Professional Documents

Culture Documents

Loans Against ICICI Pru Policy

Uploaded by

Umapathy KrishCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loans Against ICICI Pru Policy

Uploaded by

Umapathy KrishCopyright:

Available Formats

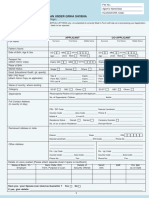

APPLICATION FOR LOAN AGAINST POLICY

Loan under a Policy will be available only on its acquiring a Surrender Value.

Policy Number Date D D M M Y Y Y Y

Name of Policyholder (Proposer)

Salutation First Name Surname

Contact Nos.

STD Residence STD Office Ext. ISD Mobile

E-Mail ID

Contact details mentioned above will be updated in all future communication.

Dear Sir / Madam,

I, _______________________________________________________________________, the holder of the above mentioned policy, agree to the Terms &

Conditions mentioned in this form and hereby apply for a loan against this policy.

Request you to advance me a loan of amount as selected below:

Amount Rs. i.e. Rs.

(amount in figures) (amount in words)

OR

Maximum amount available as loan against policy

NOTICE OF ASSIGNMENT

Notice is hereby given that I, the holder of the policy, have assigned the above policy to ICICI Prudential Life Insurance Company Ltd., whose Registered

Office is at ICICI PruLife Towers,1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025.

ABSOLUTE ASSIGNMENT AGAINST VALUABLE CONSIDERATION

I, the holder of the above mentioned Policy issued by ICICI Prudential Life Insurance Company Limited (the Company), do hereby absolutely transfer

and assign the rights and benefits of the said Policy in favour of the Company for a valuable consideration. I acknowledge that the assignment shall be

complete and effectual only upon the execution of this endorsement. I also acknowledge that the assignment shall not be operative as against the

Company until a notice in writing of this assignment and either the said endorsement or the instrument itself or a copy thereof certified to be correct by

both the assignor and the assignee or their duly authorised agent has been delivered to the specified office of the Company. I hereby declare that receipt

of benefits arising under the policy by the Assignee/ Company, shall be valid and sufficient discharge of the said loan.

Executed on this ______________ day of _________________________, 20______ at ________________________.

_______________________________________________________________________________________________________________________________________

Signature of Assignor/ Policholder

DECLARATION

The Assignor has duly executed the endorsement on the Policy, and that the signature/ thumb impression is of the Assignor affixed on the date and place

herein above stated.

Full name of Witness _______________________________________________________________ (Relationship with Assignor) ___________________________

Comm/Form/Loan/1.0

Stamp/ Time Stamp

_______________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________

Date: D D M M Y Y Y Y

Signature of Witness Signature/ Thumb impression

of Assignor/ Policyholder Place:

ACKNOWLEDGEMENT OF APPLICATION FOR LOAN AGAINST POLICY

Proposal/ Policy No.: Stamp/ Time Stamp

Name of Policyholder:

Branch Name:

Date: D D M M Y Y Y Y Received by:

APPLICATION FOR LOAN AGAINST POLICY

Terms & Conditions

I agree and understand that the loan against this policy shall be granted, subject to the following conditions:

1. The Policy shall be assigned absolutely to and held by the Company as security for the repayment of the loan and of the interest thereon and of all expenses

which may be incurred in connection therewith.

2. The rate of interest applicable to the loan will be of a variable nature and will be revised annually and compounded half-yearly.

3. The interest will fall due on the next half-yearly Policy Anniversary and on every Half-yearly Anniversary thereafter.

4. The loan amount may be repaid at any time during the term of the Policy. However, interest shall be charged for a minimum period of 6 months.

5. The Company shall not be bound to accept the repayment for any loan. For an amount less than Rs. 1000/-, any amount received by the Company for the

repayment of a loan will be adjusted first against the outstanding interest and the balance, if any, will be directed towards the repayment of the principal

amount.

