Professional Documents

Culture Documents

The Power of The Monthly Pivots

Uploaded by

ValuEngine.comOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Power of The Monthly Pivots

Uploaded by

ValuEngine.comCopyright:

Available Formats

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Newtown, PA. ValuEngine

covers over 7,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock

picks, and commentary can be found HERE.

September 3, 2010 – The Power of the Monthly Pivots.

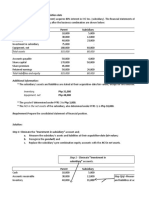

The yield on the 10-Year US Treasury is above my new monthly pivot at 2.562, which is a sign

favoring stocks. Gold’s is between my semiannual pivots at $1218.7 and $1260.8 with my

monthly risky level at $1263.8. Crude oil is above my monthly pivot at $74.45 with my annual

pivot at $77.05. The euro could be the negative divergence for stocks as my quarterly value

level lags at 1.2167. The major equity averages straddle monthly pivots at 10,164 on Dow

Industrials, 1074.9 S&P 500, 2196 NASDAQ, 4364 Dow Transports and 652.82 on Russell 2000.

10-Year Note – (2.628) My weekly value level is 2.648 with monthly, quarterly and daily pivots at

2.562, 2.495 and 2.514 and my semiannual risky level at 2.249. My annual value levels are 2.813 and

2.999. Note that the decline in yield is no longer overdone on the daily chart.

Courtesy of Thomson / Reuters

Comex Gold – ($1253.10) Semiannual, weekly, quarterly and annual value levels are $1218.7,

$1211.5, $1140.9 and $1115.2 with daily, semiannual and monthly risky levels at $1259.9, $1260.8 and

$1263.8. Note that gold is still overbought on its daily chart.

Courtesy of Thomson / Reuters

Nymex Crude Oil – ($74.99) My daily pivot is $74.32 with a monthly pivot at $74.45, and annual,

weekly and semiannual risky levels at $77.05, $81.35 and $83.94. Note that crude oil is no longer

oversold on the daily chart profile.

Courtesy of Thomson / Reuters

The Euro – (1.2822) Daily, quarterly and monthly value levels are 1.2799, 1.2167, 1.1721 and 1.1424

with weekly and semiannual risky levels at 1.3170 and 1.4733. Note that the euro is no longer

oversold on its daily chart.

Courtesy of Thomson / Reuters

Daily Dow: (10,320) Daily and quarterly value levels are 10,086 and 7,812 with a monthly pivot at

10,164, and annual, semiannual, weekly and annual risky levels at 10,379, 10,558, 10,904 and

11,235. My annual risky level at 11,235 was tested at the April 26th high of 11,258.01. The 50-day

simple moving average is 10,261 with the 21-day at 10,300, and 200-day simple moving average

as resistance at 10,451.

Courtesy of Thomson / Reuters

That’s today’s Four in Four. Have a great day.

Richard Suttmeier

Chief Market Strategist

ValuEngine.com

(800) 381-5576

Send your comments and questions to Rsuttmeier@Gmail.com. For more information on our products

and services visit www.ValuEngine.com

As Chief Market Strategist at ValuEngine Inc, my research is published regularly on the website www.ValuEngine.com.

I have daily, weekly, monthly, and quarterly newsletters available that track a variety of equity and other data parameters as

well as my most up-to-date analysis of world markets. My newest products include a weekly ETF newsletter as well as the

ValuTrader Model Portfolio newsletter. You can go HERE to review sample issues and find out more about my research.

“I Hold No Positions in the Stocks I Cover.”

