Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

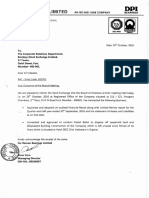

BIL ENERGY SYSTEMS LIMITED

POWER BEHIND PDWER

Dated: 11 th November, 2016

To,

Department of Corporate Services

Bombay Stock Exchange Ltd. (BSE)

P.}. Towers, Dalal Street,

Mumbai - 400 001

Stock Code 533321

Fax: 022 2272 3121

The Manager-Listing Department

National Stock Exchange of India Limited

Exchange Plaza, Bandra Kurla Complex,

Bandra (East), Mumbai - 400 051

Stock Code BILENERGY

Fax: 022 26598120

Dear Sir,

Sub: Outcome of the meeting of the Board of Directors held on 11 th November,

2016 and Submission of Q-II Results along with Limited Review Report by

Statutory Auditors.

This is to inform you that a meeting of the Board of Directors of the Company was held

on Friday, 11 th November, 2016 at 2 nd Floor, Vikas Chambers, Junction of Link and

Marve Road, Malad (W), Mumbai-400064 at 04.00 p.m., to transact the business as given

below:

1. Un-audited Financial Results for the quarter/half year ended on 30 th September,

2016 (the copy 01 the same;s enclosed herewith);

2. Limited Review Report issued by the Statutory Auditors of the Company for the quarter

/ half year ended on 30 th September, 2016 was noted (the copy of the same is enclosed

herewith);

Kindly take the same on your records.

Thanking You,

~=~Vours

faithfully,

BIL ENERGY SYSTEMS LIMITED

RESH

Director

DIN: 06873425

End: As above

Registered office: 2

nd

Floor, Vikas Chamber, Link & Marve Road, Malad (West), Mumbai-400064,

Maharashtra

Tel: +91 2242728080, Fax: + 91 2228811225, Website: www.bilenergy.com, email:

investors@bilenergy.com, CIN: L28995MH2010PLC199691

BIL ENERGY SYSTEMS LIMITED

Registered Office: 201 Vikas Chamber, In. of Link & Marve Road, Malad (W), Mumbai -400064

CIN No.:- L28995MH2010PLC199691 Websile:-www.bilenergy.com Email 10:- investors@bilenergy.com Telephone No.:- 022-42728080 Fax No.:-Q22-28811225

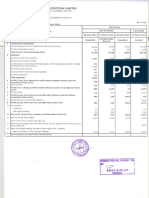

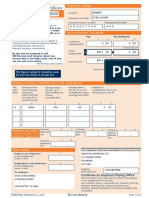

Unaudited Financial Results for the Quarter and Half Year ended on 30th September, 2016

PART I

(Rs. in Lacs)

Particulars

Quarter

ended

30.09.2016

(Unaudited)

(1)

1

Income from Operations

Net Sales I Income from Operations (Net of excise duty)

Total Income from operations (net)

Expenses

a) Cost of materials consumed

b) Purchase of stock in trade

c) Changes in mventones ot tinlShed goods, work m progress

and stock in trade

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Other expenses

Total Expenses

Profit \ (Loss) from Operations before Other Income, inance

costs and exceptional items (1-2)

Other Income

Profit \ (Loss) from ordinary activities before finance costs

and exceptional items (3+4)

5

6

Finance costs

Profit \ (Loss) from ordinary activities after finance costs but before

exceptional items (5-6)

7

8 Exceptional Items (Provision for Doubtful Debts)

a) Provision for dou btful debts

b) Provision for dimunition in Value of Quoted Investment

9 Profit \ (Loss) from Ordinary Activities before tax (7-8)

10 Tax Expenses

11 Net Profit \ (Loss) from Ordinary Activities after tax (9-10)

12 Extraordinary items (net of tax expenses)

13 Net Profit \ (Loss) for the period (11+12)

14

Paid Up Equity Share Capital

Face Value of Equity Shares (in Rupees)

Il{eserves excluding !{evaluallon !{eserves as per balance sheet

15 of previous year

16 Earning Per Share (In Rs.)

a) Basic

b) Diluted

PART II

A PARTICULARS OF SHAREHOLDING

1 Public shareholding

- Number of Shares (In Lac)

- Percentage of Shareholding

2 Promoters and promoter group Shareholding

a) Pledged I Encumbered

- Number of Shares (In Lac)

- Percentage of Shares

Preceding

Quarter

ended

30.06.2016

Corresponding

Quarter ended

30.09.2015

(Unaudited)

