Professional Documents

Culture Documents

International Corporate Finance

Uploaded by

cara09250 ratings0% found this document useful (0 votes)

44 views10 pagesReviewer

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views10 pagesInternational Corporate Finance

Uploaded by

cara0925Reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

CHAPTER 1: MULTINATIONAL FINANCIAL WHY FIRMS PURSUE INTERNATIONAL

MANAGEMENT: AN OVERVIEW BUSINESS

o THEORY OF COMPETITIVE ADVANTAGE

Agency problem: conflict of goals between a - specialization by countries can increase

firms managers and shareholders production efficiency

Agency costs: ensuring that managers - a country that specializes in some

maximize shareholder wealth products may not produce other

products, so trade between countries is

- agency costs are normally larger for essential

MNC than for purely domestic firms for - allows firm to penetrate foreign markets

several reasons: o IMPERFECT MARKETS THEORY

MNCs with subsidiaries scattered - factors of production are somewhat

around the world may experience immobile

larger agency problems because - there are costs and often restrictions

monitoring the managers of related to the transfer of labor and other

distant subsidiaries in foreign resources used for production

countries is more difficult - MNCs often capitalize on a foreign

Foreign subsidiary managers who countrys particular resources

are raised in diff cultures may not - Imperfect markets provides incentive for

follow uniform goals firms to seek out foreign opportunities

The sheer size of the larger o PRODUCT CYCLE THEORY

MNCs can also create significant - firms become established in the home

agency problems market as a result of some perceived

Some non US managers tend to advantage over existing competitors

downplay the short term effects of - foreign demand will initially be

decisions which may result in accommodated by exporting

decisions for foreign subsidiaries - then produce product in foreign market

of US based MNCs that maximize to reduce transpo costs

subsidiary values or pursue other - as a firm matures, it may recognize

goals additional opportunities outside its home

country

PARENT CONTROL OF AGENCY HOW FIRMS ENGAGE IN INTERNATIONAL

PROBLEMS TRADE

- proper governance o International trade

- clearly communicate the goals for each - relatively conservative approach that

subsidiary to ensure that all of them can be used by firms to: penetrate

focus on maximizing the value of MNC markets (by exporting) or to obtain

- through implementing compensation supplies at a low cost (by importing)

plans that reward managers who satify - minimal risk because firms doesnt place

MNC goals any of its capital at risk

- provide MNCs stock or options to buy o Licensing

as part of compensation - arrangement whereby one firm provides

its technology (copyrights, patents,

MANAGEMENT STRUCTURE OF AN MNC trademarks, or trade names) in

- centralized management style: exchange for fees or others

reduces agency costs because it - Allows firms to use their technology in

allows managers of the parent to control foreign markets without a major

foreign subsidiaries and thus reduces investment and without transportation

the power of subsidiary managers costs that result from exporting

- however, parents managers may make - Major disadvantage: difficult to ensure

poor decisions for the subsidiary if they quality control in foreign production

are less informed than the subsidiarys process

managers about its setting and financial o Franchising

characteristics - one firm provides a specialized sales or

- decentralized management style: service strategy, support assistance,

more likely to result to higher agency and possibly an initial investment in the

costs because subsidiary managers franchise in exchange for periodic fees

may make decisions that fail to - allows firms to penetrate markets

maximize the value of the entire MNC without major investment in foreign

- some MNCs attempt to achieve countries

advantages of both by allowing o Joint ventures

subsidiary managers to make the key - venture that is jointly owned and

decisions while parents management operated by two or more firms

monitors those decisions to ensure they - A firm may enter the foreign market by

are in the MNCs best interest. engaging in a joint venture with firms

that reside in those markets.

- Allows two firms to apply their respective

cooperative advantages in a given

project.

o Acquisitions of Existing Operations

- means of penetrating foreign markets

- give firms full control over their foreign

businesses and enable the MNC to

quickly obtain a large portion of foreign

market share

- however, it can lead to large losses - dollar cash flows: funds received by the firm

because of the large investment minus funds needed to pay expenses or taxes

required or to reinvest in the firm (such as an investment

- some engage in partial international to replace old computers or machinery)

acquisitions in order to obtain a toehold - this is estimated from knowledge about

or stake in foreign operations, this various existing projects

approach lessen the risk because of a - all other things constant, an increase in

smaller investment requirement but the expected cash flows over time increase the

firm will not have complete control value of a firm

-

o Establishment of New foreign - cost of capital: required rate of return

subsidiaries - weighted average of the cost of capital

based on all of the firms project

- requires large investment - all other things constant, an increase in

the firms required rate of return will

- firms can penetrate markets by

reduce the value of the firm because

establishing new operations in foreign

expected cash flows must be discounted

countries.

at a higher interest rate

- Requires a large investment o Multinational Model: cash flows may be

coming from various countries and so may

- Acquiring new as opposed to buying be denominated in different foreign

existing allows operations to be countries

tailored exactly to the firms needs.