You might also like

- Richard Suttmeier Is The Chief Market Strategist atDocument4 pagesRichard Suttmeier Is The Chief Market Strategist atValuEngine.comNo ratings yet

- Crude Oil Tests My Annual Pivot at $77.05 Yet AgainDocument4 pagesCrude Oil Tests My Annual Pivot at $77.05 Yet AgainValuEngine.comNo ratings yet

- Crude Oil Tests My Semiannual Risky Level at $83.94Document4 pagesCrude Oil Tests My Semiannual Risky Level at $83.94ValuEngine.comNo ratings yet

- Home On The Ranges Following Early September MovesDocument4 pagesHome On The Ranges Following Early September MovesValuEngine.comNo ratings yet

- Closes Dow 11,444.08 and SPX 1228.74 Signal MOJO Run.Document4 pagesCloses Dow 11,444.08 and SPX 1228.74 Signal MOJO Run.ValuEngine.comNo ratings yet

- Without A Weekly Sell Signal Stocks Should Reach New YTD HighsDocument4 pagesWithout A Weekly Sell Signal Stocks Should Reach New YTD HighsValuEngine.comNo ratings yet

- Four in Four ReportDocument4 pagesFour in Four ReportValuEngine.comNo ratings yet

- Equity Trading Ranges Since August 9th Remain in PlaceDocument5 pagesEquity Trading Ranges Since August 9th Remain in PlaceValuEngine.comNo ratings yet

- My Weekly Pivots Provided A Sense of Stability For Stocks On Monday.Document1 pageMy Weekly Pivots Provided A Sense of Stability For Stocks On Monday.ValuEngine.comNo ratings yet

- The Most Important Level Held Again - 2335 On The NASDAQDocument5 pagesThe Most Important Level Held Again - 2335 On The NASDAQValuEngine.comNo ratings yet

- Stocks Will Likely Avoid Negative Weekly Closes This Week.Document4 pagesStocks Will Likely Avoid Negative Weekly Closes This Week.ValuEngine.comNo ratings yet

- The Weekly Charts For The Major Equity Averages Are Negative!Document4 pagesThe Weekly Charts For The Major Equity Averages Are Negative!ValuEngine.comNo ratings yet

- Four in Four ReportDocument4 pagesFour in Four ReportValuEngine.comNo ratings yet

- The NASDAQ Is Well Above Its Nov '07 High While Transports and Small Caps Lag All Time Highs Set in 2011.Document5 pagesThe NASDAQ Is Well Above Its Nov '07 High While Transports and Small Caps Lag All Time Highs Set in 2011.ValuEngine.comNo ratings yet

- Record Low 10-Year Yield, Record High Gold Risk Aversion!Document5 pagesRecord Low 10-Year Yield, Record High Gold Risk Aversion!ValuEngine.comNo ratings yet

- On The Cusp of A Dow Theory Buy SignalDocument5 pagesOn The Cusp of A Dow Theory Buy SignalValuEngine.comNo ratings yet

- Weekly Charts Are Negative and Not Yet OversoldDocument5 pagesWeekly Charts Are Negative and Not Yet OversoldValuEngine.comNo ratings yet

- Four in Four ReportDocument4 pagesFour in Four ReportValuEngine.comNo ratings yet

- Lower US Credit Rating Greets New Bear Market For StocksDocument4 pagesLower US Credit Rating Greets New Bear Market For StocksValuEngine.comNo ratings yet

- The S&P 500 Is Poised To Set A New 52-Week HighDocument5 pagesThe S&P 500 Is Poised To Set A New 52-Week HighValuEngine.comNo ratings yet

- The Stock Market Is Poised For Neutral Weekly ClosesDocument5 pagesThe Stock Market Is Poised For Neutral Weekly ClosesValuEngine.comNo ratings yet

- Monday's Highs Straddled 11,491 Dow and 1210.7 SPXDocument5 pagesMonday's Highs Straddled 11,491 Dow and 1210.7 SPXValuEngine.comNo ratings yet

- The Bear Market Myth Is Bogus! The Bear Has Roared Since August!Document6 pagesThe Bear Market Myth Is Bogus! The Bear Has Roared Since August!ValuEngine.comNo ratings yet

- The Dow Is Between Its Quarterly Pivots at 12,478 and 12,796.Document5 pagesThe Dow Is Between Its Quarterly Pivots at 12,478 and 12,796.ValuEngine.comNo ratings yet

- My Market Call For October Was On The Money!Document5 pagesMy Market Call For October Was On The Money!ValuEngine.comNo ratings yet

