Professional Documents

Culture Documents

Sales Tax Holiday

Uploaded by

KristenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Tax Holiday

Uploaded by

KristenCopyright:

Available Formats

2017 ARKANSAS SALES TAX HOLIDAY

Arkansas will hold its annual sales tax holiday, beginning Saturday, August 5, 2017 at 12:01 a.m. and ending

Sunday, August 6, 2017 at 11:59 p.m. State and local sales tax will not be collected during this 48-hour period on

the sale of: (1) Clothing and footwear if the sales price is less than one hundred dollars ($100) per item; (2) Clothing

accessories and equipment if the sales price is less than fifty dollars ($50) per item; (3) School supplies; (4) School

art supplies; and (5) School instructional materials.

For more information, contact a customer service representative by phone Monday through

Friday from 8:00 a.m. to 4:30 p.m. at (501) 682-7104.

Clothing - Less Than $100.00 Per Item.

EXEMPT: Includes all human wearing apparel suitable for general use.

Aprons, household and shop Formal wear Rubber pants

Athletic supporters Garters and garter belts Sandals

Baby receiving blankets Girdles Scarves

Bathing suits and caps Gloves & mittens for general use Shoes and shoe laces

Beach capes and coats Hats and caps Slippers

Belts and suspenders Hosiery Sneakers

Boots Insoles for shoes Socks and stockings

Coats and jackets Lab coats Steel toed shoes

Costumes Neckties Underwear

Diapers, including disposables Overshoes Uniforms, athletic & non-athletic

Earmuffs Pantyhose Wedding apparel

Footlets Rainwear

Clothing Accessory or Equipment - Less Than $50.00 Per Item.

EXEMPT: Incidental item worn on the person or in conjunction with clothing..

Briefcases Jewelry

Cosmetics Sun glasses, non-prescription

Hair notions, including barrettes, Umbrellas

hair bows, & hair nets Wallets

Handbags Watches

Handkerchiefs Wigs and hair pieces

School Supplies

EXEMPT: An item commonly used by a student in a course of study. Limited to items listed below.

Binders Glue, paste, and paste sticks Paper - loose leaf ruled notebook

Book bags Highlighters paper, copy paper, graph paper,

Calculators Index cards tracing paper, manila paper,

Cellophane tape Index card boxes colored paper, poster board, and

Blackboard chalk Legal pads construction paper

Compasses Lunch boxes Pencils

Composition books Markers Pens

Crayons Notebooks Protractors

Erasers Pencil boxes and other school Rulers

Folders - expandable, pocket, supply boxes Scissors

plastic, and manila Pencil sharpeners Writing tablets

School Art Supply

EXEMPT: An item commonly used by a student in a course of study for artwork. Limited to items listed below.

Clay and glazes Sketch and drawing pads

Paints - acrylic, tempora, and oil Watercolors

Paintbrushes for artwork

School Instructional Material

EXEMPT: Written material commonly used by a student in a course of study as a reference and to learn the subject

being taught. Limited to items listed below.

Reference books Textbooks

Reference maps and globes Workbooks

TAXABLE:

Sewing Equipment and Supplies: Protective Equipment: Sport or Recreational Equipment:

Knitting Needles Breathing Masks Ballet and Tap Shoes

Patterns Clean Room Apparel and Equipment Cleated or Spiked Athletic Shoes

Pins Ear and Hearing Protectors Gloves - baseball, bowling, boxing,

Scissors Face Shields hockey, and golf

Sewing Machines Hard Hats Goggles

Sewing Needles Helmets Hand and Elbow Guards

Tape Measures Paint or Dust Respirators Life Preservers and Vests

Thimbles Protective Gloves Mouth Guards

Buttons Safety Glasses and Goggles Roller and Ice Skates

Fabric Safety Belts Shin Guards

Lace Tool Belts Shoulder Pads

Thread Welders Gloves and Masks Ski Boots

Yarn Waders

Zippers Wetsuits and Fins

Belt buckles sold separately Costume masks sold separately Patches and Emblems Sold Separately