- May require smaller investment than

buying existing firm.

SUMMARY OF METHODS

- Any method of increasing international

business that requires a direct

investment in foreign operations is

referred to as direct foreign Valuation of an MNC that uses two

investment (DFI) currencies

- International trade and licensing usually - Could measure its expected dollar cash

not included flows in any period by multiplying the

- Franchising and joint ventures then to expected cash flow in each currency by

require some investment but only to a the expected exchange rate at which

limited degree that currency would be converted to

- Foreign acquisition and establishment of dollars and then summing those two

new foreign subsidiaries represent the products.

largest portion of DFI. Valuation of an MNC that uses

multiple currencies

VALUATION MODEL FOR AN MNC - derive an expected dollar cash flow

value for each currency

o Domestic Model: not engaged in any foreign - combine cash flows among currencies

transactions within a given period

- present value of its expected cash

flows Valuation of an MNCs cash flows over

multiple periods

- apply single period process to all future

periods

- discount the estimated total dollar cash

flow for each period at the weighted cost

of capital

UNCERTAINTY SURROUNDING MNC

CASH FLOWS

o Exposure to international economic Current account: summary of

conditions the flow of funds between one

- If economic conditions in a foreign specified country and all other

country weaken, purchase of products countries due to purchases of

decline and MNC sales in that country goods and services or to the cash

may be lower than expected. flows generated by income-

producing financial assets

Capital account: summary of the

flow of funds resulting from the

sale of assets between one

specified country and all other

countries over a specified period

of time, new foreign investments

made by a country

Financial account- special

types of investments (DFI and

portfolio investment)

For all accounts, inflow of funds

generate positive numbers (credits);

for the countrys balance whereas

transactions that reflect outflows of

funds generate negative numbers

(debits)

o Exposure to international political risk

- A foreign government may increase Current account

taxes or impose barriers on the MNCs 1) Payments for merchandise

subsidiary. (goods) and services

o Exposure to exchange rate risk - Tangible products that are

- If foreign currencies related to the MNC transported between countries

subsidiary weaken against the U.S. - Services represent tourism and other

dollar, the MNC will receive a lower services such as legal, insurance,

amount of dollar cash flows than was and consulting services provided for

expected. customers in other countries

- Diff between total exports and

HOW UNCERTAINTY AFFECTS THE MNCS imports is referred to as the balance

COST OF CAPITAL of trades

- Exports= inflow of funds; import=

- A higher level of uncertainty increases outflow of funds

the required rate of return of investors, 2) Factor income

thus the MNCs cost of obtaining capital, - Interest and dividend payments

which lowers the firms valuation. received by investors on foreign

investments in financial assets

SUMMARY: - Income received= inflow; income

paid= outflow

The valuation model of an MNC shows that the 3) Transfer payments

MNCs value is favorably affected when its - Aid, grants, and gifts from one

expected foreign cash inflows increase, the country to another

currencies denominating those cash inflows

increase, or the MNCs required rate of return Capital account

decreases. Conversely, the MNCs value is - Originally included in the financial

adversely affected when its expected foreign account

cash inflows decrease, the values of currencies - Patents and trademarks

denominating those cash flows decrease - Minor account items compared to

(assuming that they have net cash inflows in financial account items

foreign currencies), or the MNCs required rate

of return increases. Financial account

1) Direct foreign investment

CHAPTER 2: INTERNATIONAL FLOW OF

- Investment in fixed assets that can

FUNDS

be used to conduct business

operations

BALANCE OF PAYMENTS

- Acquisition of a foreign company

- summary of transactions between

domestic and foreign residents for a - Construction of a new manufacturing

plant

specific country over a specified

period of time. - Expansion of plant in a foreign

country

- Transactions by businesses,

2) Portfolio investment

individuals, and the government

- Transactions involving long term trade and thereby create jobs within

financial assets such as stocks and a country:

