Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

TARAPUR

TRANSFORMERS LTD.

Dated: 11 th November, 2016

To,

Department of Corporate Services

Bombay Stock Exchange Ltd. (BSE)

P.'. Towers, Dalal Street,

Mumbai - 400001

Stock Code 533203

Fax: 02222723121

The Manager-Listing Department

National Stock Exchange of India Limited

Exchange Plaza, Bandra-Kurla Complex,

Bandra (East), Mumbai - 400051

Stock Code TARAPUR

Fax: 02226598120

Dear Sir,

Sub: Outcome of the me:ting of the Board of Directors held on 11 th November,

2016 and Submission of Q-II Results along with Limited Review Report by

Statutory Auditors.

This is to inform you that a meeting of the Board of Directors of the Company was held at

Friday, 11 th November, 2016 at 2 nd Floor, Vikas Chambers, Junction of Link and Marve Road,

Malad (W), Mumbai-400064 at 05.00 p.m., to transact the business as given below:

1. Un-audited financial results for the quarter jhalf year ended on 30 th September, 2016.

(the copy of the same ;s enclosed herewith);

2. Limited Review Report issued by the Statutory Auditors of the Company for the quarter j

half year ended on 30 th September, 2016 was noted (the copy of the same is enclosed

herewith);

Kindly take the same on your records.

Thanking You,

SURESH ORE

Managing Director

DIN: 06873425

End: as above

Regd. Office: J-20, MIDC, Tarapur Industrial Area, Boisar, Tal- Palghar, Dist.- Thane- 401 506.

Admin Office: 201-204, Vikas Chambers, Link & Marve Road, Malad (W), Mumbai- 400064, India.

Tel: +91 2242728080, Fax: + 91 2228811225, Website: www.tarapurtransformers.com, email:

complianceofficer@ tarapurtransformers.com, CIN: L99999MH1988PLC047303

RAMAN S. SHAH & ASSOCIATES

CHARTERED ACCOUNTANTS

CA Raman S. Shah, B.Com ,F.C.A.

CA Santosh A. Sankhe, B.Com ,F.C.A.

CA Bharat C. Bhandari,B.Com ,F.C.A.

LIMITED REVIEW REPORT

To,

The Board of Directors

Tarapur Transformers Limited.

1.

We have reviewed the accompanying statement of unaudited financial results of

TARAPUR TRANSFORMERS LIMITED for the quarter ended 30Th September, 2016 which has

been initialed by us for identification purposes. This statement is the responsibility of the

Company's Management and has been approved by the Board of Directors. Our

responsibility is to issue a report on these financial statements based on our review.

2.

We conducted our review in accordance with the Standard on Review Engagement (SRE)

2410, "Review of Interim Financial Information performed by the Independent Auditor of

the Entity" issued by the Institute of Chartered Accountants of India. This Standard

requires that we plan and perform the review to obtain moderate assurance as to

whether the financial statements are free of material misstatements. A review of interim

of financial information consists principally of applying analytical procedures for financial

data and making enquiry of persons respons'ible for financial and accounting matters. It is

substantially less in scope than an audit conducted in accordance with generally

accepted auditing standards, the objective of which is the expression of op'inion

regarding the financial statements taken as a whole. Accordingly we do not express such

an opinion.

3.

Based on our review conducted as above, nothing has come to our attention that causes

us to believe that the accompanying statement of unaudited financial results prepared in

accordance with applicable accounting standards and other recognized accounting

practices and policies has not disclosed the information required to be disclosed in terms

of Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015 including the manner in which it is to be disclosed, or that it contains

any material misstatement.

For Raman S. Shah & Associates

Chartered Accountants

Place :Mumbai

Date :11 th November, 2016

Head Office :- Sam Plaza,'A' Wing,IInd Floor,H.K.Irani Road,Dahanu Road (W) 401602

Branch Office:-1)A-104,Ist Floor,Inder Darshan BUilding,Jamli Gali,Borivali(W),Mumbai(W),400092

2)118-121,Ist Floor,"Harmony Plaza",Tarapur Road,Boisar,401501

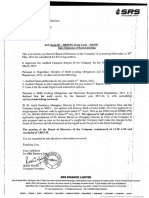

TARAPUR TRANSFORMERS LIMITED

Registered Office: J-20, MIOC, Tarapur Industrial Area, Boisar, Thane - 401506.

