Professional Documents

Culture Documents

Notes To Accounts TRIF Constructions 31 Mar 10 - Cut 1

Uploaded by

cmakuldeepOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes To Accounts TRIF Constructions 31 Mar 10 - Cut 1

Uploaded by

cmakuldeepCopyright:

Available Formats

TRIF Constructions Private Limited

Schedules to the financial statements

for the year ended 31 March 2010

(Currency: Indian Rupees)

1. Background

TRIF Constructions Private Limited ('the Company') was incorporated on 29 October

2008 to carry on the business in India or abroad of development of real estate and

infrastructural facilities. The Company is a wholly owned subsidiary of Tata Advance

Systems Limited.

2. Statement of significant accounting policies

(a) Basis of preparation of financial statements

The financial statements are prepared under the historical cost convention, on the accrual

basis of accounting in accordance with the accounting principles generally accepted in

India (‘Indian GAAP’) and comply with the Companies (Accounting Standards)

Rules, 2006 issued by the Central Government, in consultation with National Advisory

Committee on Accounting Standards (‘NACAS’) and relevant provisions of Companies

Act, 1956 (‘the Act’) to the extent applicable.

(b) Use of estimates

The preparation of financial statements in conformity with Indian GAAP requires the

management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and the disclosure of contingent liabilities on the date of the

financial statements and the reported amounts of revenues and expenses during the

reported period. Management believes that the estimates made in the preparation of the

financial statements are prudent and reasonable. Actual results could differ from those

estimates. Any revision to accounting estimates is recognised prospectively in current

and future periods.

(c) Income taxes

Income tax expense comprises current income tax (i.e. amount of tax for the period

determined in accordance with the income tax law) and deferred tax charge or credit

(reflecting the tax effects of timing differences between accounting income and taxable

income for the period). The deferred tax charge or credit and the corresponding deferred

tax liabilities or assets are recognized using the tax rates that have been enacted or

substantively enacted by the balance sheet date. Deferred tax assets are recognized only

to the extent there is reasonable certainty that the assets can be realized in future;

however; where there is unabsorbed depreciation or carried forward loss under taxation

laws, deferred tax assets are recognized only if there is a virtual certainty of realization

of such assets. Deferred tax assets are reviewed at each balance sheet date and written

down or written up to reflect the amount that is reasonably/virtually certain (as the case

may be) to be realized.

TRIF Constructions Private Limited

Schedules to the financial statements

for the year ended 31 March 2010

(Currency: Indian Rupees)

(d) Earning per share

Basic earning per share is calculated by dividing the net profit/loss for the period

attributable to the equity share holders by the weighted average number of equity shares

outstanding during the period.

For the purpose of calculating diluted earnings per share, the net profit/loss for the

period attributable to the equity shareholders and the weighted average number of shares

outstanding during the period are adjusted for the effects of all dilutive potential equity

shares outstanding during the period, except where the results would be anti-dilutive.

(e) Foreign currency translation

Foreign exchange transactions are recorded at the spot rates on the date of the respective

transactions. Exchange differences arising on foreign exchange transactions settled

during the period are recognized in the profit and loss account of the period.

Monetary assets and liabilities denominated in foreign currencies as at the balance sheet

date are translated at the closing exchange rates on that date; the resultant exchange

differences are recognized in the profit and loss account.

(f) Provisions and contingencies

The Company creates a provision where there is present obligation as a result of a past

event that probably requires an outflow of resources and a reliable estimate can be made

of the amount of the obligation. A disclosure for a contingent liability is made when

there is a possible or a present obligation that may, but probably will not require an

outflow of resources. When there is a possible obligation in respect of which the

likelihood of outflow of resources is remote, no provision or disclosure is made.

TRIF Constructions Private Limited

Schedules to the financial statements

for the year ended 31 March 2010

(Currency: Indian Rupees)

3. Micro, Small and Medium Enterprises

Under the Micro, Small and Medium Enterprises Development Act, 2006 ('MSMED') which

came into force from 2 October 2006, certain disclosures are required to be made relating to

Micro, Small and Medium enterprises. On the basis of the information and records available

with the management, there are no outstanding dues to the Micro and Small enterprises as

defined in the Micro, Small and Medium Enterprises Development Act, 2006 as set out in the

following disclosures:

2010 2009

Principal amount remaining unpaid to any supplier as at the period

end - -

Interest due thereon - -

Amount of interest paid by the Company in terms of section 16 of

the MSMED, along with the amount of the payment made to the

supplier beyond the appointed day during the accounting period.

