Professional Documents

Culture Documents

Project Budget Worksheet v2 7

Uploaded by

metroroadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Budget Worksheet v2 7

Uploaded by

metroroadCopyright:

Available Formats

IRAP PROJECT BUDGET

Company:

Project Name:

Start Date: End Date:

Direct Labour Costs

Salaried (T4) employee's time

spent working on project Unit of Rate - $ per Sub-Total ($/unit x #

supported by IRAP Time unit # of units of units)

Total $ - A

Overhead (Not supported) Client ITA

Costs are based on Supported Recommended Recommended Internal

Salary Costs (A) Enter agreed upon % below

% %

Total $ - B

Contractor Labour Fee's (Supported)

Unit of Rate - $ per Sub-Total ($/unit X #

Time unit # of units of units)

Total $ - C

IRAP TOTAL PROJECT COST (A+B+C) $ -

Rate Units List

1 June 14, 2005

fixed price, hour, day, week, month, year

2 June 14, 2005

COMPANY PROJECT BUDGET

IRAP TOTAL PROJECT COST: $ -

Other Project Costs (not supported)

Salary (not supported but working on the project)

Salary Overhead (not supported but working on the project)

Contractor (not supported but working on the project)

Equipment

Direct Materials & Supplies

Travel

OTHER:

Total $ -

TOTAL PROJECT COST (of the company) $

3 June 14, 2005

A20: Overhead Costs

For NRC-IRAP purposes, overhead costs are costs that can be directly associated with a client's specific project activities and must be allocated on a

reasonable basis. Overhead costs are to be included in the calculation of the total NRC-IRAP Project Cost. Examples of overhead costs considered

by the Program may include but are not limited to: supervisory costs, accounting expenses, office personnel, purchasing, computer support, leasing

of materials, location, and maintenance and materials handling.

When submitting your proposal to NRC-IRAP, you must provide an estimate of your overhead costs for the project. The maximum overhead that

NRC-IRAP will allow to the project is no more than 65% of your supported employees' salary costs. Appropriateness of overhead estimates will

be determined through the business assessment phase of NRC-IRAP's process. Although the overhead costs are not supported, they do make up

part of how NRC-IRAP calculates your Project Costs.

Direct Labour Costs include only employee's who are supported and have payroll deductions (ie CPP, Tax, UI) withheld from the Firm go in this

Section.

A26: Contractor Quote Requirements

Contractor quotes/invoices must segregate costs. Labour fees are the only element supported by NRC-IRAP.

Quotes/proposals/agreements must be signed by both the Contractor & the Firm.

Individuals providing services to the Firm, who do not have payroll deductions withheld by the Firm, go in this Section.

E21: Overhead Percentage

The percentage for the Overhead costs needs to be mutually agreed upon between the Client and the ITA

4 June 14, 2005

You might also like

- Welding Procedure PreparationDocument122 pagesWelding Procedure Preparationthe_badass1234100% (21)

- Pricing ScheduleDocument13 pagesPricing ScheduleAnonymous ZcrLZQNo ratings yet

- Template ProjectTrackingDocument12 pagesTemplate ProjectTrackingTarek YehiaNo ratings yet

- Fluid Power Graphic SymbolsDocument24 pagesFluid Power Graphic SymbolsJShearer94% (16)

- 2.01 Project Charter TemplateDocument3 pages2.01 Project Charter TemplateajitbakshiNo ratings yet

- Functional Lead Dashboard ITICDocument12 pagesFunctional Lead Dashboard ITICamit_singhalNo ratings yet

- Excel Gantt Chart Template: Make Impressive Powerpoint Gantt Charts For Important MeetingsDocument9 pagesExcel Gantt Chart Template: Make Impressive Powerpoint Gantt Charts For Important MeetingsLim Shan NeeNo ratings yet

- Budget CalculatorDocument9 pagesBudget CalculatorVhuso Mwafuka MaringeNo ratings yet

- Forecasting ModelDocument92 pagesForecasting ModelDoan Kieu MyNo ratings yet

- Audit Fees For Initial Audit Engagements Before and After SOXDocument20 pagesAudit Fees For Initial Audit Engagements Before and After SOXNugraha AhmadNo ratings yet

