Professional Documents

Culture Documents

Arbdc March 2012

Uploaded by

Héctor Ceballos OspinaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arbdc March 2012

Uploaded by

Héctor Ceballos OspinaCopyright:

Available Formats

INTRODUCTION

The global economic slowdown in 2011 was caused by the euro zones

fiscal and financial crisis, which deepened toward the end of the year.

In this adverse global context, the Colombian economy grew by 5.9%,

its third highest rate in the past thirty years, while inflation stood at

3.7%, within the target range of 2% - 4%. This process of economic

recovery and consolidation has been accompanied by a monetary

policy designed to keep inflation around a long term target of 3% and

use of resources around the economys potential capacity.

The global economy, after growing by 5.2% in 2010, seemingly

announcing the final end of the 2008 crisis, slowed to a growth rate

of 3.8% last year, according to IMF estimates. The slowdown in 2011

was caused by factors connected with the economic crisis in Europe,

which deepened steadily over the year and became critical in the fourth

quarter. Though Greece was long known to be in difficulty, its economic

situation worsened in 2011 due to the lack of a credible rescue plan,

which was successively postponed amid political tensions among the

major European governments over how to share the costs of the rescue.

This prolonged inaction in the face of a worsening crisis led to a loss of

confidence in the region, causing symptoms of contagion to appear in

other countries such as Ireland and Portugal. The contagion then spread

to the larger economies of Spain and Italy, and fears arose about the

viability of the euro, given the danger of these countries public debt

becoming generally unsustainable.

The US economy

showed mixed The US economy, for its part, showed mixed signals during 2011 and

signals during 2011 in the early part of this year. Although the countrys GDP slowed from

and in the early part 3% in 2010 to 1.7% in 2011, its performance has been improving

o this year. gradually. In the first half of 2011, interruption in the Japanese supply

11

OKCongreso-2012marzo-ingles.indd 11 16/01/14 11:11

In 2011, as in chain, debate over the US debt ceiling and high oil prices were reflected

previous years, in a slowdown of US economic activity, with annualized quarterly

global growth was growth barely reaching 0.4% in the first quarter and 1.3% in the second.

driven by emerging However, as some of these factors were gradually surmounted and the

economies, albeit at US economy managed to withstand the European crisis, confidence

a slower pace. began to rise, household spending became stronger, and manufacturing

started to expand. Thus, in the third quarter US GDP grew by 1.8%

(annualized quarterly rate) and in the fourth quarter by 3.0%. This may

be regarded as a favorable performance, considering that the structural

imbalances that led to the crisis have not yet been fully dealt with. As

evidence of improvement in the US economy, the unemployment rate

has began to decrease, claims for unemployment insurance have fallen,

and consumer confidence and consumption show positive signs.

In 2011, as in previous years, global growth was driven by emerging

economies, albeit at a slower pace. The IMF estimates that these

economies expanded by 6.2% in 2011, compared with 7.3% in 2010.

The slowdown was partly caused by weaker external demand, and by

In this highly

the lagged effect of restrictive monetary and fiscal policies adopted in

unequal global

2010 by several emerging Asian and Latin American countries after

context with

detecting some symptoms of overheating.

the prospect

of continued

In this highly unequal global context with the prospect of continued

uncertainty,

uncertainty, the Colombian economys performance has been

the Colombian

outstanding. GDP grew by 4% in 2010 and improved increasingly in

economys

2011, rising to a high of 7.5% in the third quarter, comparable to the

performance has

quarterly rates seen in 2006 and 2007, when world production was

been outstanding.

expanding apace and external demand was a major driver of economic

activity in Colombia. Although fourth-quarter growth slowed to 6.1%

in 2011, as a result of weaker external demand and the progressive

withdrawal of monetary stimulus, the growth rate for the year as a whole

stood at 5.9%, one of the highest rates in decades. This result clearly

shows that Colombia has managed to withstand the negative shock of

the European crisis, in conditions in which the US, the countrys main

trading partner, has been growing at moderate rates.