- Weekly Closes Above The Five-Week MMAS Are Positive.Document5 pagesWeekly Closes Above The Five-Week MMAS Are Positive.ValuEngine.com100% (1)

- The Dow, SPX, Transports and Russell 2000 Lag Their 50-Day SMAsDocument5 pagesThe Dow, SPX, Transports and Russell 2000 Lag Their 50-Day SMAsValuEngine.comNo ratings yet

- US Stocks Remain Overvalued and OverboughtDocument4 pagesUS Stocks Remain Overvalued and OverboughtValuEngine.comNo ratings yet

- Dow Transports & Russell 2000 Are Lagging Versus Their 2011 Highs.Document5 pagesDow Transports & Russell 2000 Are Lagging Versus Their 2011 Highs.ValuEngine.comNo ratings yet

- The Weekly Charts Are Positive For The Major Equity Averages.Document5 pagesThe Weekly Charts Are Positive For The Major Equity Averages.ValuEngine.comNo ratings yet

- Four in Four ReportDocument5 pagesFour in Four ReportValuEngine.comNo ratings yet

- Negative Weekly Charts Trump Technical Breakouts.Document5 pagesNegative Weekly Charts Trump Technical Breakouts.ValuEngine.comNo ratings yet

- Closes Above 4806.1 Transports and 11,205.03 Industrials Is A Dow Theory Buy Signal.Document4 pagesCloses Above 4806.1 Transports and 11,205.03 Industrials Is A Dow Theory Buy Signal.ValuEngine.comNo ratings yet

- Beware of The Ides of OctoberDocument2 pagesBeware of The Ides of OctoberValuEngine.comNo ratings yet

- Transports Pop Above This Week's Pivot at 5293.Document5 pagesTransports Pop Above This Week's Pivot at 5293.ValuEngine.comNo ratings yet

- Four in Four ReportDocument4 pagesFour in Four ReportValuEngine.comNo ratings yet

- Right Back To Where We Started FromDocument6 pagesRight Back To Where We Started FromValuEngine.comNo ratings yet

- A Weekly Close For The Dow Above 10,379 Targets 10,558Document5 pagesA Weekly Close For The Dow Above 10,379 Targets 10,558ValuEngine.comNo ratings yet

- Friday's Closes May Confirm or Deny The August Highs As Cycle Highs.Document2 pagesFriday's Closes May Confirm or Deny The August Highs As Cycle Highs.Richard SuttmeierNo ratings yet

- Oil Tests $112.24 Overnight Then Back To My Semiannual Pivot at $109.84.Document2 pagesOil Tests $112.24 Overnight Then Back To My Semiannual Pivot at $109.84.Richard SuttmeierNo ratings yet

- SOX Rebounds, But Remains Below Its 50-Day at 445.34Document5 pagesSOX Rebounds, But Remains Below Its 50-Day at 445.34ValuEngine.comNo ratings yet

- The Nasdaq Sets A New Multi-Year High at 3708.41.Document2 pagesThe Nasdaq Sets A New Multi-Year High at 3708.41.Richard SuttmeierNo ratings yet

- Today We Look at The Weekly ChartsDocument4 pagesToday We Look at The Weekly ChartsValuEngine.comNo ratings yet

- The Weekly Chart For The NASDAQ Is Now Negative.Document1 pageThe Weekly Chart For The NASDAQ Is Now Negative.Richard SuttmeierNo ratings yet

- The Miss-Interpretation of Economic DataDocument5 pagesThe Miss-Interpretation of Economic DataValuEngine.comNo ratings yet

- Huge Risk / Reward in July and in The Second Half of 2011.Document4 pagesHuge Risk / Reward in July and in The Second Half of 2011.ValuEngine.comNo ratings yet

- Markets As We Approach The End of 2010Document2 pagesMarkets As We Approach The End of 2010ValuEngine.comNo ratings yet

- The Nasdaq Sets Another New All Time Multi-Year High at 3824.44.Document2 pagesThe Nasdaq Sets Another New All Time Multi-Year High at 3824.44.Richard SuttmeierNo ratings yet

