Professional Documents

Culture Documents

Prelim Cost Acctng

Uploaded by

Anonymous JgyJLTqpNSCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelim Cost Acctng

Uploaded by

Anonymous JgyJLTqpNSCopyright:

Available Formats

Masters Technological Institute of Mindanao

Department of Accountancy

Acctng 312 (Cost Acctng)

PRELIM EXAM

I. PROBLEM SOLVING. Answer the following problems. Show your supporting computations in a separate sheet of

paper.

1. Under Pick Companys job order costing system, manufacturing overhead is applied to work-in-process using a

predetermined annual overhead rate. During January 2016, Picks transactions included the following:

Direct materials issued to production P90 000

Indirect materials issued to production 8 000

Manufacturing overhead incurred125 000

Manufacturing overhead applied 113 000

Direct Labor cost..107 000

Pick had neither beginning nor ending work-in-process inventory. What was the cost of jobs completed in January 2016?

2. Ajax Corporation transferred P72 000 of raw materials to its production department in February and incurred P37

000 of conversion costs (P22 000 of direct labor and P15 000 of overhead). At the beginning of the period, P14 000 of

inventory (material and conversion costs) was in process. At the end of the period, P18 000 of inventory was in process.

What was the cost of goods manufactured?

3. The Childers Company manufactures widgets. During the fiscal year just ended, the company incurred prime costs

of P1 500 000 and conversion costs of P1 800 000. Overhead is applied at the rate of 200% of direct labor cost. How

much of the above costs represent material cost?

4. The following cost data were taken from the records of a manufacturing company:

Depreciation on factory equipment 1 000

Depreciation on sales office 500

Advertising 7 000

Freight-out (shipping) 3 000

Wages of production workers 28 000

Raw materials used 47 000

Sales salaries and commission 10 000

Factory rent 2 000

Factory insurance 500

Materials handling 1 500

Administrative salaries 2 000

Based upon the above information, the manufacturing costs incurred during the year was?

5. The following selected information pertains to Ajax Processing Co.: direct materials, P62 500; indirect materials, P12,

500; factory payroll, P75 000 of direct labor and P11 250 of indirect labor, and other factory overhead incurred, P37

500. The total conversion cost was?

6. Ambo Inc. manufactured 50 000 kilos of compound Am in 2016 at the following costs:

Opening work-in-process of P88 125

Materials of P182,500 of which 90% is direct materials

Labor of P242 500 of which 93% is direct labor

Closing work-in-process of P67 500

Factory overhead is 125% of direct labor cost and includes indirect materials and indirect labor. The cost of goods

manufactured is?

7. The work-in-process account of the Malinta Co which uses a job order cost system follows:

WORK-IN-PROCESS

APR 1 BALANCE P25 000 Finished Goods P125 450

DIRECT MATERIALS 50 000

DIRECT LABOR 40 000

OVERHEAD APPLIED 30 000

Overhead is applied to production at a predetermined rate based on direct labor cost. The work-in-process on Apr 30

represents the cost of Job No. 456, which has been charged with direct labor cost of P3 000 and Job No. 789 which has

By: Ms. SAHARA U. MAROHOM, CPA

Masters Technological Institute of Mindanao

Department of Accountancy

Acctng 312 (Cost Acctng)

PRELIM EXAM

been charged with applied overhead of P2 400. The cost of direct materials charged to Job No. 456 and Job No. 789

amounted to?

8. Flor Company consumed P450 000 of direct materials during May 2016. At of the month, the direct materials inventory

of Flor was P25 000 lower than the May 1 inventory level. How much was the direct materials purchased during May

2016?

9-10. The following data are available for two companies at the end of their fiscal years: Determine the amounts

indicated by question marks.

Company A: Company B:

Finished goods, Jan1 $600,000 Gross Profit $96,000

Cost of goods manufacture 3,800,000 Cost of goods manufactured 340,000

Sales 4,000,000 Finished goods, Jan 1 45,000

Gross profit on sales 20% Finished goods, Dec 31 52,000

Finished goods inventory, end ? Work in process, Jan 1 28,000

Work in process, Dec 3 38,000

Sales ?