With the external context deteriorating and uncertain, Colombias

favorable economic growth in 2011 was driven by the strengthening

Colombias favorable of domestic demand, which expanded by 8.8%, comparable with peak

economic growth in growth in 2006. As detailed in this Report, fixed capital investment was

2011 was driven by the strongest spending item of domestic demand, growing by 16.6%,

the strengthening of the second highest rate since 2000. Investment in machinery and

domestic demand. equipment and transport equipment stands out in this item, which was

12

OKCongreso-2012marzo-ingles.indd 12 16/01/14 11:11

Fixed capital driven by high international commodity prices and by low commercial

investment was the interest rates over much of the year. Investment in buildings (including

strongest spending housing) also grew well, by 5.3%, after shrinking for two years in a

item of domestic row. Investment in civil works continued to expand briskly, by 6.7%, a

demand. higher rate than the average for the two previous years.

Similar to investment, in 2011 growth in household spending was as

strong as in the peak periods and, at registered an expansion of 6.5%,

which is almost two percentage points higher than in 2010. The items

that contributed the most to this performance were durable and semi-

durable goods, with average growth rates close to 20%. Consumption

of these goods benefited from abundant credit at relatively low interest

rates and also from rising consumer confidence.

The economic activities that contributed most to growth in 2011 were

mining, transport and communications, and trade. Mining continued

In 2011 growth in to show double-digit expansion as in the previous four years, driven

household spending, by increasing oil production thanks to high crude prices, favorable

as in investment, was conditions for investment, and relatively successful exploration. The

as strong as in the extraction of coal and other minerals also increased at a good pace as a

peak periods. result of high international prices and large inflows of foreign investment.

Good performance by the sectors of transport and communications and

trade was consistent with the behavior of household spending.

The economys growth in 2010 and its further strengthening in 2011 have

begun to produce positive effects on the labor market. Job creation has

been expanding at record rates, significantly reducing unemployment,

down to levels not seen in decades. Lower unemployment nationwide

is particularly significant, considering that it has occurred in a context

of rising labor supply, as measured by the global participation rate. This

means that people desirous of entering the labor market have managed

to find job opportunities. Job creation has been strongest in the sectors

of trade, industry, construction and services. This behavior of the labor

market confirms the economys robust growth, driven in particular by

domestic demand. Despite the foregoing, the informal sector accounts

The economys for a high share of the job market, and Colombias unemployment rate

growth in 2010 continues to be one of the highest in Latin America.

and its further

strengthening in The process of economic recovery and consolidation has been

2011 have begun accompanied by a monetary policy designed to play its part by keeping

to produce positive inflation around the target and the use of resources near the economys

effects on the labor potential capacity. This should help to make growth sustainable, so as

market. to avoid the traditional excesses that experience has repeatedly shown

13

OKCongreso-2012marzo-ingles.indd 13 16/01/14 11:11

Monetary policy to be costly to well-being. To this end, starting from February 2011

has accompanied the monetary stimulus began to be gradually withdrawn, by means of

the process of nine increments of 25 basis points in the policy interest rate. Thus, the

economic recovery one-day expansion repo rate was raised from 3%, appropriate for an

and consolidation, economy on the brink of recession, to 5.25%, more consistent with

playing the part strong domestic demand and a positive output gap.

expected of it.

Every decision by Banco de la Repblicas Board of Directors has been

taken after rigorous analysis of the economic situation and outlook, and

after careful assessment of risks. In particular, as the threat of a European

crisis began to intensify last September, it was decided to make a long

pause in the adjustment process, in the expectation of greater information

that would provide a clearer idea of the fate of the region and its capacity

to cause contagion to Colombias economy. Adjustments were resumed

in November, when it was concluded that the Colombian economy was

showing great strength despite adverse external conditions.