You might also like

- Coquette Lingerie Catalog 2015Document344 pagesCoquette Lingerie Catalog 2015Manolo López Pérez75% (4)

- Wedding Reception ScriptDocument8 pagesWedding Reception ScriptMarlette S. Hugo100% (4)

- Basic Leathercrafting: All the Skills and Tools You Need to Get StartedFrom EverandBasic Leathercrafting: All the Skills and Tools You Need to Get StartedRating: 4 out of 5 stars4/5 (5)

- Encylopedia of Love-MagickDocument77 pagesEncylopedia of Love-Magickxxanankexx399088% (8)

- GET THE RENAISSANCE LOOKDocument11 pagesGET THE RENAISSANCE LOOKVea Fil100% (2)

- Lopez - Caño Wedding Reception ProgramDocument6 pagesLopez - Caño Wedding Reception ProgramDegee O. Gonzales77% (13)

- Fearless & Fun Lingerie Catalog 2014Document62 pagesFearless & Fun Lingerie Catalog 2014Manolo López Pérez75% (4)

- Wifeexperiencecatalog 2013Document67 pagesWifeexperiencecatalog 2013api-19498110050% (2)

- Sissy MaidDocument30 pagesSissy MaidAlfredo Nunes da SilvaNo ratings yet

- Wedding Reception ScriptDocument5 pagesWedding Reception ScriptPauline Mae Araneta100% (3)

- Fabulous Cosplay Footwear: Create Easy Boot Covers, Shoes & Tights for Any CostumeFrom EverandFabulous Cosplay Footwear: Create Easy Boot Covers, Shoes & Tights for Any CostumeRating: 5 out of 5 stars5/5 (1)

- Wedding Script Ideas and ExamplesDocument9 pagesWedding Script Ideas and ExamplesRegiel TolentinoNo ratings yet

- Wedding Script 5Document88 pagesWedding Script 5AnnamaAnnama63% (8)

- Almost FinishedDocument21 pagesAlmost FinisheddjwierNo ratings yet

- Reception PartyDocument7 pagesReception Partyalfie521No ratings yet

- Wedding ScriptDocument8 pagesWedding ScriptMhelody Gutierrez BelmonteNo ratings yet

- Carolina Valdez - Somebody To LoveDocument117 pagesCarolina Valdez - Somebody To LoveUchechukwu Obiakor75% (4)

- Making Anglo Saxon Garb PDFDocument19 pagesMaking Anglo Saxon Garb PDFOrsolya Eszter Kiszely100% (1)

- Emcee Script For A Wedding ReceptionDocument6 pagesEmcee Script For A Wedding ReceptionSannie Remotin100% (1)

- Wedding Reception Program ScriptDocument16 pagesWedding Reception Program ScriptJoweena JulianaNo ratings yet

- Wedding Program for Claribert Lagman and Mary OmandamDocument6 pagesWedding Program for Claribert Lagman and Mary OmandamJohn Dx LapidNo ratings yet

- Late 19th century and 21st century stockings: From risqué to redefinedDocument18 pagesLate 19th century and 21st century stockings: From risqué to redefinedMary LangridgeNo ratings yet

- Wedding MC ScriptDocument2 pagesWedding MC ScriptMD MC DetlefNo ratings yet

- Lingerie - For Modesty or PleasureDocument5 pagesLingerie - For Modesty or PleasureRicha Gupta0% (1)

- Find The School Supplies Names in The Word Search. Then, Label The PicturesDocument1 pageFind The School Supplies Names in The Word Search. Then, Label The PicturesLeo Mosquera RenteriaNo ratings yet

- ScriptDocument4 pagesScriptEdwil John C VillanuevaNo ratings yet

- Christine and Zoreen Nuptials Call To EnjoinDocument7 pagesChristine and Zoreen Nuptials Call To Enjoinjrose fay amatNo ratings yet

- Holiday Itemized ListDocument2 pagesHoliday Itemized ListBRENDANo ratings yet

- 2022 Back To School Sales Tax Holiday Fact SheetDocument2 pages2022 Back To School Sales Tax Holiday Fact SheetFOX54 News HuntsvilleNo ratings yet

