Professional Documents

Culture Documents

Flowchart of Tax Remedies I. Remedies Un

Uploaded by

Kevin Ken Sison GancheroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flowchart of Tax Remedies I. Remedies Un

Uploaded by

Kevin Ken Sison GancheroCopyright:

Available Formats

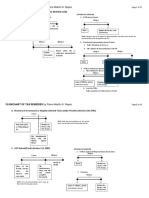

FLOWCHART OF TAX REMEDIES by Pierre Martin D.

Reyes

I. REMEDIES UNDER THE NATIONAL INTERNAL REVENUE CODE

A. Assessments (Section 228, NIRC)

30 days

30 days

Period within CIR or

Authorized Representative

to decide

LOA

PAN

Reply

OPTIONS OF TAXPAYER

1. If CIR denies Protest:

IF RECONSIDERATION

180 days

15 days

Page 1 of 12

FLD/

FAN

Protest

NOTE: Taxpayer may file a Motion for Reconsideration with the CIR but it shall not

toll the 30-day period to appeal to the CTA.

IF REINVESTIGATION

60 days

Petition for Review with

CTA Division

FDDA

180 days

2. If authorized representative denies Protest:

a. Follow Procedure in I(A)(1); or

b. File a Motion for Reconsideration with CIR

Submit

Documents

Period within CIR or

authorized representative

to decide

30 days

30 days

FDDA

MR with CIR

Petition for Review with

CTA Division

3. If CIR or authorized representative does not act within the 180-day

a.

File a Petition for Review within 30 days; or

period:

30 days

Lapse of 180-day period

(deemed a denial)

Petition for Review with

CTA Division

b. Await for FDDA

Follow procedure in either I(A)(1) or I(A)(2).

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 2 of 12

B. Recovery of Erroneously or Illegally Collected Taxes and/or Penalties (Section 229, NIRC)

2 years

Date of Payment

or Withholding of

Tax

NOTE: Both the administrative and the judicial

claim must be filed within the two-year period.

Petition for

Review with

CTA Division

File Administrative

Claim

with

CIR

(before

Judicial

Claim)

C. VAT Refund/Credit (Section 112, NIRC)

120 days

2 years

Close of the

Taxable Quarter

when

the

relevant

sales

were made

File

Administrative

Claim with CIR

and

submit

complete

documents

Period to

decide

OPTIONS OF TAXPAYER

1. If CIR or authorized Representative denies claim:

30 days

Petition for

Review with

CTA Division

Denial

2. If inaction:

30 days

NOTE: Only the administrative claim must be

filed within the two-year period.

Lapse of 120-day period

(considered a denial)

Petition for

Review with

CTA Division

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

II.

Page 3 of 12

REMEDIES UNDER THE LOCAL GOVERNMENT CODE

A. Local Business Tax

1. Assessment

60 days

60 days

1. If P300,000 (or P400,000 for Metro Manila)

15 days

15 days

Notice

of

Assessment

Protest to

Local

Treasurer

30 days

Period to

decide

Denial by

LT

or

Lapse of

60 days

Appeal

to MTC

Appeal

to RTC

Petition

for

Review

to

the

CTA en

banc

2. If P300,000 (or P400,000 for Metro Manila)

30 days

15 days

Denial by

LT

or

Lapse of

60 days

NOTE: The period to appeal shall be interrupted by a timely motion for new trial

or reconsideration. In any case, if the motion is denied, the movant has a fresh

period of 15 days from receipt or notice of order denying or dismissing the

motion for reconsideration within which to file the appeal. (Neypes Doctrine)

Appeal

to RTC

Petition

for

Review

to the

CTA

Division

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 4 of 12

2. Refund

2 years

1. If P300,000 (or P400,000 for Metro Manila)

Follow procedure in II(A)(1).

Date of

Payment of

Tax

Appeal to

either MTC

or RTC

2. If P300,000 (or P400,000 for Metro Manila)

Follow procedure in II(A)(2).

File Claim for Refund

before

Local

Treasurer

NOTE: Both the administrative and the judicial

claim must be filed within the two-year period.