- Mapping of Fidic Red Book 1999 Contract Clauses To Project Phases Project Life CycleDocument8 pagesMapping of Fidic Red Book 1999 Contract Clauses To Project Phases Project Life CycleShahzadNo ratings yet

- Request Letter for Limited Legal PracticeDocument3 pagesRequest Letter for Limited Legal PracticeJOHN VINCENT S FERRER100% (1)

- GSMA - The Mobile Economy 2020 PDFDocument62 pagesGSMA - The Mobile Economy 2020 PDFtobeca100% (1)

- Project Budget Worksheet v2 7Document4 pagesProject Budget Worksheet v2 7metroroadNo ratings yet

- Return On Investment (ROI) - Definitions and Descriptions: ROI ( (Total Benefit - Total Costs) /total Cost) 100Document7 pagesReturn On Investment (ROI) - Definitions and Descriptions: ROI ( (Total Benefit - Total Costs) /total Cost) 100SumedhNo ratings yet

- Screw Thread CalculationsDocument4 pagesScrew Thread Calculationsyauction50% (2)

- Project Planning Monitoring Tool MacroDocument11 pagesProject Planning Monitoring Tool MacroToni SeoNo ratings yet

- Cumulative Cost Curve Percent TemplateDocument10 pagesCumulative Cost Curve Percent TemplatensadnanNo ratings yet

- Master Planning Schedule Phase1 06.11.2013Document612 pagesMaster Planning Schedule Phase1 06.11.2013keymal9195No ratings yet

- Equipment Inventory List Physical Condition Financial StatusDocument2 pagesEquipment Inventory List Physical Condition Financial Statusgafia1123No ratings yet

- Source of Project CostDocument10 pagesSource of Project CostBaginda HutapeaNo ratings yet

- FSA Gasket Handbook - June 2017Document138 pagesFSA Gasket Handbook - June 2017Dijin MaroliNo ratings yet

- Personal Expense Tracker 7Document1 pagePersonal Expense Tracker 7Sivamuthu KumarNo ratings yet

- Project Management Tool HRDocument13 pagesProject Management Tool HRpjuan211No ratings yet

- Planned / Actual & Forecast Quantities: Major Boq ItemsDocument1 pagePlanned / Actual & Forecast Quantities: Major Boq Itemsburerey100% (1)

- Jabil RMS SAM2RMS Product ManualDocument49 pagesJabil RMS SAM2RMS Product Manualfirst goldchipNo ratings yet

- Operations Projects Service Performance: Financial Snapshot Project Resource Hours Service OfferingsDocument1 pageOperations Projects Service Performance: Financial Snapshot Project Resource Hours Service OfferingsEdd AguaNo ratings yet

- Pert Chart Template - WsDocument2 pagesPert Chart Template - WsCath CarmonaNo ratings yet

- Expense SheetDocument2 pagesExpense SheetMuhammad Atique MabNo ratings yet

- Sales Force MotivatorsDocument15 pagesSales Force MotivatorsAshirbadNo ratings yet

- The Effect of Engagement Partner Workload On Audit QualityDocument24 pagesThe Effect of Engagement Partner Workload On Audit QualityAldi HidayatNo ratings yet

- PWC Experience Radar 2013 Business To Business Software IndustryDocument56 pagesPWC Experience Radar 2013 Business To Business Software Industryy_f2000No ratings yet

- Challenge The Boss or Stand DownDocument17 pagesChallenge The Boss or Stand DownBahagian Kolaborasi Keusahawanan Jpkk50% (4)

- Org Chart PWC - The Official Board 2Document1 pageOrg Chart PWC - The Official Board 2Cáo ĐỏVNNo ratings yet

- Inputs Outputs: Navigation MenuDocument10 pagesInputs Outputs: Navigation MenuasepNo ratings yet

- OIG Investigation 2018-0005: Palm Tran - Contractor Maruti Fleet & Management, LLCDocument111 pagesOIG Investigation 2018-0005: Palm Tran - Contractor Maruti Fleet & Management, LLCSabrina LoloNo ratings yet

