Professional Documents

Culture Documents

Chapter 12

Uploaded by

Marki MendinaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 12

Uploaded by

Marki MendinaCopyright:

Available Formats

Week 4 Problems

12.1: Middleton Clinic had total assets of $500,000 and an equity balance of

$350,000 at the end of 2007. One year later, at the end of 2008, the clinic

had $575,000 in assets and $380,000 in equity. What was the clinics dollar

growth in assets during 2008, and how was this growth financed?

Middleton Clinic experienced a $75,000 growth in assets (difference of

total assets in 2007 were $500,000 from total assets in 2008 of $575,000).

Assets are the resources owned by a company that will generate income for

them in the future. To explain how this growth was financed, we have to look

at the liabilities and equity:

Liabilities at the end of each respective year are calculated as shown:

2007: Liabilities = assets equity

x = $500,000 - $350,000

x = $150,000

2008: Liabilities = assets equity

x = $575,000 - $380,000

x = $195,000

Difference in liabilities between both years: $45,000 ($195,000 - $150,000)

Equity in 2007 was $350,000 while the equity at the end of 2008 is

$380,000. The difference in equity between both years is $35,000.

Total increase in liabilities and equity from 2007 to 2008 was $75,000.

The growth in assets was fully financed by both liabilities and

assets.

12.2: San Mateo Healthcare had an equity balance of $1.38 million at the

beginning of the year. At the end of the year, its equity balance was $1.98

million. Assume that San Mateo is a not-for-profit organization. What was its

net income for the period?

Net income is calculated by deducting expenses from the total revenues of

the company. Net income can also be calculated by taking the difference of

equity from the starting point to the ending point of a period of time and

considering drawings. This is because equity is the amount which is owner-

invested in the company and factors in net income.

Net income = equity at the end equity in the beginning + drawings

X = $1.98 million - $1.38 million + $0

X = $0.60 million

Net income is $600,000

12.3: Here is financial statement information on four not-for-profit clinics:

Pittman Rose Beckman Jaffe

December 31, 2007:

Assets $ 80,000 $ 100,000 g $ 150,000

Liabilities 50,000 d $ 75,000 j

Equity a 60,000 45,000 90,000

December 31, 2008:

Assets b 130,000 180,000 k

Liabilities 55,000 62,000 h 80,000

Equity 45,000 e 110,000 145,000

During 2008:

Total revenues c 400,000 i 500,000

Total expenses 330,000 f 360,000 l

A = $30,000 Equity = assets liabilities

X = $80,000 - $50,000

X = $30,000

B = $100,000 Equity = assets liabilities

$45,000 = X - $55,000

$100,000 = X

C = $345,000 Total revenues = net income + total expenses

X = $15,000 + $330,000

X = $345,000

Net income = equity at end equity in beginning +

drawings

X = $45,000 - $30,000 + 0

X = $15,000

D = $40,000 Equity = assets liabilities

$60,000 = $100,000 X

X = $40,000

E = $68,000 Equity = assets liabilities

X = $130,000 - $62,000 = $68,000

F = $392,000 Net income = equity at end equity in beginning +

drawings

X = $68,000 - $60,000 + $0

X = $8,000

Total expense = total revenue net income

X = $400,000 - $8,000

X = $392,000

G = $120,000 Equity = assets liabilities

$45,000 = X - $75,000

X = $120,000

H = $70,000 Equity = assets liabilities

$110,000 = $180,000 X

X = $70,000

I = $425,000 Net income = equity at end equity in beginning +

drawings

X = $110,000 - $45,000 + $0

X = $65,000

Total expense = total revenue net income

X = $65,000 + $360,000

X = $425,000

J = $60,000 Equity = assets liabilities

$90,000 = $150,000 X

X = $60,000

K = $225,000 Equity = assets liabilities

$145,000 = x - $80,000

X = $225,000

L = $445,000 Net income = equity at end equity in beginning +

drawings

X = $145,000 - $90,000 + $0

X = $55,000

Total expense = total revenue net income

X = $500,000 - $55,000

X = $445,000

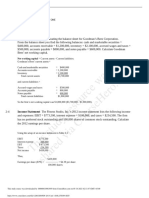

12.4: Warren Clinics balance sheet:

Liabilities: Amount Assets Amount

($) ($)

Equity $230,000 Net property and $150,00

equipment 0

Long term debt $120,000 Long term investments $100,00

0

Other long term liabilities $10,000 Accounts receivable $60,000

Account payable $20,000 Cash $30,000

Other assets $40,000

Total liabilities and $380,00 Total assets $380,0

equity 0 000

This balance sheet makes sense because total assets are supposed to be

equal to total liabilities and equity which is the case for Warren Clinic

12.5:

a) The balance sheet for BestCareHMO is different than Park Ridge Homecare

in that this balance sheet is an assessment for just June 30, 2008 meaning

that it is the balance sheet for the first 6 months of 2008. Park Ridge

Homecares balance sheet (table 12.1) shows that it includes both 2007 and

2008 so it differs from BCHMO because it is two rather than just 6 months.

