Professional Documents

Culture Documents

Understanding a Model Balance Sheet

Uploaded by

Hina JeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding a Model Balance Sheet

Uploaded by

Hina JeeCopyright:

Available Formats

DEPARTMENT OF HEALTH SERVICES STATE OF WISCONSIN

Division of Quality Assurance Chapter 50.02(2)(a), Wis. Stats.

F-62674A (Rev. 07/08) Page 1 of 2

MODEL BALANCE SHEET

This form may be used when submitting a license application for an Adult Family Home (AFH), a Community Based Residential

Facility (CBRF), or a Home Health Agency (HHA).

Read instructions on page 2 before completing this form.

Name Agency Date Completed

Address

ASSETS LIABILITIES

Current Assets Current Liabilities

Cash in Bank Accounts Payable

Other Short Term Investments

Loans Payable (due within 12 months)

(e.g., money market, stocks, CDs)

Prepaid Expenses Accrued Payroll / Withholding

Receivables Taxes Payable

Other (Specify.) Current Portion of Long Term Debt

Other (Specify.)

Total Assets (Current) Total Liabilities (Current)

Fixed Assets Long Term Liabilities

Vehicles Loans Payable (due after 12 months)

(e.g., land contract, mortgage, vehicles,

Furniture and Equipment

bank loans, etc.)

Leasehold Improvements

Real Estate / Buildings

Other (Specify.) Other (Specify.)

Total Assets (Fixed) Total Liabilities (Long Term)

TOTAL ASSETS TOTAL LIABILITIES

(Current plus Fixed) (Current plus Long Term)

Total Assets must equal the sum total of owners total liability and owners equity (net worth).

OWNERS EQUITY (NET WORTH) TOTAL ASSETS

TOTAL ASSETS TOTAL LIABILITIES

TOTAL LIABILITIES OWNERS EQUITY

OWNERS EQUITY TOTAL ASSETS

F-62674A (Rev. 07/08) Page 2 of 2

MODEL BALANCE SHEET

This balance sheet is used when submitting a license application for an Adult Family Home (AFH), a Community Based

Residential Facility (CBRF), or a Home Health Agency (HHA). The Model Balance Sheet is a suggested format; however,

the same basic information is required when using another format. Other balance sheet formats containing the

required information will be accepted.

A. What is a balance sheet? What is it used for?

A balance sheet is a financial snapshot of you or your business at a given date in time. The balance sheet provides

information on what you or your business own (assets), what you or your business owe (liabilities), and your net

worth or the value of the business (equity). The term balance sheet is derived from the fact that these accounts

must always be in balance. Assets must always equal the sum of liabilities and equity. By analyzing your balance

sheet, one can assess your financial status and examine the following:

Can you or your business meet short term obligations?

Can you or your business pay all current and long term debts as they come due?

Are you or your business overly indebted, i.e., do your liabilities exceed your assets?

B. Terms

1. Current Assets are assets that are usually converted to cash within one year. They include, but are not limited to:

Cash On hand and/or on deposit and is available

Short Term Investments Generally converted easily into cash, e.g., money market funds, U.S.

Government securities

Receivables Money that customers owe to you or your business

Prepaid Expenses Items like insurance premiums or rentals which you have already paid but have not yet

used.

2. Fixed Assets are tangible assets with a useful life greater than a year. They include, but are not limited to:

Vehicles

Furniture and Equipment

Leasehold Improvements improvements on a leased asset that increase the value of the asset

Land

Buildings

3. Total Assets is the sum total dollar value of current and fixed assets.

4. Current Liabilities are those obligations that are usually paid within 12 months. They include, but are not

limited to

Accounts Payable

Taxes Payable

Loans Payable (due within one year)

Current Portion of Long Term Debt

Accrued Payroll and Withholding (includes any wages or withholdings owed to or for employees that have

not yet been paid)

5. Long Term Liabilities are any debts owed that are due more than one year out from the current date, including

loans payable, e.g., mortgage, vehicle loan, bank loan.

