Professional Documents

Culture Documents

Full Feasibility Analysis

Uploaded by

api-281781447Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Full Feasibility Analysis

Uploaded by

api-281781447Copyright:

Available Formats

Full Feasibility Analysis

From Preparing Effective Business Plans by Bruce R. Barringer

Note: All fields can be expanded to provide additional space to respond to the questions. A

copy of this template, along with each of the assessment tools, is also available in

PDF format at the authors Web site at www.prenhall.com/entrepreneurship.

Introduction

A. Name of the proposed business

Chocolate Caf with Paintball.

B. Name of the founder (or founders)

Siriwat Tumthong

C. One paragraph summary of the business

The chocolate Caf will offer a variety of chocolate-based food and drinks, with

the addition of an indoor paintball ground.

Part 1: Product/Service Feasibility

Issues Addressed in This Part

A. Product/service desirability

B. Product/service demand

Assessment Tools

Concept Statement Test

Write a concept statement for your product/service idea. Show the concept statement

to 5 to 10 people. Select people who will give you informed and candid feedback.

Attached a blank sheet to the concept statement, and ask the people who read the

statement to (1) tell you three things they like about your product/service idea, (2)

provide three suggestions for making it better, (3) tell you whether they think the

product or service idea is feasible (or will be successful), and (4) share any additional

comments or suggestions.

Summarize the information you obtain from the concept statement into the following

three categories:

* Strengths of the product or service ideathings people who evaluated your

product or service concept said they liked about the idea

* Suggestions for strengthening the ideasuggestions made by people for

strengthening or improving the idea

* Overall feasibility of the product or service conceptreport the number of

people who thing the idea is feasible, the number of people who think it isnt

feasible, and any additional comments that were made

* Other comments and suggestions

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Buying Intentions Survey

Distribute the concept statement to 15 to 30 prospective customers (do not include

any of the people who completed the concept statement test) with the following

buying intentions survey attached. Ask each participant to read the concept statement

and complete the buying intentions survey. Record the number of people who

participated in the survey and the results of the survey here.

Along with the raw data recorded here, report the percentage of the total number of

people you surveyed that said they would probably buy or definitely would buy your

product or service if offered. This percentage is the most important figure in gauging

potential customer interest.

One caveat is that people who say that they intend to purchase a product do

not always follow through, so the numbers resulting from this activity are almost

always optimistic. Still, the numbers provide you with a preliminary indication of

how your most likely customers will respond to your potential product or service

offering.

How likely would you be to buy the product or service described above?

___0___ Definitely would buy

___1___ Probably would buy

___4___ Might or might not buy

___5___ Probably would not buy

___1___ Definitely would not buy

Additional questions may be added to the buying intentions survey.

Conclusion (expand fields and report findings, in discussion form, for each area)

A. Product/service desirability

Its for teenager because teenagers dont have that much to do apart from walking

around, watching movie, or go shopping. This will take advantage of that gap.

There is a fatal flaw in the paintball part; the chocolate would drive ants into the

Caf.

B. Product/service demand

The people didnt like the idea much. More people would not buy it than they

would buy it.

C. Product/service feasibility (circle the correct response)

Not Feasible Unsure Feasible

D. Suggestions for improving product/service feasibility.

The chocolate paint ball should just change to paint ball with normal paint instead

of using chocolate and just use black and white paint ball.

Part 2: Industry/Market Feasibility

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Issues Addressed in This Part

A. Industry attractiveness

B. Target market attractiveness

C. Timeliness of entry into the target market

Assessment Tools

Industry Attractiveness

To the extent possible, assess the industry at the five-digit NAICS code level your

potential business will be entering. Use a broader industry category (less NCICS

digits) if appropriate (http://www.census.gov/epcd/www/naicstab.htm).

Assess the attractiveness of the industry the potential business plans to enter on each

of the following dimensions.