CIN NO.L99999MH1988PLC047303, website: www.tarapurlransformers.com, email id : complianceofficer@tarapurlransformers.com,

Tel No. +91-22-42728065, Fax No. 022- 28811225

Unaudited Financial Results for the Quarter and Half Year ended on 30th September, 2016

PART I

(Rs. in Lacs)

Particulars

Income from Operations

Net Sales / Income from Operations (Net of excise duty)

Total Income from operations (net)

Year to date

Year to date

figures for

figures for

Previous

current

previous Year ended

period

year ended

ended

Three

Months

ended

Preceding

three months

ended

Corresponding

three months

ended in

previous year

Unaudited

Unaudited

Unaudited

Unaudited

Unaudited

30.09.16

30.06.16

30.09.15

30.09.16

30.09.15

(Audited)

31.03.16

894.01

894.01

420.35

420.35

499.54

499.54

1314.36

1314.36

841.53

841.53

2200.21

2200.21

1.60

897.84

81.00

406.25

117.38

454.13

82.60

1304.09

121.42

821.22

521.52

2046.22

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Other expenses

Total Expenses

(20.64)

8.12

46.31

18.88

952.11

(85.19)

10.53

45.80

29.71

488.10

(101.76)

16.51

50.92

31.80

568.98

(105.83)

18.65

92.11

48.59

1440.21

(152.64)

31.83

99.80

56.72

978.35

(380.85)

69.35

195.90

185.72

2637.86

Profit \ (Loss) from Operations before Other Income, finance

costs and exceptional items (1-2)

(58.10)

(67.75)

(69.44)

(125.85)

(136.82)

(437.65)

Other Income

Profit \ (Loss) from ordinary activities before finance costs and

exceptional items (3+4)

39.93

44.96

51.95

84.89

102.52

336.81

(18.17)

0.44

(22.79)

0.88

(17.49)

0.31

(40.96)

1.32

(34.30)

1.64

(100.84)

4.21

(18.61)

(18.61)

(23.67)

(17.80)

(17.80)

(42.28)

(35.94)

(105.05)

(42.28)

(35.94)

5

6

Expenses

a) Cost of materials consumed

b) Purchase of stock in trade

C) Changes in uwentones ottinisheet gooets, work in progress and

stock in trade

Finance costs

Profit \ (Loss) from ordinary activities afler finance costs but before exceptional

items (5-6)

7

8

9

10

11

12

13

Exceptionalltems (Loss on sales of Investments/Fixed Assets)

Profit \ (Loss) from Ordinary Activities before tax (7-8)

Tax Expenses

Net Profit \ (Loss) from Ordinary Activities after tax (9-10)

Extraordinary items (net of tax expenses)

Net Profit \ (Loss) for the period (11 +12)

14

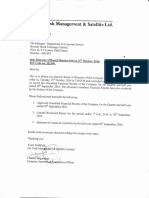

Paid Up Equity Share Capital

Face Value of Equity Shares (in Rupees)

Il<eserves l::xclueting Revaluation l<eserves as per balancesheet ot

15 previous year

16 Earning Per Share (In Rs.)

a) Basic

b) Diluted

PART II

A PARTICULARS OF SHAREHOLDING

1 Public shareholding

- Number of Shares (In Lac)

Percentage of Shareholding

2 Promoters and promoter group SharehoIding

a) Pledged / Encumbered

- Number of Shares (In Lac)

- Percentage of Shares

(as a

(18.61)

(23.67)

(23.67)

(42.28)

(42.28)

(35.94)

(35.94)

(10505)

(105.05)

(105.05)

(18.61)

(23.67)

(17.80)

(17.80)

1950.00

10.00

1950.00

10.00

1950.00

10.00

1950.00

10.00

1950.00

10.00

1950.00

10.00

3464.91

3311.92

3242.80

(0.10)

(0.10)

(0.12)

(0.12)

(0.09)

(0.09)

(0.22)

(0.22)

(0.18)

(0.18)

(0.54)

(0.54)

