Professional Documents

Culture Documents

The Reston Transportation Service District (TSD) - FINAL

Uploaded by

Terry MaynardOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Reston Transportation Service District (TSD) - FINAL

Uploaded by

Terry MaynardCopyright:

Available Formats

Another Unwarranted Special Tax on

Restons Station Area Residents

Reston 20/20 Committee

November 7, 2016

The RNAG has two purposes:

Generate a street improvement plan that will accommodate increased

traffic in Restons urbanizing areas.

Create a funding plan to finance the street improvements.

RNAG actually comprises two groups:

The Stakeholders Group made up mostly of developers and their

associates.

RAs CEO represents Reston Association on this group.

Five Restonians selected by Supervisor Hudgins comprise the

Community Group portion of the RNAG.

None of the Community Group members lives in the Reston station

areas.

Robert Goudie, member of the Stakeholders Group and Executive Director of the

RTCA lives in RTC West.

Reston 20/20 Committee

November 7, 2016

The tax proposal is called a Transportation Service District (TSD).

The TSD applies to all property owners in the Reston Metro station areas.

This includes about 2,600 current homeowners.

The value of owned homes in Restons urban area is ~$1.9 billion.

Reston 20/20 Committee

November 7, 2016

FCDOT puts the overall Private Share

Reston road funding gap at $350

million over 40 years.

The Private Share comprises both a

developer Road Fund & the allproperty owner TSD tax.

The TSD portion of the funding gap

varies depending on how much is

funded by the Road Fund.

The TSD tax would go to fill an alleged

$108MM-$175MM funding gap

depending on the option selected.

RNAG is currently recommending three

options with TSD tax rates ranging

from $.017-$.027/$100 valuation

depending on the option.

Reston 20/20 Committee

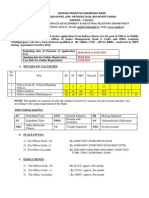

Contribution Rates and Related Shortfall

Funding Scenarios Proposed

Scenario 1: Tysons residential rates

Scenario 2: Tysons commercial rates

Scenario 3: Rates proportional to

development in Reston TSAs

Scenario 4: Tysons rates and Service

District over Reston TSAs

Scenario 5: Tysons rates and Tax District

over Reston TSAs

Scenario 6: Tysons Rates and Service

District over Reston &TSAs

Scenario 7: Tysons Rates and Service

District over Small District 5

Scenario 8: General adjustment from

Tysons rates, -11%

Scenario 9: Specific adjustments from

Tysons rates, +15% residential, -19%

commercial

Scenario 10: Splits $350M equally

between Road Fund/Service District

and maintains Tysons proportions for

Res/Com road fund rates

Scenario 11: Similar total out of pocket

expense per Road Fund (residential)

contribution and Service District (avg.

home) contribution

Road Fund

Transportation Service District -- Reston TSAs

Residential Commercial

(per DU)

(per GSF)

Added Funding Transportation TSD Contribution

Needed to Meet Service District (%) to $350M

$350M ($M)

Rate

Funding Gap

$2,571

$4,627

$18.34

$12.63

$0

$0

N/A

N/A

0%

0%

$7,058

$5.88

$0

N/A

0%

$2,571

$12.63

$79

0.012

22%

$2,571

$12.63

$79

N/A

22%

$2,571

$12.63

$79

0.012

22%

$2,571

$12.63

$79

0.012

22%

$2,288

$11.24

$108

0.017

31%

$2,957

$10.23

$80

0.013

23%

$1,635

$8.19

$175

0.027

50%

$2,080

$10.09

$132

0.02

38%

November 7, 2016

With 3%/year appreciation over the

four decade planning period, the

TSD will add an average of $320$350 annually to homeowners tax

bills if there are no rate increases.

The Board of Supervisors can

increase the TSD tax rate anytime.

A similar TSD tax in Tysons has seen rates

rise from $.04/$100 to $.05/$100 valuation.

