Professional Documents

Culture Documents

Cheat Sheet

Uploaded by

Anonymous ODAZn6VL60 ratings0% found this document useful (0 votes)

211 views2 pagesTest 1 cheat sheet ACT 421

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTest 1 cheat sheet ACT 421

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

211 views2 pagesCheat Sheet

Uploaded by

Anonymous ODAZn6VL6Test 1 cheat sheet ACT 421

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

C4: Differential = fv of consideration-bv of NIA diff = GW + FV Excess, GW = FV of considFV of NIA Cons S/E=Ps S.E.

+NCI, GW = NCI +SE

1.Brindle Company purchased 100 percent of Monroe Company's voting common stock for $648,000 on January 1, 20X4. At that

date, Monroe reported assets of $690,000 and liabilities of $230,000. The book values and fair values of Monroe's assets were equal

except for land, which had a fair value $108,000 more than book value, and equipment, which had a fair value $80,000 more than

book value. The remaining economic life of all depreciable assets at January 1, 20X4, was five years. Monroe reported net income of

$68,000 and paid dividends of $34,000 in 20X4. Investment Income = 68000-(80000/5) = 52000

GoldEnterprisesacquired100percentofPremiumBuildersstockonDecember31, Common stock 140,000

20X4. Balance sheet data for Gold and Premium on January 1, 20X5, are as follows Retained earnings 10,000

Enterprises Gold Enterprises

Premium Builders

D C Consol Investment in Premium Builders 150,000

Cash and Receivables 80,000 30,000 2000 108,000

Buildings & equipment (net)12,000

Inventory 150,000 350,000 7000 507,000 Inventory 7,000

Buildings & Equipment (net) 430,000 80,000 12000 522,000 Investment in Premium Builders 17,000

Investment in Premium Stock 167,000 167000 0 Cash and receivables 2,000

Total Assets 827,000 460,000 1,137,000

Current Liabilities 100,000 110,000 210,000

Long-Term Debt 400,000 200,000 600,000

Common Stock 200,000 140,000 140000 200,000

Retained Earnings 127,000 10,000 10000 127,000

TotalLiabilities&StockholdersEquity

827,000 460,000 1,137,000

Atthedateofthebusinesscombination,Premiumscashandreceivableshadafair

value of $28,000, inventory had a fair value of $357,000, and buildings and equipment

2. had a fair value of $92,000.

3. On January 1, 20X1, Big Company (Big) bought 30% of the outstanding stock of Little Company (Little) for $110,000 which provided Big with

the ability to significantly influence the decisions of Little. Little reported assets of $400,000 and liabilities of $100,000 on that date. As part of its

analysis before buying these shares, Big determined that Little owned a patent that had not been recorded despite having a remaining useful life of

five years and a value of $20,000. During 20X1, Little reported net income of $70,000 and paid cash dividends of $30,000. What investment income

should Big report for 20X1? Investment Income = 30% * 70,000 20000/5*30% = 19,800

C3. NCI = NCI% * Subs BV,.. Consolidated S.E = Ps S.E. + NCI,.. Consolidate R.E.= Ps R.E. = Beg R.E.+NI-Dividend

4. Xing Corporation owns 80 percent of the voting common shares of Adams Corporation. Noncontrolling interest was assigned $24,000 of income

in the 20X9 consolidated income statement. What amount of net income did Adams Corporation report for the year? = 24000*5=120000

5. Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value

and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders'

equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000.

Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

Total consolidated assets = 500k+400k-20k(AR)

= 880k

Total Liab = 150k+280k+250k-20k(AP) = 660k

Consolidated S.E. = 220K

Pete Inc. Acquires Sake for Cash 2,500, C.S of

1,If par value of cs is $1, and you receive 2000

shares, what is investment in sake? Debit

Investment in sake 3,500, Credit cash 2,500, C.S.

Ex.) Unit A is assigned $100k of goodwill from merger, A+L assigned = 200 and APIC 980. (MV = Par + APIC)

$320,000 , FV of NAs = $280k. 320k-280k = 40k implied value of gw

Good will impairment = carrying amount of GW Implied value of gw. So. 100k-40k= 60k of gw impairment.

