Professional Documents

Culture Documents

Case Study: Blake Electronics Develops Home Electronics

Uploaded by

Mohit JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study: Blake Electronics Develops Home Electronics

Uploaded by

Mohit JainCopyright:

Available Formats

CaseStudy

Starting Right Corporation

After watching a movie about a young woman who quit a

successful corporate career to start her own baby food company, Julia Day decided that she wanted to do the same. In

the movie, the baby food company was very successful. Julia

knew, however, that it is much easier to make a movie about

a successful woman starting her own company than to actually do it. The product had to be of the highest quality, and

Julia had to get the best people involved to launch the new

company. Julia resigned from her job and launched her new

company-Starting Right.

Julia decided to target the upper end of the baby food market by producing baby food that contained no preservatives but

had a great taste. Although the price would be slightly higher

than for existing baby food, Julia believed that parents would

be willing to pay more for a high-quality baby food. Instead of

putting baby food in jars, which would require preservatives to

stabilize the food, Julia decided to try a new approach. The baby

food would be frozen. This would allow for natural

no preservatives, and outstanding nutrition.

Getting good people to work for the new co

also important. Julia decided to find people w

ence in finance, marketing, and production to gl

with Starting Right. With her enthusiasm and

Julia was able to find such a group. Their first steI

velop prototypes of the new frozen baby food and

a small pilot test of the new product. The pilot te

rave reviews.

The final key to getting the young company oj

start was to raise funds. Three options were considf

rate bonds, preferred stock, and common stock. Ju

that each investment should be in blocks of $30,O

more, each investor should have an annual incoill(

$40,000 and a net worth of $100,000 to be eligible

Starting Right. Corporate bonds would return 13%]

CASE STUDY

s. Julia furthermore guaranteed that investors

bonds would get at least $20,000 back at the

s. Investors in preferred stock should see their

~ntincrease by a factor of 4 with a good market

;tmentworth only half of the initial investment

ablemarket. The common stock had the greatest

mitialinvestment was expected to increase by a

Ia good market, but investors would lose every'ketwas unfavorable. During the next five years,

thatinflation would increase by a factor of 4.5%

Questions

!ky,a retired elementary school teacher, is connvestingin Starting Right. She is very conserva,.s ariskavoider.What do you recommend?

111

2. Ray Cahn, who is currently a commodities broker, is also

considering an investment, although he believes that there is

only an 11% chance of success. What do you recommend?

3. Lila Battle has decided to invest in Starting Right. While

she believes that Julia has a good chance of being successful, Lila is a risk avoider and very conservative. What

is your advice to Lila?

4. George Yates believes that there is an equally likely

chance for success. What is your recommendation?

5. Peter Metarko is extremely optimistic about the market

for the new baby food. What is your advice for Pete?

6. Julia Day has been told that developing the legal documents for each fundraising alternative is expensive. Julia

would like to offer alternatives for both risk-averse and

risk-seeking investors. Can Julia delete one of the financial alternatives and still offer investment choices for risk

seekers and risk avoiders?

I

II

I

I

I

I

I

, II

; I'

~I

,I

II

I

'I

I

!y

ctronics

'e Blakefounded Blake Electronics in Long Beach,

0 manufacture resistors, capacitors, inductors, and

)Diecomponents. During the Vietnam War, Steve

operator, and it was during this time that he be;ientat repairing radios and other communications

Steve viewed his four-year experience with the

nixedfeelings. He hated army life, but this experiimthe confidence and the initiative to start his own

firm.

Ieyears,Steve kept the business relatively unchanged.

,talannual sales were in excess of $2 million. In 1996,

, Jim,joined the company after finishing high school

~arsof courses in electronics at Long Beach Commu:e.Jim was always aggressive in high school athletics,

:ameeven more aggressive as general sales manager

lectronics. This aggressiveness bothered Steve, who

onservative. Jim would make deals to supply compalectroniccomponents before he bothered to fmd out if

tronicshad the ability or capacity to produce the comIseveral occasions this behavior caused the company

iarrassingmoments when Blake Electronics was unable

the electronic components for companies with which

ade deals.

00, Jim started to go after government contracts for

: components. By 2002, total annual sales had inmore than $10 million, and the number of employees

200. Many of these employees were electronic sped graduates of electrical engineering programs from

Iges and universities. ,But Jim's tendency to stretch

~ctronics to contracts continued as well, and by 2007,

'ectronics had a reputation with government agencies

fpany that could not deliver what it promised. Almost

It,government contracts stopped, and Blake Electroneft with an idle workforce and unused manufacturing

equipment. This high overhead started to melt away profits, and

in 2009, Blake Electronics was faced with the possibility of sustaining a loss for the first time in its history.