- Role of Effective Communication in OrganizationsDocument4 pagesRole of Effective Communication in OrganizationssantoshNo ratings yet

- Chỉ số T1: MEDA Cause code LINE Type Error BASE Type Error Work ShiftDocument61 pagesChỉ số T1: MEDA Cause code LINE Type Error BASE Type Error Work ShiftLê Tiến HảiNo ratings yet

- Personlig BudgetDocument6 pagesPersonlig BudgetAnn SundkvistNo ratings yet

- Atlas Budget TemplateDocument13 pagesAtlas Budget Templateapi-3701155100% (1)

- Project Charter TemplateDocument7 pagesProject Charter TemplateSHRUTI DAWAR-DMNo ratings yet

- Responsibility MatrixDocument1 pageResponsibility MatrixAzeemNo ratings yet

- Project Safety Management SystemDocument16 pagesProject Safety Management SystemrosevelvetNo ratings yet

- Sales & Revenue Dashboard: October 2012Document4 pagesSales & Revenue Dashboard: October 2012Ramesh RadhakrishnarajaNo ratings yet

- Guide to Form T661 SR&ED Expenditures ClaimDocument40 pagesGuide to Form T661 SR&ED Expenditures ClaimmetroroadNo ratings yet

- Bapi DissDocument72 pagesBapi DissBapi MandalNo ratings yet

- PW CDocument4 pagesPW CAnonymous DduElf20ONo ratings yet

- Responding To The Growing Threat of Human-Operated Ransomware AttacksDocument13 pagesResponding To The Growing Threat of Human-Operated Ransomware AttacksAmita Singh RajputNo ratings yet

- Uk Work Permit Authorization Form 11Document3 pagesUk Work Permit Authorization Form 11William Timothy100% (1)

- Norma CMAA 70Document90 pagesNorma CMAA 70Marcelo Navarro100% (7)

- Sspc-Pa 14Document6 pagesSspc-Pa 14Anonymous rYZyQQot5580% (5)

- 3-Year Cash Flow ProjectionsDocument11 pages3-Year Cash Flow ProjectionsAna-Maria LambingNo ratings yet

- Salary CalculatorDocument19 pagesSalary Calculatorvirag_shahsNo ratings yet

- Research Title: Gathering and Preparation of MaterialsDocument4 pagesResearch Title: Gathering and Preparation of MaterialsAnonymous 6yl2tnnNo ratings yet

- BUDGET PREPARATION-ManuscriptDocument3 pagesBUDGET PREPARATION-ManuscriptAlex Murphy SusiNo ratings yet

- Treasury Analysis WorksheetDocument5 pagesTreasury Analysis WorksheetiPakistan100% (3)

- Expense Claim Form JR 03.18Document4 pagesExpense Claim Form JR 03.18Joe RouseNo ratings yet

- Empowerment Technologies - G12 MEEDocument11 pagesEmpowerment Technologies - G12 MEEMac Reniel EdoraNo ratings yet

- SR&ED Audit Preparation: InformationDocument5 pagesSR&ED Audit Preparation: InformationmetroroadNo ratings yet

- Comprehensive Maintenance Plan 052005Document37 pagesComprehensive Maintenance Plan 052005Waleed AhmadNo ratings yet

- Reimbursement FormDocument1 pageReimbursement FormChrisinius Lawrencor HodakahnNo ratings yet

- ENGT 3510 Project Management Class DeliverablesDocument58 pagesENGT 3510 Project Management Class DeliverablesMontellia GantNo ratings yet

- The State of Mobile Internet Connectivity 2019: Connected SocietyDocument60 pagesThe State of Mobile Internet Connectivity 2019: Connected SocietyEmily LansegaNo ratings yet

- Segment Wise Revenue and Cost Analysis of Consumer Goods CompanyDocument47 pagesSegment Wise Revenue and Cost Analysis of Consumer Goods Companyrahul1094No ratings yet

- Project Budget Excel TemplateDocument5 pagesProject Budget Excel Templateعمر El KheberyNo ratings yet

- Pro/Feature: Package $ Product Short Description Acrony MDocument18 pagesPro/Feature: Package $ Product Short Description Acrony MSumeet SainiNo ratings yet

