Professional Documents

Culture Documents

Try Lang Po

Uploaded by

MonicaSumanga0 ratings0% found this document useful (0 votes)

49 views2 pagesHHHH

Original Title

try lang po

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHHHH

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views2 pagesTry Lang Po

Uploaded by

MonicaSumangaHHHH

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

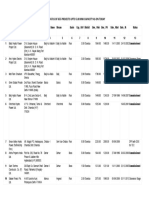

Topic: Application of Payments; Art.

1252 o Unsatisfied, Liggett then appealed, but judgment was

just affirmed and thus ruled that the proceeds of the

LIGGETT & MYERS v. ASSOCIATED INSURANCE sale of the cigarettes should first be applied to the

internal revenue taxes, payment of which was

Facts: guaranteed by a bond

o Petitioner Liggett and Myers entered into an Issue:

agreement with P.C. Ailmal that the former would WON it was correctly upheld that the proceeds of the sale of

advance to the latter 66 cases of Chesterfield cigarettes which constitute as partial payment should first

cigarettes (taxes pre-paid) on the condition that be applied to the internal revenue taxes

Ailmal would return an equal quantity of fresh

Chesterfield cigarettes, tax-free, upon arrival of his Which debt should the amount be applied

own order from Liggetts office in New York

o To guarantee the payment of IR taxes, Ailmal and Held:

respondent Associated Insurance and Surety Co. The issue of when of two obligations, the secured or the

executed a bond in favor of Liggett. (P14,520) unsecured, is more onerous to the debtor, would only be

o When the shipment arrived, Ailmal failed to pay the decisive where payment can not be applied in accordance

corresponding exchange tax on his letter of credit so with the rules immediately preceding Art. 1254;

Liggett was compelled to remit the sum thereof to 1252, the exercise of the exclusive right of the debtor to

avoid delay in the processing of documents make application of the payment, if the same has not been

o The latter now is demanding for reimbursement done, or to modify what has been stated, provided that he

o Ailmal asked for a 60-day extension, although after it obtains in every cases the acceptance of the debtor

had lapsed, the latter still failed to settle the expressly or tacitly

obligation

o Liggett instituted an action demanding Ailmal to (1) Here, the debtor has the right of choice on where to apply

deliver 66 cases of Chesterfield cigarettes in good the payment, initially, the proceeds were intended for partial

condition, (2) to pay the taxes thereon, (3) and all payment of the 66 cases of cigarettes, contrary to what the

other fees incidental thereon respondents were contending that the bond should be paid

o To minimize damages that might result from the since it has the nature of a lien, therefore more onerous;

prolonged storage of cigarettes, plaintiff paid the BULLSHIT

required taxes, withdrew the merchandise to the

warehouse and sold it

o That the proceeds of the sale be applied as partial

payment of Ailmals obligation to deliver to plaintiff

66 cases of fresh Chesterfield cigarettes;

o 15,664 was collected from the sale since 61 cases

were the only ones who were in good condition plus

the fact that they were sold in a much lower price,

which fell short of the obligation

o Lower court ruled that Ailmal was not liable to pay

the indemnity bond so he was of a 10,000-difference

only

Topic: Art. 1253

only the amount of the principal obligation,

MAGDALENA ESTATES v. RODRIGUEZ without exercising its right to apply a portion

of P655.89 to the payment of the alleged

Facts: interest due despite its presumed knowledge

of its right to do so, the appellee showed that

The appellants bought from the appellee a parcel of it waived or condoned the interests due.

land in QC.

