Professional Documents

Culture Documents

Sage X3 - User Guide - HTG-Employee Expense Reports PDF

Uploaded by

caplusincOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sage X3 - User Guide - HTG-Employee Expense Reports PDF

Uploaded by

caplusincCopyright:

Available Formats

How To Guide

Employee Expense Reports

Table of Contents

Determine the categories for tracking employee expenses ................................................................... 2

Establish a general ledger account for each expense ............................................................................ 2

Set up an Expenses costs accounting code for each expense group .............................................. 3

Set up a Miscellaneous Business Partners accounting code for each expense group .................. 3

Set up the Mileage Allowance for your Mileage charge code ................................................................ 6

Set up the User account for expense processing ................................................................................... 7

Set up the Miscellaneous BP that is linked to the User account ........................................................... 8

Processing expense reports ...................................................................................................................... 9

Posting expense reports .......................................................................................................................... 10

Expense posting generates a Log file ..................................................................................................... 11

Journal entry generated for the Expense Posting ................................................................................... 12

March 2010 Sage Page 1 of 12

Employee Expense Reports

Determine the categories for tracking employee expenses

In this example we will track the following:

1. Airfare

2. Automobile

3. Mileage

4. Hotel

5. Employee Meals

6. Parking

Establish a general ledger account for each expense

Go to... Common Data / GL Accounting Tables / General / GL Accounts.

March 2010 Sage Page 2 of 12

Employee Expense Reports

Set up an Expenses costs accounting code for each expense group

Go to... Parameters / Financials / Accounting Interface / Accounting Codes.

Repeat setting up codes for each expense group.

Assign the respective GL

account here.

March 2010 Sage Page 3 of 12

Employee Expense Reports

Set up a Miscellaneous Business Partners accounting code for each expense group

Go toParameters / Financials / Accounting Interface / Accounting Codes.

Assign a Collective employee expense clearing account to line 8, Expenses Costs. This accounting

code line is referenced by the EXP (Refund of Expenses) automatic journal.

March 2010 Sage Page 4 of 12

Employee Expense Reports

Setup a charge code for each of your expense groups.

Go to Parameters / AP-AR Accounting / Expenses / Charge Codes.

Assign the corresponding

Expense cost accounting code

(see p.3).

Set the Valuation type to

Unitary for all charge

codes except Mileage,

which should be set to

Costs Miles/Km.

March 2010 Sage Page 5 of 12

Employee Expense Reports

Set up the Mileage Allowance for your Mileage charge code

Go to Parameters / AP-AR Accounting / Expenses / Mileage allowances.

Set up Category 1 with its respective reimbursement allowance per mile.

(In the below example for Category 1, $0.41/mile is the reimbursement rate).

March 2010 Sage Page 6 of 12

Employee Expense Reports

Set up the User account for expense processing

Go to Parameters / Users / Users.

Now set up the A/P and A/R Parameters Definitions for the User. Go to the Parameter Definitions tab

and define the EXPBPR field to be MISC, which is the miscellaneous business partner account setup for

expense processing.

March 2010 Sage Page 7 of 12

Employee Expense Reports

Set up the Miscellaneous BP that is linked to the User account

Go to Common Data / BPs / BPs.

On the Accounting tab, assign the EXP Miscellaneous Business Partners Accounting Code to the BP.

March 2010 Sage Page 8 of 12

Employee Expense Reports

Processing expense reports

Go to AP-AR Accounting / Expenses / Expense Form entry.

First select the Employee (User) and then choose the Period.

Qty - For the mileage you can enter the actual number of miles traveled and X3 will calculate the mileage

reimbursement. For any other charge, set the quantity to 1.

You can assign a dimension to the charge code line. Depending on how you wish to structure your

dimension types, you can have one charge code and use dimensions to catalog the different elements

(airfare, hotel, auto, etc.).

March 2010 Sage Page 9 of 12

Employee Expense Reports

Posting expense reports

Go to AP-AR Accounting / Expenses / Expense Posting.

This function posts the expense entries and a credit to the expense clearing account.

Check this box to get an

actual journal entry to

be generated.

