Professional Documents

Culture Documents

Post Buy Back Offer (Company Update)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Post Buy Back Offer (Company Update)

Uploaded by

Shyam SunderCopyright:

Available Formats

AARTI INDUSTRIES LIMITED

Registered Office: Plot Nos. 801, 801/23, GIDC Estate, Phase III, Vapi - 396 195, Dist. Valsad, Gujarat;

Corporate Office: 71, Udyog Kshetra, 2nd Floor, Mulund - Goregaon Link Road, L.B.S. Marg,

Mulund (West), Mumbai - 400 080; Corporate Identity Number (CIN): L24110GJ1984PLC007301;

Tel. No.: +91 22 6797 6666; Fax: +91 22 2565 3185/3234; Email: investorrelations@aartigroup.com;

Website: www.aartigroup.com; Contact Person: Mrs. Mona Patel, Company Secretary & Compliance Officer

POST BUYBACK PUBLIC ANNOUNCEMENT FOR THE ATTENTION OF EQUITY SHAREHOLDERS/BENEFICIAL OWNERS OF EQUITY

SHARES OF AARTI INDUSTRIES LIMITED.

This public announcement (Post Buyback Public Announcement) is being made in compliance with Regulation 19(7) of the

Securities and Exchange Board of India (Buy Back of Securities) Regulations, 1998 and subsequent amendments thereof

(Buyback Regulations). This Post Buyback Public Announcement should be read in conjunction with the public announcement

dated October 18, 2016, published on October 19, 2016 (Public Announcement) and letter of offer dated November 12, 2016

(Letter of Offer). The terms used but not defined in this Post Buyback Public Announcement shall have the same meanings as

assigned in the Public Announcement and the Letter of Offer.

1.

THE BUYBACK

1.1. Aarti Industries Limited (Company) had announced the Buyback upto 12,00,000 (Twelve Lac) fully paid-up equity shares of the

Company of face value ` 5/- (Rupee Five Only) each (Equity Shares), representing up to about 1.44% of the total number of

Equity Shares of the Company, from all the equity shareholders/beneficial owners of the Company who holds Equity Shares as on

the record date i.e. Wednesday, November 2, 2016 (Record Date), on a proportionate basis, through the tender offer using stock

exchange mechanism (Tender Offer), at a price of ` 800/- (Rupees Eight Hundred Only) per Equity Share (Buyback Price) for

an aggregate maximum amount of upto ` 96,00,00,000/- (Rupees Ninety Six Crore Only) (Buyback Size) excluding costs such as

brokerage, securities transaction tax, service tax, stamp duty, etc., (Transaction Cost) (Buyback), which represents 9.62% of

the fully paid-up equity share capital and free reserves (including securities premium account) as per latest audited balance sheet of

the Company for the financial year ended March 31, 2016 on standalone basis, is within the statutory limits of 10% (Ten Percent) of

fully paid-up share capital and free reserves (including securities premium account) under the board of directors approval route as per

the provisions of the Companies Act, 2013.

1.2. The Company had adopted the Tender Offer route for the purpose of the Buyback. The Buyback was implemented using the

Mechanism for acquisition of shares through Stock Exchange notified by SEBI vide circular CIR/CFD/POLICYCELL/1/2015 dated

April 13, 2015.

1.3. The Buyback opened on Thursday, November 24, 2016 and closed on Wednesday, December 7, 2016.

2.

DETAILS OF BUYBACK

2.1. The total number of Equity Shares bought back under the Buyback were 12,00,000 Equity Shares (Twelve Lac), at a price of

` 800/- (Rupees Eight Hundred Only) per Equity Share.

2.2. The total amount utilized in the Buyback was ` 96,00,00,000/- (Rupees Ninety Six Crore Only) excluding Transaction Cost.