C4: Differential = fv of consideration-bv of NIA diff = GW + FV Excess, GW = FV of considFV of NIA Cons S/E=Ps S.E.+NCI, GW = NCI +SE

Wilhelm

Kaiser Company

Corporation Q: Total Assets in Cons B.S. =

Consolid 200000+140000+350000+250000-

Item Debit Credit Debit Credit Debit Credit

ated 118000-80000= 742000

Q: Total Liab on Cons B.S. =

Current 100k+100k+80k+50k= 330k

$200,000 $140,000 340000

Assets

Q: Retained Earnings refer to bottom

Depreciable

350,000 250,000 80000 520000

Assets Pale Company was established on January 1, 20X1.

Investment Along with other assets, it immediately purchased land

in Kaiser for $80,000, a building for $240,000, and equipment

162,000 162000 0

Company for $90,000. On January 1, 20X5, Pale transferred these

Stock assets, cash of $21,000, and inventory costing $37,000

Depreciatio to a newly created subsidiary, Bright Company, in

27,000 10,000 37000 exchange for 10,000 shares of Brights $6 par value

n Expense

Other stock. Pale uses straight-line depreciation and useful

95,000 60,000 155000 lives of 40 years and 10 years for the building and

Expenses

equipment, respectively, with no estimated residual

Dividends values. Prepare the journal entry that Pale recorded

20,000 10,000 30000

Declared when it transferred the assets to Bright, and the

entry that Bright recorded for the receipt of assets

Accumulate and issuance of common stock to Pale.

d

$118,000 $80,000 80000 -118000

Depreciatio

n

Investment in408,000

Bright Company common stock

Total

742000 AccumulateddepreciationBuildings

24,000

Assets

Current AccumulateddepreciationEquipment

36,000

100,000 80,000 -180000

Liabilities Inventory 37,000

Long-Term

100,000 50,000 -150000 Equipment 90,000

Debt

Common Land 80,000

100,000 50,000 50000 -100000

Stock Cash 21,000

Retained

150,000 100,000 100000 -150000 Buildings 240,000

Earnings

Sales 250,000 110,000

Income Cash 21,000

from 36,000 Equipment 90,000

Subsidiary Land 80,000

$854,000 $854,000 $470,000 $470,000

Buildings 240,000

=250k-27k-

Parent NI = NI=164K = 95k+36k 40,000 = Sub Income

Inventory 37,000

RE = Beg RE + NI - Div Common stock 60,000

Retained =150k+164 Additional paid-in capital348,000

Earinings k-20k NCI =0.1*(50k+100k+40k-10k)

AccumulateddepreciationBuildings

24,000

=100k+294

S.E. k+18k 412k =18000^

AccumulateddepreciationEquipment

36,000

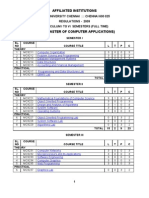

On January 1, 20X8, Wilhelm Corporation acquired 90 percent of Kaiser Company's voting stock, at underlying

book value. The fair value of the noncontrolling interest was equal to 10 percent of the book value of Kaiser at

that date. Wilhelm uses the equity method in accounting for its ownership of Kaiser. On December 31, 20X9,

the trial balances of the two companies are as follows:

You might also like

- Dividend Discount and Residual Income Models ExplainedDocument2 pagesDividend Discount and Residual Income Models ExplainedMohammad DaulehNo ratings yet

- Trustees Under IndenturesDocument233 pagesTrustees Under IndenturesPaul9268100% (6)

- Investment Appraisal - Payback ComputationDocument3 pagesInvestment Appraisal - Payback Computation411hhapNo ratings yet

- SQL-Problems Solutions PDFDocument11 pagesSQL-Problems Solutions PDFManpreet Singh100% (1)

- Accounting FM NotesDocument2 pagesAccounting FM NotessapbuwaNo ratings yet

- Finance Final Cheat SheetDocument1 pageFinance Final Cheat SheetAnonymous OEdl6l28QANo ratings yet

- Test 2 Cheat SheetDocument2 pagesTest 2 Cheat SheetAnonymous ODAZn6VL6100% (2)

- Operating Ratio + Operating Profit Ratio 1Document6 pagesOperating Ratio + Operating Profit Ratio 1Prakash ReddyNo ratings yet

- Process ValidationDocument116 pagesProcess ValidationsamirneseemNo ratings yet

- FFXV Comrades Cheat SheetDocument122 pagesFFXV Comrades Cheat SheetMissAphonicNo ratings yet

- Case 1Document2 pagesCase 1Chiks JpegNo ratings yet

- GPO - Most Recent Tips and TricksDocument24 pagesGPO - Most Recent Tips and Trickspl_arlandiNo ratings yet

- Security On A ShoestringDocument6 pagesSecurity On A ShoestringAndrew Richard ThompsonNo ratings yet