Industry Attractiveness Assessment Tool

(used to assess the broad industry, rather than the specific target market, you plan

to enter)

Low Potential Moderate Potential High Potential

1. Number of competitors Many Few None

2. Age of industry Old Middle aged Young

3. Growth rate of industry Little or no Moderate growth Strong growth

growth

4. Average net income for Low Medium High

firms in the industry

5. Degree of industry Concentrated Neither Fragmented

concentration concentrated nor

fragmented

6. Stage of industry life Maturity Growth phase Emergence

cycle phase or phase

decline phase

7. Importance of industrys Ambivalent Would like to Must have

products and/or services have

to customers

8. Extent to which business Low Medium High

and environmental

trends are moving in

favor of the industry

9. Number of exciting new Low Medium High

product and services

emerging from the

industry

10. Long-term prospects Weak Neutral Strong

Target Market Attractiveness

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Identify the portion or specific market within your broader industry that you plan to

target.

Assess the attractiveness of the target market on each of the following dimensions.

Target Market Attractiveness Assessment Tool

(used to assess the specific target market, rather than the broader industry, you plan

to enter)

Low Potential Moderate Potential High Potential

1. Number of competitors Many Few None

in target market

2. Growth rate of firms in Little to no Slow growth Rapid growth

the target market growth

3. Average net income for Low Medium High

firms in the target

market

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Low Potential Moderate Potential High Potential

4. Methods for generating Unclear Somewhat clear Clear

revenue in the industry

5. Ability to create barriers Unable to May or may not be Can create

to entry for potential create able to create

competitors

6. Degree to which Satisfied Neither satisfied or Unsatisfied

customers feel satisfied by dissatisfied

the current offerings in the

target market

7. Potential to employ low Low Moderate High

cost guerrilla and/or buzz

marketing techniques to

promote the firms product

or services

8. Excitement surrounding Low Medium High

new product/service

offerings in the target

market

Market Timeliness

Determine the extent to which the window of opportunity for the proposed business

is open or closed based on the following criteria.

Determine the timeliness of entering a specific target market based on other criteria.

Market Timeliness Assessment Tool

Low Potential Moderate Potential High Potential

1. Buying mood of Customers are Customers are in a Customers are

customers not in a buying moderate buying in an aggressive

mood mood buying mood

2. Momentum of the market Stable to losing Slowly gaining Rapidly gaining

momentum momentum momentum

3. Need for a new firm in the Low Moderate High

market with your offerings

or geographic location

4. Extent to which business Low Medium High

and environmental trends

are moving in favor of the

target market

5. Recent or planned Large firms Rumors that large No larger firms

entrance of large firms entering the firms may be entered the

into the market market entering the market market or are

rumored to be

entering the

market

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Conclusion (expand fields and report findings, in discussion form, for each area)

A. Industry attractiveness

The industry attractiveness is moderate. Although there were not much firms to

compete with, its hard to know if the customer will be interested or not as its not

important to their life. There is not much change in the technology because not

much people help with the paintball industry, however the paintball industry is still

growing thus our business will hire someone to find ways to improve with the

industry.

B. Target market attractiveness

The target market is attractive because the growth in teenagers targeted company

are rapid and their buying power is increasing. Moreover, there was not much

competitor for the business so its easier to feast from this target market.

C. Market timeliness

The timing is quiet great is because there are not much competitor and the

customer are willing to spend money. The customer has not had other alternative to

choose from and the industry of adventurous entertainment and gaining the

momentum.

D. Industry/market feasibility (circle the correct response)

Not Feasible Unsure Feasible

E. Suggestions for improving industry/market feasibility.

Should make the business more attractive with good use of media and

advertisement.

Part 3: Organizational Feasibility

Issues Addressed in This Part

A. Management prowess

B. Resource sufficiency

Assessment Tools

Management Prowess

Use the following table to candidly and objectively rate the prowess of the founder

or group of founders who will be starting the proposed venture.

