Professional Documents

Culture Documents

Ch09 TB Hoggetta8e

Uploaded by

Alex SchuldinerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch09 TB Hoggetta8e

Uploaded by

Alex SchuldinerCopyright:

Available Formats

Testbank

to accompany

Accounting

8th Edition

by

John Hoggett, Lew Edwards,

John Medlin, Matthew Tilling

& Evelyn Hogg

Prepared by

Barbara Burns

John Wiley & Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

Chapter 9: Cost accounting systems

Multiple Choice

1. The costing system used when entities provide goods or services in response to customer

orders and specifications is known as:

a. Process costing

b. Job costing

c. Equivalent unit costing

d. Conversion costing

ANSWER B

Section 9.1

2. Match the business with the most likely type of costing system.

1. Oil refinery

2. Automotive brake repairer

3. Bathroom renovator

4. Commercial printer

5. Management consultant

I. Job costing

II. Process costing

a. 1 and I, 2 and II, 3 and I, 4 and II, 5 and I

b. 1 and II, 2 and I, 3 and I, 4 and I, 5 and I

c. 1 and I, 2 and I, 3 and I, 4 and II, 5 and II

d. 1 and II, 2 and II, 3 and I, 4 and I, 5 and I

ANSWER B

Section 9.1

3. The statement concerning the job cost order that is incorrect is:

a. It provides an itemised list of all costs charged to a particular job

b. Orders for incomplete jobs serve as a subsidiary ledger for the work in process account

c. It traces all costs to jobs

d. The control number assigned to each job is recorded on the job order

ANSWER C

Section 9.2

4. Which best describes the set of costs that are debited directly to work in process inventory?

a. Actual direct materials, actual direct labour, actual overhead

b. Actual indirect materials, actual direct labour, applied overhead

c. Actual indirect materials, actual indirect labour, actual overhead

d. Actual direct materials, actual direct labour, applied overhead

John Wiley and Sons Australia, Ltd 2012 9.2

Chapter 9: Cost accounting systems

ANSWER D

Section 9.3

5. For 2011 The Iron Works planned the following:

Factory overhead costs $180 000

Direct labour cost ($8.00 an hour) x (15 000 hrs) $120 000

Machine hours 48 000

Direct material cost $108 000

The predetermined overhead rate is based on direct labour hours and planned production

during 2011 is 12 000 units. The estimated cost per unit produced is:

a. $34

b. $28.60

c. $25

d. $19

ANSWER A

(Direct materials $9 + Direct labour $10 + O/H $15*)*1.25 hrs $12.

Section 9.3

6. The Work in Process account of Village Manufacturing shows a balance of $42 000 at the

end of an accounting period. The job cost orders of the two uncompleted jobs show charges

of $15 000 and $7000 for materials used and charges of $10 000 and $5000 for direct labour

used. From this information it appears that the company is using a predetermined overhead

rate as a percentage of direct labour costs, of:

a. 13.5%

b. 50.0%

c. 33.3%

d. 300%

ANSWER C

$42 000 ($15 000+$7000+$10,000+$5000)/(10 000 + 5000) = $5000/$15 000 = 33.3%.

Section 9.3

7. Manufacturing costs assigned to inventory should appear on the income statement in the

period in which:

a. The goods are completed

b. Cash is collected for the goods sold

c. The sale of goods is recorded

d. The purchase order to manufacture the goods is received

ANSWER C

Section 9.3

8. G Repair Services uses job order costing. At the end of the month the following information

was available:

Job X-1 Job X-2 Job X-3

Direct materials $50 $60 $30

Direct labour $20 $30 $10

9.3 John Wiley and Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

Actual overhead costs are $100. Overhead is applied on the basis of 200% of direct labour

costs. Jobs X-1 and X-2 have been completed and sold. Job X-3 is not yet complete. At

month-end the work in process inventory balance is:

a. $320

b. $260

c. $60

d. $40

ANSWER C

($30 + $10 + OH (200% $10)

