Professional Documents

Culture Documents

0802PM

Uploaded by

ZerohedgeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0802PM

Uploaded by

ZerohedgeCopyright:

Available Formats

CAMERON HANOVER

[DAILY PETROSPECTIVE] August 2, 2010

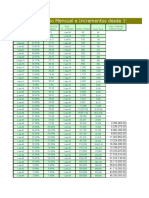

Energy Prices Settlements

Heating Oil Crude Oil

Month High Low Settle Change Volume Month High Low Settle Change Volume

SEP 217.00 208.74 215.38 6.57 46813 SEP 81.77 78.83 81.34 2.39 280913

OCT 219.69 211.59 218.19 6.66 12761 OCT 82.15 79.28 81.76 2.37 77170

NOV 222.26 214.90 220.98 6.73 7686 NOV 82.67 79.87 82.30 2.35 35421

DEC 224.90 217.35 223.56 6.69 10555 DEC 83.22 80.44 82.82 0.46 63788

JAN 227.42 222.40 226.15 6.69 2487 JAN 83.56 81.19 83.30 2.24 8238

FEB 229.23 224.80 228.08 6.69 599 FEB 83.91 81.75 83.74 2.19 3308

MAR 230.06 227.50 228.98 6.67 547 MAR 84.49 82.55 84.15 2.15 2564

APR 229.87 227.50 228.62 6.49 155 APR 84.58 83.84 84.54 2.11 1531

MAY --- --- 228.45 6.32 0 MAY 85.12 84.20 84.91 2.08 1393

JUN 229.56 225.00 228.58 6.15 1036 JUN 85.61 83.42 85.26 2.04 8826

JUL --- --- 229.83 5.98 0 JUL 85.59 85.25 85.59 2.00 2297

AUG --- --- 231.20 5.85 0 AUG 86.00 85.71 85.80 1.99 1231

Unleaded Gasoline Natural Gas

Month High Low Settle Change Volume Month High Low Settle Change Volume

SEP 219.24 211.91 216.85 4.61 38291 SEP 5.01 4.68 4.70 -0.222 111895

NOV 207.82 201.67 206.16 5.09 6578 OCT 5.01 4.70 4.72 -0.210 48860

DEC 208.15 202.03 206.63 5.31 7923 NOV 5.15 4.89 4.91 -0.164 25700

JAN 209.68 206.77 208.51 5.39 964 DEC 5.34 5.13 5.15 -0.114 19010

FEB 211.34 210.55 210.67 5.46 279 JAN 5.47 5.27 5.28 -0.108 17516

MAR 214.00 212.04 212.97 5.42 193 FEB 5.43 5.24 5.25 -0.103 4875

APR 226.50 224.39 225.22 5.32 159 MAR 5.33 5.14 5.15 -0.101 6320

MAY --- --- 226.10 5.25 0 APR 5.12 4.96 4.97 -0.088 4969

JUN 226.10 224.45 226.70 5.20 189 MAY 5.07 4.98 4.99 -0.084 1265

JUL --- --- 226.90 5.20 0 JUN 5.17 5.01 5.02 -0.079 694

AUG --- --- 226.65 5.20 0 JUL 5.13 5.07 5.07 -0.074 757

AUG 5.17 5.11 5.12 -0.069 826

Early Evening Market Review for Monday

Oil prices broke out decisively to the upside on Monday, breaking above

resistance at $79.69, $80.00, $80.40 and $80.82. It is what the bulls needed to

do to generate a convincing signal that this market intends to move higher. By

settling at $81.34, above all of those resistance levels, the bulls wwere able to

negate last Tuesday’s technical failure and they broke decisively over all the

resistance generated since the end of May.

Technically, prices now have a sound reson to advance on the major highs,

the highs for 2010, at $87.19. It was from that high that we had a technical

failure in early May, which effectively set us upon a course of steep decline and

then consolidation. Prices have now broken out of their trading range.

Page | 1 Research: 203.801.0771

Sales: 203.504.2786

www.cameronhanover.com Powered by FMX | Connect

CAMERON HANOVER

[DAILY PETROSPECTIVE] August 2, 2010

It could not have come at a less likely time, in a number of ways. Last week’s inventory figures showed the

US sitting on generous supplies of crude oil and refined products, and economic statistics since early May have

been almost all either anemic or downright disappointing. For weeks, economic data have done little to allay

fears that we may be headed into a double-dip recession. Some figures have had ‘silver linings’ or

‘underpinnings of hope,’ but few have been unequivocally bullish.