The incremental increases to Colombias policy rate have been

transmitted to borrowing and lending rates in the economy, in both

nominal and real terms. This has helped to begin a moderation of the

sharply rising trend in borrowing observed all through 2011, particularly

corporate borrowing. Yet, credit continues to grow apace. In February

this year the financial systems overall loan portfolio increased at an

average real annual rate of almost 16% and consumer credit at 21%. This

behavior was displayed last year by several Latin American countries,

where, as in Colombia, debt as a share of GDP has increased.

The rapid expansion of credit in Colombia has led the Banks Board of

Directors to take great care in periodically monitoring credit quality and

risks to the financial system. As described in this Report, no increase has

been seen in default indicators or debt-quality deterioration that could

compromise the financial systems stability. However, risky consumer

loans and microcredit have been growing faster, and it is therefore

important to continue monitoring them.

Every decision by

the Banks Board of In a context of high economic growth, rising domestic demand and

Directors has been overall expansion in credit as described above, inflation rose in 2011,

taken after rigorous ending the year at 3.37%, compared with 3.17% in 2010. Although this

analysis of the result can hardly be classed as inflation overflowfor it stands within

economic situation the 2%-4% target range, it does cause the Board concern because

and outlook, inflation in 2011 continued to move away from the long-term target

and after careful set at 3%. The monetary authority cannot feel too pleased with this

assessment of risks situation, in a setting in which inflation expectations for a year or more

14

OKCongreso-2012marzo-ingles.indd 14 16/01/14 11:11

The evolution of ahead run close to 4%, and demand is rising at levels liable to use up

annual consumer spare capacity. The Board has therefore been taking decisions that it

inflation over the first considers to be timely and appropriate, as stated above.

two months of 2012

has been promising. The evolution of annual consumer inflation over the first two months of

2012 has been promising. In February annual CPI change stood at 3.5%,

almost 20bp down from what it was at the end of 2011, interrupting its

trend of moving away from the 3% target. Over the same period the

average of core inflation indicators also fell slightly, from 3.15% to

3.05%. This improved behavior was achieved despite the continued rise

in fuel prices caused by higher world oil quotes. Two items contributed

to this improvement. First, food inflation began to ease as rainfall

became normal once more and led to recovery in food supply. Second,

inflation in tradable goods has also slowed, in part because of the lower

exchange rate. The easing of core inflation over the first two months of

this year may indicate that the adjustment made to monetary policy is

beginning to operate appropriately. According to the technical staffs

The easing of core forecasts, this favorable trend in consumer inflation may continue over

inflation over the the coming months.

first two months

of this year may During 2011 changing economic conditions in Colombia and abroad caused

indicate that the the nominal exchange rate to behave differently over certain periods of the

adjustment made to year, in a context of intervention by Banco de la Repblica in the foreign

monetary policy is exchange market with daily auctions of twenty million dollars ($20m) in

beginning to operate the first nine months. From January to the end of June 2011 the Colombian

appropriately. peso tended to appreciate, amid lower risk premiums and expectations of

a higher public debt rating, which was finally granted in May and June.

Later, from August to December 2011 the peso displayed a depreciation

trend, associated with market nervousness over the sharpening crisis in

Greece and other European countries and the IMFs announcement of

fewer prospects of world economic growth. These opposite behaviors of

the pesos exchange rate against the dollar tended to offset each other, so

that the nominal exchange rate at the end of 2011 showed only a 1.5%

depreciation relative to a year earlier. The real exchange rate, for its part,

is influenced by inflation differentials between countries and provides a

better diagnosis of Colombias competitiveness by showing that the peso

depreciated in 2011 against the currencies of the countrys main trading

partners. This Report analyses these indicators in detail and also the

The intervention variables that determine them.

program was

resumed on February An appreciation trend occurred again in the first two months of 2012

6 with daily US$20m in both nominal and real terms. It resulted from less uncertainty about

competitive auctions. the fate of the European economy, improved data on the US economys

15

OKCongreso-2012marzo-ingles.indd 15 16/01/14 11:11

The economic performance, and renewed confidence in the Colombian economy,

outlook for 2012 is backed by its good performance in 2011 and favorable outlook for this

positive, with growth year. In this context, the intervention program that had been interrupted

estimated as likely to on September 30, 2011, was resumed on February 6. The Board of

range between 4% Directors has announced that such interventions shall continue to be

and 6%. made at least until August in daily amounts of not less than US$20m.