bonds that do not affect the Restrictions on imports

transfer of control - when govt imposes tax on imported

- Represents purchase of foreign goods (tariffs) and maximum limit

financial assets without changing that can be imported (quotas) to

control of the company discourage imports

3) Other capital investments Subsidies for exporters

- Transactions involving short term - offer subsidies to its domestic firms

financial assets such as money so that they can produce products at

market securities between countries a lower cost than their global

4) Errors and omissions and reserves competitors

- dumping: exporting of products that

IMPACT OF OUTSOURCING ON TRADE were produced with the help of

o Outsourcing: process of subcontracting to government subsidies

a third party in another country to provide Restrictions on Piracy

supplies or services that were previously - a govt that doesnt act to minimize

produced internally piracy may indirectly reduce imports

- increases international trade activity and may even discourage MNCs

- allows MNCs to conduct operations from exporting to that market

at a lower cost Environmental restrictions

FACTORS AFFECTING INTERNATIONAL - when a govt imposes environmental

TRADE FLOWS restrictions, local firms experience

Cost of labor higher costs of production

- firms in countries where labor costs Labor laws

are low typically have an advantage - more restrictive laws, higher

when competing globally, especially expenses for labor, other factors

in labor-intensive industries being equal

Inflation Business laws

- if a countrys inflation rate increases - more restrictive laws, not able to

relative to the countries with which it compete globally

trades, then its current account Tax breaks

should decrease, other things equal - govt financial support that could

- consumers and corporations in that benefit firms that export products

country will most likely purchase Country trade requirements

more goods overseas because of - a govt may require that MNCs

high inflation and the countrys complete various forms or obtain

exports to other countries will decline licenses before they can export

National income products to its country

- if a countrys national income level - causes inefficiency and delays

increases by a higher percentage Government Ownership or

than those of other countries, then its subsidies

current account should decrease, - some govts maintain ownership in

other things being equal firms that are major exporters

- as income rises, so does Country security laws

consumption of goods, increased - Governments may impose certain

demand for foreign goods restrictions when national security is

Credit conditions a concern, which can affect on trade.

- credit conditions tend to tighten when

economic conditions weaken Policies to Punish Country

because corporations are then less Governments

able to repay debt - Many expect countries to restrict

- banks are less willing to provide imports from countries that...

financing to MNCs, reducing - Fail to enforce environmental laws

corporate spending and child labor laws

- As MNCs reduce spending, they also - Initiate war against another

reduce demand for imported supplies country

resulting to a decline in international - Unwilling to participate in a war

trade flows

Government policies EXCHANGE RATES

- each countrys govt wants to - If a countrys currency begins to rise

increase exports because more in value against other currencies

exports lead to more production and then its current account balance

income and may also create jobs. should decrease, other things being

- There are several types of policies equal.

often used to improve balance of - As the currency strengthens, goods

exported by that country will become

more expensive to the importing FACTORS AFFECTING INTERNATIONAL

countries and so the demand for PORTFOLIO INVESTMENT

such goods will decrease o Tax rates on Interest/ Dividends:

investors prefer to invest in country

HOW EXCHANGE RATES MAY CORRECT A where taxes interest/dividend income

BALANCE OF TRADE DEFICIT from investments are relatively low

- When a home currency is exchanged o Interest rates: money tends to flow to

for a foreign currency to buy foreign countries with high interest rates as long

goods, then the home currency as the local currencies are not expected

faces downward pressure, leading to weaken

to increased foreign demand for the o Exchange rates: if a countrys home

countrys products. currency is expected to strengthen, then

foreign investors may be willing to invest

WHY EXCHANGE RATES MAY NOT in that countrys securities in order to

CORRECT A BALANCE OF TRADE DEFICIT benefit from the currency movement

- Exchange rates will not automatically correct

any international trade balances when other CHAPTER 3: INTERNATIONAL FINANCIAL

forces are at work. MARKETS

LIMITATIONS OF A WEAK HOME Foreign exchange market: allows exchange

CURRENCY SOLUTION of one currency for another

- large banks serve this market by

o Competition: when a countrys currency holding inventories of each currency

weakens, foreign companies may lower so that they can accommodate

their prices to remain competitive. requests by individuals or MNCs

o Impact of other currencies: a country that

has balance of trade deficit with many HISTORY OF FOREIGN EXCHANGE

countries is not likely to solve all deficits o Gold standard: from 1876 to 1913,

simultaneously. exchange rates were dictated by the

o Prearranged international trade gold standard, thus, rate between two

transactions: international transactions currencies was determined by their

cannot be adjusted immediately. The lag is relative convertibility rates per ounce of

estimated to be 18 months or longer, gold

leading to a J-curve effect. o Agreements on Fixed Exchange

o Intracompany trade: Many firms purchase Rates

products that are produced by their - Bretton woods agreement:

subsidiaries. These transactions are not agreement that calls for fixed

necessarily affected by currency exchange rates between currencies,

fluctuations. this lasted until 1971

- Smithsonian agreement: US dollar

EXCHANGE RATES AND INTERNATIONAL

became overvalued so officials reset

FRICTION

it

All governments cannot weaken their o Floating Exchange Rate System

home currencies simultaneously. - currencies have been allowed to

Actions by one government to weaken fluctuate in accordance with market

its currency causes another countrys forces; however, their respective

currency to strengthen. central banks are periodically

Government attempts to influence intervening to stabilize exchange

exchange rates can lead to international rates

disputes.