- Materials On SiteDocument44 pagesMaterials On Sitearchie_728No ratings yet

- My First ExperimentDocument4 pagesMy First ExperimentRamesh RadhakrishnarajaNo ratings yet

- Engineer KeysDocument2 pagesEngineer KeysSajidNaeemNo ratings yet

- Mep Services: Malik Saeed SB, Citi Developers, Citi Tower, MultanDocument1 pageMep Services: Malik Saeed SB, Citi Developers, Citi Tower, MultanFaheem MushtaqNo ratings yet

- DMCI Royalton Manpower Distribution by Work TypeDocument1 pageDMCI Royalton Manpower Distribution by Work TypeRyanNo ratings yet

- Gantt-Chart - LDocument8 pagesGantt-Chart - LDuong HoangNo ratings yet

- PHD Project Budget Process - Coursematerial - Sept2021Document25 pagesPHD Project Budget Process - Coursematerial - Sept2021Savas BOYRAZNo ratings yet

- Labor and Equipment Pricing for Detailed Construction EstimatesDocument28 pagesLabor and Equipment Pricing for Detailed Construction EstimatesRyanNo ratings yet

- Project Budget Template 22Document11 pagesProject Budget Template 22koum juniorNo ratings yet

- Tanya's Comprehensive Guide To Feline Chronic Kidney DiseaseDocument11 pagesTanya's Comprehensive Guide To Feline Chronic Kidney Diseasemetroroad100% (1)

- Astm A786 PDFDocument11 pagesAstm A786 PDFLuis Esteban Armijos MacasNo ratings yet

- Edusat Presentation On Pneumatics5Document147 pagesEdusat Presentation On Pneumatics5metroroadNo ratings yet

- CDH1 MP5Document44 pagesCDH1 MP5DTNo ratings yet

- Hoist Monorail Pre Commissioning ITPDocument7 pagesHoist Monorail Pre Commissioning ITPmetroroadNo ratings yet

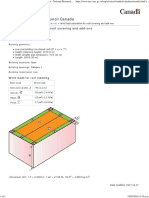

- Wind Load Calculation For Roof Covering and Add-Ons - National Research Council CanadaDocument1 pageWind Load Calculation For Roof Covering and Add-Ons - National Research Council CanadametroroadNo ratings yet

- A955305 PDFDocument177 pagesA955305 PDFAnonymous EOy00uV7Z100% (1)

- Wire Rope Engineering HandBookDocument139 pagesWire Rope Engineering HandBookhari1008108No ratings yet

- B5 1R1Document74 pagesB5 1R1Mohamed Osman AbdallaNo ratings yet

- Welding Line Analsys SampleDocument9 pagesWelding Line Analsys SamplemetroroadNo ratings yet

- Modeling Expansion Joints in CAEPIPEDocument17 pagesModeling Expansion Joints in CAEPIPEGeetanjali YallaNo ratings yet

- EN - 08 SAF and SAW - TCM - 12-107699 PDFDocument66 pagesEN - 08 SAF and SAW - TCM - 12-107699 PDFPetter PeñaNo ratings yet

- FUNdaMENTALs Topic 10Document85 pagesFUNdaMENTALs Topic 10metroroadNo ratings yet

- Sample Qs Manual PDFDocument59 pagesSample Qs Manual PDFDairon GutierrezNo ratings yet

- SP SP VP V PR) : Velocity Pressure Method Calculation SheetDocument6 pagesSP SP VP V PR) : Velocity Pressure Method Calculation SheetAnkit LonareNo ratings yet

- Guidelines For Resolving Claimants' SR&ED ConcernsDocument4 pagesGuidelines For Resolving Claimants' SR&ED ConcernsmetroroadNo ratings yet

- Project Costing Guide - Client 20050606Document7 pagesProject Costing Guide - Client 20050606metroroadNo ratings yet

- SCC Requirements and Guidance For The Accreditation of Testing LaboratoriesDocument22 pagesSCC Requirements and Guidance For The Accreditation of Testing LaboratoriesmetroroadNo ratings yet

