE PAPERS INTERCONNECTION COSTSDocument8 pagesAPC ISSUE PAPERS INTERCONNECTION COSTSItzel TajimaroaNo ratings yet

- Strategic and Economic Aspects of Network Sharing in FTTH/PON ArchitecturesDocument13 pagesStrategic and Economic Aspects of Network Sharing in FTTH/PON ArchitecturesSilvia AzcurraNo ratings yet

- FTTH Network Rollouts: Is There A Winning Model in Europe?: Joëlle Toledano ArcepDocument16 pagesFTTH Network Rollouts: Is There A Winning Model in Europe?: Joëlle Toledano ArcepAnonymous JmeZ95P0No ratings yet

- 1 Deep Fiber FTTHDocument5 pages1 Deep Fiber FTTHNordin ZakariaNo ratings yet

- General About TechnologiesDocument32 pagesGeneral About Technologiesrohit022No ratings yet

- Detecon Opinion Paper FTTX Roll-Out: A Commercial Perspective Beyond TechnologyDocument11 pagesDetecon Opinion Paper FTTX Roll-Out: A Commercial Perspective Beyond TechnologyDetecon InternationalNo ratings yet

- OECD Communications Outlook 2011: Summary in EnglishDocument5 pagesOECD Communications Outlook 2011: Summary in Englishuser2127No ratings yet

- Open Access Network (OAN) & Fixed Mobile Convergence (FMC) : Foundation For A Competitive New Business ModelDocument8 pagesOpen Access Network (OAN) & Fixed Mobile Convergence (FMC) : Foundation For A Competitive New Business ModelHedi HmidaNo ratings yet

- More For Less: Telcos Will Continue To Stretch The Life of Copper NetworksDocument17 pagesMore For Less: Telcos Will Continue To Stretch The Life of Copper Networksvignesh_velappanNo ratings yet

- Femtocell-Based Network Enhancement by Interference Management and CoordinationDocument2 pagesFemtocell-Based Network Enhancement by Interference Management and CoordinationsorinartistuNo ratings yet

- Spectrum Policy in Canada: Levelling The Playing Field For Affordable Rates and Breadth of ChoiceDocument13 pagesSpectrum Policy in Canada: Levelling The Playing Field For Affordable Rates and Breadth of ChoiceOpenMedia_caNo ratings yet

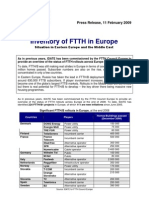

- Inventory of FTTH in Europe: Press Release, 11 February 2009Document4 pagesInventory of FTTH in Europe: Press Release, 11 February 2009nitsuiNo ratings yet

- ITU-D Regional Development Forums 2010 On NGN and Broadband (ARB, EUR & CIS Regions)Document18 pagesITU-D Regional Development Forums 2010 On NGN and Broadband (ARB, EUR & CIS Regions)walia_anujNo ratings yet

- Analysys Mason Brief - Covid 19 - Operators Are Likely To Prioritise FTTP Capex 2020Document3 pagesAnalysys Mason Brief - Covid 19 - Operators Are Likely To Prioritise FTTP Capex 2020Andrey PritulyukNo ratings yet

- Regulating NGN Access Networks in Germany (Detecon Executive Briefing)Document6 pagesRegulating NGN Access Networks in Germany (Detecon Executive Briefing)Detecon InternationalNo ratings yet

- 2020 Vision For LTEDocument6 pages2020 Vision For LTEMouslem BouchamekhNo ratings yet

- LTE and M2M - 2012 AjitDocument19 pagesLTE and M2M - 2012 AjitAjit JaokarNo ratings yet

- Technological and Cost-Based Comparison of Next Generation PON Technologies: 10GPON and WDM PONDocument15 pagesTechnological and Cost-Based Comparison of Next Generation PON Technologies: 10GPON and WDM PONwilfriedNo ratings yet

- Comparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesDocument9 pagesComparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesWewe SlmNo ratings yet

- IMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkDocument11 pagesIMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkManas RanjanNo ratings yet

- Oughton, Frias - 2018 - The Cost, Coverage and Rollout Implications of 5G Infrastructure in Britain-AnnotatedDocument17 pagesOughton, Frias - 2018 - The Cost, Coverage and Rollout Implications of 5G Infrastructure in Britain-AnnotatedRenato DumontNo ratings yet

- Fiber To The HomeDocument35 pagesFiber To The HomeABHISHEKNo ratings yet

- Fiber HomeDocument10 pagesFiber HomezuckzzzNo ratings yet

- Telecommunications InfrastructureDocument3 pagesTelecommunications InfrastructureAruna MalikNo ratings yet

- Paper Lte Top 12 ChallengesDocument7 pagesPaper Lte Top 12 ChallengesDarshan MaldeNo ratings yet