Section 9.3

9. Which most accurately describes the flow of costs through the accounting system?

a. Purchases, to Finished Goods, to Work in Process

b. Work in Process, to Cost of sales

c. Factory overhead applied, to Work in Process, to Finished Goods

d. Purchases, to Factory overhead, to Cost of sales

ANSWER C

Section 9.3

10. Predetermined overhead rates are necessary for how many of the following reasons?

Actual overheads are not incurred evenly over the period

Product costs need to be calculated promptly for decision- making

Overhead cannot be traced directly to products because of its indirect nature

a. 0

b. 1

c. 2

d. 3

ANSWER D

Section 9.3

11. The Pike Supply Company distributes overhead based on direct labour dollars. The

estimated manufacturing overhead for the year was $484,000 and the estimated direct

labour dollars for the year were $110,000. Indicate the amount of underapplied or

overapplied overhead if actual direct labour was $118,000 and actual manufacturing

overhead was $497,400:

a. $21,800 underapplied

b. $21,800 overapplied

c. $15,000 overapplied

d. $15,000 underapplied

ANSWER B

Rate is $484,000 / $110,000 = $4.40 per labour dollar.

$4.40 x $118,000 = $519,200 applied - actual $497,400 overhead = $21,800 overapplied

Section 9.3

John Wiley and Sons Australia, Ltd 2012 9.4

Chapter 9: Cost accounting systems

12. Petlyn Pty Ltd applies overhead to completed jobs using a predetermined rate of 60% of

direct labour costs. If Job No 22 shows $9,000 of factory overhead applied, how much

was the direct labour cost of the job?

a. $5,400

b. $12,000

c. $15,000

d. $14,400

ANSWER C

$9,000/60% = $15,000.

Section 9.3

13. In 2011, Brunswick Plumbing Supplies planned the following:

Factory overhead costs $180,000

Direct labour costs (15,000 hours at $8.00 per hour) $120,000

Machine Hours 48,000

Direct material costs $108,000

The predetermined overhead rate is based on direct labour hours and planned production

during 2011 is 12,000 units. The estimated cost per unit produced is:

a. $24.00

b. $44.00

c. $34.00

d. $26.00

ANSWER C

Costs of $180,000 + $120,000 + $108,000 = $408,000/12,000 units = $34.00

Section 9.3

14. Which of these is not a source document for job costing?

a. Materials requisition record

b. Labour hours/time sheets record

c. Invoice for factory expense

d. The marketing managers expense sheet

ANSWER D

Section 9.3

15. Small Budget Production uses a predetermined overhead rate based upon direct labour hours.

The firm has the following budgeted and actual data for the current year:

Budgeted factory overhead cost $5,000

Actual factory overhead cost $6,000

Budgeted direct labour hours 1,000

Actual direct labour hours 1,100

What was the amount of under-or over-applied overhead for the year?

a. $500 overapplied

b. $500 underapplied

c. $1,000 underapplied

d. $1,000 overapplied

9.5 John Wiley and Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

ANSWER B

Actual overhead - applied overhead = $6,000 ($5 1,100 DLH) = $500 underapplied.

Section 9.3

16. Magenta Ltd uses a job order costing system and applies factory overhead, based on direct

labour hours, at a rate of $2 per direct labour hour. The data relating to production for last

period is:

Direct materials $13 000

Indirect materials 2 300

Direct labour (18 000 hours) 54 000

Production supervisor salaries 13 700

Maintenance costs 7 000

Factory rent 8 100

Factory utilities 1 800

Depreciation on machinery 2 200

The overhead under or over-applied after overhead has been charged to production is:

a. $900 over-applied

b. $900 under-applied

c. $2700 over-applied

d. $2700 under-applied

ANSWER A

(Actual overhead applied overhead = $35 100 - $36 000)

Section 9.3

17. Black Cat Limited supplies the following information. Manufacturing overhead is applied

on the basis of direct labour hours.

Estimated manufacturing overhead costs $2,295,000

Estimated direct labour hours 340,000

Actual direct labour hours 348,000

Actual manufacturing overhead costs $2,357,000

Compute the amount of overapplied or underapplied overhead.

a. $8,800 underapplied

b. $8,000 overapplied

c. $8,000 underapplied

d. $8 800 overapplied

ANSWER C

Rate is $2,295,000 / 340,000hours = $6.75 per hour.