In view of an unpaid balance of P5,000, the Issue: WoN the appellee waived or condoned the interests

appellants executed a promissory note. due

The appellants and the Luzon Surety Co, Inc. NO

executed a bond in favor of the appellee. The appellee did not protest when it accepted the

When the obligation of the appellants became due payment of P5,000.00 because it knew that that was

and demandable, Luzon Surety Co. paid to appellee the complete amount undertaken by the surety as

P5,000. appearing in the contract. The liability of a surety is

Subsequently the appellee demanded from the not extended, by implication, beyond the terms of his

appellants the payment of P655.89 corresponding to contract.

the alleged accumulated interests on the principal of (On application of payments) Appellants are relying

P5,000.00. on Article 1253 of the Civil Code, but the rules

Appellants refused to pay interest. contained in Articles 1252 to 1254 of the Civil Code

apply to a person owing several debts of the same

Appellee filed a suit in the Municipal Court of Manila

kind of a single creditor. They cannot be made

to enforce the collection.

applicable to a person whose obligation as a mere

The Municipal Court rendered judgment in favor of surety is both contingent and singular.

the appellee and ordered the appellants to pay (On novation) The mere fact that the creditor

appellee P655.89 with interest at legal rate from

receives a guaranty or accepts payments from a third

November 10, 1958 (date of the filing of complaint)

person who has agreed to assume the obligation,

Appellants appealed to CFI - Manila, which affirmed when there is no agreement that the first debtor shall

the decision of the Municipal Court. be released from responsibility does not constitute a

Appellants defenses: novation, and the creditor can still enforce the

o The pleadings do not show that there was obligation against the original debtor.

demand made by the appellee for the The surety bod is not a new and separate contract

payment of accrued interest. but an accessory of the promissory note.

o By demanding payment from the surety,

appellee accepted unqualifiedly the amount of

P5,000.00 as performance by the obligor

and/or obligors of the obligation in its favor.

o The unqualified acceptance of payment made

by the Luzon Surety Co., Inc. of P5,000.00 or

You might also like

- Magdalena Estate v. Rodriguez Land Sale Interest CaseDocument2 pagesMagdalena Estate v. Rodriguez Land Sale Interest CaseSocNo ratings yet

- CREDIT Additional CasesDocument10 pagesCREDIT Additional CasesbcarNo ratings yet

- Magdalena Estate vs. Rodriguez, 18 SCRA 967Document6 pagesMagdalena Estate vs. Rodriguez, 18 SCRA 967rowela jane paanoNo ratings yet

- Commonwealth Insurance Corporation vs. Ca: Insurance Company, Inc. We Have Sustained TheDocument6 pagesCommonwealth Insurance Corporation vs. Ca: Insurance Company, Inc. We Have Sustained TheAisha TejadaNo ratings yet

- G. R. No. L-10414, April 18, 1958Document4 pagesG. R. No. L-10414, April 18, 1958JB AndesNo ratings yet

- Case Title: TopicDocument3 pagesCase Title: TopicMark Anthony Javellana SicadNo ratings yet

- MAGDALENA ESTATES, INC., vs. ANTONIO A. RODRIGUEZ and HERMINIA C. RODRIGUEZDocument3 pagesMAGDALENA ESTATES, INC., vs. ANTONIO A. RODRIGUEZ and HERMINIA C. RODRIGUEZJaysonNo ratings yet

- Facts: Ong Chi, Doing Business Under The Firm Name "Tableria de Luxe Sued Francisco Reyes, JRDocument6 pagesFacts: Ong Chi, Doing Business Under The Firm Name "Tableria de Luxe Sued Francisco Reyes, JRburnboneNo ratings yet

- Baylon Case DigestDocument4 pagesBaylon Case DigestLance MorilloNo ratings yet

- OBLICON - Novation - RequisitesDocument57 pagesOBLICON - Novation - RequisitesCGNo ratings yet

- Cred Transaction CaseDocument4 pagesCred Transaction CaseLouie SalladorNo ratings yet

- 2 - Magdalena Estates Inc Vs RodriguezDocument3 pages2 - Magdalena Estates Inc Vs RodriguezLariza Aidie100% (1)

- Case Nos. 65-73 in ObliConDocument4 pagesCase Nos. 65-73 in ObliConMajorie ArimadoNo ratings yet