Monday’s manufacturing sector data seems to have turned everything around, and is being credited with

renewing “investors’ faith in the global recovery,” according to Dow Jones. Equities certainly seem to have

been convinced, and the DJIA gained 208.44 to 10,674.38 in Monday’s trading. A number of other

economically-sensitive commodities also benefited from this set of figures.

July manufacting indices in the US, UK and in the euro-zone all came in stronger than had been anticipated.

And these figures seem to have caught a number of people leaning the wrong way, especially in oil after we

had what looked like a technical failure a week ago. It now seems to have been just the latest in a long line of

‘fake-outs’ and traps in the oil complex. The US dollar sank to its lowest level since May 4th and copper and

other ‘industrial’ commodities had strong days.

The US ISM manufacting index actually dropped in July, to 55.5, from 56.2 in June. But, it was much less of

a decline than had been feared and was a sign that US manufacturing was stronger than believed. Capital

Economics (CE) pointed out on Monday afternoon that “Even after July’s dip, it is still consistent with

annualized GDP growth of around 4%,” which is more than most analysts have been talking about lately. The

index also drew strength from its employment index, which led CE to comment that “labor market conditions

are better than most realize.” Oil, copper and equities were convinced. And equities may be the key to

rebuilding flagging confidence over the near term. Of course, we do need to be aware that new orders fell to

their lowest level since June, 2009, in the latest set of figures. Analysts had expected worse news, though.

And construction spending unexpectedly increased in June. There was a 0.1% increase in expenditures that

once again caught market participants leaning the wrong way, especially after a revised 1.0% decline in May.

Economists had been predicting a decline of 0.5%, so any gain had to be seen as being constructive.

The bottom line seems to have been that diminished expectations have not been realized, and that

represents a kind of good news.

In other oil-relasted news, a DOE Expectations

tropical depression has reportedly Category Dow Jones Bloomberg Reuters

formed in the middle of the Atlantic Crude Oil dn 0.200 dn 1.500 dn 1.000 mln bbls

Ocean, according to the National Distillate up 0.700 up 1.000 up 1.100

Hurricane Center. This will give us Gasoline dn 0.800 dn 1.000 dn 0.700

something to watch and may keep Utilization dn 0.7% dn 0.5% dn 0.6%

sellers at bay.

Crude Oil Daily Technical Chart

Crude oil prices had a decisive upside breakout on Monday.

Page | 2 Research: 203.801.0771

Sales: 203.504.2786

www.cameronhanover.com Powered by FMX | Connect

You might also like

- Energy Prices: Ameron HanoveDocument3 pagesEnergy Prices: Ameron HanoveDvNetNo ratings yet

- Energy Prices: Ameron HanoveDocument3 pagesEnergy Prices: Ameron HanoveDvNetNo ratings yet

- 0812PMDocument2 pages0812PMZerohedgeNo ratings yet

- 0119PMDocument3 pages0119PMadmin3341No ratings yet

- Energy Prices: Ameron HanoveDocument3 pagesEnergy Prices: Ameron HanoveDvNetNo ratings yet

- Energy Prices: Ameron HanoveDocument3 pagesEnergy Prices: Ameron HanoveDvNetNo ratings yet

- Ameron Hanove: Aily Nergy EdgerDocument12 pagesAmeron Hanove: Aily Nergy Edgeradmin3341No ratings yet

- 0809PMDocument2 pages0809PMZerohedgeNo ratings yet

- ACT HISTÓRICO SMM y CuantíasDocument9 pagesACT HISTÓRICO SMM y CuantíasJose BustamanteNo ratings yet

- Energy Prices: Ameron HanoveDocument3 pagesEnergy Prices: Ameron HanoveDvNetNo ratings yet

- Economic Highlights - Fuel and Sugar Prices Were Raised To Reduce - 16/7/2010Document3 pagesEconomic Highlights - Fuel and Sugar Prices Were Raised To Reduce - 16/7/2010Rhb InvestNo ratings yet

- TD Economics: Weekly Commodity Price ReportDocument6 pagesTD Economics: Weekly Commodity Price ReportInternational Business TimesNo ratings yet

- Managerial Economics - Trend Analysis of Petroleum ProductsDocument5 pagesManagerial Economics - Trend Analysis of Petroleum ProductsTaha SuhailNo ratings yet

- Energy Prices: Ameron HanoveDocument3 pagesEnergy Prices: Ameron HanoveDvNetNo ratings yet

- Weekly Commodities CommentaryDocument6 pagesWeekly Commodities CommentaryInternational Business TimesNo ratings yet