- Communiqué: Beyond The Digital Dividend - Is It Time To Open Up UHF To Operators?Document8 pagesCommuniqué: Beyond The Digital Dividend - Is It Time To Open Up UHF To Operators?jamesoksNo ratings yet

- Competition Policy Ternds in TelecommunicationDocument3 pagesCompetition Policy Ternds in Telecommunicationphuonganh285No ratings yet

- Telecommunications Policy: Martin CaveDocument6 pagesTelecommunications Policy: Martin CavecarolrosapNo ratings yet

- GPON Vs Gigabit EthernetDocument17 pagesGPON Vs Gigabit EthernetWewe SlmNo ratings yet

- Tech Wars Part 1 Ext EI 0128Document8 pagesTech Wars Part 1 Ext EI 0128DanielMontielNo ratings yet

- Enable 4GGB PDFDocument4 pagesEnable 4GGB PDFeldim2011No ratings yet

- The International Telecommunications Regime: Domestic Preferences And Regime ChangeFrom EverandThe International Telecommunications Regime: Domestic Preferences And Regime ChangeNo ratings yet

- Spectrum Spats: There Is Simply Not Enough Spectrum To Go RoundDocument21 pagesSpectrum Spats: There Is Simply Not Enough Spectrum To Go RoundKaran KadabaNo ratings yet

- Econex Presentation 1Document38 pagesEconex Presentation 1calixrvNo ratings yet

- The Drivers To Lte Solution PaperDocument9 pagesThe Drivers To Lte Solution PaperproformapNo ratings yet

- 612858Document42 pages612858Araceli MartínezNo ratings yet

- Business Process & Strategy For Fibre Optics NigeriaDocument25 pagesBusiness Process & Strategy For Fibre Optics Nigeriaomoyegun100% (1)

- Spain EDPRtelecomannexDocument9 pagesSpain EDPRtelecomannex779635006No ratings yet

- FTTH DocumentationDocument26 pagesFTTH DocumentationVivek Rastogi100% (1)

- PCN Juniper NetworksDocument21 pagesPCN Juniper NetworksVinaigar MurthyNo ratings yet

- National Roaming Regulation in the EU and BeyondDocument25 pagesNational Roaming Regulation in the EU and Beyondjulian_binevNo ratings yet

- Long Term Evolution LTE EbookDocument44 pagesLong Term Evolution LTE EbookMahinda Saman BandaraNo ratings yet

- European TV White SpEuropean TV White Spaces Analysisaces AnalysisDocument109 pagesEuropean TV White SpEuropean TV White Spaces Analysisaces AnalysisJasenka DizdarevicNo ratings yet

- A Business Model For Municipal FTTHB Networks The Case of Rural GreeceDocument18 pagesA Business Model For Municipal FTTHB Networks The Case of Rural GreeceReeza PalmNo ratings yet

- PM WorkDocument9 pagesPM WorkFarhan AmdaniNo ratings yet

- Digital Dividend Offers Opportunities and ChallengesDocument5 pagesDigital Dividend Offers Opportunities and ChallengespavlodeNo ratings yet

- Optical Components and Their Role in Optical NetworksDocument4 pagesOptical Components and Their Role in Optical NetworksManveen KaurNo ratings yet

- Toshiba Satellite M115-S3094 System SpecsDocument11 pagesToshiba Satellite M115-S3094 System SpecsKeyJockey1965No ratings yet

- Ono K. - Representations of Integers As Sums of Squares - J. Number Theory 95 (2002) 253-258 PDFDocument6 pagesOno K. - Representations of Integers As Sums of Squares - J. Number Theory 95 (2002) 253-258 PDFJapari JaporaNo ratings yet

- Ebook - Hack - Discovery NmapDocument16 pagesEbook - Hack - Discovery Nmapapi-26021296100% (3)

- Windows API For Visual Basic and REALbasicDocument34 pagesWindows API For Visual Basic and REALbasicLuis Argenis ZabalaNo ratings yet

- NASA: 59402main Model SimpleDocument3 pagesNASA: 59402main Model SimpleNASAdocumentsNo ratings yet

- Nmap The Art of Port Scanning PDFDocument6 pagesNmap The Art of Port Scanning PDFJapari JaporaNo ratings yet

- NfdfsjjgsDocument28 pagesNfdfsjjgsGonzalo Flor CarrascosaNo ratings yet

- Video Satellite LE Read MeDocument1 pageVideo Satellite LE Read Meakira756No ratings yet

- Weather Satellite Converter PDFDocument1 pageWeather Satellite Converter PDFJapari JaporaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Video Satellite Read MeDocument3 pagesVideo Satellite Read MeJamesNo ratings yet

- Acer Travel Mate 4150 & 4650 Service GuideDocument127 pagesAcer Travel Mate 4150 & 4650 Service GuideJeremy HarperNo ratings yet