- Manila Surety Vs Almeda Assoc Insurance Vs BacolodDocument5 pagesManila Surety Vs Almeda Assoc Insurance Vs BacolodColeenNo ratings yet

- CaseDocument8 pagesCaseLoNo ratings yet

- Obligations and ContractsDocument5 pagesObligations and ContractsTherese ElleNo ratings yet

- COMMONWEALTH INSURANCE Corp. Vs CA DigestDocument6 pagesCOMMONWEALTH INSURANCE Corp. Vs CA DigestSheila RosetteNo ratings yet

- HSBC estopped from foreclosing after accepting paymentsDocument19 pagesHSBC estopped from foreclosing after accepting paymentsSGTNo ratings yet

- Plaintiff-Appellee Defendants-Appellants Roxas & Sarmiento Somera, Baclig & SavelloDocument5 pagesPlaintiff-Appellee Defendants-Appellants Roxas & Sarmiento Somera, Baclig & SavelloNicorobin RobinNo ratings yet

- Manila Surety Fidelity Co. vs AlmedaDocument4 pagesManila Surety Fidelity Co. vs AlmedaSheila RosetteNo ratings yet

- Catholic Vicar Apostolic V CA 165 Scra 515Document4 pagesCatholic Vicar Apostolic V CA 165 Scra 515Aleks OpsNo ratings yet

- Oblicon 5th Week DigestDocument5 pagesOblicon 5th Week DigestClarinda MerleNo ratings yet

- CASES Feb14Document16 pagesCASES Feb14John Michael RamosNo ratings yet

- 1 Guaranty Effect Digest Part 1Document4 pages1 Guaranty Effect Digest Part 1Joseph MacalintalNo ratings yet

- Obli Cases - TuesdayDocument13 pagesObli Cases - TuesdayMonicaSumangaNo ratings yet

- LIM TAY Vs CADocument2 pagesLIM TAY Vs CAStella LynNo ratings yet

- Commonwealth Insurance v. CADocument6 pagesCommonwealth Insurance v. CACZARINA ANN CASTRONo ratings yet

- Pioneer Insurance vs. CADocument5 pagesPioneer Insurance vs. CAaftb321No ratings yet

- Oblicon CasesDocument11 pagesOblicon CasesCess LazagaNo ratings yet

- Manila Surety & Fidelity Co., Inc. vs. AlmedaDocument9 pagesManila Surety & Fidelity Co., Inc. vs. AlmedaAnonymous WDEHEGxDhNo ratings yet

- Oblicon Case Digests Week 1 Chapter 2Document64 pagesOblicon Case Digests Week 1 Chapter 2Abdullah JulkanainNo ratings yet

- INA Seeks Payment for Insured Goods Destroyed in FireDocument2 pagesINA Seeks Payment for Insured Goods Destroyed in FireKaren Joy MasapolNo ratings yet

- Art 1268Document13 pagesArt 1268MarielleTajonMandingNo ratings yet

- Obligations and Contracts Case DigestDocument31 pagesObligations and Contracts Case DigestJennica Gyrl G. DelfinNo ratings yet

- Caltex Petitions IAC on Debt Collection and Mortgage ForeclosureDocument4 pagesCaltex Petitions IAC on Debt Collection and Mortgage ForeclosureKazumi ShioriNo ratings yet

- Manila Surety and Fidelity Co V AlmedaDocument4 pagesManila Surety and Fidelity Co V AlmedaRhenfacel ManlegroNo ratings yet

- Lim Tay V CADocument2 pagesLim Tay V CAChilzia RojasNo ratings yet

- Defendant Filed An Opposition To The Plaintiff's Petition. The Court Denied The SameDocument21 pagesDefendant Filed An Opposition To The Plaintiff's Petition. The Court Denied The SameMan RJNo ratings yet

- Obligations With A Penal ClauseDocument7 pagesObligations With A Penal ClausejustineNo ratings yet