II. THEORIES. Classify each cost by completing the table provided.

Porter Company manufactures furniture, including tables. Selected costs are given below:

1. The tables are made of wood that costs $100 per table.

2. The tables are assembled by workers, at a wage cost of $40 per table.

3. Workers assembling the tables are supervised by a factory supervisor who is paid $25,000 per year.

4. Electrical costs are $2 per machine-hour. Four machine-hours are required to produce a table.

5. The straight-line amortization cost of the machines used to make the tables totals $10,000 per year.

6. The salary of the president of Porter Company is $100,000 per year.

7. Porter Company spends $250,000 per year to advertise its products.

8. Salespersons are paid a commission of $30 for each table sold.

9. Instead of producing the tables, Porter Company could rent its factory space out at a rental income of

$50,000 per year

Period

To Units Of Cost To Units of

COST Product Cost

Products Sold (Selling & Product Sold

Admin)

Direct Direct Manufacturing

Variable Fixed Direct Indirect

Materials Labor Overhead

1. Wood used in a table ($100

per table)

x x x

2. Labor cost to assemble a

table ($40 per table)

3. Salary of the factory

supervisor ($25,000 per year)

4. Cost of electricity to produce

tables ($2 per machine hour)

5. Amortization of machines

used to produce tables ($10,000

per year)

6. Salary of the company

president ($100,000 per year)

7. Advertising expense

($250,000 per year)

8. Commissions paid to sales

persons ($30 per table sold)

9. Rental income forgone on

factory space ($50,000 per year)

By: Ms. SAHARA U. MAROHOM, CPA

You might also like

- Accounting For Production Losses in A Job Order CostingDocument2 pagesAccounting For Production Losses in A Job Order CostingMARYGRACE FERRER100% (1)

- LeaseDocument8 pagesLeaseKim PeriaNo ratings yet

- Advanced Financial Accounting & Reporting Cost ConceptsDocument6 pagesAdvanced Financial Accounting & Reporting Cost ConceptsMarynelle Labrador SevillaNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- Stand CostingDocument38 pagesStand CostingaydhaNo ratings yet

- CH 18Document39 pagesCH 18Ja RedNo ratings yet

- Cost Terminology and Cost Behaviors: Learning ObjectivesDocument17 pagesCost Terminology and Cost Behaviors: Learning ObjectivesJonnah ArriolaNo ratings yet

- Cost Accounting RefresherDocument15 pagesCost Accounting Refresherfat31udm100% (1)

- Stracos Module 1 Quiz Cost ConceptsDocument12 pagesStracos Module 1 Quiz Cost ConceptsGemNo ratings yet

- Ac102 ch2Document21 pagesAc102 ch2Fisseha GebruNo ratings yet

- Quiz - Ppe Cost 2Document1 pageQuiz - Ppe Cost 2Ana Mae HernandezNo ratings yet

- ACYCST2 Mock Comprehensive Examination KeyDocument9 pagesACYCST2 Mock Comprehensive Examination KeyGian Carlo RamonesNo ratings yet

- Quiz-2 AnswerDocument1 pageQuiz-2 AnswerChandanMatoliaNo ratings yet

- Seatwork For BA202.SaturdayDocument2 pagesSeatwork For BA202.SaturdayMelcanie Tiala YatNo ratings yet

- Cfas ReviewerDocument2 pagesCfas ReviewerElaine Ü LubianoNo ratings yet

- Far Eastern University: ACT 1109 HO-01Document2 pagesFar Eastern University: ACT 1109 HO-01Maryrose Sumulong100% (1)

- Costacc HWDocument2 pagesCostacc HWRikka Takanashi100% (1)

- Absorption and Variable CostingDocument2 pagesAbsorption and Variable CostingJenni LoricoNo ratings yet

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Document14 pagesACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNo ratings yet

- Projected Sales Cash Receipts Accounts Receivables Budgets Cash Budget AnalysisDocument3 pagesProjected Sales Cash Receipts Accounts Receivables Budgets Cash Budget AnalysisJamaica Marjadas100% (1)

- Financial Statement Ratio AnalysisDocument45 pagesFinancial Statement Ratio Analysisbilly100% (1)

- Cost Accumulation Comp PDFDocument29 pagesCost Accumulation Comp PDFGregorian JerahmeelNo ratings yet

- Canvass Ia QuizDocument32 pagesCanvass Ia QuizLhowellaAquinoNo ratings yet

- q3. Fs QuizzerDocument13 pagesq3. Fs QuizzerClaudine DuhapaNo ratings yet

- PpeDocument7 pagesPpeJasmine Marie Ng CheongNo ratings yet

- Standard Costing, Operational Performance Measures, and The Balanced Scorecard (SoftCopy - Solman)Document40 pagesStandard Costing, Operational Performance Measures, and The Balanced Scorecard (SoftCopy - Solman)Hannah Grace JustoNo ratings yet

- ACYCST Cost Accounting Quiz ReviewerDocument123 pagesACYCST Cost Accounting Quiz ReviewerelelaiNo ratings yet

- Cost Quizzer6Document6 pagesCost Quizzer6LumingNo ratings yet

- Investments in Debt Securities QuizDocument7 pagesInvestments in Debt Securities QuizChristine Jean MajestradoNo ratings yet

- ACYMAG1 Exercise Set #1Document9 pagesACYMAG1 Exercise Set #1123r12f10% (1)