March 2010 Sage Page 10 of 12

Employee Expense Reports

Expense posting generates a Log file

March 2010 Sage Page 11 of 12

Employee Expense Reports

Journal entry generated for the Expense Posting

March 2010 Sage Page 12 of 12

You might also like

- How To Setup A Workflow To Email Invoice To Customer Contact?Document6 pagesHow To Setup A Workflow To Email Invoice To Customer Contact?Kudakwashe MlalaziNo ratings yet

- Sage X3 - User Guide - HTG-Single Level BOM PDFDocument6 pagesSage X3 - User Guide - HTG-Single Level BOM PDFcaplusincNo ratings yet

- Training: (Texte)Document22 pagesTraining: (Texte)Thulani NdlovuNo ratings yet

- Sage X3 - User Guide - HTG-Purge Parameters PDFDocument8 pagesSage X3 - User Guide - HTG-Purge Parameters PDFcaplusinc100% (1)

- Sage X3 - User Guide - Setting Up The ODG Document Types and Journal CodesDocument3 pagesSage X3 - User Guide - Setting Up The ODG Document Types and Journal CodescaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Fiscal Year End Closing PDFDocument5 pagesSage X3 - User Guide - HTG-Fiscal Year End Closing PDFcaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Service and Carrier Setup PDFDocument5 pagesSage X3 - User Guide - HTG-Service and Carrier Setup PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Methods of Assigning Cost To A Fixed Asset in X3Document6 pagesSage X3 - User Guide - Methods of Assigning Cost To A Fixed Asset in X3caplusincNo ratings yet

- Sage X3 - User Guide - HTG Import Tracking PDFDocument36 pagesSage X3 - User Guide - HTG Import Tracking PDFcaplusincNo ratings yet

- Training: January 2012Document54 pagesTraining: January 2012Thulani NdlovuNo ratings yet

- "How To " Guide Inter-Site TransfersDocument15 pages"How To " Guide Inter-Site TransfersMohamed Ali BourigaNo ratings yet

- Day 3Document3 pagesDay 3Mohamed AliNo ratings yet

- Day 9Document3 pagesDay 9Mohamed AliNo ratings yet

- Day 7Document5 pagesDay 7Mohamed AliNo ratings yet

- Sage X3 - User Guide - HTG-Shipping Interface PDFDocument18 pagesSage X3 - User Guide - HTG-Shipping Interface PDFcaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Adding An Office Doc To A Screen PDFDocument6 pagesSage X3 - User Guide - HTG-Adding An Office Doc To A Screen PDFcaplusincNo ratings yet

- Day 12Document13 pagesDay 12Mohamed AliNo ratings yet

- Day 11Document6 pagesDay 11Mohamed AliNo ratings yet

- Sage X3 - User Guide - Sale of Fixed Assets in X3Document7 pagesSage X3 - User Guide - Sale of Fixed Assets in X3caplusincNo ratings yet

- Sage X3 - User Guide - HTG-Using Financial Charges in X3 PDFDocument7 pagesSage X3 - User Guide - HTG-Using Financial Charges in X3 PDFcaplusincNo ratings yet

- Sage X3 HTG - How To Restrict Users From Accessing Certain Companies or SitesDocument6 pagesSage X3 HTG - How To Restrict Users From Accessing Certain Companies or SitesgavjohanNo ratings yet

- INV309 - Reordering Replenishment Storage Plan - SlidesDocument57 pagesINV309 - Reordering Replenishment Storage Plan - SlidesNiko Christian ArnaldoNo ratings yet

- Sage X3 - User Guide - Setting Up The Fixed Asset Accounting CodesDocument2 pagesSage X3 - User Guide - Setting Up The Fixed Asset Accounting CodescaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Setting Up A Workflow For A Batch Task PDFDocument8 pagesSage X3 - User Guide - HTG-Setting Up A Workflow For A Batch Task PDFcaplusincNo ratings yet

- "" H How T Ow To o " " G Guide Uide E ED DIP I Pro Rocess Cessin Ing GDocument9 pages"" H How T Ow To o " " G Guide Uide E ED DIP I Pro Rocess Cessin Ing GMohamed AliNo ratings yet

- Sage X3 - User Guide - HTG-Purchase Planning PDFDocument7 pagesSage X3 - User Guide - HTG-Purchase Planning PDFcaplusincNo ratings yet

- How To Automatically Stop and Start The Batch Server and Journal Status Monitor (Accounting Tasks)Document5 pagesHow To Automatically Stop and Start The Batch Server and Journal Status Monitor (Accounting Tasks)CHIBOUB AchrafNo ratings yet

- Material Variance Calculation in X3Document3 pagesMaterial Variance Calculation in X3ruzhaNo ratings yet