TSD tax rates in Tysons are expected to

rise to $.06/$100 or more as growth

accelerates.

The Board could increase the Reston TSD

rates to comparable levels.

The tax will continue indefinitely,

including after all the streets have

been built or upgraded as planned.

Reston 20/20 Committee

With 3%/year appreciation, the Reston

TSD would generate $168MM$268MM over the 40-year plan period.

November 7, 2016

The grid of streets comprises $305MM

of the so-called $350MM funding gap.

The grid of streets are privately-owned

streets on developer property between

Restons public roads, such as RTC.

In essence, Reston station area residents

public taxes will be transferred to

developers to build private roads in their

for-profit ventures.

In Tysons, developers pay for the

development of all its grid of streets.

The Planning Commission recommended this

approach and the Board approved it.

Tysons grid of streets is projected to cost $865MM

over 40 years in $2012, less than for Restons station

areas although Tysons covers a larger area2,100

acres vs. Restons 1,700 acres.

Reston station area homeowners would pay some $80MM-$150MM for

these private roads depending on the funding option.

Reston 20/20 Committee

November 7, 2016

The new Reston Master Plan calls for:

Population in the station areas to increase eight-fold to 88,000 residents.

Employment in the station areas to increase by half to 123,000 jobs.

Tysons transportation plan calls for spending $953MM on bus transit over 40 years.

Tysons currently has limited bus transit service.

NO Tysons TSD funds will be used to fund the transit.

The bus service will serve about 200K employees and about 100K residents at buildout.

FCDOT claims that re-routing the current Reston bus service will be adequate to meet future needs.

It will not be adequate.

So how does this make sense?

Reston TSA Comprehensive Plan Development Potential

New

Added Jobs & Total GSF & Total Jobs &

Land Use

Development

Residents

DUs

Residents

Potential (GSF)

Dwelling Units

5,860

11,720

38,140

76,280

44,000

88,000

Residential

5,860,000

46,940,000

52,800,000

Office

20,982,169

69,941

8,717,831

29,059

29,700,000

99,000

Retail

1,094,476

2,432

1,005,524

2,234

2,100,000

4,667

Industrial

841,957

1,684

-251,957

(504)

590,000

1,180

Institutional

2,096,840

5,242

303,160

758

2,400,000

6,000

Hotel

936,782

2,342

3,963,218

9,908

4,900,000

12,250

Total Non-Res

25,952,224

81,641

13,737,776

41,456

39,690,000

123,097

Total

31,812,224

93,361

60,677,776

117,736

92,490,000

211,097

Reston Funding Plan: Potential Cost Allocations, FCDOT Presentation, February 22, 2016

2010 Existing

Land Use (GSF)

Reston 20/20 Committee

Current Jobs &

Residents

November 7, 2016

With 3%/year property value

appreciation, TSD revenues will

outstrip County tax revenue goals by

$60MM-$93MM.

Because the TSD revenues must

be spent in the Reston TSD, the

surplus will almost certainly be

spent on better bus serviceand

require a higher tax rate.

40-Year TSD Tax Revenues with 3%/Yr Appreciation ($MM 2016)

TSD Tax

Rate

$.017/$100

$.020/$100

$.027/$100

TSD Revenue

Goal

$108

$132

$175

TSD Revenue @

3%/Yr Appreciation

$168

$198

$268

Excess Tax

Revenue

$60

$66

$93

The 60 million GSF of added space

by developers will generate huge

profits even after investment costs.

3% appreciation/year will only nearly

double those profits over 40 years.

Appreciation will be critical to new

development profits.

40-Year Reston Station Area Developer Profits*

Net Operating Income

New Construction

Existing Development

Total

Total per Year

No

Appreciation

$203

$44,559

$44,762

$1,119

3%/Yr

Appreciation

$2,576

$83,996

$86,571

$2,164

*Estimated based on data from Boston Properties 2015 annual

report.