Management Prowess Assessment Tool

Low Potential Moderate Potential High Potential

1. Passion for the business Low Moderate High

idea

2. Relevant industry None Moderate Extensive

experience

3. Prior entrepreneurial None Moderate Extensive

experience

4. Depth of professional Weak Moderate Strong

and social networks

5. Creativity among Low Moderate High

management team

members

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

6. Experience and expertise None Moderate High

in cash flow

management

7. College graduate No college Some college Graduated or

education education but not are currently

currently in college in college

Resource Sufficiency

The focus in this section is on nonfinancial resources. Use the following table to rate

your resource sufficiency in each category.

The list of resources is not meant to be exhaustive. A list of the 6 to 12 most critical

nonfinancial resources for your proposed business is sufficient.

An explanation of the rating system used in the first portion of the table is as follows:

1 Available

2 Likely to be available: will probably be available and will be within my budget

3 Unlikely to be available: will probably be hard to find or gain access to, and

may exceed my budget

4 Unavailable

5 NA: not applicable for my business

Resource Sufficiency Assessment Tool

Ratings Resource Sufficiency

1 2 3 4 5 Office space

1 2 3 4 5 Lab space, manufacturing space, or space to launch a

service business

1 2 3 4 5 Contract manufacturers or outsource providers

1 2 3 4 5 Key management employees (now and in the future)

1 2 3 4 5 Key support personnel (now and in the future)

1 2 3 4 5 Key equipment needed to operate the business

(computers, machinery, delivery vehicles)

1 2 3 4 5 Ability to obtain intellectual property protection on key

aspects of the business

1 2 3 4 5 Support of local and state government if applicable for

business launch

1 2 3 4 5 Ability to form favorable business partnerships

Ratings: Strong, Neutral,

or Weak

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Strong Proximity to similar firms (for the purpose of knowledge

sharing)

Neutral Proximity to suppliers

Strong Proximity to customers

Weak Proximity to a major research university (if applicable)

Conclusion (expand fields and report findings, in discussion form, for each area)

A. Management prowess

The Founder has no experience in the field of business and has not graduated yet.

However, the owner is full of passion and love and is learning as best as he could

to be able to manage the business.

B. Resource sufficiency

Resource is affordable with some difficulty and might not be as good as it was

planned to be. Partnership are yet to be taken into consideration as the business is

not yet stable enough to accept big decision and would not be able to take that

much risk.

C. Organizational feasibility (circle the correct response)

Not Feasible Unsure Feasible

D. Suggestions for improving organizational feasibility

Should study and learn more about business first before starting your own business

with no knowledge or experiences.

Part 4: Financial Feasibility

Issues Addressed in This Part

A. Total startup cash needed

B. Financial performance of similar businesses

C. Overall financial attractiveness of the proposed venture

Assessment Tools

Total Start-Up Cash Needed

The startup costs (which include capital investments and operating expenses) should

include all the costs necessary for the business to make its first sale. New firms

typically need money for a host of purposes, including the hiring of personnel, office

or manufacturing space, equipment, training, research and development, marketing,

and the initial product rollout.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

At the feasibility analysis stage, it is not necessary for the number to be exact.

However, the number should be fairly accurate to give an entrepreneur an idea of the

dollar amount that will be needed to launch the firm. After the approximate dollar

amount is known, the entrepreneur should determine specifically where the money

will come from to cover the startup costs.

The total startup cash needed can be estimate using the following table.

Total Startup Cash Needed (to Make First Sale)

Capital Investments Amount

Property 1,000,000(1month)

Furniture and fixtures 1,000,000

Computer equipment 100,000

Other equipment 500,000

Vehicles 400,000

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Operating Expenses Amount

Legal, accounting, and professional services 30,000(1month)

Advertising and promotions 100,000

Deposits for utilities

Licenses and permits 200,000

Prepaid insurance 500,000

Lease payments 30,000(1month)

Salary and wages 200,000

Payroll taxes 14,000

Travel 50,000

Signs 10,000

Tools and supplies 50,000

Starting inventory 200,000

Cash (working capital) 100,000

Other expense 1

Other expense 2

Total Startup Cash Needed = 4,454,000

Comparison of the Financial Performance of Proposed Venture to Similar Firms

Use the following tables to compare the proposed new venture to similar firms in

regard to annual sales (Year 1 and Year 2) and profitability (Year 1 and Year 2).

