Professional Documents

Culture Documents

Statement of Change in Working Capital & Inflows/Outflows of Working Capital

Uploaded by

Chandani DesaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Change in Working Capital & Inflows/Outflows of Working Capital

Uploaded by

Chandani DesaiCopyright:

Available Formats

HOSP 2110 (Management Acct) Learning Centre

Statement of Change in Working Capital &

Inflows/Outflows of Working Capital

The statement of changes in working capital shows the net change in working

capital over a time period of operation. Preparing the statement of changes in

working capital is one of the easiest financial statements to do. Recall that

working capital is the difference between current assets and current liabilities.

Working Capital = Current Assets Current Liabilities

The first step is copying down the current assets and current liabilities from the

balance sheet for both years. Then subtract total current liabilities from total

current assets to get working capital for each year. Finally, determine the change

in working capital between the two years (taking the more recent years working

capital and subtracting the older years working capital). Below is a sample

statement of changes in working capital:

2009 2010

CurrentAssets

Cash $30,000 $35,000

Accountsreceivable $6,000 $4,000

Totalcurrentassets $36,000 $39,000

CurrentLiabilities

Accountspayable $9,500 $11,000

Accruedexpensespayable $7,300 $8,200

Totalcurrentliabilities $16,800 $19,200

WorkingCapital $19,200 $19,800

NetChangeinWorkingCapital $600

Total $19,800 $19,800

The working capital for 2009 was $19,200 and for 2010 was $19,800. Working

capital increased by $600 from 2009 to 2010. If working capital increases, the net

change in working capital is entered in the column of the less recent year.

Working capital for 2009 is added to the net change in working capital to give the

same number (in the total row) as the working capital in 2010. If working capital

decreases, the change in working capital is entered in the column of the more

recent year.

The other statement involving working capital is the statement of inflows (called

sources) and outflows (called uses) of working capital. This is very similar to the

statement of cash flows in that you are identifying the inflows and outflows that

explain the net change in working capital. The statement of inflows and outflows

of working capital is also much easier to prepare than the statement of cash

flows.

2013 Vancouver Community College Learning Centre. Authored

by Emilyby Emily Simpson

Simpson

Student review only. May not be reproduced for classes.

1. Cross off all the current assets and current liabilities and retained earnings

from the balance sheet. (Just to remind yourself that these accounts are

not involved in the statement of inflows and outflows of working capital).

2. Identify any changes in the remaining balance sheet accounts (fixed

assets, long-term liabilities, owners equity, net income, dividends). Label

the increases or decreases as inflows or outflows using the same rules as

for the statement of cash flows. (Dont look at changes in the total rows!)

3. Identify any inflow or outflow in the form of net income and dividends paid.

4. Construct the statement using two sections: Source Inflows and Use

Outflows. For every item identified as an inflow, list it under Source Inflows

with an adequate description and the value of change. Do the same for

the Use Outflows section. Note that outflows are not listed as negative

numbers. Subtracting net outflow from net inflow gives the net change in

working capital. This should match the value from the statement of

changes in working capital. A sample statement is shown below:

SourceInflows

Netincome $14,100

Saleoffurnishings 3,500

Saleoflongterminvestment 5,500

Depreciation 2,500

NetInflow $25,600

UseOutflows

Dividendspaid $4,000

Redemptionofcommonstock 15,000

Purchaseofequipment 6,000

Netoutflow $25,000

Netchangeinworkingcapital $600

Practice Problems

1. A Nanaimo resort has the following comparative balance sheet for 2008

and 2009. Net income for 2009 was $141,100 and dividends of $154,200

were paid out. Prepare a statement of changes in working capital and a

statement of source inflows and use outflows of working capital for 2009.