In contrast, station area homeowners will likely pay out $168MM-$268MM in

TSD taxes ($2016)--~$400-$500/year on average--with no financial return.

Reston 20/20 Committee

November 7, 2016

The Board has chosen not to be flexible in either its allocation of

existing tax revenues or increasing county-wide tax rates to cover

the cost of Restons roads, much less expanding its bus system.

Shifting 1-1.5% in annual County transportation funding budget, now at

$300MM, would generate the $3-$4MM needed to fill the Reston road

funding gap.

Alternatively, very small increases in County tax rates would achieve

the same goal.

A change in the RE property tax rate would be less than a millionth of one

percent.

A $.0002/$100 addition to the C&I $.0125/$100 tax would also fill the

funding gap.

Other County tax rates, individually or combined, could also be increased

by very small amounts to help fund Restons road improvement needs.

Reston 20/20 Committee

November 7, 2016

Both the County and developers will see huge financial gains from development and

appreciation of property in Restons station areas.

The County will collect an extra $4 BILLION in base property tax revenues over the next

40 years because of new development in Restons station areas with no rate increase.

The Reston road improvements would use less than 10% of this extra base property tax revenue.

Expanding bus service would add hundreds of millions to County costs over several

decadesand lead to substantial TSD rate increases that would continue indefinitely.

Reston station area homeowners will see NO increase in their income as a result of the

development, yet they are being asked to fund between 1/3 and of the TSD costand will likely

end up paying a much larger share.

Those who benefit financially from Restons urbanizing development--developers

& the County--should bear all the costs of developing its infrastructure, including

street improvements and additional bus service.

The Reston TSD tax proposal is not about the small amount of funding needed to

improve public streets in the Reston station areas to serve future growth.

The reason for the proposed Reston TSD is that the Board wants to create

a new tax revenue stream whose rates and uses it controls indefinitely.

Reston 20/20 Committee

November 7, 2016

10

You might also like

- RCA Letter To Supervisor Alcorn Re "Parking Reimagined"Document4 pagesRCA Letter To Supervisor Alcorn Re "Parking Reimagined"Terry MaynardNo ratings yet

- FC Response in Doe Case 03122Document15 pagesFC Response in Doe Case 03122Terry MaynardNo ratings yet

- "Right-Sizing" Fairfax County Parking: A Grab For Our Tax Dollars, Not Improvement in Our Quality of LifeDocument3 pages"Right-Sizing" Fairfax County Parking: A Grab For Our Tax Dollars, Not Improvement in Our Quality of LifeTerry MaynardNo ratings yet

- Rca Zmoc Res - 011921Document4 pagesRca Zmoc Res - 011921Terry MaynardNo ratings yet

- County Assessment of Needed Infrastructure Repairs For Lake Anne Village CenterDocument109 pagesCounty Assessment of Needed Infrastructure Repairs For Lake Anne Village CenterTerry MaynardNo ratings yet

- Estimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Document10 pagesEstimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Terry MaynardNo ratings yet

- Doe v. Fairfax Police Officer 1Document19 pagesDoe v. Fairfax Police Officer 1Terry MaynardNo ratings yet

- Letter To TF CornerstoneDocument6 pagesLetter To TF CornerstoneTerry MaynardNo ratings yet

- RA PRC Letter Aug2018Document8 pagesRA PRC Letter Aug2018Terry MaynardNo ratings yet

- BOS Agenda Item For Hearing On The PRC Zoning Ordinance Amendment - 03052019Document40 pagesBOS Agenda Item For Hearing On The PRC Zoning Ordinance Amendment - 03052019Terry MaynardNo ratings yet

- LARCA Audit & RecommendationsDocument34 pagesLARCA Audit & RecommendationsTerry Maynard100% (1)

- Reston Roadways Apparently Not Studied, and Thus Not Modelled, in Reston Network Analysis: Final Report, October 18, 2018Document6 pagesReston Roadways Apparently Not Studied, and Thus Not Modelled, in Reston Network Analysis: Final Report, October 18, 2018Terry MaynardNo ratings yet