- -

Amount of interest due and payable for the period of delay in

making payment (which have been paid but beyond the appointed

day during the period) but without adding the interest specified

under the MSMED - -

Amount of interest accrued and remaining unpaid at the end of the

accounting period - -

4. Earning per share

Profit / (Loss) attributable to equity shareholders (A) (91,257) (57,370)

Weighted average number of equity shares outstanding during the 10,000 10,000

period (B)

Basic and diluted earnings per equity share (Face value of Rs.10/- (9.13) (5.74)

per share) (A / B)

TRIF Constructions Private Limited

Schedules to the financial statements

for the year ended 31 March 2010

(Currency: Indian Rupees)

5. Related Party Disclosure

Names of related parties

i. Holding Company

Tata Realty and Infrastructure Limited (upto 24th February 2010)

Tata Advance Systems Limited (w.e.f 25th February 2010)

ii. Ultimate Holding Company

Tata Sons Limited

iii. Fellow subsidiaries

1. Acme living Solutions Private Limited

2. Ahinsa Realtors Private Limited

3. Ardent Structures Private Limited

4. Arrow Infraestate Private Limited

5. Gurgaon Infratech Private Limited (Formerly Unitech Infratech Private Limited)

6. Gurgaon Realtech Limited (Formerly Unitech Realtech Limited)

7. Gurgaon Constructwell Private Limited (Formerly Unitech Construct Well Private

Limited)

8. Landscape Structures Private Limited

9. TRIL Roads Private Limited (Formerly known as Navinya Buildcon Private Limited)

10. Pioneer Infratech Private Limited

11. TRIF Gandhinagar Projects Private Limited

12. TRIF Hyderabad Projects Private Limited

13. TRIF Kochi Projects Private Limited (upto 30th March 2010)

14. TRIF Kolkata Projects Private Limited

15. TRIF Property Development Private Limited

16. TRIF Infrastructure Private Limited

17. TRIF Real Estate And Development Private Limited

18. TRIF Realty Projects Private Limited

19. TRIF Trivandrum Projects Private Limited

20. TRIL Airport Developers Limited

21. TRIL Constructions Limited

22. TRIL Developers Limited

23. Avana Integrated Systems Private Limited (Formerly known as TRIF Erectors

Private Limited up to 24th Feb 2010)

24. TRIF Mega Projects Private Limited

25. TRIL Logistics Private Limited (Formerly known TRIF Modern Super Structure

Private Limited)

26. TRIF Structures and Builders Private Limited

27. TRIF Gurgaon Housing Projects Private Limited

TRIF Constructions Private Limited

Schedules to the financial statements

for the year ended 31 March 2010

(Currency: Indian Rupees)

Details of transactions with Related Parties

Particulars Total

2010 2010

Tata Realty and Infrastructure Limited

Inter Corporate Deposits received and paid 40,000 40,000

(Nil) (Nil)

Interest expense 1,357 1,357

(Nil) (Nil)

Tata Advance Systems Limited 50,000 50,000

Inter Corporate Deposits received (Nil) (Nil)

Outstanding at the year end

Tata Advance Systems Limited

Unsecured loan 50,000 50,000

Note: Previous period figure are in brackets

6. Contingent Liabilities

2010 2009

Claims against the Company not acknowledged as debt Nil Nil

7. Segmental Information

The Company is operating in the real estate and infrastructure industry. The Company

has only one reportable business segment, which is development of real estate and

infrastructure facilities. Accordingly, these financial statements are reflective of the

information required by the Accounting Standard 17, for the property development

segment.

8. Capital commitment and contingencies

Estimated amount of contracts remaining to be executed on capital account and not

provided for (net of advances) Rs Nil.

TRIF Constructions Private Limited

Schedules to the financial statements

for the year ended 31 March 2010

(Currency: Indian Rupees)

9. Auditors’ remuneration (including service tax)

2010 2009

Audit fees 11,030 11,030

11,030 11,030

10. Supplementary profit and loss information

10.1 Quantitative information

The activities of the Company are not capable of being expressed in any generic unit and

hence, it is not possible to give the quantitative details required under paragraphs 3, 4C

and 4D of Part II of Schedule VI to the Act.

10.2 Other matters

Information with regard to other matters specified in Part II of Schedule VI to the Act is

either nil or not applicable to the Company for the year.

For SNB Associates For and on behalf of the

Board of Directors of

Chartered Accountants TRIF Constructions Private Limited

S Lakshmanan Lt. General (Retd.) Davinder

Kumar

Partner – M. No. 20045 Director

Sukaran Singh

Director

Place: Mumbai

Date:

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Wyckoff 2018 Financial StatementsDocument38 pagesWyckoff 2018 Financial StatementsJonathan LaMantiaNo ratings yet

- Chapter 2 Financial StatementsDocument664 pagesChapter 2 Financial StatementsfarhansignsNo ratings yet

- Comparative and Common Size AnalysisDocument4 pagesComparative and Common Size Analysisvishwastiwari100% (1)