2.3. The Registrar to the Buyback i.e. Link Intime India Private Limited (Registrar), considered 4,561 valid bids for 2,88,07,784

Equity Shares in response to the Buyback resulting in the subscription of approximately 24.01 times of the maximum number of

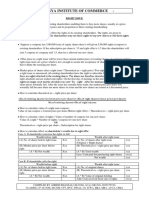

Equity Shares proposed to be bought back. The details of valid bids considered by the Registrar(#), are as follows:

Category of Shareholders

No. of Equity Shares

Reserved in the Buyback

Total Equity Shares

Validly Tendered

%

Response

a) Reserved category for Small

Shareholders

1,80,000

3,025

2,19,890

122.16%

b) General category for eligible equity

shareholder other than the Small

Shareholders

10,20,000

1,536

2,85,87,894

2802.73%

12,00,000

4,561

2,88,07,784

2400.65%

Total

#

No. of

Valid Bids

As per the certificate dated December 15, 2016 provided by the Registrar

Note: a) Small Shareholders have validly tendered 2,19,890 Equity Shares. However, against the total Buyback entitlement of 1,80,000

Equity Shares, the Buyback entitlement of the valid bids in the Buyback was only 41,900 Equity Shares (including acceptance of

1 (One) Equity Share each from 1,192 eligible equity shareholder who had zero entitlement as on Record Date and had bid additional

Equity Shares). In view of the aforesaid response, 1,77,990 additional Equity Shares were validly tendered, out of which 1,38,100

Equity Shares have been accepted in proportion of the additional Equity Shares tendered. Accordingly, out of 2,19,890 Equity Shares

validly tendered by the eligible equity shareholders in this category, 1,80,000 Equity Shares have been accepted in the Buyback.

b) General category for eligible equity shareholder other than the Small Shareholders have validly tendered 2,85,87,894 Equity Shares.

However, against the total Buyback entitlement of 10,20,000 Equity Shares, the Buyback entitlement of the valid bids in the Buyback

was only 6,91,260 Equity Shares. In view of the aforesaid response, 2,78,96,634 additional Equity Shares were validly tendered, out

of which 3,28,740 Equity Shares have been accepted in proportion of the additional Equity Shares tendered. Accordingly, out of

2,85,87,894 Equity Shares validly tendered by the eligible equity shareholders in this category, 10,20,000 Equity Shares have been

accepted in the Buyback.

2.4. All valid bids were considered for the purpose of acceptance in accordance with the Buyback Regulations and the Letter of Offer.

The communication of acceptance/rejection will be dispatched to the registered address of the respective eligible equity shareholders,

by the Registrar on or before December 19, 2016.

2.5. The settlement of all valid bids was completed by the Clearing Corporation on December 16, 2016. The funds in respect of accepted

Equity Shares were paid out to the respective Seller Members/custodians.

2.6. Demat Equity Shares accepted under the Buyback were transferred to the Companys demat escrow account on December 16, 2016.

Excess demat Equity Shares or unaccepted demat Equity Shares were returned to respective Seller Members/custodians by the

Clearing Corporation on December 16, 2016. For Equity Shares tendered in physical form, the share certificates in respect of

unaccepted equity shares will be dispatched to the registered address of the respective eligible equity shareholders, by the Registrar

on or before December 19, 2016.

2.7. The extinguishment of 12,00,000 Equity Shares accepted under the Buyback, out of which, 404 Equity Shares in Physical form have

been extinguished on December 16, 2016 and 11,99,596 Equity Shares in dematerialized form is currently under process and shall be

completed on or before December 23, 2016.

3.

CAPITAL STRUCTURE AND SHAREHOLDING PATTERN

3.1. The capital structure of the Company, pre Buyback i.e. as on Record Date and post Buyback, is as follows:

Sr.

Pre Buyback

No.

Particulars

1.

Authorized Share Capital

2.

No. of

Equity Shares

Issued, Subscribed and Paid-up Capital

Post Buyback

Amount

(` in Lac)

No. of

Equity Shares

Amount

(` in Lac)

23,01,50,320

Equity Shares of

` 5/- each

11,507.52

23,01,50,320

Equity Shares of

` 5/- each

11,507.52

8,33,20,383

Equity Shares of

` 5/- each

4,166.02

8,21,20,383*

Equity Shares of

` 5/- each

4,106.02

*Subject to extinguishment of 11,99,596 Equity Shares held in dematerialized form.