- Gift Suggestions PDFDocument2 pagesGift Suggestions PDFmariakaNo ratings yet

- IBS Hyderabad checklist for juniors moving to campus (38 charactersDocument8 pagesIBS Hyderabad checklist for juniors moving to campus (38 charactersNaresh RajuNo ratings yet

- Ask Yourself: Does It ?: SparkDocument1 pageAsk Yourself: Does It ?: SparkRiku Okazaki100% (1)

- Konmari ChecklistDocument1 pageKonmari ChecklistThoraNo ratings yet

- Reuse_Centre_Acceptable_Items_BrochureDocument1 pageReuse_Centre_Acceptable_Items_BrochureaandersNo ratings yet

- Do you like HandicraftsDocument1 pageDo you like HandicraftsCarmen YusteNo ratings yet

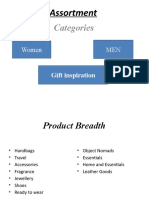

- Assortment Categories Gift inspiration Product BreadthDocument11 pagesAssortment Categories Gift inspiration Product BreadthShrutiNo ratings yet

- Complete Details - Arkansas PDFDocument1 pageComplete Details - Arkansas PDFAnonymous DlSBty583No ratings yet

- Checklist MDIGurgaon PG'20Document4 pagesChecklist MDIGurgaon PG'20nikhilNo ratings yet

- How To Make An Article-2-6Document5 pagesHow To Make An Article-2-6alfindwiyanto91No ratings yet

- What-We-Need ONLINE 2017 PDFDocument1 pageWhat-We-Need ONLINE 2017 PDFLouis Jean Jean CathuleNo ratings yet

- SBK Backpack Blitz 2023 Flyer FINDocument1 pageSBK Backpack Blitz 2023 Flyer FINWTKR News 3No ratings yet

- 2022 Florida Back-To-School Sales Tax Holiday - External FAQs - ConsumersDocument10 pages2022 Florida Back-To-School Sales Tax Holiday - External FAQs - ConsumersMelissa R.No ratings yet

- 2021/22 Gift Suggestions PDFDocument6 pages2021/22 Gift Suggestions PDFJack LynchNo ratings yet

- Houseware, Tableware, Kitchenware and Hotelware Including EpnsDocument5 pagesHouseware, Tableware, Kitchenware and Hotelware Including EpnsApurva AdinavarNo ratings yet

- P.O.D. Business Full ListDocument10 pagesP.O.D. Business Full ListNitesh LaguriNo ratings yet

- Movers SummaryDocument17 pagesMovers SummaryMarta Gallardo SantosNo ratings yet

- Declutter Cheat SheetDocument7 pagesDeclutter Cheat Sheetgddy857cnfNo ratings yet

- Classroom objects and vocabularyDocument17 pagesClassroom objects and vocabularyMarta Gallardo SantosNo ratings yet

- Hobbies, Leisure and LifestyleDocument9 pagesHobbies, Leisure and LifestyleAdam PazúrikNo ratings yet

- Sachdeva StationersDocument11 pagesSachdeva StationersMishrafashion HubNo ratings yet

- Personal and common objectsDocument9 pagesPersonal and common objectssugandaraj522No ratings yet

- Survival List 2.oDocument17 pagesSurvival List 2.oeric.t.dawson3No ratings yet

- Leh ChecklistDocument2 pagesLeh Checklistnitin singhNo ratings yet

- UntitledDocument20 pagesUntitledRANDILO LUMAYNONo ratings yet

- ClothingDocument12 pagesClothingAlex RusiniakNo ratings yet

- Grade 7 Supplies Grade 8 Supplies Grade 9 Supplies Art SuppliesDocument1 pageGrade 7 Supplies Grade 8 Supplies Grade 9 Supplies Art SuppliesAbdullahMofarrahNo ratings yet

- Clothing Materials: Prepared byDocument33 pagesClothing Materials: Prepared bytotol99No ratings yet