$6.75 x 348,000 hours = $2,349,000 applied - $2,357,000 actual = $8,000 underapplied

Section 9.3

18. Equivalent units are:

a. The number of whole units represented by the finished units plus the partly completed

units

b. The number of whole units represented by the finished units

c. The units represented by the total manufacturing costs for the period

d. The units that would have been produced under optimum circumstances

ANSWER A

John Wiley and Sons Australia, Ltd 2012 9.6

Chapter 9: Cost accounting systems

Section 9.4

19. Which of these is not a section of a cost of production report?

a. Physical flow schedule

b. Costs to be accounted for

c. Costs accounted for

d. GST summary

ANSWER D

Section 9.4

20. Beginning balance Job No 58 $18,800

Direct Materials issued to job in the current period $30,600

Direct Labour charged to job in the current period $24,500

Manufacturing overhead applied in the current period $ 40,100

Total number of units produced by Job 58 30,000

What is the unit cost for Job 58?

a. $3.85

b. $3.80

c. $4.00

d. $3.91

ANSWER B

Costs of $18,800 + $30,600 + $24,500 + $40,100 = $114,000 /30,000 units = $3.80

Section 9.4

21. Smith Co started 40 000 units into production during the current period and completed

28 000. The other 12 000 units were 30% complete as to conversion costs at the end of

the period. Total costs were $60 000 for material and $36 000 for conversion costs.

Material is added at the beginning of the production process. Unit raw material and

conversion costs for the period were:

Raw materials cost Conversion cost

a. $5.00 $10.00

b. $1.50 $10.00

c. $5.00 $ .90

d. $1.50 $ 1.14

ANSWER D

(Raw materials $60 000/40 000 EU = $1.50; Conversion $36 000/31 600 EU = $1.14)

Section 9.5

22. Port Manufacturing uses the weighted-average method of computing equivalent units of

production. For beginning work in process there were 9000 units 30% complete as to

materials and conversion costs. For ending work in process there were 5000 units 60%

complete as to materials and conversion costs. 13 000 units were completed during the year.

Determine the equivalent units of production.

a. 16 000

b. 19 300

c. 20 000

d. 22 300

9.7 John Wiley and Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

ANSWER A

Completed units + (60% ending WIP (5000 units) +13 000 units = 16,000 EU.

Section 9.5

23. Which of these differs between job order and process costing?

a. Basic purpose

b. Focal point for cost accumulation

c. Tracing of direct costs and allocation of indirect costs

d. Cost flows

ANSWER B

Section 9.6

24. The correct statement concerning process costing is:

a. The type of production is heterogeneous

b. The flow of products is separated by jobs

c. The control document is a cost of production report

d. Record keeping is more detailed than for job costing

ANSWER C

Section 9.6

25. The correct statement concerning cost accounting for service type businesses is:

a. Cost information is needed for different reasons in a service business than in a

manufacturing business

b. The cost object is normally activities

c. Actual costs rather than budgeted costs are used to determine overhead application rates

d. To determine the rate at which direct labour costs are applied to a particular job a labour

cost per hour is developed for each employee.

ANSWER D

Section 9.7

26. In an ideal just-in-time processing plant, the inventories held are:

a. Direct materials

b. Work in process

c. Finished goods

d. Supplies of packaging

ANSWER B

Section 9.8

27. Something that is not a feature of just-in-time processing is:

a. Strict quality control

b. A steady, reliable supply of raw materials and labour

c. A variable demand from customers

d. Efficiency in the production process

ANSWER C

John Wiley and Sons Australia, Ltd 2012 9.8

Chapter 9: Cost accounting systems

Section 9.8

28. It is incorrect concerning Activity-Based Costing [ABC] that:

a. Production processes are broken down into activities

b. Cost drivers are used to assign costs between activities

c. The use of cost drivers allows management to apply overhead more accurately to

products with different production requirements

d. It is now used by firms much more commonly than traditional costing

ANSWER D

Section 9.9

29. The statement concerning cost drivers that is incorrect is:

a. As direct labour shrinks as a proportion of manufacturing costs it becomes a more

accurate factor by which to apply overhead to products

b. A cost driver is a measure of the activity that causes overhead costs

c. In modern day manufacturing there has been a decline in labour costs and an increase in

factory overheads as a percentage of product costs

d. Inaccurate application of overhead to products can lead to wrong conclusions about

which products are profitable

ANSWER A

Section 9.9

30. The statement concerning Activity-based costing (ABC) that is not true is:

a. It has been introduced to overcome distortions in costing multiple products which occur

when a single base is used to apply overhead to products

b. ABC is cheaper and less time consuming to implement than traditional costing systems

c. Overhead costs are accumulated by activities and then assigned to cost objects using a

different cost driver for each activity.