- Sage X3 - User Guide - HTG-Create A Clean PILOT Folder PDFDocument8 pagesSage X3 - User Guide - HTG-Create A Clean PILOT Folder PDFcaplusincNo ratings yet

- Day 5Document3 pagesDay 5Mohamed AliNo ratings yet

- Day 8Document2 pagesDay 8Mohamed AliNo ratings yet

- Creating A PILOT FolderDocument10 pagesCreating A PILOT FolderTapiwa Mupasiri HoveNo ratings yet

- IN101: Inventory Fundamentals Sage ERP X3Document98 pagesIN101: Inventory Fundamentals Sage ERP X3Thulani NdlovuNo ratings yet

- Stock Out of Sync in Sage X3Document3 pagesStock Out of Sync in Sage X3ruzhaNo ratings yet

- Day 10Document3 pagesDay 10Mohamed AliNo ratings yet

- How To Delete A FolderDocument2 pagesHow To Delete A FolderKudakwashe MlalaziNo ratings yet

- Sage X3 - User Guide - Scrapping Fixed Assets in X3Document4 pagesSage X3 - User Guide - Scrapping Fixed Assets in X3caplusincNo ratings yet

- Sage X3 - User Guide - HTG-SmartForecast Interface PDFDocument11 pagesSage X3 - User Guide - HTG-SmartForecast Interface PDFcaplusinc100% (1)

- NPI X3021-01 Negoce Purchasing SlidesDocument59 pagesNPI X3021-01 Negoce Purchasing SlidesIvan PépointNo ratings yet

- Sage X3 - User Guide - HTG-SMC3 Rate Shopping PDFDocument17 pagesSage X3 - User Guide - HTG-SMC3 Rate Shopping PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Setting Up Depreciation Types and Depreciation Methods in X3Document4 pagesSage X3 - User Guide - Setting Up Depreciation Types and Depreciation Methods in X3caplusincNo ratings yet

- Sage X3 - User Guide - HTG-Allergens PDFDocument11 pagesSage X3 - User Guide - HTG-Allergens PDFcaplusincNo ratings yet

- Day 4Document8 pagesDay 4Mohamed AliNo ratings yet

- HTG - Creating A PILOT Folder For Sage ERP X3 Standard EditionDocument10 pagesHTG - Creating A PILOT Folder For Sage ERP X3 Standard EditionMohamed AliNo ratings yet

- Sage X3 - User Guide - HTG-Lockbox Processing PDFDocument7 pagesSage X3 - User Guide - HTG-Lockbox Processing PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Revising A Depreciation Schedule in X3Document4 pagesSage X3 - User Guide - Revising A Depreciation Schedule in X3caplusincNo ratings yet

- Analyze Financial Data with DimensionsDocument15 pagesAnalyze Financial Data with DimensionsThulani NdlovuNo ratings yet

- How To Overcome The Table Full' Error in Sage X3 While Importing The FileDocument1 pageHow To Overcome The Table Full' Error in Sage X3 While Importing The FileNgocNo ratings yet

- SageERPX3 V7 U9-U10 ClosingFiscalPeriodsAndYearsDocument14 pagesSageERPX3 V7 U9-U10 ClosingFiscalPeriodsAndYearsUsman Khan100% (1)

- Adding Message Boxes in Sage X3Document2 pagesAdding Message Boxes in Sage X3Axl AxlNo ratings yet

- ST X3 FinancialAcctSeries NFRDocument138 pagesST X3 FinancialAcctSeries NFRsabeur100% (1)

- Sage X3 - User Guide - HTG-Creating A Copy of A Folder PDFDocument14 pagesSage X3 - User Guide - HTG-Creating A Copy of A Folder PDFcaplusinc50% (2)

- Sage X3 - User Guide - HTG-Order Holds PDFDocument9 pagesSage X3 - User Guide - HTG-Order Holds PDFcaplusincNo ratings yet

- Sage X3 - How To Print Sales Orders in X3Document4 pagesSage X3 - How To Print Sales Orders in X3caplusincNo ratings yet

- Sage X3 - User Guide - HTG-Setting Up Common Sales Pricing Rules PDFDocument23 pagesSage X3 - User Guide - HTG-Setting Up Common Sales Pricing Rules PDFcaplusinc100% (1)