As described in this Report, the economic outlook for 2012 is positive,

with growth estimated as likely to range between 4% and 6%,

depending on how the European situation develops and how it affects

the global economy and Colombias economy. Although global demand

is expected to weaken, the emerging economies growth will help to

keep commodity prices high, boosting foreign investment flows into

Colombia and the countrys revenues through favorable terms of trade.

Private demand is also expected to stay strong as a result of consumer

and investor confidence remaining at record levels. Expansion in public

investment will probably contribute to this scenario. The leading

indicators of economic activity for the first two months of 2012 confirm

that the Colombian economy continues to perform well.

The present Report to Congress contains four chapters. Chapter I reviews

the international context, analyzing the background to and development

of the European crisis, and also the developed and emerging economies

performance in 2011 and their prospects for 2012. Chapter II provides

a detailed assessment of Colombias economic results in 2011 in terms

of economic activity, employment, and the financial sector and external

sectors. It also describes the main aspects of the countrys monetary,

fiscal and exchange rate policy that contributed to macroeconomic

stability, and analyzes the outlook for the present year. Chapter III

reviews the behavior of Colombias international reserves, as regards

their composition, management policy, investment performance and

status of claims. Lastly, Chapter IV describes Banco de la Repblicas

financial position. As is customary, the Report deals in greater depth

with specific subjects, presented in individual Boxes, to provide a better

understanding of Colombias economy and the global economy, and

also of the work of Banco de la Repblica.

16

OKCongreso-2012marzo-ingles.indd 16 16/01/14 11:11

You might also like

- Rich Dad Poor DadDocument26 pagesRich Dad Poor Dadchaand33100% (17)

- Executive Summary: The Global OutlookDocument34 pagesExecutive Summary: The Global OutlookmarrykhiNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFSapna VermaNo ratings yet

- Hostile Takeover of Mindtree: An Analysis of Benefits and ChallengesDocument4 pagesHostile Takeover of Mindtree: An Analysis of Benefits and Challengesanuj rakheja100% (1)

- Briefcase On Company Law Briefcase SeriesDocument180 pagesBriefcase On Company Law Briefcase SeriesAminath ShahulaNo ratings yet

- Evolution of Industrial Policy in IndiaDocument7 pagesEvolution of Industrial Policy in IndiaNeeraj YadavNo ratings yet

- Inflation Complete (Research Paper)Document9 pagesInflation Complete (Research Paper)najabat110100% (1)

- Swedbank Economic Outlook April 2011Document24 pagesSwedbank Economic Outlook April 2011Swedbank AB (publ)No ratings yet

- GREEK ECONOMIC OUTLOOKDocument25 pagesGREEK ECONOMIC OUTLOOKanisdangasNo ratings yet

- Bad News From AbroadDocument3 pagesBad News From AbroadvictorramphalNo ratings yet

- Past and Current Data in The PhilippinesDocument3 pagesPast and Current Data in The Philippinesnikko palmaNo ratings yet

- Economic Outlook Q2 2011Document5 pagesEconomic Outlook Q2 2011Mark PaineNo ratings yet

- Pakistan Economic Survey 2010-2011Document225 pagesPakistan Economic Survey 2010-2011d-fbuser-47221125No ratings yet

- Pakistan Economic Survey 2010 2011Document272 pagesPakistan Economic Survey 2010 2011talhaqm123No ratings yet

- Balance of Payments: Lobal ConomyDocument19 pagesBalance of Payments: Lobal ConomyMba MicNo ratings yet

