Professional Documents

Culture Documents

Cash Flow Cal

Uploaded by

uygh gCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Cal

Uploaded by

uygh gCopyright:

Available Formats

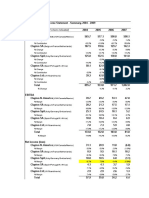

Cash Flow

1 2 3

2007A 2008A 2009A 2010A 2011A 2012F 2013F 2014F

Revenue 524.8 436.9 357.5 328.4 299.5 287.1 282.5 288.1

Growth Rate -16.7% -18.2% -8.1% -8.8% -4.1% -1.6% 2.0%

Operating Profit 30.2 40.1 26.5 6.3 14.2 13.7 21.3

Growth Rate 6.9% 11.2% 8.1% 2.1% 4.9% 4.8% 7.4%

Cash flow item

D&A 27.7 24.9 22.8 22.1 20 16 12

CAPEX 16.3 6.2 5.5 3.5 5 5.5 5.9

B/S item

NWC 26.2 21.8 17.9 16.4 15 14.4 14.1 14.4

Tax rate 35%

EBIT * (1-Tc) 19.63 26.065 17.225 4.095 9.23 8.905 13.845

Plus: D&A 27.7 24.9 22.8 22.1 20 16 12

Less: CAPEX -16.3 -6.2 -5.5 -3.5 -5 -5.5 -5.9

Less: Chg in NWC 4.4 3.9 1.5 1.4 0.6 0.3 -0.3

FCF 35.43 48.665 36.025 24.095 24.83 19.705 19.645

Terminal Value

PV 23.60 17.81 16.88

NPV 99.71

Less: Tempa 30 0.3008694

Net PV 69.71

Plus: Cash 23.1 16.149917

Less: IBD 685 478.90447

Equity Value -592.19 -462.75

4 5

2015F 2016F

293.9 299.8

2.0% 2.0%

28.1 30

9.6% 10.0%

9 6

6 6

14.7 15

18.265 19.5

9 6

-6 -6

-0.3 -0.3

20.965 19.2

12.1

17.12 24.30

Discount Factor

Risk premium 6.0%

Debt beta 0.2

Risk Free rate 2.9%

Cost of Debt 8.0%

Term Loan 0.551656 5% 3%

Senior Notes 0.448344 11.75% 5%

Equity Beta 2.29

Equity 0.0516717

Debt 0.9483283

Beta_u 0.31

r_e 4.7%

r_wacc 5.19%

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- TacticsDocument4 pagesTacticsuygh gNo ratings yet

- Basm - Ftmba - 2017Document9 pagesBasm - Ftmba - 2017uygh gNo ratings yet

- Roland Berger Regenerative MedicineDocument16 pagesRoland Berger Regenerative Medicineuygh gNo ratings yet

- CourierDocument14 pagesCourieruygh gNo ratings yet

- Abbott Memo Draft 1Document8 pagesAbbott Memo Draft 1uygh gNo ratings yet

- Case Draft - Key Findings NotesDocument44 pagesCase Draft - Key Findings Notesuygh gNo ratings yet

- Cost Benefit For AbsenteeismDocument2 pagesCost Benefit For Absenteeismuygh gNo ratings yet

- Workbook 1Document3 pagesWorkbook 1uygh gNo ratings yet

- Cadbury Schweppes: Public Limited CompanyDocument64 pagesCadbury Schweppes: Public Limited Companyuygh gNo ratings yet

- Case Draft - Key Findings NotesDocument44 pagesCase Draft - Key Findings Notesuygh gNo ratings yet

- Financial and Background Analysis ClyatonDocument16 pagesFinancial and Background Analysis Clyatonuygh gNo ratings yet

- Consulting Course - Mercury CaseDocument18 pagesConsulting Course - Mercury Caseuygh gNo ratings yet

- Hansson Exhibits PS (Draft 1)Document17 pagesHansson Exhibits PS (Draft 1)uygh gNo ratings yet

- Clayton ExhibitsDocument4 pagesClayton Exhibitsuygh gNo ratings yet

- El Cerrito Presentation (DRAFT) - BASM 523 - Sept 11, 2017Document9 pagesEl Cerrito Presentation (DRAFT) - BASM 523 - Sept 11, 2017uygh gNo ratings yet

- Disney Memo Draft 1Document4 pagesDisney Memo Draft 1uygh gNo ratings yet

- BASM 523 - Management Consulting and Corporate Decision Support 2Document10 pagesBASM 523 - Management Consulting and Corporate Decision Support 2uygh gNo ratings yet

- Abbott Memo Draft 3Document3 pagesAbbott Memo Draft 3uygh gNo ratings yet

- Facebook CALDocument3 pagesFacebook CALuygh gNo ratings yet

- Mercury CaseDocument23 pagesMercury Caseuygh gNo ratings yet

- Abbott ABT PDFDocument39 pagesAbbott ABT PDFuygh g100% (1)

- BAEN502 - Growing and Exiting A Venture - Outline.v1Document7 pagesBAEN502 - Growing and Exiting A Venture - Outline.v1uygh gNo ratings yet