Foreign exchange dealers: serve as

INTERNATIONAL CAPITAL FLOWS intermediaries in the foreign exchange market

FACTORS AFFECTING DFI by exchanging currencies desired by MNCs or

o Changes in restrictions: lowered individuals.

restriction, more DFI

o Privatization: selling of some of their Spot market: most common type of forex

operations to corporations and investors transaction, immediate exchange, exchange

o Potential Economic Growth: greater rate is known as spot rate

potential, more likely to attract DFI - often completed electronically

o Tax rates: countries that impose lower - currencys liquidity affects the ease

tax rates, attract DFI with which it can be bought or sold

o Exchange rates: firms typically pursue by an MNC

DFI in other countries where local

currency is expected to strengthen Interbank market: when a bank begins to

against their own experience shortage of a particular foreign

currency, it can purchase that currency from

other banks

INTERPRETING FOREIGN EXCHANGE

Attributes of Banks that provide FOREX QUOTATIONS

o Competitiveness of quote

o Special relationship with the bank: Direct quotations: quotations that report the

bank can offer cash management value of a foreign currency in dollars

services or be willing to make a special Indirect quotation: number of units of a

effort to find currencies for the foreign currency per dollar, reciprocal of the

corporation direct quotation

o Speed of execution

o Advice about current market - if a currencys direct exchange rate is rising

condition over time, then its indirect exchange rate must

o Forecasting advice be declining over time

FOREIGN EXCHANGE QUOTATIONS Cross exchange rate: reflects the amount of

- at any moment, exchange rate one foreign currency per unit of another foreign

between two currencies should be currency

similar across various banks that

provide FOREX services CURRENCY DERIVATIVE

Bid/Ask Spreads of Banks - contract with a price that is partially

- commercial banks charge fees for derived from the value of the

conducting foreign exchange underlying currency that it

transactions; thus, they buy a represents.

currency from customers at a slightly o Forward contracts

lower price than the price at which - agreement between an MNC and a

they sell it forex dealer that specifies the

- banks bid price (buy quote) for a currencies to be exchanged, forward

foreign currency will always be less rate, and the date at which the

than its ask price (sell quote) transaction will occur

- normally expressed as a percentage - MNCs use this to hedge future

of the ask quote payments that they expect to make

or receive in a foreign currency so

that they need not to worry about

= fluctuations in the spot rate until the

time of their future payments

- spread is larger for illiquid currencies o Forward market

that are less frequently traded - Market in which forward contracts

are traded, OTC market, and its main

FACTORS THAT AFFECT THE SPREAD participants are the foreign exchange

o (+) Order costs: clearing costs and dealers and the MNCs that wish to

recording transactions obtain a forward contract

o (+) Inventory costs: cost of maintaining - hedge receivables and payables

an inventory of a particular currency o Futures contract

- holding an inventory involves an - specifies a standard volume of a

opportunity costs because the funds particular currency to be exchanged

could have been used for some other on a specific settlement date at the

purpose. If interest rates are high, futures rate

then the opportunity cost of holding o Options contract: offer more flexibility

an inventory should be relatively than forward or futures contracts because

high. they are not obligations

o (-) Competition: the more intense the Call option: provides the right to buy

competition, the smaller the spread a specific currency at a specific price

quoted by intermediaries called the strike price or exercise

o (-) Volume: currencies that are more price within a specific period of time

liquid are less likely to experience a - used to hedge future payables

sudden change in price Put option: provides the right to sell

- currency that have a large trading a specific currency at a specific price

volume are more liquid, it has within a specific period of time

enough depth that a few large - used to hedge future receivables

transactions are unlikely to cause the

currencys price to change abruptly

o (+) Currency risk: some currencies CHAPTER 4: EXCHANGE RATE

experience more volatility because DETERMINATION

economic or political conditions that cause

the demand for and supply of the currency Cash flows are highly dependent on

to change abruptly exchange rates

MEASURING EXCHANGE RATE in the amt of pounds supplied (sold) in

MOVEMENTS the market.