- Sage X3 - User Guide - HTG-Deleting Folders PDFDocument12 pagesSage X3 - User Guide - HTG-Deleting Folders PDFcaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Setting Up GL Allocations PDFDocument5 pagesSage X3 - User Guide - HTG-Setting Up GL Allocations PDFcaplusincNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- br100 Oracle Internet ExpensesDocument34 pagesbr100 Oracle Internet Expensespraveen801No ratings yet

- Settlement Cost Element SAPDocument3 pagesSettlement Cost Element SAPAni Nalitayui LifityaNo ratings yet

- Sage X3 - User Guide - REF-North American Reports PDFDocument7 pagesSage X3 - User Guide - REF-North American Reports PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Setting Up Fixed Asset CategoriesDocument2 pagesSage X3 - User Guide - Setting Up Fixed Asset CategoriescaplusincNo ratings yet

- Sage X3 - User Guide - Setting Up LocalizationsDocument4 pagesSage X3 - User Guide - Setting Up LocalizationscaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Service and Carrier Setup PDFDocument5 pagesSage X3 - User Guide - HTG-Service and Carrier Setup PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Setting Up Depreciation Types and Depreciation Methods in X3Document4 pagesSage X3 - User Guide - Setting Up Depreciation Types and Depreciation Methods in X3caplusincNo ratings yet

- Sage X3 - User Guide - HTG-ADC PDFDocument24 pagesSage X3 - User Guide - HTG-ADC PDFcaplusinc75% (4)

- Sage X3 - User Guide - HTG-Allergens PDFDocument11 pagesSage X3 - User Guide - HTG-Allergens PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Methods of Assigning Cost To A Fixed Asset in X3Document6 pagesSage X3 - User Guide - Methods of Assigning Cost To A Fixed Asset in X3caplusincNo ratings yet

- Sage X3 - User Guide - Setting Up Fixed AssetsDocument7 pagesSage X3 - User Guide - Setting Up Fixed AssetscaplusincNo ratings yet

- Sage X3 - User Guide - Setting Up Asset TypesDocument2 pagesSage X3 - User Guide - Setting Up Asset TypescaplusincNo ratings yet

- Sage X3 - User Guide - Setting Up The Fixed Asset Accounting CodesDocument2 pagesSage X3 - User Guide - Setting Up The Fixed Asset Accounting CodescaplusincNo ratings yet

- Sage X3 - User Guide - How To Install The Fixed Assets Add-On in V5.1Document9 pagesSage X3 - User Guide - How To Install The Fixed Assets Add-On in V5.1caplusincNo ratings yet

- Sage X3 - User Guide - Format of The Imported Fixed AssetDocument4 pagesSage X3 - User Guide - Format of The Imported Fixed Assetcaplusinc0% (1)

- Sage X3 - User Guide - Fixed Asset Transfers in X3Document5 pagesSage X3 - User Guide - Fixed Asset Transfers in X3caplusincNo ratings yet

- Sage X3 - User Guide - Scrapping Fixed Assets in X3Document4 pagesSage X3 - User Guide - Scrapping Fixed Assets in X3caplusincNo ratings yet

- Sage X3 - User Guide - Sale of Fixed Assets in X3Document7 pagesSage X3 - User Guide - Sale of Fixed Assets in X3caplusincNo ratings yet

- Sage X3 - User Guide - Setting Up Accounting Code LinesDocument1 pageSage X3 - User Guide - Setting Up Accounting Code Linescaplusinc0% (1)

- Sage X3 - User Guide - Revising A Depreciation Schedule in X3Document4 pagesSage X3 - User Guide - Revising A Depreciation Schedule in X3caplusincNo ratings yet

- Sage X3 - User Guide - Creating Monthly Depreciation Expense Entries in X3Document5 pagesSage X3 - User Guide - Creating Monthly Depreciation Expense Entries in X3caplusincNo ratings yet

- Sage X3 - User Guide - Fixed Asset Revaluations in X3Document4 pagesSage X3 - User Guide - Fixed Asset Revaluations in X3caplusincNo ratings yet

- Sage X3 - User Guide - REF-North American Reports PDFDocument7 pagesSage X3 - User Guide - REF-North American Reports PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Fixed Assets Training Agenda (Rev1)Document2 pagesSage X3 - User Guide - Fixed Assets Training Agenda (Rev1)caplusincNo ratings yet