- BOS Agenda Item For Hearing On The PRC Zoning Ordinance Amendment - 03052019Document40 pagesBOS Agenda Item For Hearing On The PRC Zoning Ordinance Amendment - 03052019Terry MaynardNo ratings yet

- Hunter Mill Supervisor Candidates' Statements To CPR 6.19Document13 pagesHunter Mill Supervisor Candidates' Statements To CPR 6.19Terry MaynardNo ratings yet

- CPR Letter To Supervisor Hudgins 12.19.18Document1 pageCPR Letter To Supervisor Hudgins 12.19.18Terry MaynardNo ratings yet

- CPR's Proposed Changes in The Reston Master PlanDocument20 pagesCPR's Proposed Changes in The Reston Master PlanTerry MaynardNo ratings yet

- Supr. Hudgins Letter To RA-CPR Stating The County Is Moving Forward With Increased Reston DensityDocument1 pageSupr. Hudgins Letter To RA-CPR Stating The County Is Moving Forward With Increased Reston DensityTerry MaynardNo ratings yet

- CPR's Proposed Amendments To The Reston Master PlanDocument22 pagesCPR's Proposed Amendments To The Reston Master PlanTerry Maynard100% (1)

- A Preliminary Report On RA's Mishandling of The Purchase and Renovation of The Tetra PropertyDocument10 pagesA Preliminary Report On RA's Mishandling of The Purchase and Renovation of The Tetra PropertyTerry MaynardNo ratings yet

- Cover Letter To Supervisor Cathy Hudgins Transmitting The CPR's Recommended Changes To The Reston Master PlanDocument2 pagesCover Letter To Supervisor Cathy Hudgins Transmitting The CPR's Recommended Changes To The Reston Master PlanTerry MaynardNo ratings yet

- RA Members' Presentation To RA BOD On The Tetra PurchaseDocument44 pagesRA Members' Presentation To RA BOD On The Tetra PurchaseTerry MaynardNo ratings yet

- Installment II Summary of Lake House Appraisals Comparison ChartDocument5 pagesInstallment II Summary of Lake House Appraisals Comparison ChartTerry MaynardNo ratings yet

- FINAL PRC Slides - Community Presentation 9 20 17 PDFDocument35 pagesFINAL PRC Slides - Community Presentation 9 20 17 PDFTerry MaynardNo ratings yet

- Summary of CPR Recommendations and LexiconDocument3 pagesSummary of CPR Recommendations and LexiconTerry MaynardNo ratings yet

- CPR Statement To RA Board of Directors With Appendices - FINALDocument15 pagesCPR Statement To RA Board of Directors With Appendices - FINALTerry MaynardNo ratings yet

- Draft RA Letter To Supervisor Hudgins With Topics For Change in Reston Master PlanDocument4 pagesDraft RA Letter To Supervisor Hudgins With Topics For Change in Reston Master PlanTerry MaynardNo ratings yet

- The Proposed Reston PRC Zoning Ordinance Amendment: The County's Rush To Ruin Reston, June 26, 2017Document14 pagesThe Proposed Reston PRC Zoning Ordinance Amendment: The County's Rush To Ruin Reston, June 26, 2017Terry Maynard100% (1)

- Installment II - Summary of Lake House Appraisals, 2010 vs. 2015Document4 pagesInstallment II - Summary of Lake House Appraisals, 2010 vs. 2015Terry MaynardNo ratings yet

- Reston Association: Review of The Tetra/Lake House Project, StoneTurn Group, February 28, 2017Document31 pagesReston Association: Review of The Tetra/Lake House Project, StoneTurn Group, February 28, 2017Terry MaynardNo ratings yet