Comparison of the Financial Performance of Proposed Venture to Similar Firms

Assessment Tool

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Annual Sales

Estimate of Proposed Ventures Explanation of How the Estimate

Annual SalesYear 1 Was Computed

Estimate of Year 1 Sales ____18,432,000______ 1game = 800baht per person

Summary: How proposed annual sales, on 1week =480 people

average, compares to similar firms (circle one)

800 * 48 * 480 =18,432,000

Below Average Average Above Average

Estimate of Year 2 Sales ____30,720,000______ 1game = 800baht per person

Summary: How proposed annual sales, on 1week = 800 people

average, compares to similar firms (circle one)

800 * 48 * 800 =30,720,000

Below Average Average Above Average

Net Income

Estimate of Proposed Ventures Explanation of How the Estimate

Net IncomeYear 1 was Computed

Estimate of Year 1 Net Income 12 month rent=12,000,000

____2,648,000______

Other expense=3,784,000

Summary: How proposed net income, on

average, compares to similar firms (circle one) Income =18,432,000

Below Average Average Above Average Net Income=18,432,000

15,784,000= 2,648,000

Estimate of Year 2 Net Income 12 month rent=12,000,000

____14,936,000______

Other expense=3,784,000

Summary: How proposed net income, on

average, compares to similar firms (circle one) Net Income=30,720,000

15,784,000= 14,936,000

Below Average Average Above Average

Overall Financial Attractiveness of the Proposed Venture

The following factors are important in regard to the overall financial attractiveness of

the proposed business.

Assess the strength of each factor in the following table.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

Overall Financial Attractiveness of Proposed Venture Assessment Tool

Low Potential Moderate Potential High Potential

1. Steady and rapid growth in Unlikely Moderately likely Highly likely

sales during the first one to

three years in a clearly

defined target market

2. High percentage of Low Moderate Strong

recurring incomemeaning

that once you win a client,

the client will provide

recurring sources of

revenue

3. Ability to forecast income Weak Moderate Strong

and expenses with a

reasonable degree of

certainty

4. Likelihood that internally Unlikely Moderately likely Highly likely

generated funds will be

available within two years

to finance growth

5. Availability of exit Unlikely to be May be available Likely to be

opportunity for investor if unavailable available

applicable

Conclusion (report finding for each area)

A. Total startup cash needed

4,054,000

B. Financial performance of similar businesses

Make more profit than the other business. Most Business make 10,800,000

because their business are far away, this make the tourist their main customer. Our

business is in the city so its more convenient for the customer to come and play.

C. Financial feasibility (circle the correct response)

Not Feasible Unsure Feasible

D. Suggestions for improving financial feasibility

Make the some cheap viral promotion to gain more customers. Lower the expense

that doesnt help in making profit like some ingredient for the menu that doesnt

sell well. Changing the location to a cheaper location would also help with the cost

of the business.

Overall Feasibility: Summary and Conclusion

Overall Feasibility of the Suggestions for Improving

Business Idea Based on the Feasibility

Each Part

Product/Market Feasibility Not feasible The chocolate paint ball

Unsure should just change to paint

Feasible ball with normal paint

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

instead of using chocolate

and just use black and with

paint ball.

Industry/Market Feasibility Not feasible Should make the business

Unsure more attractive with good

Feasible use of media and

advertisement.

Organizational Feasibility Not feasible Should study and learn

Unsure more about business first

Feasible before starting your own

business with no

knowledge or experiences.

Financial Feasibility Not feasible Make the some cheap viral

Unsure promotion to gain more

Feasible customers. Lower the

expense that doesnt help

in making profit like some

ingredient for the menu

that doesnt sell well.

Changing the location to a

cheaper location would

also help with the cost of

the business.

Overall Assessment Not feasible Lower the cost and gain

Unsure more experiences in the

Feasible business field first before

opening the business

yourself.