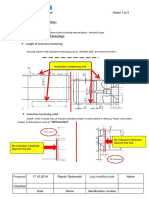

In 2010, Steve decided to look at the possibility of manufacturing electronic components for home use. Although this was a

totally new market for Blake Electronics, Steve was convinced

that this was the only way to keep Blake Electronics from dipping into the red. The research team at Blake Electronics was

given the task of developing new electronic devices for home

use. The first idea from the research team was the Master Control Center. The basic components for this system are shown in

Figure 3.15.

~

~

I

I

I

FIGURE 3.15

Master Control Center

~

I

0 0

Master 9Qqtrol Box

d

Outlet

Adapter

0

0

tight Switch

Adapter

~ -""..

0

Lightbulb

Disk

p,

II

pi

i/

II

'

I

I

!

~

!

d

,I

II

I,

q

I'

01

HI

I

II

~

h

I

p

I

I

;

r

II

'f'.

I. "

I

.

112

CHAPTER 3

DECISION

ANALYSIS

The heart of the system is the master control box. This unit,

which would have a retail price of $250, has two rows of five

buttons. Each button controls one light or appliance and can be

set as either a switch or a rheostat. When set as a switch, a light

finger touch on the button either turns a light or appliance on

or off. When set as a rheostat, a finger touching the button controls the intensity of the light. Leaving your finger on the button

makes the light go through a complete cycle ranging from off to

bright and back to off again.

To allow for maximum flexibility, each master control box

is powered by two D-sized batteries that can last up to a year,

depending on usage. In addition, the research team has developed three versions of the master control box-versions A, B,

and C. If a family wants to control more than 10 lights or appliances, another master control box can be purchased.

The lightbulb disk, which would have a retail price of

$2.50, is controlled by the master control box and is used to

control the intensity of any light. A different disk is available

for each button position for all three master control boxes.

By inserting the lightbulb disk between the lightbulb and the

socket, the appropriate button on the master control box can

completely control the intensity of the light. If a standard light

switch is used, it must be on at all times for the master control

box to work.

One disadvantage of using a standard light switch is that

only the master control box can be used to control the particular

light. To avoid this problem, the research team developed a speciallight switch adapter that would sell for $15. When this device is installed, either the master control box or the light switch

adapter can be used to control the light.

When used to control appliances other than lights, the master

control box must be used in conjunction with one or more outlet

adapters. The adapters are plugged into a standard wall outlet, and

the appliance is then plugged into the adapter. Each outlet adapter

has a switch on top that allows the appliance to be controlled

from the master control box or the outlet adapter. The price of

each outlet adapter would be $25.

The research team estimated that it would cost $500,000 to

develop the equipment and procedures needed to manufacture

the master control box and accessories. If successful, this venture could increase sales by approximately $2 million. But will

the master control boxes be a successful venture? With a 60%

chance of success estimated by the research team, Steve had

serious doubts about trying to market the master control boxes

even though he liked the basic idea. Because of his reservations, Steve decided to send requests for proposals (RFPs) for

TABLE 3.15

Unsuccessful

venture

Success Figures for MAl

35

20

15

30

additional marketing research to 30 marketingresea

nies in southern California.

The first RFP to come back was from a sma!

called Marketing Associates, Inc. (MAl), whichWI

$100,000 for the survey. According to its proposa

been in business for about three years and has cond

100 marketing research projects. MAl's major sf

peared to be individual attention to each account,(

staff, and fast work. Steve was particularly interestel

of the proposal, which revealed MAl's successreco

vious accounts. This is shown in Table 3.15.

The only other proposal to be returned wasI

office of Iverstine and Walker, one of the larges

research firms in the country. The cost for a com]

would be $300,000. While the proposal did not cont

success record as MAl, the proposal from Iverstine

did contain some interesting information. The ch

ting a favorable survey result, given a successful,

90%. On the other hand, the chance of getting an

survey result, given an unsuccessful venture, was

it appeared to Steve that Iverstine and Walker WOll

predict the success or failure of the master control

great amount of certainty.