Assets 31Dec08 31Dec09

CurrentAssets

Cash $25,200 $29,600

Accountsreceivable 12,550 12,900

Creditcardreceivables 9,700 8,000

Inventories 2,850 1,100

Marketablesecurities 2,000 3,000

Prepaidexpenses 6,100 4,200

TotalCurrentAssets $58,400 $58,800

2013 Vancouver Community College Learning Centre.

Student review only. May not be reproduced for classes. 2

Property,plant,andequipment

Land $194,000 $194,000

Building 9,800,000 9,800,000

Furniture 184,000 134,000

Equipment 736,400 803,400

AccumulatedDepreciation (2,400,000) (2,544,200)

NetProperty,plantandequipment $8,514,400 $8,387,200

OtherAssets $509,000 $609,000

TotalAssets $9,081,800 $9,055,000

LiabilitiesandStockholdersEquity

CurrentLiabilities

Accountspayable $13,700 $15,700

Wagespayable 4,200 5,000

NotesPayable 4,900 3,700

Currentmortgagepayable 15,300 15,900

TotalCurrentLiabilities $38,100 $40,300

LongtermLiabilities

Mortgagepayable $7,710,200 $7,704,300

TotalLiabilities $7,748,300 $7,744,600

StockholdersEquity

Commonstock $960,000 $950,000

Retainedearnings 373,500 360,400

TotalStockholdersEquity $1,333,500 $1,310,400

TotalLiabilitiesandSE $9,081,800 $9,055,000

2. Prepare a statement of changes in working capital and a statement of

inflows and outflows in working capital based on the following information.

Net income for 2010 was $8,000 and dividends of $7,000 were paid.

Assets 2009 2010

CurrentAssets

Cash $15,800 $16,600

Creditcardreceivables $813 $747

Accountsreceivable 7,387 6,853

Inventories 4,925 6,275

Marketablesecurities 2,975 3,425

TotalCurrentAssets $31,900 $33,900

Property,plant,andequipment

Furniture/Equipment $15,700 $19,700

Accumulateddepreciation (4,600) (5,600)

NetProperty,plantandequipment $11,100 $14,100

TotalAssets $43,000 $48,000

LiabilitiesandStockholdersEquity

CurrentLiabilities

Accountspayable $3,800 $6,100

Accruedexpensespayable 800 700

Taxespayable 2,400 1,200

TotalCurrentLiabilities $7,000 $8,000

2013 Vancouver Community College Learning Centre.

Student review only. May not be reproduced for classes. 3

LongtermLiabilities

Mortgagepayable $24,800 $26,800

TotalLiabilities $31,800 $34,800

StockholdersEquity

Commonstock $5,200 $6,200

Retainedearnings 6,000 7,000

TotalStockholdersEquity $11,200 $13,200

TotalLiabilitiesandSE $43,000 $48,000

Solutions

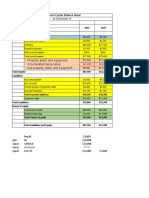

1.StatementofChangesinWorkingCapitalfortheyear2009

CurrentAssets 2008 2009

Cash $25,200 $29,600

Accountsreceivable 12,550 12,900

Creditcardreceivables 9,700 8,000

Inventories 2,850 1,100

Marketablesecurities 2,000 3,000

Prepaidexpenses 6,100 4,200

TotalCurrentAssets $58,400 $58,800

CurrentLiabilities

Accountspayable $13,700 $15,700

Wagespayable 4,200 5,000

NotesPayable 4,900 3,700

Currentmortgagepayable 15,300 15,900

TotalCurrentLiabilities $38,100 $40,300

WorkingCapital $20,300 $18,500

NetChangeinWorkingCapital(decrease) 1,800

Total $20,300 $20,300

StatementofInflowsandOutflowsinWorkingCapitalfor2009

SourceInflows

NetIncome $141,100

Saleoffurniture 50,000

Depreciation 144,200

NetInflow $335,300

UseOutflows

Purchaseofequipment $67,000

Purchaseofotherassets 100,000

Paymentofmortgagepayable 5,900

Redemptionofcommonstock 10,000

Dividendspaid 154,200

NetOutflow $337,100

NetChangeinWorkingCapital ($1,800)

2013 Vancouver Community College Learning Centre.

Student review only. May not be reproduced for classes. 4

2.