- Stock Market Resiliency and VulnerabilityDocument4 pagesStock Market Resiliency and VulnerabilityValuEngine.comNo ratings yet

- Four in Four ReportDocument1 pageFour in Four ReportRichard SuttmeierNo ratings yet

- The Nasdaq and Russell 2000 Set New Multiyear and All-Time Highs.Document2 pagesThe Nasdaq and Russell 2000 Set New Multiyear and All-Time Highs.Richard SuttmeierNo ratings yet

- Four in Four ReportDocument5 pagesFour in Four ReportValuEngine.comNo ratings yet

- Four in Four ReportDocument1 pageFour in Four ReportRichard SuttmeierNo ratings yet

- Four in Four ReportDocument1 pageFour in Four ReportRichard SuttmeierNo ratings yet

- August 10, 2012 - The Weekly Chart For Dow Transports Can Become Negative.Document1 pageAugust 10, 2012 - The Weekly Chart For Dow Transports Can Become Negative.Richard SuttmeierNo ratings yet

- Look For New Monthly and Quarterly Risky Levels and New Semiannual Value Levels.Document4 pagesLook For New Monthly and Quarterly Risky Levels and New Semiannual Value Levels.ValuEngine.comNo ratings yet

- Four in Four ReportDocument4 pagesFour in Four ReportValuEngine.comNo ratings yet

- Holding Weekly Pivots Indicates Strength Into Friday's Employment Data.Document1 pageHolding Weekly Pivots Indicates Strength Into Friday's Employment Data.ValuEngine.comNo ratings yet

- Inside the Currency Market: Mechanics, Valuation and StrategiesFrom EverandInside the Currency Market: Mechanics, Valuation and StrategiesNo ratings yet

- ValuEngine Weekly: Tech Stocks, General Motors, and MoreDocument5 pagesValuEngine Weekly: Tech Stocks, General Motors, and MoreValuEngine.comNo ratings yet

- ValuEngine Weekly: Basic Materials Stocks, Raytheon, Valuation Watch, and MoreDocument6 pagesValuEngine Weekly: Basic Materials Stocks, Raytheon, Valuation Watch, and MoreValuEngine.comNo ratings yet

- ValuEngine Weekly: Finance Stocks, Twitter, Valuation Watch, and MoreDocument5 pagesValuEngine Weekly: Finance Stocks, Twitter, Valuation Watch, and MoreValuEngine.comNo ratings yet

- ValuEngine Weekly: Aerospace Stocks, JCPenney, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Aerospace Stocks, JCPenney, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalDocument6 pagesValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Construction Stocks, JPMorgan Chase, Valuation Watch, and MoreDocument6 pagesValuEngine Weekly: Construction Stocks, JPMorgan Chase, Valuation Watch, and MoreValuEngine.comNo ratings yet

- ValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalDocument6 pagesValuEngine Weekly: Consumer Staples, Volkswagen, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Basic Materials Sector, General Electric, Valuation Study, and MoreDocument10 pagesValuEngine Weekly: Basic Materials Sector, General Electric, Valuation Study, and MoreValuEngine.comNo ratings yet

- ValuEngine Weekly: Basic Materials Stocks, Twitter, Market Valuations, Benzinga Show, and ValuEngine CapitalDocument11 pagesValuEngine Weekly: Basic Materials Stocks, Twitter, Market Valuations, Benzinga Show, and ValuEngine CapitalValuEngine.comNo ratings yet

- December 2, 2016: Market OverviewDocument7 pagesDecember 2, 2016: Market OverviewValuEngine.comNo ratings yet

- ValuEngine Weekly: Industrial Products, Macy's, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Industrial Products, Macy's, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Finance Stocks, Horizon Pharma, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Finance Stocks, Horizon Pharma, and ValuEngine CapitalValuEngine.comNo ratings yet

- December 2, 2016: Market OverviewDocument7 pagesDecember 2, 2016: Market OverviewValuEngine.comNo ratings yet