Conclusionbriefly summarize your justification for your overall assessment.

This caf is for teenager because teenagers dont have that much to do when they

went to a mall. This will take advantage of that gap by operating as a caf and a paintball

field, which will serve as a new choice for the people and still continuing the concept of a

caf thats in the mall. There is a fatal flaw in the paintball part; the chocolate would

drive ants into the Caf. The people didnt like the idea much. More people would not

buy it than they would buy it.

The industry is moderately attractive, as there were not much firms to compete

with. However, its hard to know if the customer will be interested or not as its not

important to their life. But as entertainment market is still growing, the momentum might

be in our favors. As there are not many firms in the field, when the momentum came, the

profit will be massive. The timing is also great as there were no huge competitor to come

in the market.

The management prowess is not good. The experience is not enough for opening

the business but this means that there are rooms for improvement before actually opening

the business. The owner is interested in the business and would put so much effort into

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

making the company good. The resource is affordable with some difficulty and will not

be as good as it would exceed the budget. Thus, the quality and the quantity will have to

be reduced.

The start up value is low but it excludes the monthly rent thats needed to be paid.

However, from estimation, the net profit from the fist year would already be enough to

paid for the business. The advertising will be viral and cheap, and would attract customer

to be interested in the game. More importantly, the game is cheap considering the price of

similar firms and the location its in.

To conclude, theres a high chance that the company will be successful from the

fact that this firm is relatively cheap and would attract customer considering the location.

There were not many firm in the business thus will grant us advantages when the

paintball market start gaining its momentum.

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall

You might also like

- Knowledge Management and Emotional Intelligence in OrganizationsDocument27 pagesKnowledge Management and Emotional Intelligence in OrganizationsSahil PrakashNo ratings yet

- Pasa Report Feasibility StudyDocument11 pagesPasa Report Feasibility Studyperckys kabudiNo ratings yet

- Technical and Operational AspectDocument6 pagesTechnical and Operational AspectNanase SenpaiNo ratings yet

- Sample Operational Financial Analysis ReportDocument8 pagesSample Operational Financial Analysis ReportValentinorossiNo ratings yet

- Facility Layout ProjectDocument17 pagesFacility Layout ProjectaakineNo ratings yet

- Group4 Chaper I VDocument96 pagesGroup4 Chaper I VDyesa Bolival Baldoza100% (1)

- The Feasibility StudyDocument4 pagesThe Feasibility StudyRobert FloresNo ratings yet

- Footwear Retail Outlet Pre-Feasibility StudyDocument18 pagesFootwear Retail Outlet Pre-Feasibility StudyhammadicmapNo ratings yet

- Feasibility StudyDocument4 pagesFeasibility StudyJohn M MachariaNo ratings yet

- Financial FeasibilityDocument2 pagesFinancial Feasibilityaryanboxer786No ratings yet

- Profitability IndexDocument4 pagesProfitability Indexrahul5335No ratings yet

- Mekeni Info..Document4 pagesMekeni Info..Carla Robas100% (1)

- Consumer Behaviour After CovidDocument2 pagesConsumer Behaviour After CovidHimadri JanaNo ratings yet

- Comparison of Ford and Honda and Brief SWOT For Both CompaniesDocument47 pagesComparison of Ford and Honda and Brief SWOT For Both CompaniesSohham Paringe100% (1)

- Calculate cash flows for replacement projectsDocument3 pagesCalculate cash flows for replacement projectsnamitaguptafk0% (1)

- 1027 02 Swot Analysis PowerpointDocument6 pages1027 02 Swot Analysis PowerpointmohamedbosilaNo ratings yet

- IoT-Based Gas Leak Detection and Alert SystemDocument13 pagesIoT-Based Gas Leak Detection and Alert Systemvivekanand_bonalNo ratings yet

- Feasiblity FormatDocument15 pagesFeasiblity FormatMikko Yan Abilar TurquezaNo ratings yet

- E-Magazine Feasibility StudyDocument17 pagesE-Magazine Feasibility StudyMoshwene Phofa100% (1)