Another difference between the balance sheet is BHCMOs balance sheet lists

net property and equipment after deducting the accumulated depreciation

where the Park Ridge Homecare lists the depreciation and the actual amount

of property separately .

b) The debt ratio for Best Cares HMO is 43.52% which is higher than the

debt ratio for Park Ridge HomeCare which is $13.04% -- there is a 30.48%

difference in debt ratio percentage. For BestCare HMO, their total assets are

$9,869,000 and 43.52% of that is being financed by long term debt which

is $4,295,000. For Park Ridge Homecare, their total assets are $1,181,000

and of that, 13.04% are being financed by long term debts, which is

$154,000.

Best Cares Debt ratio:

Long term debt = $4,295,000

Total assets = $9,869,000

Debt ratio = $4,295,000/$9,869,000 = 43.52%

Park Ridge Homecares ratio:

Long term debt: $154,000

Total assets: $1,181,000

Debt ratio = $154,000/$1,181,000 = 13.04%

12.6:

a)

The balance sheet of Green Valley Nursing Home is different from Park Ridge

Homecares balance sheet in the following ways:

Park Ridge Homecares balance sheet includes both 2007 and 2008

years while Green Valley Nursing Homes balance sheet includes one

year data, since it is reporting it on December 31, 2008

On PRHs balance sheet, it shows an equity value whereas in GVNHs

balance sheet, it shows the shareholders equity which contains both

the common stock and the retained earnings.

The balance sheet of GVNH is different form BHCMO in these following ways:

The timeline of GVNH includes one entire year (since it reports its

findings in December) while in BHCMO, it only includes 6 months

GVNH lists the accumulated depreciation of its property and equipment

so it can be deducted to calculate the amount of net property and

equipment whereas BHCMO doesnt list the depreciation and instead

already calculates it as a part of the net property and equipment

amount listed.

b) Debt ratio: Green Valley Nursing Homes debt ratio is 67.92%, which is the

highest percentage of the debt ratios compared. This means that of Green

Valley Nursing homes total assets of $2,502,992, 67.92% are financed by

long term debts which is $1,700,000. Green Valley Nursing Home has the

most in terms of amount of assets that are being financed by long term

debts. There is a 24.40% increase in debt ratio percentage between GVNHI

and BHCMO (67.92% - 43.52%). There is a 54.88% increase in the debt ratio

between GVNH and PRH.

Best Cares Debt ratio:

Long term debt = $4,295,000

Total assets = $9,869,000

Debt ratio = $4,295,000/$9,869,000 = 43.52%

Park Ridge Homecares ratio:

Long term debt: $154,000

Total assets: $1,181,000

Debt ratio = $154,000/$1,181,000 = 13.04%

Green Valley Nursing Home ratio:

Long term debt: $1,700,000

Total assets: $2,502,992

Debt ratio = $1,700,000/2,502,992= 67.92%

You might also like

- Southeastern Homecare Cost of CapitalDocument4 pagesSoutheastern Homecare Cost of Capitaldrhugh38910% (3)

- Financial Ratios Questions With AnswersDocument6 pagesFinancial Ratios Questions With AnswersKyla Ramos Diamsay100% (1)

- Problems CHAPTER 17Document4 pagesProblems CHAPTER 17Nelson Acosta100% (2)

- Quantative Methods Final Assesment Test 2Document16 pagesQuantative Methods Final Assesment Test 2Gaurav SonkeshariyaNo ratings yet

- JIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test MethodsDocument43 pagesJIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test Methodsbignose93gmail.com0% (1)

- Week 4Document7 pagesWeek 4Marki Mendina100% (1)

- Week 2-2Document8 pagesWeek 2-2Marki Mendina100% (1)

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Quizzes Chapter 3 Acccounting EquationDocument7 pagesQuizzes Chapter 3 Acccounting EquationAmie Jane Miranda100% (2)

- Assignment 2Document14 pagesAssignment 2Bryent GawNo ratings yet

- Lab 2 ReportDocument9 pagesLab 2 Reportsherub wangdiNo ratings yet

- Mba HW Prob 1Document2 pagesMba HW Prob 1Mercedes JNo ratings yet

- HPA 14 Assignemnt Due November 16thDocument5 pagesHPA 14 Assignemnt Due November 16thcNo ratings yet

- Pre AssessmentDocument16 pagesPre Assessmentaboulazhar50% (2)