3.2. Details of eligible equity shareholders from whom Equity Shares exceeding 1% of the total Equity Shares bought back have been

accepted under the Buyback Offer are as under:

Sr.

No.

Number of Equity

Shares accepted

under the Buyback

Name of Shareholder

Equity Shares

accepted as a % of

total Equity Shares

bought back

Equity Shares

accepted as a % of

post buyback

Equity Shares

1.

Hetal Gogri Gala

1,30,648

10.89

2.

Rashesh Chandrakant Gogri

89,259

7.44

0.16

0.11

3.

Mirik Rajendra Gogri

86,910

7.24

0.11

4.

Renil Rajendra Gogri

83,521

6.96

0.10

5.

Rajendra Vallabhaji Gogri

83,211

6.93

0.10

6.

Aarti Rajendra Gogri

57,169

4.76

0.07

7.

Jaya Chandrakant Gogri

54,065

4.51

0.07

8.

HDFC Trustee Company Limited HDFC Prudence Fund

50,506

4.21

0.06

9.

Chandrakant Vallabhaji Gogri

43,848

3.65

0.05

10.

Sarla Shantilal Shah

28,153

2.35

0.03

0.03

11.

Shantilal Tejshi Shah

22,159

1.85

12.

DSP Blackrock Micro Cap Fund

19,298

1.61

0.02

13.

Manisha Rashesh Gogri

16,315

1.36

0.02

14.

Pictet Country (Mauritius) Limited

14,536

1.21

0.02

15.

Nehal Garewal

13,753

1.15

0.02

7,93,351

66.11

0.97

Total

3.3. The shareholding pattern of the Company, pre Buyback i.e. as on Record Date and post Buyback, is as under:

Pre Buyback

Category of Shareholder

Number of

shares

Promoter and Persons in Control

Post Buyback*

% to the

existing Equity

Share capital

4,56,59,088

54.80

Foreign Investors (including Non-Resident Indians

FIIs and Foreign Mutual Funds)

33,98,792

4.08

Financial Institutions/Banks & Mutual Funds

promoted by Banks/Institutions

98,12,541

11.78

Others (Public, Public Bodies Corporate, etc.)

2,44,49,962

29.34

Total

8,33,20,383

100.00

Number of

shares

% to post

Buyback Equity

Share capital

4,48,97,949

54.67

3,72,22,434

45.33

8,21,20,383

100.00

*Subject to extinguishment of 11,99,596 Equity Shares held in dematerialized form.

4.

MANAGER TO THE BUYBACK

INGA CAPITAL PRIVATE LIMITED

Naman Midtown, 21st Floor, A Wing,

Senapati Bapat Marg, Elphinstone (West),

Mumbai - 400 013, Maharashtra.

Tel. No.: +91 22 4031 3489; Fax No.: +91 22 4031 3379;

Contact Person: Mr. Ashwani Tandon;

Email: ail.buyback@ingacapital.com; Website: www.ingacapital.com;

SEBI Registration No: INM000010924;

CIN: U74140MH1999PTC122493.

5.

DIRECTORS RESPONSIBILITY

As per Regulation 19(1)(a) of the Buyback Regulations, the Board of Directors of the Company accepts responsibility for the

information contained in this Post Buyback Public Announcement or any other information advertisement, circular, brochure, publicity

material which may be issued and confirms that such document contains true, factual and material information and does not contain

any misleading information.

For and on behalf of the Board of Directors of Aarti Industries Limited

Sd/Rashesh Chandrakant Gogri

Vice Chairman and

Managing Director

Date : December 17, 2016

Place : Mumbai

Size: 16(w) x 50(h)

Sd/Parimal Hasmukhlal Desai

Director

Sd/Mona Patel

Company Secretary

PRESSMAN

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Morgan Stanley Q4 2021 Strategic UpdateDocument21 pagesMorgan Stanley Q4 2021 Strategic UpdateZerohedgeNo ratings yet

- Sample MemoDocument30 pagesSample MemoHimanshuSethNo ratings yet

- Important Practical Questions New Syllabus SFM by Aaditya Jain SirDocument72 pagesImportant Practical Questions New Syllabus SFM by Aaditya Jain SirVijayaNo ratings yet