- TD Economics: Weekly Commodity Price ReportDocument6 pagesTD Economics: Weekly Commodity Price ReportInternational Business TimesNo ratings yet

- Livestock Economist Tim Petry's Guide to Lean Hog MarketingDocument38 pagesLivestock Economist Tim Petry's Guide to Lean Hog MarketingSaipolNo ratings yet

- Rel 0909 SFDocument1 pageRel 0909 SFqtipxNo ratings yet

- MNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFDocument8 pagesMNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFANIL PARIDANo ratings yet

- Oil Search (Osh) 1. BackgroundDocument7 pagesOil Search (Osh) 1. BackgroundMian NgNo ratings yet

- Ecl SummaryDocument1 pageEcl Summaryram kum,arNo ratings yet

- Financial Calculation of Ratios Of: By:-Awish Mirza Baig 9202155Document20 pagesFinancial Calculation of Ratios Of: By:-Awish Mirza Baig 9202155awishmirzaNo ratings yet

- January 2007 Charleston Market ReportDocument4 pagesJanuary 2007 Charleston Market ReportbrundbakenNo ratings yet

- Weekly Commodity Price ReportDocument6 pagesWeekly Commodity Price ReportInternational Business TimesNo ratings yet

- Weekly Commodity Price ReportDocument6 pagesWeekly Commodity Price ReportInternational Business TimesNo ratings yet

- Popsicle Unilever 7.6% Klondike Empire of Carolin 5.4% Eskimo Pie Eskimo Pie 5.3% Snickers Mars 4.8% Weight Watchers H.J. Heinz 4.3%Document18 pagesPopsicle Unilever 7.6% Klondike Empire of Carolin 5.4% Eskimo Pie Eskimo Pie 5.3% Snickers Mars 4.8% Weight Watchers H.J. Heinz 4.3%Irakli SaliaNo ratings yet

- ANZ Commodity Daily 599 050412Document5 pagesANZ Commodity Daily 599 050412ChrisBeckerNo ratings yet

- Convert 100 USD to PI (US Dollar to Plian) - BeInCryptoDocument1 pageConvert 100 USD to PI (US Dollar to Plian) - BeInCryptoalan.abdulla112No ratings yet

- 0816PMDocument2 pages0816PMZerohedgeNo ratings yet

- The Clearing Corporation of India Ltd Settlement ReportDocument5 pagesThe Clearing Corporation of India Ltd Settlement ReportRohit AggarwalNo ratings yet

- Weekly Commodity Price ReportDocument6 pagesWeekly Commodity Price ReportInternational Business Times100% (3)

- US Corporate Bond Issuance: All Data Are Subject To RevisionDocument5 pagesUS Corporate Bond Issuance: All Data Are Subject To RevisionÂn TrầnNo ratings yet

- Sample IAS 29 COS ComputationDocument29 pagesSample IAS 29 COS ComputationShingirai CynthiaNo ratings yet

- FMDQ Quotes - 2Document9 pagesFMDQ Quotes - 2James BestNo ratings yet

- ANZ Commodity Daily 610 260412Document5 pagesANZ Commodity Daily 610 260412David4564654No ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- Commodity Research Report 21 August 2018 Ways2CapitalDocument13 pagesCommodity Research Report 21 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- Date Nifty Future Price Long 8800 PE (Dec Expiry) Short 8600 PE (Nov Expiry) Points Earned Profit/LossDocument2 pagesDate Nifty Future Price Long 8800 PE (Dec Expiry) Short 8600 PE (Nov Expiry) Points Earned Profit/LossAnonymous rOv67RNo ratings yet

- Yearly analysis of gross purchases, gross sales, net investments by instrument type and currency for Indian marketsDocument6 pagesYearly analysis of gross purchases, gross sales, net investments by instrument type and currency for Indian marketsvenkyquietNo ratings yet

- HistoryDocument16 pagesHistoryPratap SahooNo ratings yet

- India's foreign exchange reserves from 1990-2004Document21 pagesIndia's foreign exchange reserves from 1990-2004profvishalNo ratings yet

- NghiacandoitDocument10 pagesNghiacandoitNghia Tuan NghiaNo ratings yet

- USDA Export Sales Report - Current and Recent HistoryDocument2 pagesUSDA Export Sales Report - Current and Recent HistoryPhương NguyễnNo ratings yet

- SK 121201Document29 pagesSK 121201BoomdayNo ratings yet

- RBS - Round Up 300610Document9 pagesRBS - Round Up 300610egolistocksNo ratings yet