6. Total Liabilities is the sum total dollar value of current and long term liabilities.

7. Owners Equity is the amount left when you subtract total liabilities from total assets. Examples:

Total Assets $ 100,000 Total Assets $ 60,000

Total Liabilities - $ 50,000 OR Total Liabilities - $ 75,000

Owners Equity $ 50,000 (+) Owners Equity $ 15,000 (-)

C. Total Assets must equal the sum total of owner's total liabilities and owners equity (net worth). Examples:

Total Liabilities $ 50,000 Total Liabilities $ 75,000

Owners Equity + $ 50,000 OR Owners Equity - $ 15,000

Total Assets $ 100,000 Total Assets $ 60,000

You might also like

- The Balance Sheet and Income Statement ExplainedDocument2 pagesThe Balance Sheet and Income Statement ExplainedKamaljit Singh100% (1)

- Bakery Business PlanDocument27 pagesBakery Business PlanNafeh SaemdahrNo ratings yet

- Toast Profit Loss Statement Template 2022Document24 pagesToast Profit Loss Statement Template 2022Krishna SharmaNo ratings yet

- PortfolioDocument49 pagesPortfolioapi-373140726No ratings yet

- Understanding Financial Statements and Financial RatiosDocument5 pagesUnderstanding Financial Statements and Financial RatiosJana Rose PaladaNo ratings yet

- Balance Sheet InterpretationDocument3 pagesBalance Sheet InterpretationprettymandyNo ratings yet

- Food and BeverageDocument62 pagesFood and BeverageTom TommyNo ratings yet

- Peach Aviation - Cover SheetDocument1 pagePeach Aviation - Cover SheetAnonymous 9IodFpqNo ratings yet

- Business PlanDocument26 pagesBusiness PlanJoanne BayyaNo ratings yet

- Food Truck Business Plan 10Document5 pagesFood Truck Business Plan 10Tine DiosoNo ratings yet

- A Step by Step CART Decision Tree Example - Sefik Ilkin Serengil PDFDocument26 pagesA Step by Step CART Decision Tree Example - Sefik Ilkin Serengil PDFMohit Kumar Goel 169070% (1)

- Investment Evaluation: Professor Tim Thompson Kellogg School of ManagementDocument36 pagesInvestment Evaluation: Professor Tim Thompson Kellogg School of ManagementAmund BremerNo ratings yet

- Debits and CreditsDocument14 pagesDebits and CreditsLyca SorianoNo ratings yet

- Doraville Food TrucksDocument7 pagesDoraville Food TrucksZachary HansenNo ratings yet

- St. Roch Community Partner Draft PlanDocument20 pagesSt. Roch Community Partner Draft PlanKatherine SayreNo ratings yet

- Finale Sportsbar and GrillDocument13 pagesFinale Sportsbar and GrillChetna MishraNo ratings yet

- Balance Sheet (Amount in RS.) : Current AssetsDocument4 pagesBalance Sheet (Amount in RS.) : Current AssetsNaval VaswaniNo ratings yet

- SunShine Cafe A Breakfast Restaurant Business PlanDocument77 pagesSunShine Cafe A Breakfast Restaurant Business PlanJason DurdenNo ratings yet

- Caroline Center Upholstery Business PlanDocument37 pagesCaroline Center Upholstery Business PlanBtsibandaNo ratings yet

- Cupcakes Will Be Picked Up A Day Prior To EventDocument3 pagesCupcakes Will Be Picked Up A Day Prior To EventCamilles Culinary-CreationsNo ratings yet

- Operations Management PresentationDocument7 pagesOperations Management Presentationmahum raufNo ratings yet

- Food Truck OrdinanceDocument9 pagesFood Truck Ordinancechristie zizoNo ratings yet

- An Explanation of Debits and CreditsDocument4 pagesAn Explanation of Debits and Creditskishorepatil8887100% (1)