- DocxDocument4 pagesDocxMartin MwendaNo ratings yet

- Double Entry Accounting Assessment QuestionsDocument7 pagesDouble Entry Accounting Assessment QuestionsLhaiela AmanollahNo ratings yet

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- Fundamentals and Applications of Renewable Energy by Mehmet Kanoglu, Yunus Cengel, John CimbalaDocument413 pagesFundamentals and Applications of Renewable Energy by Mehmet Kanoglu, Yunus Cengel, John CimbalaFrancesco Nocera100% (1)

- Chapter 13Document9 pagesChapter 13Marki MendinaNo ratings yet

- Corp Fin Test PDFDocument6 pagesCorp Fin Test PDFRaghav JainNo ratings yet

- Finance - Exam 3Document15 pagesFinance - Exam 3Neeta Joshi50% (6)

- Correct Option Creditors Expected Claim Is $37,800Document2 pagesCorrect Option Creditors Expected Claim Is $37,800Neeta Joshi100% (1)

- Bond After-Tax Yield CalculatorDocument7 pagesBond After-Tax Yield CalculatorJohnNo ratings yet

- QM 2Document38 pagesQM 2Devansh Jain100% (1)

- Corp Fin Test 2 PDFDocument9 pagesCorp Fin Test 2 PDFT Surya Kandhaswamy100% (2)

- Bab 12Document5 pagesBab 12ScribdTranslationsNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Chapter 3 Problems - FinmgtDocument11 pagesChapter 3 Problems - FinmgtLaisa Vinia TaypenNo ratings yet

- Finance Report2Document8 pagesFinance Report2Sadman Sharar 1931037030No ratings yet

- SALOMON-CASE_STUDY (Repaired)Document8 pagesSALOMON-CASE_STUDY (Repaired)kylaasio8No ratings yet

- Preparing a Cash Flow StatementDocument7 pagesPreparing a Cash Flow StatementMiconNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Financial Analysis and Credit Risk RatiosDocument2 pagesFinancial Analysis and Credit Risk RatiosToño H' ChauNo ratings yet

- 317 Midterm 1 Practice Exam SolutionsDocument9 pages317 Midterm 1 Practice Exam Solutionskinyuadavid000No ratings yet

- WCM Complete NumericalDocument5 pagesWCM Complete Numericalabubakar naeemNo ratings yet

- Finance Quiz 1Document3 pagesFinance Quiz 1brnycNo ratings yet

- Fin 201 1stsolution SetDocument6 pagesFin 201 1stsolution Set123xxNo ratings yet

- Analyze Financial RatiosDocument12 pagesAnalyze Financial RatiosPerumalla AkhilNo ratings yet

- Corporate Finance Canadian 7th Edition Ross Solutions ManualDocument25 pagesCorporate Finance Canadian 7th Edition Ross Solutions ManualToniSmithmozr100% (60)

- Balance Sheet ChangesDocument5 pagesBalance Sheet ChangeskatnissNo ratings yet

- Analyzing financial statements and expensesDocument5 pagesAnalyzing financial statements and expensesVallabhRemaniNo ratings yet

- Final Exam Practice - Comprehensive (With Answers)Document22 pagesFinal Exam Practice - Comprehensive (With Answers)Brandon ErbNo ratings yet

- Folk Exam Chapter 14 QuestionsDocument2 pagesFolk Exam Chapter 14 QuestionsjhouvanNo ratings yet

- NAME: - : Problems #1-12. (From Chapter 4)Document8 pagesNAME: - : Problems #1-12. (From Chapter 4)Kateryna TernovaNo ratings yet

- Horizontal&Vertical Analysis Sample ProblemDocument3 pagesHorizontal&Vertical Analysis Sample ProblemGenner RazNo ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Financial Reporting & AnalysisDocument9 pagesFinancial Reporting & AnalysisNuman Rox0% (1)

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- FM AssignmentDocument7 pagesFM Assignmentkartika tamara maharaniNo ratings yet

- Question - FS and FADocument6 pagesQuestion - FS and FANguyễn Thùy LinhNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Dwnload Full Corporate Finance Canadian 7th Edition Ross Solutions Manual PDFDocument26 pagesDwnload Full Corporate Finance Canadian 7th Edition Ross Solutions Manual PDFgoblinerentageb0rls7100% (10)

- Question - BS and FADocument6 pagesQuestion - BS and FANguyễn Thùy LinhNo ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Financial Statement Analysis: Practice Exercises PE 15Document29 pagesFinancial Statement Analysis: Practice Exercises PE 15Samuel EtanaNo ratings yet

- 2011-02-09 035108 Finance 14Document4 pages2011-02-09 035108 Finance 14SamNo ratings yet

- Accounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1Document15 pagesAccounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1RabinNo ratings yet