Steve pondered the situation. Unfortunately, 1

ing research teams gave different types of inform:

proposals. Steve concluded that there would be no

two proposals could be compared unless he got add

mation from Iverstine and Walker. Furthermore,

sure what he would do with the information, an.

be worth the expense of hiring one of the markel

firms.

Discussion Questions

1. Does Steve need additional information fre

and Walker?

2. What would you recommend?

You might also like

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- The Great Depression of Debt: Survival Techniques for Every InvestorFrom EverandThe Great Depression of Debt: Survival Techniques for Every InvestorRating: 4 out of 5 stars4/5 (1)

- P Set I - 2010-1Document2 pagesP Set I - 2010-1Vishnu MeenaNo ratings yet

- The Big Idea CompilationDocument30 pagesThe Big Idea CompilationCarolyn McClendon100% (2)

- Principles of Economics I: Microeconomics Final (1/16/2009) : Part I. Multiple Choice (15 Questions, 30%)Document8 pagesPrinciples of Economics I: Microeconomics Final (1/16/2009) : Part I. Multiple Choice (15 Questions, 30%)Trần Triệu VyNo ratings yet

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDocument13 pagesMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDrMichelleHutchinsonwdimp100% (18)

- Food Inc.: Group No: 9 Section: DDocument5 pagesFood Inc.: Group No: 9 Section: DShreyas RaoNo ratings yet

- GPC U3C4L1-L4 Economics Q&A, Practice QuestionsDocument51 pagesGPC U3C4L1-L4 Economics Q&A, Practice Questionsnvrf4jnyn5No ratings yet

- Test Bank For Essentials of Marketing Management 1st Edition MarshallDocument92 pagesTest Bank For Essentials of Marketing Management 1st Edition MarshallXolani MpilaNo ratings yet

- Testiana Deni W Mid Test For Toeic GenapDocument11 pagesTestiana Deni W Mid Test For Toeic GenapArii YatiiNo ratings yet

- MGT-206 - Assignment 1 - 23.7.2020Document3 pagesMGT-206 - Assignment 1 - 23.7.2020SajidNo ratings yet

- Exam 1 Practice ProblemsDocument6 pagesExam 1 Practice ProblemsAnonymous VTbxBSoqWzNo ratings yet

- Consulting Case: Business TurnaroundDocument72 pagesConsulting Case: Business TurnaroundJerryJoshuaDiazNo ratings yet

- 11-Bba-02 Chapter 1 & 2Document8 pages11-Bba-02 Chapter 1 & 2Al EscobalNo ratings yet

- Macroeconomics Australia in The Global Environment Australian 1st Edition Parkin Solutions ManualDocument36 pagesMacroeconomics Australia in The Global Environment Australian 1st Edition Parkin Solutions Manualmilordaffrapy3ltr3100% (20)

- Starting Right CorporationDocument3 pagesStarting Right CorporationFrancis MacatugobNo ratings yet

- HomeworkDocument15 pagesHomeworkIonuț RaduNo ratings yet

- Final Exam ReviewDocument19 pagesFinal Exam ReviewJeromy Rech100% (1)

- Assignment #2Document10 pagesAssignment #2Liyana Abdul RahmanNo ratings yet

- STUDENT PORTFOLIO COVERS KEY TOPICSDocument24 pagesSTUDENT PORTFOLIO COVERS KEY TOPICSLaura Natalia Mozo LeonNo ratings yet

- Apple Management Strategic Management Case StudyDocument15 pagesApple Management Strategic Management Case StudyJedNur Kusayin100% (5)

- Y0999Document8 pagesY0999Jerry RodNo ratings yet

- Peter Thiel Good Pitch Deck ExampleDocument11 pagesPeter Thiel Good Pitch Deck Exampleapi-20471885290% (20)

- FALL 2012 Makeup ExamDocument10 pagesFALL 2012 Makeup ExamUFECO2023No ratings yet

- Foundations of Microeconomics 7th Edition Bade Solutions ManualDocument14 pagesFoundations of Microeconomics 7th Edition Bade Solutions ManualEricYoderptkao100% (19)

- Ib Mid-Term Test 2021-2022Document7 pagesIb Mid-Term Test 2021-2022With PM MeetingNo ratings yet

- BB Bakery's Wedding Cake ProfitsDocument4 pagesBB Bakery's Wedding Cake ProfitsSahil ThadaniNo ratings yet

- Ch. 1 Lecture NotesDocument40 pagesCh. 1 Lecture NotesJulia RobinsonNo ratings yet