(2)

(Unaudited)

(3)

Half Year

ended

30.09.2016

Half Year

ended

30.09.2015

(Unaudited) (Unaudited)

(4)

(5)

Year ended

31.03.2016

(Audited)

(6)

1193.34

1193.34

599.00

599.00

818.39

818.39

1792.34

1792.34

1535.03

1535.03

2751.68

2751.68

92.23

882.47

269.50

320.75

417.12

438.48

361.73

1203.22

746.52

760.69

897.98

1654.77

111.91

32.41

106.34

14.15

1239.51

(117.52)

26.83

105.49

7.57

612.62

(84.19)

34.70

107.64

19.03

932.78

(5.61)

59.24

211.83

21.72

1852.13

(88.37)

70.37

214.56

40.76

1744.53

(7.64)

140.25

427.91

72.07

3185.34

(46.17)

(13.62)

(114.39)

(59.79)

(209.50)

(433.66)

68.12

79.92

94.19

148.04

188.87

469.52

21.95

15.19

66.30

8.68

(20.20)

18.38

88.25

23.87

(20.63)

34.05

35.86

55.43

6.76

57.62

(1.99)

0.34

59.27

(38.58)

64.38

(19.57)

(16.80)

59.27

59.27

(42.81)

42.47

(54.68)

36.44

0.15

(91.27)

0.25

(91.52)

(91.52)

1057.08

1.00

1057.08

1.00

1057.08

1.00

1057.08

1.00

1057.08

1.00

1057.08

1.00

1346.42

1292.94

1303.94

(0.02)

(0.02)

0.06

0.06

(0.04)

(0.04)

(0.09)

(0.09)

(0.08)

(0.08)

562.42

53.21%

562.42

53.21%

23.25

0.31

(16.80)

(16.80)

562.42

53.21%

562.42

53.21%

1.73

2.25

(42.56)

0.25

(42.81)

562.42

53.21%

21.26

0.65

42.47

42.47

0.04

0.04

562.42

53.21%

54.67

6.05

(80.29)

0.25

(80.54)

(80.54)

321.50

321.50

472.04

321.50

472.04

321.50

64.99%

64.99%

95.43%

64.99%

95.43%

64.99%

30.41%

30.41%

44.65%

30.41%

44.65%

30.41 %

173.16

35.01%

173.16

35.01 %

22.62

4.57%

173.16

35.01%

22.62

4.57%

173.16

35.01%

16.38%

16.38%

2.14%

16.38%

2.14%

16.38%

(as a % of total shareholding of promoter and promoter group)

- Percentage of Shares (as a % of 'Olal share cap;lal of the Compan)')

b) Non-encumbered

- Number of Shares (In Lac)

- Percentage of Shares

(as a % of tot-.al shareholding of promoter a.nd promoter group)

- Percentage of Shares (as a % of 'Olal share cap;lal of 'he Compan)')

B

INVESTOR COMPLAINTS

Complaints at the beginning of the Quarter

NIL

Received

During the

Ouarter

0

Disposed off During Quarter

Remaining unresolved at the end of the

quarter 30.09.2016

NIL

BIL ENERGY SYSTEMS LIMITED

Registered Office: 201 Vikas Chamber, In. of Link & Marve Road, Malad (W), Mumbai -400064

CIN No.:- L28995MH2010PLC199691 Website:-www.bilenergy.com Email 10:- investors@bilenergy.com Telephone No.:- 022-42728080 Fax No.:-022-28811225

Unaudited Financial Results for the Quarter and Half Year ended on 30th September, 2016

"otes:

(Rs. in Lacs)