107.97

55.37%

107.97

55.37%

107.97

55.37%

107.97

55.37%

107.97

55.37%

107.97

55.37%

84.16

84.16

84.16

84.16

84.16

84.16

96.71%

96.71%

96.71%

96.71%

96.71%

96.71%

43.16%

43.16%

43.16%

43.16%

43.16%

43.16%

of lolal shareholding of promoter and promoter group)

- Percentage of Shares (as a" of lolal sharecapi'al of !he Company)

b) Non-encumbered

- Number of Shares (In Lac)

- Percentage of Shares

2.87

2.87

2.87

2.87

2.87

2.87

3.29%

3.29%

3.29%

3.29%

3.29%

3.29%

1.47%

1.47%

1.47%

1.47%

1.47%

1.47%

(as a % of total shareholding of promoter and promoter Reoup)

- Percentage of Shares (as a" of tolal sharecap",,1 of 'he Company)

INVESTOR COMPLAINTS

Complaints at the beginning of the Quarter

NIL

g~SFO~

rfJ....'/

-....::~"

.

.

1~~1';f1~)

~q.lt ."'~

..

~"'J.

Received

During the

iQuarter

0

Disposed off During Quarter

Remaining unresolved at the end of the

quarter 30.09.2016

NIL

J\Jotes:

(Rs. in Lacs)

As at :.u:03.20i6

Audited

1) Discosure of statement of asets and liabilities for the period ended 30th September 2016

As at 30.09.2016

Unaudited

Unaudited statement of Assets & Liabilities as on 30th September, 2016

A

EQUITY AND LIABILITIES

1 Shareholders' Funds

a) Share Capital

b) Reserves and Surplus

1950.00

Sub Total - Shareholders' Funds

1950.00

3464.91

5414.91

Sub Total- Non Current Liabilities

56.84

56.84

56.84

56.84

3453.06

3437.52

Sub Total - Currnet Liabilities

TOTAL - EQUITY AND LIABILITIES

2495.24

335.70

6284.00

11755.75

1991.22

346.00

5774.74

11024.38

2784.40

132.21

779.63

Sub Total- Non Current Assets

2674.80

132.21

779.86

0.00

3586.87

3696.24

Sub Total-Current Assets

TOTAL ASSETS

482.30

721.06

4353.15

224.40

2387.97

8168.88

11755.75

482.30

618.72

3598.52

211.35

2417.25

7328.14

11024.38

2 Non -Current Liabilities

a) Deferred Tax Liabilities (Net)

b) Long-Term Borrowings

3 Current liabilities

a) Short -Term Borrowings

b) Trade Payabies

c) Other Current Liabilities

ASSETS

1 Non -Current Assets

a) Tangible Assets

b) Intangible Assets

c) Long- Term Loans and Advances

d) Other Non-Current Assets

f

2 Current assets

a) Current Investments

b) Inventories

c) Trade Receivables

d) Cash and Cash Equivalents

e) Short-Term Loans and Advances

3242.80

5192.80

2 The above results were reviewed by Audit Committee and approved by the Board of directors of the Company at its meeting held at Mumbai On

11 th November,2016 and published in accordance with Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

3 The above result are drawn without taking into account transaction of Baroda Unit as the same has not been received due to technical reason.

4 The auditors have conducted a "Limited Review" of the above financial results.

5 The Company primarily deals in the business of manufacturing and repairs of Transformers as single segment hence Segment Reporting as defined in

Accounting Standard 17(AS-17) issued by the Institute of Chartered Accountants of India is not applicable to the Company.

6 The lender Bank has issued notice dated 30/05/2015 u/ s 13(2) of Securitization & Reconstruction of Financial Assets & Enforcement of Seurity

Intrest Act, 2002 and has sought to recalled the entire oustanding amounts alleged to be Rs.40.26 crores allegedly owing to them by the company.

In view of Legal notice and based On Legal advice received by the company it has been decided not to provide any interest On liability

of Canara Bank w.e.f. 1st April, 2014.

7 The lender Bank has issued notice dated 31/12/2015 u/ s 13(2) of Securitization & Reconstruction of Financial Assets & Enforcement of Security

Interest Act, 2002 and has sought to recalled the entire outstanding amount alleged to be Rs.l.81 crores allegedly owing to them by the company.