- Acer Travel Mate 4150 & 4650 Service GuideDocument127 pagesAcer Travel Mate 4150 & 4650 Service GuideJeremy HarperNo ratings yet

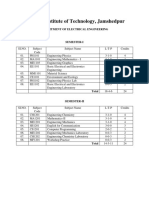

- Electrical BtechDocument27 pagesElectrical BtechNikhil AnandNo ratings yet

- 2015 Model Predictive Control MPC's Role in The Evolution of Power ElectronicsDocument15 pages2015 Model Predictive Control MPC's Role in The Evolution of Power Electronicsdaiduongxanh14113No ratings yet

- Application Note: Horn Loaded 18'' SubwooferDocument21 pagesApplication Note: Horn Loaded 18'' SubwooferRafael7990No ratings yet

- EFM32 Zero Gecko Family EFM32ZG Data SheetDocument104 pagesEFM32 Zero Gecko Family EFM32ZG Data SheetHans ClarinNo ratings yet

- HW Rest Part1Document5 pagesHW Rest Part1Anand SridharanNo ratings yet

- Mux 100 B. Diagram StarterDocument1 pageMux 100 B. Diagram StarterLuis Fernando Garcia S100% (1)

- Afpl SLD 2ndf To 5thfDocument34 pagesAfpl SLD 2ndf To 5thfAbstruse RonNo ratings yet

- File 20230707 203258 43yc4Document33 pagesFile 20230707 203258 43yc4NhươngNo ratings yet

- Cha 4 PS IDocument23 pagesCha 4 PS ITsega Solomon KidaneNo ratings yet

- ABB PQ Filters Improve Power QualityDocument35 pagesABB PQ Filters Improve Power QualityBaqiyyatusShulkhaShulkhaNo ratings yet

- Adaptive Overtaking Control and Effective Power Generation (AOC-EPG) SystemDocument5 pagesAdaptive Overtaking Control and Effective Power Generation (AOC-EPG) SystemInternational Organization of Scientific Research (IOSR)No ratings yet

- ProjectDocument4 pagesProjectAsraNo ratings yet

- Comm RefDocument670 pagesComm RefStarLink1No ratings yet

- RN-AC106-3A: Low Frequency Accelerometer, Side Connector, 500 MV/GDocument1 pageRN-AC106-3A: Low Frequency Accelerometer, Side Connector, 500 MV/GkylegazeNo ratings yet

- IEEE 802 Network Engineering by Obedience Munashe KuguyoDocument9 pagesIEEE 802 Network Engineering by Obedience Munashe KuguyoObedience Munashe Kuguyo100% (15)

- Analysis and Testing of Shaft Current Measurement DevicesDocument48 pagesAnalysis and Testing of Shaft Current Measurement DevicesRigoberto UrrutiaNo ratings yet

- Ec2305 Transmission Lines and Waveguides L T P C 3 1 0 4Document1 pageEc2305 Transmission Lines and Waveguides L T P C 3 1 0 4durgadevikarthikeyanNo ratings yet

- Uc Creg 097 2008Document399 pagesUc Creg 097 2008algotrNo ratings yet

- P1022 Qoriq Integrated Processor Design Checklist: Application NoteDocument41 pagesP1022 Qoriq Integrated Processor Design Checklist: Application NoteDanielle AtkinsNo ratings yet

- Yagi Antenna PaperDocument4 pagesYagi Antenna PaperJean Franco SánchezNo ratings yet

- Metron Safety Analyzer QA - 90 - Service User Manual PDFDocument112 pagesMetron Safety Analyzer QA - 90 - Service User Manual PDFandres2013bioNo ratings yet

- Vibrating Wire Indicator: Model Edi-51VDocument2 pagesVibrating Wire Indicator: Model Edi-51Vdox4printNo ratings yet

- Rtos ProjectDocument19 pagesRtos Projectsreelekha9No ratings yet

- Aptio V Status CodesDocument13 pagesAptio V Status CodesAnderson Andrade de LimaNo ratings yet

- Diode Symbols: Go To WebsiteDocument3 pagesDiode Symbols: Go To WebsiteMay Ann SabanganNo ratings yet

- Building A Soldering StationDocument28 pagesBuilding A Soldering StationDaniel Anton100% (1)

- Catalog Pneumercator tms3000 Spec SheetDocument2 pagesCatalog Pneumercator tms3000 Spec SheetEdgar P. Putong Jr.No ratings yet

- Olympian 4001 OmniMetrix Installation Guide PDFDocument2 pagesOlympian 4001 OmniMetrix Installation Guide PDFAndresan507No ratings yet

- Inter Trip RelayDocument10 pagesInter Trip RelayNam Hoai Le100% (1)