- (FINAL) Module 2 Case DigestsDocument67 pages(FINAL) Module 2 Case DigestsDavie DemetilloNo ratings yet

- Atty suspended for neglecting land titling caseDocument4 pagesAtty suspended for neglecting land titling caseCourtney Tirol100% (1)

- San Diego Vs AlzulDocument3 pagesSan Diego Vs AlzulEcnerolAicnelav100% (1)

- Digests Art 1250-1279Document5 pagesDigests Art 1250-1279Gino LascanoNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 759. Docket 34693Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 759. Docket 34693Scribd Government DocsNo ratings yet

- Mariano Rodriguez v. Belgica Settlement DisputeDocument6 pagesMariano Rodriguez v. Belgica Settlement DisputeStephen Neil Casta�oNo ratings yet

- CA upholds insurer's subrogation rights against store for unpaid goods destroyed in fireDocument3 pagesCA upholds insurer's subrogation rights against store for unpaid goods destroyed in fireCJ CasedaNo ratings yet

- Gaisano Cagayan, IncDocument3 pagesGaisano Cagayan, IncCJ CasedaNo ratings yet

- Civil Law Review Ii MidtermsDocument8 pagesCivil Law Review Ii MidtermsKatherine Jane UnayNo ratings yet

- Plaintiffs Avelina and Mariano Velarde (Herein Petitioners) For The Sale of Said Property, Which Was, However, Under LeaseDocument22 pagesPlaintiffs Avelina and Mariano Velarde (Herein Petitioners) For The Sale of Said Property, Which Was, However, Under LeaseThalia SalvadorNo ratings yet

- Gaisano Cagayan Inc. v. Insurance Company Of20210424-12-1yqxlc7Document9 pagesGaisano Cagayan Inc. v. Insurance Company Of20210424-12-1yqxlc7Sitty MangNo ratings yet

- Digest Aug 10 CreditDocument23 pagesDigest Aug 10 CreditCesyl Patricia BallesterosNo ratings yet

- MT Civ Topics TLC LatestDocument4 pagesMT Civ Topics TLC LatestFrancis PunoNo ratings yet

- Delacruz Lorelin-Case DigestDocument16 pagesDelacruz Lorelin-Case DigestLoren's Acads AccountNo ratings yet

- RCBC vs. CA Insurance Proceeds DisputeDocument11 pagesRCBC vs. CA Insurance Proceeds Disputechelsimaine100% (1)

- Manila Surety & Fidelity Co., Inc., vs. Noemi AlmedaDocument2 pagesManila Surety & Fidelity Co., Inc., vs. Noemi AlmedaAices SalvadorNo ratings yet

- Obligation and Contract ReportDocument35 pagesObligation and Contract ReportJeanette FormenteraNo ratings yet

- Credit Digest Batch 7Document16 pagesCredit Digest Batch 7ylessinNo ratings yet

- Obligations and Contracts HWDocument22 pagesObligations and Contracts HWJessamyn DimalibotNo ratings yet

- Jhen Powerpoint Law 1Document95 pagesJhen Powerpoint Law 1Farah Tolentino NamiNo ratings yet

- Red Notes Criminal LawDocument73 pagesRed Notes Criminal LawMonicaSumangaNo ratings yet

- Rules of EvidenceDocument17 pagesRules of EvidenceMonicaSumangaNo ratings yet

- EVIDence InadmissibilityDocument6 pagesEVIDence InadmissibilityMonicaSumangaNo ratings yet

- Nego Doctrines RMD BusmenteDocument5 pagesNego Doctrines RMD BusmenteMonicaSumangaNo ratings yet

- Ejercito v. OrientalDocument2 pagesEjercito v. OrientalMonicaSumanga0% (1)

- Evidence - Judge Sia: Trial ObjectionsDocument4 pagesEvidence - Judge Sia: Trial ObjectionsMonicaSumangaNo ratings yet

- Evid Concepts ElectronicDocument7 pagesEvid Concepts ElectronicMonicaSumangaNo ratings yet