3. Assail Tax Ordinance

30 days

Effectivity of

Tax Ordinance

60 days

Appeal to

Secretary of

Justice

Period for the

SOJ to decide

30 days

Denial by

SOJ

or

lapse of

60 days

15 days

Appeal

to the

RTC

15 days (extendible)

Appeal to

Court of

Appeals

Appeal to

Supreme

Court

NOTE: The period to appeal shall be interrupted by a timely motion for new trial

or reconsideration. In any case, if the motion is denied, the movant has a fresh

period of 15 days from receipt or notice of order denying or dismissing the

motion for reconsideration within which to file the appeal (Neypes Doctrine)

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 5 of 12

B. Real Property Tax

1. Assessment

a. Erroneous Assessment

30 days

Pay

with

Protest

60 days

60 days

Protest to

Local

Treasurer

Period to

decide

Denial by

LT

or

Lapse of

60 days

Appeal

to LBAA

b. Illegal Assessment

30 days

15 days

Issuance

of Illegal

Assessm

ent

File

Injuncti

on with

RTC

120 days

Petition

for

Review

to the

CTA

Division

30 days

Denial

by LBAA

or Lapse

of 120days

30 days

Appeal

to the

CBAA

Adverse

Decision of

the CBAA

Petition

for

Review to

the CTA

en banc

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 6 of 12

2. Refund

2 years

60 days

If denied or inaction by the Local Treasurer

Date

Payment

of

File Claim

with Local

Treasurer

NOTE: Only the administrative claim must be

filed within the two-year period.

Period to

decide

Follow Procedure in II(B)(1).

-

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

III.

Page 7 of 12

REMEDIES UNDER THE CUSTOMS MODERNIZATION AND TARIFF ACT.

A. Assessments

15 days

1. If protest is sustained

30 days

The COC shall make the appropriate order and the entry reassessed, if necessary.

Payment

under

Protest

Protest

to

Commissioner

of

Customs

(COC)

Period to

decide

2. If protest is denied

30 days

NOTE: Assessment shall be deemed final within

15 days after receipt of the notice of assessment.

Denial by

the COC

Petition for

Review to

the

CTA

Division

B. Refund

1. If the claim and application is for refund of duties.

12 months

If the claim is denied

If denied by the COC

30 days

30 days

Date

payment

of

File Claim

with Bureau

Denial

NOTE: Only the administrative claim must be

filed within the 12-month period. The CMTA did

not specify the office within which to file the

claim for refund

Appeal

COC

to

Period to

decide

Follow procedure in III(A)(2).

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 8 of 12

2. If the claim and application is for refund of duties and taxes.

As to refund of the duties element

Follow procedure under III(B).

As to refund of internal revenue taxes element

Follow procedure under I(B).

Note: The Bureau of Customs shall cause the refund of internal revenue taxes after issuance of a certification from the CIR

granting claim for refund, whether wholly or partially.

C. Forfeiture

1. If importer is aggrieved by decision of District Collector

15 days or 5 days

if perishable

Adverse

decision

of District

Collector

Notice of

Appeal to

District

Collector

30 days or 15

days if perishable

goods

The District

Collector

shall

transmit

records to

COC

Period

for COC

to decide

1. If importer aggrieved by decision of COC

Follow Procedure in III(A)(2).

2. If no decision rendered (inaction)

The adverse decision of the District Collector is deemed affirmed.

Follow Procedure in III(A)(2).

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 9 of 12

2. If government is aggrieved by decision of the District Collector (Automatic Review)

30 days or 10

days if perishable

goods

5 days

Adverse

decision

of District

Collector

Elevate

Records

to CoC

Receipt of

records by

CoC

If no decision rendered within the said period or when a decision adverse to

government is rendered by the COC involving goods with FOB or FCA value of

P10,000,000.00

Period

for COC

to decide

5 days

COC

Elevate

records to

SoF

If importer aggrieved by decision of COC

Follow Procedure in III(A)(2).

3. If the importer is aggrieved by the decision of the Secretary of Finance on automatic review

30 days

Adverse

decision

of SOF

Petition for

Review to

the

CTA

Division

NOTE: The decision of the SOF

whether or not a decision was

rendered by the COC within 30 days,

or within 10 days in the case of

perishable goods, from receipt of the

records, shall be final upon the

Bureau.

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

IV.

Page 10 of 12

APPELLATE REMEDIES IN THE COURT OF TAX APPEALS

15 days

Petition for

Review

before the

CTA Division

Adverse

Decision of

the

CTA

Division

MR

of

CTA Div.