- Guide To Claiming The Alberta Scientific Research and Experimental Development (Sr&Ed) Tax CreditDocument7 pagesGuide To Claiming The Alberta Scientific Research and Experimental Development (Sr&Ed) Tax CreditmetroroadNo ratings yet

- CRA Software Webinar 23-Jan-17 EowSpcsd Wo2-EDocument60 pagesCRA Software Webinar 23-Jan-17 EowSpcsd Wo2-EmetroroadNo ratings yet

- Client Report GuidelinesDocument1 pageClient Report GuidelinesmetroroadNo ratings yet

- SR&ED Template 2014Document4 pagesSR&ED Template 2014metroroadNo ratings yet

- Industrialization and Political Development in Nigeria (A Case Study of Rivers State (2007-2014) 3B.1Document41 pagesIndustrialization and Political Development in Nigeria (A Case Study of Rivers State (2007-2014) 3B.1Newman EnyiokoNo ratings yet

- English TestDocument2 pagesEnglish TestDusan VulicevicNo ratings yet

- An Internship Report On: Supervised byDocument8 pagesAn Internship Report On: Supervised byarshed_69No ratings yet

- Laboratory OfficerDocument8 pagesLaboratory OfficerTim DoustNo ratings yet

- Summer RoseDocument9 pagesSummer Rosesummer absolomNo ratings yet

- Small Business FeaturesDocument4 pagesSmall Business FeatureshikunanaNo ratings yet

- PT&T Policy Banning Married Women UnlawfulDocument13 pagesPT&T Policy Banning Married Women UnlawfultheresagriggsNo ratings yet

- Emerging Trends in HRMDocument3 pagesEmerging Trends in HRMSaurav GhaiNo ratings yet

- Himal Iron and Steel QuestionareDocument9 pagesHimal Iron and Steel QuestionareAdarsha Man TamrakarNo ratings yet

- Lecture NO. 8: Labor Management RelationsDocument97 pagesLecture NO. 8: Labor Management RelationsAlviNo ratings yet

- The Project Team: 2022 Dole Handbook Workers' Statutory Monetary Benefits 2022 EDITIONDocument55 pagesThe Project Team: 2022 Dole Handbook Workers' Statutory Monetary Benefits 2022 EDITIONRavenclaws91No ratings yet

- Apple SR 2016 Progress ReportDocument33 pagesApple SR 2016 Progress Reportโยอันนา ยุนอา แคทเธอรีน เอี่ยมสุวรรณNo ratings yet

- ENZ Education Consultancy Client FormDocument3 pagesENZ Education Consultancy Client Formmaria lorraine dinopolNo ratings yet

- Business Organization OrgChart Organigramm - Exercises v1bDocument4 pagesBusiness Organization OrgChart Organigramm - Exercises v1bBob E ThomasNo ratings yet

- Safety and Security IssuesDocument70 pagesSafety and Security IssuesSaad K. Al-taamryNo ratings yet

- Max Weber: Early LifeDocument14 pagesMax Weber: Early LifeSaleha ShahidNo ratings yet

- E.L.I.T.E. Program Brochure VfinalDocument9 pagesE.L.I.T.E. Program Brochure VfinalRohit SharmaNo ratings yet

- DixitDocument10 pagesDixitDixiT SharmANo ratings yet

- Mining Careers Pathway ChartDocument1 pageMining Careers Pathway Chartvivek_pandeyNo ratings yet

- Chapter 9 Maintaining Labor Management Relations F Chuaco, ShirleyDocument31 pagesChapter 9 Maintaining Labor Management Relations F Chuaco, ShirleyShie Castillo Chuaco100% (1)

- Pro Services in Dubai - Pro Services in Abu DhabiDocument23 pagesPro Services in Dubai - Pro Services in Abu DhabiShiva kumarNo ratings yet

- Œÿç Ënÿç Q Ÿàÿ F ( Ÿ B+Àÿ (Œÿsú (Àÿ: Samantaray AcademyDocument24 pagesŒÿç Ënÿç Q Ÿàÿ F ( Ÿ B+Àÿ (Œÿsú (Àÿ: Samantaray AcademypratidinNo ratings yet

- Mine Project Director Job PostingsDocument2 pagesMine Project Director Job PostingsScott O'BrienNo ratings yet