d. ABC can be applied in service businesses as well as in manufacturing businesses

ANSWER B

Section 9.9

31. It is true that Just-in-time (JIT) processing:

a. Is most suitable for small businesses

b. Reflects a push approach to manufacturing

c. Runs the risk of interruptions in supply

d. Applies to inputs of materials rather than outputs of products

ANSWER C

Section 9.8

32. Equivalent units of production measures:

a. The number of partial jobs completed in the period

b. The production level which could have been achieved under optimum circumstances

c. The number of full units that could have been completely produced with the effort

expended

d. The number of jobs started but not completed in the period

9.9 John Wiley and Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

ANSWER C

Section 9.5

33. The flow of goods in a firm that uses process costing is, work in process at the start 5000

units complete, units started 54,000, units finished 50,000, work in process end of period

9000 units 1/3 complete. Raw materials are issued at the end of the production process.

Using the weighted average method, the equivalent units as to conversion cost for the period

are:

a. 53,000 units

b. 50,000 units

c. 54,000 units

d. 57,000 units

ANSWER A

50,000 completed units for materials and conversion costs and 3,000 partly completed units

(9000 x 1/3) for conversion costs. = 53,000 equivalent units for conversion costs.

Section 9.6

34. Which of these inputs are debited to a work in-process account with a process costing

system?

a. Direct materials and direct labour

b. Direct labour and factory overhead applied

c. Direct materials, direct labour and factory overhead applied

d. Direct materials and factory overhead applied

ANSWER C

Section 9.4

35. The method of calculating equivalent units where the costs assigned to the beginning

inventory of work-in-process are combined with the current periods costs of production and

the degree of completion of the beginning units is ignored is the:

a. first-in-first-out method

b. last-in-last-out method

c. last-in-first-out method

d. weighted average method

ANSWER D

Section 9.4

John Wiley and Sons Australia, Ltd 2012 9.10

Chapter 9: Cost accounting systems

Fill-in the blanks

1. The two types of cost accounting systems are j______ costing and p________ costing.

ANSWER job; process

Section 9.1

2. The control document used in job order costing is the j_____ c_______ order.

ANSWER job cost

Section 9.2

3. When a job is completed, the costs recorded on its job cost order are totalled and the

amount (debited/credited) __________ to finished goods inventory.

ANSWER debited

Section 9.2

4. Direct materials are issued to work in process upon receipt of a properly prepared and

authorised m___________ r______________.

ANSWER materials requisition

Section 9.3

5. Factory overhead is charged to jobs by means of a predetermined o______________ rate.

ANSWER overhead

Section 9.3

6. The combined cost of direct labour and factory overhead incurred in converting raw

materials into finished goods is known as c________________ cost.

ANSWER conversion

Section 9.4

7. The applied factory overhead is (debited/credited) ____________________ to the factory

overhead account.

ANSWER credited

Section 9.3

8. The usual treatment for under-applied overhead at year-end is to add it to ___________

__ ________ sold.

ANSWER cost of goods

Section 9.3

9. P___________ costing is used by firms with continuous production flows which are

usually found in industries which mass produce.

9.11 John Wiley and Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

ANSWER Process

Section 9.4

10. E____________ u___________ are a measure of how many whole units of production

are represented by the units finished, plus the units partially finished, in a process costing

operation.

ANSWER Equivalent units

Section 9.4

11. A________-________ costing is a system in which overhead costs are accumulated by

activities and the cost pools for each activity are assigned to the cost object by means of

individual cost drivers.

ANSWER activity-based

Section 9.9

Exam type questions

QUESTION 9.1

The Hutton Manufacturing Company distributes manufacturing overhead based on direct

labour hours. The estimated manufacturing overhead for the year was $484,000 and the

estimated direct labour hours for the year were $110,000.