- Securities Market in India: An OverviewDocument15 pagesSecurities Market in India: An OverviewShailender KumarNo ratings yet

- Bahrain Economy 2012Document54 pagesBahrain Economy 2012Usman MoonNo ratings yet

- E HalfyearDocument104 pagesE HalfyearJiawei YeNo ratings yet

- World Economy 2011Document48 pagesWorld Economy 2011Arnold StalonNo ratings yet

- World Economic Situation and Prospects 2011Document48 pagesWorld Economic Situation and Prospects 2011Iris De La CalzadaNo ratings yet

- RBI Governor's review of monetary policy highlights rising inflation concernsDocument12 pagesRBI Governor's review of monetary policy highlights rising inflation concernsranjithalimiNo ratings yet

- Bahrain Economic Quarterly: Second Quarter 2012Document54 pagesBahrain Economic Quarterly: Second Quarter 2012GeorgeNo ratings yet

- Swedbank Economic Outlook, 2010, April 22 PDFDocument27 pagesSwedbank Economic Outlook, 2010, April 22 PDFSwedbank AB (publ)No ratings yet

- RBI Macro Economic and Monetary Developments 2010-11Document60 pagesRBI Macro Economic and Monetary Developments 2010-11tarun.mitra19854923No ratings yet

- Prospects 2011Document7 pagesProspects 2011IPS Sri LankaNo ratings yet

- Chart 3.1: Outlook For Real GDP Growth in 2012Document1 pageChart 3.1: Outlook For Real GDP Growth in 2012Sha Kah RenNo ratings yet

- Muss A 0409Document16 pagesMuss A 0409kitten301No ratings yet

- 27 Review and Out Look of The Malaysian EconomyDocument5 pages27 Review and Out Look of The Malaysian Economynas466No ratings yet

- Economic Snapshot For June 2011Document4 pagesEconomic Snapshot For June 2011Center for American ProgressNo ratings yet

- 18 Econsouth Fourth Quarter 2012Document6 pages18 Econsouth Fourth Quarter 2012caitlynharveyNo ratings yet

- APEC Economic Trends Analysis: APEC Policy Support UnitDocument18 pagesAPEC Economic Trends Analysis: APEC Policy Support UnitManu NuñezNo ratings yet

- World Economy in 2010 Yearly ReviewDocument5 pagesWorld Economy in 2010 Yearly ReviewJohn Raymond Salamat PerezNo ratings yet

- Vol 41Document45 pagesVol 41ANKIT_XXNo ratings yet

- World Economic Outlook, IMF April 2013Document4 pagesWorld Economic Outlook, IMF April 2013redaekNo ratings yet

- Massive Global Stimulus Needed to Counter DownturnDocument4 pagesMassive Global Stimulus Needed to Counter DownturnRahul YenNo ratings yet

- AR2019 Managementreport enDocument10 pagesAR2019 Managementreport enCodrutaNo ratings yet

- The Global Economy No. 3/2011Document4 pagesThe Global Economy No. 3/2011Swedbank AB (publ)No ratings yet

- Euro Crisis Impact on IndiaDocument18 pagesEuro Crisis Impact on Indiaडॉ. शुभेंदु शेखर शुक्लाNo ratings yet

- World Economy: Confidence Takes Welcome TurnDocument6 pagesWorld Economy: Confidence Takes Welcome Turnapi-210904824No ratings yet

- Economic Outlook: Slowing Growth, But Recovery On Track - 08/09/2010Document13 pagesEconomic Outlook: Slowing Growth, But Recovery On Track - 08/09/2010Rhb InvestNo ratings yet

- Macro Economic and Monetary Developments First Quarter Review 2011-12Document62 pagesMacro Economic and Monetary Developments First Quarter Review 2011-12abinash229138No ratings yet

- Midyear Budget 2008Document24 pagesMidyear Budget 2008New York SenateNo ratings yet

- IMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011Document12 pagesIMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011babstar999No ratings yet