- Sage X3 - User Guide - HTG-Fiscal Year End Closing PDFDocument5 pagesSage X3 - User Guide - HTG-Fiscal Year End Closing PDFcaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Using Financial Charges in X3 PDFDocument7 pagesSage X3 - User Guide - HTG-Using Financial Charges in X3 PDFcaplusincNo ratings yet

- Sage X3 - User Guide - Fixed Asset ExplosionsDocument4 pagesSage X3 - User Guide - Fixed Asset ExplosionscaplusincNo ratings yet

- Sage X3 - User Guide - HTG-Year End Simulation PDFDocument3 pagesSage X3 - User Guide - HTG-Year End Simulation PDFcaplusincNo ratings yet

- Sage X3 - User Guide - HTG-RNI Report PDFDocument6 pagesSage X3 - User Guide - HTG-RNI Report PDFcaplusincNo ratings yet

- Marketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDocument7 pagesMarketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDisha MathurNo ratings yet

- SS ISO 9004-2018 - PreviewDocument12 pagesSS ISO 9004-2018 - PreviewKit ChanNo ratings yet

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDocument2 pagesDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNo ratings yet

- Bharathi Real EstateDocument3 pagesBharathi Real Estatekittu_sivaNo ratings yet

- Licensing ProposalDocument6 pagesLicensing ProposalKungfu SpartaNo ratings yet

- Basic Economic Questions ExplainedDocument20 pagesBasic Economic Questions ExplainedRiemann SolivenNo ratings yet

- Randy Gage Haciendo Que El Primer Circulo Funciones RG1Document64 pagesRandy Gage Haciendo Que El Primer Circulo Funciones RG1Viviana RodriguesNo ratings yet

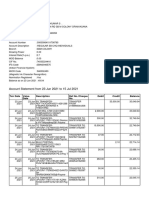

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Case Study: When in RomaniaDocument3 pagesCase Study: When in RomaniaAle IvanovNo ratings yet

- Contract CoffeeDocument5 pagesContract CoffeeNguyễn Huyền43% (7)

- APSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Document28 pagesAPSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Arvic LauNo ratings yet

- ERP Selection Keller Manufacturing 850992 - EmeraldDocument10 pagesERP Selection Keller Manufacturing 850992 - EmeraldNiraj KumarNo ratings yet

- Corpo Bar QsDocument37 pagesCorpo Bar QsDee LM100% (1)

- Pakistan Is Not A Poor Country But in FactDocument5 pagesPakistan Is Not A Poor Country But in Factfsci35No ratings yet

- GEAR 2030 Final Report PDFDocument74 pagesGEAR 2030 Final Report PDFAnonymous IQlte8sNo ratings yet

- Roberto Guercio ResumeDocument2 pagesRoberto Guercio Resumeapi-3705855No ratings yet

- Digests IP Law (2004)Document10 pagesDigests IP Law (2004)Berne Guerrero100% (2)

- Bid Doc ZESCO06614 Mumbwa Sanje Reinforcement July 2014 FinalDocument374 pagesBid Doc ZESCO06614 Mumbwa Sanje Reinforcement July 2014 FinalmatshonaNo ratings yet

- BharatBenz FINALDocument40 pagesBharatBenz FINALarunendu100% (1)

- AM.012 - Manual - UFCD - 0402Document23 pagesAM.012 - Manual - UFCD - 0402Luciana Pinto86% (7)

- Kotler & Keller (Pp. 325-349)Document3 pagesKotler & Keller (Pp. 325-349)Lucía ZanabriaNo ratings yet

- The Cochran Firm Fraud Failed in CA Fed. CourtDocument13 pagesThe Cochran Firm Fraud Failed in CA Fed. CourtMary NealNo ratings yet

- Role of Market ResearchDocument2 pagesRole of Market ResearchGaurav AgarwalNo ratings yet

- MIS - Systems Planning - CompleteDocument89 pagesMIS - Systems Planning - CompleteDr Rushen SinghNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- The Theory of Interest Second EditionDocument43 pagesThe Theory of Interest Second EditionVineet GuptaNo ratings yet

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDocument24 pagesSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNo ratings yet

- FEU V TrajanoDocument1 pageFEU V TrajanoPeperonii0% (2)

- Sri Ganesh Engg - ProfileDocument19 pagesSri Ganesh Engg - Profileshikharc100% (1)

- Sage Pastel Partner Courses...Document9 pagesSage Pastel Partner Courses...Tanaka MpofuNo ratings yet