REQUIRED:

a) Calculate the charge out rate for overhead.

b) Indicate the underapplied or overapplied overhead under each of the following

independent situations:

i. Actual direct labour hours 98,000, actual manufacturing overhead $418,800

ii. Actual direct labour hours 118,000, actual manufacturing overhead $497,400

iii. Actual direct labour hours 114,000, actual manufacturing overhead $510,000

QUESTION 9.2

Consider the following data prepared for the Assembly Division of Stanley Aerospace for the

month of May. The company uses the weighted-average method of process costing.

Physical units Direct materials Conversion

(jet engines) costs

Beginning work-in-progress May 1# 8 $4,933,600 $910,400

Started in May 2011 50

Completed during May 2011 46

Ending work-in-progress May 31* 12

Costs added during May 2011 $32,200,000 $13,920,000

# Degree of completion: direct materials 90%; conversion cost 40%

* Degree of completion: direct materials 60%; conversion cost 30%

John Wiley and Sons Australia, Ltd 2012 9.12

Chapter 9: Cost accounting systems

REQUIRED:

a) Compute equivalent units for direct materials and conversion costs. (Use the weighted

average method)

b) Calculate cost per equivalent unit for direct materials and conversion costs.

c) Prepare a cost of production report.

Solutions exam type questions

SOLUTION QUESTION 9.1

a)

Charge out rate = Estimated manufacturing overhead costs / estimated direct labour hour

= $484,000 / 110,000

= $4.40 per direct labour hour.

b) i.

Applied overhead: $4.40 x 98,000 direct labour hours = $431,200 applied

$431,200 applied manufacturing overhead

$418,800 less actual manufacturing overhead

$ 12,400 overapplied manufacturing overhead

b) ii.

Applied overhead: $4.40 x 118,000 direct labour hours = $519,200 applied

$519,200 applied manufacturing overhead

$497,400 less actual manufacturing overhead

$ 21,800 overapplied manufacturing overhead

b) iii.

Applied overhead: $4.40 x $114,000 direct labour hours = $501,600 applied

$501,600 applied manufacturing overhead

$510,000 less actual manufacturing overhead

$ 8,400 underapplied manufacturing overhead

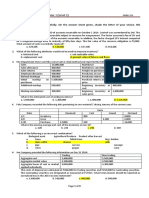

SOLUTION 9.2

(a)

Equivalent units (direct materials) = 53.2 units

Equivalent units (conversion cost) = 49.6 units

Stanley Aerospace Assembly Division

Flow of production Physical units (given) Equivalent units Equivalent units

(Direct materials) (Conversion costs)

9.13 John Wiley and Sons Australia, Ltd 2012

Testbank to accompany Accounting 8e

Work in progress 8

beginning

Started during 50

current period

To account for 58

Completed and 46 46 46

transferred out

Work in progress end 12 # 7.2 # 3.6

(12 x 60%) (12 x 30%)

Accounted for 58

Work done to date # 53.2 # 49.6

# units to be used in the cost of production report.

b)

Cost per equivalent unit- direct materials $698,000

Cost per equivalent unit- conversion cost $299,000

c)

Stanley Aerospace, Assembly Division,

Cost of Production Report For the month ended 31 May 2011

Total production

costs Direct materials Conversion costs

$ $ $

Work in progress - beginning 5,844,000 4,933,600 910,400

Costs added - current period 46,120,000 32,200,000 13,920,000

Costs incurred to date 37,133,600 14,830,400

Divide by equivalent units 53.2 units 49.6 units

Cost per equivalent units to date 698,000 299,000

Total costs to account for 51,964,000

Assignment of costs:

Completed and transferred (46) 45,862,000 (46 units x (46 units x

698,000) 299,000)

Work in progress - ending - 5,025,600 7.2 units x 698,000

direct materials

Work in progress - ending - 1,076,400 3.6 units x

conversion costs 299,000

Total work in progress 6,102,000

Total costs accounted for 51,964,000

John Wiley and Sons Australia, Ltd 2012 9.14

You might also like

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- 2012 EE enDocument76 pages2012 EE enDiane MoutranNo ratings yet

- Chapter 15 Transfer Pricing QDocument9 pagesChapter 15 Transfer Pricing QMaryane AngelaNo ratings yet