- FEM IntroductionDocument47 pagesFEM IntroductionShanmuga RamananNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Enhancing reliability of CRA piping welds with PAUTDocument10 pagesEnhancing reliability of CRA piping welds with PAUTMohsin IamNo ratings yet

- The Supektibol Intangibles: Multiple ChoiceDocument70 pagesThe Supektibol Intangibles: Multiple ChoiceErica PortesNo ratings yet

- FE 445 M1 CheatsheetDocument5 pagesFE 445 M1 Cheatsheetsaya1990No ratings yet

- JIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test MethodsDocument43 pagesJIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test Methodsbignose93gmail.com0% (1)

- P3.5 Different Forms of Business CombinationDocument8 pagesP3.5 Different Forms of Business CombinationAgnes CahyaNo ratings yet

- Accident Causation Theories and ConceptDocument4 pagesAccident Causation Theories and ConceptShayne Aira AnggongNo ratings yet

- Sec of Finance Purisima Vs Philippine Tobacco Institute IncDocument2 pagesSec of Finance Purisima Vs Philippine Tobacco Institute IncCharlotte100% (1)

- Fundamentals and Applications of Renewable Energy by Mehmet Kanoglu, Yunus Cengel, John CimbalaDocument413 pagesFundamentals and Applications of Renewable Energy by Mehmet Kanoglu, Yunus Cengel, John CimbalaFrancesco Nocera100% (1)

- Cheat SheetDocument1 pageCheat Sheetsullivn1No ratings yet

- Business Enterprises Cheat SheetDocument37 pagesBusiness Enterprises Cheat Sheetmca1001No ratings yet

- FMV Cheat SheetDocument1 pageFMV Cheat SheetAyushi SharmaNo ratings yet

- Cheat Sheet Measuring ReturnsDocument1 pageCheat Sheet Measuring ReturnsthisisatrolNo ratings yet

- Ruble 4Document43 pagesRuble 4anelesquivelNo ratings yet

- Acctg 581C - Fall 2011 - Test 2 Chapters 7-10 - Que-ADocument12 pagesAcctg 581C - Fall 2011 - Test 2 Chapters 7-10 - Que-Ajess_eng_1100% (1)

- Aqueous solutions and redox reactionsDocument1 pageAqueous solutions and redox reactionsDanielle GuindonNo ratings yet

- Annual Report Analysis of Allied BankDocument4 pagesAnnual Report Analysis of Allied BankAhmedNo ratings yet

- Cheat Sheet Derivatif Securities UTSDocument2 pagesCheat Sheet Derivatif Securities UTSNicole sadjoliNo ratings yet

- MCA Syllabus Regulation 2009 Anna UniversityDocument61 pagesMCA Syllabus Regulation 2009 Anna UniversityJGPORGNo ratings yet

- 5 Ways To Animate A React App PDFDocument33 pages5 Ways To Animate A React App PDFCristhian CruzNo ratings yet

- Fin Cheat SheetDocument3 pagesFin Cheat SheetChristina RomanoNo ratings yet

- Bloomberg Commands Cheat SheetDocument2 pagesBloomberg Commands Cheat SheetDong SongNo ratings yet

- Isom 2700 Cheat Sheet - 1Document2 pagesIsom 2700 Cheat Sheet - 1Jiny LeeNo ratings yet

- Harshad Mehta's Stock Market Scam - 3 Weeks AgoDocument9 pagesHarshad Mehta's Stock Market Scam - 3 Weeks AgoHardik ShahNo ratings yet

- Sequences and SeriesDocument1 pageSequences and SeriestawananyashaNo ratings yet

- Oracle Soa Maturity Model Cheat SheetDocument8 pagesOracle Soa Maturity Model Cheat Sheethelpmyinternet100% (2)

- Govt Agency Trader Sales Cheat SheetDocument1 pageGovt Agency Trader Sales Cheat SheetLoudie Lyn JunioNo ratings yet

- National Roads Authority: Project Appraisal GuidelinesDocument15 pagesNational Roads Authority: Project Appraisal GuidelinesPratish BalaNo ratings yet

- Strand 500 Key Cheat SheetsDocument6 pagesStrand 500 Key Cheat SheetsXaleDmanNo ratings yet

- FireBase React Mini Project Ersources Note PDFDocument1 pageFireBase React Mini Project Ersources Note PDFSandeep DwivediNo ratings yet