- Restaurant Development & ClassificationDocument14 pagesRestaurant Development & ClassificationRizkiy Ahmad FadlillahNo ratings yet

- FSM 120 Recipe Standrdization+CostingDocument5 pagesFSM 120 Recipe Standrdization+CostingAkarin MittongtareNo ratings yet

- Agreement: Carmen'S Kitchen'S Services Provided Are Detailed As FollowsDocument2 pagesAgreement: Carmen'S Kitchen'S Services Provided Are Detailed As FollowsJhei VictorianoNo ratings yet

- Supplemental DocumentsDocument14 pagesSupplemental DocumentsarlNo ratings yet

- Catering ContractDocument2 pagesCatering ContractSasha_James_7064100% (1)

- 9089 FormDocument10 pages9089 Formjorba60No ratings yet

- Restaurant Market Analysis: Types of Questions AnsweredDocument10 pagesRestaurant Market Analysis: Types of Questions Answeredraj78723786No ratings yet

- Business Plan For Mobile Food CourtDocument13 pagesBusiness Plan For Mobile Food CourtMd. Al- AminNo ratings yet

- 8CERA FOOD TRUCK BUSINESS PLANDocument9 pages8CERA FOOD TRUCK BUSINESS PLANAlyssa LeonidoNo ratings yet

- Bakery Business Plan Executive SummaryDocument11 pagesBakery Business Plan Executive SummaryTendai KaleaNo ratings yet

- Hotel Management & Catering Technology SyllabusDocument81 pagesHotel Management & Catering Technology SyllabusYelesh LanjewarNo ratings yet

- Basics Track Franchise Default and TerminationDocument48 pagesBasics Track Franchise Default and TerminationJill StuartNo ratings yet

- 1035 - Balance Sheet TemplateDocument1 page1035 - Balance Sheet TemplateWin NguyenNo ratings yet

- Business Plan Take Out Pizza: Executive SummaryDocument13 pagesBusiness Plan Take Out Pizza: Executive SummarySaji SajidaNo ratings yet

- Catering PackageDocument3 pagesCatering PackageRosemarie Galvez-FelimonNo ratings yet

- The Right Ingredients For Your Career: Bachelor'S and Associate Degree ProgramsDocument1 pageThe Right Ingredients For Your Career: Bachelor'S and Associate Degree ProgramsShane BrownNo ratings yet

- 2018 Bread Bakery Business Plan in NigerDocument6 pages2018 Bread Bakery Business Plan in Nigerminychil banteyhunNo ratings yet

- Barmanagementpartone 220328155613Document257 pagesBarmanagementpartone 220328155613yudhiNo ratings yet

- Maximizing bar revenue through upselling drinks and live musicDocument2 pagesMaximizing bar revenue through upselling drinks and live musicangry birdNo ratings yet

- Ashiana Housing LTD: Detailed ReportDocument24 pagesAshiana Housing LTD: Detailed ReportArchit GroverNo ratings yet

- Sample Cleaning SOPDocument3 pagesSample Cleaning SOPArifNo ratings yet

- Global Quick Service Restaurant (QSR) Market Factbook (2022 Edition)Document29 pagesGlobal Quick Service Restaurant (QSR) Market Factbook (2022 Edition)Azoth Analytics100% (1)

- General Employment APDocument2 pagesGeneral Employment APcjkeeme100% (5)

- Business Model Chipotle Mexican Grill - EditedDocument7 pagesBusiness Model Chipotle Mexican Grill - EditedHarlem MwasNo ratings yet

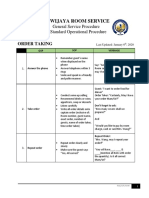

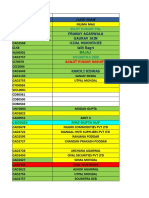

- SRIWIJAYA ROOM SERVICE PROCEDURESDocument6 pagesSRIWIJAYA ROOM SERVICE PROCEDURESEdo HadiNo ratings yet

- Business Plan TemplateDocument15 pagesBusiness Plan TemplateEng RemoonNo ratings yet