- Activity-Based Costing True-False StatementsDocument5 pagesActivity-Based Costing True-False StatementsSuman Paul ChowdhuryNo ratings yet

- 2 - Handout On Cost Concept and ClassificationDocument3 pages2 - Handout On Cost Concept and ClassificationofrecioAM100% (1)

- Leslie Company Manufacturing Department Cost of Production Report For January Materials Conversion CostDocument8 pagesLeslie Company Manufacturing Department Cost of Production Report For January Materials Conversion Costmaica G.No ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- Exercise 5 Short Computations Backflush CostingDocument2 pagesExercise 5 Short Computations Backflush CostingsarahbeeNo ratings yet

- Vbook - Pub Business Combination QuizDocument3 pagesVbook - Pub Business Combination QuizRialeeNo ratings yet

- This Study Resource Was: Long Quiz No. 1Document7 pagesThis Study Resource Was: Long Quiz No. 1JS ItingNo ratings yet

- Costing Accounting Practice SetDocument2 pagesCosting Accounting Practice SetKristel SumabatNo ratings yet

- 1.05 Cost Accumulation SystemsDocument37 pages1.05 Cost Accumulation SystemsmymyNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- Chapter 2. COST IDocument8 pagesChapter 2. COST IyebegashetNo ratings yet

- Basic Concepts and Job Order Cost CycleDocument15 pagesBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- Homework On Presentation of Financial Statements (Ias 1)Document4 pagesHomework On Presentation of Financial Statements (Ias 1)Jazehl Joy ValdezNo ratings yet

- ch14 TestDocument43 pagesch14 TestDaniel HunksNo ratings yet

- CSI Inc's Investment Account AuditDocument4 pagesCSI Inc's Investment Account Auditandrei jude matullanoNo ratings yet

- Practice Questions Inventories # 2 With AnswersDocument9 pagesPractice Questions Inventories # 2 With AnswersIzzahIkramIllahiNo ratings yet

- AP balances suppliersDocument8 pagesAP balances suppliersWater MelonNo ratings yet

- Advanced Financial Accounting and Reporting (CPALE Review)Document3 pagesAdvanced Financial Accounting and Reporting (CPALE Review)Micko LagundinoNo ratings yet

- 07 Lecture Notes - Gross Profit and Retail Method PDFDocument1 page07 Lecture Notes - Gross Profit and Retail Method PDFJobelle Gallardo AgasNo ratings yet

- CFAS Questions Chaps 1 and 2Document13 pagesCFAS Questions Chaps 1 and 2King SigueNo ratings yet

- Barton Co. Balance Sheet For Branch December 31, 20x4Document27 pagesBarton Co. Balance Sheet For Branch December 31, 20x4Love FreddyNo ratings yet

- COST ACCOUNTING JOB-ORDER COSTING ProbleDocument2 pagesCOST ACCOUNTING JOB-ORDER COSTING ProbleEleonora MarinettiNo ratings yet

- MOCK QUALIFYING QUIZ 1 - OBLICONDocument6 pagesMOCK QUALIFYING QUIZ 1 - OBLICONIrene SheeranNo ratings yet

- Assignment - Karla Company Provided The Following Information For 2016Document1 pageAssignment - Karla Company Provided The Following Information For 2016April Boreres33% (3)

- Auditing Problems Review: Key Equity and Bond CalculationsDocument2 pagesAuditing Problems Review: Key Equity and Bond CalculationsgbenjielizonNo ratings yet

- Cost and MGT Acct AssignmentDocument3 pagesCost and MGT Acct Assignmentasnake libsieNo ratings yet

- QuestionsDocument13 pagesQuestionsKRZ. Arpon Root Hacker100% (1)

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- The Earth's SubsystemDocument2 pagesThe Earth's SubsystemAnonymous JgyJLTqpNSNo ratings yet

- Activity:: 1. Make A Pictograph of The Gender of The PupilsDocument5 pagesActivity:: 1. Make A Pictograph of The Gender of The PupilsAnonymous JgyJLTqpNSNo ratings yet

- Detailed Lesson PlanDocument4 pagesDetailed Lesson PlanAnonymous JgyJLTqpNS89% (19)

- In Times of American Occupation in MindanaoDocument3 pagesIn Times of American Occupation in MindanaoAnonymous JgyJLTqpNSNo ratings yet

- Cost of Capital Capital Structure Dividend ProblemsDocument26 pagesCost of Capital Capital Structure Dividend ProblemsAnonymous JgyJLTqpNSNo ratings yet

- Modern Cinderella Film Retells Classic TaleDocument6 pagesModern Cinderella Film Retells Classic TaleAnonymous JgyJLTqpNSNo ratings yet