6. In the event of the failure to repay the loan when required or to pay interest, the policy shall be terminated by the Company without giving any notice, and the

Company shall be entitled to apply the Surrender Value towards repayment of the interest, principal and expenses. the balance remaining of the Surrender

value, if any, shall be paid to the party entitled thereto.

7. In the event of an application for a subsequent loan under the Policy, the outstanding loan and interest, if any, on the existing loan shall be deducted out of the

total loan available and the balance only will be advanced to the applicant.

8. In case the Policy shall attain maturity or become a Claim due to death or any supplementary benefit and when the amount of the loan or any portion thereof is

outstanding, the Company shall be entitled to deduct such an amount together with all interest upto the date of maturity, or of death, or of the event under the

supplementary benefit; as the case may be from the Policy Moneys and balance only shall become due and payable.

9. I also state that I have read the Quotation, and have understood the rate of interest as mentioned therein. I am also aware that the Company reserves the right to

revise the rules and regulations that govern loans, even after the loan is sanctioned.

10. If the loan amount along with accrued unpaid interest is equal to the value of the units, then the policy will terminate and no benefit and/ or money will be

payable to the policyholder.

11. Loan processing fee of Rs. 250 will be deducted while processing the loan.

DECLARATION

I, the policyholder/ Assignor do hereby declare that I have read and understood the Terms & Conditions mentioned herein above and agree to abide by

the same.

Signed by me on this ______________ day of __________________________ 20_____.

_______________________________________________________________________________________________________________________________________

Signature of Assignor/ Policyholder

ELECTRONIC PAYOUT METHODS

Please tick one of the options :

National Electronic Fund Transfer (NEFT)

Electronic Clearing System (ECS)

Direct Credit (Select banks)

If none of the above options are selected, the default option will be Cheque.

Please attach a cancelled copy of your cheque if any of the above payout options is selected.

Name of Account Holder

Salutation First Name Surname

Bank Name _______________________________________________________________________________________________________________________________________

Branch Name _______________________________________________________________________________________________________________________________________

A/c Type Current Savings Please strike off unfilled cells wherever applicable.

*A/c Number

MICR Code (Only mandatory for ECS mode) (You can get this code from your cheque book)

IFSC Code (Only mandatory for NEFT Mode) (You can get this code from your bank)

The Payout mode selected in this form would be used by the Company to make subsequent payouts, if any, to the Proposer. Payouts would be in

accordance and subject to the Terms & Conditions of the policy.

I would not hold ICICI Prudential Life Insurance Co. Ltd. responsible in case of non-credit to my bank account or if the transaction is delayed or not

effected at all for reasons of incomplete/ incorrect information. Further, the Company reserves the right to use any alternative payout option including

a demand draft/ payable at par, cheque inspite of opting for Electronic Payout Method.

Responsibility of providing IFSC Code lies with the Policyholder. Please note that IFSC code for RTGS & IFSC code for NEFT may be different.

* To be filled in case a cancelled copy of your cheque is not attached:

*A/c Number

I hereby take the sole responsibility for the correctness of my Bank Account number and other details of this form. I undertake that I will not hold the

Company responsible in any manner for any transactions effected by the Company due to incorrect Bank Account number or other details stated by

me.

_______________________________________________________________________________________________________________________________________

Signature of Assignor/ Policyholder

Kindly call our Customer Service Toll Free Number 1-800-22-2020 from your MTNL or BSNL line

Call Center timings: 9.00 a.m. to 9.00 p.m. Monday to Saturday (except national holidays)

Communication Address

ICICI Prudential Life Insurance Company Ltd., Vinod Silk Mills Compound, Chakravarthy Ashok Road, Ashok Nagar, Kandivali (E), Mumbai - 400 101.