- Prosperity Weaving Mills LTDDocument10 pagesProsperity Weaving Mills LTDRehman ChaudehryNo ratings yet

- Feasibility (Finish) (Repaired)Document89 pagesFeasibility (Finish) (Repaired)Honey Ericka PerezNo ratings yet

- 25 - Marketing Channels - Value Networks.Document2 pages25 - Marketing Channels - Value Networks.zakavision100% (1)

- Group 6: Nguyễn Quốc Lợi Lê Minh Cường Lê Thu Hương Nguyễn Hồng Khôi Đặng Thị Hoài ThươngDocument4 pagesGroup 6: Nguyễn Quốc Lợi Lê Minh Cường Lê Thu Hương Nguyễn Hồng Khôi Đặng Thị Hoài ThươngCường LêNo ratings yet

- Governmental Accounting Test QuestionsDocument2 pagesGovernmental Accounting Test QuestionstcsaulsNo ratings yet

- Let's Go South? The Reasons and Solutions To The Conflict in MindanaoDocument21 pagesLet's Go South? The Reasons and Solutions To The Conflict in Mindanaomoeen basayNo ratings yet

- Dhampur Sugar MillsDocument27 pagesDhampur Sugar MillsSuneel SinghNo ratings yet

- Feasibility Study TemplateDocument23 pagesFeasibility Study TemplateAhamed Zajith0% (1)

- Chapter 01 Intro To Production and Operations ManagementDocument43 pagesChapter 01 Intro To Production and Operations ManagementDuga RennabelleNo ratings yet

- Mark Feasibility StudyDocument1 pageMark Feasibility StudyMark Rivera MediloNo ratings yet

- Financial Analysis MeasuresDocument35 pagesFinancial Analysis MeasuresHari SharmaNo ratings yet

- Final Project Report 1Document28 pagesFinal Project Report 1chinmay451No ratings yet

- Operations ManagementDocument29 pagesOperations ManagementumairNo ratings yet

- B. Market Segmentation and JustificationDocument6 pagesB. Market Segmentation and JustificationBakLalu0% (1)

- Power Organizational BehaviourDocument40 pagesPower Organizational BehaviourRowan RodriguesNo ratings yet

- Name: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1Document2 pagesName: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1DianeNo ratings yet

- Presentation GEDocument22 pagesPresentation GESahil KhoslaNo ratings yet

- Lawrencedale Agro Processing India Private Limited 20.05.2020Document11 pagesLawrencedale Agro Processing India Private Limited 20.05.2020Akash DherangeNo ratings yet

- Feasibility Study of Student LoanDocument38 pagesFeasibility Study of Student LoanAlauddin Ahmed Jahan100% (1)

- Revised Chapter I - Galicayo Restaurant 1Document23 pagesRevised Chapter I - Galicayo Restaurant 1Megustas tearsNo ratings yet

- Porters 5 Forces Presentation1Document8 pagesPorters 5 Forces Presentation1Tapan Shah100% (1)

- Feasibility Report - Pizza RestaurantDocument12 pagesFeasibility Report - Pizza RestaurantSachin Chaudhry33% (3)

- Carrefour IndiaDocument6 pagesCarrefour IndiaMakwinja Jane QuiencyNo ratings yet

- Feasibility StudyDocument17 pagesFeasibility Studyjameson0% (1)

- Growth of India's Service SectorDocument115 pagesGrowth of India's Service SectorAASTHA VERMANo ratings yet

- Sample Contents of A Completed Feasibility StudyDocument4 pagesSample Contents of A Completed Feasibility StudyMatthew DasigNo ratings yet

- Presentation 2-Feasibility Study PDFDocument18 pagesPresentation 2-Feasibility Study PDFMohamedRaahimNo ratings yet

- Establishing A StudentDocument223 pagesEstablishing A StudentCharity VenusNo ratings yet

- Restaurant QuestionnaireDocument2 pagesRestaurant Questionnairegirlie ValdezNo ratings yet