Decision

or MNT

15 days (extendible)

Adverse

Resolution

of the CTA

Division

Petition

for

Review

before

the CTA

En Banc

15 days

Adverse

Decision of

the CTA-EB

MR of

CTA-EB

Decision

15 days (extendible)

Adverse

Resolution

of the CTAEB

Petition for

Review to the

Supreme

Court

NOTE: A petition for review of a decision or resolution of the

CTA in Division must be preceded by the filing of a timely MR

or MNT with the Division. The filing of a MR or MNT, however,

with the CTA en banc is not mandatory.

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

V.

Page 11 of 12

ASSAILING THE VALIDITY OF REVENUE ISSUANES

A. Quasi-Judicial (BIR Rulings)

30 days

30 days

Petition for

Review with

CTA Division

Appeal to

Secretary of

Finance

Adverse Ruling

B. Quasi-Legislative (Revenue Regulations, Revenue Memorandum Circulars, or Revenue Memorandum Orders)

1. If in the exercise of the Secretary of Finances rule-making power (Revenue Regulations)

If there is no breach

Issuance of

the SOF

Declaratory

Relief (Rule

63) with the

RTC

If there is breach

Breach of

the

issuance

15 days

15 days

Petition for

Certiorari

(Rule

65)

with

the

RTC

15 days (extendible)

Court of

Appeals

Supreme

Court

15 days (extendible)

Court of

Appeals

Supreme

Court

NOTE: The period to appeal shall be

interrupted by a timely motion for new

trial or reconsideration In any case, if the

motion is denied, the movant has a fresh

period of 15 days from receipt or notice

of order denying or dismissing the

motion for reconsideration within which

to file the appeal (Neypes Doctrine)

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes

Page 12 of 12

2. If in the exercise of the CIRs power to interpret tax laws (Revenue Memorandum Circulars and Revenue Memorandum Orders)

30 days

Issuance

of

the

CIR

Request

for Review

before the

SOF

Adverse

Decision of

the SOF

15 days

Petition for

Certiorari

(R65) before

the RTC

15 days (extendible)

Court of

Appeals

Supreme

Court

You might also like

- RA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsDocument66 pagesRA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsAgui S. T. PadNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- Tax Remedies in Flowchart 102019Document2 pagesTax Remedies in Flowchart 102019Cecilbern ayen BernabeNo ratings yet

- Tax Remedies Flowchart (Revised)Document6 pagesTax Remedies Flowchart (Revised)GersonGamas0% (1)

- Tax Rem FlowchartDocument4 pagesTax Rem FlowchartDennisSaycoNo ratings yet

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument11 pagesTAX REMEDIES by Sababan Reviewer 2008 Edolaydyosa95% (20)

- Flowchart Remedies of A TaxpayerDocument2 pagesFlowchart Remedies of A TaxpayerRab Thomas BartolomeNo ratings yet

- Tax 2 (Remedies & CTA Jurisdiction)Document13 pagesTax 2 (Remedies & CTA Jurisdiction)Monice RiveraNo ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Tax 01-Lesson 02 - Tax RemediesDocument42 pagesTax 01-Lesson 02 - Tax RemediesShannise Dayne Chua0% (1)

- Taxpayer Tax Assessment Process BIR IssuesDocument3 pagesTaxpayer Tax Assessment Process BIR IssuesPetrovich Tamag50% (4)

- Philippine Transfer Taxes and Value Added Tax-2011Document54 pagesPhilippine Transfer Taxes and Value Added Tax-2011Chris Rivero100% (2)

- Tax Remedies and Powers of the BIRDocument103 pagesTax Remedies and Powers of the BIRMellie Morcozo100% (1)

- Tax2 - Local Taxation ReviewerDocument4 pagesTax2 - Local Taxation Reviewercardeguzman88% (8)

- Flowchart of Tax Remedies I. Remedies Un PDFDocument12 pagesFlowchart of Tax Remedies I. Remedies Un PDFJunivenReyUmadhayNo ratings yet

- Taxation 2 InglesDocument151 pagesTaxation 2 InglesJoseph Rinoza Plazo100% (11)

- TAX REMEDIES AND FILING REQUIREMENTSDocument11 pagesTAX REMEDIES AND FILING REQUIREMENTSNingning Carios100% (1)

- RemediesDocument45 pagesRemediesCzarina100% (1)

- Tax Finals ReviewerDocument51 pagesTax Finals ReviewerCelestino Law100% (2)

- YTLC Tax Remedy FlowchartDocument3 pagesYTLC Tax Remedy Flowchartalfx216100% (1)

- Remedies Under Local Government CodeDocument15 pagesRemedies Under Local Government Codecmv mendoza100% (3)