- Practice MidtermDocument8 pagesPractice MidtermghaniaNo ratings yet

- Corporate Law - Cheat Sheet (Lecture 2) PDFDocument1 pageCorporate Law - Cheat Sheet (Lecture 2) PDFSarah CamilleriNo ratings yet

- Software Architecture Cheat Sheet For Daily UsageDocument6 pagesSoftware Architecture Cheat Sheet For Daily Usagesosaheriberto20018404No ratings yet

- EX3 - MEEN 363 Cheat SheetDocument7 pagesEX3 - MEEN 363 Cheat SheetYashNo ratings yet

- Valuation of BondsDocument27 pagesValuation of BondsAbhinav Rajverma100% (1)

- Chapter 4 Interest Rate FormulasDocument4 pagesChapter 4 Interest Rate FormulasJohnNo ratings yet

- Overview of Financial Management Concepts and ToolsDocument4 pagesOverview of Financial Management Concepts and ToolsPeixuan Zhuang100% (1)

- Cheat SheetDocument1 pageCheat Sheetheuwensze6831No ratings yet

- Managerial Fin - Midterm Cheat - Copy2Document2 pagesManagerial Fin - Midterm Cheat - Copy2JoseNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- Partnership AppDocument22 pagesPartnership AppPeter AkramNo ratings yet

- Pale Company transfers assets to newly created subsidiary SightDocument6 pagesPale Company transfers assets to newly created subsidiary SightKristilyn CartaNo ratings yet

- Midsemester Exam-C Problem 1: Show Your CalculationsDocument5 pagesMidsemester Exam-C Problem 1: Show Your CalculationsMario KaunangNo ratings yet

- Exercise AFA1 For CH1-004-10!12!23Document12 pagesExercise AFA1 For CH1-004-10!12!23Srey NeangNo ratings yet

- 1. mergers and inv in subsDocument4 pages1. mergers and inv in subsmartinfaith958No ratings yet

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Lec 3Document7 pagesLec 3ahmedgalalabdalbaath2003No ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Soal Jawaban AKL CHP 1Document5 pagesSoal Jawaban AKL CHP 1Allpacino DesellaNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- BAP Eboard MeetingDocument1 pageBAP Eboard MeetingAnonymous ODAZn6VL6No ratings yet

- Strategic MGMT 1.23.18Document1 pageStrategic MGMT 1.23.18Anonymous ODAZn6VL6No ratings yet

- As-IS DFD Level 1: Appointment ScheduleDocument1 pageAs-IS DFD Level 1: Appointment ScheduleAnonymous ODAZn6VL6No ratings yet

- Pembroke Recreation Dept Job AppDocument3 pagesPembroke Recreation Dept Job AppAnonymous ODAZn6VL6No ratings yet

- Fin Final ExamplesDocument2 pagesFin Final ExamplesAnonymous ODAZn6VL6No ratings yet

- Homework 1Document2 pagesHomework 1Anonymous ODAZn6VL6No ratings yet

- Fin 383 Final Cheat SheetDocument1 pageFin 383 Final Cheat SheetAnonymous ODAZn6VL6No ratings yet

- WEEK 4 Chapter 8 QuizDocument2 pagesWEEK 4 Chapter 8 QuizAnonymous ODAZn6VL6No ratings yet

- BAP Speaking RulesDocument1 pageBAP Speaking RulesAnonymous ODAZn6VL6No ratings yet

- Report From The President's Task Force On 21st Century PolicingDocument116 pagesReport From The President's Task Force On 21st Century PolicingColin DailedaNo ratings yet

- Intro To Auditing Things To Review Different Types of Auditing Opinions Ex.) Qualified, Unqualified, No Opinion, Adverse Etc 5 W's and How 10 GaasDocument1 pageIntro To Auditing Things To Review Different Types of Auditing Opinions Ex.) Qualified, Unqualified, No Opinion, Adverse Etc 5 W's and How 10 GaasAnonymous ODAZn6VL6No ratings yet

- mgt3 2Document1,218 pagesmgt3 2Anonymous ODAZn6VL6No ratings yet

- Fin Formula Cheat SheetDocument4 pagesFin Formula Cheat SheetAnonymous ODAZn6VL6No ratings yet

- Emailing PowerUpRewardsDocument1 pageEmailing PowerUpRewardsAnonymous ODAZn6VL6No ratings yet

- Woolf - DecayOfEssay Outlne With NotesDocument3 pagesWoolf - DecayOfEssay Outlne With NotesAnonymous ODAZn6VL6No ratings yet

- Trace Log 20150106140555Document6 pagesTrace Log 20150106140555Anonymous ODAZn6VL6No ratings yet