- The Forces Shaping The Economy Over 2012Document10 pagesThe Forces Shaping The Economy Over 2012economicdelusionNo ratings yet

- Brazil Russia India China South AfricaDocument3 pagesBrazil Russia India China South AfricaRAHULSHARMA1985999No ratings yet

- 2011-12 Monetary PolicyDocument21 pages2011-12 Monetary PolicyNitinAggarwalNo ratings yet

- Financial CrisisDocument70 pagesFinancial CrisisSubodh MayekarNo ratings yet

- H.issue That Will Make or Break 2015Document5 pagesH.issue That Will Make or Break 2015Mazana ÁngelNo ratings yet

- JPF Its The Politics StupidDocument2 pagesJPF Its The Politics StupidBruegelNo ratings yet

- Cid 185112Document3 pagesCid 185112Swedbank AB (publ)No ratings yet

- 3 Way Split ArticleDocument3 pages3 Way Split ArticlesumairjawedNo ratings yet

- By Dinesh Sundaram Keerthi Sagar Prabhu Prithviraj Sindhu V.VaikunthDocument25 pagesBy Dinesh Sundaram Keerthi Sagar Prabhu Prithviraj Sindhu V.VaikunthSindhu ViswanathanNo ratings yet

- Reserve Bank of India Second Quarter Review of Monetary Policy 2011-12Document20 pagesReserve Bank of India Second Quarter Review of Monetary Policy 2011-12FirstpostNo ratings yet

- India and The Global Economy: Tate OF THE Lobal ConomyDocument21 pagesIndia and The Global Economy: Tate OF THE Lobal ConomyrajNo ratings yet

- My Work1Document14 pagesMy Work1lyndaumoruNo ratings yet

- Chile's Economic Recovery from Earthquake and Financial CrisisDocument6 pagesChile's Economic Recovery from Earthquake and Financial CrisisHenry ChavezNo ratings yet

- 4feb11 Retrospectiva2010 Scenarii2011 PDFDocument16 pages4feb11 Retrospectiva2010 Scenarii2011 PDFCalin PerpeleaNo ratings yet

- Market Report JuneDocument17 pagesMarket Report JuneDidine ManaNo ratings yet

- World Economic Outlook UpdateDocument13 pagesWorld Economic Outlook UpdateSachin Kumar BassiNo ratings yet

- India Economic Update: September, 2011Document17 pagesIndia Economic Update: September, 2011Rahul KaushikNo ratings yet

- Inflation in Pakistan 2001 To 2010Document4 pagesInflation in Pakistan 2001 To 2010Abdur RehmanNo ratings yet

- The Reform of Europe: A Political Guide to the FutureFrom EverandThe Reform of Europe: A Political Guide to the FutureRating: 2 out of 5 stars2/5 (1)

- Middle East and North Africa Quarterly Economic Brief, July 2013: Growth Slowdown Extends into 2013From EverandMiddle East and North Africa Quarterly Economic Brief, July 2013: Growth Slowdown Extends into 2013No ratings yet

- Jul 06 AbstractDocument3 pagesJul 06 AbstractHéctor Ceballos OspinaNo ratings yet

- Mar 07 Abstract 1Document4 pagesMar 07 Abstract 1Héctor Ceballos OspinaNo ratings yet

- Introduction Congress Jul 05Document4 pagesIntroduction Congress Jul 05Héctor Ceballos OspinaNo ratings yet

- Res March 2005Document3 pagesRes March 2005Héctor Ceballos OspinaNo ratings yet

- Introduction Congress Jul 05Document4 pagesIntroduction Congress Jul 05Héctor Ceballos OspinaNo ratings yet

- Ijd Mar 2017 Eng IntroductionDocument5 pagesIjd Mar 2017 Eng IntroductionHéctor Ceballos OspinaNo ratings yet

- Ijd Mar 2017 Eng IntroductionDocument5 pagesIjd Mar 2017 Eng IntroductionHéctor Ceballos OspinaNo ratings yet