Unaudited statement of Assets & Liabilities as on 30th September 2016

A

EQUITY AND LIABILITIES

Shareholders' Funds

a) Share Capital

b) Reserves and Surplus

Non -Current Liabilities

a) Long-Term Borrowings

b) Other Long Term Liabilities

Sub Total- Non Current Liabilities

Current Liabilities

a) Short -Term Borrowings

b) Trade Payables

c) Other Current Liabilities

As at

30.09.2016

Unaudited

As at

31.03.2016

Audited

1057.08

1346.42

2403.50

1057.08

4.34

4.34

4.34

4.34

7979.01

7979.01

1303.94

2361.02

r-----------t-----------1

1032.56

1178.99

972.64

938.59

Sub Total- Currnet Liabilities

9984.21

10096.59

TOTAL - EQUITY AND LIABILITIESt---------:-7=-.::-::-::+-------~:-:-:"-::-::1

12392.05

12461.95

f

BASSETS

1 Non -Current Assets

a) Tangible Assets

b) Capital Work in Progress

c) Long- Term Loans and Advances

Sub Total- Non Current Assets

2 Current assets

a) Current Investments

a) Inventories

b) Trade Receivables

c) Cash and Cash Equivalents

d) Short-Term Loans and Advances

e) Share Application Money Given

3978.48

315.24

86.43

4380.15

4189.75

315.24

86.45

4591.44

162.35

163.00

83.32

77.70

4557.66

3859.59

11.95

38.18

3196.62

3732.04

0.00

0.00

Sub Total-Current Assets

8011.90

7870.51

TOTAL - ASSETSt---------:-7=:-::-::+--------:-:-::-::-:--::-::1

12392.05

12461.95

1)

The Company primarily deals in the business of Electrical Steel Products and Other Steel Products as single segment hence Segment Reporting as defined in

Accounting Standard 17 (AS-I?) issued by The Institute of Chartered Accountants of India is not applicable to the Company.

2)

The above results were reviewed by Audit Committee and approved by the Board of directors of the Company at its meeting held at Mumbai on 11th

November 2016.and published in accordance with regulation 33 of the SEBI (Lisitng Obligations and Disclosure Requirements) Regulations, 2015.

3)

4)

The auditors have conducted a "Limited Review" of the above financial results.

Other income includes interest, commission, rent etc.

5)

6)

The lender bank has recalled the entire oustanding amounts alleged to be Rs.89.84 crores as per order dated 14/05/2015.

Previous period figures have been regrouped and reclassified, where ever necessary, to make them comparable with current quarter figures.

Place : Mumbai

Date: 11.11.2016

For & on behalf of the Board of Directors

Suresh More

Director (DIN 06873425)

Bansal Bansal & Co.

Chartered Accountants

INDEPENDENT AUDITOR'S REVIEW REPORT

To The Board of Directors

BIL ENERGY SYSTEM LIMITED

1. We have reviewed the accompanying statement of unaudited financial results of BIL

ENERGY SYSTEMS LIMITED for the quarter ended September 30, 2016. This

statement is the responsibility of the company's management and has been approved

by the Board of Directors. Our responsibility is to issue a report on these financial

results based on our review .

2. We conducted our review in accordance with the Standard on Review Engagement

(SRE) 2400 'Engagements to Review Financial Statements issued by the Institute of

Chartered Accountants of India. This standard requires that we plan and perform

the review to obtain moderate assurance as to whether the financial statement is free

of material misstatement. A review is limited primarily to inquiries of Company

personnel and analytical procedures applied to financial data and thus provide less

assurance than an audit. We have not performed an audit and accordingly, we do

not express an audit opinion.

3. The company has not provided for interest payable to State Bank of India

amounting to Rs. 328.13 lakh for the quarter ended 30 th September, 2016. As a

result, the Loss for the quarter ended 30 th September 2016 is understated by

Rs. 328.13 lakh & current liabilities as at 30 th September, 2016 is understated by

Rs. 328.13 lakh and also reserves are overstated by Rs 328.13 lakh. Total interest

not provided for the half year ended 30 th September, 2016 is Rs. 643.38 lakh. The

Company has not provided for interest payable to State Bank of India amounting

to Rs.1179.56 lakh for the year ended 31st March 2016 and Rs 1045.121akh for the

year ended 31st March 2015. The Company has also not made any provision for

penal interest claimed by the bank. The amount of penal interest cannot be

quantified as the details have not been received from the bank.

4. The lender' Bank of Bilpower Limited has pursuant to certain corporate guarantees

given by the company demanded from the company their dues from Bilpower

Limited amounting to Rs 215.82 crores. No provision has been made in the

accounts for the probable loss that may arise on account of above demand of

Rs. 215.82 crores.

5. Loan given includes 4 interest free unsecured loans of Rs.179.33 lakh.

6. Based on our review conducted as above, nothing has come to our attention that

causes us to believe that the accompanying Statement of unaudited financial results

prepared in accordance with applicable accounting standards and other recognized

accounting practices and policies has not disclosed the information required to be

120, Building No.6, Mittal Industrial Estate, Andheri Kurla Road,. Andh.eri (East), Mumbai - 400 059.

Tel.:+91 2266622444 Fax: +91 226662 2423 Email: mall@bansalbansal.com

disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015 including the manner in which it is to be disclosed,

or that it contains any material misstatement.