- PHY101 Practice FinalDocument5 pagesPHY101 Practice FinalAnonymous ODAZn6VL6No ratings yet

- Annotated BibDocument4 pagesAnnotated BibAnonymous ODAZn6VL6No ratings yet

- Kenneth Bowers Poster LabDocument1 pageKenneth Bowers Poster LabAnonymous ODAZn6VL6No ratings yet

- AbimpDocument2 pagesAbimpanon-840981No ratings yet

- Trace Log 20150106140555Document6 pagesTrace Log 20150106140555Anonymous ODAZn6VL6No ratings yet

- Luma EmuDocument2 pagesLuma EmuMartin LoquishoNo ratings yet

- DeMolay Notice January 2011Document2 pagesDeMolay Notice January 2011Anonymous ODAZn6VL6No ratings yet

- Tour TextDocument24 pagesTour TextEmily janeNo ratings yet

- Woolf DecayOfEssayDocument3 pagesWoolf DecayOfEssayAnonymous ODAZn6VL6No ratings yet

- ItemsDocument3 pagesItemsJack LiuNo ratings yet

- Drop The GameDocument5 pagesDrop The GameFernando FigueroaNo ratings yet

- Banned PlayersDocument1 pageBanned PlayersAnonymous ODAZn6VL6No ratings yet

- Why Companies Choose Corporate Bonds Over Bank LoansDocument31 pagesWhy Companies Choose Corporate Bonds Over Bank Loansতোফায়েল আহমেদNo ratings yet

- 04 Activity 2Document2 pages04 Activity 2Jhon arvie MalipolNo ratings yet

- Presentation Pineda Research CenterDocument11 pagesPresentation Pineda Research CenterPinedaMongeNo ratings yet

- Java MCQ questions and answersDocument65 pagesJava MCQ questions and answersShermin FatmaNo ratings yet

- Parasim CADENCEDocument166 pagesParasim CADENCEvpsampathNo ratings yet

- Spain Price List With VatDocument3 pagesSpain Price List With Vatsanti647No ratings yet

- Characteristics: Wheels Alloy Aluminium Magnesium Heat ConductionDocument4 pagesCharacteristics: Wheels Alloy Aluminium Magnesium Heat ConductionJv CruzeNo ratings yet

- E200P Operation ManualDocument26 pagesE200P Operation ManualsharmasourabhNo ratings yet

- Lab - Activity CCNA 2 Exp: 7.5.3Document13 pagesLab - Activity CCNA 2 Exp: 7.5.3Rico Agung FirmansyahNo ratings yet

- UPGRADEDocument2 pagesUPGRADEVedansh OswalNo ratings yet

- Capran+980 CM en PDFDocument1 pageCapran+980 CM en PDFtino taufiqul hafizhNo ratings yet

- FilesDocument12 pagesFilesRajesh TuticorinNo ratings yet

- A Research About The Canteen SatisfactioDocument50 pagesA Research About The Canteen SatisfactioJakeny Pearl Sibugan VaronaNo ratings yet

- SEEPZ Special Economic ZoneDocument2 pagesSEEPZ Special Economic ZonetarachandmaraNo ratings yet

- Manual de Instalare Centrala de Incendiu Adresabila 1-4 Bucle Teletek IRIS PRO 250bucla 96 Zone 10000 EvenimenteDocument94 pagesManual de Instalare Centrala de Incendiu Adresabila 1-4 Bucle Teletek IRIS PRO 250bucla 96 Zone 10000 EvenimenteAlexandra DumitruNo ratings yet

- Exp19 Excel Ch08 HOEAssessment Robert's Flooring InstructionsDocument1 pageExp19 Excel Ch08 HOEAssessment Robert's Flooring InstructionsMuhammad ArslanNo ratings yet

- BUSN7054 Take Home Final Exam S1 2020Document14 pagesBUSN7054 Take Home Final Exam S1 2020Li XiangNo ratings yet

- Business PlanDocument9 pagesBusiness PlanRico DejesusNo ratings yet

- Cycles in Nature: Understanding Biogeochemical CyclesDocument17 pagesCycles in Nature: Understanding Biogeochemical CyclesRatay EvelynNo ratings yet

- Corena s2 p150 - Msds - 01185865Document17 pagesCorena s2 p150 - Msds - 01185865Javier LerinNo ratings yet

- Market Participants in Securities MarketDocument11 pagesMarket Participants in Securities MarketSandra PhilipNo ratings yet