- Tax Remedies Under The NircDocument119 pagesTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- Tax Remedies Principles and CasesDocument75 pagesTax Remedies Principles and CasesGeorge PandaNo ratings yet

- RR 2-98Document85 pagesRR 2-98restless11No ratings yet

- OM No. 2018-04-03Document2 pagesOM No. 2018-04-03Christian Albert HerreraNo ratings yet

- Notes On Tax Remedies of The Government and TaxpayersDocument74 pagesNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- Taxation 2017 Bar Q ADocument18 pagesTaxation 2017 Bar Q AImma Foosa50% (2)

- RR 12-1999Document21 pagesRR 12-1999anorith8867% (6)

- Revenue Regulations No 12-99Document3 pagesRevenue Regulations No 12-99Zoe Dela CruzNo ratings yet

- Supreme Court Rules in Favor of Philex in VAT Refund CaseDocument2 pagesSupreme Court Rules in Favor of Philex in VAT Refund CaseBarem Salio-anNo ratings yet

- Overview of Handling BIR Tax Audit in The PhilippinesDocument3 pagesOverview of Handling BIR Tax Audit in The PhilippinesMarietta Fragata Ramiterre100% (2)

- Taxation - 8 Tax Remedies Under NIRCDocument34 pagesTaxation - 8 Tax Remedies Under NIRCcmv mendoza100% (3)

- Tax Administration Powers and RemediesDocument16 pagesTax Administration Powers and Remediescristiepearl100% (6)

- BIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Document5 pagesBIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Archie Guevarra100% (3)

- Tax 2 Remedies Digests KoDocument29 pagesTax 2 Remedies Digests KoMary Ann LeeNo ratings yet

- Taxation Up To VAT Complete With Notes From RR and RMC. Tababa 1Document96 pagesTaxation Up To VAT Complete With Notes From RR and RMC. Tababa 1Val Escobar Magumun100% (1)

- Rev Regs No. 12-99 (As Amended) - 08012014Document27 pagesRev Regs No. 12-99 (As Amended) - 08012014Jacob DalisayNo ratings yet

- Taxation One Complete Updated (Atty. Mickey Ingles)Document116 pagesTaxation One Complete Updated (Atty. Mickey Ingles)Patty Salas - Padua100% (11)

- RMC 5-01Document3 pagesRMC 5-01Yosef_d0% (1)

- Tax RemediesDocument3 pagesTax RemediesigorotknightNo ratings yet

- Tax Judicial Remedies of GovernmentDocument34 pagesTax Judicial Remedies of GovernmentNoullen Banuelos100% (5)

- TAX NOTES (LEGAL GROUNDDocument103 pagesTAX NOTES (LEGAL GROUNDyani ora100% (3)

- Notice of DiscrepancyDocument4 pagesNotice of DiscrepancyMartin PagtanacNo ratings yet

- TRAIN Law Lecture by Dr. Lim PDFDocument12 pagesTRAIN Law Lecture by Dr. Lim PDFAnonymous 8SUSyvGc3d100% (1)

- Taxation Law Updates by Atty. OrtegaDocument21 pagesTaxation Law Updates by Atty. Ortegavillanueva9guapster9100% (1)

- Tax+Remedies Nirc 2011 AteneoDocument103 pagesTax+Remedies Nirc 2011 AteneoGracia Jimenez-CastilloNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- TAX 2 REVIEW - REMEDIESDocument24 pagesTAX 2 REVIEW - REMEDIESManuel VillanuevaNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesArielle CabritoNo ratings yet

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerHaze Q.No ratings yet

- Question The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealDocument3 pagesQuestion The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealMowie AngelesNo ratings yet

- Taxation-2-Power-Point-part-2Document32 pagesTaxation-2-Power-Point-part-2Vince Q. MatutinaNo ratings yet

- Tax Assessment and Collection ProceduresDocument1 pageTax Assessment and Collection ProceduresBetson CajayonNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- 180-Day Period On Tax AssessmentDocument6 pages180-Day Period On Tax AssessmentRowie DomingoNo ratings yet

- IP law secures exclusive rights of inventorsDocument5 pagesIP law secures exclusive rights of inventorsKevin Ken Sison GancheroNo ratings yet