- Grade 7 Stationery Requirements - 2023Document2 pagesGrade 7 Stationery Requirements - 2023Nokutenda KachereNo ratings yet

- Product Categories List - Sent - MasdealDocument6 pagesProduct Categories List - Sent - Masdealamit acharyaNo ratings yet

- Uses of PlantsDocument22 pagesUses of PlantsZohraQureshiNo ratings yet

- Welcome ClassDocument11 pagesWelcome Classapi-548619877No ratings yet

- 4H Impromptu ListingDocument13 pages4H Impromptu ListingAxyl LlantoNo ratings yet

- CK3 Teacher's BookDocument192 pagesCK3 Teacher's BookEstefania PaulozzoNo ratings yet

- Ag Mechanics Safety: Safety Is No AccidentDocument29 pagesAg Mechanics Safety: Safety Is No AccidentBONGO John Ryan C.100% (1)

- Words That Are Frequently Used As Answers in Ielts ListeningDocument18 pagesWords That Are Frequently Used As Answers in Ielts ListeningНастяNo ratings yet

- PT Dress CodeDocument5 pagesPT Dress CodeSanjanaNo ratings yet

- Primary Requirements 2023Document2 pagesPrimary Requirements 2023Daniel GallowayNo ratings yet

- Packinbhg ListDocument3 pagesPackinbhg ListJay PatelNo ratings yet

- Camp Packing List v2Document2 pagesCamp Packing List v2blessingNo ratings yet

- 04 Classification of FabricsDocument22 pages04 Classification of FabricsYash BhimaniNo ratings yet

- Comprehensive KonMari ChecklistDocument5 pagesComprehensive KonMari ChecklistFatiha FiprinaNo ratings yet

- Donation SuggestionsDocument1 pageDonation Suggestionsapi-547912992No ratings yet

- Comprehensive KonMari ChecklistDocument6 pagesComprehensive KonMari ChecklistGanea IoanaNo ratings yet

- Recycling GuideDocument21 pagesRecycling GuideAniko TuzkoNo ratings yet

- To Bring ListDocument1 pageTo Bring ListDF Retreat Registration Info BrochureNo ratings yet

- All Clear For Bulgaria 7th Grade Students BookDocument120 pagesAll Clear For Bulgaria 7th Grade Students BookJulia GalasNo ratings yet

- Grade 1 Coursebook Curriculum Sample W Overview 2021Document85 pagesGrade 1 Coursebook Curriculum Sample W Overview 2021Mishkath IoeNo ratings yet

- Zikra School Summer Holiday Worksheet UKG .Document10 pagesZikra School Summer Holiday Worksheet UKG .Abid HussainNo ratings yet

- Document 1Document1 pageDocument 1Shaikh MinhajuddinNo ratings yet

- Preschoolers: ToddlersDocument4 pagesPreschoolers: ToddlersNur Farisa AzizNo ratings yet

- Basketry: Presented By: Aqsa SajidDocument13 pagesBasketry: Presented By: Aqsa SajidAsma IftekharNo ratings yet

- Retreat Pack List PDFDocument1 pageRetreat Pack List PDFAnonymous EvQTzHNo ratings yet

- Winter packing list for CanadaDocument3 pagesWinter packing list for CanadaSmile Foreign EducationNo ratings yet

- Hot Springs AffidavitDocument1 pageHot Springs AffidavitKristenNo ratings yet

- Arkansans Urged To Use Caution With Outdoor Burning Throughout Thanksgiving HolidayDocument1 pageArkansans Urged To Use Caution With Outdoor Burning Throughout Thanksgiving HolidayKristenNo ratings yet

- Appeal DismissedDocument1 pageAppeal DismissedKristenNo ratings yet

- Letter To Col Bryant State Police Re Officer Involved Shooting of Aries ClarkDocument3 pagesLetter To Col Bryant State Police Re Officer Involved Shooting of Aries ClarkKristenNo ratings yet

- Jeff Long Written Notice of TerminationDocument1 pageJeff Long Written Notice of TerminationKristenNo ratings yet