- Review Sheet Exam 2Document17 pagesReview Sheet Exam 2photo312100% (1)

- Variable Cost Analysis Using High-Low MethodDocument6 pagesVariable Cost Analysis Using High-Low MethodApoorva DhimarNo ratings yet

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- Analyze BJ Company ProfitabilityDocument11 pagesAnalyze BJ Company ProfitabilityMUHAMMAD AZAMNo ratings yet

- PRACTICE EXERCISES INTANGIBLES Students 2021Document3 pagesPRACTICE EXERCISES INTANGIBLES Students 2021Nicole Anne Santiago SibuloNo ratings yet

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Document10 pagesThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNo ratings yet

- Nobles Acct10 Tif 21Document205 pagesNobles Acct10 Tif 21Marqaz MarqazNo ratings yet

- A-2 Final Review 15-16 KeyDocument10 pagesA-2 Final Review 15-16 KeydanNo ratings yet

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanNo ratings yet

- Calculating variable and fixed costs for units producedDocument12 pagesCalculating variable and fixed costs for units producedashibhallau100% (1)

- MAS Midterm Review: Products, Budgets, ROI & Variance AnalysisDocument12 pagesMAS Midterm Review: Products, Budgets, ROI & Variance AnalysisZyrelle DelgadoNo ratings yet

- Ace 202Document4 pagesAce 202bacad lyca jaynNo ratings yet

- Tutorial 1 Chapter 7Document8 pagesTutorial 1 Chapter 7Aqila Syakirah IVNo ratings yet

- Prologue: Managerial Accounting and The Business EnvironmentDocument156 pagesPrologue: Managerial Accounting and The Business EnvironmentMarcus MonocayNo ratings yet

- Kuis Perbaikan UTS AKbi 2016-2017Document6 pagesKuis Perbaikan UTS AKbi 2016-2017Rizal Sukma PNo ratings yet

- Managerial Accounting Changes Due to E-Business, Globalization & New IndustriesDocument7 pagesManagerial Accounting Changes Due to E-Business, Globalization & New IndustriesvkdocNo ratings yet

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- Property Plant Equipment: Sukhpreet KaurDocument79 pagesProperty Plant Equipment: Sukhpreet KaurJeryl AlfantaNo ratings yet

- Pedriani Company Job Order Costing for January 2014Document8 pagesPedriani Company Job Order Costing for January 2014mohitgaba19No ratings yet

- Assignment - Intangible AssetDocument5 pagesAssignment - Intangible AssetJane DizonNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Test of Labour Overheads and Absorption and Marginal CostingDocument4 pagesTest of Labour Overheads and Absorption and Marginal CostingzairaNo ratings yet

- Invest in Equity SecuritiesDocument3 pagesInvest in Equity SecuritiesGIRLNo ratings yet

- 9.1 Objective 9.1: Chapter 9 Inventory Costing and Capacity AnalysisDocument76 pages9.1 Objective 9.1: Chapter 9 Inventory Costing and Capacity AnalysisMayank AgarwalNo ratings yet

- Soal AkmDocument5 pagesSoal AkmCarvin HarisNo ratings yet

- ACC2002L Financial Management Question PackDocument67 pagesACC2002L Financial Management Question PackAhamed NabeelNo ratings yet

- Final Exam, s1, 2019 FINALDocument12 pagesFinal Exam, s1, 2019 FINALShivneel NaiduNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- Ais The Expenditure Cycle Purchasing To Cash Disbursements Test BankDocument29 pagesAis The Expenditure Cycle Purchasing To Cash Disbursements Test Bankgutlaysophia06No ratings yet

- Job Costing CADocument13 pagesJob Costing CAmiranti dNo ratings yet

- Accounting Test Prep 1Document9 pagesAccounting Test Prep 1Swathi ShekarNo ratings yet

- Effective Interest AmortizationDocument25 pagesEffective Interest AmortizationSheila Grace BajaNo ratings yet

- CH 4Document10 pagesCH 4Abrha Giday0% (1)

- This Study Resource Was: InstructionsDocument3 pagesThis Study Resource Was: InstructionsRama fauziNo ratings yet

- CHAPTER 23: Biological Assets: Problem 1Document2 pagesCHAPTER 23: Biological Assets: Problem 1Mark IlanoNo ratings yet