- ValuEngine Weekly: Medical Stocks, Toyota Motor, Valuation Warning, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Medical Stocks, Toyota Motor, Valuation Warning, and ValuEngine CapitalValuEngine.comNo ratings yet

- December 2, 2016: Market OverviewDocument7 pagesDecember 2, 2016: Market OverviewValuEngine.comNo ratings yet

- ValuEngine Weekly: Construction Stocks, Mylan, Market Valuation Study, and ValuEngine CapitalDocument10 pagesValuEngine Weekly: Construction Stocks, Mylan, Market Valuation Study, and ValuEngine CapitalValuEngine.comNo ratings yet

- Ve Weekly NewsDocument7 pagesVe Weekly NewsValuEngine.comNo ratings yet

- ValuEngine Weekly: Oils/Energy Stocks, Deutsche Bank, Benzinga Pre-Market Prep, and ValuEngine CapitalDocument8 pagesValuEngine Weekly: Oils/Energy Stocks, Deutsche Bank, Benzinga Pre-Market Prep, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Health Care Stocks, Tesla, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Health Care Stocks, Tesla, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Retail/Wholesale Stocks, Softbank, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Retail/Wholesale Stocks, Softbank, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Autos/Tires/Trucks, Volkswagen, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Transport Stocks, Boeing, Brexit, and ValuEngine CapitalDocument8 pagesValuEngine Weekly: Transport Stocks, Boeing, Brexit, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Basic Materials Stocks, UPS, ValuEngine View Results, and ValuEngine CapitalDocument8 pagesValuEngine Weekly: Basic Materials Stocks, UPS, ValuEngine View Results, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Tech Stocks, Apple, and ValuEngine CapitalDocument8 pagesValuEngine Weekly: Tech Stocks, Apple, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Consumer Staples Stocks, Cooper Standard, New Market Highs, and ValuEngine CapitalDocument8 pagesValuEngine Weekly: Consumer Staples Stocks, Cooper Standard, New Market Highs, and ValuEngine CapitalValuEngine.comNo ratings yet

- Ve Weekly NewsDocument8 pagesVe Weekly NewsValuEngine.comNo ratings yet

- ValuEngine Weekly: Finance Stocks, FOX, Valuations, and ValuEngine CapitalDocument10 pagesValuEngine Weekly: Finance Stocks, FOX, Valuations, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Industrial Product Stocks, Apple, Valuations, and ValuEngine CapitalDocument11 pagesValuEngine Weekly: Industrial Product Stocks, Apple, Valuations, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Construction Stocks, Hewlett Packard, and ValuEngine CapitalDocument7 pagesValuEngine Weekly: Construction Stocks, Hewlett Packard, and ValuEngine CapitalValuEngine.comNo ratings yet

- ValuEngine Weekly: Tech Stocks, Cigna, Chinese Reports, and ValuEngine CapitalDocument8 pagesValuEngine Weekly: Tech Stocks, Cigna, Chinese Reports, and ValuEngine CapitalValuEngine.comNo ratings yet

- SBI Annual Report 2015 16Document290 pagesSBI Annual Report 2015 16bbaalluuNo ratings yet

- 2015 Annual Report PDFDocument316 pages2015 Annual Report PDFTanmay SrivastavNo ratings yet

- Equity ValuationDocument32 pagesEquity Valuationprince455No ratings yet

- Venture Capital Notes and Study MaterialDocument5 pagesVenture Capital Notes and Study MaterialManish SinghNo ratings yet

- IBA Second Term Exam (A) Spring 2016 Financial ManagementDocument6 pagesIBA Second Term Exam (A) Spring 2016 Financial ManagementHaneefa Soomro0% (1)

- Case 3 Report - 1208 2056Document26 pagesCase 3 Report - 1208 2056api-3748540No ratings yet

- KESCOTariffOrderFY2014 151oct2014 pdf101201441458PMDocument433 pagesKESCOTariffOrderFY2014 151oct2014 pdf101201441458PMTejas ShahNo ratings yet