- Money Don't Sleep Federal FugitivesDocument1 pageMoney Don't Sleep Federal FugitivesKristen0% (1)

- Fin Aid UpdateDocument2 pagesFin Aid UpdateKristenNo ratings yet

- Arkansas QB Cole Kelley ArrestedDocument1 pageArkansas QB Cole Kelley ArrestedKristenNo ratings yet

- La'Changes Concert - Herbert Broadway Letter 10-24-17Document2 pagesLa'Changes Concert - Herbert Broadway Letter 10-24-17KristenNo ratings yet

- ABA Mental Illness Resolution, 122-A, 2006, Paragraph 1Document2 pagesABA Mental Illness Resolution, 122-A, 2006, Paragraph 1KristenNo ratings yet

- Appeal DismisedDocument1 pageAppeal DismisedKristenNo ratings yet

- Arkansas Supreme Court RulingDocument4 pagesArkansas Supreme Court RulingKristenNo ratings yet

- GWYNN Filed Complaint, AffidavitDocument12 pagesGWYNN Filed Complaint, AffidavitKristenNo ratings yet

- Money Don't Sleep Defendant ListDocument9 pagesMoney Don't Sleep Defendant ListKristenNo ratings yet

- Email To Sen. FlowersDocument1 pageEmail To Sen. FlowersKristen100% (1)

- Capitol Police ReportDocument1 pageCapitol Police ReportKristenNo ratings yet

- Shigella-Related Daycare ClosureDocument2 pagesShigella-Related Daycare ClosureKristenNo ratings yet

- LRPD Chief's ResponseDocument4 pagesLRPD Chief's ResponseKristenNo ratings yet

- Sausage Recall LabelsDocument1 pageSausage Recall LabelsKristenNo ratings yet

- Sausage Recall LabelsDocument1 pageSausage Recall LabelsKristenNo ratings yet

- AG On Williams vs. ArkansasDocument29 pagesAG On Williams vs. ArkansasKristenNo ratings yet

- Statement From All My Sons Moving & StorageDocument1 pageStatement From All My Sons Moving & StorageKristenNo ratings yet

- Attorney General Response To Marcel Williams Stay To SCOTUSDocument21 pagesAttorney General Response To Marcel Williams Stay To SCOTUSKristenNo ratings yet

- AG On Williams vs. Wendy KelleyDocument33 pagesAG On Williams vs. Wendy KelleyKristenNo ratings yet

- AG Federal District Court ResponseDocument28 pagesAG Federal District Court ResponseKristenNo ratings yet

- SCOTUS Denies Stay of ExecutionDocument1 pageSCOTUS Denies Stay of ExecutionKristenNo ratings yet

- AG On Williams Petition For Stay 1Document43 pagesAG On Williams Petition For Stay 1KristenNo ratings yet

- Attorney General Response To Jones Motion To SCOTUSDocument16 pagesAttorney General Response To Jones Motion To SCOTUSKristenNo ratings yet

- Jack Jones Motion For Stay of ExecutionDocument3 pagesJack Jones Motion For Stay of ExecutionKristenNo ratings yet

- US International Trade Commission Rulings And Harmonized Tariff Schedule DetailsDocument8 pagesUS International Trade Commission Rulings And Harmonized Tariff Schedule Detailsgkanagaraj1963No ratings yet

- Celebrating Love: A Wedding Reception ProgramDocument13 pagesCelebrating Love: A Wedding Reception ProgramTormis Albios Alegarbes RamosNo ratings yet

- Wedding Script April 8 2017Document9 pagesWedding Script April 8 2017Ricky AguilarNo ratings yet

- Sample Wedding ProgrammeDocument8 pagesSample Wedding ProgrammeGj RilloNo ratings yet

- (NOTE: Test Microphone Before Speaking.) (Background Music: - )Document15 pages(NOTE: Test Microphone Before Speaking.) (Background Music: - )robbie_delavega7000No ratings yet

- Lingerie Manufacturing Unit ProcessesDocument16 pagesLingerie Manufacturing Unit ProcessesNeetek SahayNo ratings yet