- Iip June 2010Document9 pagesIip June 2010kdasNo ratings yet

- Gold Price Settled Up For The Week and Month As A Federal: Weekly Commodity UpdateDocument8 pagesGold Price Settled Up For The Week and Month As A Federal: Weekly Commodity UpdateAnil ParidaNo ratings yet

- Nissin Corporation (A) PerciDocument44 pagesNissin Corporation (A) PerciScribdTranslationsNo ratings yet

- Upgrade From National Bank To WCPDocument12 pagesUpgrade From National Bank To WCPForexliveNo ratings yet

- ANZ Commodity Daily 702 110912Document5 pagesANZ Commodity Daily 702 110912ftforfree9766No ratings yet

- Ekadharma International Tbk. (S)Document3 pagesEkadharma International Tbk. (S)RomziNo ratings yet

- NP EX19 10a JinruiDong 2Document9 pagesNP EX19 10a JinruiDong 2Ike DongNo ratings yet

- STEEL MATERIALS COST HistoryDocument16 pagesSTEEL MATERIALS COST HistoryToniNo ratings yet

- Daily Minimum Wage Rates by Region from 1989-2016Document11 pagesDaily Minimum Wage Rates by Region from 1989-2016casseyraizaNo ratings yet

- Gold Prices: Technical DataDocument8 pagesGold Prices: Technical DataJulio Alcázar GómezNo ratings yet

- Portfolio OptimizationDocument46 pagesPortfolio OptimizationJaco CrouseNo ratings yet

- Reliance Industries stock performance 2009-2010Document13 pagesReliance Industries stock performance 2009-2010Smriti TrivediNo ratings yet

- Japanese Yen Per USDDocument7 pagesJapanese Yen Per USDShoaibUlHassanNo ratings yet

- Exhibit 1 Polaroid Recent Financial Results ($ Millions)Document5 pagesExhibit 1 Polaroid Recent Financial Results ($ Millions)Arijit MajiNo ratings yet

- Earnings Presentation Q1 2024Document18 pagesEarnings Presentation Q1 2024ZerohedgeNo ratings yet

- 2404_fs_milex_2023Document12 pages2404_fs_milex_2023ZerohedgeNo ratings yet

- Fomc Minutes 20240131Document11 pagesFomc Minutes 20240131ZerohedgeNo ratings yet

- TSLA Q4 2023 UpdateDocument32 pagesTSLA Q4 2023 UpdateSimon AlvarezNo ratings yet

- NSF Staff ReportDocument79 pagesNSF Staff ReportZerohedge Janitor100% (1)

- Fomc Minutes 20231213Document10 pagesFomc Minutes 20231213ZerohedgeNo ratings yet

- BOJ Monetary Policy Statemetn - March 2024 Rate HikeDocument5 pagesBOJ Monetary Policy Statemetn - March 2024 Rate HikeZerohedge0% (1)

- JPM Q1 2024 PresentationDocument14 pagesJPM Q1 2024 PresentationZerohedgeNo ratings yet

- Fomc Minutes 20240320Document11 pagesFomc Minutes 20240320ZerohedgeNo ratings yet

- Warren Buffett's Annual Letter To ShareholdersDocument16 pagesWarren Buffett's Annual Letter To ShareholdersFOX Business100% (2)

- Rising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumDocument51 pagesRising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumZerohedge100% (1)

- TBAC Basis Trade PresentationDocument34 pagesTBAC Basis Trade PresentationZerohedgeNo ratings yet

- Hunter Biden Indictment 120723Document56 pagesHunter Biden Indictment 120723New York PostNo ratings yet

- BTCETFDocument22 pagesBTCETFZerohedge JanitorNo ratings yet

- AMD Q3'23 Earnings SlidesDocument33 pagesAMD Q3'23 Earnings SlidesZerohedgeNo ratings yet

- X V Media Matters ComplaintDocument15 pagesX V Media Matters ComplaintZerohedge Janitor100% (1)

- Earnings Presentation Q3 2023Document21 pagesEarnings Presentation Q3 2023ZerohedgeNo ratings yet

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- 3Q23 PresentationDocument12 pages3Q23 PresentationZerohedgeNo ratings yet

- Jerome Powell SpeechDocument6 pagesJerome Powell SpeechTim MooreNo ratings yet

- 2023-09-14 OpinionDocument42 pages2023-09-14 OpinionZerohedgeNo ratings yet

- Tesla Inc Earnings CallDocument20 pagesTesla Inc Earnings CallZerohedge100% (1)

- Yellow Corporation Files Voluntary Chapter 11 PetitionsDocument2 pagesYellow Corporation Files Voluntary Chapter 11 PetitionsZerohedgeNo ratings yet