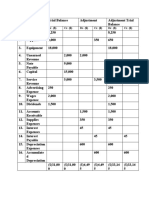

StatementofChangeinWorkingCapitalfortheyear2010

CurrentAssets 2009 2010

Cash $15,800 $16,600

Creditcardreceivables $813 $747

Accountsreceivable 7,387 6,853

Inventories 4,925 6,275

Marketablesecurities 2,975 3,425

TotalCurrentAssets $31,900 $33,900

CurrentLiabilities

Accountpayables $3,800 $6,100

Accruedexpensespayable 800 700

Taxespayable 2,400 1,200

TotalCurrentLiabilities $7,000 $8,000

WorkingCapital $24,900 $25,900

NetChangeinWorkingCapital

(increase) $1,000

Total $25,900 $25,900

StatementofSourceInflowsandUseOutflowsin

WorkingCapitalfor2010

SourceInflows

Netincome $8,000

Depreciation 1,000

Issueofcommonstock 1,000

Borrowingonlongtermmortgagepayable 2,000

NetInflows $12,000

UseOutflows

Purchaseoffurniture/equipment $4,000

Dividendspaid 7,000

NetOutflows $11,000

NetChangeinWorkingCapitalfor2010 $1,000

2013 Vancouver Community College Learning Centre.

Student review only. May not be reproduced for classes. 5

You might also like

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Hartman Corp 2014 SOCFDocument3 pagesHartman Corp 2014 SOCFIden PratamaNo ratings yet

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Cash Flow ExampleDocument10 pagesCash Flow ExampleewaidaebaaNo ratings yet

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Document2 pagesComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- TUGAS MANAJEMEN KEUANGAN 1: Analisis Arus Kas dan Neraca Neff IndustriesDocument2 pagesTUGAS MANAJEMEN KEUANGAN 1: Analisis Arus Kas dan Neraca Neff IndustriesNan BaeeeNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Kesmore CorporationDocument1 pageKesmore CorporationAyeshaNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- Light Anti-Theft Wallet Lock Financial Plan DraftDocument8 pagesLight Anti-Theft Wallet Lock Financial Plan DraftKyle TimonNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Chapter 3 Financial Statements, Free Cash FlowDocument2 pagesChapter 3 Financial Statements, Free Cash FlowPik Amornrat SNo ratings yet

- Generate Statement of Cash FlowsDocument2 pagesGenerate Statement of Cash FlowsAlyssa AlejandroNo ratings yet

- Ch23 StatementofCashFlowExamples Zeke and ZoeDocument4 pagesCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNo ratings yet

- Small business cash flow analysisDocument2 pagesSmall business cash flow analysisAgANo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionDocument44 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionSumit Kumar Dam33% (3)

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Financial Ratios QuestionsDocument5 pagesFinancial Ratios QuestionsUmmi KalthumNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Professor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsDocument3 pagesProfessor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsPrecious Uminga100% (1)

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- University of Business& Technology: Worksheet # 4Document3 pagesUniversity of Business& Technology: Worksheet # 4nikowawaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (1)

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Solve Cash Flow ProblemsDocument3 pagesSolve Cash Flow ProblemsMichelle ManuelNo ratings yet

- Financial Statement AdjustmentsDocument5 pagesFinancial Statement AdjustmentsHasan NajiNo ratings yet

- Finding Operating and Free Cash FlowsDocument5 pagesFinding Operating and Free Cash FlowsM.TalhaNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (27)

- Calculating Financial Metrics for Lan & Chen TechnologiesDocument12 pagesCalculating Financial Metrics for Lan & Chen TechnologiesQudsiya KalhoroNo ratings yet

- Accts Imp QnsDocument4 pagesAccts Imp QnsnishabilochiNo ratings yet

- Sadecki Corp ratios reveal improved profitabilityDocument9 pagesSadecki Corp ratios reveal improved profitabilitymohitgaba19No ratings yet