- Real Estate Option CaseDocument2 pagesReal Estate Option CaseMonicaSumangaNo ratings yet

- EVIDENCE ADMISSIBILITY GUIDELINESDocument3 pagesEVIDENCE ADMISSIBILITY GUIDELINESMonicaSumanga100% (1)

- Control and MGT (Campos-Based)Document3 pagesControl and MGT (Campos-Based)MonicaSumangaNo ratings yet

- American Bible Society V City of Manila GR NoDocument3 pagesAmerican Bible Society V City of Manila GR NoMonicaSumangaNo ratings yet

- JLT Agro v. BalansagDocument2 pagesJLT Agro v. BalansagMonicaSumangaNo ratings yet

- Notes:: CASE TITLE: Geraldez v. CA Topic: Fraud Ponente: AuthorDocument1 pageNotes:: CASE TITLE: Geraldez v. CA Topic: Fraud Ponente: AuthorMonicaSumangaNo ratings yet

- Notice of Dishonor 16 BenRicovPeopleDocument2 pagesNotice of Dishonor 16 BenRicovPeopleMonicaSumangaNo ratings yet

- Case List Nov. 4Document2 pagesCase List Nov. 4MonicaSumangaNo ratings yet

- SBTC v. RCBCDocument8 pagesSBTC v. RCBCMonicaSumangaNo ratings yet

- Any Person Who Is Prejudiced by A Simulated Contract May Set Up Its InexistenceDocument2 pagesAny Person Who Is Prejudiced by A Simulated Contract May Set Up Its InexistenceMonicaSumangaNo ratings yet

- Atrium Management v. CA, E.T. Henry and Co.Document3 pagesAtrium Management v. CA, E.T. Henry and Co.bearzhugNo ratings yet

- Gardose Vs TarrozaDocument6 pagesGardose Vs TarrozaAriane AquinoNo ratings yet

- Dizon v. GaborroDocument2 pagesDizon v. GaborroMonicaSumangaNo ratings yet

- DEED OF SALE OF MOTOR VEHICLE-templateDocument2 pagesDEED OF SALE OF MOTOR VEHICLE-templateIvy Mallari QuintoNo ratings yet

- 111987-2005-Solidbank Corp. v. Mindanao Ferroalloy Corp.Document16 pages111987-2005-Solidbank Corp. v. Mindanao Ferroalloy Corp.MonicaSumangaNo ratings yet

- Rebus Sic Stantibus Doctrine and Pre-Termination of Lease AgreementDocument2 pagesRebus Sic Stantibus Doctrine and Pre-Termination of Lease AgreementMonicaSumangaNo ratings yet

- SBTC v. RCBCDocument8 pagesSBTC v. RCBCMonicaSumangaNo ratings yet

- Case List Nov. 4Document2 pagesCase List Nov. 4MonicaSumangaNo ratings yet

- Int'l. Corporate Bank v. CADocument6 pagesInt'l. Corporate Bank v. CAMonicaSumangaNo ratings yet

- Notice of Dishonor 16 BenRicovPeopleDocument2 pagesNotice of Dishonor 16 BenRicovPeopleMonicaSumangaNo ratings yet

- PNB v. CADocument6 pagesPNB v. CAMonicaSumangaNo ratings yet

- Metrobank v. CabilzoDocument6 pagesMetrobank v. CabilzoMonicaSumangaNo ratings yet

- Producers Bank of The Philippines v. Excelsa Industries, Inc.Document11 pagesProducers Bank of The Philippines v. Excelsa Industries, Inc.MonicaSumanga0% (1)

- Genocide/Politicides, 1954-1998 - State Failure Problem SetDocument9 pagesGenocide/Politicides, 1954-1998 - State Failure Problem SetSean KimNo ratings yet

- Oxfordhb 9780199731763 e 13Document44 pagesOxfordhb 9780199731763 e 13florinaNo ratings yet