- BofA The Presentation Materials - 3Q23Document43 pagesBofA The Presentation Materials - 3Q23Zerohedge100% (1)

- Powell 20230825 ADocument16 pagesPowell 20230825 AJuliana AméricoNo ratings yet

- TBAC Presentation Aug 2Document44 pagesTBAC Presentation Aug 2ZerohedgeNo ratings yet

- SCA Transit FeesDocument2 pagesSCA Transit FeesZerohedgeNo ratings yet

- Fomc Minutes 20230726Document10 pagesFomc Minutes 20230726ZerohedgeNo ratings yet

- Hunter Biden ReportDocument64 pagesHunter Biden ReportZerohedge50% (2)

- November 2021 Secretary Schedule RedactedDocument62 pagesNovember 2021 Secretary Schedule RedactedNew York PostNo ratings yet

- Steven - Perkins DRUNK TRADERDocument19 pagesSteven - Perkins DRUNK TRADERjigarchhatrolaNo ratings yet

- Taurian Curriculum Framework Grade 11 BSTDocument6 pagesTaurian Curriculum Framework Grade 11 BSTDeepak SharmaNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- Kirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemDocument33 pagesKirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemMurali MohanNo ratings yet

- KOMALDocument50 pagesKOMALanand kumarNo ratings yet

- TaxDocument18 pagesTaxPatrickBeronaNo ratings yet

- B7AF102 Financial Accounting May 2023Document11 pagesB7AF102 Financial Accounting May 2023gerlaniamelgacoNo ratings yet

- Investment Property Accounting StandardDocument18 pagesInvestment Property Accounting StandardvijaykumartaxNo ratings yet

- Annexure-I-Bharat Griha RakshaDocument64 pagesAnnexure-I-Bharat Griha RakshaAtul KumarNo ratings yet

- Zillow 2Q22 Shareholders' LetterDocument17 pagesZillow 2Q22 Shareholders' LetterGeekWireNo ratings yet

- Accounting: Paper 3Document12 pagesAccounting: Paper 3cheah_chinNo ratings yet

- ROT MeasurementDocument10 pagesROT Measurementsourabh kantNo ratings yet

- Toaz - Info Preparation of Financial Statements and Its Importance PRDocument7 pagesToaz - Info Preparation of Financial Statements and Its Importance PRCriscel SantiagoNo ratings yet

- Jawaban Soal InventoryDocument4 pagesJawaban Soal InventorywlseptiaraNo ratings yet

- MAS Annual Report 2010 - 2011Document119 pagesMAS Annual Report 2010 - 2011Ayako S. WatanabeNo ratings yet

- T3-Sample Answers-Consideration PDFDocument10 pagesT3-Sample Answers-Consideration PDF--bolabolaNo ratings yet

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet

- Mrunal Economy Handouts PCB8 2023-24Document901 pagesMrunal Economy Handouts PCB8 2023-24Adharsh Surendhiran100% (3)

- Business Plan 1. Executive SummaryDocument2 pagesBusiness Plan 1. Executive SummaryBeckieNo ratings yet

- 2122 s3 Bafs Notes STDocument3 pages2122 s3 Bafs Notes STKiu YipNo ratings yet

- Draft Dispossessory Appeal OptionsDocument12 pagesDraft Dispossessory Appeal Optionswekesamadzimoyo1No ratings yet

- Meaning of BankDocument4 pagesMeaning of Bankgh100% (1)

- Engineering CodeDocument217 pagesEngineering CodeSudeepSMenasinakaiNo ratings yet

- Hybrid Agreement Business Project Management ReportDocument45 pagesHybrid Agreement Business Project Management Reportandrei4i2005No ratings yet

- Gaur City Center Chambers & Wholesale Mart Price List W.E.F. 07.02.2019Document1 pageGaur City Center Chambers & Wholesale Mart Price List W.E.F. 07.02.2019Nitin AgnihotriNo ratings yet

- PFRS 16 Lease Accounting GuideDocument2 pagesPFRS 16 Lease Accounting GuideQueen ValleNo ratings yet

- ICSB Hand BookDocument39 pagesICSB Hand BookSubarna Saha100% (1)

- Megaworld Corporation Shelf Registration of Up to P30B Debt SecuritiesDocument117 pagesMegaworld Corporation Shelf Registration of Up to P30B Debt SecuritiesEunji eunNo ratings yet

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- Dianne FeinsteinDocument5 pagesDianne Feinsteinapi-311780148No ratings yet