For Bansal Bansal & Co.

Chartered Accountants

Firm Reg. No. 100986W

..J

Place of Signature: Mumbai

Date: 11th November, 2016.

)J ______ _..

~

You might also like

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Final ReportDocument28 pagesFinal ReportLương Vân TrangNo ratings yet

- ECO 372 Final Exam GuideDocument16 pagesECO 372 Final Exam GuideECO 372 Week 5 Final ExaminationNo ratings yet

- IBF QuestionDocument13 pagesIBF QuestionSaqib JawedNo ratings yet

- Detail P&LDocument2 pagesDetail P&LPuteh BeseryNo ratings yet

- MACRO Practice TestDocument22 pagesMACRO Practice TestTee_Tee57No ratings yet

- Ismail Arshad (1947172) ECO-01Document3 pagesIsmail Arshad (1947172) ECO-01ismail malikNo ratings yet

- Problems Solved Pay Back PeriodDocument7 pagesProblems Solved Pay Back PeriodAfthab MuhammedNo ratings yet

- MhizhaDocument84 pagesMhizhaInnocent MakayaNo ratings yet

- PGDTDocument68 pagesPGDTFahmi AbdullaNo ratings yet

- Auditing Fixed Assets ControlsDocument20 pagesAuditing Fixed Assets ControlsTesfahun tegegnNo ratings yet

- 09-PCSO2019 Part2-Observations and RecommDocument40 pages09-PCSO2019 Part2-Observations and RecommdemosreaNo ratings yet

- Tax Revenue Performance in KenyaDocument47 pagesTax Revenue Performance in KenyaMwangi MburuNo ratings yet

- GST Returns - Types, Forms, Due Dates & PenaltiesDocument7 pagesGST Returns - Types, Forms, Due Dates & PenaltiesRaj ArlaNo ratings yet

- Hemh108 PDFDocument20 pagesHemh108 PDFhoneygarg1986No ratings yet

- 57 Promenade Pty LTD: BISM7202 Assignment - Semester 1, 2020 Assignment TemplateDocument34 pages57 Promenade Pty LTD: BISM7202 Assignment - Semester 1, 2020 Assignment Templateharoon nasirNo ratings yet

- Rimbunan Sawit Berhad - Annual Report 2016Document154 pagesRimbunan Sawit Berhad - Annual Report 2016Appie KoekangeNo ratings yet

- Company Car Policy Doc Download Car PolicyDocument2 pagesCompany Car Policy Doc Download Car PolicyNiraj SaneNo ratings yet

- 07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Document51 pages07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Ahmed El KhateebNo ratings yet

- Economics Model QP & Ms Xii 2022-23Document14 pagesEconomics Model QP & Ms Xii 2022-23HarshitNo ratings yet

- Dividend Decisions 1 PDFDocument29 pagesDividend Decisions 1 PDFArchana RajNo ratings yet

- AdityaDocument1 pageAdityaankit ojhaNo ratings yet

- The Chase Manhattan Bank (National Association) v. Corporacion Hotelera de Puerto Rico, Municipality of San Juan, Intervenor-Appellant, 516 F.2d 1047, 1st Cir. (1975)Document4 pagesThe Chase Manhattan Bank (National Association) v. Corporacion Hotelera de Puerto Rico, Municipality of San Juan, Intervenor-Appellant, 516 F.2d 1047, 1st Cir. (1975)Scribd Government DocsNo ratings yet

- Tax Invoice for Fitness EquipmentDocument1 pageTax Invoice for Fitness EquipmentVenkat DeepakNo ratings yet

- SITXGLC001 AnswersDocument5 pagesSITXGLC001 AnswersShivam Anand ShuklaNo ratings yet

- Vodafone International Holdings B.V. vs. Union of India & Anr. (2012) 6SCC613 Tax Avoidance/Evasion: Correctness of Azadi Bachao CaseDocument18 pagesVodafone International Holdings B.V. vs. Union of India & Anr. (2012) 6SCC613 Tax Avoidance/Evasion: Correctness of Azadi Bachao CasearmsarivuNo ratings yet

- Employee's Withholding Exemption and County Status CertificateDocument2 pagesEmployee's Withholding Exemption and County Status CertificateAparajeeta GuhaNo ratings yet

- LUMS Applied Taxation Course OverviewDocument5 pagesLUMS Applied Taxation Course Overviewnetflix accountNo ratings yet

- ExternalitiesDocument10 pagesExternalitiesozdolNo ratings yet