- Indian Medicinal PlantsDocument121 pagesIndian Medicinal PlantsN S Arun KumarNo ratings yet

- Legal Maxim V02Document29 pagesLegal Maxim V02singam harikanthNo ratings yet

- A Christmas Carol AdaptationDocument9 pagesA Christmas Carol AdaptationTockington Manor SchoolNo ratings yet

- MT 1 Combined Top 200Document3 pagesMT 1 Combined Top 200ShohanNo ratings yet

- 1 Ancient-IndiaDocument14 pages1 Ancient-Indiakaushik joshiNo ratings yet

- Kina Finalan CHAPTER 1-5 LIVED EXPERIENCES OF STUDENT-ATHLETESDocument124 pagesKina Finalan CHAPTER 1-5 LIVED EXPERIENCES OF STUDENT-ATHLETESDazel Dizon GumaNo ratings yet

- Booklet - CopyxDocument20 pagesBooklet - CopyxHåkon HallenbergNo ratings yet

- Ds 1Document8 pagesDs 1michaelcoNo ratings yet

- Exp Mun Feb-15 (Excel)Document7,510 pagesExp Mun Feb-15 (Excel)Vivek DomadiaNo ratings yet

- A Review Article On Integrator Circuits Using Various Active DevicesDocument7 pagesA Review Article On Integrator Circuits Using Various Active DevicesRaja ChandruNo ratings yet

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDocument45 pagesList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21No ratings yet

- Christian Mission and Conversion. Glimpses About Conversion, Constitution, Right To ReligionDocument8 pagesChristian Mission and Conversion. Glimpses About Conversion, Constitution, Right To ReligionSudheer Siripurapu100% (1)

- Here Late?", She Asked Me.: TrangDocument3 pagesHere Late?", She Asked Me.: TrangNguyễn Đình TrọngNo ratings yet

- Web Design Course PPTX Diana OpreaDocument17 pagesWeb Design Course PPTX Diana Opreaapi-275378856No ratings yet

- Amadora V CA Case DigestDocument3 pagesAmadora V CA Case DigestLatjing SolimanNo ratings yet

- Basic Principles of Social Stratification - Sociology 11 - A SY 2009-10Document9 pagesBasic Principles of Social Stratification - Sociology 11 - A SY 2009-10Ryan Shimojima67% (3)

- Erp Software Internship Report of Union GroupDocument66 pagesErp Software Internship Report of Union GroupMOHAMMAD MOHSINNo ratings yet

- AOM NO. 01-Stale ChecksDocument3 pagesAOM NO. 01-Stale ChecksRagnar Lothbrok100% (2)

- Case Study - Succession LawDocument2 pagesCase Study - Succession LawpablopoparamartinNo ratings yet

- AC & Crew Lists 881st 5-18-11Document43 pagesAC & Crew Lists 881st 5-18-11ywbh100% (2)

- Hac 1001 NotesDocument56 pagesHac 1001 NotesMarlin MerikanNo ratings yet

- Unitrain I Overview enDocument1 pageUnitrain I Overview enDragoi MihaiNo ratings yet

- SK Council Authorizes New Bank AccountDocument3 pagesSK Council Authorizes New Bank Accountt3emo shikihiraNo ratings yet

- Álvaro García Linera A Marxist Seduced BookDocument47 pagesÁlvaro García Linera A Marxist Seduced BookTomás TorresNo ratings yet

- Class 9 Maths Olympiad Achievers Previous Years Papers With SolutionsDocument7 pagesClass 9 Maths Olympiad Achievers Previous Years Papers With Solutionskj100% (2)

- McKesson Point of Use Supply - FINALDocument9 pagesMcKesson Point of Use Supply - FINALAbduRahman MuhammedNo ratings yet

- Evolution of The Indian Legal System 2Document7 pagesEvolution of The Indian Legal System 2Akhil YarramreddyNo ratings yet

- Chapter 3Document11 pagesChapter 3Leu Gim Habana PanuganNo ratings yet