- COST ALLOCATION and ACTIVITY-BASED COSTINGDocument5 pagesCOST ALLOCATION and ACTIVITY-BASED COSTINGBeverly Claire Lescano-MacagalingNo ratings yet

- Assignment 1 - Chapter 2Document6 pagesAssignment 1 - Chapter 2Ho Thi Phuong ThaoNo ratings yet

- Lecture 2 (For Student)Document46 pagesLecture 2 (For Student)vaneciaNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- ACC 123 Cost Concepts and Behavior Practice ProblemsDocument2 pagesACC 123 Cost Concepts and Behavior Practice ProblemsFrancine Thea M. LantayaNo ratings yet

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Fin 018 Problem SolvingDocument7 pagesFin 018 Problem SolvingVincenzo CassanoNo ratings yet

- Break-Even Analysis: Cost-Volume-Profit AnalysisDocument64 pagesBreak-Even Analysis: Cost-Volume-Profit AnalysisKelvin LeongNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- Valuing Bonds Yield Maturity CurrentDocument12 pagesValuing Bonds Yield Maturity CurrentLaraNo ratings yet

- MA1 test chapter 03 costingDocument4 pagesMA1 test chapter 03 costingshahabNo ratings yet

- Ryerson University Department of Economics ECN 204 Midterm Winter 2013Document22 pagesRyerson University Department of Economics ECN 204 Midterm Winter 2013creepyslimeNo ratings yet

- Answer Key - Financial ManagementDocument5 pagesAnswer Key - Financial ManagementAstro AstroNo ratings yet

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

- Ppe - WorksheetDocument7 pagesPpe - Worksheetbereket nigussieNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Easy RoundDocument3 pagesEasy RoundAllen Carambas AstroNo ratings yet

- Test Bank Business Environment and Concepts 2Document69 pagesTest Bank Business Environment and Concepts 2Sky SoronoiNo ratings yet

- Ch08 TB Hogget8eDocument14 pagesCh08 TB Hogget8eAlex SchuldinerNo ratings yet

- Ch10 TB Hoggetta8eDocument17 pagesCh10 TB Hoggetta8eAlex Schuldiner73% (15)

- Ch07 TB Hoggetta8eDocument20 pagesCh07 TB Hoggetta8eAlex Schuldiner50% (2)

- Ch03 TB Hoggetta8eDocument15 pagesCh03 TB Hoggetta8eAlex Schuldiner75% (8)

- Ch05 TB Hoggetta8eDocument18 pagesCh05 TB Hoggetta8eAlex Schuldiner100% (2)

- Ch06 TB Hoggetta8eDocument16 pagesCh06 TB Hoggetta8eAlex Schuldiner93% (14)

- Ch04 TB Hoggetta8eDocument19 pagesCh04 TB Hoggetta8eAlex Schuldiner100% (10)

- Ch02 TB Hoggetta8eDocument11 pagesCh02 TB Hoggetta8eAlex Schuldiner100% (1)

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Ch01 TB Hoggetta8eDocument11 pagesCh01 TB Hoggetta8eAlex SchuldinerNo ratings yet

- Exam 1 5Document6 pagesExam 1 5Alex Schuldiner0% (1)

- Exam 1 8Document9 pagesExam 1 8Kenneth DelacruzNo ratings yet

- Stalingrad: A Turning Point in World War IIDocument9 pagesStalingrad: A Turning Point in World War IIidunnololNo ratings yet

- Practice Exam Chapters 1-4 Solutions: Problem IDocument6 pagesPractice Exam Chapters 1-4 Solutions: Problem IJesse NgaliNo ratings yet

- Practice Exam Chapters 1-5 Adjusting EntriesDocument7 pagesPractice Exam Chapters 1-5 Adjusting Entriesswoop9No ratings yet

- The End of MADDocument38 pagesThe End of MADAlex SchuldinerNo ratings yet

- DocumentDocument1 pageDocumentAlex SchuldinerNo ratings yet

- The End of MADDocument38 pagesThe End of MADAlex SchuldinerNo ratings yet

- Exam 1 5Document6 pagesExam 1 5Alex Schuldiner0% (1)