- Ijd Mar 2017 Eng IntroductionDocument5 pagesIjd Mar 2017 Eng IntroductionHéctor Ceballos OspinaNo ratings yet

- Perfect Substitutes and Perfect ComplementsDocument2 pagesPerfect Substitutes and Perfect ComplementsVijayalaxmi DhakaNo ratings yet

- Chapter 24 Finance, Saving, and InvestmentDocument32 pagesChapter 24 Finance, Saving, and InvestmentastridNo ratings yet

- Economic History of The PhilippinesDocument4 pagesEconomic History of The PhilippinesClint Agustin M. RoblesNo ratings yet

- Talent Corp - Final Report (Abridged) PDFDocument211 pagesTalent Corp - Final Report (Abridged) PDFpersadanusantaraNo ratings yet

- User Exits in Sales Document ProcessingDocument9 pagesUser Exits in Sales Document Processingkirankumar723No ratings yet

- Mishkin Econ13e PPT 17Document25 pagesMishkin Econ13e PPT 17Huyền Nhi QuảnNo ratings yet

- Introduction of GSTDocument27 pagesIntroduction of GSTaksh40% (5)

- 12 Jun 2019 PDFDocument12 pages12 Jun 2019 PDFAnonymous dy7g4jzo7No ratings yet

- JPM - Economic Data AnalysisDocument11 pagesJPM - Economic Data AnalysisAvid HikerNo ratings yet

- Survey highlights deficits facing India's minority districtsDocument75 pagesSurvey highlights deficits facing India's minority districtsAnonymous yCpjZF1rFNo ratings yet

- K&N Case Group - 3Document41 pagesK&N Case Group - 3priya_pritika6561100% (1)

- The World Trade Organiation and World Trade Patterns: Chapter - 40Document8 pagesThe World Trade Organiation and World Trade Patterns: Chapter - 40Halal BoiNo ratings yet

- Unified DCR 37 (1 AA) DT 08 03 2019..Document6 pagesUnified DCR 37 (1 AA) DT 08 03 2019..GokulNo ratings yet

- Paul Slomski Resume 2009.1Document2 pagesPaul Slomski Resume 2009.1Paul SlomskiNo ratings yet

- Mini R50 Engine Electrical System Parts ManualDocument23 pagesMini R50 Engine Electrical System Parts Manualdaz7691No ratings yet

- High Capacity Stacker-F1-G1-H1 Safety Guide en - USDocument14 pagesHigh Capacity Stacker-F1-G1-H1 Safety Guide en - UShenry lopezNo ratings yet

- IRCTCs e-Ticketing Service DetailsDocument2 pagesIRCTCs e-Ticketing Service DetailsOPrakash RNo ratings yet

- Monopolistic CompetitionDocument14 pagesMonopolistic CompetitionRajesh GangulyNo ratings yet

- Amazon's Rise from Online Bookseller to Global Retail GiantDocument2 pagesAmazon's Rise from Online Bookseller to Global Retail GiantJuliana MorenoNo ratings yet

- PRC Ready ReckonerDocument2 pagesPRC Ready Reckonersparthan300No ratings yet

- SolergyDocument3 pagesSolergyArsalan AhmedNo ratings yet

- Economic Impact of Accelerating Permit Local Development and Govt RevenuesDocument6 pagesEconomic Impact of Accelerating Permit Local Development and Govt RevenuesQQuestorNo ratings yet

- How To Calculate Man Months V 3Document2 pagesHow To Calculate Man Months V 3manojghorpadeNo ratings yet

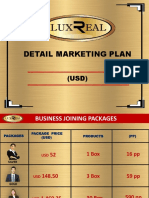

- Luxreal Detail Marketing Plan (2019) UsdDocument32 pagesLuxreal Detail Marketing Plan (2019) UsdTawanda Tirivangani100% (2)

- Pip (Program Implementation Plan)Document2 pagesPip (Program Implementation Plan)sureesicNo ratings yet