You might also like

- Service Level Agreement TemplateDocument4 pagesService Level Agreement TemplateSUNIL PUJARI100% (1)

- Performance-based rewards boost productivityDocument2 pagesPerformance-based rewards boost productivityAqib FidaNo ratings yet

- The Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowFrom EverandThe Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowRating: 5 out of 5 stars5/5 (1)

- Dmgt505 Management Information SystemDocument272 pagesDmgt505 Management Information SystemJitendra SinghNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- OilGas DCF NAV ModelDocument21 pagesOilGas DCF NAV ModelbankiesoleNo ratings yet

- Project Report On Marketing Environment of Coca ColaDocument18 pagesProject Report On Marketing Environment of Coca ColaSiddiqui Jamil94% (16)

- Fishbone DiagramDocument1 pageFishbone DiagramAsri Marwa UmniatiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)zaki ansariNo ratings yet

- Level I of CFA Program 5 Mock Exam December 2020 Revision 2Document45 pagesLevel I of CFA Program 5 Mock Exam December 2020 Revision 2JasonNo ratings yet

- P1-1a 6081901141Document2 pagesP1-1a 6081901141Mentari AnggariNo ratings yet

- Jaipur-Kishangarh Section Concession Agreement SummaryDocument99 pagesJaipur-Kishangarh Section Concession Agreement SummaryRobert MillerNo ratings yet

- Commercial Lease Tenant ProfileDocument4 pagesCommercial Lease Tenant ProfileDarryl Jay Medina67% (3)

- Central Banking and Monetary Policy PDFDocument43 pagesCentral Banking and Monetary Policy PDFWindyee TanNo ratings yet

- SalaryMulti PurposeEmergencyHousingBusinessLAF SampleOnlyDocument3 pagesSalaryMulti PurposeEmergencyHousingBusinessLAF SampleOnlyDivine Grace Mandin88% (8)

- Minor Alteration Form - Client PDFDocument2 pagesMinor Alteration Form - Client PDFSonu SinghNo ratings yet

- Application Form AlterationsDocument2 pagesApplication Form AlterationsSonu SinghNo ratings yet

- Know Yor Customer - Addendum: (For Third Party Payment)Document2 pagesKnow Yor Customer - Addendum: (For Third Party Payment)Shrikant GawhaneNo ratings yet

- Icici Insurance Mis 21-Apr-2022Document1 pageIcici Insurance Mis 21-Apr-2022Raj KumarNo ratings yet

- Health Check Up Claim Form 16 MarchDocument2 pagesHealth Check Up Claim Form 16 MarchGautam JenaNo ratings yet

- Notice of Assignment: Details of The AssigneeDocument2 pagesNotice of Assignment: Details of The Assigneevikash pandeyNo ratings yet

- IA Hartford Indemnity AgreementDocument1 pageIA Hartford Indemnity AgreementDënnis DukeNo ratings yet

- Redit Pplication and Pen Ccount Greement: Names of Owners, Partners or OfficersDocument1 pageRedit Pplication and Pen Ccount Greement: Names of Owners, Partners or OfficersLucy ArdanowskiNo ratings yet

- Loan Application Form: Borrower'S Personal Information (Mandatory)Document4 pagesLoan Application Form: Borrower'S Personal Information (Mandatory)HANNAH CHARIS CANOYNo ratings yet

- SBI Life - Assignment FormDocument2 pagesSBI Life - Assignment FormAgrawal DeekshaNo ratings yet

- Loan Application Form: Page 1 of 4Document4 pagesLoan Application Form: Page 1 of 4Mina Berdos SabitNo ratings yet

- Annexure To Personal GuaranteeDocument4 pagesAnnexure To Personal GuaranteeMitesh MehtaNo ratings yet

- Genius Joining Kit-1Document8 pagesGenius Joining Kit-1Aditya RajNo ratings yet

- TREDA Membership FormDocument10 pagesTREDA Membership FormInter 4DMNo ratings yet

- The Citizen Co-Operative Bank LTD.: F-5 Account Opening FormDocument1 pageThe Citizen Co-Operative Bank LTD.: F-5 Account Opening FormnaguficoNo ratings yet

- X Purchaser Acknowledgement FormDocument2 pagesX Purchaser Acknowledgement FormManu BansalNo ratings yet

- Nomination Form Da 1 EnglishDocument1 pageNomination Form Da 1 EnglishManish Kumar KingraniNo ratings yet