- IB 2 Modes of EntryDocument46 pagesIB 2 Modes of EntryRicha AnandNo ratings yet

- Innovation Management Types Management Practices and Innovation Performance in Services Industry of Developing EconomiesDocument15 pagesInnovation Management Types Management Practices and Innovation Performance in Services Industry of Developing EconomiesLilis PurnamasariNo ratings yet

- Infrastructural Decisions in Operations StrategyDocument5 pagesInfrastructural Decisions in Operations StrategyVidyadhar Raju VarakaviNo ratings yet

- Matthias Haber - Improving Public ProcurementDocument44 pagesMatthias Haber - Improving Public ProcurementMatt HaberNo ratings yet

- STUDY OF HOTEL INDUSTRY IN KHANDESH REGION by P A ANAWADE PDFDocument11 pagesSTUDY OF HOTEL INDUSTRY IN KHANDESH REGION by P A ANAWADE PDFanawade100% (1)

- Kane County Food Hub Feasibility Study Summary ReportDocument16 pagesKane County Food Hub Feasibility Study Summary ReportAngelieV.Remedios0% (1)

- Accounting 101 Chapter 1Document39 pagesAccounting 101 Chapter 1Md. Riyad Mahmud 183-15-11991No ratings yet

- Demand and Supply GapDocument2 pagesDemand and Supply GapVhia Marie Alvarez Cadawas100% (1)

- Feasibility Study & Financial AnalysisDocument33 pagesFeasibility Study & Financial AnalysissteveNo ratings yet

- Risk Return RelationshipDocument10 pagesRisk Return RelationshipJunaid PantheeranNo ratings yet

- Full Feasibility AnalysisDocument14 pagesFull Feasibility Analysisapi-339252193No ratings yet

- Full Feasibility AnalysisDocument13 pagesFull Feasibility Analysisapi-338950517No ratings yet

- Brand Analysis ReportDocument7 pagesBrand Analysis Reportapi-281781447No ratings yet

- The Best Ice Cream EverDocument6 pagesThe Best Ice Cream Everapi-281781447No ratings yet

- Movie Analysis EssayDocument3 pagesMovie Analysis Essayapi-281781447100% (1)

- GBDocument4 pagesGBapi-281781447No ratings yet

- ColoDocument1 pageColoapi-281781447No ratings yet

- GBDocument4 pagesGBapi-281781447No ratings yet

- The HolocaustDocument2 pagesThe Holocaustapi-281781447No ratings yet

- Survive Draft 2Document4 pagesSurvive Draft 2api-281781447No ratings yet

- Resear Paper Format Title and SubheadingsDocument4 pagesResear Paper Format Title and Subheadingsapi-281781447No ratings yet

- 1007 Steve Sean FoodlabelDocument2 pages1007 Steve Sean Foodlabelapi-281781447No ratings yet

- Siriwat TumthongDocument12 pagesSiriwat Tumthongapi-281781447No ratings yet

- Siriwat Tumthong ComputerDocument5 pagesSiriwat Tumthong Computerapi-281781447No ratings yet

- KSB Megaflow V: Pumps For Sewage, Effuents and MisturesDocument18 pagesKSB Megaflow V: Pumps For Sewage, Effuents and MisturesKorneliusNo ratings yet

- RefrigerationDocument11 pagesRefrigerationBroAmirNo ratings yet

- Sample Style GuideDocument5 pagesSample Style Guideapi-282547722No ratings yet

- DML Sro Karnal RMSDocument5 pagesDML Sro Karnal RMSEr Rohit MehraNo ratings yet

- The hyperwall: A multiple display wall for visualizing high-dimensional dataDocument4 pagesThe hyperwall: A multiple display wall for visualizing high-dimensional dataMahendra PututNo ratings yet

- Design Rules CMOS Transistor LayoutDocument7 pagesDesign Rules CMOS Transistor LayoututpalwxyzNo ratings yet

- Dont CryDocument8 pagesDont CryIolanda Dolcet Ibars100% (1)