- Practice Exam Chapters 1-5 Adjusting EntriesDocument7 pagesPractice Exam Chapters 1-5 Adjusting Entriesswoop9No ratings yet

- CAP - 5 - 54. Billions and Billions of Demons - by Richard C. Lewontin - The New York Review of BooksDocument11 pagesCAP - 5 - 54. Billions and Billions of Demons - by Richard C. Lewontin - The New York Review of BooksRaimundo Filho100% (1)

- Trilead bis(carbonate) dihydroxide identified as SVHC due to reproductive toxicityDocument7 pagesTrilead bis(carbonate) dihydroxide identified as SVHC due to reproductive toxicityCekinNo ratings yet

- GEK_30375M Lubrication SpecificationsDocument34 pagesGEK_30375M Lubrication SpecificationsMARITZA GABRIELA ARIZABAL MEDINANo ratings yet

- CKD EsrdDocument83 pagesCKD EsrdRita Lakhani100% (1)

- EDC MS 6.4 System DescriptionDocument10 pagesEDC MS 6.4 System Descriptionmarsh2002No ratings yet

- Catalogo - Itens 10 e 34Document15 pagesCatalogo - Itens 10 e 34Anderson Silva CarvalhoNo ratings yet

- KitchenAid 5ksm150psDocument18 pagesKitchenAid 5ksm150psFrancisco AlvarezNo ratings yet

- WasdabDocument13 pagesWasdabfakhri84No ratings yet

- Butonal NS 175 TDSDocument2 pagesButonal NS 175 TDSPT. PITAGORAS KONSULTANNo ratings yet

- 1 s2.0 S0149763418301957 MainDocument24 pages1 s2.0 S0149763418301957 MainjackNo ratings yet

- List of Job Specific Safety PPE Used On Site.Document2 pagesList of Job Specific Safety PPE Used On Site.Aejaz MujawarNo ratings yet

- Research Paper - Perceptions of Grade 11 STEM Students Towards ContraceptivesDocument9 pagesResearch Paper - Perceptions of Grade 11 STEM Students Towards ContraceptivesKyle BinuyaNo ratings yet

- Egyptian GlyphsDocument35 pagesEgyptian GlyphsDrMoor0% (1)

- A Lesson Design in HELE 6 Chapter 2Document6 pagesA Lesson Design in HELE 6 Chapter 2Jestoni Paragsa100% (5)

- Agemp Two MarksDocument8 pagesAgemp Two MarksKishore CrazeNo ratings yet

- Fire & Gas Design BasisDocument2 pagesFire & Gas Design BasisAdil MominNo ratings yet

- Msae Msae2018-Arwm012 Full Dronespraying 2Document4 pagesMsae Msae2018-Arwm012 Full Dronespraying 2Muhammad Huzaifah Mohd RoslimNo ratings yet

- Explorations in PersonalityDocument802 pagesExplorations in Personalitypolz2007100% (8)

- Flow Meter SpecificationDocument2 pagesFlow Meter SpecificationDan4ChristNo ratings yet

- Coca-Cola's CSR efforts to refresh world sustainablyDocument4 pagesCoca-Cola's CSR efforts to refresh world sustainablyAfolarin AdioNo ratings yet

- Body Language - Julius FastDocument30 pagesBody Language - Julius FastPat Kifrynski100% (1)

- Frenny PDFDocument651 pagesFrenny PDFIftisam AjrekarNo ratings yet

- PositionsDocument4 pagesPositionsMixsz LlhAdyNo ratings yet

- How Children Learn LanguageDocument28 pagesHow Children Learn LanguageHuỳnh Lê Quang ĐệNo ratings yet

- Ravi ProjectDocument92 pagesRavi ProjectAvinash Avii100% (1)

- List of Employees with Start and End DatesDocument394 pagesList of Employees with Start and End DatesMuhammad Faishal TazakkaNo ratings yet

- Physical Science - q3 - Slm3Document15 pagesPhysical Science - q3 - Slm3Boyet Alvarez AtibagosNo ratings yet

- Teardrop by Lauren KateDocument47 pagesTeardrop by Lauren KateRandom House Teens88% (16)

- Brand Mgt. StarbucksDocument3 pagesBrand Mgt. StarbucksPrashansa SumanNo ratings yet