- IB Interview Guide, Module 4: Accounting and the 3 Financial StatementsDocument99 pagesIB Interview Guide, Module 4: Accounting and the 3 Financial StatementsCarloNo ratings yet

- Capital Gains Section ParticularsDocument15 pagesCapital Gains Section ParticularsNiyati DholakiaNo ratings yet

- Chapter 8 OSC PSC, Loan Capital and Bond ValuationDocument34 pagesChapter 8 OSC PSC, Loan Capital and Bond Valuationathirah jamaludinNo ratings yet

- AerCap - Q220 - 6-KDocument59 pagesAerCap - Q220 - 6-Khero111983No ratings yet

- Business Restructuring: Pushparaj KulkarniDocument23 pagesBusiness Restructuring: Pushparaj KulkarniCma Pushparaj KulkarniNo ratings yet

- MertonDocument12 pagesMertonrajivagarwalNo ratings yet

- Corporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationDocument256 pagesCorporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationRaoul TurnierNo ratings yet

- Finance FinalDocument15 pagesFinance Finaldingdong ditchNo ratings yet

- Chapter 13--Distribution of Retained Earnings: Dividends and Stock Repurchases ExplainedDocument26 pagesChapter 13--Distribution of Retained Earnings: Dividends and Stock Repurchases Explainedmarcia1416No ratings yet

- Valuation Practical Sums - CS Vaibhav Chitlangia - Yes Academy For CS, PuneDocument18 pagesValuation Practical Sums - CS Vaibhav Chitlangia - Yes Academy For CS, PuneAkshaya RautNo ratings yet

- Bemobi Programa de Recompra 2210Document2 pagesBemobi Programa de Recompra 2210Kaype AbreuNo ratings yet

- Caso Jackson Automotive SystemDocument7 pagesCaso Jackson Automotive SystemDiego E. Rodríguez100% (2)

- 2019 Nvent Institutional Investor and Analyst Day: Redwood City, CaliforniaDocument75 pages2019 Nvent Institutional Investor and Analyst Day: Redwood City, CaliforniaJulio LeeNo ratings yet

- Buyback of SharesDocument10 pagesBuyback of Sharesaditijain_jprNo ratings yet

- Financial Management 2 Assignment 1: Dividend Policy at FPL GroupDocument9 pagesFinancial Management 2 Assignment 1: Dividend Policy at FPL GroupDiv_nNo ratings yet

- Agency Issues in AppleDocument5 pagesAgency Issues in AppleKhai EmanNo ratings yet

- Financial Times (UK Edition) No. 41,387 (28 Jul 2023)Document26 pagesFinancial Times (UK Edition) No. 41,387 (28 Jul 2023)Csm 112No ratings yet

- Policy Update On Gujarat Psus.: Key FinancialsDocument1 pagePolicy Update On Gujarat Psus.: Key FinancialsRavichandra BNo ratings yet

- rev-mat-2-IA Print PDFDocument31 pagesrev-mat-2-IA Print PDFAyaka FujiharaNo ratings yet

- Misc Topic in SFMDocument19 pagesMisc Topic in SFMChandreshNo ratings yet

- Glencore Anual Report 2021Document262 pagesGlencore Anual Report 2021Vladímir Nikolai Zeballos RojasNo ratings yet

- Netflix Q410 Letter To ShareholdersDocument17 pagesNetflix Q410 Letter To ShareholdersTechCrunchNo ratings yet

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- ISFM Mutual Fund Mock TestDocument37 pagesISFM Mutual Fund Mock TestHrishikesh kateNo ratings yet

- Company Law test: Share Capital, Charges, Deposits, Debentures and MembershipDocument26 pagesCompany Law test: Share Capital, Charges, Deposits, Debentures and MembershipShrikant RathodNo ratings yet

- CF ProjectDocument7 pagesCF ProjectKiềuu AnnhNo ratings yet

- Vodafone Group PLC H1 Report (2011)Document42 pagesVodafone Group PLC H1 Report (2011)RCR Wireless News IndiaNo ratings yet