- Master Application For An Address ChangeDocument3 pagesMaster Application For An Address ChangeluismariohernandezNo ratings yet

- PCI Membership FormDocument2 pagesPCI Membership Formesprajan1973No ratings yet

- RHED Financing Application Form 1Document2 pagesRHED Financing Application Form 1Kenneth InuiNo ratings yet

- CDF - CCD For HsecDocument1 pageCDF - CCD For HsecNishanth VarmaNo ratings yet

- App Form Apna Office IndividualDocument6 pagesApp Form Apna Office IndividualKadhar AnwarNo ratings yet

- Think Again!: Policy Surrender FormDocument2 pagesThink Again!: Policy Surrender FormSumitt SinghNo ratings yet

- Sahara Application FormDocument2 pagesSahara Application Formprincesingh814579No ratings yet

- Absolute Assignment Other Than Keyman Form EnglishDocument2 pagesAbsolute Assignment Other Than Keyman Form EnglishSubin SNo ratings yet

- Annexure VI: Proposal Form For Lic'S Cancer CoverDocument5 pagesAnnexure VI: Proposal Form For Lic'S Cancer Coversarbjeet kumarNo ratings yet

- COVID-19 Questionnaire: Dd/Mm/Yyyy Dd/Mm/YyyyDocument1 pageCOVID-19 Questionnaire: Dd/Mm/Yyyy Dd/Mm/Yyyyankit bhuvaNo ratings yet

- Samriddhi Loan Application FormDocument2 pagesSamriddhi Loan Application Formpritikoshti55No ratings yet

- Philippine Deposit Insurance Corporation Buyer InformationDocument3 pagesPhilippine Deposit Insurance Corporation Buyer InformationEmmy Bags WalletNo ratings yet

- Consent Form PDFDocument1 pageConsent Form PDFNUR YASMIN MUNAWWARAH JEFRINo ratings yet

- Application For Housing Loan Under Griha ShobhaDocument7 pagesApplication For Housing Loan Under Griha ShobhaDr BusinessNo ratings yet

- Beneficiary Nomination FormDocument5 pagesBeneficiary Nomination FormBodhivarman SelvarajuNo ratings yet

- Reimbursement Expense Receipt Reimbursement Expense Receipt: Entity NameDocument1 pageReimbursement Expense Receipt Reimbursement Expense Receipt: Entity NameKimi No Na WaNo ratings yet

- Sworn Statement TemplateDocument1 pageSworn Statement TemplateBabarNo ratings yet

- Form of Assignment 3848Document4 pagesForm of Assignment 3848Devi ShivajiNo ratings yet

- Declaration Form by The Sponsoring Facility: Personal DetailsDocument1 pageDeclaration Form by The Sponsoring Facility: Personal DetailsMohammed TazminullaNo ratings yet

- Consent FormDocument1 pageConsent Formgood timesNo ratings yet

- Declaration Cum UndertakingDocument1 pageDeclaration Cum UndertakingSatishNo ratings yet

- Partial Withdrawal V7 1101122022Document2 pagesPartial Withdrawal V7 1101122022Raj KumarNo ratings yet

- SBI LifeDocument2 pagesSBI LifeLakshmi Kanta JenaNo ratings yet

- Annexure-A To H-11-12-2019Document10 pagesAnnexure-A To H-11-12-2019Rohit nandiNo ratings yet

- Corporate Re Kyc FormDocument3 pagesCorporate Re Kyc FormDesikanNo ratings yet

- Change or Designate Life Insurance BeneficiariesDocument1 pageChange or Designate Life Insurance BeneficiariesKenneth Cyrus OlivarNo ratings yet

- Lur332 0Document1 pageLur332 0Saki DacaraNo ratings yet

- Lagos Property Rent Receipt TemplateDocument1 pageLagos Property Rent Receipt TemplateOlusegun Ezekiel OluseunNo ratings yet

- AIA policy change of address formDocument4 pagesAIA policy change of address formchiaNo ratings yet

- Citibank Nomination FormDocument1 pageCitibank Nomination Formabhishekthakur19No ratings yet