- The Recalcitrant Director: Corporate Legality vs ResponsibilityDocument5 pagesThe Recalcitrant Director: Corporate Legality vs ResponsibilityFateen M BaderNo ratings yet

- Ivey - Case Book - 2005Document26 pagesIvey - Case Book - 2005g_minotNo ratings yet

- Essay Questions Chapters 1 Thru 16Document96 pagesEssay Questions Chapters 1 Thru 16DianaNo ratings yet

- Mid Term - Version ADocument7 pagesMid Term - Version Alam ivanNo ratings yet

- Respostas e Aplicações em InglêsDocument193 pagesRespostas e Aplicações em InglêsRPDPNo ratings yet

- Reading Comprehension 1Document6 pagesReading Comprehension 1Gagan Jeet SikhNo ratings yet

- OPERRES First Long Exam Reviewer. Show All Solutions. Round Off Final Answers To The Nearest Two Decimal Places and Encircle/box ThemDocument5 pagesOPERRES First Long Exam Reviewer. Show All Solutions. Round Off Final Answers To The Nearest Two Decimal Places and Encircle/box ThemNikita San MagbitangNo ratings yet

- Foundations of Macroeconomics 8th Edition Bade Solutions ManualDocument13 pagesFoundations of Macroeconomics 8th Edition Bade Solutions ManualDennisLongonjqi100% (15)

- prk21ms1099 Assignment 1Document15 pagesprk21ms1099 Assignment 1PRK21MS1099 GOPIKRISHNAN JNo ratings yet

- EA210190 Rino Icon BS.Document25 pagesEA210190 Rino Icon BS.Minhaz RahmanNo ratings yet

- What Is Economics?Document102 pagesWhat Is Economics?khNo ratings yet

- Economics-2 Final ExaminationDocument2 pagesEconomics-2 Final ExaminationG JhaNo ratings yet

- Accounting Textbook Solutions - 23Document19 pagesAccounting Textbook Solutions - 23acc-expertNo ratings yet

- Economic Analysis Case Studies Group AssignmentDocument16 pagesEconomic Analysis Case Studies Group AssignmentNike AlabiNo ratings yet

- Homework Assignment PDFDocument3 pagesHomework Assignment PDFFayyazAhmadNo ratings yet

- 10 Companies With Sustainable Competitive Advantages For Long TermDocument5 pages10 Companies With Sustainable Competitive Advantages For Long TermReyn CebuNo ratings yet

- Dogswell's New Pet Food Line Threatens Company ProfitsDocument12 pagesDogswell's New Pet Food Line Threatens Company ProfitsLe Kien0% (1)

- The Challenge of Entrepreneurs HiDocument19 pagesThe Challenge of Entrepreneurs HiBindu Sigdel100% (1)

- Marketing Mini Case #1 - Marketing ConceptsDocument2 pagesMarketing Mini Case #1 - Marketing ConceptsPriscilla WilliamsNo ratings yet

- Ans 10Document5 pagesAns 10apurvaNo ratings yet

- Global StrategyDocument12 pagesGlobal StrategychanduNo ratings yet

- Ch. 9 Production and ProductivityDocument6 pagesCh. 9 Production and ProductivityHANNAH GODBEHERENo ratings yet

- Full Download Foundations of Macroeconomics 8th Edition Bade Solutions ManualDocument34 pagesFull Download Foundations of Macroeconomics 8th Edition Bade Solutions Manualtimiditycadmico407100% (41)

- ExercisesDocument46 pagesExercisesLola Maso CecNo ratings yet

- The Canadian Business System: ESSAY QUESTIONS. Write Your Answer in The Space Provided or On A Separate Sheet of PaperDocument10 pagesThe Canadian Business System: ESSAY QUESTIONS. Write Your Answer in The Space Provided or On A Separate Sheet of Paperapi-301437610No ratings yet

- Full Download Managerial Economics 7th Edition Samuelson Solutions ManualDocument35 pagesFull Download Managerial Economics 7th Edition Samuelson Solutions Manualsebastianrus8c100% (40)

- Ass1 Macro sp20Document3 pagesAss1 Macro sp20NoorNo ratings yet

- Worksheet 1 PDFDocument6 pagesWorksheet 1 PDFJuan Antonio Limo DulantoNo ratings yet

- Why Most Product Launches FailDocument10 pagesWhy Most Product Launches FailFreeman EllisNo ratings yet

- Gokongwei Case StudyDocument3 pagesGokongwei Case StudyChristine AntiqueraNo ratings yet