- Eco 7 XL Final VersionDocument12 pagesEco 7 XL Final VersionAbhijan Carter BiswasNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- MB20104 FRS&a Unit I Theory MaterialsDocument23 pagesMB20104 FRS&a Unit I Theory MaterialsSarath kumar CNo ratings yet

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorNo ratings yet

- Honeywell USD Rev1Document1 pageHoneywell USD Rev1cmakuldeepNo ratings yet

- Asmacs Netgear SwitchesDocument1 pageAsmacs Netgear SwitchescmakuldeepNo ratings yet

- Audited - TRIF Constructions PVT LTD Financials As of 31 Mar 10Document9 pagesAudited - TRIF Constructions PVT LTD Financials As of 31 Mar 10cmakuldeepNo ratings yet

- LOR TRIF ConstructionsDocument4 pagesLOR TRIF ConstructionscmakuldeepNo ratings yet

- Constructions - 0910 Sub-JV Annex 1-16Document62 pagesConstructions - 0910 Sub-JV Annex 1-16cmakuldeepNo ratings yet

- Audited - TRIF Constructions PVT LTD Financials As of 31 Mar 10Document9 pagesAudited - TRIF Constructions PVT LTD Financials As of 31 Mar 10cmakuldeepNo ratings yet

- Audit Report Trif ConstDocument2 pagesAudit Report Trif ConstcmakuldeepNo ratings yet

- Tasl - TBDocument9 pagesTasl - TBcmakuldeepNo ratings yet

- Steps in The Manual Accounting Process (Accounting Cycle)Document50 pagesSteps in The Manual Accounting Process (Accounting Cycle)hyunsuk fhebieNo ratings yet

- Acct101 Financial Accounting: Instructions To CandidatesDocument26 pagesAcct101 Financial Accounting: Instructions To CandidatesYing Sheng ÖNo ratings yet

- Capital Budgeting Techniques: Prepared by Toran Lal VermaDocument32 pagesCapital Budgeting Techniques: Prepared by Toran Lal VermaRishabh SharmaNo ratings yet

- As A Recent Graduate You Have Been Hired by CanadianDocument2 pagesAs A Recent Graduate You Have Been Hired by CanadianAmit PandeyNo ratings yet

- Tugas 2 AklDocument3 pagesTugas 2 Akledit andraeNo ratings yet

- Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No DifferentialDocument121 pagesReporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No DifferentialZahra Zafirah AmaliaNo ratings yet

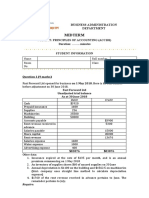

- Midterm: Hoa Lac Subject: Principles of Accounting (Acc101) Duration: .. Minutes Student InformationDocument2 pagesMidterm: Hoa Lac Subject: Principles of Accounting (Acc101) Duration: .. Minutes Student InformationNguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Ficha 2Document4 pagesFicha 2Elsa MachadoNo ratings yet

- Example of BookkepingDocument8 pagesExample of BookkepingMathew Visarra0% (1)

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburNo ratings yet

- Intermediate Accounting 1 NotesDocument18 pagesIntermediate Accounting 1 NotesLyka EstradaNo ratings yet

- Notes On Capital BudgetingDocument3 pagesNotes On Capital BudgetingCheshta Suri100% (1)

- Mergers and Acquisitions:: A Review of Valuation MethodsDocument5 pagesMergers and Acquisitions:: A Review of Valuation MethodsApooNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet

- Adjusting Entries Practice Question December 22, 2022Document5 pagesAdjusting Entries Practice Question December 22, 2022Mohammed AhamadNo ratings yet

- Revision Accounting PrinciplesDocument7 pagesRevision Accounting PrinciplesAnim Sani100% (2)

- Easy Northern Forest Products 90 Copy of 0 324 53131 1 Case 90DIRDocument5 pagesEasy Northern Forest Products 90 Copy of 0 324 53131 1 Case 90DIRPhạm Hà DươngNo ratings yet

- Question 2-Practice Question: Canseco CompanyDocument2 pagesQuestion 2-Practice Question: Canseco CompanyLordy AdanzaNo ratings yet

- Undergraduate Program: 0 OntentsDocument37 pagesUndergraduate Program: 0 OntentsLawrenceF777No ratings yet

- Seatwork 01 Audit of Intangible Assets - ReviewDocument4 pagesSeatwork 01 Audit of Intangible Assets - ReviewDan Andrei BongoNo ratings yet

- Pre-Session HandoutDocument6 pagesPre-Session HandoutNavdeep SinghNo ratings yet

- Statement of Changes in EquityDocument8 pagesStatement of Changes in EquityGonzalo Jr. RualesNo ratings yet

- Financial Statement Analysis & Valuation: Nusrat Jahan BenozirDocument10 pagesFinancial Statement Analysis & Valuation: Nusrat Jahan BenozirTamzid Ahmed LikhonNo ratings yet