- Mumbai DivisionDocument3 pagesMumbai DivisionJuzz BujjiNo ratings yet

- Major Alterations Form.Document1 pageMajor Alterations Form.ASHWINI BHOSALENo ratings yet

- 1 - Sample Loan GUARANTEEDocument3 pages1 - Sample Loan GUARANTEETalha MaboodNo ratings yet

- ACEF APPLICATION FormDocument2 pagesACEF APPLICATION FormDaniel Mirabel100% (3)

- Icici Insurance Mis 19-July 2022Document1 pageIcici Insurance Mis 19-July 2022Raj KumarNo ratings yet

- Business Loan Application Form IDFC BankDocument8 pagesBusiness Loan Application Form IDFC BankSNo ratings yet

- FLH020 MembershipStatusVerificationSlip V01Document1 pageFLH020 MembershipStatusVerificationSlip V01Ritchiel MirasolNo ratings yet

- Fuck YouDocument2 pagesFuck YouAli Rajai (Verified Gamer)No ratings yet

- Combine Ac Opening FormDocument10 pagesCombine Ac Opening FormUmapathy KrishNo ratings yet

- Impact of Value of TimeDocument9 pagesImpact of Value of TimeUmapathy KrishNo ratings yet

- My Slam Book-1Document2 pagesMy Slam Book-1Umapathy KrishNo ratings yet

- Contents - SafetyDocument1 pageContents - SafetyUmapathy KrishNo ratings yet

- Indian Contract Act 1872Document7 pagesIndian Contract Act 1872Aman KambojNo ratings yet

- Role Play MpuDocument2 pagesRole Play MpukebayanmenawanNo ratings yet

- MQ3 Spr08gDocument10 pagesMQ3 Spr08gjhouvanNo ratings yet

- Who Blows The Whistle On Corporate FraudDocument41 pagesWho Blows The Whistle On Corporate FraudDebNo ratings yet

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- Executive Order From Governor Gretchen WhitmerDocument5 pagesExecutive Order From Governor Gretchen WhitmerWNDUNo ratings yet

- Sip Report MadhushreeDocument25 pagesSip Report MadhushreeMadhushreeNo ratings yet

- Idfc Institute Housing ReportDocument118 pagesIdfc Institute Housing ReportDhruval Jignesh PatelNo ratings yet

- Chapter 2 Macro SolutionDocument12 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Intermediate Accounting 1 Module - The Accounting ProcessDocument16 pagesIntermediate Accounting 1 Module - The Accounting ProcessRose RaboNo ratings yet

- Act1110 Quiz No. 1 Legal Structures QuestionnaireDocument9 pagesAct1110 Quiz No. 1 Legal Structures QuestionnaireKhloe Nicole AquinoNo ratings yet

- Energy Crisis PPT in Macro EconomicsDocument34 pagesEnergy Crisis PPT in Macro Economicsmansikothari1989100% (2)

- Historical Economics: A Bridge Between Liberal Arts and Business StudiesDocument350 pagesHistorical Economics: A Bridge Between Liberal Arts and Business StudiesBui Trung HieuNo ratings yet

- Tugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, DDocument19 pagesTugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, Dbizantium greatNo ratings yet

- Customer Updation Form For Non IndividualDocument3 pagesCustomer Updation Form For Non IndividualThamilarasan PalaniNo ratings yet

- Business Advantage Advanced Unit2 Standardisation and DifferentiationDocument5 pagesBusiness Advantage Advanced Unit2 Standardisation and DifferentiationIgnacio LombardiNo ratings yet

- 空白信用证版本Document5 pages空白信用证版本ansontzengNo ratings yet

- Saudi Arabia Report 2018 PDFDocument9 pagesSaudi Arabia Report 2018 PDFSandy SiregarNo ratings yet

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- For The Families of Some Debtors, Death Offers No RespiteDocument5 pagesFor The Families of Some Debtors, Death Offers No RespiteSimply Debt SolutionsNo ratings yet