- Coca-Cola (2) Advertising&Promotional StrtegyDocument104 pagesCoca-Cola (2) Advertising&Promotional StrtegyAbhishek SinghNo ratings yet

- Chapter 1 - Understanding The Supply ChainDocument17 pagesChapter 1 - Understanding The Supply ChainMohit JainNo ratings yet

- Dabur and Ariba Consulting GroupDocument10 pagesDabur and Ariba Consulting GroupMohit Jain50% (2)

- Claim lost items at Delhi airportDocument2 pagesClaim lost items at Delhi airportpunitlalwaniNo ratings yet

- Bussiness Plan, Prashant DabralDocument6 pagesBussiness Plan, Prashant DabralMohit JainNo ratings yet

- Supply Chain and Value-Creation: Makrand Agrawal (B43) Palash Verma (E35) Sai Praveen (D23)Document18 pagesSupply Chain and Value-Creation: Makrand Agrawal (B43) Palash Verma (E35) Sai Praveen (D23)Mohit JainNo ratings yet

- Multiple Regression Analysis in Educational ResearchDocument14 pagesMultiple Regression Analysis in Educational ResearchMohit JainNo ratings yet

- Research Study On HCL Product - 158944627Document49 pagesResearch Study On HCL Product - 158944627Mohit JainNo ratings yet

- Best Brands in The Cadbury Portfolio & Their TaglinesDocument6 pagesBest Brands in The Cadbury Portfolio & Their TaglinesMohit JainNo ratings yet

- Presentation Ford & ToyotaDocument40 pagesPresentation Ford & ToyotaPhoneix12No ratings yet

- Aluminum Content in DeodorantsDocument19 pagesAluminum Content in DeodorantsMohit JainNo ratings yet

- Pizza Hut and Dominozz Comparative StudyDocument72 pagesPizza Hut and Dominozz Comparative Studyhashmimahmood0581720No ratings yet

- RetailDocument10 pagesRetailMohit JainNo ratings yet

- Lakme Report FinalDocument68 pagesLakme Report Finalvids548No ratings yet

- Marketing Research Project On Comparative Analysis of 4 Stroke Bikes With QuestionnaireDocument78 pagesMarketing Research Project On Comparative Analysis of 4 Stroke Bikes With QuestionnaireAman Chauhan50% (2)

- MRF Group - 10: B2B Marketing Strategy for Madras Rubber Factory TyresDocument13 pagesMRF Group - 10: B2B Marketing Strategy for Madras Rubber Factory TyresMohit JainNo ratings yet

- Chapter Seventeen: Correlation and RegressionDocument80 pagesChapter Seventeen: Correlation and RegressionMohit JainNo ratings yet

- Chapter 1Document28 pagesChapter 1Mohit JainNo ratings yet

- How Bidorbuy ICow Guinness and Unilever Succeeded in AfricaDocument5 pagesHow Bidorbuy ICow Guinness and Unilever Succeeded in AfricaMohit JainNo ratings yet

- Dabur's Spend Management Journey with AribaDocument4 pagesDabur's Spend Management Journey with AribaMohit JainNo ratings yet

- Conflict & Negotiation NDocument5 pagesConflict & Negotiation NMohit JainNo ratings yet

- Zarafinalppt 131114102320 Phpapp02Document22 pagesZarafinalppt 131114102320 Phpapp02Mohit JainNo ratings yet

- Bridgestone and MRF Tyre IndustryDocument83 pagesBridgestone and MRF Tyre IndustrySankar Rajan69% (16)

- Nooyi Case StudyDocument5 pagesNooyi Case StudyMohit JainNo ratings yet

- GE and TeamDocument5 pagesGE and TeamMohit JainNo ratings yet

- Elements of Business Laws and ManagementDocument479 pagesElements of Business Laws and ManagementYogesh Sahani100% (1)

- 19699ipcc Blec Law Vol1 Chapter2Document62 pages19699ipcc Blec Law Vol1 Chapter2Chaitu ChaituNo ratings yet

- MotivationDocument4 pagesMotivationHitesh SharmaNo ratings yet

- Chapter 6 Simulation - CaseDocument2 pagesChapter 6 Simulation - CaseMohit JainNo ratings yet

- Elemental Composition of Dalang': A Food Condiment From Evaporated Extract of Borassus Aethiopum Fruit AshDocument3 pagesElemental Composition of Dalang': A Food Condiment From Evaporated Extract of Borassus Aethiopum Fruit AshsardinetaNo ratings yet