Exchange rate: measures value of one

currency in units of another currency o DECREASE IN DEMAND SCHEDULE

Depreciation: decline in currencys - If demand decreases, inward shift in

value the schedule, there will be surplus

Appreciation: increase in currencys - Banks will respond by lowering the

value exchange rate of the pound resulting to

increase in the quantity demanded and

PERCENT CHANGE IN FOREIGN decrease in amount of pounds sold in

CURRENCY VALUE= S- St-1/St-1 the market

o INCREASE IN SUPPLY SCHEDULE

- Positive percentage change indicate that - Supply increases because of British

currency has appreciated and vice versa demand for US dollars, outward shift in

supply schedule, resulting to surplus

Forex movements tend to be larger for - Banks will respond by lowering

longer time horizons exchange rate of the pound

o DECREASE IN SUPPLY SCHEDULE

EXCHANGE RATE EQUILIBRIUM - Suppy decrease because of british firms

- Price of a currency is determined by the needing fewer dollars, inward shift in

demand for that currency relative to its supply schedule, there will be shortage

supply - Banks will respond by increasing the

- A currency should exhibit the price at exchange rate of the pound

which demand equals supply

FACTORS THAT INFLUENCE EXCHANGE

US DOLLAR vs. BRITISH POUND RATES (affects demand and supply)

DEMAND FOR A CURRENCY

- Schedule is downward sloping o RELATIVE INFLATION RATES

- Because corporations and individuals in - Changes can affect international trade

the US would purchase more british activity

goods when pound is worth less and - A sudden jump in US inflation cause

vice versa some US consumers to buy more British

products instead of US products. There

SUPPLY OF A CURRENCY would be an increase in the US demand

- Upward sloping for British goods, which represents an

- Because when the pounds value is increase in the US demand for British

high, british consumers and firms are pounds.

more willing to exchange their pounds - In addition, it would also reduce the

for dollars to purchase US products or British desire for US goods therefore

securities reducing supply of pounds for sale at

any given exchange rate

EQUILIBRIUM

- Shortage: quantity demanded exceeds o RELATIVE INTEREST RATES

supply - Changes can affect investment in

- Surplus: quantity demanded is less foreign securities

than the supply - If US interest rates rise while british

rates remain constant, US investors will

CHANGE IN THE EQUILIBRIUM EXCHANGE likely reduce their demand for pounds,

RATE since US rates are now more attractive

- Exchange rate varies because banks - Since US rates will be more attractive,

that serve as intermediaries in the supply of pounds for sale by british

foreign exchange market adjust the investors should increase as they

price of which they are willing to buy and establish more bank deposits in the US

sell a particular currency in the face of a - There will be an inward shift in demand

sudden shortage or excess of that for pound and outward shift in the supply

currency of pounds for sale, the equilibrium

exchange rate should decrease

o INCREASE IN DEMAND SCHEDULE o REAL INTEREST RATES

- Demand can change any time - A relatively high interest rate may attract

- If demand increases, outward shift in foreign inflows to invest in securities

the schedule (ceteris paribus), there offering high yields, that high rate may

will be a shortage reflect expectations of relatively high

- Banks will respond by raising the inflation

exchange rate of the pound resulting to - High inflation can place downward

a decrease in the quantity demanded in pressure on the local currency, some

the forex market as well as an increase foreign investors may be discouraged

from investing in securities denominated previously invested in the country now

in that currency want to get out

- In such cases, it is useful to consider Impact of Signals on Currency

real interest rates, which adjusts the Speculation

nominal interest rate for inflation - day to day speculation on future

exchange rate movements is typically

REAL INTEREST RATE = NOMINAL driven by signals of future interest rate

INTEREST RATE INFLATION RATE movements

- speculative positions in currencies may

o RELATIVE INCOME LEVELS adjust quickly, increasing exchange rate

- Income can affect the amount of imports volatility

demanded, it can also affect exchange

rates INTERACTION OF FACTORS

- Increase income levels reflect favorable

economic condition, hence, British firms o TRADE FLOWS

would probably increase their - generally less responsive to news

investments in US if income level - inflation, income, trade restrictions

increases there. As a result, supply of o FINANCIAL FLOWS

British pounds in the market will - extremely responsive to news

increase (shift outward) - interest rate, capital flow, exchange rate

- an increase in US income levels could The sensitivity of an exchange rate to these

also have an indirect effect on the factors depends on the volume of international

pounds exchange rate by influencing transactions between the two countries

interest rates

- Under economic growth, business INFLUENCE OF FACTORS ACROSS

demand for loans tends to increase and MULTIPLE CURRENCY MARKETS

thus cause a rise in interest rates - each exchange rate has its own market,

higher interest rates attract foreign meaning its own demand and supply

investors; this is another reason why the conditions

supply schedule of british pounds may - value of the british pound in dollars is

increase enough to offset any effect of influenced by the US demand for

increased US income levels on the pounds and the amounts of pounds

demand schedule supplied to the market

IMPACT OF LIQUIDITY ON EXCHANGE

o GOVERNMENT CONTROLS RATE ADJUSTMENT

1) through imposing foreign exchange - liquidity of a currency affects exchange

barriers rates sensitivity to specific transactions

2) imposing foreign trade barriers - if currencys spot market is liquid then its

3) intervening (buying and selling exchange rate will not be highly

currencies) in the forex market sensitive to a single large purchase or

4) affecting macro variables such as sale, so change in equilibrium exchange

inflation, interest rates, and income rate will be relatively small

levels

CAPITALIZING ON EXPECTED EXCHANGE

o EXPECTATIONS RATE MOVEMENTS

Impact of favorable expectations

- ex: investors may temporarily invest o Institutional speculation based on

funds in Canada if they expect Canadian expected appreciation

interest rates to increase, such rise may - if they believe that a particular currency