- Presentation On BAJAJDocument19 pagesPresentation On BAJAJVaibhav AgarwalNo ratings yet

- EOG Project2010Document34 pagesEOG Project2010Amey Kadam100% (2)

- Tugas 1Document8 pagesTugas 1Muhammad Robby Firmansyah Ar-RasyiedNo ratings yet

- Guide: Royal Lepage Estate Realty BrandDocument17 pagesGuide: Royal Lepage Estate Realty BrandNazek Al-SaighNo ratings yet

- DTOcean - Optimal Design Tools For Ocean Energy ArraysDocument94 pagesDTOcean - Optimal Design Tools For Ocean Energy ArraysWilson NevesNo ratings yet

- Active Control of Flow Separation Over An Airfoil Using Synthetic JetsDocument9 pagesActive Control of Flow Separation Over An Airfoil Using Synthetic JetsDrSrujana ReddyNo ratings yet

- Advances in Remediation-eBookDocument88 pagesAdvances in Remediation-eBookalinerlfNo ratings yet

- Difference Between AND: Shahirah Nadhirah Madihah Suhana AtiqahDocument11 pagesDifference Between AND: Shahirah Nadhirah Madihah Suhana AtiqahShahirah ZafirahNo ratings yet

- Digital Logic and Microprocessor Design With Interfacing 2nd Edition Hwang Solutions ManualDocument27 pagesDigital Logic and Microprocessor Design With Interfacing 2nd Edition Hwang Solutions Manualdacdonaldnxv1zq100% (27)

- Tur C PDFDocument86 pagesTur C PDFWilliam LambNo ratings yet

- Item No. Specification Requested Offered Specifications 1.1. 1.1 Law and CertificatesDocument23 pagesItem No. Specification Requested Offered Specifications 1.1. 1.1 Law and CertificatesSaša StankovićNo ratings yet

- InductorsDocument13 pagesInductorsManish AnandNo ratings yet

- Nazneen Wahab CVDocument5 pagesNazneen Wahab CVRavi MittalNo ratings yet

- Amptec Issue 7Document8 pagesAmptec Issue 7Linda Turner-BoothNo ratings yet

- Marco OH Lighting-Business Plan PDFDocument43 pagesMarco OH Lighting-Business Plan PDFsjcoolgeniusNo ratings yet

- A Polypropylene Film With Excellent Clarity Combined With Avery Dennison Clearcut™ Adhesive Technology and With A Glassine LinerDocument4 pagesA Polypropylene Film With Excellent Clarity Combined With Avery Dennison Clearcut™ Adhesive Technology and With A Glassine LinerAhmad HaririNo ratings yet

- Control and On-Off Valves GuideDocument87 pagesControl and On-Off Valves Guidebaishakhi_b90100% (3)

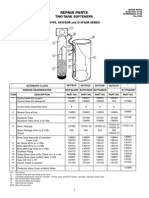

- Star S07FS32DR Water Softener Repair PartsDocument1 pageStar S07FS32DR Water Softener Repair PartsBillNo ratings yet

- Audio (Amplifier) - Electrical DiagnosticsDocument195 pagesAudio (Amplifier) - Electrical DiagnosticsRafael CherechesNo ratings yet

- Nord Motors Manual BookDocument70 pagesNord Motors Manual Bookadh3ckNo ratings yet

- Results Part III - Part III-March 2017 - ElectricalDocument3 pagesResults Part III - Part III-March 2017 - ElectricalTharaka MunasingheNo ratings yet

- HTML Project RestaurantDocument8 pagesHTML Project RestaurantSandeep Chowdary0% (1)

- Letter To Local Residents From Sutton Council Re. Lidl Development To Replace Matalan Ref DM2019-02113 10 January 2020Document5 pagesLetter To Local Residents From Sutton Council Re. Lidl Development To Replace Matalan Ref DM2019-02113 10 January 2020etajohnNo ratings yet

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (54)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (12)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (19)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesFrom EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesRating: 5 out of 5 stars5/5 (21)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (794)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)