- Induction Hardening - Interpretation of Drawing & Testing PDFDocument4 pagesInduction Hardening - Interpretation of Drawing & Testing PDFrajesh DESHMUKHNo ratings yet

- AMYLOIDOSISDocument22 pagesAMYLOIDOSISMohan ChoudharyNo ratings yet

- Versant ModifiedDocument57 pagesVersant ModifiedAryan Kharadkar100% (3)

- Orientation Report PDFDocument13 pagesOrientation Report PDFRiaz RasoolNo ratings yet

- Finals-Insurance Week 5Document19 pagesFinals-Insurance Week 5Ryan ChristianNo ratings yet

- Goat Milk Marketing Feasibility Study Report - Only For ReferenceDocument40 pagesGoat Milk Marketing Feasibility Study Report - Only For ReferenceSurajSinghalNo ratings yet

- Specifications Sheet ReddyDocument4 pagesSpecifications Sheet ReddyHenry CruzNo ratings yet

- BS en 12201 5 2011Document20 pagesBS en 12201 5 2011fatjon31100% (4)

- Presentation 123Document13 pagesPresentation 123Harishitha ManivannanNo ratings yet

- History: Ludwig Hunger: About Us: Home - Ludwig Hunger GMBHDocument3 pagesHistory: Ludwig Hunger: About Us: Home - Ludwig Hunger GMBHPatrizio MassaroNo ratings yet

- Typhoon Ulysses Philippines Deadly StormDocument2 pagesTyphoon Ulysses Philippines Deadly Stormjai mansosNo ratings yet

- Blood Group 3Document29 pagesBlood Group 3Hamirie JoshuaNo ratings yet

- Chapter 7 (Additional Notes) Thermodynamics Review (Power Plant Technology by M Wakil)Document29 pagesChapter 7 (Additional Notes) Thermodynamics Review (Power Plant Technology by M Wakil)Aries SattiNo ratings yet

- Print Date:: Container No NO Size Seal No Seal Party Supplier Status Movement TypeDocument3 pagesPrint Date:: Container No NO Size Seal No Seal Party Supplier Status Movement TypeYudha PermanaNo ratings yet

- Common Herbs and Foods Used As Galactogogues PDFDocument4 pagesCommon Herbs and Foods Used As Galactogogues PDFHadi El-MaskuryNo ratings yet

- Solid Waste ManagementDocument26 pagesSolid Waste ManagementPamela MendozaNo ratings yet

- PPS120 Rev10 0309 PDFDocument2 pagesPPS120 Rev10 0309 PDFArfanAliNo ratings yet

- Advanced Composite Materials Design EngineeringDocument19 pagesAdvanced Composite Materials Design EngineeringpanyamnrNo ratings yet

- Binge-Eating Disorder in AdultsDocument19 pagesBinge-Eating Disorder in AdultsJaimeErGañanNo ratings yet

- Poultry DiseasesDocument5 pagesPoultry DiseasesAnjum IslamNo ratings yet

- Earth and Life Science DLLDocument6 pagesEarth and Life Science DLLGsoon Sibulan100% (3)

- Standardization Parameters For Production of Tofu Using WSD-Y-1 MachineDocument6 pagesStandardization Parameters For Production of Tofu Using WSD-Y-1 MachineAdjengIkaWulandariNo ratings yet

- IIT2019 RIT-1-CPM Chemistry TestDocument15 pagesIIT2019 RIT-1-CPM Chemistry TestPRAKHAR GUPTANo ratings yet

- Company Profile 2Document7 pagesCompany Profile 2R Saravana KumarNo ratings yet

- 500 Important Spoken Tamil Situations Into Spoken English Sentences SampleDocument7 pages500 Important Spoken Tamil Situations Into Spoken English Sentences SamplerameshdurairajNo ratings yet

- SmartRunway SmartLandingDocument39 pagesSmartRunway SmartLandingMikeNo ratings yet

- Advanced Radiographic Techniques PDFDocument21 pagesAdvanced Radiographic Techniques PDFelokfaiqNo ratings yet

- Three Bucket Method & Food ServiceDocument4 pagesThree Bucket Method & Food Servicerose zandrea demasisNo ratings yet

- Fund. of EnterpreneurshipDocument31 pagesFund. of EnterpreneurshipVarun LalwaniNo ratings yet