- PlotDocument3 pagesPlotAnonymous JgyJLTqpNSNo ratings yet

- MATH2070 Computer Project: Organise Porject FoldDocument4 pagesMATH2070 Computer Project: Organise Porject FoldAbdul Muqsait KenyeNo ratings yet

- Supply Chain ManagementDocument30 pagesSupply Chain ManagementSanchit SinghalNo ratings yet

- Photoshop Tools and Toolbar OverviewDocument11 pagesPhotoshop Tools and Toolbar OverviewMcheaven NojramNo ratings yet

- Chapter 3: Elements of Demand and SupplyDocument19 pagesChapter 3: Elements of Demand and SupplySerrano EUNo ratings yet

- EPS Lab ManualDocument7 pagesEPS Lab ManualJeremy Hensley100% (1)

- BAM PPT 2011-09 Investor Day PDFDocument171 pagesBAM PPT 2011-09 Investor Day PDFRocco HuangNo ratings yet

- Conversion of Units of Temperature - Wikipedia, The Free Encyclopedia PDFDocument7 pagesConversion of Units of Temperature - Wikipedia, The Free Encyclopedia PDFrizal123No ratings yet

- Okuma Osp5000Document2 pagesOkuma Osp5000Zoran VujadinovicNo ratings yet

- Model S-20 High Performance Pressure Transmitter For General Industrial ApplicationsDocument15 pagesModel S-20 High Performance Pressure Transmitter For General Industrial ApplicationsIndra PutraNo ratings yet

- As 1769-1975 Welded Stainless Steel Tubes For Plumbing ApplicationsDocument6 pagesAs 1769-1975 Welded Stainless Steel Tubes For Plumbing ApplicationsSAI Global - APACNo ratings yet

- MSBI Installation GuideDocument25 pagesMSBI Installation GuideAmit SharmaNo ratings yet

- 01 Automatic English To Braille TranslatorDocument8 pages01 Automatic English To Braille TranslatorShreejith NairNo ratings yet

- Department of Labor: kwc25 (Rev-01-05)Document24 pagesDepartment of Labor: kwc25 (Rev-01-05)USA_DepartmentOfLaborNo ratings yet

- RTL8316C GR RealtekDocument93 pagesRTL8316C GR RealtekMaugrys CastilloNo ratings yet

- LPM 52 Compar Ref GuideDocument54 pagesLPM 52 Compar Ref GuideJimmy GilcesNo ratings yet

- Elementary School: Cash Disbursements RegisterDocument1 pageElementary School: Cash Disbursements RegisterRonilo DagumampanNo ratings yet

- Gates em Ingles 2010Document76 pagesGates em Ingles 2010felipeintegraNo ratings yet

- Overhead Door Closers and Hardware GuideDocument2 pagesOverhead Door Closers and Hardware GuideAndrea Joyce AngelesNo ratings yet

- Expert Business Analyst Darryl Cropper Seeks New OpportunityDocument8 pagesExpert Business Analyst Darryl Cropper Seeks New OpportunityRajan GuptaNo ratings yet

- Bernardo Corporation Statement of Financial Position As of Year 2019 AssetsDocument3 pagesBernardo Corporation Statement of Financial Position As of Year 2019 AssetsJean Marie DelgadoNo ratings yet

- 2.8 V6 5V (Aha & Atq)Document200 pages2.8 V6 5V (Aha & Atq)Vladimir Socin ShakhbazyanNo ratings yet

- "60 Tips On Object Oriented Programming" BrochureDocument1 page"60 Tips On Object Oriented Programming" BrochuresgganeshNo ratings yet

- Peter Wilkinson CV 1Document3 pagesPeter Wilkinson CV 1larry3108No ratings yet

- 5.PassLeader 210-260 Exam Dumps (121-150)Document9 pages5.PassLeader 210-260 Exam Dumps (121-150)Shaleh SenNo ratings yet

- Dairy DevelopmentDocument39 pagesDairy DevelopmentHemanth Kumar RamachandranNo ratings yet

- Gerhard Budin PublicationsDocument11 pagesGerhard Budin Publicationshnbc010No ratings yet

- Supplier Quality Requirement Form (SSQRF) : Inspection NotificationDocument1 pageSupplier Quality Requirement Form (SSQRF) : Inspection Notificationsonnu151No ratings yet

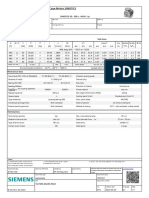

- 1LE1503-2AA43-4AA4 Datasheet enDocument1 page1LE1503-2AA43-4AA4 Datasheet enAndrei LupuNo ratings yet

- Introduction To Elective DesignDocument30 pagesIntroduction To Elective Designabdullah 3mar abou reashaNo ratings yet

- Tutorial 5 HExDocument16 pagesTutorial 5 HExishita.brahmbhattNo ratings yet