- Tax 2-3-18Document3 pagesTax 2-3-18Kevin Ken Sison GancheroNo ratings yet

- Cta 2D CV 06681 D 2006aug31 Ref PDFDocument17 pagesCta 2D CV 06681 D 2006aug31 Ref PDFKevin Ken Sison GancheroNo ratings yet

- Urgent MotionDocument2 pagesUrgent MotionKevin Ken Sison GancheroNo ratings yet

- 11 - Pinlac vs. PeopleDocument14 pages11 - Pinlac vs. PeopleKevin Ken Sison GancheroNo ratings yet

- How To Properly Adjudicate DebatesDocument4 pagesHow To Properly Adjudicate DebatesKevin Ken Sison GancheroNo ratings yet

- 12 - New Filipino Maritime Agencies, Inc. vs. DatayanDocument17 pages12 - New Filipino Maritime Agencies, Inc. vs. DatayanKevin Ken Sison GancheroNo ratings yet

- Arraignment and PretrialDocument8 pagesArraignment and PretrialKevin Ken Sison Ganchero100% (1)

- Digests Ipl 9-9-16Document3 pagesDigests Ipl 9-9-16Kevin Ken Sison GancheroNo ratings yet

- Castillo Castro E. Castro F. de Vera Fadera Fernando Frias Ganchero Lim RementinaDocument1 pageCastillo Castro E. Castro F. de Vera Fadera Fernando Frias Ganchero Lim RementinaKevin Ken Sison GancheroNo ratings yet

- TroDocument8 pagesTrokaiaceegeesNo ratings yet

- ALS TaxLawRevREMEDIES090610Document5 pagesALS TaxLawRevREMEDIES090610Dianna Louise Dela GuerraNo ratings yet

- FCN US GermanyDocument27 pagesFCN US GermanyKevin Ken Sison GancheroNo ratings yet

- Executive Poli KevDocument4 pagesExecutive Poli KevKevin Ken Sison GancheroNo ratings yet

- Until R8Document25 pagesUntil R8Kevin Ken Sison GancheroNo ratings yet

- Japan SocietyDocument34 pagesJapan SocietyKevin Ken Sison GancheroNo ratings yet

- NCBA ReviewerDocument8 pagesNCBA ReviewerKevin Ken Sison GancheroNo ratings yet

- How To Properly Adjudicate DebatesDocument4 pagesHow To Properly Adjudicate DebatesKevin Ken Sison GancheroNo ratings yet

- Anzaldo vs. ClaveDocument7 pagesAnzaldo vs. ClaveKevin Ken Sison GancheroNo ratings yet

- 04 Crisologo V SingsonDocument6 pages04 Crisologo V SingsonKevin Ken Sison GancheroNo ratings yet

- Special Agreement: Jointly Notified To The Court On 12 September 2016Document22 pagesSpecial Agreement: Jointly Notified To The Court On 12 September 2016len_dy010487No ratings yet

- Tax Law I: Nature of Income Madrigal V Rafferty Facts:: Divided Into 2 in Computing For The Additional Income TaxDocument2 pagesTax Law I: Nature of Income Madrigal V Rafferty Facts:: Divided Into 2 in Computing For The Additional Income TaxKevin Ken Sison GancheroNo ratings yet

- Admin agencies' quasi-legislative power & A.O. No. 308Document2 pagesAdmin agencies' quasi-legislative power & A.O. No. 308Kevin Ken Sison GancheroNo ratings yet

- Managing Buried Treasure Across Frontiers: The International Law of Transboundary AquifersDocument11 pagesManaging Buried Treasure Across Frontiers: The International Law of Transboundary AquifersKevin Ken Sison GancheroNo ratings yet

- How To Properly Adjudicate DebatesDocument4 pagesHow To Properly Adjudicate DebatesKevin Ken Sison GancheroNo ratings yet

- Oral Advocacy TipsDocument7 pagesOral Advocacy TipsShoaib KhanNo ratings yet

- Rule 39: Execution, Satisfaction and Effect of JudgmentsDocument26 pagesRule 39: Execution, Satisfaction and Effect of JudgmentsKevin Ken Sison GancheroNo ratings yet

- Income Taxation ReviewerDocument51 pagesIncome Taxation ReviewerKevin Ken Sison GancheroNo ratings yet

- LTD Consolidated Case DigestsDocument122 pagesLTD Consolidated Case DigestsKevin Ken Sison Ganchero100% (1)

- The Great Hack and data privacy in the PhilippinesDocument2 pagesThe Great Hack and data privacy in the PhilippinesVINCENT ANGELO ANTENo ratings yet