cause further capital flows into Canada, is presently valued lower than it should

which would place upward pressure on be in the foreign exchange market, they

the Canadian dollars value may consider investing in that country

- expectations can influence exchange now before it appreciates

rates because they commonly motivate - then they would liquidate their

institutional investors to take foreign investment in that currency after it

currency positions appreciates to benefit from selling it for a

Impact of Unfavorable expectations higher price than they paid

- just as speculators can place upward HOW?

pressure on a currencys value when 1) Borrow money.

they expect it to appreciate, they can 2) Convert the money into the currency

place downward pressure on a currency that will appreciate.

when they expect it to depreciate. 3) Invest the converted money at the

- Expectations of a crisis may lead to an lending rate of the country that is

increase in the supply of the countrys expected to appreciate.

currency for sale in the forex market 4) Use the proceeds from the converted

because foreign investors who money to repay the borrowed money at

the borrowing rate.

5) Subtract to get speculative profit

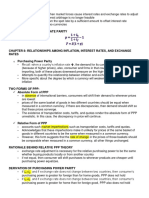

PREMIUM OR DISCOUNT ON THE

o Institutional speculation based on FORWARD RATE

expected depreciation = (1 + )

- if they believe that a particular currency

is presently valued higher than it should

be in the FOREX market, they may 360

borrow funds in that currency now and =

convert it to their local currency now o Forward premium: percentage by which

- the plan is to repay the loan in that the forward rate exceeds the spot rate

currency after it depreciates

HOW? - when forward rate < spot rate, forward

1) Borrow the currency that is about to premium is negative, and the forward

depreciate. rate exhibits a discount

2) Convert it to your local currency.

3) Lend the money at your country. ARBITRAGE

4) Use the proceeds to repay the borrowed - forward rates typically differ from the

currency. spot rate

5) Subtract to get speculative profit. - If forward rate were the same as the

spot rate then some investors could use

The potential returns from foreign currency arbitrage to earn higher returns than

speculation are high for financial institutions would be possible domestically and

that have large borrowing capacity. without incurring additional risk

- that is why forward rate contains a

THE CARRY TRADE premium or discount that reflects the

- investors attempt to capitalize on the difference between home interest rate

difference in interest rates between two and foreign interest rate

countries

- borrowing a currency with low interest OFFSETTING A FORWARD CONTRACT

rate and investing the funds in a - the MNC can negotiate the forward sale

currency with a high interest rate with the same bank with which it

- the term was derived from cost of carry negotiated the forward purchase to

which in financial markets represents simply offset, the bank will charge a fee

the cost of holding (or carrying) a for the service, which will be the

position in some asset difference between the forward rate at

the time of the forward purchase and the

RISK OF THE CARRY TRADE time it will be offset

- exchange rates may move opposite to

what the investors expected, which USING FORWARD CONTRACTS FOR SWAP

would cause a loss. Just as financial TRANSACTIONS

leverage can magnify gains from a carry - a swap transaction involves a spot

trade, it can also magnify losses from a transaction along with a corresponding

carry trade forward contract that will ultimately

reverse the spot transaction

CHAPTER 5: CURRENCY DERIVATIVES - these do not expose the firm to

exchange rate movements because it

FORWARD MARKET has locked in the rate at which the

- facilitates trading of forward contracts on pesos will be converted back to dollars

currencies

- not used by consumers or small firms Non-deliverable forward contract (NDF):

- MNCs use forward contracts to hedge agreement regarding a position in a specified

their imports amount of a specified currency, a specified

- Ability of a forward contract to lock in an exchange rate, and a specified future

exchange rate can create an opportunity settlement date.