- How To Read Financial Statement PDFDocument31 pagesHow To Read Financial Statement PDFMazen AlbsharaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Accounting journal entries and trial balancesDocument15 pagesAccounting journal entries and trial balancesSamuel PurbaNo ratings yet

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- Assignement 01Document6 pagesAssignement 01Abdul SamiNo ratings yet

- Practice+Quiz+ +quiz+#1 Solutions+to+PsDocument6 pagesPractice+Quiz+ +quiz+#1 Solutions+to+PsmareagodinezNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Current AssetsDocument7 pagesCurrent AssetssyraNo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- MT2 Ch02Document24 pagesMT2 Ch02api-3725162No ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Consolidated Cash Flow StatementDocument4 pagesConsolidated Cash Flow Statementlaale dijaanNo ratings yet

- Tugas05 AKM1M 21013010130 Shavira Aisyah MaharaniDocument7 pagesTugas05 AKM1M 21013010130 Shavira Aisyah MaharanicaNo ratings yet

- Smart Pushcart FINANCIAL PLAN DraftDocument8 pagesSmart Pushcart FINANCIAL PLAN DraftKyle TimonNo ratings yet

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementPhan Hải YếnNo ratings yet

- Unique Aspects of Accounting - Non-Profit and Healthcare OrganizationsDocument28 pagesUnique Aspects of Accounting - Non-Profit and Healthcare Organizationss430230No ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- R 12 EngDocument60 pagesR 12 EngChandani DesaiNo ratings yet

- Ohio Driver's Handbook SummaryDocument87 pagesOhio Driver's Handbook SummaryKevin LiuNo ratings yet

- DL ManualDocument132 pagesDL ManualRumman Ul AhsanNo ratings yet

- Nyse CL 2016Document132 pagesNyse CL 2016Chandani DesaiNo ratings yet

- DVD ListDocument1 pageDVD ListChandani DesaiNo ratings yet

- MV 44Document3 pagesMV 44Chandani DesaiNo ratings yet

- II963Document2 pagesII963Chandani DesaiNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12Chandani DesaiNo ratings yet

- Reimers Finacct03 sm09 PDFDocument48 pagesReimers Finacct03 sm09 PDFChandani DesaiNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Capital Gains Tax Rates May Change in Biggest Tax Bill in DecadesDocument5 pagesCapital Gains Tax Rates May Change in Biggest Tax Bill in DecadesChandani DesaiNo ratings yet

- 7I Important Questions With Solution of FM Covering 50 Marks 8C70248A PDFDocument88 pages7I Important Questions With Solution of FM Covering 50 Marks 8C70248A PDFMoud KhalfaniNo ratings yet

- Canon D420 - Windows 8 Notice - ENGDocument1 pageCanon D420 - Windows 8 Notice - ENGSaulNo ratings yet

- PCA Notice en Us RDocument1 pagePCA Notice en Us RDavidch7No ratings yet

- 7I Important Questions With Solution of FM Covering 50 Marks 8C70248A PDFDocument88 pages7I Important Questions With Solution of FM Covering 50 Marks 8C70248A PDFMoud KhalfaniNo ratings yet

- CH 23Document7 pagesCH 23Salma AttiqueNo ratings yet

- CH 23Document7 pagesCH 23Salma AttiqueNo ratings yet

- DVDDocument5 pagesDVDChandani DesaiNo ratings yet

- Final Paper20 Revised Business ValuationDocument698 pagesFinal Paper20 Revised Business ValuationSukumar100% (5)

- Pgcworking Capital Assessment PDFDocument39 pagesPgcworking Capital Assessment PDFChandani DesaiNo ratings yet

- CIE ANNUAL REPORT HIGHLIGHTSDocument8 pagesCIE ANNUAL REPORT HIGHLIGHTSSana ZargarNo ratings yet

- VNXX Fico BBPDocument36 pagesVNXX Fico BBPvinay bangrawaNo ratings yet

- Financial Accounting Basics and Key ConceptsDocument30 pagesFinancial Accounting Basics and Key ConceptsKrishnendu MukherjeeNo ratings yet