- Mercury CaseDocument23 pagesMercury Caseuygh gNo ratings yet

- Starbucks Memo Draft 1Document2 pagesStarbucks Memo Draft 1uygh gNo ratings yet

- Group 4: My Name Is Shan ..Weijian ShanDocument4 pagesGroup 4: My Name Is Shan ..Weijian Shanuygh gNo ratings yet

- RIghtNow TechnologiesDocument2 pagesRIghtNow Technologiesuygh gNo ratings yet

- The Rise of Private Equity in China - A Case Study of Successful ADocument82 pagesThe Rise of Private Equity in China - A Case Study of Successful Auygh gNo ratings yet

- Real StoryDocument9 pagesReal Storyuygh gNo ratings yet

- SDB Memo Draft 1Document5 pagesSDB Memo Draft 1uygh gNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Alphabet Bean BagsDocument3 pagesAlphabet Bean Bagsapi-347621730No ratings yet

- CERTIFICATE - Guest Speaker and ParentsDocument4 pagesCERTIFICATE - Guest Speaker and ParentsSheryll Eliezer S.PantanosaNo ratings yet

- Intel It Aligning It With Business Goals PaperDocument12 pagesIntel It Aligning It With Business Goals PaperwlewisfNo ratings yet

- Syllabus For The Post of ASI - Traffic - WardensDocument2 pagesSyllabus For The Post of ASI - Traffic - WardensUbaid KhanNo ratings yet

- SHS Track and Strand - FinalDocument36 pagesSHS Track and Strand - FinalYuki BombitaNo ratings yet

- Sample PPP Lesson PlanDocument5 pagesSample PPP Lesson Planapi-550555211No ratings yet

- Syllabus Sibos CLTDocument5 pagesSyllabus Sibos CLTgopimicroNo ratings yet

- Barnett Elizabeth 2011Document128 pagesBarnett Elizabeth 2011Liz BarnettNo ratings yet

- Bioethics: Bachelor of Science in NursingDocument6 pagesBioethics: Bachelor of Science in NursingSherinne Jane Cariazo0% (1)

- Wells Fargo StatementDocument4 pagesWells Fargo Statementandy0% (1)

- Dwnload Full Marriage and Family The Quest For Intimacy 8th Edition Lauer Test Bank PDFDocument35 pagesDwnload Full Marriage and Family The Quest For Intimacy 8th Edition Lauer Test Bank PDFrainbow.basque1cpq100% (10)

- Brochure Financial Planning Banking & Investment Management 1Document15 pagesBrochure Financial Planning Banking & Investment Management 1AF RajeshNo ratings yet

- Week 4-LS1 Eng. LAS (Types of Verbals)Document14 pagesWeek 4-LS1 Eng. LAS (Types of Verbals)DONALYN VERGARA100% (1)

- Other Project Content-1 To 8Document8 pagesOther Project Content-1 To 8Amit PasiNo ratings yet

- Transportation ProblemDocument12 pagesTransportation ProblemSourav SahaNo ratings yet

- Inflammatory Bowel DiseaseDocument29 pagesInflammatory Bowel Diseasepriya madhooliNo ratings yet

- Centre's Letter To States On DigiLockerDocument21 pagesCentre's Letter To States On DigiLockerNDTVNo ratings yet

- The Forum Gazette Vol. 2 No. 23 December 5-19, 1987Document16 pagesThe Forum Gazette Vol. 2 No. 23 December 5-19, 1987SikhDigitalLibraryNo ratings yet

- Surrender Deed FormDocument2 pagesSurrender Deed FormADVOCATE SHIVAM GARGNo ratings yet

- The Gnomes of Zavandor VODocument8 pagesThe Gnomes of Zavandor VOElias GreemNo ratings yet

- Information BulletinDocument1 pageInformation BulletinMahmudur RahmanNo ratings yet

- DSA Interview QuestionsDocument1 pageDSA Interview QuestionsPennNo ratings yet

- Unit 9Document3 pagesUnit 9Janna Rick100% (1)

- God Love Value CoreDocument11 pagesGod Love Value CoreligayaNo ratings yet

- Lcolegario Chapter 5Document15 pagesLcolegario Chapter 5Leezl Campoamor OlegarioNo ratings yet

- GPAODocument2 pagesGPAOZakariaChardoudiNo ratings yet

- CARET Programme1 Bennett-1Document10 pagesCARET Programme1 Bennett-1TerraVault100% (3)

- Electric Vehicles PresentationDocument10 pagesElectric Vehicles PresentationKhagesh JoshNo ratings yet

- Category Theory For Programmers by Bartosz MilewskiDocument565 pagesCategory Theory For Programmers by Bartosz MilewskiJohn DowNo ratings yet

- Structuring Your Novel Workbook: Hands-On Help For Building Strong and Successful StoriesDocument16 pagesStructuring Your Novel Workbook: Hands-On Help For Building Strong and Successful StoriesK.M. Weiland82% (11)