- Restaurant SOP Template PDFDocument23 pagesRestaurant SOP Template PDFYounes Yousri100% (2)

- Dandy Horse Ranch ProposalDocument28 pagesDandy Horse Ranch ProposalBoulder City Review100% (1)

- UIUC ADV 150 Assignments 1+2, FA13Document6 pagesUIUC ADV 150 Assignments 1+2, FA13Nicholas EzykNo ratings yet

- F&B StandardsDocument5 pagesF&B StandardsDeepak BillaNo ratings yet

- Annual Operational PlanDocument120 pagesAnnual Operational Planl100% (1)

- NASBP Joint Venture Presentation - Final 05.26.16Document32 pagesNASBP Joint Venture Presentation - Final 05.26.16Zerubabel KibebeNo ratings yet

- Retox Franchise Inception Cost BreakdownDocument9 pagesRetox Franchise Inception Cost BreakdownRohit GujarNo ratings yet

- Sample Business Plan: Executive SummaryDocument24 pagesSample Business Plan: Executive SummarySneha KhuranaNo ratings yet

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs Templateminhtutran1983No ratings yet

- Balance Sheet Template PDFDocument2 pagesBalance Sheet Template PDFSubha ManNo ratings yet

- Benefits of Lean Construction To AffordaDocument8 pagesBenefits of Lean Construction To AffordaHina JeeNo ratings yet

- Assignement-3 (Conducting - A - Feasibility - Study - Fact - Sheet)Document4 pagesAssignement-3 (Conducting - A - Feasibility - Study - Fact - Sheet)Hina JeeNo ratings yet

- A Case Study On Agile and Lean Project M PDFDocument9 pagesA Case Study On Agile and Lean Project M PDFHina JeeNo ratings yet

- (Case Study) KelloggsDocument4 pages(Case Study) KelloggsNikoletta KovinicNo ratings yet

- Mcdonald'S Corporation: Permissions@Hbsp - Harvard.Edu or 617.783.7860Document31 pagesMcdonald'S Corporation: Permissions@Hbsp - Harvard.Edu or 617.783.7860Hina JeeNo ratings yet

- Wal-Mart SustainabilityDocument10 pagesWal-Mart SustainabilityJie ChiNo ratings yet

- (Case Study) KelloggsDocument4 pages(Case Study) KelloggsNikoletta KovinicNo ratings yet

- Chapter 8Document34 pagesChapter 8Hina JeeNo ratings yet

- MIS Report On Coca-ColaDocument16 pagesMIS Report On Coca-ColaAnmol ChaudhryNo ratings yet

- Ark Mit Power Bank Blance SheetDocument1 pageArk Mit Power Bank Blance SheetHina JeeNo ratings yet

- Strategy Management Final ProjectDocument2 pagesStrategy Management Final ProjectHussain ShahNo ratings yet

- Personal Balance SheetDocument1 pagePersonal Balance SheetLeonardNo ratings yet

- Sevice Marketing 1assignmentDocument5 pagesSevice Marketing 1assignmentHina JeeNo ratings yet

- Samsung ReportDocument4 pagesSamsung ReportShanoJeeNo ratings yet

- (A) Was Entering The Indian Market With A Standardised Product A Mistake? JustifyDocument6 pages(A) Was Entering The Indian Market With A Standardised Product A Mistake? JustifyShanoJeeNo ratings yet

- (A) Was Entering The Indian Market With A Standardised Product A Mistake? JustifyDocument6 pages(A) Was Entering The Indian Market With A Standardised Product A Mistake? JustifyShanoJeeNo ratings yet

- Balance SheetDocument2 pagesBalance SheetHina JeeNo ratings yet

- Mis ReportDocument23 pagesMis ReportHina JeeNo ratings yet

- Balance Sheet Comparison FY-YEAR to FY-YEARDocument2 pagesBalance Sheet Comparison FY-YEAR to FY-YEARM. Nauman HamidNo ratings yet

- Nfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineDocument72 pagesNfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineAmol BhawariNo ratings yet

- Tarak (Z100)Document564 pagesTarak (Z100)Tarak PaulNo ratings yet

- Nism Equity DerivativesDocument65 pagesNism Equity DerivativesPoonam JadhavNo ratings yet

- 2 Chart Patterns PDFDocument25 pages2 Chart Patterns PDFChandraNo ratings yet

- Prit PPT ProjectDocument16 pagesPrit PPT ProjectpriteshNo ratings yet

- Cash Flow StatementDocument46 pagesCash Flow StatementSiraj Siddiqui100% (1)

- BALIC Annual Report10 11Document144 pagesBALIC Annual Report10 11Manuj KinraNo ratings yet

- Robert and Vincent Tchenguiz - Tchenguiz BrothersDocument1 pageRobert and Vincent Tchenguiz - Tchenguiz BrothersRadallWeissNo ratings yet

- Sonali BankDocument45 pagesSonali BankMohiuddin MuhinNo ratings yet

- Wanta: Black Swan, White Hat Chapter 1Document11 pagesWanta: Black Swan, White Hat Chapter 1Marilyn MacGruder BarnewallNo ratings yet

- Adani PowerDocument10 pagesAdani PowerMontu AdaniNo ratings yet

- Opposing Motion to Dismiss Foreclosure ComplaintDocument33 pagesOpposing Motion to Dismiss Foreclosure Complaintprosper4less8220No ratings yet

- Philippine Public Sector Accounting Standards 16 Investment PropertyDocument3 pagesPhilippine Public Sector Accounting Standards 16 Investment PropertyAr LineNo ratings yet

- Flagt Checklist of RequirementsDocument1 pageFlagt Checklist of Requirementssnikkirose17No ratings yet

- Impact of marginal costing and leverages on cement industriesDocument10 pagesImpact of marginal costing and leverages on cement industriesrakeshkchouhanNo ratings yet

- LboDocument3 pagesLborranjan27No ratings yet

- Banking Questions For IBPS Gr8AmbitionZDocument25 pagesBanking Questions For IBPS Gr8AmbitionZshahenaaz3No ratings yet

- Interpretation of ContractsDocument8 pagesInterpretation of ContractsJasmin CuliananNo ratings yet

- % BOLLINGER B and BOLLINGER BAND WIDTH 25 5Document8 pages% BOLLINGER B and BOLLINGER BAND WIDTH 25 5alistair7682No ratings yet

- DuPont RatioDocument6 pagesDuPont RatioOmer007No ratings yet

- Mahindra Susten Private Limited Signed OffDocument53 pagesMahindra Susten Private Limited Signed OffI am whoNo ratings yet

- Dematerialisation of Securities Mba ProjectDocument68 pagesDematerialisation of Securities Mba ProjectPriyankana Bose33% (3)

- Pankaj Tiberwal Farewell Note (Kotak AMC)Document6 pagesPankaj Tiberwal Farewell Note (Kotak AMC)SiddharthNo ratings yet

- Tutorial 3: Bonds/Fixed Income SecuritiesDocument14 pagesTutorial 3: Bonds/Fixed Income Securities1 KohNo ratings yet

- Demat & Depo Business OverviewDocument12 pagesDemat & Depo Business OverviewNishant AnandNo ratings yet

- Reason For Outbound Call Manual HumanaticDocument6 pagesReason For Outbound Call Manual HumanaticJose Richard Giray100% (1)

- Gold Prices in IndiaDocument7 pagesGold Prices in IndiatechcaresystemNo ratings yet

- Accounting For InvestmentDocument29 pagesAccounting For InvestmentSyahrul AmirulNo ratings yet

- Data Preparation For Strategy ReturnsDocument6 pagesData Preparation For Strategy ReturnsNumXL ProNo ratings yet

- CW2 AnswerDocument12 pagesCW2 AnswerFrankie NguyenNo ratings yet