In view of Legal notice and based On Legal advice received by the company it has been decided not to provide any interest On liability of

DhanJaxmi Bank w.e.f 1st April, 2015.

8 Other income includes interest, etc.

9 Previous period figures have been regrouped and reclassified,where necessary,to make them comparable with current quarter figures.

For & on

Place: Mumbai

beha\~~h\pDiIeclors

Suresh More

Director

Date: 11.11.2016

Din: 068734Z5

You might also like

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Performance For The Half Year Ended September 30, 2016 (Company Update)Document5 pagesPerformance For The Half Year Ended September 30, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document6 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document13 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Updates On Financial Results For June 30, 2016 (Result)Document3 pagesUpdates On Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- P1 - Corporate Reporting April 11Document20 pagesP1 - Corporate Reporting April 11Abdurrazaq PanhwarNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument35 pagesFinancial Statement Analysis: K R Subramanyam John J WildSeven seasNo ratings yet

- Lesson 2.1 & 2.2: Financial AnalysisDocument9 pagesLesson 2.1 & 2.2: Financial AnalysisIshi MaxineNo ratings yet

- Finaco1 Module 2 AssignmentDocument10 pagesFinaco1 Module 2 AssignmentbLaXe AssassinNo ratings yet

- CV. Linggarjati Cash Receipt Journal March 2010Document64 pagesCV. Linggarjati Cash Receipt Journal March 2010Verro CasparoNo ratings yet

- Final Draft Banana ChipsDocument35 pagesFinal Draft Banana ChipsJeff Cammagay100% (3)

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- BA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsDocument23 pagesBA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsRed Ashley De LeonNo ratings yet

- Presentation of Statement of Financial PositionDocument14 pagesPresentation of Statement of Financial PositionMylene Santiago100% (1)

- Apples and OrangesDocument12 pagesApples and OrangesKate GouldNo ratings yet

- Access Full Year Financials 2020 WebDocument2 pagesAccess Full Year Financials 2020 WebFuaad DodooNo ratings yet

- Tables - SAP Basis Tutorials - TrainingDocument216 pagesTables - SAP Basis Tutorials - TrainingMarco CorreiaNo ratings yet

- Chap 014Document27 pagesChap 014kainattariq67% (3)

- Ch19 Income TaxDocument7 pagesCh19 Income TaxVioni HanifaNo ratings yet

- Replacement AnalysisDocument34 pagesReplacement AnalysisShamsul AffendiNo ratings yet

- ACCT105 Quiz 11 - Depreciation calculationsDocument8 pagesACCT105 Quiz 11 - Depreciation calculationsAway To PonderNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Amendment in Income Tax Act Through Finance Act 2021Document14 pagesAmendment in Income Tax Act Through Finance Act 2021rahul dantkaleNo ratings yet

- EBMC 3103 Engineering Economics TitleDocument7 pagesEBMC 3103 Engineering Economics TitleLynnNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- Accounting Concept, Covention and PrinciplesDocument30 pagesAccounting Concept, Covention and PrinciplesShalini TiwariNo ratings yet

- Specialty Gifts Business PlanDocument44 pagesSpecialty Gifts Business PlannoomittaNo ratings yet

- Data Sampoerna PDFDocument3 pagesData Sampoerna PDFaldo saragihNo ratings yet

- Intangible Assets Problems 6-1 (Amsterdam Enterprises)Document5 pagesIntangible Assets Problems 6-1 (Amsterdam Enterprises)ExequielCamisaCrusperoNo ratings yet

- Theoretical Failure of IAS 41Document5 pagesTheoretical Failure of IAS 41Tosin YusufNo ratings yet

- Partnership Dissolution DisputeDocument4 pagesPartnership Dissolution DisputejessapuerinNo ratings yet

- Klabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsDocument10 pagesKlabin Reports 2nd Quarter Earnings of R$ 15 Million: HighlightsKlabin_RINo ratings yet

- Discounted Cash FlowDocument9 pagesDiscounted Cash FlowAditya JandialNo ratings yet

- Ias 37 PDFDocument27 pagesIas 37 PDFmohedNo ratings yet

- Thesis On Ias 16Document4 pagesThesis On Ias 16BestCustomPaperWritingServiceCanada100% (2)