- Subject 1: Home and Away: Statements of Financial Position at 30 June 20X7Document5 pagesSubject 1: Home and Away: Statements of Financial Position at 30 June 20X7Dumitru DiremiaNo ratings yet

- Meralco Vs Jan Carlo Gala March 7Document3 pagesMeralco Vs Jan Carlo Gala March 7Chezca MargretNo ratings yet

- Universal Banking in IndiaDocument6 pagesUniversal Banking in IndiaashwanidusadhNo ratings yet

- SC Rules School Heads Liable for Student Death Under Art. 2180Document3 pagesSC Rules School Heads Liable for Student Death Under Art. 2180Tenet ManzanoNo ratings yet

- Italian WarsDocument14 pagesItalian WarsLaura MayoNo ratings yet

- Dhaka Ashulia Elevated Expressway PDFDocument192 pagesDhaka Ashulia Elevated Expressway PDFEmdad MunnaNo ratings yet

- International Instruments Relating To Intellectual Property RightsDocument11 pagesInternational Instruments Relating To Intellectual Property Rightsशैल अनुकृति100% (4)

- Bredol SepesifikasiDocument2 pagesBredol SepesifikasiAhmad ArifNo ratings yet

- Reyes vs. Lim, G.R. No. 134241, 11aug2003Document2 pagesReyes vs. Lim, G.R. No. 134241, 11aug2003Evangelyn EgusquizaNo ratings yet

- View Generated DocsDocument1 pageView Generated DocsNita ShahNo ratings yet

- CASE - 1 Luxor Writing Instruments Private LimitedDocument6 pagesCASE - 1 Luxor Writing Instruments Private LimitedtubbychampNo ratings yet

- Review of Literature Empirical Research On Corporate GovernanceDocument5 pagesReview of Literature Empirical Research On Corporate GovernanceaflsjizafNo ratings yet

- Red Cross Youth and Sinior CouncilDocument9 pagesRed Cross Youth and Sinior CouncilJay-Ar ValenzuelaNo ratings yet

- Gramsci Hegemony Separation PowersDocument2 pagesGramsci Hegemony Separation PowersPrem VijayanNo ratings yet

- 2.2 Cyber Security Policy Development and Implementation-1-1Document17 pages2.2 Cyber Security Policy Development and Implementation-1-1Llal SantiagoNo ratings yet

- P290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFDocument5 pagesP290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFM A Osmani TahsinNo ratings yet

- NLRC Affirms Manager's Suspension for Sexual HarassmentDocument3 pagesNLRC Affirms Manager's Suspension for Sexual HarassmentSylina AlcazarNo ratings yet

- Feati University v. BautistaDocument2 pagesFeati University v. BautistaMae Anne SandovalNo ratings yet

- Balibago Faith Baptist Church vs. Faith in Christ Jesus BaptistDocument3 pagesBalibago Faith Baptist Church vs. Faith in Christ Jesus BaptistThamiya SageNo ratings yet

- Astm D6440 - 1 (En)Document2 pagesAstm D6440 - 1 (En)svvasin2013No ratings yet

- Fernandez v. Kalookan Slaughterhouse, Inc., G.R. No. 225075 PDFDocument10 pagesFernandez v. Kalookan Slaughterhouse, Inc., G.R. No. 225075 PDFBrylle Vincent LabuananNo ratings yet

- Read, Trace, Write, and Glue: FREE-WinterDocument18 pagesRead, Trace, Write, and Glue: FREE-Winteralana reneNo ratings yet

- Flexible Benefit Plan - v1.17Document58 pagesFlexible Benefit Plan - v1.17Mukesh SinghNo ratings yet

- Justice For AllDocument20 pagesJustice For AllRahul rajNo ratings yet

- RemLaw Transcript - Justice Laguilles Pt. 2Document25 pagesRemLaw Transcript - Justice Laguilles Pt. 2Mark MagnoNo ratings yet

- Application Form Registration of Job, Service Contractor, Sub ContractorDocument1 pageApplication Form Registration of Job, Service Contractor, Sub ContractorJane PerezNo ratings yet

- General PHYSICS 2 Week 1Document24 pagesGeneral PHYSICS 2 Week 1senpai notice me0% (1)

- Eddie BurksDocument11 pagesEddie BurksDave van BladelNo ratings yet

- SB 912 064ulDocument2 pagesSB 912 064ulRafael PeresNo ratings yet