cost in some cases - it does not result to actual exchange of

BID/ASK SPREAD the currencies; no delivery

- tends to be wider for forward contracts - instead, one party makes a payment to

that have an obligation further into the the other party based on the exchange

future rate at the future date

- longer contract leaves the bank more - even though an NDF does not involve

exposed to the risk of appreciation of a delivery, it can effectively hedge future

certain currency foreign currency payments anticipated

- because market for short term forward by an MNC

contracts tends to be more liquid, which CURRENCY FUTURES MARKET

means that banks can more easily o Currency futures contracts: specifying a

create offsetting positions for a given standard volume of a particular currency

forward contract

to be exchanged on a specific settlement o Closing Out a Futures Position

date - close out a position by selling an

- used by MNCs to hedge their foreign identical futures contract

currency positions - gain or loss will depend on the price of

- traded by speculators who hope to purchasing futures versus selling futures

capitalize on their expectations of - price of a futures contract changes over

exchange rate movements time in accordance with movements in

the spot rate and also with changing

Forward Futures expectations about what the spot rates

Size of Customized Standardized value will be on settlement date

contract - if spot rate increases, then futures

Delivery date Customized Standardized

Participants Banks, brokers, Banks, brokers, price is likely to increase as well,

and MNCs. and MNCs. hence, purchase and subsequent

Public Qualified public sale would be profitable

speculation not speculation - most currency futures contracts are

encouraged. encouraged.

closed out before settlement date

Security None as such, Small security

deposit but deposit required

compensating SPECULATION WITH CURRENCY FUTURES

balances or lines - some attempts to capitalize on their

of credit expectations of a currencys future

required

movement

Clearing Handling Handled by

operation contingent on exchange - If they expect a currency to appreciate,

individual banks clearinghouse. they can purchase a futures contract

and brokers. No Daily settlements that will lock in the price at which they

separate to the market buy it, and then sell these at the

clearinghouse price.

prevalent spot rate if their expectation

function.

Marketplace Telecomm Central exchange happened

network floor with

worldwide comm EFFICIENCY OF THE CURRENCY FUTURES

Regulation Self- regulating Commodity MARKET

Futures Trading

Commission

- if a currency futures market is efficient,

Liquidation Most settled by Most by offset; then at any time the futures price for a

actual delivery; very few delivery currency should reflect all available info.

some by offset, Hence, price should represent an

but at a cost unbiased estimate of the currencys spot

Transaction Set by the Negotiated

rate on the settlement date.

costs spread between brokerage fees

banks buy and - There should not be abnormal profits

sell prices

CURRENCY OPTIONS MARKET

PRICING CURRENCY FUTURES

- normally similar to forward rate for a o OVER THE COUNTER MARKET

given currency and settlement date o CURRENCY CALL OPTION

because of potential arbitrage if not o FACTORS AFFECTING CURRENCY

- futures contract and forward contracts of CALL OPTION PREMIUM

a given currency and settlement date HOW FIRMS USE CURRENCY CALL

should have the same price, or else OPTIONS

guaranteed profits are possible (assume o Using Call options to hedge payables

no transaction costs) o Using Call Options to Hedge Project

Bidding

CREDIT RISK OF CURRENCY FUTURES o Using Call Options to Hedge Target

CONTRACTS Bidding

- neither party needs to worry about credit

risk of the counterparty SPECULATING WITH CURRENCY CALL

- imposing margin requirements to cover OPTIONS

fluctuations in the value of a contract

HOW FIRMS USE CURRENCY FUTURES CURRENCY PUT OPTIONS

o Purchasing Futures to Hedge Payables FACTORS AFFECTING CURRENCY PUT

- locks in the price at which a firm can OPTION PREMIUMS

purchase a currency so that we dont HEDGING WITH CURRENCY PUT OPTIONS

have to worry about changes in the spot

rate CHAPTER 6: GOVERNMENT INFLUENCE

o Selling Futures to Hedge Receivables ON EXCHANGE RATES

- locks in the price at which a firm can sell CHAPTER 7: INTERNATIONAL ARBITRAGE

a currency AND INTEREST RATE PARITY

- appropriate if you expect the foreign

currency to depreciate against its home

currency

You might also like

- FINALS - Global FinDocument11 pagesFINALS - Global Fincara0925100% (1)

- QuestionsDocument1 pageQuestionscara0925No ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement Analysiscara0925No ratings yet

- International Corporate FinanceDocument10 pagesInternational Corporate Financecara0925No ratings yet

- Global FinanceDocument3 pagesGlobal Financecara0925No ratings yet

- Business EthicsDocument3 pagesBusiness Ethicscara0925No ratings yet

- CHAPTER 8 - Global FinDocument2 pagesCHAPTER 8 - Global Fincara0925No ratings yet

- Business EthicsDocument3 pagesBusiness Ethicscara0925No ratings yet

- Chap007 HWK 2Document14 pagesChap007 HWK 2cara0925No ratings yet

- CHAPTER 8 - Global FinDocument2 pagesCHAPTER 8 - Global Fincara0925No ratings yet