- ICARE - AFAR - PreWeek - Batch 4Document14 pagesICARE - AFAR - PreWeek - Batch 4john paulNo ratings yet

- Ratio Analysis of Orion Pharmaceuticals LimitedDocument64 pagesRatio Analysis of Orion Pharmaceuticals Limitedrifat67% (3)

- Summary, Conclusions and RecommendationsDocument6 pagesSummary, Conclusions and RecommendationsJustine BartolomeNo ratings yet

- Guidance on Auditing Fixed AssetsDocument8 pagesGuidance on Auditing Fixed Assetsmandarab76No ratings yet

- Basic AccountingDocument1 pageBasic AccountingMikaela Shayne AguirreNo ratings yet

- Amazon Spain Approves 2019 AccountsDocument78 pagesAmazon Spain Approves 2019 AccountsLaura Gomez SánchezNo ratings yet

- Si - 1Document1 pageSi - 1Kuro YukiNo ratings yet

- Financial Statement Analysis OverviewDocument15 pagesFinancial Statement Analysis OverviewTheresa EditNo ratings yet

- ARDENTDocument19 pagesARDENTSajeel LatheefNo ratings yet

- Table of Content Title Page NoDocument26 pagesTable of Content Title Page Nopradeep110No ratings yet

- Basic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamDocument10 pagesBasic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamBai Dianne BagundangNo ratings yet

- Management Accounting Tools in Fast Food OperationsDocument14 pagesManagement Accounting Tools in Fast Food OperationsNgọc HunterNo ratings yet

- ISA - UK and Ireland - 2101Document16 pagesISA - UK and Ireland - 2101Gunawan Hutomo M PNo ratings yet

- Horizontal&Vertical Analysis Sample ProblemDocument3 pagesHorizontal&Vertical Analysis Sample ProblemGenner RazNo ratings yet

- MARGARINE INDUSTRIES 2011 Annual ReportDocument60 pagesMARGARINE INDUSTRIES 2011 Annual Reportrachna357100% (1)

- PPM3023 Financial Services Semester 1 SESSION 2022/2023 Individual Assignment 1 E-BookDocument10 pagesPPM3023 Financial Services Semester 1 SESSION 2022/2023 Individual Assignment 1 E-BookAqmar HarithNo ratings yet

- Notes On Group Financial Statements 18th Ed FullDocument533 pagesNotes On Group Financial Statements 18th Ed FullVeron Govender100% (1)

- Full DisclosureDocument22 pagesFull DisclosurepanjiNo ratings yet

- Love Enterprises Year-End Trial BalanceDocument8 pagesLove Enterprises Year-End Trial BalanceSheen CaválidaNo ratings yet

- Chapter 11Document33 pagesChapter 11pranav sarawagiNo ratings yet

- 2010 Paper by Paper Guide (1) CimaDocument24 pages2010 Paper by Paper Guide (1) CimaUpeksha SrilalNo ratings yet

- Internal Auditor Characteristics, Senior Management Support, and EffectivenessDocument19 pagesInternal Auditor Characteristics, Senior Management Support, and EffectivenessThiwanka GunasekaraNo ratings yet

- Sagar Cement - Financial STMT AnalysisDocument79 pagesSagar Cement - Financial STMT AnalysisRamesh AnkathiNo ratings yet

- NYIF Accounting Module Quiz 4 With AnswersssDocument3 pagesNYIF Accounting Module Quiz 4 With AnswersssShahd Okasha0% (1)

- Assurance Services and The Integrity of Financial Reporting, 8 EditionDocument19 pagesAssurance Services and The Integrity of Financial Reporting, 8 EditionFriista Aulia LabibaNo ratings yet

- CA Mohit Khandelwal resume - Finance professional with experience in auditing, taxation, and complianceDocument3 pagesCA Mohit Khandelwal resume - Finance professional with experience in auditing, taxation, and complianceThe Cultural CommitteeNo ratings yet

- BBP FI 03 Asset Accounting v.0Document20 pagesBBP FI 03 Asset Accounting v.0shailendra kumar100% (2)