- Pengantar Akuntansi (Tugas Kelompok)Document2 pagesPengantar Akuntansi (Tugas Kelompok)pekka19981No ratings yet

- Mock Test SolutionsDocument11 pagesMock Test SolutionsMyraNo ratings yet

- False (Only Profit Increases Owner's Equity Not Cash Flow)Document6 pagesFalse (Only Profit Increases Owner's Equity Not Cash Flow)Sarah GherdaouiNo ratings yet

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocument30 pagesSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (11)

- Baby Threw Up After Feeding - What To Give For Acid RefluxDocument25 pagesBaby Threw Up After Feeding - What To Give For Acid RefluxMarki Mendina100% (1)

- Crash Multiplex Series For High Yields PDFDocument1 pageCrash Multiplex Series For High Yields PDFMarki MendinaNo ratings yet

- CMS Peads 1 & 2 AnswersDocument12 pagesCMS Peads 1 & 2 AnswersMohamed Abib100% (1)

- OPTHALMOLOGYDocument12 pagesOPTHALMOLOGYMarki MendinaNo ratings yet

- Namal College Admissions FAQsDocument3 pagesNamal College Admissions FAQsSauban AhmedNo ratings yet

- ECED Lab ReportDocument18 pagesECED Lab ReportAvni GuptaNo ratings yet

- CONFLICT ManagementDocument56 pagesCONFLICT ManagementAhmer KhanNo ratings yet

- DS 20230629 SG3300UD-MV SG4400UD-MV Datasheet V16 ENDocument2 pagesDS 20230629 SG3300UD-MV SG4400UD-MV Datasheet V16 ENDragana SkipinaNo ratings yet

- cp2021 Inf03p02Document242 pagescp2021 Inf03p02bahbaguruNo ratings yet

- The Power of Flexibility: - B&P Pusher CentrifugesDocument9 pagesThe Power of Flexibility: - B&P Pusher CentrifugesberkayNo ratings yet

- Safety of High-Rise BuildingsDocument14 pagesSafety of High-Rise BuildingsHananeel Sandhi100% (2)

- Trustees Under IndenturesDocument233 pagesTrustees Under IndenturesPaul9268100% (6)

- WSM 0000410 01Document64 pagesWSM 0000410 01Viktor Sebastian Morales CabreraNo ratings yet

- Current Affairs Q&A PDF June 9 2023 by Affairscloud 1Document21 pagesCurrent Affairs Q&A PDF June 9 2023 by Affairscloud 1Yashika GuptaNo ratings yet

- Jodi Ridgeway vs. Horry County Police DepartmentDocument17 pagesJodi Ridgeway vs. Horry County Police DepartmentWMBF NewsNo ratings yet

- Shri Siddheshwar Co-Operative BankDocument11 pagesShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- PDF Problemas Ishikawa - Free Download PDF - Reporte PDFDocument2 pagesPDF Problemas Ishikawa - Free Download PDF - Reporte PDFNewtoniXNo ratings yet

- Duct Design ChartDocument7 pagesDuct Design ChartMohsen HassanNo ratings yet

- High Frequency Voltage Probe Non-Availability on GeMDocument2 pagesHigh Frequency Voltage Probe Non-Availability on GeMjudeNo ratings yet

- Wheat as an alternative to reduce corn feed costsDocument4 pagesWheat as an alternative to reduce corn feed costsYuariza Winanda IstyanNo ratings yet

- Maintenance: ASU-600 SeriesDocument54 pagesMaintenance: ASU-600 SeriesMichael Maluenda Castillo100% (2)

- PNW 0605Document12 pagesPNW 0605sunf496No ratings yet

- WEEK 8 HW WS - B - Graphs & ChartsDocument6 pagesWEEK 8 HW WS - B - Graphs & Chartsangela trioNo ratings yet

- Kunci Jawaban Creative English 3BDocument14 pagesKunci Jawaban Creative English 3BLedjab Fatima67% (3)

- High Uric CidDocument3 pagesHigh Uric Cidsarup007No ratings yet

- 272 Concept Class Mansoura University DR Rev 2Document8 pages272 Concept Class Mansoura University DR Rev 2Gazzara WorldNo ratings yet

- HealthFlex Dave BauzonDocument10 pagesHealthFlex Dave BauzonNino Dave Bauzon100% (1)

- Maximizing Revenue of IT Project DevelopmentDocument4 pagesMaximizing Revenue of IT Project DevelopmentJulius Mark CerrudoNo ratings yet

- Recommended lubricants and refill capacitiesDocument2 pagesRecommended lubricants and refill capacitiestele123No ratings yet

- Statement of PurposeDocument2 pagesStatement of Purposearmaan kaurNo ratings yet

- Article 4Document31 pagesArticle 4Abdul OGNo ratings yet