- Letter From Mediaworld Team Members Re Mishandling of Tetra Purchase, Renovation, and AuditDocument3 pagesLetter From Mediaworld Team Members Re Mishandling of Tetra Purchase, Renovation, and AuditTerry MaynardNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Far-1 Revaluation JE 2Document2 pagesFar-1 Revaluation JE 2Janie HookeNo ratings yet

- ME Tutorial 14Document2 pagesME Tutorial 14Tamanna SinghNo ratings yet

- Profit Driven Digital MarketingDocument28 pagesProfit Driven Digital MarketingSike Thedeviant100% (8)

- James Schulz, Petitioner, v. Commissioner of Internal Revenue, RespondentDocument4 pagesJames Schulz, Petitioner, v. Commissioner of Internal Revenue, RespondentMegan AglauaNo ratings yet

- Situs of TaxationDocument1 pageSitus of TaxationDanica Christele AlfaroNo ratings yet

- Fybaf Sem1Document8 pagesFybaf Sem1Shubhs TayalNo ratings yet

- Intermediate Accounting I IntangiblesDocument7 pagesIntermediate Accounting I IntangiblesGiny BenavidezNo ratings yet

- Policy Proposal On Caregiving: Child Care, Early Education, and After School CareDocument5 pagesPolicy Proposal On Caregiving: Child Care, Early Education, and After School CareNga TranNo ratings yet

- MBA - Financial Statements for Dzibodi Ltd and CADocument14 pagesMBA - Financial Statements for Dzibodi Ltd and CALaud ListowellNo ratings yet

- Income Taxation Chapter 14 SolutionsDocument2 pagesIncome Taxation Chapter 14 SolutionsENo ratings yet

- SAP Basic ConceptsDocument9 pagesSAP Basic Conceptsganesanmani1985No ratings yet

- CT20110377825Document13 pagesCT20110377825Raghuram DasariNo ratings yet

- Working Capital Project Report 2Document48 pagesWorking Capital Project Report 2Evelyn KeaneNo ratings yet

- VLCC Profit Loss 2012 PDFDocument45 pagesVLCC Profit Loss 2012 PDFAnkit SinghalNo ratings yet

- Auditing MaterialityDocument7 pagesAuditing MaterialityRey Joyce AbuelNo ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- MBA-640 - Week 09 - Final ProjectDocument45 pagesMBA-640 - Week 09 - Final ProjectJoey DayNo ratings yet

- Assumption Sheet Financial ModelDocument5 pagesAssumption Sheet Financial ModelVishal SachdevNo ratings yet

- CRE Operating MemorandumDocument70 pagesCRE Operating MemorandumAndre Hall-RodriguesNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- APL - Excise and Service Tax - Final - 03-17Document22 pagesAPL - Excise and Service Tax - Final - 03-17ananda_joshi5178No ratings yet

- Walmart Financial Ratio Analysis 2002-2003Document1 pageWalmart Financial Ratio Analysis 2002-2003Pamela WilliamsNo ratings yet

- Draft Contract For Valuation WorksDocument4 pagesDraft Contract For Valuation WorksTekeba Birhane50% (2)

- John Case WorksheetDocument10 pagesJohn Case Worksheetzeeshan33% (3)

- Human Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inDocument8 pagesHuman Resoruces Development & Industrial Relations Department Phones: 08562 250137, Email: Apgbhrd@apgb - In, Web: WWW - Apgb.inJeshiNo ratings yet

- APVATACT2005Document122 pagesAPVATACT2005Manoj SinghNo ratings yet

- Mcdo RatiosDocument3 pagesMcdo RatiosMykaNo ratings yet

- Definition and Nature of Management ControlDocument4 pagesDefinition and Nature of Management ControlAlma Calvelo Musni100% (2)

- Consolidation of Parent and Subsidiary FinancialsDocument18 pagesConsolidation of Parent and Subsidiary FinancialsLloydNo ratings yet

- Job CostingDocument15 pagesJob CostingRoshna RamachandranNo ratings yet