- CFA Questions and SolutionsDocument16 pagesCFA Questions and Solutionsvip_thb_2007No ratings yet

- LogisticsDocument38 pagesLogisticscara0925No ratings yet

- Management accounting reports for internal decision makingDocument2 pagesManagement accounting reports for internal decision makingcara0925100% (1)

- LawDocument15 pagesLawcara0925No ratings yet

- BankingDocument2 pagesBankingcara0925No ratings yet

- Obli ConDocument16 pagesObli Concara0925No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fin201 Investment Management t2 2017Document14 pagesFin201 Investment Management t2 2017Antonin de VincentNo ratings yet

- Ajay Kumar Garg Institute of Management GhaziabadDocument3 pagesAjay Kumar Garg Institute of Management GhaziabadNiharika Satyadev JaiswalNo ratings yet

- Overview of Financial Management... MBADocument32 pagesOverview of Financial Management... MBAbiggykhairNo ratings yet

- Process of Deposit MobilizationDocument6 pagesProcess of Deposit MobilizationMuhammad Yasir89% (18)

- ACI Model CodeDocument3 pagesACI Model CodeHangoba ZuluNo ratings yet

- Toll Brothers 2007Document14 pagesToll Brothers 2007Eesha Ü CaravanaNo ratings yet

- Tutorial 1 (Solutions)Document11 pagesTutorial 1 (Solutions)AlfieNo ratings yet

- Internal Assignment of Financial & Accounting ManagementDocument26 pagesInternal Assignment of Financial & Accounting ManagementBasudev SharmaNo ratings yet

- US Dollar Forecast: Hawkish Fed Path May Not Ensure Bullish Q1 2022Document13 pagesUS Dollar Forecast: Hawkish Fed Path May Not Ensure Bullish Q1 2022boyomanNo ratings yet

- InvestmentDocument46 pagesInvestmentUtkarsha Movva100% (1)

- Financial System OverviewDocument10 pagesFinancial System OverviewHussen AbdulkadirNo ratings yet

- Chapter 4 Organization and Functioning of Securities MarketsDocument71 pagesChapter 4 Organization and Functioning of Securities Marketsditayohana100% (1)

- Summer Intership Report On Angel Broking LTD PUNEDocument39 pagesSummer Intership Report On Angel Broking LTD PUNEavneesh99100% (8)

- FN107-1342 - Footnotes Levin-Coburn Report.Document1,037 pagesFN107-1342 - Footnotes Levin-Coburn Report.Rick ThomaNo ratings yet

- Systems Trading BettingDocument282 pagesSystems Trading BettingKiril Zagorski100% (2)

- Importance of International FinanceDocument2 pagesImportance of International FinanceUmair AliNo ratings yet

- Securities Regulation-E&E (6th Ed.)Document24 pagesSecurities Regulation-E&E (6th Ed.)Larry Rogers100% (1)

- INVESTMENT MANAGEMENT CHAPTER 1Document44 pagesINVESTMENT MANAGEMENT CHAPTER 1Divya SindheyNo ratings yet

- The Mutual Fund Marketing and Sales Strategies at NJ India InvestDocument29 pagesThe Mutual Fund Marketing and Sales Strategies at NJ India InvestbatmanNo ratings yet

- CH 1, 7 Mid RevisionDocument27 pagesCH 1, 7 Mid RevisionMonaIbrheemNo ratings yet

- 1 SEM BCOM - Indian Financial System PDFDocument35 pages1 SEM BCOM - Indian Financial System PDFShambhavi JNo ratings yet

- NISM VA Mutual Fund Short NotesDocument38 pagesNISM VA Mutual Fund Short NotesAryan PanditaNo ratings yet

- Prospectus Sidomuncul 2013Document384 pagesProspectus Sidomuncul 2013JarjitUpinIpinJarjit100% (1)

- FIN 072 Quiz 1 Financial System Answer KeyDocument4 pagesFIN 072 Quiz 1 Financial System Answer KeyThat's FHEVulousNo ratings yet

- Principles and Practices of BankingDocument63 pagesPrinciples and Practices of BankingPaavni SharmaNo ratings yet

- Commodities Compendium 190117 RX e 263687Document94 pagesCommodities Compendium 190117 RX e 263687Dionysius Septian Cahya OlivianoNo ratings yet

- Blackbook Project On Foreign Exchange and Its Risk Management - 237312993Document61 pagesBlackbook Project On Foreign Exchange and Its Risk Management - 237312993Aman Tiwari75% (4)

- 143 Valuation Securities Analysis Chap1-4Document66 pages143 Valuation Securities Analysis Chap1-4Tan Serkee100% (1)

- Exam3 PRM PDFDocument378 pagesExam3 PRM PDFAlp SanNo ratings yet