- Ultimate Strategy Guide Option AlphaDocument80 pagesUltimate Strategy Guide Option AlphaVincenzo Tavernise100% (3)

- Summary of Chapter 11 - Positive Theory of Accounting PolicyDocument1 pageSummary of Chapter 11 - Positive Theory of Accounting PolicySausan SaniaNo ratings yet

- Assignment ACC705 T2 2017Document5 pagesAssignment ACC705 T2 2017babar zuberiNo ratings yet

- Vijay Hemant Sonaje and Dr. Shriram S. NerlekarDocument8 pagesVijay Hemant Sonaje and Dr. Shriram S. NerlekarsugeethaNo ratings yet

- MBA - MM 103 Product & Brand Management: 1. All Questions Are Compulsory in Section A. Section A Carries 20 MarksDocument3 pagesMBA - MM 103 Product & Brand Management: 1. All Questions Are Compulsory in Section A. Section A Carries 20 MarksMeraj MominNo ratings yet

- Vinacafe Bien Hoa Final ReportDocument24 pagesVinacafe Bien Hoa Final ReportQuang NguyenNo ratings yet

- Analisis Vertikal Dan Horizontal Terhadap Laporan Keuangan PT Perkebunan Nusantara Iii (Pesero) MedanDocument14 pagesAnalisis Vertikal Dan Horizontal Terhadap Laporan Keuangan PT Perkebunan Nusantara Iii (Pesero) MedanEndang Nur IslamiNo ratings yet

- Kiplinger's Personal Finance - January 2018 PDFDocument74 pagesKiplinger's Personal Finance - January 2018 PDFjkavinNo ratings yet

- Total Assets 335,000 80,000: Additional InformationDocument8 pagesTotal Assets 335,000 80,000: Additional InformationHohohoNo ratings yet

- Finance& Financial Management Risk, Cost of Capital & Capital BudgetingDocument39 pagesFinance& Financial Management Risk, Cost of Capital & Capital BudgetingJuan SanguinetiNo ratings yet

- Elite Patterns For ETFs&Stocks Free ChapterDocument22 pagesElite Patterns For ETFs&Stocks Free Chapter413000No ratings yet

- The Biblical Money CodeDocument31 pagesThe Biblical Money CodedusinkNo ratings yet

- Blackrock Global AllocationDocument12 pagesBlackrock Global AllocationrobertcoeNo ratings yet

- ALFONSO S. TAN, Petitioner vs. Securities and Exchange Commission G.R. No. 95696 March 3, 1992Document2 pagesALFONSO S. TAN, Petitioner vs. Securities and Exchange Commission G.R. No. 95696 March 3, 1992vivivioletteNo ratings yet

- Avendus Wealth ManagementDocument2 pagesAvendus Wealth ManagementavendusNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Mauro F Guillén - Esteban García-Canal - The New Multinationals - Spanish Firms in A Global Context (2010, Cambridge University Press) PDFDocument236 pagesMauro F Guillén - Esteban García-Canal - The New Multinationals - Spanish Firms in A Global Context (2010, Cambridge University Press) PDFNicolasNo ratings yet

- List of Project Topics Capital Markets and Securities LawDocument4 pagesList of Project Topics Capital Markets and Securities Lawsonu peterNo ratings yet

- A Brief Summary of The Caesars Entertainment Examiner's ReportDocument5 pagesA Brief Summary of The Caesars Entertainment Examiner's ReportUH_Gaming_ResearchNo ratings yet

- Bachrach V SeifertDocument1 pageBachrach V SeifertKling KingNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- By:-Nirmal Joshi Mayuresh Kumbhar Pallavi Indurkar Niranjan Tiwari Manali Suryavanshi Minu PareekDocument15 pagesBy:-Nirmal Joshi Mayuresh Kumbhar Pallavi Indurkar Niranjan Tiwari Manali Suryavanshi Minu PareekVinayak PatilNo ratings yet

- False Breakouts: Why Most Traders Fall Victim ToDocument71 pagesFalse Breakouts: Why Most Traders Fall Victim ToaddinfoNo ratings yet